Product

Polyacetal Resin Price Trend and Forecast

Polyacetal Resin Price Trend and Forecast

Polyacetal Resin Regional Price Overview

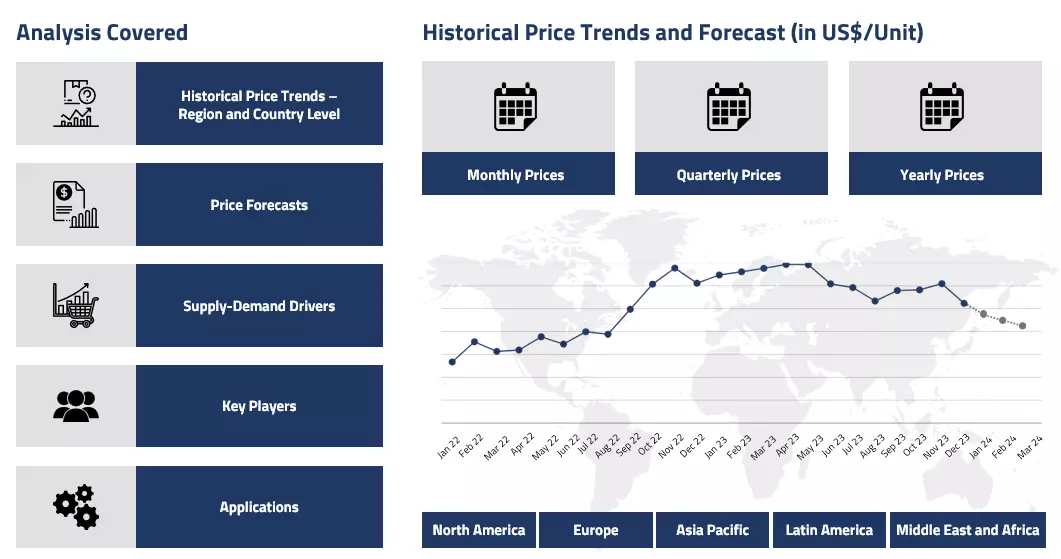

Get the latest insights on price movement and trend analysis of Polyacetal Resin in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Polyacetal Resin Price Trend for the First Half of 2025

Asia

In H1’25, the Polyacetal Resin market in Asia showed a mixed but mostly stable trend. Early in the year, China’s market saw soft demand due to the Lunar New Year break and a slowdown in construction and automotive sectors. Formaldehyde prices briefly dipped in February, easing cost pressures for resin producers. However, by March, prices began rising again as downstream demand recovered, especially from the electric vehicle and electronics sectors.

Polyacetal Resin Price Chart

Please Login or Subscribe to Access the Polyacetal Resin Price Chart Data

India saw stronger movement due to methanol supply tightness and rising prices, which pushed up production costs for formaldehyde and resins. Despite intermittent supply challenges and fluctuating raw material prices, Polyacetal Resin prices in the region remained supported by steady industrial demand and improved sentiment toward the end of the period.

Europe

In Europe, Polyacetal Resin prices moved upward in H1’25. The first quarter saw a steady increase driven by sharp gains in formaldehyde prices, caused by production cost inflation, natural gas price spikes, and logistics bottlenecks like port strikes. Even as methanol prices trended downward, the continued tightness in formaldehyde supply kept resin costs elevated. Although traditional demand from construction and automotive was weak, stable consumption in coatings, adhesives, and high-performance plastics kept the resin market firm. By the end of H1, some supply-side pressure had eased, but pricing remained high due to lingering feedstock and energy cost impacts.

North America

In North America, Polyacetal Resin prices climbed steadily throughout H1’25. The early part of the year was stable, but things changed in February and March when formaldehyde prices surged due to regulatory uncertainty and unplanned plant outages. Methanol prices remained soft overall, but tight formaldehyde supply and strong demand from the automotive and industrial sectors kept resin prices firm. Although the construction sector was sluggish, infrastructure spending helped support consistent resin consumption. By June, the market remained tight, and supply constraints from earlier disruptions continued to influence pricing dynamics.

Analyst Insight

According to Procurement Resource, Polyacetal Resin prices are expected to stay firm with potential upward movement if feedstock supplies remain tight or demand from automotive and electronics continues to grow.

Polyacetal Resin Price Trend for the Year 2024

Asia

In 2024, the Asian market for polyacetal resin showed a fluctuating price trend, largely driven by instability in the methanol market, which is a key feedstock. Early in the year, prices were slightly firm due to a rise in crude oil costs and production halts during festive periods in China and India. However, as methanol prices in Asia began to show signs of volatility—especially with a decline seen towards the end of Q2—polyacetal resin prices followed suit.

The inconsistent demand from downstream industries like electronics and automotive also limited price support. In the second half of the year, prices saw some short-lived increases due to supply disruptions from plant maintenance and weather-related issues, but they eventually stabilized as production normalized and inventories balanced out.

Europe

European polyacetal resin prices were shaped primarily by regulatory pressures and methanol cost dynamics throughout 2024. Early in the year, prices were stable as both feedstock and formaldehyde costs remained under control. However, ongoing shipping challenges and EU environmental regulations began impacting production costs mid-year, which caused slight price fluctuations. A cautious buying approach and fluctuating methanol supply from Asia added to the market uncertainty. Overall, the European market maintained relatively moderate pricing movements due to steady demand from the construction and automotive sectors, even as producers navigated evolving sustainability standards and geopolitical pressures.

North America

The North American polyacetal resin market experienced notable price variability in 2024, influenced by both feedstock trends and logistics issues. Early-year supply chain disruptions—like reduced shipping capacity through the Panama Canal and hurricane-related facility shutdowns—created temporary upward pressure on prices. While methanol availability was mostly stable domestically, any price shifts in upstream formaldehyde were quickly reflected in resin pricing. Later in the year, with supply chain recovery and stable demand from industrial and consumer goods sectors, pricing gradually returned to more typical levels.

Analyst Insight

According to Procurement Resource, Polyacetal Resin prices are expected to show moderate fluctuations, closely tracking methanol and formaldehyde trends alongside downstream sector demand.

Polyacetal Resin Price Trend for the Second Half of 2023

Asia

In the second half of 2023, the polyacetal resin market in Asia experienced fluctuating price trends. The first part of the period, from July to September, showed an upward momentum. This was largely due to increased demand from downstream industries like automotive, electronics, and construction. Supportive pricing of feedstock methanol, which showed a steady rise in the region during Q3, also pushed prices higher.

However, the momentum weakened in Q4. While methanol prices in China slightly increased, the Indian market saw a drop, and formaldehyde prices showed instability. These mixed signals from upstream materials and flat downstream demand resulted in narrow price movements, with frequent ups and downs in the final months of the year.

Europe

The European market saw a downward trend for polyacetal resin during H2’23. In Q3, weak demand, high inventories, and falling methanol prices weighed heavily on the market. The situation did not improve much in Q4. Although methanol prices remained mostly stable and logistics were disrupted slightly due to geopolitical issues, overall demand did not pick up significantly. As a result, polyacetal resin prices remained under pressure, with occasional small rises towards the end of the year driven more by cost-side constraints than strong consumption.

North America

North America had a mixed trend for polyacetal resin in H2’23. The third quarter was sluggish due to economic uncertainties, high interest rates, and weak downstream demand, particularly in construction and manufacturing. Methanol and formaldehyde prices also showed softness during this time. However, in Q4, things turned slightly positive. A rise in methanol prices, along with improved demand from the automotive and antifreeze sectors during winter, helped stabilize the resin market. Prices saw a moderate rebound as supply tightened and consumption picked up.

Analyst Insight

According to Procurement Resource, Polyacetal Resin prices are expected to stay volatile, influenced by raw material trends and demand recovery in key downstream sectors.

Polyacetal Resin Price Trend for the First Half of 2023

Asia

In the Asia-Pacific region, the price trend of polyacetal resin oscillated in the first quarter and then gained stability in the second quarter. The demand from international buyers in the initial phase of the first quarter led to a rise in the prices of polyacetal resin. However, towards the end phase of Q1, the number of offtakes reduced with low interest from domestic as well as international buyers while the supply chains in the region remained potent.

In addition to this, the economic conditions of the region also deteriorated, which continued to influence the market in the second quarter, too. But the market activities in this quarter were later on supported by the reduced level of inventories. The trend was, however, challenged by the feeble movement of the downstream industries and oversupply in the end months of Q2.

Europe

The European countries faced high uncertainties in the market fundamentals as the demand from end-user industries remained low along with the supply chains. In March, the price trend of polyacetal resin stabilized a little with the help of the automotive and construction industries. But after that, in the second quarter, the price trend declined due to low demand from the downstream industries, especially from the automotive industries. The rates of interest and inflation also added up as another challenge for the already struggling polyacetal resin price trend.

North America

In the first quarter, the price trend of polyacetal resin faced lower interest of buyers from the downstream industries and slow movement of the economy. Due to fluctuations in the economic sectors, certain manufacturers had to shut their production plants, which hampered the growth of the polyacetal resin price trend.

In the second quarter, the financial constraints remained on the production rates, which eventually led to the decline in sales and overall profit margins of the traders. The major key players also faced certain issues in the supply chains, which ultimately resulted in the decline in the price trend of polyacetal resin.

Analyst Insight

According to Procurement Resource, the price trend of Polyacetal Resin is estimated to showcase a falling trajectory as the market activities seem to be hampered by the slow movement of downstream industries and challenging economic conditions.

Polyacetal Resin Price Trend for the Second Half of 2022

Asia

The polyacetal resin market saw a bearish trend in the third quarter of 2002. A downward fall was observed due to the decline in the demand from the paints, adhesives, and electronics sectors. The sluggish supply due to the low availability of raw materials further negatively impacted the prices of the resin in the Asia-Pacific market. The fourth quarter also witnessed an uneven trend in prices. The major causes of the decline remained the same as that of the quarter third. The Indian and Chinese markets, however, saw an uprising trend, primarily due to the restricted supply and limited availability of the product.

Europe

The European region followed in the footsteps of the Asian-Pacific market as the prices saw a decline in both the third and fourth quarters. Disruptions in the supply chains, uncertainties, and high costs of energy and power production led to a decline in prices. The ongoing Russia-Ukraine conflict further caused ripples in the market adding to another cause for the decline in the prices. The cost for base materials was, however, in favour of the price’s sentiments.

North America

The North American market saw a decline in the prices of resins. The trend was majorly affected by the demand from the end-user industries. The demand declined due to the rise in production and operational costs, rise in inventories, and surplus availability of the product in the market.

Analyst Insight

The prices of Polyacetal Resin are likely to decrease during the coming month given a decline in demand from the end-user industries and the rise in inventories and operational and production costs of the material.

Procurement Resource provides latest prices of Polyacetal Resin. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Polyacetal Resin

Polyacetal Resin is an opaque semi-crystalline thermoplastic which contains the functional group of a carbon-bonded to two -OR groups. It is one-hundred percent recyclable, and due to its high tensile strength and durability, it is widely used in producing precision parts. The resin is a good alternative to metals due to its low friction and wears characteristics and the excellent balance of chemical and physical properties.

Polyacetal Resin Product Details

| Report Features | Details |

| Product Name | Polyacetal Resin |

| HS CODE | 39071000 |

| CAS Number | 9002-81-7 |

| Industrial Uses | Drug Delivery Systems, Automotives, Electrical & Electronics, Industrial Designs |

| Synonyms | Polyoxymethylene (POM), Polyacetal, Polyformaldehyde |

| Molecular Weight | Variable |

| Supplier Database | BASF, Chevron Phillips Chemical Co., DOW, ExxonMobil, INEOS |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Polyacetal Resin Production Processes

- Polyacetal Resin Production from Silver-Catalyzed Process

During this process, aqueous formaldehyde is reacted with an alcohol (usually methanol) to form a hemiformal. This mixture undergoes dehydration either by extraction or vacuum distillation to form formaldehyde. The formaldehyde is then polymerized by anionic catalysis, and the resulting polymer is stabilized by acetic anhydride forming the final product- polyacetal resin.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Related News

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com