Dow Chemicals Is Looking To Close The Propylene Oxide In Some Of The European Locations

Smaller Locations in Europe Will Potentially Be Part of Dow Shutdown Plans

On Thursday, the US-based chemicals major's CEO stated that Dow plans on cutting costs via headcount reduction and closing down certain assets likely to hit operations of small scale in its European portfolio amidst a broader global movement.

More details of the plans were announced by the company to actuate USD 1 billion in cost savings through 2023, with USD 500 million in gains before interest, tax, depreciation and amortisation (EBITDA) likely to be pushed through a 2,000-person headcount drop, certain shutdowns and improvements in the process.

Request Access For Regular Price Update of Propylene Oxide

The company is set on saving an extra USD 500 million by lowering the expenditure on turnaround, decreasing purchases of raw materials, as well as relieving some spending.

To prioritise business operations towards more cost or growth-advantaged markets as a consequence of changing energy cost landscape witnessed since the beginning of the Ukraine war, the measures for cost-cutting will likely get rid of about 6% of the company's workforce worldwide.

As per the CEO Jim Fitterling, these measures will not be solely concentrated on Europe; however, the region's changing dynamics as governments had a hard time adapting to the loss of the majority of cheap Russian gas that fueled the continent was the main factor in Dow's monetary results previous year.

He said approximately 60% of the almost USD 3 billion drop in 2022 company profits before interest and taxes (EBIT), to USD 6.59 billion, was linked to the pricing of energy in Europe and the cooling effect it had on demand.

The circumstances enhanced in the fourth quarter on the back of a warmer winter and the region's inventory conditions being more favourable; however, long-term competitiveness continues to be a problem.

Fitterling referring to an investor call on Thursday stated that they've done an admirable job, particularly in Germany, swaying away from Russia's natural gas to other sources. Though they still have to refer to the long-term energy policies and work with governments s well as member states of the EU on energy policies because they are far away from Europe's long-term competitiveness.

Smaller Investments In The Perimeter

As per Fitterling, no precise sites or locations were publicly earmarked for closure, with better transparency anticipated prior to the quarter's end; however, the decisions made are under the process of being worked through so far, primarily falling on smaller European assets.

Dow has major integrated cracker operations in, Tarragona, Netherlands, Spain, Terneuzen, and Bohlen, Germany and also in Schkopau and Stade in the nation. The company also has operations in smaller sites like Barry, UK, and Leuna, Germany.

Even the bigger integrated complexes include units that are witnessing more challenged economics. In September 2022, Trinseo declared its plans to shut down its Bohlen styrene plant, that have possible implications for benzene operations at Dow's site.

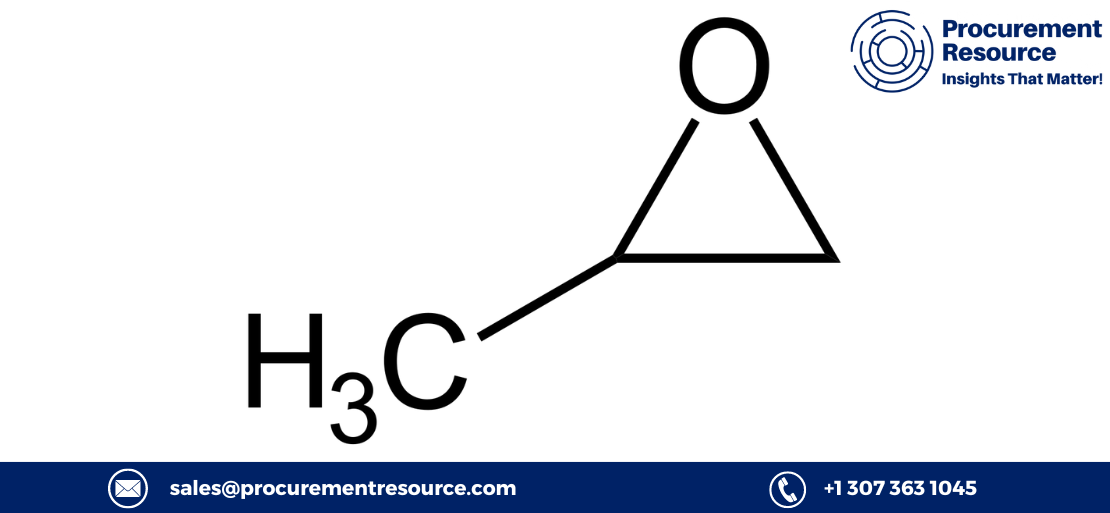

The propylene oxide operations of Stade also use older chlorohydrin technology, which is not as economical compared to the process technologies employed at the more recent production units.

The emphasis on unit closure plans will likely struggle to stay competitive despite the price movements of energy, as per Fitterling.

He stated that the decisions declared today around restructuring were made after looking at locations that will be contested in any scenario and taking action on those.

The company focused less on its bigger operations, in spite of the European cracker operation's economic standing as not as competitive in comparison to lower-cost North American units. Still, conversations are continuing with the governments in Europe regarding improvements in the site's long-term economics.

Fitterling stated that on big sites like their cracker sites, they are still capable of running cashflow positive, and they are working on the energy situation. So, they will keep continuing analysing that throughout the year and notice what type of work they can carry out along with the governments in order to make them more competitive in the longer run.

Read More About Propylene Oxide Production Cost Reports - REQUEST FREE SAMPLE COPY IN PDF

The plans for headcount reduction are not solely concentrated on Europe, but the region's conditions are a significant part of the movement's impetus.

The decisions regarding the site and assets made up until now are smaller-scale locations where they will presumably be challenged through the year. That list is yet to be released as they are working through that with the European works councils, but they will accomplish that by nearing the quarter end.

As per the following Procurement Resource article, it can be summarised that Dow plans on cutting costs via headcount reduction and closing down certain assets likely to hit operations of a small scale in its European portfolio amidst a broader global movement.

.webp)

-(1).webp)