Product

Methyl Tert-Butyl Ether Price Trend and Forecast

Methyl Tert-Butyl Ether Price Trend and Forecast

Methyl Tert-Butyl Ether Regional Price Overview

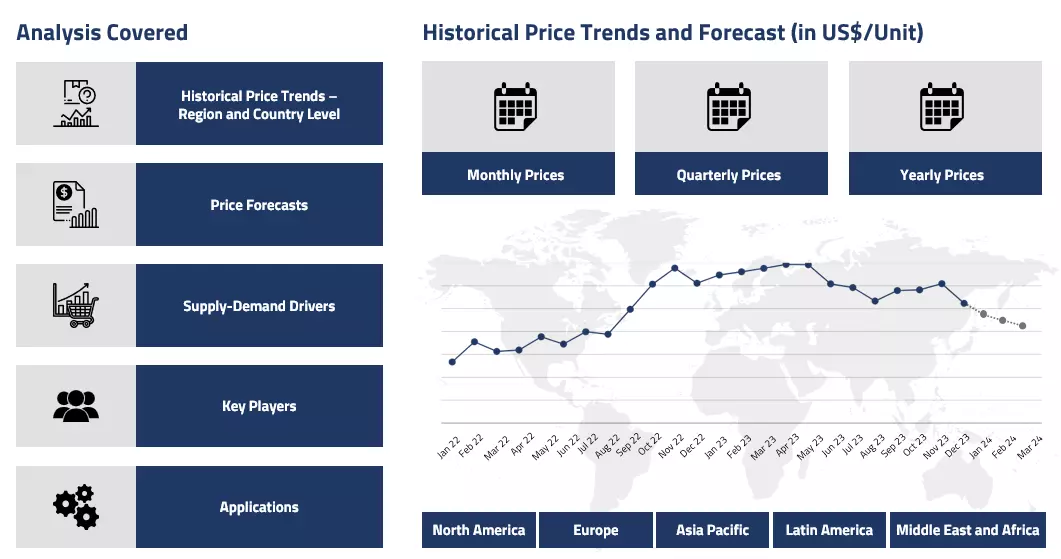

Get the latest insights on price movement and trend analysis of Methyl Tert-Butyl Ether (MTBE) in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Methyl Tert Butyl Ether (MTBE) Price Trend for the Q4 of 2024

Asia

In Asia, MTBE markets faced significant downward pressure throughout Q4’24. The region experienced oversupply conditions as several new production capacities came online, particularly in China. Demand remained subdued due to slower economic growth and reduced gasoline consumption in key markets.

Methyl Tert-Butyl Ether Price Chart

Please Login or Subscribe to Access the Methyl Tert-Butyl Ether Price Chart Data

Feedstock methanol prices also declined during the quarter, which contributed to lower production costs and put additional pressure on MTBE prices. Southeast Asian markets saw particularly weak demand as refineries adjusted their production rates in response to poor margins.

Europe

European MTBE markets showed mixed trends during Q4. The market initially maintained some stability due to planned maintenance at several production facilities, but prices eventually softened due to declining feedstock costs and weaker gasoline demand. Rotterdam spot prices faced pressure from increased imports and reduced buying interest from gasoline blenders. The automotive sector's slower performance and seasonal reduction in driving activity further weakened demand. However, some support came from ongoing refinery maintenance activities that helped prevent a steeper price decline.

North America

North American MTBE markets experienced a notable downturn in Q4. The US Gulf Coast saw significant price decreases driven by abundant methanol supply and reduced demand from gasoline blenders. Refineries scaled back their operations in response to lower crude oil prices, which led to decreased MTBE consumption.

The market also faced pressure from high inventory levels and cautious buying behaviour among intermediaries. Despite some logistical challenges, the overall supply remained comfortable throughout the quarter, keeping prices under pressure.

Analyst Insight

According to Procurement Resource, continued pressure is anticipated on MTBE prices in the coming months, with potential stabilization dependent on gasoline demand recovery and crude oil price movements.

Methyl Tert-Butyl Ether Price Trend for the Q3 of 2024

Asia

The Asian MTBE market encountered substantial headwinds during the quarter, characterized by a pronounced downward trend. Regional markets, particularly China, faced significant demand contraction from downstream industries.

The persistent weak demand in petrochemical and fuel sectors, combined with abundant supply and cautious purchasing behaviours, exerted considerable downward pressure on prices. Production disruptions, intermittent market adjustments, and the broader challenges in butanol and methanol markets created a complex pricing environment. The region's energy transition strategies and increasing focus on alternative fuel technologies further dampened MTBE market prospects.

Europe

European MTBE markets navigated a challenging landscape marked by structural market challenges and declining demand. The quarter witnessed a continued erosion of market fundamentals, driven by stringent environmental regulations, reduced gasoline consumption, and aggressive shifts towards alternative fuel technologies. The intersection of butanol, methanol, and broader chemical market dynamics created a challenging pricing environment. Regulatory pressures, particularly those related to emissions reduction and fuel standards, significantly impacted market sentiment. The construction and transportation sectors' subdued performance further contributed to the market's negative trajectory.

North America

The North American Methyl Tert-Butyl Ether (MTBE) market in Q3’24 experienced a notable decline, reflecting broader challenges in the chemical and fuel markets. The downturn was primarily driven by reduced demand from the transportation and fuel sectors, with shifting energy priorities and increased focus on alternative fuel technologies playing a significant role. Production challenges, coupled with reduced gasoline consumption and regulatory pressures, contributed to a weakening market sentiment. The interplay between butanol and methanol market dynamics further complicated the MTBE pricing landscape, creating additional market uncertainty.

Analyst Insight

According to Procurement Resource, the price trend for Methyl Tert-Butyl Ether (MTBE) is likely to record a persistent downward trend, influenced by accelerating energy transition strategies, regulatory frameworks, and technological innovations.

Methyl Tert-Butyl Ether Price Trend for the Q2 of 2024

Asia

The Chinese methyl tert-butyl ether market faced bearish sentiments during the majority of the second quarter, with some month-on-month fluctuations resulting in a significant downtrend. This decline was primarily due to high operating rates of feedstock methanol, which eased production costs, coupled with low downstream demand from the gasoline sector. The oversupply of methanol, a key feedstock for methyl tert-butyl ether, translated to lower production costs and contributed to the excessive supply.

Despite the resumption of operations at some methyl tert-butyl ether production facilities, the overall operating rates remained low, indicating cautious production strategies amid abundant stockpiles. The weak demand from downstream industries, particularly the gasoline sector, further dampened market enthusiasm. Intermediaries and downstream users adopted a wait-and-see approach, limiting purchases to essential restocking needs. Additionally, the decline in the international crude oil market negatively impacted the refined oil market, including gasoline, thereby reducing the demand for methyl tert-butyl ether.

Europe

In the European markets, the methyl tert-butyl ether prices bore an uncertain trend, with fluctuations driven by oscillations in the prices of raw materials and gasoline derivatives. The market's primary drivers initially performed well with the rise in production costs and downstream procurement rates. But as the feedstock market turned bearish in the later half, the prices of methyl tert-butyl ether moved southwards. As the quarter progressed further, production and imports overpowered the procurement rates and, therefore, disrupted the supply-demand balance of the market, resulting in the bearish tone of methyl tert-butyl ether prices.

North America

In the USA, the methyl tert-butyl ether market remained bullish, majorly towards the end phase of the quarter, supported by strong spot trading activities and an improving outlook for the gasoline industry. The demand for methyl tert-butyl ether returned to the regional market, driven by the gradual utilization of existing stocks and the need for fresh supplies.

The price of methyl tert-butyl ether surged in early April, supported by brisk trading volumes from the downstream gasoline blending sector and high market fundamentals. Additionally, exports of methyl tert-butyl ether from the USA to South America traded at moderate levels, indicating stable international demand. The overall positive sentiment in the US market was largely driven by improving gasoline futures, which played a crucial role in sustaining the upward price trend for methyl tert-butyl ether.

Analyst Insight

According to Procurement Resource, the price of Methyl Tert-Butyl Ether is estimated to be subdued under the influence of excessive production as global operations are expected to work most efficiently in the next quarters as well while the procurement rates are not likely to grow parallel with it.

Methyl Tert-Butyl Ether (MTBE) Price Trend for the Q1 of 2024

| Product | Category | Region | Price | Time Period |

| Methyl Tert-Butyl Ether | Chemicals | USA | 1175 USD/MT | January’24 |

| Methyl Tert-Butyl Ether | Chemicals | Asia | 825 USD/MT | March’24 |

Stay updated with the latest Methyl Tert-Butyl Ether prices, historical data, and tailored regional analysis

Asia

In China, the surge in the methyl tert-butyl ether price trend was gradual rather than steep, as observed in other parts of the world. The slow movement of the region’s industrial growth was a consequence of the onset of Chinese New Year holidays and spring festivities. However, after the holiday season, the market conditions improved at an exceptional rate, supported by the significant incline in the sales figures of automotive industries.

The imports of methyl tert-butyl ether also faced logistical hurdles of uneven raining and snowing patterns, resulting in a limited influx of the methyl tert-butyl ether in the region. Additionally, the globally inclining cost of crude oil and naphtha eventually resulted in the surge in the overall momentum of methyl tert-butyl ether price trend during the first quarter of 2024.

Europe

In European countries, during the first quarter of 2024, the upstream costs soared by a significant margin, leading to an uptrend in the prices of methyl tert-butyl ether. The crude oil, naphtha, and ethylene surged by remarkable percentages, raising the production costs for the manufacturers. Therefore, amid the rising interest of the downstream industries, the traders raised the price quotations of methyl tert-butyl ether resulting in the northward movement of methyl tert-butyl ether price trend.

Additionally, amid the gushing end-user demand, the supply of the commodity in the region remained on the lower end throughout the quarter as attacks on shipments by Houthi communities due to ongoing Israel-Hamas crises diverted these shipments. Further, the inventories dried up at a much faster pace than anticipated by the manufacturers, straining the supply chains and favoring the northward movement in the methyl tert-butyl ether price trend.

North America

In the global markets, the surge in the cost of feedstock chemicals raised the price bar of methyl tert-butyl ether. This uptrend was also reflected in North America’s methyl tert-butyl ether pricing patterns during the first quarter of 2024. The escalating cost of crude oil further raised the overall cost of production, further supporting the methyl tert-butyl ether price trend.

After an initial phase of stagnancy in the downstream industries, the demand from derivative markets such as butyl rubber improved significantly throughout the first quarter. Additionally, the automotive industries also witnessed a remarkable bloom, adding to the uptick in the demand dynamics of the market. On the other hand, the supply of methyl tert-butyl ether remained on the lower end due to ongoing trading challenges in the global market, widening the gap between the supply and demand sectors of the market.

Analyst Insight

According to Procurement Resource, the price trend of Methyl Tert-Butyl Ether is expected to be driven by the rising cost of ethylene, naphtha, and crude oil, along with improving the appetite of the downstream industries in the forthcoming quarters.

Methyl Tert-Butyl Ether (MTBE) Price Trend for October - December of 2023

Asia

In the fourth quarter of 2023, the Asian price trend for Methyl Tertiary-Butyl Ether (MTBE) experienced significant fluctuations. Starting in October, MTBE prices in Asia, particularly in China, showed a downward trend, dropping from 7,900 RMB/ton to 6,950 RMB/ton due to weak demand and fluctuations in the crude oil market.

The market continued to be bearish in November, with prices further declining to 6,587 RMB/ton, affected by the international crude oil market downturn and limited export orders. In December, the MTBE market initially weakened before showing a marginal rise towards the end of the month, closing at around 6,555 RMB/ton. The fluctuating crude oil prices and the overall weak consolidation in the international market, coupled with the upcoming New Year holiday demand, influenced this trend.

Europe

Europe saw the MTBE fluctuating price trend in the fourth quarter of 2023 mirroring the global trend with its own regional variations. October saw a rise in MTBE prices, following the global crude oil market trend and regional supply-demand dynamics. However, as the quarter progressed, the market experienced a decline, partly due to the easing crude oil prices and a subdued demand scenario.

Towards the end of December, the market was closed, indicating a pause in trading activities, possibly due to the holiday season and year-end adjustments. Overall, the European MTBE market reflected a mix of influences from the global crude oil market and regional economic factors.

North America

The North American MTBE price trend displayed a fluctuating trend in the fourth quarter of 2023, aligning with global market movements. The initial months saw a decrease in MTBE prices, influenced by a decline in crude oil prices and a surplus supply situation. In December, the market witnessed a slight increase in prices, possibly due to geopolitical tensions and supply chain disruptions.

The fluctuation in the US crude oil inventories and the overall economic data indicating weak demand patterns also played a role in shaping the MTBE market dynamics. Despite the slight uptick in prices towards the end of the quarter, the market remained largely subdued, reflecting the broader challenges in the global MTBE market, including the impact of holiday season slowdowns and ongoing geopolitical tensions.

Analyst Insight

According to Procurement Resource, the MTBE price trend is expected to see a jumbled price trend amidst miscellaneous demand dynamics globally in 2024.

Methyl Tert-Butyl Ether Price Trend for the July - September of 2023

Asia

The Asia Pacific chemical market grew rapidly in the third quarter of 2023, boosting the demand for methyl tert-butyl ether. The result of this robust demand could be seen in the rise in the number of exports and tight supply of the product. Further, the rise in the cost of crude oil also supported the rise in the methyl tert-butyl ether price trend. In view of increased demand, the manufacturers increased their production rates, giving the overall market a boost.

Europe

In European countries, the methyl tert-butyl ether price trend were supported by the positive sentiments shown by the consumer sector. The demand throughout the third quarter of 2023 inclined gradually while due to lower production rates of the manufacturing sector, the level of methyl tert-butyl ether inventories declined by a great margin. Thus, this limited supply, rising demand, and improving trading activities of European countries helped in the rise in the methyl tert-butyl ether price trend.

North America

The purchasing potential of the consumers showcased significant improvement in the third quarter of 2023. In North America, the consumption of gasoline and diesel also increased by several folds, while the OPEC+ restriction led to a significant incline in production costs. Thus, the combined result of a surge in demand and a rise in manufacturing costs led to the rise in the methyl tert-butyl ether price trend.

Analyst Insight

According to Procurement Resource, the price trend of Methyl Tert-Butyl Ether are expected to face northwards in the upcoming quarters as its demand from the end-user industries is inclining, but the global inventories of Methyl tert-butyl ether are depleting.

Methyl Tert-Butyl Ether (MTBE) Price Trend for the First Half of 2023

Asia

Asian Methyl Tert-Butyl Ether (MTBE) market performed fairly well during the first half of 2023. Prices remained on an inclined trajectory for the majority of the time period. As the demand from the downstream gasoline industry and the feedstock methanol prices improved, the price trend for Methyl Tert-Butyl Ether (MTBE) inclined. Producers in the Asian region had to ramp up their production capabilities in order to be able to cater to rising domestic and international demands.

Europe

The price trend for Methyl Tert-Butyl Ether (MTBE) exhibited mixed patterns in the European region during H1 2023. The market started with strong fundamentals in the first quarter, as both downstream and upstream cost support elevated the prices. There was a rise in queries, and feedstock prices also improved. But as the inventory levels rose in Q2, prices started dipping because of falling demands. Competition with cheap Asian markets also affected the demand fundamentals, causing the Methyl Tert-Butyl Ether (MTBE) prices to decline in the European region.

North America

The US Methyl Tert-Butyl Ether (MTBE) market had a slow start at the beginning of the first quarter of 2023. But the trend started improving as factors such as high production costs, enhanced feedstock prices coupled with improved demands from the downstream gasoline market set the Methyl Tert-Butyl Ether (MTBE) prices on an inclined track, and the positive trend continued for the rest of the said period.

Analyst Insight

According to the Procurement Resource, the price trend for Methyl Tert-Butyl Ether (MTBE) will likely oscillate in the upcoming quarter. The unsettled downstream demands, coupled with the volatile feedstock prices, will impact the MTBE market.

Methyl Tert-Butyl Ether Price Trend For the Q2, Q3 and Q4 of 2022

Asia

The price trend for methyl tert-butyl ether recorded a mixed pattern during the said period. In Q2, the prices inclined given the disruptions in supply chains and logistics. The high demand amid the rising prices of feedstock methanol and isobutylene further pushed the prices higher. However, the trend reversed in the second half and the methyl tert-butyl ether market projected downwards.

The inventories piled due to the demand destruction of the domestic market. The price trend also suffered from disruptions in trade activities along with weak demand and high volatility in the prices of raw materials. The downstream demand sector for gasoline was weak in the last two quarters of 2022 resulting in a decline in the profit margins of producers and turn declining the prices of methyl tert-butyl ether.

Europe

The European market flourished in the second and third quarters as downstream demand inclined. The rising demand affected the inventories and the availability of the product in the market decreased further aiding the price trend for methyl tert-butyl ether. However, production levelled up with this rising demand, and because of this, the fourth quarter faced the problem of oversupply. The accumulation of products caused a disbalance in the supply-demand dynamics leading to a fall in MTBE prices.

North America

In the North American region, the prices of methyl tert-butyl ether followed an inclining trajectory as the supply was unable to keep up with the rising demand for the commodity.

The market witnessed rising purchasing activities and disruptions in the supply-demand equilibrium in the initial months of the said period. However, the trend was reversed in the fourth quarter as the prices of natural gas declined and the supply of the product surged. With the availability of enough stocks and feeble demand, the price trend for methyl tert-butyl ether followed a downward trajectory.

Analyst Insight

According to Procurement Resource, the price trend for methyl tert-butyl ether (MTBE) are expected to fluctuate in the coming months. The MTBE prices will be majorly affected by the status of supply-demand equilibria and the fluctuating prices of crude oil and gas.

Methyl Tert-Butyl Ether Price Trend For the Q1 of 2022

Asia

In February of the first quarter of 2022, South Korea ceased supplies of MTBE to Russia, joining the United States and the European Union in distancing itself from Moscow following the invasion of Ukraine. Due to shifting energy prices, the Asian market remained unpredictable, and a number of manufacturers contemplated reducing production rates due to the high cost of feedstock Methanol.

In February, Methyl Tert-Butyl Ether prices in India were 1,474 USD/MT. In February and March, major manufacturers of MTBE shut down their facilities for maintenance, which further pushed up costs. In March 2022, the arbitrage window for moving MTBE from China to Singapore has increased significantly due to the price increase in Singapore.

Europe

In the first quarter of 2022, the market remained solid despite an exceptional increase in crude oil prices compared to the previous quarter. The insufficiency of transportation and manpower throughout the region hampered regional distribution due to logistical challenges. In the final week of March, costs began to decline as a result of ample supply and weak market demand.

The price of the chemical in Germany increased by 2% in the first quarter compared to the previous quarter. The Russia-Ukraine war is believed to be the primary cause of the European MTBE market's extreme volatility.

North America

In the first quarter of 2022, Methyl Tert-Butyl Ether prices increased due to supply constraints and solid demand from downstream consumers. In the second part of the quarter, escalating tensions between Russia and Ukraine exacerbated the gasoline shortfall in the downstream industries.

Due to the increase in operating costs, downstream gasoline prices increased dramatically as a result of a large plant turnaround in the second part of the quarter affecting output units. In the United States, the price of the chemical increased as a result of a rise in the cost of natural gas as a result of intensifying international sanctions on Russia. Comparing the first quarter to the previous quarter, the price of the chemical on the domestic market increased by 3%.

Methyl Tert-Butyl Ether Price Trend For the Fourth Quarter of 2021

Asia

Comparing the fourth quarter of 2021 to the previous three quarters, it was noted that MTBE prices increased in Asia. In late October, MTBE prices were sustained by robust values of upstream oil and robust demand from the pharmaceutical business.

The demand for the chemical in India remained consistent, and as a result, there was only a slight fluctuation in pricing. According to the statistics, MTBE commerce was small during the previous month, but there were numerous imports from Israel at about the same price.

In the last week of December, Methyl Tert-Butyl Ether prices in India reached an all-time high, fluctuating between 1,475 USD/MT Ex-Bhiwandi and 1,555 USD/MT Ex-Bhiwandi for the Pharma Grade. The market on the Indian subcontinent mirrored the worldwide MTBE market, where market dynamics worsened towards the end of the year. Demand also witnessed a period of consumption stagnation due to the pharma sector's demand growth reaching a plateau.

Europe

Comparing Q2 and Q3, the price of the chemical in the European market increased significantly in Q4. This tendency was the outcome of an increase in methanol and acetic acid as well as a good trade environment. The demand in Germany and Belgium remained robust, with the downstream sector driving demand growth.

As the year drew to a close, however, gasoline remained weak against naphtha, making it less profitable for gasoline blenders to use naphtha as a blending component and reducing the need for octane boosters such as MTBE. Additionally, the impending New Year had a negative impact on the industries, resulting in a decrease in demand and an increase in inventories.

North America

In the fourth quarter of 2021, MTBE prices in the United States rose relative to the previous quarter. In November, prices were reported to be hanging between 898 USD/MT FOB USGC and 956 USD/MT FOB USGC, which was the highest point.

With the advent of the New Year and the increase of new Omicron cases in the last week of December, the market saw a modest decline in price, but remained robust. The price was sustained by a lack of coal and an increase in the cost of methanol and isobutylene. Weak trade activity and enough product supply towards the end of the year led to a low pricing.

Methyl Tert-Butyl Ether Price Trend For First, Second and Third Quarters of 2021

Asia

The Asian MTBE market remained substantially limited during Q1 2021. The demand from the gasoline blending industry increased, due to the return of industrial and commercial operations in the region.

The consistent usage pushed up the regional Methyl Tert-Butyl Ether prices in first half of the quarter. Moreover, globally low upstream supplies in February influenced the prices by a large proportion. In India MTBE offtakes were drastically curtailed in the beginning part of the second quarter.

Demand remained constant in China as the introduction of consumption tax in mid-June by the Chinese government maintained the MTBE pricing trend. Hence the Asian blenders took a conservative strategy to obtain significant amounts of MTBE. The gasoline blending demand in China and Malaysia remained tight while domestic inventories in South Korea showed a growth in Q2.

With the restoration of industrial and commercial operations in Asia-Pacific during the third quarter of 2021, demand in the region had a good resuscitation. In India, offtakes climbed significantly during this quarter, while prices stabilized after seeing a steady decline during the previous quarter.

Europe

During the first quarter of 2021, supplies were curtailed in the European area, as numerous plants were working at decreased efficiency owing to the extreme cold weather in the Northwest European region. Furthermore, the domestic consumption fell owing to lockdown in significant areas of the region, which resulted in lower demand from the downstream gasoline blenders.

Imports further declined as a key factory from the Middle East ceased its turnaround in the second quarter. Constant offtakes from the pharmaceuticals industry substantially increased the MTBE demand in Europe. FOB ARA (Amsterdam-Rotterdam-Antwerp) bids were estimated about 687 USD/MT in the first half of the quarter.

North America

MTBE supplies in the North American area were scarce, during the first quarter of 2021. However, the demand started a rapid increase despite the low supply scenario, thereby resulting in fewer shipments to other areas in Q1 2021. MTBE prices in the US increased by 75 USD/MT to 670 USD/MT in FOB New York.

During the second quarter of 2021, FOB Texas MTBE offers in May were traded at 680 USD/MT, drawing cues from the improving market sentiments amidst the mass vaccination drive and boosted the offtakes from the gasoline blending industry. In the beginning of the third quarter of 2021, MTBE prices decreased.

Methyl Tert-Butyl Ether Price Trend For the Year 2020

Asia

The supply of MTBE in the Southeast Asian market remained inconsistent as a result of a number of plant shutdowns and restarts. Towards the end of September, S-Oil of Korea was reportedly doing a maintenance turnaround at its MTBE facility, while Chandra Asri of Indonesia launched its plant in early September.

The supply difficulties were worsened by the shutdown of Taiwan's Formosa plant in the second part of the third quarter owing to a fire risk at its upstream facilities. As a result of the global pandemic's effect on oil consumption, there was a continued lack of demand.

Reduced differential between derivative 92 RON gasoline and MTBE reflected its decreased utilization on the regional petrochemical market, which therefore had a direct influence on its costs. Since the emergence of Coronavirus, the demand for pharma-grade MTBE has led to a significant increase in price.

In accordance with the market perspective, the price of MTBE Pharma grade in India had a continual increase and was estimated at 1,250 USD/MT.

Europe

Europe's supply fundamentals were significantly facilitated by the easing of containment restrictions across the continent. From July to September, operating rates increased in tandem with the restoration of robust market activity.

Peak demand season in the European region supported the resuscitation in consumption of methanol-based fuel oxygenate along the nations of the Mediterranean region, such as Spain, Greece, and Italy. Even after the reappearance of Coronavirus in a number of regions, the MTBE market remained balanced due to strong seasonal demand.

North America

Beginning in the first quarter of 2020 and continuing into the third quarter of 2020, supply shortages persisted as a result of the devastating effects of hurricanes in the Gulf Coast area of the United States. The region's export potential decreased in comparison to the previous fiscal year as a result of a decline in the use of petrochemical products owing to the spread of Covid-19.

However, consumption of MTBE increased compared to the preceding quarter, as several nations resumed market activity with relative ease in response to Covid-19 control efforts. Overall, the market in the United States experienced a decline due to the fact that a significant portion of domestic output is devoted to meeting international demand.

Procurement Resource provides latest prices of MTBE (Methyl Tert-Butyl Ether). Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Methyl Tert-Butyl Ether

MTBE or Methyl Tert-Butyl Ether is basically a colourless liquid with a distinctive anaesthetic-like odour. Its vapours are heavier than air. Its boiling point is about 131°F while its flash point is about 18°F. It is also less dense than water and soluble in it. It belongs to the group of chemicals commonly known as oxygenates that increase the oxygen content of gasoline. It is utilised as an octane booster in gasoline.

Methyl Tert-Butyl Ether Product Details

| Report Features | Details |

| Product Name | Methyl Tert-Butyl Ether |

| Industrial Uses | Fuel and fuel additive, Blending component, Ether of acyclic hydrocarbon, Octane improver, Automotive, Solvent, Anti-knocking agent |

| Chemical Formula | (CH3)3COCH3 |

| Synonyms | Tert-Butyl Methyl Ether, 1634-04-4, 2-Methoxy-2-Methylpropane |

| Molecular Weight | 88.15 g/mol |

| Supplier Database | Acros Organics, SABIC, LyondellBasell Industries Holdings B.V., Reliance Industries Ltd, Evonik Industries AG |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal, and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Methyl Tert-Butyl Ether Production Process

- Production of MTBE from Raffinate-1 and Methanol via Etherification; from C4 Raffinate and Methanol; from Butane and Methanol; from Isobutylene and Methanol

MTBE is produced from raffinate-1 and methanol using an etherification process, which is initially carried out in a conventional reactor and then in a reactive distillation column. This results in the formation of MTBE.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com