Product

Ethylene Oxide Price Trend and Forecast

Ethylene Oxide Price Trend and Forecast

Ethylene Oxide Regional Price Overview

Get the latest insights on price movement and trend analysis of Ethylene Oxide in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Ethylene Oxide Price Trend for the First Half of 2025

| Product | Category | Region | Price | Time Period |

| Ethylene Oxide | Chemicals | China | 913 USD/MT | May 2025 |

Stay updated with the latest Ethylene Oxide prices, historical data, and tailored regional analysis

Asia

During the first half of 2025, the ethylene oxide market in Asia, particularly in China and Japan, experienced mixed price movement. In Q1, prices in China saw a brief increase, supported by inventory drawdowns and temporary tightness in supply after the Lunar New Year holidays. Demand from key sectors like mono ethylene glycol (MEG), polyethylene terephthalate (PET), and glycol ethers remained steady, helping prices hold firm through February.

Ethylene Oxide Price Chart

Please Login or Subscribe to Access the Ethylene Oxide Price Chart Data

However, by Q2, the market weakened as inventory levels recovered and downstream demand slowed. Overproduction earlier in the year led to oversupply concerns, while buying interest remained cautious. Stable feedstock costs and limited new demand from textiles and automotive applications kept prices on a downward path through Q2, with regional market sentiment turning bearish. In the Chinese domestic market the prices settled at around 913 USD/MT (Spot FD) during May’25.

Europe

In Europe, ethylene oxide prices dropped steadily through H1’25. The decline was mainly driven by falling feedstock ethylene costs, which reduced production costs across the board. In Q1, despite a stable start and some uptick in demand from MEG and PET applications, the market soon softened due to weak economic activity in several European countries.

March brought sharper price corrections as logistics issues at major ports like Hamburg and Bremerhaven added to supply chain inefficiencies. In Q2, trader destocking activity and subdued industrial demand, especially in solvents and elastomers, continued to weigh on prices. Mixed downstream demand signals — with MEG slightly up but DEG down — created little incentive for price recovery. Overall, the region remained oversupplied, and weak fundamentals kept prices trending lower.

North America

North America saw a more dynamic ethylene oxide market in H1’25. Q1 began with steady pricing as producers entered the year with low inventories and anticipated maintenance turnarounds. A short-lived price surge in January and February resulted from tight supply expectations due to scheduled outages across ethylene and EO production units.

However, by March, declining feedstock ethylene prices and slower-than-expected demand from MEG and other derivatives led to a reversal in the price trend. Moving into Q2, the market saw increasing inventories and stable yet unspectacular downstream demand, particularly from the polyester, antifreeze, and paint sectors. Despite operational stability, buyers remained cautious, and the spot market turned weaker as sellers sought to reduce surplus stock.

Future Outlook

According to Procurement Resource, Ethylene Oxide prices are likely to remain under pressure globally unless there is a meaningful recovery in demand or supply becomes more constrained through extended maintenance or unplanned outages.

Ethylene Oxide Price Trend for Q4 of 2024

Asia

In Asia, especially China, the ethylene oxide market showed a gradual rise in prices during the early part of Q4’24. This was supported by increased feedstock costs and improving demand from downstream industries such as automotive and construction. The rebound followed earlier price drops in Q2 and suggested a recovery in market confidence.

However, the price growth was limited as players in the market were cautious due to expectations of new production capacities. In the latter part of the quarter, prices remained steady. Production increased as some plants came back online, and demand held up in areas like surfactants and ethanolamines. The market stayed balanced without major changes or disruptions as the year ended.

Europe

In Europe, the ethylene oxide market remained mostly stable in the beginning of Q4. Prices did not shift much, as supply and demand were fairly even. However, there was no strong push from downstream sectors like packaging and construction, which kept market activity low. As the quarter moved into November and December, the market started to weaken slightly. Sluggish demand and broader economic concerns, including inflation and political instability, added pressure. Even with some recovery in production and exports, the overall mood stayed cautious, and prices dipped toward the end of the quarter.

North America

In North America, ethylene oxide prices declined during the first half of Q4’24. Weaker demand from PET and automotive sectors, along with falling ethylene prices, led to a soft market. Natural events such as Hurricane Beryl and issues in ethane recovery further slowed down the market.

Despite stable supply levels, prices kept dropping. However, the situation improved in the second half. End-of-year buying activity picked up, and tighter supply conditions supported a price rebound. By December, market sentiment had turned more positive.

Analyst Insight

According to Procurement Resource, moving into early 2025, market players expect steady demand and stable pricing trends across key Ethylene oxide markets.

Ethylene Oxide Price Trend for Q3 of 2024

| Product | Category | Region | Price | Time Period |

| Ethylene Oxide | Chemicals | China | 936 USD/MT | July'24 |

| Ethylene Oxide | Chemicals | China | 972 USD/MT | September'24 |

Stay updated with the latest Ethylene Oxide prices, historical data, and tailored regional analysis

Asia

The prices of ethylene oxide showed an inclining trend in the Asian markets during the third quarter of 2024. Regional incline in the upstream costs pushed the ethylene oxide prices up in the Asian markets. The average spot prices of ethylene oxide in the Chinese markets were approximately 936 USD/MT in July, which rose by approximately 4% to around 972 USD/MT in September of 2024. This appreciation in ethylene oxide prices was also attributed to a desirably positive response from the downstream chemical and disinfecting industries which are the primary consumers of ethylene oxide.

Some major production houses, like Osaka Petrochemical's plant, witnessed a delay in restarting ethylene production after a scheduled maintenance shutdown early in the quarter because of a failure discovered in steam supply systems. These situations also added to the supply challenges and prompted the prices to remain elevated. Overall, a positive market performance was witnessed.

Europe

The price of ethylene oxide showed a relatively favorable trend in the third quarter of 2024. The market sentiments were similar to the Chinese market. The rising prices were supported by the rising upstream ethylene prices. The manufacturing firms were operating at lower production capacities primarily because of the increasing operational costs affecting the supply in the market. A tight supply stimulated forward movement in prices.

Apart from this, Clariant and OMV signed a letter of intent to enhance the use of renewable carbon in the European ethylene supply chain. This highlighted both companies’ intent to expand their bio-based ethylene oxide derivatives portfolio with low-carbon ethylene sourced from OMV in alliance with the European Union sustainability goals.

North America

The ethylene oxide price trend in North American markets resembled the performance of the Asian and European markets. By mid-August US ethylene prices experienced substantial surges which made the cost support for ethylene oxide even stronger. The hurricane season in North America added to the already existing supply chain constraints.

More Logistical challenges were brought about by Hurricane Beryl, leading to tighter supply in the market. Apart from this, some unplanned plant outrages, including an unplanned outage at Nova Chemicals' ethylene cracker in Louisiana, affected the supply. These supply constraints contributed to the rise in prices. However, as the downstream industries struggle with higher prices, the US market is likely to stabilize moving forward.

Analyst Insight

According to Procurement Resource, the ethylene oxide prices are expected to show a stable and positive performance in the near future since the demand outlook seems supportive going forward as well.

Ethylene Oxide Price Trend for Q2 of 2024

| Product | Category | Region | Price | Time Period |

| Ethylene Oxide | Chemicals | China | 967 USD/MT to 930 USD/MT | Q2'24 |

Stay updated with the latest Ethylene Oxide prices, historical data, and tailored regional analysis

Asia

In the second quarter of 2024, the price of ethylene oxide in China demonstrated a trend moved southwards with a gradual decline in the monthly average of ethylene oxide prices from 967 USD/MT to 930 USD/MT. Initially, the pace of decline was slower than the later phase of the quarter as the market prices remained firm, reflecting the carried-over momentum from the first quarter. Then, the instability was influenced by the elevated prices of upstream raw materials, particularly ethylene, which raised the cost of production and reduced the profit margins of producers.

While some of the downstream product's prices reported slight gains, the demand for ethylene oxide was overall suppressed by unstable prices of polycarboxylate water-reducing agent monomers throughout the first quarter. Additionally, on the demand side, furfuryl alcohol, a key derivative of ethylene oxide, continued trade on the lower end of the pricing spectrum due to the loss of sales figures of end-user industries such as resins, plasticizers, solvents, and rocket fuels.

Europe

The European ethylene oxide market experienced a downturn in prices due to weak fundamentals and heightened competition amid declining demand and high production costs, similar to the Asian market in the second quarter of 2024. Despite sufficient supply to meet downstream needs, accumulating stock levels pressured the producers and traders to reduce prices. Additionally, the demand from the ethylene glycol sector was slower than anticipated by the manufacturing sector, defying seasonal trends, and market transactions were muted due to the low buying interest of the consumers.

Further, major producers like INEOS reported decreased earnings, reflecting the challenging market conditions. Therefore, given the current market dynamics, the traders anticipate continued weak downstream demand along with a decline in raw material prices and sufficient supply levels amid a lackluster economic recovery and potential excess capacity in the petrochemical sector, resulting in the subdued pricing dynamics of ethylene oxide throughout Q2'24.

North America

The pricing pattern of ethylene oxide in North America was no different than the Asian and European countries, as the weak momentum of the market here also fell short amid the challenging trading atmospheres. The overseas transactions of the market were reduced by a great margin as the cost of transportation increased, decreasing the interest of international players, particularly the Asian countries. The economic indicators of the market also extended only limited support and a rise in interest rates amid depressed downstream demand forced the production houses to lower their efficiency rates as well as their price quotations of ethylene oxide.

Analyst Insight

According to Procurement Resource, the price trend of Ethylene Oxide is expected to continued proceeding in the southward direction as the market projections depicted by its primary drivers such as raw materials and end-user sales figures does not look much promising.

Ethylene Oxide Price Trend for Q1 of 2024

| Product | Category | Region | Price | Time Period |

| Ethylene Oxide | Chemicals | USA | USD 1300/MT | March 2024 |

| Ethylene Oxide | Chemicals | Europe | USD 1400/MT | March 2024 |

Stay updated with the latest Ethylene Oxide prices, historical data, and tailored regional analysis

Asia

In China, during the first quarter of 2024, the price of ethylene oxide in China experienced a slight increase, as tight supply in certain regions due to steady domestic production and maintenance plans for individual units depleted the inventories.

The downstream industries also saw a rebound in prices, while related products like ethylene glycol began to move southwards, leading to a varying trend in the demand dynamics of the market. Overall, demand for downstream monomers was average, with good demand for polyethers, esters, and other materials purchasing ethylene oxide.

The start of terminal real estate construction, however, boosted the momentum of the market while factors related to production and output rates remained under the bar as spring festivities and the Chinese New Year season halted operational activities. However, cautiousness within the downstream infrastructure industry regarding high-priced monomers may limit upward price trends for ethylene oxide raw material.

Europe

In the first quarter of 2024, European chemical and resin markets are witnessing greater spot price volatility due to increased reliance on spot volumes by buyers and reduced contract commitments compared to previous quarters, supporting an uptrend in the prices of ethylene oxide. However, in the initial phase of the quarter, the buyers shifted away from pricier European contracts towards cheaper spot volumes, often imported from producers in the US or the Middle East.

However, import delays, Red Sea freight chaos, production issues, and industrial action have contributed to a rise in the demand for domestically produced quantities and raised the pricing trajectory of ethylene oxide. Despite these changes, Europe's aging infrastructure, dependence on costly naphtha-based feedstocks, and competition with Asia and the US continued to pose challenges to the region's chemical industry.

North America

In the first quarter, the global ethylene oxide market witnessed a steady rise in prices driven by supply-demand imbalances, increased production costs, and rising trading uncertainties. In the US, ethylene oxide prices surged by a noticeable margin as compared to Q4 of 2023 as the cost of its feedstock inclined by several folds. The rising geopolitical tensions, notably the conflict between Russia and Ukraine, contributed to an expected increase in the US.

Ukrainian drone attacks on Russian refining facilities exacerbated issues in the crude oil market, further affected by the Red Sea crisis. Despite this, an incline in freight rates, such as those from China to North America and North Europe to North America, further raised the overall cost of production and raised the bar for traders.

Analyst Insight

According to Procurement Resource, the price trend of Ethylene Oxide is estimated to further incline with the increase in the prices of feedstock ethylene and persistent challenges in the global supply trends of the region.

Ethylene Oxide Price Trend for October - December of 2023

| Product | Category | Region | Price | Time Period |

| Ethylene Oxide | Chemicals | China | 922 USD/MT | October'23 |

| Ethylene Oxide | Chemicals | China | 898 USD/MT | December'23 |

| Ethylene Oxide | Chemicals | India | 748 USD/MT | October'23 |

| Ethylene Oxide | Chemicals | India | 772 USD/MT | December'23 |

Stay updated with the latest Ethylene Oxide prices, historical data, and tailored regional analysis

Asia

Ethylene Oxide is an important petrochemical that is industrially derived by oxidizing the hydrocarbon ethane. Ethylene Oxide plays a critical role in the plastics and polymer industry, so the market demands for Ethylene Oxide usually vary between moderate and high levels. However, because of its origin, the crude oil prices also impact the Ethylene Oxide market trend massively. During the final quarter of the year 2023, the Ethylene Oxide prices oscillated for the entire period.

The fall in the crude oil prices pushed the Ethylene Oxide prices down at first in the Chinese market as the first two months witnessed a downfall of around 7%. However, the downstream demands balanced the trade situation in the following month by pushing the prices up again slightly. Still, the overall market sentiments were largely downward wavering.

The Chinese market witnessed its monthly average prices going from around 922 USD/MT in October to around 898 USD/MT in December of 2023. On the other hand, the Indian market witnessed a consistent incline throughout the said period as the monthly average prices went from about 748 USD/MT in October to around 772 USD/MT in December, yielding an appreciation of about 3%.

Europe

The European Ethylene Oxide market also registered mixed market trend during the given period. The first half of the fourth quarter was firmer than the second half. The positive demand dynamics at the beginning of the quarter pushed the prices up; however, the approaching holiday season brought these industrial activities to a short-term halt, which again pushed the market trend downwards. Overall, varying price curve was observed throughout the quarter.

North America

Influenced by global trend, the American Ethylene Oxide market also exhibited short-range variations in the price graph during the said period. Plunging crude oil prices pushed the prices down; however, the market demands provided some relief. The general market sentiments were largely mixed throughout Q4’23.

Analyst Insight

According to Procurement Resource, the Ethylene Oxide price trend are likely to follow a similar fluctuating pattern in the coming quarter as the current market drivers do not suggest much change in the dynamics going forward.

Ethylene Oxide Price Trend for July - September of 2023

| Product | Category | Region | Price | Time Period |

| Ethylene Oxide | Chemicals | China | 831 USD/MT | July’23 |

| Ethylene Oxide | Chemicals | China | 889 USD/MT | September’23 |

| Ethylene Oxide | Chemicals | India | 675 USD/MT | July’23 |

| Ethylene Oxide | Chemicals | India | 715 USD/MT | September’23 |

Stay updated with the latest Ethylene Oxide prices, historical data, and tailored regional analysis

Asia

The price graph of ethylene oxide registered an upward growth in the Chinese domestic market during the said period. Despite the dull demands from the downstream ethoxylates and ethylene glycol markets, the price trend for ethylene oxide inclined considering the dramatic rise in the feedstock prices.

With Saudia Arabia and Russia committing to further production cuts to stabilize their internal economies and the current global oil markets, petrochemical and its allied sectors were affected worldwide. The rise in upward cost pressure was the main reason behind the prices in ethylene oxide prices.

The spot prices of ethylene oxide went from around 831 USD/MT in July’23 to around 889 USD/MT in September’23 in the Chinese domestic market. A similar trend was observed in the Indian domestic market, where the ethylene oxide prices went from around 675 USD/MT in July’23 to around 715 USD/MT in September’23.

Europe

A mixed price sentiment was witnessed for the ethylene oxide market in the European markets. Initially, the prices tumbled, given the high inflation rates and reduced buyer’s confidence in the market. The cautious buying activity kept the spot prices at bay. However, towards the end of the third quarter, the prices began to rise, given the increase in upstream cost pressure.

The rise in naphtha prices in accordance with the crude oil production cuts impacted industries worldwide. Further, a slight push from the demand side was also visible towards the end of said quarter. Hence, these two factors immensely directed the price graph of ethylene oxide towards the higher side by the end of Q3’23.

North America

The price trend for ethylene oxide fluctuated throughout the US domestic market throughout the third quarter of 2023. Initially, the prices remained on the lower side of the curve given the reduced demands, high inflation, and hiked interest rates amidst struggling consumption/purchasing capacities. However, towards the end of the third quarter, the demand increased, and the supply contracted. The production cuts by OPEC+ and Russia impacted the petrochemical sector worldwide. Also, the maintenance shutdowns impacted the price analysis of ethylene oxide.

Analyst Insight

According to Procurement Resource, the price trend for ethylene oxide are expected to rise further, given the current economic scenario. The production cuts will heavily impact the supplies, and with the winter months approaching, demands are likely to increase.

Ethylene Oxide Price Trend for the First Half of 2023

Asia

The ethylene oxide market in the Asian Pacific region showcased a fluctuating trajectory in the first two quarters of 2023. In the first quarter, the spot prices in China inclined from around 907 USD/MT in January to 1036 USD/MT in March. As the cost of energy production fluctuated heavily, the rising demand from the glycol industry aided the price incline. But in the second quarter, the price began to decline because of the stockpiling of inventories owing to feeble demand from the end-user industries. As a result, the spot prices of ethylene oxide settled at approximately 842 USD/MT in June’23.

Europe

In European nations, the price trend for ethylene oxide mirrored the trend observed in the Asian region. The prices struggled due to weak market sentiments and plunging demand from the glycol sector. The production costs were, however, stable in the region initially. During the middle of the first quarter and throughout the second quarter, the prices gained and maintained their momentum with the required support from the rising crude oil and end-user sector. The European region seemed reluctant to import raw materials from Russia, and as a result, the price trend of the commodity soared.

North America

A fluctuating trend was recorded in the ethylene oxide market in North America during the said period. In the initial months of 2023, the prices declined significantly, attributed to the EPA regulations over the production of ethylene oxide. The EPA proposed the harmful effects of this commodity and its contribution to producing carcinogens which impacted the market negatively.

The price trend, however, surged in the later months due to the limited availability of ethylene oxide as many manufacturers had to halt their production. In addition, the feedstock ethylene market also supported the surge in prices and led to the northward movement of ethylene oxide prices.

Analyst Insight

According to Procurement Resource, the price trend for Ethylene oxide are estimated to improve in the upcoming quarter as the rebounding demand and the inclining upstream cost pressure seems to support the rising prices.

Ethylene Oxide Price Trend for the Second Half of 2022

Asia

The price trend for ethylene oxide exhibited a declining trend in the Asia-Pacific region. This decline was majorly attributed to the shutdown of production plants in Japan and the rise in inflation in the Asian region. The prices were also affected by the destocking of the product by the producers and decreased demand from the downstream industries. The prices marginally improved during the end of Q4, however, overall, the ethylene oxide prices kept low.

Europe

The prices of ethylene oxide declined gradually as the feedstock prices decreased in the region. The supply remained strong amid the declining demand which led to the rise in inventories. Another factor contributing to the decreasing prices was the regulation of the EU Commission on the use of ethylene oxide in food products. The weak offtakes, decreased feedstock, cuts in production costs, and reduction in input costs negatively affected the market and in turn, the price trend of ethylene dioxide followed a downward trajectory.

North America

Ethylene oxide prices declined in the North American region as a result of weak sentiments from the market. The region saw an increase in inventories, sudden shutdowns, and disrupted transportation which negatively affected the ethylene oxide market. The price trend of ethylene oxide also suffered due to the EPA regulations on ethylene oxide emissions which hit the demand from the importers severely. The falling prices of crude oil and gas further contributed to the decline in ethylene oxide price trend.

Analyst Insight

According to Procurement Resource, the price trend for Ethylene Oxide are expected to fluctuate in the upcoming quarter. The coming months are likely to witness strong EPA regulations, uncertain energy production costs, and ripple effects from the ongoing Russia-Ukraine war which will affect ethylene oxide prices.

Ethylene Oxide Price Trend For Second Quarter of 2022

Asia

During the said quarter, the overall market for the chemical remained stagnant. Due to the volatile nature of global crude oil prices, the Asian petrochemicals industry suffered. The primary feedstock ethylene’s price weakened in the said quarter, averaging 1166-1176 USD/MT CFR Northeast Asia.

The high input costs and the muted market demand affected the prices of the chemical. Also, due to the below optimum polyester and plastic demand in the Chinese market, all ethylene oxide derivatives like ethylene glycol prices suffered. Per ton price of ethylene oxide averaged 7350 RMB in the Chinese domestic arena.

Europe

Due to the continuing Russian geopolitical stance, Europe is witnessing a record-breaking rise in commodity prices and energy crises. The runaway inflation coupled with rising interest rates globally has triggered the market fear of recession. The prices of feedstock ethylene weakened during the said quarter. Still, the price trend of ethylene glycol stood firm in the European domestic market because of the strong demand from the downstream polymer and polyester industries.

North America

The price trend of ethylene oxide continuously witnessed fluctuations in the US domestic arena during this quarter. Initially, the prices remained strong due to the tight supply and steady market demand. However, the upstream industries' inability to keep up with the explosive demands from the downstream sectors caused the prices to fall as the market equilibrium distorted due to the supply-demand mismatch paradox.

Analyst Insight

According to Procurement Resource, ethylene oxide prices will likely decline in the coming quarter. The decreasing feedstock ethylene prices and reduced offtakes from the market are a few reasons behind this decrease.

Ethylene Oxide Price Trend For First Quarter of 2022

Asia

The spot price of ethylene oxide in March 2022 was 8200 RMB/MT in the domestic markets of China. The ethylene market has been quite turbulent lately owing to the widespread demand, and the rising prices of international crude oil futures. The breakdown of the Caspian oil pipeline between Russia and Kazakhstan through OPC also heightened fears of short-term supply tensions.

Ethylene Oxide Price Trend For the Fourth Quarter of 2021

Asia

All through the fourth quarter of 2021, the ethylene oxide sector in Asia Pacific had conflicting sentiments. Due to coal shortages, China began to feel the effects of the energy crisis, and power rationing hampered operational rates at a number of crackers across the country. Furthermore, the resurrection of COVID, as well as harsher Chinese government standards, exacerbated the Asia Pacific freight crisis, with freight costs above 20000 USD/40ft container, affecting arbitrage from the foreign market.

As a result of the ripple effect, bids in the Chinese domestic market crested at historic highs during the last week of October, with the Ex-Shanghai discourse for technical quality soaring to 1530 USD/MT. However, the Chinese government's continued efforts to reduce power rationing lowered inflation in the domestic market, and producer quotations dropped by 22.5% by the end of the quarter.

Europe

The European market for the chemical remained stabilized in the 4th quarter of 2021, owing to the prolonged energy crisis in the home market, which weighed on production capacity proportionally due to rising energy costs. Due to low natural gas stocks, several market participants predicted that the present trend would continue until the middle of the next quarter.

Furthermore, the large drop in the arbitrage from Europe was aided by congestion, restricted access to freight vessels, and expensive rates for Asia Pacific delivery. Ethylene oxide prices in the European domestic market remained buoyant as a result, and the FD Hamburg discourse was concluded at 1795 USD/MT during the quarter ending.

North America

After the operating rates in the United States began to improve post-hurricane season, the North American ethylene oxide industry began to stabilise in the fourth quarter of 2021. Furthermore, the dramatic drop in the gap from the US was aided by congestion, restricted supply of freight vessels, and expensive rates for Asia Pacific delivery.

Furthermore, throughout the fourth quarter, cost support from upstream ethylene plummeted dramatically. The offered bids fell proportionally as a result, and the FOB Gulf coast spot discourse was decided at 1510 USD/MT towards the conclusion of the quarter.

Latin America

Braskem, a petrochemical company, said its fourth-quarter resins sales volume in Brazil declined 13% year over year, owing to lower demand in the Brazilian market. Braskem's ethylene plants in Brazil had an average utilization rate of 85% in the third quarter, which was unchanged from the previous year but 5 percentage points higher than the third quarter.

According to the company's operating forecast, ethylene production volume remained steady on a yearly basis. Mexico's polyethylene production increased by 71% from the fourth quarter of 2020, with the country's plant utilization rate improving by 34 percentage points, to 8%.

The increase was due to the suspension of operating processes in December 2020 due to a natural gas transit disruption. The increase in ethylene production led to an easy availability of feedstock for ethylene oxide production.

Ethylene Oxide Price Trend For First, Second and Third Quarters of 2021

Asia

The output in Asia remained low due to plant outages and a lack of feed ethylene throughout the region. Demand in China fell over the Chinese holidays, but it quickly rebounded, putting downward pressure on supply in the local market.

Plant failures in the United States caused a global shortage of most chemicals, while demand in the Asian market remained strong, resulting in higher prices for feedstock ethylene and downstream MEG. In India, the bulk price of the chemical rose by 34.5% since January, settling at 1261.3 USD/MT at the end of March.

During the second quarter, ethylene oxide prices fell significantly in the Asian market, owing to increasing stock availability and lower demand from downstream firms. Meanwhile, the price of ethylene fluctuated due to the regular price changes in crude oil prices.

The quick recurrence of the epidemic in India lowered demand from downstream sectors, despite ample supply availability. However, the price of ethylene remained volatile in India, impacting the price of ethylene oxide in the country. As a result, prices in India were recorded around 1214 USD/MT in the last week of June.

During the third quarter, the Asian market displayed conflicting attitudes. The Chinese market saw an increase in the pricing, accompanied by supply chain disruptions caused by congestion at many Chinese ports. Furthermore, a reduction in production rates, following China's energy crisis, wreaked havoc on ethylene oxide prices in this timeframe.

In India, prices rose somewhat from July to August, owing to stable feedstock costs and strong demand from downstream MEG goods. The prices, on the other hand, fell in September. As a result, the total market for the chemical remained stable in this quarter, as domestic leagues sold the bulk of the produce to domestic consumers at a predetermined pricing. Per ton price in India rose to 1350 USD in August from 1302 USD in July, and then fell to 1297.04 USD in September.

Europe

Despite the US gulf storm and strong export demand to Asia, European demand for the chemical remained strong throughout the quarter. Due to a lack of feedstock across the region, ethylene oxide prices remained erratic. Ethylene demand remained high from segments such as PVC, forcing producers to raise prices.

Due to production interruptions at some upstream ethylene plants, ethylene oxide supply became tighter. The unexpected three-week-long force majeure at LG Chemical's Yeosu cracker owing to a fire outbreak at the company's central control unit continued to impact upstream supply. During the quarter, unexpected plant turnarounds resulted in a loss of around 400 KT of ethylene production.

Due to strong demand for glycols and limited product supplies, the price skewed toward the Asian region. For the majority of the month, the Indian market remained relatively unaltered from the previous quarter, with market fundamentals being balanced. In India, the price increased slightly in Q4 2020, but remained stable at 1078.

USD/MT. Firmer raw material costs and rising demand from downstream MEG producers fueled the upward trend.

During the third quarter, ethylene oxide prices in Europe rose marginally, owing to strong demand from downstream glycols and ethoxylates, as well as a rise in the price of ethylene. Furthermore, the increase in the price of ethylene oxide and its derivatives in Europe was caused by high freight costs and reduced imports due to container scarcity. Manufacturers obtained promising profit margins, which were followed by robust demand from downstream sectors. FD Hamburg price settled at 1790 USD/MT, an increase of 160 USD/MT.

North America

Owing to strong demand fundamentals and damaged production capacity due to severe winter storms in North America, ethylene oxide prices rose steadily on a daily basis. Climate disaster triggered the closure of several sizable ethylene factories. The average price witnessed a dramatic jump of 48.9%, which settled at 1605 USD/MT in March, due to strong demand from Asian countries combined with limited inventory levels across the area.

Several firms reopened their plants in the second quarter after a long hiatus, boosting the country's supply of feedstock chemicals. As a result, ethylene oxide prices in the United States fluctuated from month to month in the second quarter of 2021. Demand remained strong on the domestic and global markets, particularly in Europe, where there was an acute shortage. In May, prices dropped dramatically as a result of greater supply of ethylene following the restoration of refinery operations in the United States. As a result, during May in the United States, ethylene glycol prices reached 1210 USD/MT.

Demand for the chemical and its downstream derivatives remained strong throughout the third quarter, contributing to an increase in the price. Furthermore, as a result of the Ida hurricane in August, numerous firms were forced to close down their production plants, adding to the strain on the chemical’s market. FOB-US ethylene oxide prices were estimated at 1620 USD/MT in September, up 180 USD/MT from July, owing to lower production rates and increased demand in the region.

Latin America

Ultrapar sold Oxiteno, the only South American producer of ethylene oxide and derivatives, for USD 1.3 billion in August to Indorama Ventures of Thailand. Oxiteno was the only South American manufacturer of ethylene oxide and monoethylene glycol, a critical PET resin intermediate.

Oxiteno has sites in Brazil, Latin America, and the United States. Oxiteno sold 372,000t of products in the first half, comprising commodities and specialty. It was up 7% from the early half of 2020, with domestic sales up 10%, primarily to the agrochemicals, paints, and varnish industries. In the first half of 2021, exports to the United States accounted for a 1% increase in total exports.

Ethylene Oxide Price Trend for the Year 2020

Asia

Due to production interruptions at some upstream ethylene facilities, the supply of ethylene oxide tightened. The unexpected three-week-long force majeure at LG Chemical's Yeosu cracker owing to a fire outbreak at the company's central control unit continued to impact upstream supply. During the quarter, unexpected plant turnarounds resulted in ethylene output losses of roughly 400 KT.

Due to strong demand for glycols and constrained product availability, the price in Asia has risen. For the majority of the month, the Indian industry remained relatively unaltered from the previous quarter, with market fundamentals being balanced. In Q4 2020, the price in India increased slightly, maintaining an average of 1078 USD/MT. Driving the trajectory were the firm feedstock costs and increasing demand from the downstream MEG producers.

Europe

The chemical’s supplies tightened in the fourth quarter due to a shortage of ethylene, whose inventories were low, limiting product availability to various downstream manufacturing units. The closure of the Borealis Ethylene Cracker in Stenungsund (Sweden) in December aggravated market shortages.

Upstream supply constraints and a rise in crude futures pushed the spot prices higher across Europe. Throughout the quarter, regional traders reported increased demand from the downstream detergents and medicinal industries.

North America

The availability of upstream ethylene had been steadily declining in North America, with the majority of demand channeled to the downstream glycols sector. After hurricane-related disruptions in the United States, operating rates at upstream units were heard increasing.

Formosa's new factory in Texas went online in early December, and the company ramped up production levels in Q1 FY21 due to anticipated pent-up demand. Due to strong demand for glycol ethers used in disinfectants and cleaning chemicals, the inventory levels in numerous downstream sectors decreased, although pricing remained elevated due to continuing transportation restrictions.

Latin America

In October 2020, Brazilian ethylene prices increased significantly since the beginning of the year, reaching their highest levels since 2018.This rise in cost directly affected the price of all ethylene products and derivatives, including ethylene oxide prices.

Procurement Resource provides latest prices of Ethylene Oxide. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

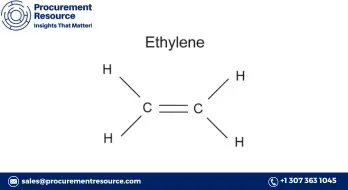

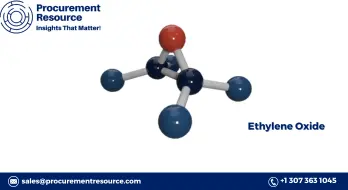

About Ethylene Oxide

Ethylene Oxide, an organic compound, is a cyclic ether and the simplest epoxide. It is a colourless gas with ether-like odour. It is a versatile compound that is used as an intermediate in the manufacture of other chemicals of industrial importance. One of the most important derivatives of this chemical is ethylene glycol, which is further utilised in the production of PET resin. A small but significant use of the chemical is as a sterilizing agent particularly in the healthcare industry.

Ethylene Oxide Product Details

| Report Features | Details |

| Product Name | Ethylene Oxide |

| Industrial Uses | Ethylene glycol, Glycol ethers, Ethanolamines, Ethoxylates, Acrylonitrile, Sterilizing and disinfecting agent, Fumigant, Antibiotics |

| Chemical Formula | C2H4O |

| Synonyms | 75-21-8, Oxirane, 1,2-Epoxyethane, Epoxyethane, Oxacyclopropane, Dimethylene oxide, Epoxide, EO or EtO |

| Molecular Weight | 44.05 g/mol |

| Supplier Database | Shell Chemical Company (Royal Dutch Shell Plc), LyondellBasell Industries NV, BASF SE, Linde AG |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Ethylene Oxide Production Processes

- Production of Ethylene Oxide via Oxidation

In this process, ethylene is utilised as a starting material. It undergoes the oxidation process in the presence of silver catalyst to finally produce Ethylene Oxide.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Related News

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com