Product

Formic Acid Price Trend and Forecast

Formic Acid Price Trend and Forecast

Formic Acid Regional Price Overview

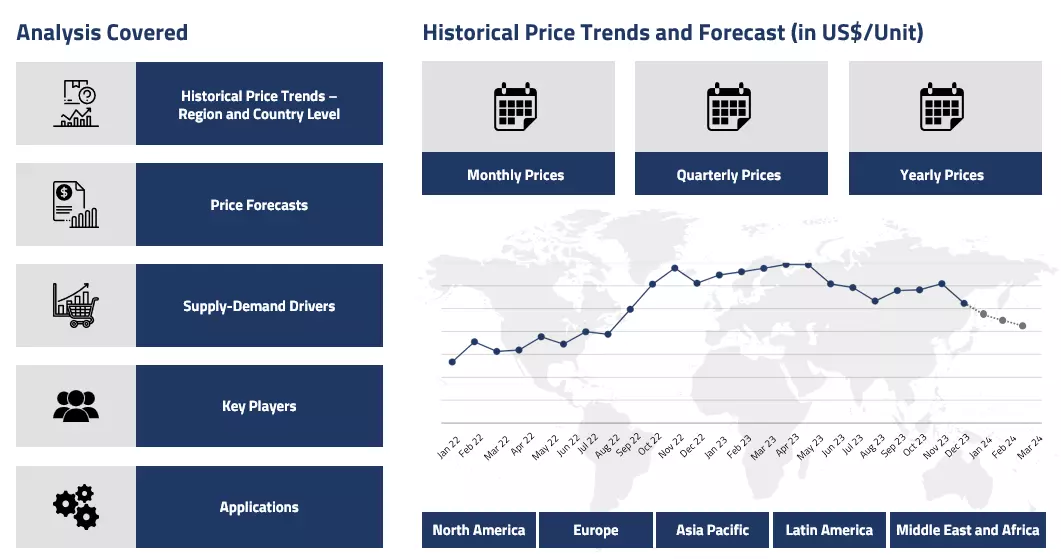

Get the latest insights on price movement and trend analysis of Formic Acid in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Formic Acid Price Trend Analysis for the First Half of 2025

Asia

In the first half of 2025, formic acid prices in Asia showed a steady upward trend. Early in the year, demand from the agricultural sector picked up as pesticide production rose, especially in China, where silage preservation and feed additives drove consistent consumption.

Formic Acid Price Chart

Please Login or Subscribe to Access the Formic Acid Price Chart Data

The pharmaceutical industry also contributed to the positive momentum with increased chemical medicine output. Despite a temporary slowdown around the Lunar New Year, domestic demand quickly rebounded as factories resumed operations and restocking activity began. Although export volumes dipped slightly, steady methanol supply and improved logistics helped maintain production without major disruptions. This balance of healthy demand and stable inputs supported the moderate rise in prices across the region.

Europe

Formic acid prices in Europe climbed throughout the first half of the year due to a mix of supply chain challenges and higher production costs. While end-user demand stayed largely unchanged, manufacturers faced pressure from persistent logistical issues, including port congestion and rerouted shipments caused by Red Sea disruptions.

Workforce shortages and strikes in key ports further delayed deliveries. Additionally, methanol prices remained firm, increasing input costs. Compounded by winter-driven energy volatility and gas supply constraints, European producers operated under tighter margins. These factors together led to a steady price increase, even without a sharp jump in downstream consumption.

North America

In North America, the first half of 2025 saw a strong rise in formic acid prices, primarily driven by robust demand and external pressures on logistics. The agrochemical sector showed strong recovery, with higher purchases of silage and animal feed preservatives.

Pharmaceutical companies also increased formic acid usage, supporting the price trend. Severe winter weather and port-related labor disruptions added to the challenges, limiting supply movement and increasing transportation costs. Despite stable methanol feedstock prices, natural gas hikes raised overall production costs, further pushing prices upward in the region.

Analyst Insight

According to Procurement Resource, Formic Acid prices may remain supported if current logistical pressures persist and downstream demand continues to stay firm across key applications.

Formic Acid Price Trend for Q4 of 2024

Asia

During the fourth quarter of 2024, the Formic Acid market in Asia, particularly China, showed a mild price increase. Production levels remained stable, with key manufacturing plants operating efficiently. The methanol supply, which had improved due to resumed operations, supported consistent production.

However, demand from major sectors like pesticides and textiles was relatively soft, especially due to seasonal slowdown. Buyers were cautious and mostly focused on fulfilling immediate requirements rather than building inventory. Even though it was the off-season for some industries, the supply-demand balance was maintained, helping keep the market steady with only a slight upward movement in prices.

Europe

In Europe, Formic Acid prices rose at a sharper rate during Q4. This was mainly due to challenges on the supply side, such as lower production rates and limited imports. Ongoing issues in shipping routes and congestion at major ports increased freight costs, which pushed overall production costs higher.

Although demand from sectors like agriculture and textiles was not particularly strong, it stayed steady enough to support the upward trend. Supply tightness played a bigger role in the price movement, as producers faced increased input costs and logistical hurdles, leading to a more noticeable price rise across the region.

North America

In North America, the Formic Acid market showed slight upward momentum. Prices edged up modestly as production remained uninterrupted and steady across the region. Rising methanol prices, driven by global supply tightness, contributed to increased production costs.

Demand held firm, especially from agricultural and leather industries, which continued to use Formic Acid in preservation and processing. Despite some logistical bottlenecks, including delays and higher shipping expenses, manufacturers managed to maintain supply levels, supporting a balanced market environment with mild price growth.

Analyst Insight

According to Procurement Resource, the market may see continued support from stable production and moderate demand, with macroeconomic policies and global supply trends likely influencing future price movements.

Formic Acid Price Trend for Q3 of 2024

Asia

In the Chinese market, formic acid witnessed a fluctuating trend during the third quarter of 2024. In the early days of the quarter, prices remained weak. The fluctuating price of feedstock, methanol, provided limited cost support, while downstream demand remained average. Enterprises operated at normal production rates, leading to a sufficient supply of formic acid. Both supply and demand were unfavorable, reflecting weak market dynamics. After a sudden drop in prices, the market stabilized throughout July.

Additionally, some production facilities were shut down for maintenance, which led to a supply shortage and a slight increase in formic acid prices in August. As production resumed, prices began to decline again. Sluggish downstream demand from pharmaceuticals and pesticides resulted in average procurement enthusiasm. Overall, formic acid prices remained volatile throughout the third quarter of 2024.

Europe

In the European market, the prices of formic acid followed a fluctuating trajectory during the third quarter of 2024. Prices wavered due to the interplay between supply and demand factors. The fluctuating prices of methanol provided limited cost support to formic acid prices. An oversupply, coupled with weak demand, put pressure on the market. In Europe's major economies, a decline in purchasing activities led to low downstream procurement, weakening demand. Throughout most of the quarter, the market adopted a wait-and-see attitude, as the fluctuating prices of methanol prompted traders to purchase only the necessary amounts.

North America

The pricing dynamics of formic acid in the North American market exhibited notable volatility. Prices experienced significant fluctuations, characterized by transient increases and decreases. These variations were primarily due to temporary disruptions in supply chains. The onset of the hurricane season introduced logistical challenges and led to the shutdown of production facilities, resulting in short-term supply disruptions. However, as supply levels gradually stabilized, prices rebounded to their typical ranges.

Analyst Insight

According to Procurement Resource, formic acid prices are expected to fluctuate in the coming months varying with the volatile pricing outlook of its feedstocks.

Formic Acid Price Trend for Q2 of 2024

Asia

The Chinese formic acid market experienced a notable price decline, driven primarily by sluggish demand from the downstream textile and leather industries throughout the second quarter of 2024. The off-season for these sectors led to minimal consumer interest, resulting in stagnant market conditions and flat downstream buying activities. This lackluster demand caused manufacturers to accumulate excess stocks, prompting some to offer substantial discounts to stimulate sales.

However, despite high freight costs, the rising supply from overseas players disrupted the supply-demand balance. Additionally, weak overseas demand and high freight charges stagnated exports. Further, the methanol market's decline, a key raw material for formic acid, was a consequence of increased methanol production between January and May 2024, weakening the production costs and forcing the producers to offer lower prices. In response, major formic acid manufacturers reduced production rates to stabilize conditions.

Europe

During Q2 2024, the European formic acid market faced a significant price decline due to the frail outlook of primary drivers of the market. The deteriorating methanol market lowered production costs, prompting manufacturers to revise their offers downward to clear existing stocks. An oversupply, coupled with weak demand from downstream industries, kept the market under pressure. In major countries such as Germany and the Netherlands, import prices continued to decline amid reduced purchasing activities as an ample supply and weakening demand persisted.

The European buyers eventually opted for purchasing on a need-to basis, leading to the bleak sentiments of the market. On the other hand, the retailers, having imported goods earlier from Germany, faced an inventory surplus, which further strained market fundamentals. This situation led to reduced profit margins and revenues for major producers, driven by lower netbacks and overall weak market conditions.

North America

The North American market of formic acid shared the global sentiments as the pricing trajectory of the commodity faced southwards. The downfall of the market was primarily driven by the rising inventories and subdued demand from the end-user industries. Additionally, the bleak scenario of economic growth eventually triggered traders and manufacturers to lower their profit margins.

The market was also hit by the lack of interest of overseas players amid escalating freight charges and longer lead times, forcing them to opt for a wait-and-see approach and resulting in the depreciation of the overall momentum of formic acid prices during the second quarter of 2024.

Analyst Insight

According to Procurement Resource, the price of Formic Acid is expected to decline in the adjacent quarters under the ill influence of limited growth of end-user industries and struggling feedstock pricing patterns.

Formic Acid Price Trend for Q1 of 2024

| Product | Category | Region | Price | Time Period |

| Formic Acid | Chemicals | USA | USD 850/MT | March 2024 |

| Formic Acid | Chemicals | Europe | USD 800/MT | March 2024 |

| Formic Acid | Chemicals | MEA | USD 600/MT | March 2024 |

| Formic Acid | Chemicals | South America | USD 800/ton | March 2024 |

Stay updated with the latest Formic Acid prices, historical data, and tailored regional analysis

Asia

In China, the domestic industrial-grade formic acid market experienced a period of stability with minor declines during the first quarter of 2024. Upstream methanol prices showed a general increase before the holiday season set in, while sulfuric acid prices remained steady, providing only minimal cost support to the formic acid price trend. The downstream demand was managed through orderly stocking based on demand, with a focus on market stabilization. Some companies offered discounts to stimulate purchasing, maintaining market stability despite weak conditions.

Post-holiday, upstream sulfuric acid prices initially rose before stabilizing, while methanol prices narrowed down, resulting in the oscillations of overall production costs of formic acid. With the gradual recovery in downstream demand, inquiries and purchases picked up, leading to a sustainable incline in the pricing trajectory of formic acid as the quarter progressed. The export profit margins of formic acid also improved in the latter half of the quarter with the rising interest of overseas players and increasing trading challenges.

Europe

In European countries, formic acid prices have witnessed an uneven trajectory throughout the first quarter of 2024, attributed to ample product stocks and decreasing natural gas prices. Initially, the market incurred the challenges of sluggish demand from downstream ventures and decreasing trading volumes due to disruption of the trading routes.

The low purchasing activities and limited engagement from downstream ventures also contributed to a drop in formic acid prices. The cost of feedstock methanol also plummeted in the region during Q1 of 2024, extending only limited support to the formic acid price trend. The production rates remained steady amidst weak spot purchasing, leading to an oversupplied market and raising the concerns of the trading community. Suppliers thus started to prioritize destocking activities over their own profit margins, further dampening trading activity and fueling uncertainty among participants.

North America

In the USA, formic acid prices dipped primarily due to ample supply, prompting producers to lower their offers to protect margins. To clear existing stocks, premium offers of formic acid cargoes were negotiated with South Korean and other Asian buyers. The weak demand also constrained the capacity to import the product from overseas suppliers, with downstream markets like MTBE also exhibiting weakness and reduced spot trading.

Amid these ripples of the market, freight costs from the USA to South Korea surged by a significant margin in March compared to February 2023. The market players also seemed to be under the stress of the rising number of stockpiles at the ports and congestion there due to a reduction in the trading capacity of the Panama Canal and the ongoing rerouting of the Red Sea trade route.

Analyst Insight

According to Procurement Resource, the price trend of Formic Acid is expected to trail the pathway paved by its feedstock methanol as the current market trend offers only a little hope to the traders and manufacturers of formic acid.

Formic Acid Price Trend for Q4 (October - December) of 2023

Asia

In the final quarter of 2023, the Asian formic acid market exhibited a fluctuating trend as the dynamics were influenced by the oscillating costs of its feedstock methanol. The Asian countries adopted norms to reduce their carbon footprints and thus boosted methanol blending capacities with fuels.

Based on these consistent improvements in the industrial sector, the traders and manufacturers expected a smooth growth in formic acid prices. However, contrary to their belief, the formic acid prices, after some stagnancy in the initial phase, steeply moved southwards. The most striking causes that the traders could point out were slow offtakes from the downstream industries and the pessimistic approach of direct consumers.

Europe

As compared to the other two regions, the formic acid price trend had a better run in the European countries. However, relative to the third quarter’s bullish trend, the formic acid prices in the fourth quarter moved with caution. The support for the product came from its feedstock methanol as it raised the cost of production and, in turn, the formic acid price graph. The end-user industries also presented appreciable demand for formic acid, and amid financial struggles, the trading sector performed well throughout the quarter, keeping the formic acid price graph above the red zone.

North America

In the US, the formic acid prices took a downturn as the rate of procurement from the downstream industries headed southwards in the fourth quarter of 2023. The feedstock costs acquired a significant appreciation, but the other market determinants stumbled. Additionally, there was an added pressure of export delays as drought-like conditions in the Panama Canal and excessive downfall in the crude oil prices called for a substantial reduction in formic acid prices, particularly in the middle of the said quarter.

Analyst Insight

According to Procurement Resource, the price trend of Formic Acid are estimated to obtain some stagnancy given that the fumbling demand from the downstream industries is to be balanced by the rising cost of production.

Formic Acid Price Trend for Q3 (July - September) of 2023

Asia

After a consistent inclination in the formic acid prices in the last two quarters, the trend bore a bearish trajectory in the third quarter of 2023. The most significant cause of this downward trend in formic acid prices was the poor demand from the end-user industries and the fall in the number of offtakes from overseas industries. In addition to this, the depreciating cost of raw materials also posed a hurdle for the traders, and due to this, they had to reduce their profit margins, hurting the overall dynamics of the formic acid market.

Europe

The northward trajectory of the formic acid price graph was influenced by the rise in demand, strong appetite, and increased purchasing potential of the consumers. In addition to this, due to limited manufacturing activities and high export rates, the depleting level of inventories also forced the prices of formic acid to move in a positive direction. However, as the quarter approached the end phase, the demand for formic acid declined consistently, increasing the stockpiles of inventories and leading to a fall in the prices of formic acid.

North America

Similar to the observations in the Asia-Pacific region, the prices of formic acid in North America also faced a consistent decline. The southwards movement of the formic acid price trend was the direct consequence of weak demand and feeble economic growth of the region. Additionally, the added competition caused by the influx of products from the European region and increased pressure of limited trading activities led to the bearish movement of the formic acid price trend.

Analyst Insight

According to Procurement Resource, the price trend of Formic acid are estimated to follow a declining trajectory in the upcoming months as the market dynamics are negatively affected by the decline in demand from the end-user industries.

Formic Acid Price Trend for the First Half of 2023

Asia

In the first quarter, the prices of formic acid fell gradually due to weak trading activities and low support from the downstream industries. Not only in the first quarter but in the second quarter also, the performance of the end-user industries was feeble. Along with the poor procurement rates in the domestic sector, the extent of exports also declined, indicating the dull sentiments of the international sector, too. In addition to this, the feedstock market also failed to provide any support to the market sentiments of formic acid, causing its price trend to face southwards.

Europe

The high level of inventories posed a challenge to the growth of the prices of formic acid during the initial phase of the first quarter, but soon, with the rise in demand and rates of exports, the trend set on its positive journey. This momentum of prices was also maintained in the second quarter too, as despite the weak feedstock costs, the prices of formic acid surged. This was supported by the consistent rise in demand, high production, and overall rise in the market activities of the downstream industries.

North America

The upscale in the price trend of formic acid was the direct result of efficient trading and a rise in the purchasing potential of buyers in North America in the first quarter of 2023. The trend, however, lost track in the second quarter, where the incline in the number of inventories and poor condition of the US economy caused by the failure of two major banks challenged the growth of formic acid prices. In addition to this, the cost of methanol, which acts as a feedstock in the production of formic acid, also declined consistently, leading to the negative movement of formic acid prices.

Analyst Insight

According to Procurement Resource, the price trend of Formic Acid is expected to oscillate as the global formic acid market will be dictated by the uncertain demand and support from the downstream industries.

Procurement Resource provides latest prices of Formic Acid. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Formic Acid

Formic acid is a colourless liquid with a pungent odour. It is corrosive in nature and miscible in water. It has its application in the dyeing and tanning industries and is also used as a reducing agent.

Formic Acid Product Details

| Report Features | Details |

| Product Name | Formic Acid |

| Industrial Uses | Pharmaceuticals, food additives, pesticides, textile industry, tanning, leather industry |

| Chemical Formula | CH2O2 |

| HS Number | 29151100 |

| CAS Number | 64-18-6 |

| Synonyms | Methanoic acid |

| Molecular Weight | 46.03 g/mol |

| Supplier Database | BASF SE, Feicheng Acid Chemicals Co. Ltd, Taminco Corporation, Perstorp AB |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Formic Acid Production Processes

Formic acid is produced by the direct hydrolyzation of carbon monoxide or reacting with alcohol. The obtained formic acid then goes through distillation to give crude formic acid.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com