Product

Copper Sulfate Price Trend and Forecast

Copper Sulfate Price Trend and Forecast

Copper Sulfate Regional Price Overview

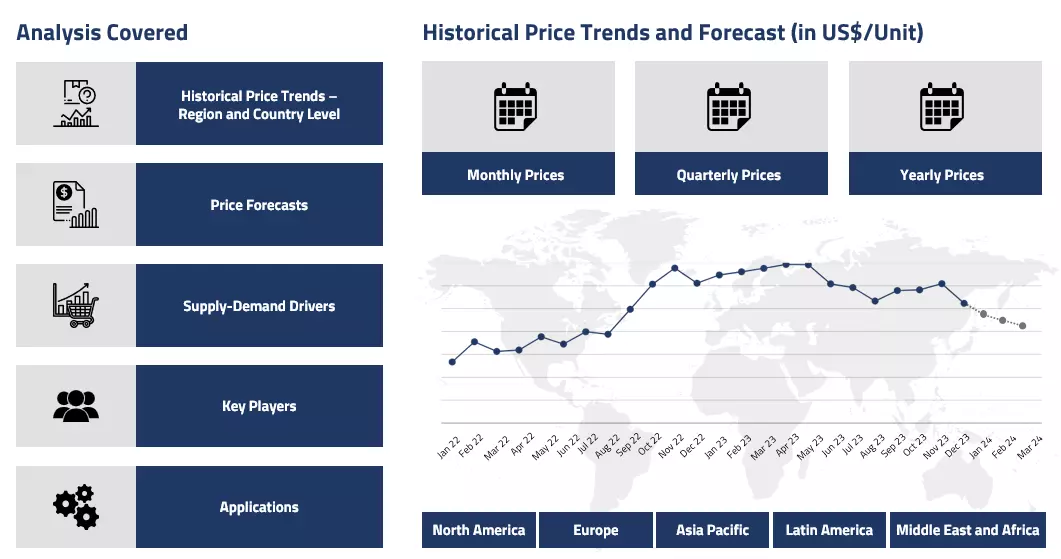

Get the latest insights on price movement and trend analysis of Copper Sulfate in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Copper Sulfate Price Trend for the Q4 of 2024

| Product | Category | Region | Price | Time Period |

| Copper Sulfate | Chemicals | USA | 2837 USD/MT | October'24 |

| Copper Sulfate | Chemicals | USA | 2825 USD/MT | November'24 |

Stay updated with the latest Copper Sulfate prices, historical data, and tailored regional analysis

Asia

The copper sulfate price graph in the Asian markets observed mixed trends during Q4 of 2024. In China, copper prices, a major feedstock for copper sulfate, initially continued to fall but later stabilized, exhibiting range-bound fluctuations. However, a decrease in downstream demand and slower destocking impacted the market's overall composition. Additionally, cold weather conditions weakened demand from the agricultural sector towards the end of the quarter.

Copper Sulfate Price Chart

Please Login or Subscribe to Access the Copper Sulfate Price Chart Data

Despite this, the region saw a gradual increase in sulfur prices throughout the period, which helped stabilize copper sulfate prices, providing some relief to manufacturers. Overall, mixed fluctuations in copper sulfate prices resulted from moderate demand patterns and fluctuating feedstock costs.

Europe

Asia and Europe experienced similar trends in copper sulfate pricing during the same period. In Europe, regional pricing was influenced by global feedstock prices, primarily imported from Asia. Initially, copper costs plummeted, followed by stabilization. However, localized copper sulfate prices continued on a wavering trajectory, impacting overall pricing. Additionally, ongoing sulfur price hikes increased cost pressures. Demand remained steady from the chemical and agricultural sectors, keeping price fluctuations within limited ranges. Overall, in Europe, the copper sulfate price graph mirrored trends seen in the Asian region, with price movements operating within established boundaries.

North America

North America saw a slight shift in copper sulfate prices compared to the previous quarter. Prices in the region began to decline gradually at the start of the quarter as demand weakened, while inventories remained steady. By the end of the quarter, prices stabilized, signaling a reversal due to higher demand, particularly from the agricultural sector. Copper sulfate prices were around 2837 USD/MT (CIF) in October and approximately 2825 USD/MT in November.

Analyst Insight

According to Procurement Resource, the prices of Copper Sulfate are expected to remain firm in the near future as similar demand patterns are anticipated, which will keep the prices steady. However, the rising prices of sulfur may affect the production costs.

Copper sulfate Price Trend for the Q3 of 2024

Asia

Copper sulfate prices generally mirror the price trends of its feedstocks, copper metal, and sulfuric acid. Influenced in a similar manner, copper sulfate prices fluctuated in the third quarter of 2024. Upstream factors were favorable, with rising sulfuric acid prices providing extra support for copper sulfate.

Demand from key industries, such as agrochemicals and electroplating, also remained strong during the quarter. As a result, the copper sulfate market maintained a generally positive outlook for the majority of the said period.

Europe

The European copper sulfate market mirrored global trends throughout the quarter. Supply chain disruptions and logistical challenges, which had kept the market constrained in the previous quarter, continued to affect the market. Demand from downstream sectors, including agrochemicals, fertilizers, and electroplating, remained average. Additionally, support from fluctuating feedstock prices was limited, causing copper sulfate prices were expected to waver. However, prices began to rise following the U.S. Federal Reserve's announcement of interest rate cuts, which were strongly supported by the increasing prices of copper metal.

North America

In the North American copper sulfate market, prices followed a fluctuating trajectory throughout the third quarter of 2024. Prices were mainly influenced by dramatic surges and declines in the copper metal industry. Additionally, regular demand from downstream sectors such as agrochemicals and fertilizers also drove the pricing sentiments.

In late September, copper metal prices benefitted from the U.S. Federal Reserve’s interest rate cuts. The Fed's decision to reduce rates by 50 basis points had a positive impact on copper prices, which rose to a two-month high on the same day. The rising prices of copper, both domestically and globally, positively affected the prices in downstream industries, including copper sulfate production.

Analyst Insight

According to Procurement Resource, the prices of copper sulfate are likely to remain volatile and may fluctuate to become strong in the coming times, depending on the prices of its feedstocks, especially copper metal, which are rising after the announcement of U.S. federal cuts.

Copper Sulfate Price Trend for the Q2 of 2024

| Product | Category | Region | Price | Time Period |

| Copper Sulfate | Chemicals | USA | 2810 USD/MT | April 2024 |

| Copper Sulfate | Chemicals | USA | 2900 USD/MT | May 2024 |

Stay updated with the latest Copper Sulfate prices, historical data, and tailored regional analysis

Asia

Copper sulfate prices are usually monitored by the oscillations in its feedstock markets, viz, copper metal and sulfuric acid. During the second quarter of the year 2024, copper sulfate prices were found to be fluctuating for the entire duration. The upstream factors kept the market-driven positively.

The feedstock prices were high, kept the production costs inclined, and also provided positive cost support to copper sulfate prices. On the other hand, the downstream demands were regular. As a result, the copper sulfate market remained buoyant in Asia throughout Q2’24, with largely positive market sentiments.

Europe

The European copper sulfate market also reflected the fluctuations of the global markets throughout Q2’24. Prices were majorly influenced by the upsurge in the copper markets worldwide. Along with this, the supply chain issues also played a huge role in determining the price momentum in European markets. Earlier, the supply chain curtailments kept the market supply deficient. However, as the supply penetration got better steadily, the local players started feeling a loss in competition. Overall, a varying price trajectory was witnessed for copper sulfate during the given duration.

North America

In the American copper sulfate market, an inclined price trajectory was observed for the second quarter of the year 2024. Within the first two months of the quarter, the monthly average prices moved from about 2810 USD/MT in April of 2024 (CIF) to around 2900 USD/MT (CIF) in May’24. These prices were heavily motivated by the dramatic surges in the copper metal industry in the States. Concurrently, the downstream agriculture and fertilizer industries were also showing positive support. After the dim winter season, the summer season again called for high fertilizer demands from the downstream agriculture sector.

Analyst Insight

According to Procurement Resource, not much change is anticipated in the Copper Sulfate price patterns going forward; the market sentiments are largely looking positive.

Copper Sulfate Price Trend for the Q1 of 2024

| Product | Category | Region | Price | Time Period |

| Copper Sulfate | Chemicals | USA | USD 2500/MT | March 2024 |

Stay updated with the latest Copper Sulfate prices, historical data, and tailored regional analysis

Asia

Copper sulfate prices follow a direct relation with the price trajectory of the feedstock copper and its oxides. During the said period of the first quarter of the year 2024 the copper sulfate gave a fine performance at the regional price index.

Copper prices surged to an 11-month high following announcements by Chinese smelters to address a decline in processing fees, potentially including production cuts. This led to a significant increase in electronic trading activity on the London Metal Exchange, breaking a period of stagnant trading.

Concerns about demand, particularly amid China's real estate crisis and global interest rate hikes, continue to weigh on the copper outlook. Owing to this the copper sulfate prices were observed surging for the entire period of the first three months of the said year. Overall, very positive market sentiments were witnessed.

Europe

The situation of the European copper sulfate market was not much different than the Asian market. Price surges in the Chinese copper sulfate industry were reflected in the European markets as well. The supply chain hurdles that the region has been facing since the onset of the Russia and Ukraine war have been affecting the supply outlook for copper sulfate as well.

Though because of dull demands the beginning of the price trend was a little tepid, the graph rebounded quickly as the consumption started supporting the market dynamics. The electronic market also saw an inclination in the later months as the end user spending finally started seeing some rise after battling severe inflation the previous year. Overall, a good market performance was observed.

North America

The copper sulfate trends were influenced by the fluctuations in the global copper sulfate markets, as the prices saw swift variations here as well. After a little rocky ride in the first half of the said quarter, the prices finally started picking up with the rise in upstream manufacturing costs. Feedstock copper prices started to surge as the LME noticed a rising trade. With this, the American markets also saw a rise in copper sulfate prices during the latter phase of Q1'24.

Analyst Insight

According to Procurement Resource, given the current supply and demand dynamics, the market projections for Copper Sulfate look positive for the coming months. Prices are expected to continue rising going forward.

Copper Sulfate Price Trend for the Second Half of 2023

Asia

The high number of imports in the Asian countries created ripples in the copper sulfate price trend, and eventually, the traders had to adjust their pricing patterns in accordance with the demand and overall market scenario. Another cause of the downfall of copper sulfate prices in the third quarter of 2023 was the exponential rise in the level of inventories and the slowing down of construction activities amid challenging economic conditions.

The fourth quarter, however, struggled with the dip in feedstock prices and rising market volatility. The influx of cheaper imports, particularly in India, eventually resulted in the downfall of the copper sulfate price trend.

Europe

In European countries, the agrochemical and fertilizer sector faced the ill consequences of the shift in sowing season due to adverse weather conditions and abrupt rainfall patterns. The demand from the other downstream industries, such as construction, also remained bleak throughout the third and fourth quarters of 2023, exerting a negative influence on the copper sulfate price trend. The cost of major raw materials such as sulfuric acid also nosedived during the aforementioned time, and along with the contraction in the consumer spending budgets, the price trend of copper sulfate slid downwards.

North America

The end-user industries of copper sulfate exhibited a bearish trend throughout the third and fourth quarters of 2023, which was well reflected in the trajectory of the copper sulfate price trend. The rise in annual inflation rates and volatility in consumer procurement rates eventually led to the downward movement of the copper sulfate price trend. However, the decline in copper sulfate prices was not steep in the fourth quarter as the supply and demand sectors achieved an equilibrium. However, the fluctuations in the production costs prevented the growth of copper sulfate prices.

Analyst Insight

According to Procurement Resource, the price trend of Copper Sulfate is expected to be based on the performance of the downstream industries and the price trajectory of its feedstock materials.

Copper Sulfate Price Trend for the First Half of 2023

Asia

The Asia-Pacific countries witnessed an upward trajectory in the prices of copper sulfate in the first quarter of 2023 as the demand and performance of downstream industries improved consistently.

The rates of production also returned to their normal levels after a long period of stagnancy with the help of rising interest from customers. However, in the second quarter, the market took a bearish turn with the rising level of inventories and reduced rates of procurement from the downstream industries. In the middle of the second quarter, the prices again gained momentum and surged with a rise in the number of inquiries.

Europe

In the first quarter, the European countries faced rising rates of inflation and poor demand from the end-user sectors. To keep the economy afloat, several banks adopted strict monetary policies to keep the market conditions afloat, which further hampered the growth of the copper sulfate market.

The fall in the prices continued in the second quarter, too, as in addition to the persistent challenges, low cost of energy production, insufficient demand, reduced manufacturing capacities, and poor performance of the agrochemical industries limited the purchasing potential of buyers, and thus, the price trend of copper sulfate faced southwards.

North America

The North American market of copper sulfate fluctuated in the first quarter of 2023 due to mixed demand sentiments, low-cost support from the upstream industries, and the high pressure of inflation and labor crisis in the region.

The second quarter was further affected by the rising banking crises, lower rates of offtakes, and weak performance of downstream agrochemical industries. In addition to this, the freight charges and cost of input energy declined significantly, thus pushing the price trend of copper sulfate in the negative direction.

Analyst Insight

According to Procurement Resource, the price trend of Copper Sulfate is expected to decline in the upcoming months as the downstream industries are estimated to perform weakly.

Copper Sulfate Price Trend for the Second Half of 2022

Asia

The prices of copper sulfate showed an overall downward trend with fluctuations in a very narrow spectrum during the second half of 2022. Sufficient supply but lesser demand contributed to the price trend of copper sulfate as enough fertilizers had been secured for the agricultural season. A little ease in crude oil prices after a long time also reduced the downstream production costs, thus the overall downward trend.

Europe

The price trend of copper sulfate in the European market remained bottom facing. Initially because of supply chain disruptions caused by the Russia - Ukraine war the manufacturing costs skyrocketed. And when the production costs returned to normal, the supply didn’t support. Low farming activities and overall low demand in the market resulted in plummeting copper sulfate prices in Europe.

North America

The copper sulfate price trend in the US replicated the international trend attributed to high supplies and low demands. Raw material costs, production costs and product requirements all stayed on the dipping side so the price trend also followed. Surplus uncalled products kept accumulating in inventories.

Analyst insight

According to Procurement Resource, the dip in copper sulfate prices seems almost like a universal trend which is very likely to remain so, attributed to the demand disruptions.

Copper II Sulfate Price Trend For the First Half of 2022

Asia

The outbreak of covid-19 disrupted the logistics and transportation across China, which resulted in the delay in shipments. These delays caused the feedstock prices to inflate, thereby affecting the price trend of copper sulfate. During the first quarter, copper sulfate prices soared owing to the strong demand from the downstream fertilizers industries.

The buyers began to hoard the product to prepare for the peak fertilizer demand season. However, the price trend declined during the second quarter owing to the renewed production after removing covid restrictions and muted market sentiment. The price of copper sulfate averaged 18800 RMB/MT in the Chinese domestic market.

Europe

The Russian invasion of Ukraine, which started during the last week of February, unleashed an economic backlash in the European region. The prices of fertilizers and important feedstocks witnessed an unprecedented rise. The price of copper sulfate surged during the first quarter due to the raised prices of feedstock copper and sulphuric acid.

However, the prices stabilized during the second quarter as the upstream costs relaxed and the market demand dwindled due to double-digit inflation. In the London Metal Exchange, the prices of feedstock copper went from 10,247 USD/MT in April to around 8245/MT in June 2022.

North America

The price trend of copper sulfate recorded an oscillating movement in the US domestic market during the first half of the said year. The prices surged in the first quarter owing to the raised feedstock prices and robust demand, whereas the prices declined during the second quarter due to the looming speculations of a global recession.

Procurement Resource provides latest prices of Copper Sulfate. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Copper Sulfate

Copper sulfate has a crystalline blue appearance with high solubility in water. It is widely used in agriculture industries as a fungicide and algaecide, as a preservative in wood industry and as a reagent in chemical manufacturing and analytical chemistry. It also finds applications in water treatment, textiles, and animal feed supplements, among other diverse applications.

Copper Sulfate Product Details

| Report Features | Details |

| Product Name | Copper Sulfate |

| Chemical formula | CuSO4 |

| Industrial Uses | Agriculture, Electroplating, Animal Feed Supplement, Water treatment, Printing and photography, Textile Industry |

| CAS Number | 7758-98-7 |

| Molecular weight | 159.609 g/mol |

| HS Code | 28332500 |

| Synonyms | Copper II Sulfate, Cupric Sulfate |

| Supplier Database | Allan Chemical Corporation, ATOTECH, NOAH Technologies Corporation and WEGO Chemical & Mineral Corp, Norkem NORDFEED, TODINI AND CO. S.P.A., Indian Platinum Private Limited, ARIHANT CHEMICAL INDUSTRIES, KGHM |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Copper Sulfate Production Processes

In this process, copper metal is treated with hot concentrated sulfuric acid to produce copper sulfate.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com