Product

Anisole Price Trend and Forecast

Anisole Price Trend and Forecast

Anisole Regional Price Overview

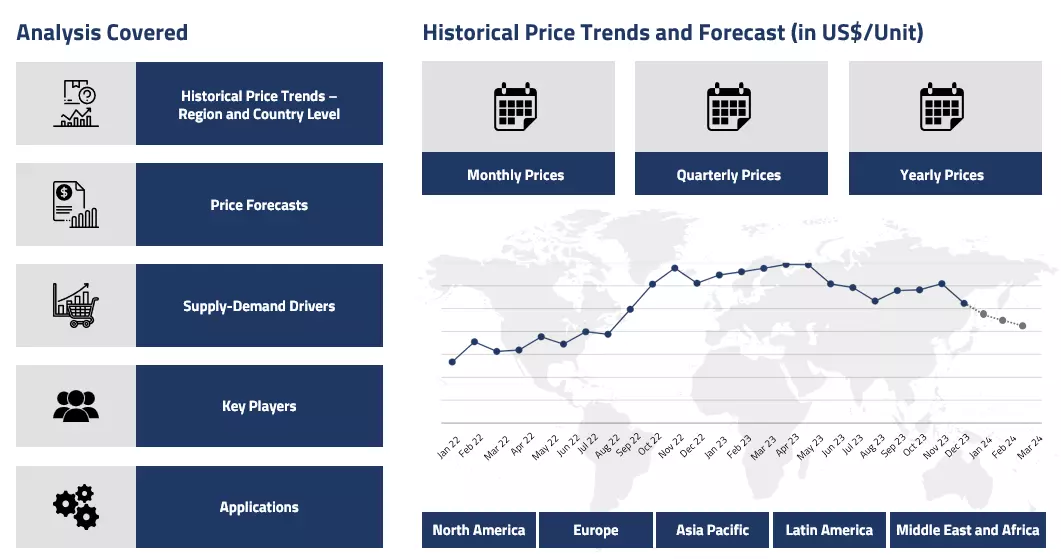

Get the latest insights on price movement and trend analysis of Anisole in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Anisole Price Trend for the Q4 of 2024

Asia

The Asian Anisole market followed a consistent downward trajectory in the fourth quarter. China's strict export restrictions remained a dominant factor, leading to significant domestic oversupply. Despite high production rates at manufacturing facilities, demand stayed weak, causing substantial inventory accumulation.

Anisole Price Chart

Please Login or Subscribe to Access the Anisole Price Chart Data

The government's continued export limitations created a notable supply-demand mismatch in the local market. Indian markets echoed this bearish trend, marked by post-festive season slowdown and weak agrochemical sector demand. Plant shutdowns for maintenance were implemented by several firms to address the supply-demand imbalance, yet prices continued to decline.

Europe

European Anisole markets saw price depreciation throughout Q4. The trend was influenced by falling feedstock costs and subdued downstream demand. Market participants maintained cautious buying patterns, keeping their inventory levels minimal. The overall chemical sector weakness in the region, combined with sufficient availability and competition from Asian markets, contributed to the downward price movement.

North America

The North American market exhibited similar bearish trends during Q4. Prices decreased due to weak demand fundamentals and comfortable inventory positions. The ongoing construction sector slowdown continued to impact the broader chemical industry, affecting Anisole consumption. Manufacturers adjusted their operating rates to manage the oversupply situation, but this did little to support prices.

Analyst Insight

According to Procurement Resource, the Anisole market is expected to see minor fluctuations in early 2025, with potential policy changes in China's export restrictions not anticipated until at least the second quarter. The current bearish trend is likely to persist until a significant improvement in downstream demand materializes.

Anisole Price Trend for the Q3 of 2024

Asia

The prices of anisole incline during the first two months of the said quarter in the Asian domestic market. The strong demand from the downstream perfume and dyes industry amidst supply shortages kept the prices of anisole on an inclining trajectory.

The price of feedstock phenol kept strong which added to the overall pricing dynamics of anisole. However, the prices started declining in September and long-term supply shortages caused the buyers to adopt wait-and-see attitude which coupled with falling prices of phenol pushed the anisole prices towards the lower end of the scale.

Europe

The European anisole market initially experienced an upward price trend, propelled by strong demand from the perfume and dye industries. Supply constraints coupled with rising feedstock phenol prices further bolstered this increase. However, the market later shifted, with prices declining as buyers became more cautious due to persistent supply uncertainties. The subsequent drop in phenol prices also contributed to the downward pressure on anisole prices in the latter part of the period.

North America

Anisole prices in the US domestic market mirrored global trends, starting with an uptick driven by high downstream sector demand and limited availability. As market conditions evolved, a price downturn emerged. This reversal was influenced by a combination of factors, including weak consumer confidence, gradual easing of supply constraints, and a softening in feedstock phenol costs. Consequently, anisole prices trended lower towards the end of the discussed period.

Analyst Insight

According to Procurement Resource, the price of Anisole is likely to remain oscillating in the coming months given the current market conditions and volatilities in the global economy.

Anisole Price Trend for the Q2 of 2024

Asia

The pricing outlook for anisole for the second quarter of 2024 was built on its performance in the previous quarter. In the Asian markets, anisole gave a pretty average performance in the first quarter and the dynamic did not offer much change this time around as well. There were both upward and downward movements seen in the price trend during the period as well. However, the magnitude largely remained range-bound.

The prices were found wavering within closed limits for the most part. Primarily it was the fluctuations in feedstock phenol and methanol markets that drove the prices for anisole in the Indian and Chinese markets since the downstream demands from chemical and polymer industries were very regular. Indian crude oil imports were constantly rising not just because of domestic consumption but because of the export opportunities as well. This influx of oil at negotiated rates took away some upstream cost pressure from the whole petrochemical sector.

Europe

Steadiness in the Asian anisole markets was being mirrored in the European markets as well. Along with the continuation of the Russia and Ukraine war, the tensions in the Middle East were also persistent. However, the armed confrontation between Israel and Iran did not heat up as per prior expectations.

This saved the associated markets, especially the petrochemical markets, from any severe deviation. In the OPEC meeting in June, the member countries discussed extending voluntary oil production cuts further to stabilize the global oil economy. Overall, the anisole market exuded borderline stability in the European markets during the second quarter of the year 2024.

North America

The story of the American anisole market was not much different from the Asian or European markets during the said period. The anisole prices were found to be wavering in the American markets as well throughout Q2’24. The market drivers were pushing the prices in both upward and downward directions; therefore, with occasional ups and downs, the prices remained tugged for the most part. The anticipated delays in the interest rate cuts also kept the commodity prices anchored in the US markets. Overall, mixed market sentiments were witnessed in Q2’24.

Analyst Insight

According to Procurement Resource, given the current supply and demand scenario, the Anisole prices are expected to remain fluctuating in the coming months as well.

Anisole Price Trend for the Q1 of 2024

| Product | Category | Region | Price | Time Period |

| Anisole | Flavours and Fragrances | Europe | USD 5500/MT | March 2024 |

Stay updated with the latest Anisole prices, historical data, and tailored regional analysis

Asia

Anisole gave an above average performance in the Asian markets during the first quarter of 2024. The Chinese market was more consistent than the Indian market, as the price trajectory was more uniformly inclined here. This price performance was heavily influenced by the market run of feedstock materials phenol and methanol. As these feedstock markets heated up, the anisole prices also caught on, driven by the rising upstream costs.

These chemical markets were primarily guided by the global incline in energy and crude oil markets as OPEC+ raised prices amidst ongoing chaos in Europe and the Middle East. Russia and Iraq, two prominent members of OPEC+, faced some output decline, which eventually reflected in the whole petrochemical industry. Overall, mixed market sentiments were observed.

Europe

The European anisole market resembled the Asian market during the said time period as the prices showed slight increments here as well. After Ukraine attacked some Russian oil refineries, it affected the region’s energy infrastructure significantly. Russian oil output dipped by about 7% as the operations got disturbed.

The downstream demands were still humble, and the inventories were also able to cater to these demands; however, a rise in the production costs pushed up the prices. The geopolitical turbulences across the globe had a role to play in disturbing the global trade dynamics. Freight challenges in the Red Sea have also impacted the market, with Middle Eastern producers facing logistical challenges.

North America

The anisole’s price trajectory in the American market reflected similarities with its Asian and European counterparts. The global surge in crude oil and energy prices pushed the price graph upwards here, while the modest demand patterns from the downstream chemical and fertilizer industries kept pushing the price graph downwards. Regional armed conflicts with Russian and Israeli wars were also reflecting poorly on the American economic machinery. Tugged between these high production costs and dull demands, anisole witnessed a varying trajectory in the American domestic market.

Analyst Insight

According to Procurement Resource, Anisole price trends are likely to continue varying in the coming months as well. Given the current macroeconomic indicators, trade sentiments will be further affected globally.

Anisole Price Trend for the October - December of 2023

Asia

The Asian anisole market exhibited variations in price patterns during the last quarter of the year 2023. Stocked-up inventories played a big part in determining anisole price trend for the said duration. Since the existing stocks were well capable of catering to the downstream demands, the prices took a downward hit. Other than this, the biggest influence on the anisole price trend is held by its feedstock materials, methanol and phenol, both of which gave an underwhelming performance at the price scale during the concerned time period.

The demands from the food and beverage industry still kept the Chinese anisole market afloat. However, the Indian anisole market’s performance was even more disappointing. The narrow gap between the supply and demand dynamics influenced the price trend in the Asian anisole market. The prices were found to be wavering throughout the three-month span of Q4’23. Overall, mixed market sentiments were observed.

Europe

The European anisole market almost replicated the Asian trend for Anisole. Regular demands from the chemical, agrochemical, and pharma sectors kept the European anisole market moving forward. Due to the global supply chain restrictions, there were some irregularities on the supply front. However, the general market trend were buoyant throughout the entire span of q4’23.

North America

In the USA Anisole market, the situation was a little better. The feedstock side provided substantial cost support as the market was high for the anisole raw material phenol. However, since the anisole demands were under control, the market could not perform that freely. Overall, blended market trend were witnessed.

Analyst Insight

According to Procurement Resource, given the current inventory situation, Anisole price trend are likely to waver accordingly in the near future.

Anisole Price Trend for the July - September of 2023

Asia

Anisole experienced a disappointing journey throughout the discussed period. Anisole is fundamentally used in the chemical and polymer industries, and both registered feeble demands for anisole throughout the entire time period. The industries in China have been struggling to stand again since the pandemic restrictions, but the great inflation after 2022’s Russian invasion of Ukraine pushed the production rates downhill.

The subsiding crude oil costs also alleviated the upstream cost pressure, further reducing the price potential for anisole. The rise in economic inflation globally challenged consumer sentiments a lot, and the various downstream industries also struggled to maintain production and prices without incurring any losses. As a result, the international queries also diminished for Chinese suppliers. With feeble demands from both domestic and international markets, the product prices wavered at the lower end of the anisole price graph.

Europe

The European market behavior for anisole was not much different from the Asian anisole markets. The price index kept inching lower and lower for the entire span of three months. Various factors contributed to such a disappointing price graph. The dependence on Chinese exports and the reduction in domestic utilization of anisole all strangled the European regional prices for anisole. Overall, muted market sentiments were observed for anisole throughout the said period.

North America

The North American anisole market could not behave any differently from the other global markets, as the price sentiments were suffering here too. The dull demands initially kept the market downward, tottering for the majority of the discussed period. Some reverse fluctuations were observed at the very end of the third quarter, but general market sentiment remained cold.

Analyst Insight

According to Procurement Resource, not much change is anticipated in the price trajectory of anisole going forward. The market is likely to remain afloat in the coming months.

Anisole Price Trend for the First Half of 2023

Asia

A declining trajectory in the price trend of anisole was observed in the first two quarters of 2023. The market was influenced by the high level of inventories and weak demand from agrochemicals, fragrances, and other related industries. In addition, the dynamics of the domestic market in the first two quarters were also weak, and the onset of the Lunar holidays in China region restricted the supply chains, which had a cumulative effect in declining the prices of anisole.

Europe

The market trend observed in the Asia Pacific region was mirrored in Europe. The prices of anisole here also faced the challenges raised by a rise in inventory levels and weak performance of the downstream industries. Due to this, the manufacturers had to cut their production rates, and with the slow demand from the domestic and overseas industries, the trend of anisole nosedived in the European region.

North America

The North American market was also not much different from the European and Asia Pacific region. The prices of anisole here also suffered from the slow demand from the dyes and pesticide industries. The market activities in the domestic region improved slowly after the holiday season, but the reduction in offtakes and a number of inquiries, along with feeble industrial movements, led to the weakening of the market for anisole.

Analyst Insight

According to Procurement Resource, the price trend for anisole are expected to remain unsettled in the coming quarter. The demand from the downstream sectors and the rising inventory levels will likely impact the anisole market.

Procurement Resource provides latest prices of Anisole. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Anisole

Anisole is an aromatic organic compound with chemical formula C7H8O that has a nice and pleasant odor. It is frequently employed as a solvent in numerous industrial processes, as a flavoring and aroma component in cosmetics and culinary items, and as a chemical synthesis intermediate. Additionally, it can operate as a monomer in polymerization processes. Agrochemicals and pharmaceuticals also use anisole as a raw material.

Anisole Product Details

| Report Features | Details |

| Product Name | Anisole |

| Chemical Formula | C7H8O |

| Industrial Uses | Solvent, Laboratory reagent, Organic synthesis, Pesticide and insecticide, Polymers |

| HS Code | 29093090 |

| CAS Number | 100-66-3 |

| Molecular Weight | 108.14 g/mol |

| Synonyms | Methoxybenzene, Methyl phenyl ether |

| Supplier Database | Solvay SA, Westman Chemicals Pvt Ltd, Benzo Chem Industries Pvt Ltd, Huaian Depon Chemical Co Ltd, Clean Science and Technology Private Limited |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Anisole Production Processes

Methanol and phenol are subjected to methylation via vapor phase technique. This process is carried out in alumina activated catalyst in fixed bed reactors.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com