Product

Linear Alpha Olefins Price Trend and Forecast

Linear Alpha Olefins Price Trend and Forecast

Linear Alpha Olefins Regional Price Overview

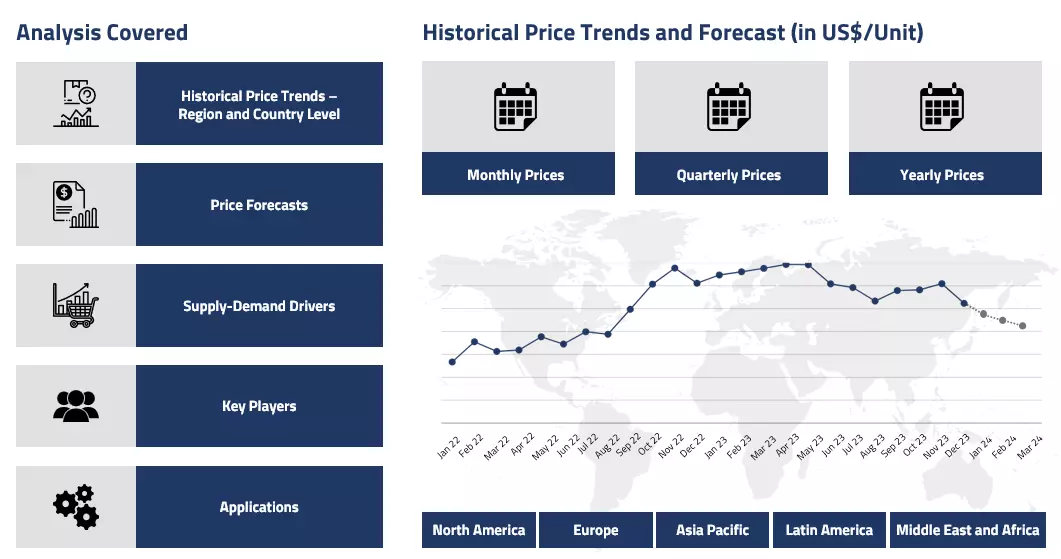

Get the latest insights on price movement and trend analysis of Linear Alpha Olefins in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Linear Alpha Olefins (LAO) Price Trend for the Q4 of 2024

Asia

In Asia, LAO markets experienced downward pressure throughout Q4’24, primarily influenced by weaker crude oil prices and sluggish demand from the polyethylene co-monomer sector. Chinese buyers remained cautious with their purchases, while Southeast Asian markets saw reduced activity due to high inventory levels.

Linear Alpha Olefins Price Chart

Please Login or Subscribe to Access the Linear Alpha Olefins Price Chart Data

The butene market was particularly affected by competition from alternative feedstocks, while hexene and octene showed more resilience due to their specialized applications. Regional producers faced margin pressure as feedstock ethylene costs remained volatile.

Europe

European LAO markets demonstrated mixed performance during Q4. The market for butene remained relatively stable despite pressure from lower crude oil prices, supported by steady demand from the polyethylene sector. Hexene and octene markets showed more strength due to limited availability and consistent demand from specialty applications. However, higher energy costs continued to impact production economics, forcing some producers to adjust operating rates. The quarter also saw increased competition from U.S. imports, particularly in the butene segment.

North America

North American LAO markets saw significant developments in Q4, marked by capacity expansions and improved export capabilities in the U.S. Gulf Coast region. The launch of new daily price assessments by major pricing agencies reflected the growing importance of the U.S. as a global LAO supplier. Strong ethylene production and favourable ethane feedstock costs supported competitive pricing for U.S. producers. However, domestic demand showed some weakness toward the end of the quarter as downstream polyethylene producers reduced operating rates to manage inventory levels.

Analyst Insight

According to Procurement Resource, potential price stabilization is anticipated in Linear Alpha Olefins (LAO) prices in early 2025, supported by expected improvements in global polyethylene demand and continued growth in specialty applications. The expansion of U.S. export capabilities may reshape global trade flows, while Asian demand recovery remains a key factor for market direction.

Linear Alpha Olefin Price Trend for the Q3 of 2024

Asia

In Q3’24, the Linear Alpha Olefin market in Asia witnessed a substantial decline, primarily due to supply disruptions and weakening demand factors. The challenging pricing environment was driven by maintenance shutdowns at key production facilities and oversupply conditions, leading to supply tightening and downward price pressure across the region.

The decline in demand for end-use products, coupled with seasonal factors and declining polymer prices, further exacerbated the price drop.

Europe

In Q3’24, the European Linear Alpha Olefin market experienced volatility in prices, marked by significant fluctuations influenced by supply-demand dynamics and macroeconomic factors. The escalations in the Middle East provided temporary upward momentum to the oil market, impacting the pricing environment for Linear Alpha Olefins in the region. However, other weakening macroeconomic factors and oversupply issues soon overshadowed the market fundamentals, leading to falling prices and prompting interventions by the European Central Bank to mitigate economic weaknesses.

North America

Concerns over falling domestic demand and oversupply challenges in the US domestic market exerted downward pressure on Linear Alpha Olefin prices in Q3’24. The increase in US commercial crude oil stocks indicated weakening demand, contributing to price fluctuations in the region. Further, the geopolitical tensions and supply risks added to the price volatility. Anticipated rate cuts by the US Federal Reserve raised concerns among analysts, highlighting the potential impact on demand dynamics and overall pricing trends for Linear Alpha Olefins in North America.

Analyst Insight

According to Procurement Resource, the prices of Linear Alpha Olefins are likely to remain volatile in the coming months given the present state of the world economy. Furthermore, the supply-demand challenges will exert pressure on the price trends.

Linear Alpha Olefins Price Trend for the Q2 of 2024

Asia

Linear alpha olefins (LAOs) are a family of hydrocarbon compounds. They are produced through the oligomerization of ethylene and are valuable intermediates in the petrochemical industry. LAOs are used in the production of a wide range of products, including polyethylene, synthetic lubricants, detergents, and plasticizers. Their unique structure allows for high reactivity and versatility, making them essential in manufacturing high-performance polymers and speciality chemicals. During the concerned period, the Linear Alpha Olefin markets exhibited a mixed performance.

After witnessing improvements in the first quarter, the growth of Linear Alpha Olefins prices showed some retardation during the second quarter of the year 2024. The price-performance was fundamentally influenced by the fluctuations in feedstock ethylene prices. In the Asian region, the turndown in price growth apparently imparted stability on Linear Alpha Olefin prices. The interplay between the supply and demand outlooks consolidated the overall market performance.

Europe

The market performance for Linear Alpha Olefins was not very different in the European markets compared to its Asin counterpart. Just like in Asia, the Linear Alpha Olefins prices showcased bound variations here as well. Primarily, it was the fluctuation in feedstock ethylene prices that drove the Linear Alpha Olefins markets around this time. Given the market ambiguity, the OPEC countries decided to extend their voluntary production cuts to balance the petroleum and petrochemical markets globally. Despite the sluggishness in upstream dynamics, the manufacturing sector still kept the demand dynamic anchored. Overall, the prices exhibited borderline buoyancy for Linear Alpha Olefin in the European markets.

North America

The American Linear Alpha Olefins market also mimicked the global trends during the second quarter of the year 2024. The prices were found to be oscillating within narrow limits here as well. After some tepidness in the first half of the said quarter, the prices saw slight normalization in the latter phase of the quarter as the supply and demand outlooks started getting more aligned. Overall, a mixed-price performance was observed.

Analyst Insight

According to Procurement Resource, going forward, the market projections for Linear Alpha Olefin look moderate. Since the petrochemical sectors are improving globally, Linear Alpha Olefins prices are expected to improve moving ahead.

Linear Alpha Olefins Price Trend for the Q1 of 2024

| Product | Category | Region | Price | Time Period |

| Linear Alpha Olefins | Chemicals | USA | USD 100/MT | March 2024 |

| Linear Alpha Olefins | Chemicals | Europe | USD 1300/MT | March 2024 |

| Linear Alpha Olefins | Chemicals | MEA | USD 1200/MT | March 2024 |

Stay updated with the latest Linear Alpha Olefins prices, historical data, and tailored regional analysis

Asia

In China, linear alpha olefin prices recovered slowly and gradually during the first quarter of 2024, particularly driven by a resurgence in Chinese manufacturing. This was evident in the market patterns that the appetite of the downstream industries inclined swiftly during the Q1 of 2024, raising the demand of linear alpha olefin. The Asian markets, however, diverted from the European and North American trends as the contraction in supply chains limited the interest of buyers in that region.

On the other hand, in Asia, the industrial growth prompted more consumption of linear alpha olefin post-holiday season, supporting the upward momentum of linear alpha olefin price trend. Additionally, despite some supply chain challenges, including high ethane costs and revised ethylene premiums, the linear alpha olefin prices were able to sustain an upward moving trajectory.

Europe

In European countries, linear alpha olefin prices saw a bullish trend globally, driven by various factors. Improved consumer sentiments post-Christmas retailing led to rising private consumption, easing inventory pressures, and boosting demand. In the first quarter of 2024, prices remained elevated also with the imports dominating over the domestic production and exceeding pressure on the inventory chains due to maintenance shutdown of several production plants.

Linear alpha olefin demand from downstream sectors like lubricants and surfactants also improved at a quicker pace, supported by competitive pricing and product mix from American markets dominating Europe. The freight prices also surged due to the Suez Crisis, impacting supply routes, while Saudi suppliers faced input price pressures from rising ethane prices, further raising the bar of linear alpha olefin prices during the Q1 of 2024.

North America

The US linear alpha olefin market faced a surge in its pricing patterns, particularly in the initial phase of the first quarter. This incline was characterized by scheduled maintenance shutdown by several production units. This scarcity, coupled with surging demand, propelled prices upwards throughout the first quarter of 2024. As linear alpha olefin inventories dipped below the expectations of the traders, the shortage intensified, creating room for traders for further price hikes.

Additionally, the market's reliance on linear alpha olefin as a vital feedstock, further heightened concerns over production slowdowns or shutdowns in downstream industries. Further, despite some recovery of the end user sector, the long-term effects of the disrupted supply chains sustained the market's upward trend amid ongoing inflationary pressures.

Analyst Insight

According to Procurement Resource, the price trend of Linear Alpha Olefin is estimated to incline in the forthcoming quarters as the growth of the downstream industries project an optimistic outlook for the linear alpha olefin market.

Linear Alpha Olefin Price Trend for the October - December of 2023

Asia

The Asian markets, especially China, faced the problem of oversupply of Linear Alpha Olefin in the region. In contrast, its demand in the domestic and overseas markets did not show any significant appreciation. The industrial sector of China also experienced a slowing down in its pace, which further complicated the movement of Linear Alpha Olefin price trend. However, in India, the Linear Alpha Olefin prices took on a bullish run as limited supplies reached Indian shores amid the restricted trade activities at the Red Sea.

Europe

In the last quarter of 2023, the logistical challenges overtook the subdued market activities of the European countries as they were the center of a major global crisis. The disruption of the Red Sea Route and additional sanctions on Russian imports restricted the influx of raw materials and other imports into the region and caused ripples in its industrial sector. Further, adverse weather conditions and abrupt rainfall also enhanced the existing list of challenges and, as a result, prevented the growth of Linear Alpha Olefin prices.

North America

Linear Alpha Olefin prices continued their downward trend in North America due to a downturn in the industrial sector and a decrease in manufacturing costs. Even during the Christmas holiday season, the downstream and direct consumer demand, especially from the cosmetics sector, remained muted, which kept Linear Alpha Olefin prices low.

Additionally, unfavorable weather, a decline in export rates to European markets, and issues in the industrial demand for lubricating oil and surfactants contributed to the decline in Linear Alpha Olefin prices.

Analyst Insight

According to Procurement Resource, the price trend of Linear Alpha Olefin are expected to struggle in the coming quarter, given the current volatilities in the demands from the downstream pharmaceutical and food sector.

Linear Alpha Olefins (LAOs) Price Trend for the July - September of 2023

Asia

The Asian Linear Alpha Olefins market observed mixed price trend during the third quarter of the year 2023. The present inventories were still able to support the existing downstream demands initially in the first month of the quarter. However, the market demands in the detergents and fuel additives sectors saw a steady rise from the middle of the quarter, and the supplies started falling short.

So, this shift in market dynamics pulled the Linear Alpha Olefin price graph up. The rise in crude oil prices also motivated the production costs. Conclusively an overall inclination in the Linear Alpha Olefin price trend was observed after having a slow start at the beginning of quarter three of 2023.

Europe

The European Linear Alpha Olefin market was heavily influenced by the Asian market trend as the prices observed fluctuating patterns here as well. The first half of the quarter was relatively tepid compared to the latter half of the quarter. The third quarter began with dull demands in the month of July; however, as the middle of the quarter approached the downstream demands from the lubricants and adhesive industries started observing a steady rise. Hence, the prices started rising as the gap between supply and demand widened. Overall, mixed market sentiments were observed for Linear Alpha Olefin in the European market during the given period of Q3’23.

North America

The North American Linear Alpha Olefin market followed the global market trend as the prices rose steadily in the third quarter. The market demands from the detergents and chemical industries drove the market fundamentals. Overall, a mixed wavering price graph was observed for Linear Alpha Olefin during the said period.

Analyst Insight

According to Procurement Resource, the price trend for Linear Alpha Olefin are expected to continue behaving in a similar manner, since all the market drivers suggest a steady nature of supply and demand gap.

Linear Alpha Olefins Price Trend for the First Half of 2023

Asia

Linear Alpha Olefins are produced from ethylene and are used in plastics, fuel, chemical, adhesive, and detergent industries. Majorly supportive but mixed price trend were observed for Linear Alpha Olefins during the first two quarters of the year 2023. With persistent revival efforts in the Chinese market to fight the consequences of such long-term lockdowns, the downstream demands for Linear Alpha Olefins surged at the beginning.

The prices were also set on an upward trajectory as the demand dynamics improved. These positive trend continued till the middle of the second quarter. It was only in the latter half of Q2’23 that the prices started subsiding marginally because the excessive supplies started piling up in the inventories as the demands plateaued after rising till a certain point. Overall, very positive market sentiments were observed with healthy market kinetics.

Europe

Mimicking the mixed price trend of the Asian market, the LAO prices in Europe also fluctuated throughout the said period. At first, encouraged by fresh demands, the prices rose in the first quarter; however, the rising momentum reversed with the shift in quarters. Linear Alpha Olefins prices declined in the second quarter to accommodate excess supplies.

North America

The North American Linear Alpha Olefins market almost replicated the European market trend since the prices first grew in Q1 and declined in Q2. Downstream demands from consuming sectors drove these price trend. Overall, market behavior was supportive.

Analyst Insight

According to Procurement Resource, given the demand dependence of Linear Alpha Olefins, the prices are likely to continue to oscillate in the coming times as well.

Linear Alpha Olefins Price Trend for the Second Half of 2022

Asia

The price trend for Linear Alpha Olefins (LAO) remained fluctuating in the said period. The absence of any significant demand remained the major reason for the downing of price trend. Even though feedstock availability was hampered periodically due to OPEC+ policies, China’s power rationing also affected the upstream costs, but these couldn’t sustain the market. Sullen demand in the market kept the prices of linear alpha olefins low.

Europe

Linear Alpha Olefins’ price trend in Europe behaved no differently, they remained oscillating attributing to the seemingly everlasting energy crisis, gas prices skyrocketed, and inflation too weakened economies. Consequently, the market itself downsized as operations were cut down. Demand barely ever gained momentum in the last two quarters of the year 2022, which kept pressing the linear alpha-olefin prices from going up. Production costs sometimes pushed the prices but overall, a very uncertain and sullen price trend was observed.

North America

The North American market for LAO remained doubtful during the second half of 2022. As the second half of the year is also accompanied by the holiday season, production and manufacturing units stayed shut and the sullen demand asked for the production to be cut down. The supply-demand clash didn’t aid the linear alpha-olefin price trend at all.

Analyst insight

According to Procurement Resource, the linear alpha-olefin price trend are looking to be slumping. Growth in this trend requires market demand to rebound, however, it seems a little distant given the global economic recession.

Linear Alpha Olefins Price Trend For the First Half of 2022

Asia

Due to intense cost pressure from upstream energy inputs, the linear alpha olefins market in South Asia has been classified as stable during Q1. Since mid-January evaluations, crude oil prices have increased by more than 10%. Olefins, a crude oil derivative, have been under inflationary cost pressure which has led refiners to raise downstream pricing.

Consequently, the cost of linear alpha olefin was estimated at 52700 INR/MT for C20-24 grade and 70100 INR/MT on a CFR basis in March. Due to changes in the feedstock olefins and upstream energy markets during the second quarter, the prices of linear alpha olefins rose in the first half of the quarter and then stabilized. At the end of the second quarter, the price of C10 Linear Alpha Olefins in India settled at 940.81 USD/MT.

Europe

Since the beginning of the first quarter, Brent crude oil prices have been highly volatile, and LNG costs have skyrocketed owing to the Russian invasion of Ukraine which started in late February 2022. The cost pressure on downstream Linear Alpha olefins has intensified as a result of high Brent crude oil and LNG prices, and as a result, LAO prices climbed significantly in Q1. As a result, LAO C10 blends were valued at 1891 USD/MT FD basis as of March 2022, while C16-18 blends were valued at 2263 USD/MT on FD basis.

These strong price trend for linear alpha olefins continued in the second quarter. LAO prices rose steadily in the first part of the quarter before declining near the conclusion due to the looming speculations about a global recession. The price of C10 linear alpha olefins rose by 5% in the first two months, and in the second quarter, LAO prices fell by 7% and reached 1619 USD/MT FD in Germany.

North America

A large portion of Q1 saw the olefins market stay positive due to high crude oil and natural gas prices. C16-18 LAO prices settled at 850 USD/MT as of March 2022, while C10 Linear Alpha Olefins blend prices were estimated at 790 USD/MT on a FOB basis. During the second quarter, natural gas prices skyrocketed, raising operating costs.

However, the demand pressure for olefins was lessened by stagnant demand and adequate inventory levels, which lowered the price trend for linear alpha olefins in the second quarter. The C10 grade was valued at 1040 USD/MT on a FOB basis. As the rumours of a US recession gained momentum near the end of the quarter, LAO demand decreased further. As a result, prices dropped by more than 10% by June 2022.

Procurement Resource provides latest prices of Linear Alpha Olefins. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Linear Alpha Olefins

Linear Alpha Olefins (LAO) are alkenes with double bonds at the primary or alpha position, the beginning of the hydrocarbon chain. The double bond's location enhances the compound's reactivity and opens a wide range of industrial applications. LOAs produced via oligomerization are used as starting materials for plastics, adhesives, detergents, and other products. The linear olefins are rare but can be made industrially in bulk quantities. Initially, olefins were obtained via the thermal cracking of petroleum and gasoline.

Linear Alpha Olefins Product Details

| Report Features | Details |

| Product Name | Linear Alpha Olefins |

| HS CODE | 29012990 |

| Industrial Uses | Fuel Additives, Lubricants, Plastics, Chemical Substrates, Adhesives, Detergents |

| Chemical Formula | CnH2n |

| Synonyms | Olefins, Alkenes, LAO |

| Supplier Database | Shell Chemicals, INEOSChevron Phillips Chemical |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Linear Alpha Olefins Production Processes

- Production of Linear Alpha Olefins from a Catalytic Ziegler Process; from Stoichiometric Ziegler Process; from Oligomerization of Ethylene

In oligomerization, the substrate is grown by combining lower molecular weight mono-olefins such as ethylene. In this process. The ethylene monomers combine to form dimers, trimers, tetramers, etc., in the presence of an acid catalyst.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e., government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com