Product

Pentaerythritol Price Trend and Forecast

Pentaerythritol Price Trend and Forecast

Pentaerythritol Regional Price Overview

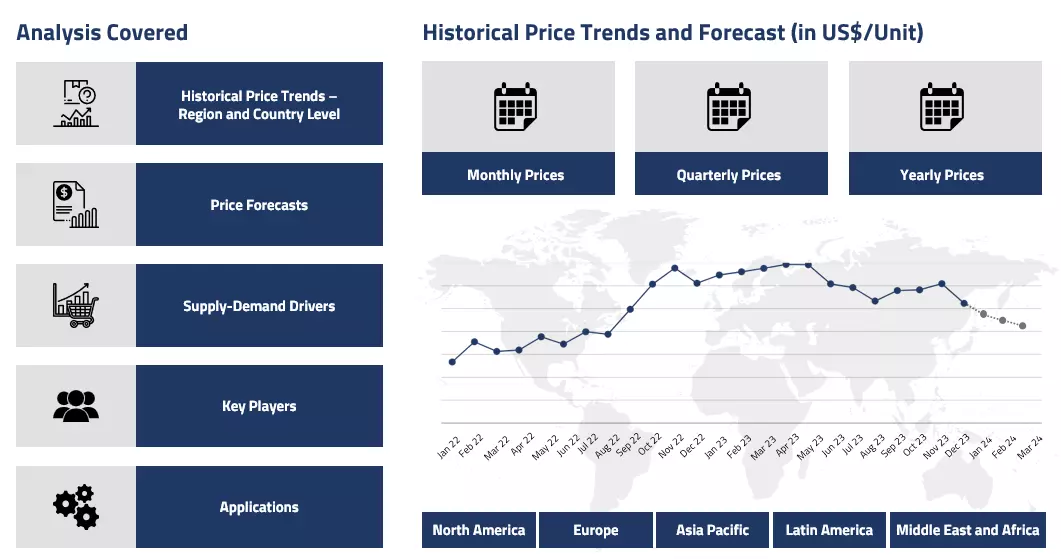

Get the latest insights on price movement and trend analysis of Pentaerythritol in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Pentaerythritol Price Trend for the Q4 of 2024

Asia

The Asian market for Pentaerythritol in Q4 2024 closely followed the price trends of formaldehyde, a key feedstock in its production. In India, formaldehyde prices rose during the early part of the quarter, driven by steady demand from the construction and resins industries. This increase influenced Pentaerythritol production costs, resulting in higher prices at the beginning of the quarter. However, as formaldehyde prices declined in the latter half of the quarter, Pentaerythritol prices also adjusted accordingly, leading to a more balanced market.

Pentaerythritol Price Chart

Please Login or Subscribe to Access the Pentaerythritol Price Chart Data

Demand for Pentaerythritol remained steady across the region, supported by its applications in coatings, lubricants, and alkyd resins. Regional manufacturers managed production levels efficiently to align with fluctuations in raw material costs, ensuring a stable supply. By the end of the quarter, prices stabilized due to balanced supply-demand dynamics and adjustments in feedstock costs.

Europe

In Europe, the Pentaerythritol market remained stable during the early weeks of Q4 2024. Consistent demand from the automotive, construction, and paint sectors contributed to a balanced pricing environment. However, as the quarter progressed, a seasonal slowdown emerged due to reduced industrial activity during the holiday period. This led to a slight decline in prices toward the end of the quarter as demand weakened. Despite this, the supply chain remained stable, with regional producers and imports ensuring adequate availability. Additionally, fluctuations in input costs caused minor price adjustments, though the overall market remained well-balanced.

North America

In North America, the Pentaerythritol market followed trends similar to those in Europe. The quarter began with stable demand from key sectors such as adhesives, resins, and construction materials. Prices remained steady in the initial phase, supported by consistent downstream activity and sufficient raw material availability. However, a seasonal slowdown toward the end of the quarter led to a marginal decline in prices as industrial operations decreased during the holiday period.

Domestic production levels were adjusted to align with the softened demand, preventing any significant surplus. By the end of the quarter, the market reflected balanced conditions, with minimal disruptions to supply or pricing.

Analyst Insight

According to Procurement Resource, the price graph is expected to follow a similar trend in the near future, primarily influenced by fluctuations in feedstock costs.

Pentaerythritol Price Trend for the Q3 of 2024

Asia

In Asia, pentaerythritol prices remained relatively stable throughout most of the third quarter. While supply issues and rising production costs were not as pronounced as in North America or Europe, the Asian market still faced its own set of challenges. In particular, the demand from the paint, coatings, and adhesives sectors, which are significant consumers of pentaerythritol, remained stable but did not show substantial growth.

The automotive sector, while important, did not see the same level of recovery as in Europe, with demand for pentaerythritol remaining modest. In China, where the construction sector plays a pivotal role in driving demand for chemicals like pentaerythritol, there was some weakness in the market due to slow construction activity. However, the anticipated improvement in infrastructure spending and the ongoing recovery of the manufacturing sector helped to keep prices steady. Additionally, as Asia remains a key exporter of pentaerythritol, regional price dynamics were influenced by global trends, particularly rising demand from Europe’s automotive sector.

Europe

In Europe, pentaerythritol prices also experienced upward pressure, particularly in Germany, where the automotive industry played a significant role in driving demand. The recovering automotive sector, bolstered by new subsidies for electric vehicles (EVs), led to increased orders from polyol manufacturers, a key sector that relies on pentaerythritol. Polyols are crucial in the production of automotive components, coatings, and adhesives, and as the EV market continued to gain momentum, the demand for these chemicals surged. This contributed to the rise in pentaerythritol prices across Europe.

The steady rise in feedstock formaldehyde prices also played a role in the upward movement of pentaerythritol prices in Europe. Formaldehyde's cost stability, despite moderate availability, provided some relief to producers, allowing them to maintain steady production rates without significant disruptions. The overall stability in supply prevented any critical shortages, even as demand surged due to the automotive recovery.

North America

In North America, pentaerythritol prices saw upward momentum at the beginning of the quarter. This was primarily driven by disturbances in supply due to declining production rates during the past weeks, resulting from rising production costs. The increased cost of feedstock formaldehyde, which is heavily influenced by the rising prices of upstream natural gas, significantly impacted pentaerythritol production.

Formaldehyde, a key input in pentaerythritol production, saw price hikes, thereby driving up overall production costs. These factors contributed to the limited availability of pentaerythritol, pushing prices higher. Furthermore, logistical challenges due to weather disruptions, such as the La Niña effect and the hurricane season, affected the supply chain, prompting market players to build inventories in anticipation of further disruptions.

However, despite these supply-side constraints, demand for pentaerythritol remained moderate, especially from the automotive sector, which has been gradually recovering. The demand for polyurethane foams, a key application of pentaerythritol, was steady, supported by the automotive and manufacturing sectors.

Analyst Insight

According to Procurement Resource, the price trend of Pentaerythritol is expected to exhibit a bearish momentum in the upcoming sessions. This anticipated price decrease is linked to ongoing inventory destocking due to lower demand from downstream markets and underperformance in economic activities, further influencing the market's demand.

Pentaerythritol Price Trend for the Q2 of 2024

Asia

The Asian pentaerythritol market resonated with its feedstock formaldehyde and methanol during the second quarter of 2024. Initially, the market sustained a balanced approach with sufficient inventories carried over from the previous quarters and stable demand for the commodity. However, as the quarter progressed, the production cost of the commodity inclined, prompting the trading and manufacturing sectors to raise their price quotations.

The trend was further supported by escalating procurement rates from domestic and overseas markets. However, the rise in freight charges and trading delays hampered the overall sentiments of the market, limiting its growth potential.

Europe

During Q2 2024, the price of pentaerythritol in the European region showed an upward trajectory starting from May as producers raised their quotations due to consistent demand surpassing supply. This increase was driven by substantial demand from paint manufacturers, which themselves saw an increase in their sales figures and volumes despite a slight decline in other market parameters.

The market faced intermediate availability of stocks, primarily due to moderate operating rates at manufacturing facilities attributed to limited supplies of feedstock formaldehyde and firm offtakes from buyers and importers. The cost of production also rose from feedstock formaldehyde due to moderate stock availability and increased prices in the competitive international market of North America, further elevating the production costs of pentaerythritol.

North America

The price trend of pentaerythritol remained stable through most of the second quarter with slight month-on-month fluctuations as producers maintained their quotations amidst a well-balanced supply and demand scenario. In the previous quarter, the number of orders for pentaerythritol was moderately low, particularly from polyol manufacturers, due to sluggish consumption in the polyurethane segment, which in turn was affected by the falling momentum of the automotive sector.

This decline was then reversed by a substantial recovery of the Chinese electric vehicles in the overseas market. On the other hand, the inventories carried over led to firm pentaerythritol inventory levels in the region during this quarter, stabilizing the supply-demand curve of the market. However, the agrochemical market exhibited a wait-and-watch approach, with stable stocking practices among insecticide producers.

Pentaerythritol production rates were moderate due to the limited availability of feedstock formaldehyde supplies, driven by consistent demand from disinfectant manufacturers and firm cost support from upstream methanol. Despite the stable cost support from feedstock formaldehyde, the production rates remained balanced, maintaining the equilibrium in supply and demand.

Analyst Insight

According to Procurement Resource, the price of Pentaerythritol is expected to be driven by the escalating cost of feedstock commodities and improving demand dynamics across the globe.

Pentaerythritol Price Trend for the Q1 of 2024

| Product | Category | Region | Price | Time Period |

| Pentaerythritol | Chemicals | USA | 1982 USD/MT | March’24 |

| Pentaerythritol | Chemicals | Europe | 1586 USD/MT | March’24 |

Stay updated with the latest Pentaerythritol prices, historical data, and tailored regional analysis

Asia

The pentaerythritol market in China experienced a surge in the later months of the quarter. The market saw slight fluctuations, with a notable rise observed in March as post-holidays, the downstream industries revamped their production rates. The price movement of pentaerythritol closely followed the changes in the methanol market, which experienced an upward trend during the same period. The downstream demand remained steady, contributing to a positive sentiment among buyers.

The manufacturers also actively shipped pentaerythritol, further supporting the upward momentum in the market. The domestic methanol market also saw a rise in March, influenced by factors such as equipment maintenance and reduced production at various facilities. Despite fluctuations, the supply of methanol remained ample throughout the quarter, supporting an upward movement in the prices of pentaerythritol.

Europe

In Germany, the pentaerythritol market saw no significant changes in inquiries amidst the ongoing economic slowdown, with consumption rates remaining moderate across downstream industries due to ample supply availability. While demand for the paint and coatings industries remained steady, inquiries from the food and beverage industries were relatively low, reflecting a decline in the food sector sales.

On similar grounds, orders from insecticide manufacturers remained sluggish due to subdued demand in the agrochemical sector during winter. However, there was a notable increase in orders from polyol industries, driven by a gradual acceleration in the automotive sector, particularly spurred by Tesla's announcement to offset withdrawn subsidies on electric vehicles by the European Government.

Additionally, stability in feedstock prices was observed due to moderate availability, influenced by supply chain disruptions via the Suez Canal amid conflicts in the Middle East, while methanol import costs spiked due to limited purchases and escalating freight costs.

North America

In the USA, pentaerythritol prices have remained unchanged in the first quarter of 2024, reflecting stable market conditions with moderate demand from downstream industries. The adequate stock levels due to increased shipping activities raised the level of domestic inventories. Among the downstream industries, the paints and coatings, along with the polymer sector, presented suitable demand for pentaerythritol, but the procurement rates from other industries, such as agrochemicals, remained subdued.

Similarly, decreased orders were also noted from polyurethane foam manufacturers, attributed to a cooling demand in the automotive industry following production halts of gas vehicles due to new regulations. The stability in pentaerythritol prices was, however, supported by consistent feedstock availability. Additionally, limited exports and increased freight costs further influenced market dynamics and kept the pricing patterns above the red zone.

Analyst Insight

According to Procurement Resource, the price trend of Pentaerythritol is expected to attain a slow pace in the near quarters as the stagnancy in downstream procurement rates and limited support from feedstock industries will lower the overall momentum of the pentaerythritol market.

Pentaerythritol Price Trend for the October - December of 2023

Asia

The decline in pentaerythritol prices in the last quarter of 2023 was based on a global decline in the cost of methanol and crude oil. Also, pentaerythritol prices in the Asia-Pacific region kept falling due to the region’s pessimistic demand dynamics. Further, both a restricted supply of upstream chemicals and a notable decline in new orders from overseas players exerted a negative impact on the pentaerythritol price trend.

In addition, the supply chains were interrupted during the quarter due to severe weather that further reduced construction industries' ventures and hampered the movement of the pentaerythritol price graph.

Europe

The European pentaerythritol market experienced a great fall, especially in the last month of the fourth quarter. The poor operating rates in production units were partially a result of cautious purchasing by the consumers as their spending budget was constrained under rising inflationary pressure.

The low demand for pentaerythritol was also caused by the reduced use of synthetic lubricants, paint swelling agents, pesticides, and polyester fibers in the market. The procurement rates were further affected by a decline in orders from the plasticizer and ink sectors. Furthermore, cheaper imports of formaldehyde, the primary feedstock for pentaerythritol, and lower upstream methanol costs due to a fall in coal prices had a negative impact on production costs.

North America

The plastics and polymer industries registered a significant downturn in their market momentum during the end quarter of 2023, which was evident in the trajectory of the pentaerythritol price graph in Q4 of 2023. Further, the market expected some support from the improvement in the quoted costs of methanol and crude oil in the past quarters, but they themselves struggled to sustain their propulsion in North American markets and thus caused limited movement of the pentaerythritol market.

Analyst Insight

According to Procurement Resource, the price trend of Pentaerythritol are estimated to be based on the functioning of the downstream industries and global prices of crude oil and coal in the upcoming months.

Pentaerythritol Price Trend for the July - September of 2023

Asia

In the Asia Pacific countries, pentaerythritol prices continued their journey southwards as its demand remained bearish throughout the third quarter. The pentaerythritol price trend suffered from a significant reduction in the number of new orders and a limited supply of upstream chemicals.

In addition to this, due to extreme weather conditions, the supply chains remained disrupted throughout the quarter. Further, the construction activities and a number of inquiries from the coatings sector also experienced a downfall, resulting in a decline in the pentaerythritol price graph.

Europe

After a period of stagnancy and stability, the pentaerythritol price trend almost experienced a double-digit percentage fall in the third quarter of 2023. The European countries failed to support the pentaerythritol market dynamics as the soaring rates of inflation and hike in interest charged by banks suggested that the economy was going through a period of recession. In addition to this, the production costs slumped by a great margin on account of the weak performance of the feedstock materials.

North America

The food and ink industries failed to support the momentum of the pentaerythritol market, and thus, the pentaerythritol price trend moved southwards in the third quarter. The quarter also faced the ill consequences of lower rates of consumer consumption and weak movement of the North American economy. The effect of feeble economic conditions was also visible in the upstream market as they also struggled with their sales figures and thus lowered their pentaerythritol procurement rates.

Analyst Insight

According to Procurement Resource, the price trend of Pentaerythritol are estimated to continue their downward journey as neither the demand from the downstream industries nor the global economic conditions seem to support the pentaerythritol prices.

Pentaerythritol Price Trend for the First Half of 2023

Asia

The Asian Pentaerythritol market witnessed mixed price patterns during the first half of 2023. The construction sector was closed for a long time because of the covid 19 pandemic and related lockdowns. However, the sector picked up pace as soon as the markets opened up. So, the demands increased steadily from the downstream adhesive, varnish, and construction industries. Pentaerythritol prices remained on an inclining trajectory for most of the H1; it was only in the later H1 that the market started to show some reverse fluctuations as the inventory levels had risen significantly.

Europe

Contrary to the Asian market, Pentaerythritol prices showed declining behaviour in the European market in the first two quarters of 2023. As consumer sentiments had turned very necessity centric because of the severe and prolonged inflation in 2022, the construction and associated sectors took a major hit and posed limited to no demands. This caused inventories to remain filled and forced suppliers to reduce the prices in order to maintain the bearish trade sentiment. Overall, low swinging price patterns for Pentaerythritol were observed.

North America

Like the European market, the American market also witnessed bearish market sentiments as the hiked bank interest rates altered consumer behaviour. But as the middle of Q2 approached, demands started picking up in the American market as other factors like energy and crude oil prices stabilized. Rising demands started consuming the inventories, and more demands allowed the suppliers to procure products at higher prices. Overall, Pentaerythritol prices rose in the end period of the second quarter.

Analyst insight

According to Procurement Resource, Pentaerythritol prices are expected to continue oscillating in the coming months, given the erratic downstream demands.

Pentaerythritol Price Trend for the Second Half of 2022

Asia

In the last two quarters of 2022, the pentaerythritol price trend faced several challenges that hindered its growth rate. The energy crisis and new strategies to deal with the pandemic restricted the proper functioning of the manufacturing sector and thus depleted the overall market sentiments of pentaerythritol. The fourth quarter, on the other hand, was adversely affected by the decline in demand from the downstream industries and cuts in the profit margins of the traders.

Europe

The effects of the ongoing Russia-Ukraine crisis and, in turn, the rise in inflation rates pushed the pentaerythritol price trend in a southward direction. Further, the third quarter also struggled with the energy crisis in the region and a fall in the cost of raw materials along with persistent delays in the supply chains. In Q4, the oil shipments passing from Russian routes were suspended, which raised the cost of production of pentaerythritol. However, consumer confidence in the pentaerythritol market remained feeble and thus led to the downfall of the pentaerythritol price trend.

North America

The trajectory of the pentaerythritol price graph failed to experience an upswing as the poor cost support from feedstock industries played the most significant role in dictating the trend of pentaerythritol prices. The weak demand from the paints and cosmetics industries and stable rates of production in the last two quarters of 2022, along with consecutive discounts being offered by the traders, suggested the bearish trend in pentaerythritol prices.

Analyst Insight

According to Procurement Resource, the price trend of Pentaerythritol are expected to trace a declining pathway as the downstream industries do not seem to support the inclination in the pentaerythritol prices.

Pentaerythritol Price Trend For the Second Quarter of 2022

Asia

Pentaerythritol prices in the Asian market exhibited a consistent price trend, despite some minor fluctuations over the course of time. Moreover, the price decreased by 2% from the previous quarter. The cost of producing PENT dropped quickly over time due to continually falling feedstock costs for acetaldehyde and formaldehyde.

However, as the quarter came to a close, PENT expenses slightly climbed in June as a result of methanol supply difficulties brought on by the region's high raw material costs as well as rising energy and fuel prices. PENT continued to be in high demand from downstream sectors, and product offtakes remained steady in Q2 2022.

Europe

The price trend for Pentaerythritol in the European region remained stable, and the product's prices climbed somewhat over the quarter. The price of acetaldehyde and formaldehyde, which are used to make PENT, climbed somewhat in the second quarter.

Cost pressure was brought on by rising energy and gas prices as a result of NG supply constraints. As a specialised chemical, nevertheless, its production rates were minimal and solely based on demand, so both the product demand and offtakes in the area remained modest. In addition, product shipments were hampered by port container constraints, which subsided by the end of Q2.

North America

Throughout Q2, the pentaerythritol price trend in the North American region was steady and firm. Feed formaldehyde prices fluctuated throughout the period, and average acetaldehyde prices and steadily falling natural gas prices raised the cost of producing PENT in the first half of the quarter.

But following the fire event at the LNG port, natural gas costs varied at the end of Q2, and they sharply dropped, stabilising the PENT's production costs. Due to the continued modest demand, production rates were lowered to satisfy the needs of the domestic market, and product offtakes were stable.

Pentaerythritol Price Trend For the First Quarter of 2022

Asia

With prices starting at 2616 USD/MT Ex-Mumbai in India during January, market attitudes prepared the way for moderate firmness in the Pentaerythritol (PENT) market in India and China this quarter. Following the festive season in India, prices rebounded in Q1, with a 7% gain in this quarter compared to the previous one and an increase in demand from downstream purchasers.

Monthly changes were noticed, resulting in a steady increase in its pricing in China. The domestic market's demand fundamentals remained constant to robust, impacting this price trend. Furthermore, regular price adjustments for PENT in China were influenced by production halts.

Europe

Pentaerythritol prices in Europe increased in the first quarter of 2022, starting at 2510 USD/MT FOB Hamburg in Germany, due to rising crude oil costs as a result of Russia's invasion of Ukraine. As a result of the war's impact on European logistics, export prices from Germany have risen.

High energy values, on the other hand, continued to send shockwaves through the product's manufacturing costs. PENT pricing in the European market was also made easier by consistent ease within and across oceanic trading rates. The market was robust throughout the quarter due to the growing downstream market for adhesives and plasticizers.

North America

In the first quarter of 2022, pentaerythritol prices in North America climbed, starting at 2345 USD/MT FOB Texas in January. Pentaerythritol prices have risen due to increased demand from the downstream synthetic resins, paints, coatings, and varnishes sectors, as well as lower stockpiles and supply rates.

The price increased in the upstream formaldehyde and acetaldehyde markets due to the continuing war between Russia and Ukraine, which indirectly influenced the price of crude petroleum. The cost of freight and shipping increased, affecting import costs in the United States and ultimately raising product prices.

Pentaerythritol Price Trend For the Fourth Quarter of 2021

Asia

In Q4 2021, PENT pricing in the domestic market was extremely erratic. Following the Indian festival season, prices rose in October due to increased demand from downstream consumers. With lowering supply from the foreign market, prices steadily stabilised in November. Traders were concerned about offtakes from some segments in the midst of the loom in the polymer sector.

After seeing an incredible increase in demand throughout the Christmas season, major manufacturers indicated a dullness in the polymer industry. Market attitude for PENT in India eventually decreased, however small price gains were noted due to inflationary pressure. As a result, during December, pentaerythritol prices were heard hanging around 2170 USD/MT.

Europe

The pentaerythritol market slowed in Q4 2021, owing to sufficient feedstock supply and a reduction in demand. High energy levels, on the other hand, continued to have an impact on the product's manufacturing costs. Pricing on the European market was also made easier by consistent ease in inter and intra oceanic trade rates. Throughout Q4, the holiday season and little trade activity kept the PENT market in the area almost constant.

North America

Pentaerythritol prices in North America dropped significantly, as the prices of the feedstocks Acetaldehyde and Formaldehyde decreased. Furthermore, decreased demand from downstream industries such as paints and coatings led to PENT's negative pricing trend throughout this time period.

The slowdown in market activity and steady reductions in freight charges also helped to lower PENT pricing in Q4. Pentaerythritol prices in the United States were estimated at 2100 USD/MT in December, notwithstanding the lacklustre demand trend.

Pentaerythritol Price Trend For First, Second and Third Quarters of 2021

Asia

Prices of its upstream methanol increased as demand increased quickly and supply was hampered. Multiple plant shutdowns in the United States impeded upstream methanol supplies, affecting the availability of feedstock formaldehyde and, as a result, PENT production across the area. During second quarter, the Asian market had strong sentiment for the chemical, which supported prices across the region.

Traders in China reported strong domestic offtakes as a result of improving economic activity, which has nearly returned to pre-pandemic levels. While in India, prices were buoyant despite weaker demand from the local polymer industry, as dealers predicted a speedy rebound, as offtakes improved week on week in June.

As a result, there was a significant price increase in June, with prices hovering over 1926 USD/MT in India. Pentaerythritol prices ex-Mumbai ended at 2460.97 USD/MT in September, an increase of about 132 USD/MT from July.

Europe

During Q1 2021, demand for PENT in Europe fluctuated from mild to low. Although other industries, such as adhesives and cosmetics, improved over the previous quarter, as several nations began to recover from the second wave of COVID 19 across the region.

Throughout Europe, pentaerythritol costs increased dramatically in the second quarter. This increase in demand was fueled by improved economic activity as a result of post-pandemic recovery in numerous European nations. Furthermore, an exceptional spike in demand for polyols such as PENT boosted market sentiments, with supply being tight during this era.

As a result, big manufacturers were forced to increase product prices. Pentaerythritol prices in Europe, the Middle East, and Africa increased by 354.3 USD/MT, effective July 1, 2021. Prices in Europe continued to rise throughout the third quarter, owing to a scarcity of feedstock and poor production rates due to the energy crisis.

Furthermore, the PENT market saw strong demand from downstream industries, causing ripples in pricing across the area. Furthermore, delivery delays caused by rising freight costs and restricted container availability supported the increase in PENT values this quarter. In September, FOB Hamburg prices increased to 2340 USD/MT.

North America

Significant demand for upstream methanol from the fuel industry, along with a global scarcity, boosted the prices, which lingered above 1560 USD/MT in February 2021, while also raising feedstock formaldehyde costs across the area. During Q2 2021, prices continued to rise, boosted by increased demand from the downstream industry across the area. Prices increased from 1854 USD/MT to 2050 USD/MT due to rising feedstock prices and strong offtakes.

The cost of various feedstock chemicals continued to rise, boosting demand for polyols. Price in North America increased exponentially in Q3, owing to a jump in the pricing of feedstocks acetaldehyde and formaldehyde. Furthermore, increased demand from downstream industries such as paints and varnishes led to the upward trend in PENT price in this time frame.

Pentaerythritol Price Trend For the Year 2020

Asia

Due to a supply constraint from Iran in November, China saw a significant increase in the price of the raw material methanol, which led to an increase in the price of all methanol derivatives, including the feedstock formaldehyde. Due to the forced shutdown of many facilities in North India by the Indian government in November, the supply of formaldehyde remained scarce.

Following the discovery of multiple factories operating without environmental clearances, these shutdowns were expected. The abrupt shortage for formaldehyde across Southeast Asia directly impacted the prices of PENT in the region.

Europe

Europe also had a shortfall of upstream methanol in Q4 2020, which resulted in a scarcity of its derivative products such as methanal and pentaerythritol. Furthermore, an incredible fire at Equinor's methanol manufacturing plant rattled the region's upstream methanol supplies.

The occurrence had a direct impact on pentaerythritol market fundamentals in Q4 2020. Although the demand of PENT from the domestic market like paint, varnish and PVC was decent throughout the quarter, market players could not gain much due to limited availability of feedstock.

North America

Due to a series of storms in the Gulf Coast in November 2020, the PENT market in the United States was badly impacted. The supply of downstream derivatives such as feedstock methanal was reduced while output of numerous upstream goods such as methanol remained low.

Because demand for PENT from the domestic market remained high owing to consistent economic recovery after COVID 19, pentaerythritol prices increased in the fourth quarter of 2020.

Procurement Resource provides latest prices of Pentaerythritol. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Pentaerythritol

The chemical substance pentaerythritol is a white solid that is classified as a polyol. Pentaerythritol is used in the manufacture of explosives, plastics, paints, appliances, cosmetics, and a variety of other commercial goods. Pentaerythritol is a combination of penta-, which refers to its five carbon atoms, and erythritol, which likewise has four alcohol groups.

Pentaerythritol Product Details

| Report Features | Details |

| Product Name | Pentaerythritol |

| Industrial Uses | Special Varnishes, Plasticizers, Insecticides, Synthetic Lubricants, Explosives, Antioxidants |

| Chemical Formula | C5H12O4 |

| Synonyms | 2,2-Bis(hydroxymethyl)1,3-propanediol, Hercules P 6, Monopentaerythritol, Tetramethylolmethane, THME, PETP, Pentaerythrite |

| Molecular Weight | 136.15 g/mol |

| Supplier Database | Mitsui Chemicals Inc, Celanese Corp, Perstorp, Copenor, Zarja Chemicals, Ercros SA |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Pentaerythritol Production Processes

- Pentaerythritol Production from Base-Catalysed Poly-Addition Reaction

Production of pentaerythritol take place by a base-catalyzed poly-addition synthesis. Formaldehyde and acetaldehyde are reacted to produce pentaerythritol and sodium formate, which is then evaporated to eliminate unconverted formaldehyde before being concentrated. The solution is then crystallised and dried.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com