Product

Ethylene Price Trend and Forecast

Ethylene Price Trend and Forecast

Regional Price Overview

Get the latest insights on price movement and trend analysis of Ethylene in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Ethylene Price Trend for the Q1 of 2024

Asia

In Asian markets, ethylene prices remained in the green zone due to heavy reliance on imports, coupled with a decline in the trading volumes of the region. Demand from downstream sectors remained stable compared to the previous quarter, benefiting from the recovery in manufacturing and transportation amid deflated energy prices. However, polyalphaolefin prices remained steady as inventory pressure eased, influenced by a robust winter season in Asian markets.

Ethylene Price Chart

Please Login or Subscribe to Access the Ethylene Price Chart Data

The ethylene market also witnessed substantial movement in the inventories as East Asian countries restocked for Lunar New Year celebrations in February, favoring the stabilization of the ethylene price trend. Along with this, the feedstock industries also projected a positive influence on the ethylene pricing patterns with the rise in its own momentum.

Europe

Ethylene prices in the European market concluded the first quarter on a softer end despite high upstream and energy prices. This meek momentum of the market was attributed to subdued market fundamentals and rising risks in the trading sector amid the ongoing geopolitical crisis in the region. In view of the current dynamics, traders introduced discounts; however, despite that demand outlook remained weak.

In Germany, ethylene prices significantly declined with muted derivative orders and average demand from the polyethylene industry. Although global crude oil prices rose, this was insufficient to boost ethylene prices domestically. Supply concerns although eased with irregular Asian and US offers to Germany, aided by an upward movement in freight charges.

North America

The growth momentum of the US ethylene market remained uncertain amid a slowdown in economic growth compared to previous quarters. Amid the speculations of reduced interests of the downstream industries and constrained spending of the consumers, the region also did not witness any new capacity additions. These bleak sentiments of the production community were further fueled by the rising stockpiles of the product in the region.

However, in the initial phase of the quarter, ethylene prices surged due to eased inventory pressure and increased consumer confidence post-Christmas retailing. But as the quarter progressed, the outlook of the market changed drastically. With the rise in the cost of production, influenced by the rise in prices of crude oil and feedstock materials, the profit margin of the traders and manufacturers began to decline, leading to the dull positioning of the ethylene price trend.

Analyst Insight

According to Procurement Resource, the price trend of Ethylene is estimated to incline in the next quarter, particularly in the Asian and European countries, as the robust outlook of the downstream industries will favor the incline in its market momentum.

Ethylene Price Trend for the October - December of 2023

Asia

The ethylene market in the Asian region observed variations in prices throughout the fourth quarter of the year 2023. The Chinese market saw a gradual rise of around 3% in the ethylene market as the monthly average prices went from around 840 USD/MT (CIF) in October to about 869 USD/MT in December’23.

These rates in the Chinese market were driven by the rise in ethylene demands from the polyethylene and ethanol industries. However, the Indian ethylene market was more influenced by the existing oversupplied ethylene inventories. So, contrary to the Chinese market, prices here witnessed swift regression over the span of three months. In the Indian market, the monthly average rates fell from around 820 USD/MT (CIF) in October to about 803 USD/MT in December’23. Hence, the general market sentiments were largely mixed for the entire region.

Europe

The ethylene prices in the European market were observed to be declining for the majority of the given period in the European market. High feedstock prices also could not help sustain the market momentum because of the feeble demands from the downstream consumption industries. Though the price projections look positive for the region in the coming months, the market sentiments were observed to be tepid during this time.

North America

The American market sentiments were mixed but largely wavered at the lower side of the curve. With dull demands and industrial disturbances because of the supply chain and ocean freight issues, the ethylene price trend weakened around the discussed time span.

Analyst Insight

According to Procurement Resource, the Ethylene market prices are likely to remain volatile in the coming months, given the current economic scenario and various macroeconomic indicators.

Ethylene Price Trend for the July - September of 2023

Asia

The price trend for ethylene surged throughout the Asia-Pacific region during the given quarter due to the dramatic rise in the upstream cost pressures. The increase in the prices of feedstock naphtha affected the price graphs of ethylene greatly. The main reason behind the rise in the prices of crude oil and its allied products was the production cuts by OPEC+ and Russia.

OPEC+ decided to continue slashing output by a million barrels per day till the end of this year. Leading oil producers Saudia Arabia and Russia committed to cutting production and bringing down the global inventories as a precautionary effort to stabilize their economies and, thereby, the global oil market.

Further, the demand from the downstream polyethylene sectors remained dull. Hence, the required momentum was provided by the feedstock costs rather than the downstream demands. Ethylene prices went from around 760 USD/MT (CIF, China) in July’23 to around 825 USD/MT (CIF, China) in September’23 in the Chinese domestic market.

Europe

The European markets registered mixed price sentiments for ethylene during the said period. Initially, considering the grim economic scenario and constricted purchasing capacities, the price graph for ethylene faced downwards during the first half of Q3’23. However, with the announcement of production cuts by OPEC+ and Russia, the upstream cost pressure increased. The high feedstock naphtha prices led to the rise in the ethylene price trend towards the end of the third quarter.

North America

The North American market almost mimicked the price trend seen in its European counterpart. Given the rising inflation and hiked interest rates, the demand from the consumption sectors declined. However, towards the end of the quarter, the rise in feedstock naphtha prices, along with some maintenance shutdowns, greatly affected the available inventories, thereby causing the ethylene price graph to rise.

Analyst Insight

According to Procurement Resource, the price trend for Ethylene are likely to remain inclined in the coming quarter, given the current production cuts by the leading oil producers and the global demands.

Ethylene Price Trend for the First Half of 2023

Asia

The price trend for Ethylene inclined in the Chinese domestic market during the initial months of the first quarter. After a long halt during the Lunar New Year holidays, the traders looked forward to stocking the product, which drove the demand for Ethylene. The end-stream polyethylene glycol sector also performed strongly, and the price trend for Ethylene inclined in the market. However, the prices declined towards the end of the first quarter as the production plants caught up with the inclining demand.

The production rates of Ethylene at one point surpassed the demand, and as a result, the inventories began to stockpile. With ample supply and weak demand from the downstream industries, the prices of Ethylene settled around 6263 RMB/MT in June’23 in the Chinese domestic market.

Europe

In the initial phase of 2023, the prices of Ethylene were stable in Europe, with a strong and consistent demand from the polyethylene sector and a strong supply of products to satisfy that demand. The rising feedstock prices led to the increase in the cost of production in addition to the high purchasing aptitude of buyers to replenish their stocks after a long tail of holidays. However, towards the end of the first quarter, the price trend of Ethylene began to decline gradually, and this trend was well followed till the end of the second quarter.

The main cause of this shift in sentiments was attributed to the drop in energy production costs, the poor performance of downstream industries, and a limited number of inquiries from the domestic and international markets.

North America

In North America, the price trend for Ethylene in the first two quarters of 2023 were adversely affected by the weak market sentiments of the polyethylene and glycol sectors. The prices were negatively impacted by the holiday season in the first quarter, so the overall market activities in the region slowed down. However, towards the end of the first quarter, the market gained momentum, and the prices began to incline. The performance of downstream industries also improved, and the demand from the end-user sector rose, leading to a surge in the prices of Ethylene.

Analyst Insight

According to Procurement Resource, the price trend for Ethylene are estimated to showcase a mixed sentiment in the coming months. The polyethylene glycol and glycol sector are expected to improve in the upcoming months, which will influence the demand and, in turn, the price trend trajectory of Ethylene.

Ethylene Price Trend for the Second Half of 2022

Asia

The demand for ethylene from the downstream industries was weak in the second half of 2022. The prices also suffered from the surplus supply of the product and rising covid cases. The production, trading, and operation sectors were thus negatively impacted and with the introduction of other market players offering cheaper options in the region, the price trend for ethylene declined in the Asia-Pacific region.

Europe

Polyethylene and glycol industries lost their momentum amid the rising inflation rates and high cost of production leading to a sluggish trend in the prices of ethylene. Along with this, the pressure from the ripple effects of the Russia-Ukraine war, fear of recession, and cheap imports from the Asia-Pacific region further aided the declining trajectory of ethylene prices.

North America

The downward trend in the prices of ethylene in the second half was majorly due to the rise in inventories and weak demand from the downstream sector in the North American region. The polyethylene and glycol chains were also disrupted by the growing recession which was also a major cause of increasing energy and natural gas rates. The stockpiling of the commodity along with uncertainties in the end-user market led to the decline in the prices of ethylene.

Analyst Insight

According to Procurement Resource, the price trend for ethylene are expected to suffer from sluggish demand, availability of cheaper imports, and rising global inflation in the upcoming quarter.

For the Second Quarter of 2022

Asia

During the said quarter, ethylene prices fell across the Asian market. Due to the increased volatility in the crude oil prices, the petrochemicals industry suffered. The Asian petrochemical market dwindled amid the recession fears, tightened supply, and lower market sentiment.

After the upliftment of covid-19 restrictions, the Chinese traders expected a turnaround in the market demand; however, no simultaneous rise occurred. The wait-and-see attitude from the downstream plastic makers and vast stockpiles of products in the market resulted in lower prices of ethylene.

The profit margins from producing Ethylene from naphtha dropped to 130 USD/MT from 450 USD in April 2022. Per ton price of ethylene averaged 1166-1176 USD CFR Northeast Asia and 1216-1226 USD CFR Southeast Asia in this quarter.

Europe

In line with the Asian counterpart, ethylene prices fell across the European domestic arena. Due to the European embargo on Russian oil, the market's watchful attitude caused the prices to fluctuate. The price averaged 1759-1768 USD/MT FD Northwest Europe and 1216-1226 USD/MT in the domestic market.

North America

The price of petrochemicals is highly dependent on the price of oil and allied products. Hence, the US domestic market followed similar global price trend for ethylene. High costs of inputs, tightened supply, and contractionary monetary policy by governments worldwide heightened the odds of recession which further caused the prices for petrochemicals to decline. The price of ethylene averaged FD 25.25 cents/lb in the said quarter.

Analyst Insight

According to Procurement Resource, ethylene prices are expected to stabilize with timely intervals of fluctuations, given the supply-demand dynamics. Currently, the upstream naphtha prices and the market sentiment are low, leading to lower prices. This environment will likely continue in the upcoming quarter, given that the other fundamentals remain healthy.

For the First Quarter of 2022

Asia

CFR Northeast Asia and Southeast Asia ethylene prices were 1346-1356 USD/MT and 1346-1356 USD/MT, respectively in March.

Europe

In Europe, the chemical was priced in the range of 1785-1794 USD/MT, down 5 USD/MT, while CIF northwest Europe price was 1540 USD/MT, up 5 USD/MT in the third week of March. The international crude oil futures price increased dramatically.

North America

On March 23, the market price was 625-642 USD/MT in the US ethylene market, down 24 USD/MT. The ethylene market in the United States has recently risen, demand has been widespread, and the price of international crude oil futures has risen dramatically.

The breakdown of the Caspian oil pipeline between Russia and Kazakhstan through OPC, which heightened fears of short-term supply tensions, was the main reason for this. On March 23, the main contract of WTI crude oil futures in the United States settled at 114.93 USD/barrel, up 5.66 USD or 5.2%. The main contract of Brent crude oil futures settled at 117.75 USD/barrel, up 5.29%.

For the Fourth Quarter of 2021

North America

After reaching an annual high of approximately 1250-1300 USD/MT in Q2 during the post-deep freeze period, when many refineries were forced to shut down or declare force majeure, spot prices reached 55% of the Q2 peak and settled at 765 USD/MT FOB Houston in the final weeks of December FY21. For the majority of Q4, the decline in natural gas prices contributed significantly to the decline in ethylene pricing.

Refineries reduced production from Q3 levels as active restocking and rerouting of shipments from Asia to Europe following the harsh frost created a surplus of C2 in the domestic markets entering Q4. Thus, supply exceeded demand throughout the most of the last quarter of 2021, adding to the downward pressure on pricing.

Asia

Asian ethylene market prognosis for Q4 FY21 was described as volatile for the most part, since the far east Asian market had a price spike in October, owing mostly to the region's import dominance. The average price for China in Q4 was estimated to be 1120 USD/MT on a CFR Shanghai basis. South-East Asia, too, had a similar pattern. The Middle East, on the other hand, had a steadier market for ethylene, with an average price of 1075 USD/MT FOB in Q4. Feedstock naphtha costs were also significantly higher in Q4 of FY21 compared to Q3 of FY21. India's ethylene prices, ex-JNPT, were roughly INR 81500 in Q4, a 13% increase over Q3 prices.

Europe

During the early half of Q4 FY21, the European market was harmed by supply-side limitations and rising freight costs. Imports from North America were quoted higher than the previous quarter, with average prices in North-West Europe evaluated at 1355 USD/MT FD Hamburg, a 10 USD/MT increase over the previous quarter. Demand from downstream polymers sectors such as polyethylene and polyvinyl chloride increased somewhat in Q4 compared to Q3, however demand from the majority of end user industries dwindled in December.

For First, Second and Third Quarters of 2021

North America

North America failed to meet the increased demand in Q1 2021, as some production facilities were forced to shut down due to force majeure and unscheduled shutdowns. The region experienced volatility in the pricing in second quarter, owing to fluctuating upstream crude prices and uncertain worldwide demand.

Economic revival resulted in a surge in demand for downstream polymers in the United States of America. While supply of downstream goods remained scarce due to limited plant operations, ethylene prices continued to rise throughout the quarter. Demand was stable until the end of the quarter.

In Q3 2021, ethylene prices in the United States of America began to decline after reaching record highs the previous quarter, aided by abundant supplies of the commodity as factories functioned at peak efficiency. Prices increased dramatically in mid-July across Texas and Louisiana, owing to the unanticipated disruptions.

In August, despite the Gulf Coast's climatic disaster, prices stabilized as a result of manufacturing plants restarting with little or no delay following the Ida Hurricane's aftermath. Thus, from July through September, FOB-US ethylene prices ranged between 1025 USD/MT and 910 USD/MT. Increased demand from downstream industries was expected to drive the prices higher in the coming months.

Asia

The Asian market faced high demand for ethylene and its derivatives from downstream industries, which boosted its prices considerably. In China, demand soared unexpectedly during the lunar holidays, but constrained supply pushed prices higher. Due to increased demand from downstream product producers, a lack of supply increased the prices across the area.

In India, supply constraints in January and February boosted prices to 854 USD/MT, before falling to 828 USD/MT in March as supply activities improved. Several price swings occurred in the Asian market during the second quarter. In India, ethylene prices continued to be driven by demand-supply imbalances, pandemic revival, upstream crude pricing, and import-export activity. Thus, during the first week of June, ethylene prices in China and India were 690 USD/MT and 843.2 USD/MT, respectively.

In the third quarter, the Asian market experienced an exponential increase in the price of ethylene, fueled by an unprecedented increase in the price of the feedstock naphtha. Additionally, the Ida storm in the United States disrupted supply chains, resulting in the region's feedstock naphtha being unavailable.

In India, tighter supply resulted in product shortages on the domestic market, which contributed to the inflation of prices during this era. Thus, Ex Mumbai ethylene prices were estimated at 1022.59 USD/MT in India, following a 130.78 USD/MT increase between July and September.

Europe

The price trend in Europe as a whole stayed upward, owing to high demand and limited product availability. Downstream polymer prices continued to rise during this period due to insufficient spot supply in the face of stable to strong downstream end user demand. However, prices continued to fluctuate in response to shifting crude oil prices in the worldwide market, while the general forecast in the European market remained favorable throughout the quarter.

In Q3 2021, the European market for ethylene saw diverse attitudes across the area. Between July and August, a little increase in its price was noted, owing to the product's restricted availability and greater logistic expenses. However, in the second part of the quarter, the prices declined as a result of diminished consumer spending power and abundant supply in the region. FR Hamburg prices increased to 1002 USD/MT in August, indicating a minor increase of 4 USD/MT from July, followed by a 37 USD/MT fall in September.

South America

After Braskem cut operating rates at all of its naphtha and gas crackers in July, Brazil's ethylene inventory was more balanced, and polyethylene sales were lower than planned in August. In July, Braskem exported 15000 MT of the chemical cargo from Trinfo in Rio Grande do Sul, with 9000 MT going to China for 921 USD/MT FOB and 6000 MT going to the Netherlands for 1004 USD/MT FOB.

For the Year 2020

North America

Hurricane Laura disrupted ethylene cracker plants, resulting in lower average production. Despite lower demand and lower ethane prices in September, the prices were higher than natural gas due to market predictions of ongoing consumption growth and a rise in exports at the end of the year. Through September, spot ethylene prices in Mont Belvieu, Texas (the main US HGL hub) averaged 2.99 USD/MMBtu, a 1.07 USD premium over natural gas spot prices at Henry Hub, which averaged 1.92 USD/MMBtu.

Asia

The market was subdued to low when the third quarter began, owing to abundant supply and consistent demand. Ethylene prices fell sharply in the first half of the quarter, with July and August bids bidding about 750-800 USD/MT CFR Northeast Asia. However, as a result of many big manufacturers temporarily ceasing operations at the end of the third quarter to balance their inventory levels, supply began to tighten.

ExxonMobil, headquartered in Singapore, shut down its 1 million tpy cracker in mid-September until the end of October for long-overdue maintenance. Buyers in Southeast Asia preferred deep-sea and Middle Eastern origin cargoes to alleviate supply chain constraints. On the demand side, spot demand was strengthened by better PE operations in anticipation of a recovery of demand during numerous Asian nations' peak season.

Europe

In 2020, the price in Europe was 30% lower that is significant compared to 2019. During the same year, less significant declines were reported in the United States of America and the Middle East, 11.4% and 15 %, respectively. The global picture for 2020 sent a clear message that Europe continues to lag behind the United States and the Middle East in terms of competitiveness.

In 2020, Europe had the highest cash cost of the chemical .European margins, which topped 600 USD/MT at the end of 2020, were expected to remain steady in Q1 2021 and then decline to 300 USD/MT by the middle of the year. To take advantage of the strong margins, Western European output increased in 2020 compared to 2019, a trend that was anticipated to continue into 2021 barring unexpected disruptions.

Procurement Resource provides latest prices of Ethylene. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About

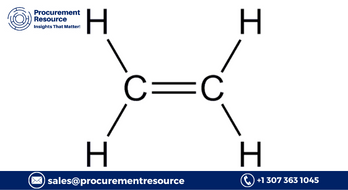

Ethylene appears as a colourless gas with a sweet odour and taste. It is lighter than air. It is the simplest alkene and flammable in nature. It is extensively used in the industrial sector to produce polyethylene, a widely used plastic having polymer chains of ethylene units. It can also be hydrated to produce ethanol.

Product Details

| Report Features | Details |

| Product Name | Ethylene |

| Industrial Uses | Polymerisation, Oxidation, Intermediates, Halogenation and hydrohalogenation, Manufacturing, Plasticisers, Hydration and oligomerisation, Processing aid, specific to petroleum production |

| Chemical Formula | C2H4 |

| Synonyms | 74-85-1, Ethene, Green ethylene |

| Molecular Weight | 28.05 g/mol |

| Supplier Database | Saudi Basic Industries Corporation (SABIC), Dow Chemical Company, LyondellBasell Industries Holdings B.V., INEOS Capital Limited, Chevron Phillips Chemical Company LLC |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Production Process

- Production of Ethylene via Steam Cracking Process

In this process, ethane is used as a feedstock and is heated at a temperature ranging from 750 to 950 °C with steam. This results in the conversion of large and complex hydrocarbons into smaller ones and further causes unsaturation, which finally produces Ethylene.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Related News

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 1203185500

UNITED KINGDOM

Phone: +44 7537 132103

Email: sales@procurementresource.com

.webp)

.webp)

.webp)