Product

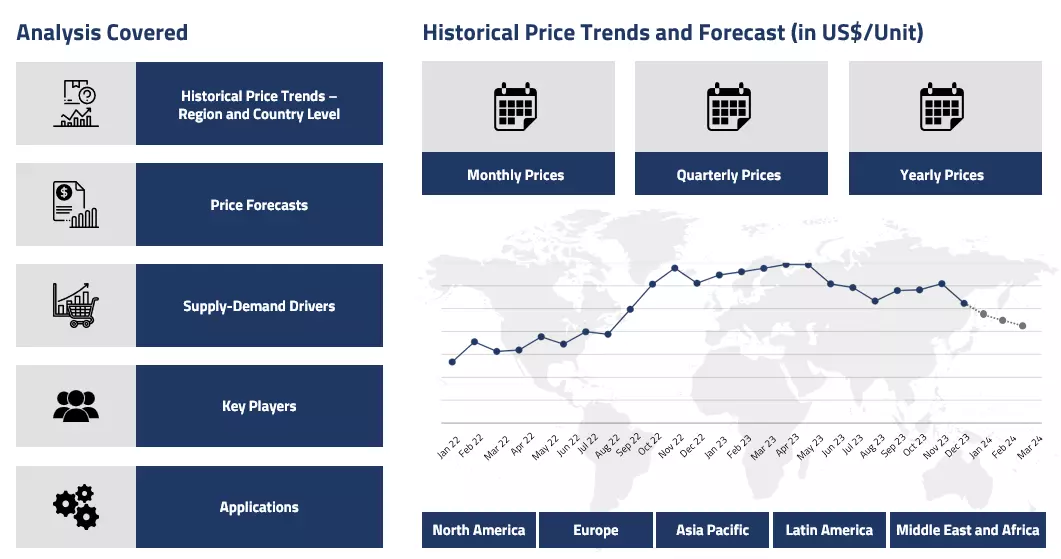

Polyether Polyol Price Trend and Forecast

Polyether Polyol Price Trend and Forecast

Polyether Polyol Regional Price Overview

Get the latest insights on price movement and trend analysis of Polyether Polyol in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Polyether Polyol Price Trend for Q2 of 2025

Asia

In Q2’25, Polyether Polyol prices in Asia steadily declined due to a combination of weak demand and lower production costs. The drop in input costs followed global market stabilization after regional geopolitical tensions eased. Despite this, consumption from key downstream sectors like construction and automotive remained sluggish.

Polyether Polyol Price Chart

Please Login or Subscribe to Access the Polyether Polyol Price Chart Data

The construction market, particularly in Japan and parts of Southeast Asia, was affected by labor shortages and project delays, while automotive demand saw limited support due to affordability issues. Rising inventories and cautious buying behaviour added downward pressure. Export performance was also uneven, with some early improvements overshadowed by reduced momentum caused by trade barriers and logistical disruptions.

Europe

In Europe, Polyether Polyol prices showed a mixed trend during the quarter. The beginning of Q2 saw some upward movement as demand held steady and production costs remained relatively high. However, as the quarter progressed, prices eased due to weaker industrial activity and a softening cost environment.

Demand varied by region—Eastern Europe and the UK saw better activity linked to energy-efficient construction, while Germany and France struggled with low consumer confidence and delayed investments. Logistics continued to be a challenge, with port congestion, freight delays, and rail disruptions adding complexity to supply operations. Even with these constraints, steady demand from insulation and flexible foam applications helped keep the market from weakening further.

North America

In North America, Polyether Polyol prices remained fairly stable through Q2’25, with slight gains seen toward the end of the quarter. The market began on a weaker note in April due to seasonal demand slowdowns and ample inventories. However, by June, stronger offtake from infrastructure and vehicle manufacturing sectors supported a price recovery.

Despite earlier cost pressures from global uncertainties, easing input costs in the second half of the quarter helped producers maintain competitive pricing. Overall, consistent demand from polyurethane applications, especially in automotive and construction insulation, kept the market balanced.

Analyst Insight

According to Procurement Resource, Polyether Polyol prices are expected to remain stable with a slight downward bias, depending on how quickly demand picks up and how input costs evolve.

Polyether Polyol Price Trend for Q1 of 2025

Asia

During the first quarter of 2025, polyether polyol prices in Asia followed the trends of the ethylene market, as ethylene is a key feedstock. Initially, prices increased due to supply constraints and steady demand from polyurethane manufacturers. However, as the quarter progressed and ethylene prices declined, polyether polyol prices followed suit.

Many buyers postponed purchases, anticipating further price reductions. In China, the Lunar New Year holiday slightly dampened trading activity, reducing overall demand and creating supply challenges. Additionally, subdued consumption from the automotive and construction sectors exerted downward pressure on prices, leading to some consolidation by the end of the quarter.

Europe

In Europe, polyether polyol prices exhibited mixed trends during the first quarter of 2025. Supply disruptions caused by operational issues, labor strikes, and severe weather initially pushed prices higher. However, weak demand from the construction and automotive sectors prevented sustained price increases. Rising energy costs added to production expenses, but manufacturers struggled to pass these costs on to consumers. In the later part of the quarter, an influx of lower-priced imports from Asia alleviated supply shortages, further weighing on prices. Market sentiment remained uncertain, with limited expectations of a price recovery.

North America

In North America, polyether polyol prices fluctuated throughout the first quarter of 2025. At the beginning of the quarter, the reopening of the downstream sector contributed to initial positive price movements. However, weak demand from the polyurethane market, particularly in the construction and automotive industries, exerted downward pressure. Unstable feedstock costs added further challenges for producers.

Although maintenance shutdowns at certain facilities temporarily reduced supply, this did not significantly impact the market due to persistently weak downstream demand. Buyers remained cautious, purchasing only essential quantities while awaiting further price declines. Even as manufacturers attempted to limit production to balance the market, demand remained insufficient to support a sustained recovery. By the end of the quarter, prices remained low, with little indication of an imminent rebound.

Analyst Insight

According to Procurement Resource, polyether polyol prices are expected to experience slight improvements in the coming months, mirroring trends in the upstream market.

Polyether Polyol Price Trend for the Second Half of 2024

Asia

The Asian region experienced fluctuating prices in the second half of 2024. The market saw some upward pressure due to rising feedstock prices, particularly propylene, which was influenced by volatility in crude oil markets. However, the price increase was short-lived, as geopolitical tensions and supply chain disruptions affected feedstock availability, leading to fluctuations.

The second half of Q3 witnessed a downward trend in prices, driven by reduced demand from downstream industries, especially the polyurethane segment, which had been facing slower growth. The market also felt the impact of weaker export orders and lower international demand. By the end of the quarter, the availability of feedstocks improved, but demand remained low, contributing to a price reduction.

Europe

In Europe, the second half of 2024 saw a more challenging environment for Polyether Polyol pricing. The market faced a decline driven by weak demand from the polyurethane sector, especially in construction, which had been in contraction due to slower housing activity. The summer months exacerbated the situation, as industrial activities slowed down and inventory levels built up. The second half of Q3 saw a drop in prices, with a continued negative sentiment as downstream demand failed to pick up.

The automotive and manufacturing sectors also struggled with subdued demand, leading to lower offtakes. Moreover, an oversupply situation in the market added downward pressure on prices. Overall, prices saw a consistent decline and the market ended the quarter with a weaker sentiment due to the combination of economic uncertainty, rising inflation, and a shift towards more sustainable materials.

North America

In North America, the Polyether Polyol market exhibited a stable pricing environment throughout the second half of 2024. Prices remained largely unchanged from the previous quarter, indicating a balanced supply-demand situation. The demand from key sectors such as construction and manufacturing remained steady, preventing any significant price movements. However, in the middle of Q3, production was briefly impacted due to constrained feedstock availability, leading to minor price increases. Despite this, the market returned to a stable position, with prices holding steady in the latter half of the quarter. The overall stability reflected a market in equilibrium, with adequate supply and moderate demand from downstream industries.

Analyst Insight

According to Procurement Resource, the Polyether polyol prices are expected to remain under pressure due to persistent demand weaknesses in key end-use industries, particularly construction and automotive.

Polyether Polyol Price Trend for the First Half of 2024

Asia

During the first half of 2024, the price trend of polyether polyol in Asia, particularly in India and China, was influenced by the fluctuating costs of its key feedstock commodities. In India, the price faced upward pressure due to rising crude oil costs and increased downstream demand from the fuel additive sector, which added to the overall production costs of polyether polyol. Despite this, the market outlook remained optimistic, supported by firm demand. In contrast, the Chinese market experienced a more subdued and downward price trend, largely driven by increased supply volumes from recent capacity additions and ongoing production expansions. This excess supply in China led to a competitive market environment where suppliers were compelled to keep prices low, even as production costs rose.

Throughout the second quarter, the Chinese market continued on a slow downtrend due to moderate raw material cost support and fluctuating prices. With an overall balanced supply and average demand, there was limited upward momentum in the market. Downstream buyers' cautious purchasing behavior further pressured prices downward, contributing to a generally stagnant market outlook. As a result, the polyether polyol prices in China received with limited cost support and a prevailing wait-and-see approach among market participants, reflecting the broader feedstock price dynamics in the region.

Europe

In the first half of 2024, polyether polyol prices in Europe were influenced primarily by high energy costs and supply chain disruptions, which affected production rates. Tensions in the Middle East, particularly after a missile attack on an oil tanker near Yemen, increased shipping traffic and delayed feedstock supplies, raising production costs.

Despite stable demand and sufficient market stocks during the early months of 2024, the market saw tight supply conditions due to delayed supply chains and high production costs of propylene oxide, the key feedstock for polyether polyol production. The construction sector and automotive manufacturers, particularly electric vehicle producers, showed firm demand for Polyol towards the end of Q2, supporting the supply crunch and upward movement of overall market dynamics.

North America

In the USA, polyether polyol prices showed a bullish trend in early 2024, driven by strained supply availability and increased production costs. A winter storm and production issues at key manufacturing units tightened supply further, pushing producers to raise prices.

The USA's manufacturing sector showed some improvement, with rising demand from the construction and furniture industries boosted by seasonal sales and increased spending. However, in mid-2024, improved feedstock availability and stable demand helped moderate the upward price trend, though the market experienced fluctuations due to supply dynamics. Looking ahead, prices are expected to rise again due to potential increases in upstream propylene costs and consistent demand from construction and manufacturing sectors, even as feedstock availability remains a concern.

Analyst Insight

According to Procurement Resource, the price trend of Polyether Polyol is expected to sustain its bullish trajectory with ample support from the downstream industries and a limited supply of the commodity in global markets.

Polyether Polyol Price Trend for the Second Half of 2023

Asia

In the end half of 2023, the price trend in polyether polyol prices showed a volatile trend. Initially, during the first half of the duration, the market encountered several challenges due to excessive inventories and subdued demands from downstream sectors, resulting in meek market sentiment.

As the fourth quarter unfolded, the number of inquiries from the downstream polyurethane industries and textile sector nosedived, exerting additional downward pressure on polyether polyol market trends. Also, with the fall in the cost of feedstock materials, the manufacturers found it difficult to sustain in the market, and thus, eventually, the market was forced to lower their price quotations of polyether polyol.

Europe

In European countries, elevated inflation levels significantly affected the purchasing potential of European consumers, leading to a downturn in economic activity and a notable decrease in downstream demand.

Carrying forward from the previous quarter, the traders throughout the third and fourth quarters struggled with excessive inventories, prompting suppliers to reduce production to restore balance. Throughout the last half of 2023, the downstream polyurethane foam market of Europe experienced predominantly bearish demand, similar to that of Asian countries.

North America

The US market of polyether polyol was no different from the Asian and European countries as the market fundamentals projected a weak momentum and supported the depreciation in the prices of polyether polyol. Additionally, shifts in consumer behavior to cheaper alternatives from Asian countries increased the competitiveness of the domestic market, and the evident rise in the economic crisis experienced by the region was also well reflected in the pricing movement of polyether polyol.

Analyst Insight

According to Procurement Resource, the price trend of Polyether Polyol is estimated to dwindle on the lower end of the spectrum as the feedstock support and inquiries from the downstream industries are expected to remain negligible.

Polyether Polyol Price Trend for the First Half of 2023

Asia

Polyol price trend had a mixed run in the first half of 2023. Initially, in quarter one, the inventories were overstocked, and downstream demands remained dampened, which kept the market sentiment muted. As quarter two arrived, the feedstock propylene oxide prices started declining, further pushing the polyol prices down. Propylene Oxide prices dipped by around 11% in the second quarter; hence the necessary upstream cost pressure required to maintain the prices were not provided, and the polyol prices fell.

Europe

The heightened inflation compromised the purchasing power of European customers. The economic downturn heavily impacted the downstream demand. The markets were already saturated with the products, which compelled the suppliers to cut production to stabilize the overall dynamics.

The downstream polyurethane foam market posed bearish demands for most of H1’23. With the arrival of cheap imports from the Chinese markets, pressure was exerted on the polyol price trend even further. The manufacturers lowered their quotations in hopes of positive product movement and to empty the existing inventories.

North America

The US market replicated the slow and declining trend of its Asian and European counterparts. Consumer behavior observed fundamental shifts because of the economic crisis the country witnessed. The reduced purchasing enthusiasm aid feeble demands caused the price trend for polyols to decline.

Analyst Insight

According to Procurement Resource, the price trend for Polyol are expected to oscillate in the coming quarter. Given the dampened market demand amid wavering feedstock prices, the polyol prices are likely to fluctuate on the lower end of the curve.

Polyether Polyol Price Trend for the Second Half of 2022

Asia

Polyol prices witnessed a mixed pricing pattern in the second half of 2022 in the Asian market. Q3 started with a declining trend because of decreased demand from the downstream industries. However, the prices started inclining mid-quarter as the inventory started reducing. The Chinese production capacities have taken a serious hit because of the industrial shutdown to contain covid-19.

The prices crashed again towards the end of the fourth quarter as the factories enhanced their production rates aided by positive upstream cost pressure. However, the falling demands could not keep up with the rising inventory stocks. Thus, the prices fell further.

Europe

The European Polyol market recorded an oscillating pattern in polyol prices. Initially, the prices subsided, given the economic downturn and dampened demands. However, as the upstream costs stabilized and feedstock propylene oxide prices rose, the prices of polyols increased in the market. This trend continued till the mid-Q4, after which the prices fell again. Given the approaching holiday season, the December slump negatively impacted the market dynamics.

North America

The polyol market in America behaved no differently than other international markets. Market offtakes and feedstock prices majorly influenced the prices. Given the fluctuating downstream demands, a series of inclines and declines were noticed. The prices picked up during March-April and slumped again as the market strived for equilibrium towards the end of Q4.

Analyst Insight

According to Procurement Resource, Polyol prices are expected to continue wavering on the declining curve given the uncertainties in the downstream demand and fluctuating upstream cost pressure.

Polyether Polyol Price Trend For the First Half of 2022

Asia

The price trend for Polyol inclined steadily during the first quarter owing to healthy pricing fundamentals. The robust downstream demand from the polyurethane and textile industries supported the high prices of polyols. With the resurgence of covid related shutdowns and geopolitical turbulence, the global supply chain was affected. Dwindling inventories and complex logistics provided much upstream cost pressure, which was aided by the solid demand from the automotive and construction sector.

The price of polyester polyol MW 3000 and ice of polyester polyol MW 3000 & μ 550 grade averaged 2798.04 USD/MT Ex- Mumbai. However, the prices in the Chinese domestic market were lower than the Indian domestic market, given the strong demand fundamentals in the domestic Indian market.

As the upstream cost pressure stabilized in the second quarter and the factories started churning out products, the manufacturers dropped their quotations to make room for new production. Hence, polyols prices fell in the second quarter in the Asia- Pacific region.

Europe

The consistent demand from the pharmaceutical, automotive, and aerospace industries kept the polyol pricing fundamentals strong in the European market. The price of polyether polyol μ 400-650 averaged 3110 USD/MT during the said period. Given the high-cost inflation and energy crisis, polyol prices reached dramatic highs. Later, towards the end of Q2, the prices for polyols plateaued and stabilized as the upstream oil and gas prices relaxed.

North America

The price of polyether polyol averaged 4516 USD/MT during the first quarter. These high pricing fundamentals were due to a plethora of factors, namely high crude oil prices, frequent supply shocks, lack of skilled labour, complex logistics and strong market sentiments.

However, with the interest hikes by the central bank and cautious buying activity in the face of rumoured speculations of recession, soon the market demand turned lacklustre, and the prices fell, averaging 2080 USD/MT towards the end of Q2.

Analyst Insight

According to Procurement and Resource, the prices of polyether polyols are expected to decline further. With governments worldwide rolling out contractionary monetary policies and the reduced buying activity in the market coupled with stockpiling of inventories will likely cause the prices to crash.

Procurement Resource provides latest prices of Polyether Polyol. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Polyether Polyol

Polyethers are of a class of organic substances which are formed by joining or polymerizing many molecules of simpler compounds (monomers) by establishing ether links between them. Polyethers which can have chainlike or networklike molecular structures are an unusually diverse group of polymers.

Polyether Polyol Product Details

| Report Features | Details |

| Product Name | Polyether Polyol |

| HS Code | 390720 |

| CAS Number | 53637-25-5 |

| Industrial Uses | Additive for Lubricants, Preparation of Synthetic Detergents, Sealants and Adhesives, Production of Polyurethanes |

| Supplier Database | BASF SE, Covestro AG, Royal Dutch Shell Plc, The Dow Chemical Company, Mitsui Chemicals, Wanhua Chemicals Group, LANXESS AG |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Polyether Polyol Production Processes

- Production of Polyether from Propylene Oxide and Ethylene Oxide

In this procedure, various chain starters are reacted in a catalysed batch process with propylene oxide and/or ethylene oxide in the presence of a catalyst.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com