Product

Mixed Xylene Price Trend and Forecast

Mixed Xylene Price Trend and Forecast

Mixed Xylene Regional Price Overview

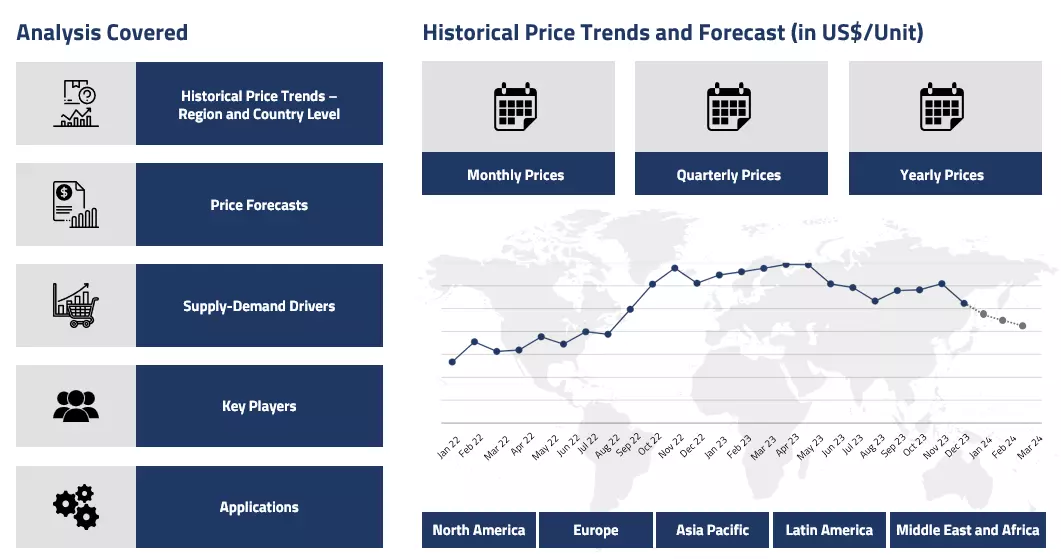

Get the latest insights on price movement and trend analysis of Mixed Xylene in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Mixed Xylene Price Trend for the Q3 of 2024

Asia

In Asia, the mixed xylene market started on a slower note, with demand from key downstream sectors like paints, coatings, gasoline blending, and lubricants remaining moderate. End-user consumption showed little improvement, keeping market sentiment soft. Chinese buyers, in particular, were cautious in procuring import cargoes, as concerns over demand continued to dominate the region.

Mixed Xylene Price Chart

Please Login or Subscribe to Access the Mixed Xylene Price Chart Data

Despite a temporary bottoming-out of prices, the overall buying enthusiasm stayed low. Super Typhoon Yagi made landfall in parts of China and Vietnam during the period, but its impact on supply chains was minimal, further reflecting the general sluggishness in the market.

Europe

In Europe, mixed xylene prices firmed in early July due to a surprising increase in domestic demand and higher upstream costs. The planned cracker outages, especially in Germany, and a rise in natural gas prices contributed to the upward trend in the first half of the quarter. However, as the quarter progressed, the market took a downward turn due to weak buying sentiments, ample material availability, and sluggish demand from downstream sectors like paints and coatings.

The construction sector's slowdown, compounded by high interest rates and inflationary pressures, further softened demand. By September, the market sentiment remained muted, with tepid inquiries and abundant stock levels pushing prices lower. Export demand also diminished, keeping the European market on a downward trajectory.

North America

In North America, mixed xylene followed a similar trend, driven by fluctuating demand from the gasoline blending sector and the broader chemical industry. In the early part of Q3, rising feedstock costs, including crude oil and naphtha, kept prices supported. However, towards the latter part of the quarter, market players reported weaker buying interest, especially in the face of economic uncertainties. Slower industrial activities and tepid downstream demand weighed down market sentiment, and producers adjusted their operating rates to align with softer demand trends.

Analyst Insight

According to Procurement Resource, the price trend of Mixed Xylene is expected to exhibit a bearish momentum in the upcoming sessions. This anticipated price decrease is linked to lower demand from downstream markets and underperformance in economic activities, further influencing the market's demand.

Mixed Xylene Price Trend for the Q2 of 2024

Asia

In Q2 2024, the Chinese mixed xylene market encountered downward pressure due to oversupply and shifting demand dynamics. Despite initial support from maintenance shutdowns and the increase in overseas demand as well as international prices, the market struggled as new production units raised the level of inventories. The major setback came from the US traders as they limited their import rates of the commodity significantly by the end of the quarter.

Initially, the wider price gap between p-xylene and mixed xylene was supported by the purchasing, but this momentum trailed off as this gap narrowed and para-xylene unit maintenance reduced procurement. Additionally, limited demand for gasoline blending due to the oversupply of blending materials and the cautious stance of the consumer sector pushed the prices further to the lower end. As a result, mixed xylene prices in China faced significant downward pressure, reflecting the declines incurred by aromatic product prices and an increasingly imbalanced supply-demand equilibrium.

Europe

In Q2 2024, mixed xylene prices in the European market witnessed a significant decline driven by multiple factors. The bearish tone of the crude oil market since the advent of the quarter due to increased production cuts by OPEC+, economic uncertainties, and subdued demand from downstream industries like p-xylene, m-xylene, and o-xylene contributed to the downward trend. Further, lower feedstock naphtha prices further reduced production costs, intensifying bearish sentiment among manufacturers.

Despite persistent disruptions in supply from the Red Sea and limited domestic operating rates, the market saw a gradual dimness in the prices throughout the second quarter. Although, the environmental challenges, including recent flooding in parts of Germany, added strain to supply lines but did not immediately impact mixed xylene production.

North America

In Q2 2024, mixed xylene prices in the US market experienced a persistent decline despite the onset of the summer driving season. The limited demand from the chemical and blending sectors, coupled with ample material availability, exerted downward pressure on prices. Despite positive movements in upstream aromatic naphtha prices, these increases were insufficient to reverse the market's downward trajectory.

Economic uncertainties and subdued consumption in end-user sectors like o-xylene, p-xylene, and m-xylene further dampened market sentiment. Sliding inquiries from the gasoline blending industry, despite the seasonal uptick in demand, also contributed to the overall bearish trend. However, the traders anticipate that the potential increase in upstream naphtha costs and optimistic forecasts for crude oil prices may support a rebound in mixed xylene prices.

Analyst Insight

According to Procurement Resource, the price of Mixed Xylene is anticipated to move northwards with the strengthening of demand from downstream sectors during the summer and tightening supply dynamics lifting the prices in the coming months.

Mixed Xylene Price Trend for the Q1 of 2024

| Product | Category | Region | Price | Time Period |

| Mixed Xylene | Chemicals | Asia | 1006 USD/MT | January 2024 |

| Mixed Xylene | Chemicals | Asia | 1032 USD/MT | March 2024 |

| Mixed Xylene | Chemicals | India | 944 USD/MT | January 2024 |

| Mixed Xylene | Chemicals | India | 1023 USD/MT | March 2024 |

Stay updated with the latest Mixed Xylene prices, historical data, and tailored regional analysis

Asia

The mixed xylene markets in Asia saw a downturn at the start of 2024 in response to rising crude oil benchmarks due to geopolitical tensions in the Gulf of Aden. The mixed xylene spot prices thus only moved from 1006 USD/MT to 1032 USD/MT in the first quarter of 2024. This abrupt stagnancy was also due to a lack of trading activity in Singapore and a reduction in intra-regional exports.

However, the oil prices surged in the New Year's first trading session, influenced by expectations of disruptions in Middle East supply chains and positive outlooks for holiday demand and economic stimulus in China, somehow supporting the pricing patterns of mixed xylene. However, the downstream industries turned southwards with the fall in the industrial growth of the market due to the initiation of the Chinese New Year holiday season, limiting the growth outlook of the market.

In India, the trajectory of mixed xylene prices was particularly opposite to what was observed in China. The spot prices of mixed xylene there grew from an average of 944 USD/MT to 1023 USD/MT during Q1 of 2024, reflecting healthy industrial growth and a surge in the cost of raw materials.

Europe

Mixed xylene prices in Europe saw a resurgence but only in the latter phase of the first quarter, supported by elevated upstream prices and tight regional supply. During the initial phase of the quarter, the downstream industry demand remained subdued due to unfavorable market conditions, exerting a negative influence on the market trajectory of mixed xylene.

The rising feedstock mixed xylene prices, however, were a key driver behind the price increase, reflecting the bullish sentiments among manufacturers. The global crude oil prices also remained on the higher end of the spectrum, fueled by ongoing OPEC+ production cuts and disruptions in shipping routes. The domestic production of mixed xylene was constrained by reduced operating rates amid challenging economic conditions, leading to supply-side pressures and increased prices.

North America

In the US market, mixed xylene prices remained on the lower end of the spectrum due to limited spot purchasing activities despite increased demand for fuel oils in exports and ship refueling. Not only mixed xylene but its derivatives also showcased mixed sentiments, reflecting the skeptical consumer confidence in the market in the initial phase. However, in the later stages of the quarter, the surge in crude oil prices and the limited influx of overseas imports moved the consumers' focus towards in-house production, supporting the overall momentum of the mixed xylene market.

Additionally, escalating geopolitical tensions and dynamics in the chemical industry, along with increased production costs of downstream derivative products, reflected the improvements during the first quarter of 2024 in the North American market, which might eventually show their influence in the near quarters.

Analyst Insight

According to Procurement Resource, the price trend of Mixed Xylene is expected to face northwards as the positive outlook of downstream demand and improvising supply chains of crude oil will support the uptick in the mixed xylene price trend.

Mixed Xylene Price Trend for the October - December of 2023

| Product | Category | Region | Price | Time Period |

| Mixed Xylene | Chemicals | India | 1115 USD/MT | October'23 |

| Mixed Xylene | Chemicals | India | 963 USD/MT | December’23 |

| Mixed Xylene | Chemicals | China | 1089 USD/MT | October'23 |

| Mixed Xylene | Chemicals | China | 976 USD/MT | December’23 |

Stay updated with the latest Mixed Xylene prices, historical data, and tailored regional analysis

Asia

The fourth quarter of the year 2023 witnessed a swift decline in the mixed xylene price trend in the major Asian markets. Heavy inventories and dull demands from the downstream rubber and leather industries also pivoted the mixed xylene market trajectory downwards.

The Indian domestic market witnessed a quarterly downfall of about 13% as the monthly average prices went from about 1115 USD/MT in October to about 963 USD/MT in December’23. Similarly, the Chinese mixed xylene market witnessed a depreciation of about 10%; the monthly average prices went from about 1089 USD/MT in October to about 976 USD/MT in December’23. Overall, slumping market trend were observed for mixed xylene throughout the fourth quarter of the year 2023.

Europe

The European market trend for mixed xylene were not very different from the Asian market trend. The prices varied in a downgrading manner as the bearish demand outlook forced the market southward in the majority of the domestic European markets. Degradation in the feedstock crude oil market also pushed the mixed xylene market down.

North America

The American mixed xylene market could not behave any differently than its Asian and European counterparts. The decline in offshore trade because of the freight disturbances pivoted the crude oil price trajectory downhill. Consequently, the mixed xylene market trend also shifted downwards. The general market sentiments were observed to be weak during this period.

Analyst Insight

According to Procurement Resource, Mixed Xylene price trend will take some time to improve as the current demand dynamics project further depreciation in the mixed xylene market.

Mixed Xylene Price Trend for the July - September of 2023

Asia

The mixed xylene prices surged by a significant margin in the third quarter of 2023 as the hike in the cost of feedstock material was sufficient in driving the mixed xylene price trend towards an upward trajectory. In addition to this, a substantial rise in the cost of production resulted in the rise in mixed xylene spot prices from approximately 1035 USD/MT to 1176 USD/MT in this quarter.

The demand was positive not only in the domestic but also in the overseas market. On the other hand, the manufacturing rates failed to incline at the pace of rising demand.

Europe

With the upswing in the cost of crude oil due to regulations sanctioned by OPEC+, increasing cost of production, and hike in demand, the mixed xylene price trend experienced an inclination in its prices. The trajectory of the mixed xylene price graph was also pushed in the green zone by lowering inventory levels in view of declined manufacturing rates and falls in the industrial and manufacturing sectors amid growing economic challenges.

North America

The bullish trajectory of mixed xylene price trend throughout the third quarter of 2023 was a consequence of the increasing cost of naphtha and restriction in the supply of crude oil from the majority of exporting nations. The drop in the North American inventories of mixed xylene and the closure of several crude oil refineries amid its rising demand also helped in the rise in the mixed xylene price trend.

Analyst Insight

According to Procurement Resource, the price trend of Mixed Xylene are expected to face northwards in the upcoming quarters as its demand from the end-user industries is inclining but the global inventories of mixed xylene are depleting.

Mixed Xylene Price Trend for the First Half of 2023

Asia

The price trend of Mixed Xylene performed fairly in the Asian market in the first half of 2023. Prices exhibited fluctuating patterns throughout the said period. As the market started reviving in China post removal of lockdown restrictions, demands from both domestic and international markets started rising.

Prices inclined, and manufacturing also started inclining along. Spot Prices started at an average of around 1008 USD/MT in January 2023 and inclined till April with around a 12% rise. But as the inventories rose and inquiries from downstream industries dipped, prices declined in the last months of the second quarter. The Chinese spot prices averaged around 1030 USD/MT in June’23.

In a similar manner, Mixed Xylene prices oscillated in the Indian domestic market. Average spot prices inclined from about 954 USD/MT in January to around 1063 USD/MT in March 2023 in the first quarter and wavered at around 1027 USD/MT in June by the end of the second quarter. Overall, the market remained afloat.

Europe

European Mixed Xylene market resembled the Asian market trend and fluctuated throughout the said period. Some inclinations in the price curve were attributed to the market demands from downstream rubber and leather industries. Whereas piled-up excess supplies dragged the prices down occasionally, the overall market sentiments remained afloat.

North America

The North American market was still stable compared to the other global markets. Market sentiments were dull as inventories were saturated, and the downstream industries didn’t pose much demand. Cheap Asian imports were available as the manufacturing sectors started reviving in China. Overall, dull market sentiments were observed.

Analyst Insight

According to the Procurement Resource, the Mixed Xylene prices are expected to fluctuate, given the current pricing fundamentals and rising inflation rates.

Mixed Xylene Price Trend for the Second Half of 2022

Asia

The prices of Mixed Xylene prices showcased a fluctuating price pattern in Asia in the second half of the year 2022. Some short-lived hikes were observed, but mostly the prices wavered on the lower end. As the third quarter began prices started falling owing to little to no demand. But as the aftereffects of covid-19 lockdown in China started fading, some industrial activities resuscitated pushing up the prices a bit, later that quarter.

The final quarter recorded a declining trend in the Mixed Xylene prices given the demand destruction amid harsh market conditions. Industrial revival in China didn’t prioritize downstream leather and rubber industries as much causing the prices to fall both in India and China.

Europe

Europe replicated the price trend as seen in the Asian market. The poor demands were attributed to the decreasing purchasing power caused by double-digit inflation and high energy costs. Even though the prices of crude oil started normalising in the last quarter, no impact on the prices was seen as the market enquiries took to a bare minimum. The hiked interest rates along with falling buyers’ confidence in the market further aided this decline.

North America

The North American market witnessed mixed price trend for Mixed Xylene during the said period. As the freight situations improved and supply chains started restoring, upstream costs were reduced and stabilized. Occasional demand hikes pushed the prices up sometimes, but overall bearish demands kept the market sentiment low.

Analyst Insight

According to Procurement Resource, the price trend for Mixed Xylene are expected to remain volatile in the coming months. Considering the sufficient inventories and falling upstream cost pressure, a significant rise in the market offtakes will directly impact the Mixed Xylene prices.

Mixed Xylene Price Trend For the First Half of 2022

Asia

Prices for Mixed Xylene surged in Asia due to increased demand from downstream battery, solvent, and intermediates companies. The price of Mixed Xylene in India increased by 8.1% in the first quarter, with prices hovering at 1342-1434 USD/MT in March.

Throughout the second quarter of 2022, the price trend of Mixed Xylene fluctuated. As a result of the COVID revival, the market was closed in April, causing the price to initially fall. Because to port congestion and low purchasing attitude, the merchandise was stacked. After the lockdown restrictions were lifted, the local market regained its vitality.

Europe

Prices of Mixed Xylene in Europe were observed to fluctuate in Q1 2022, with a drop in February reaching 815 USD/MT CIF Hamburg, then rising in March. Because of the ongoing conflict between Russia and Ukraine, the prices of upstream naphtha and crude oil fluctuated, causing fluctuations in Mixed Xylene prices.

The xylene market in the United Kingdom increased in the second quarter of 2022. The Russian incursion into Ukraine pushed up the price of upstream crude, which pushed up the price of Mixed Xylene. The shortage of raw materials as a result of restrictions against importing Russian oil increased the expenses even higher.

North America

Price trend for Mixed Xylene in North America climbed during the first quarter of 2022 due to increased demand from the paints and coatings sector. Mixed Xylene prices mirrored crude oil market’s mood, rising first to a very high level before settling into an acceptable range in the middle of Q1 2022. In the second quarter of 2022, Mixed Xylene continued to climb in the US market.

The price of Mixed Xylene increased in tandem with the price of upstream Mixed Xylene. Because of the product's scarcity, the rising tensions induced by sanctions on Russian imports increased the cost of upstream crude. Furthermore, demand from downstream Isophthalic Anhydride producers increased, further inflating the Mixed Xylene price.

Procurement Resource provides latest prices of Mixed Xylene. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Mixed Xylene

Mixed Xylene appears as a colourless, sweet-smelling liquid. It is one of the three isomers of dimethylbenzene which all together as known as xylenes. It is both insoluble in water and less dense than water.

Mixed Xylene Product Details

| Report Features | Details |

| Product Name | Mixed Xylene |

| HS CODE | 29024200 |

| CAS Number | 108-38-3 |

| Industrial Uses | Rubber Industry, Production of gasoline, Leather industry |

| Chemical Formula | C8H10 |

| Synonyms | 1,3-Xylene, 1,3-Dimethylbenzene |

| Molecular Weight | 106.16 g/mol |

| Supplier Database | Merck KGaA, Honeywell International Inc., Chevron Phillips Chemical Company, Mitsubishi Gas Chemical Company Inc. |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Mixed Xylene Production Processes

- Production of Mixed Xylene via Adsorptive Separation

This procedure involves the adsorptive separation of a mixture of C8 aromatics in order to recover Mixed Xylene along with other xylenes, which are then further separated to produce Mixed Xylene.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com