Product

Polyisoprene Price Trend and Forecast

Polyisoprene Price Trend and Forecast

Polyisoprene Regional Price Overview

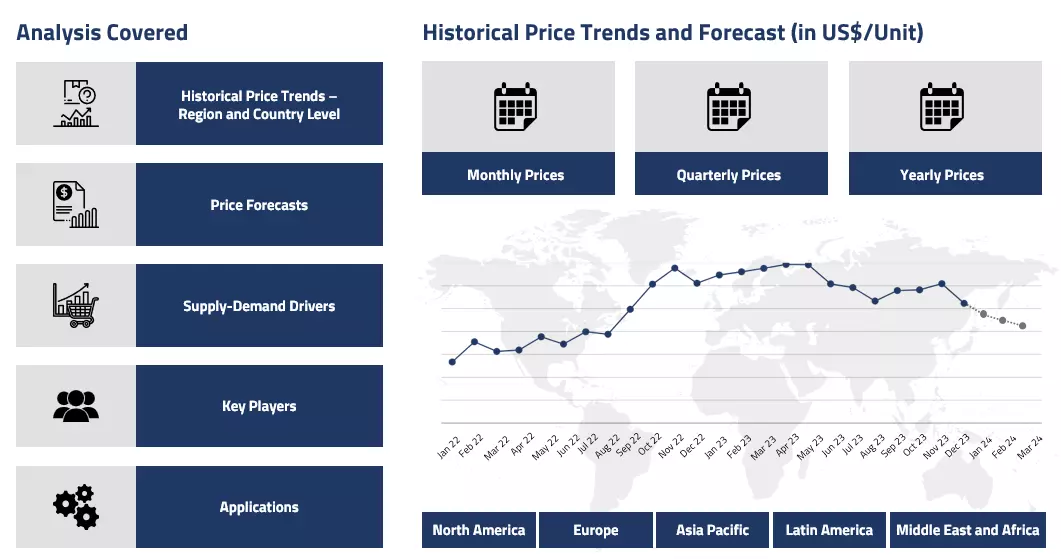

Get the latest insights on price movement and trend analysis of Polyisoprene in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Polyisoprene Price Trend for the First Half of 2025

Asia

In the first half of 2025, Polyisoprene prices in Asia remained mostly stable with some fluctuations. January and February saw weak demand from downstream industries like automotive and construction, keeping prices flat. Even though there was no significant change in import costs, especially from China, overall market sentiment stayed subdued.

Polyisoprene Price Chart

Please Login or Subscribe to Access the Polyisoprene Price Chart Data

March brought a short-lived bullish phase, as buyers in key markets such as China, India, and Indonesia ramped up procurement in anticipation of a recovery. This led to a temporary rise in prices.

However, in April, high inventories and logistical issues pulled prices down again. Through May and early June, the market stabilized, supported by steady imports and cautious buying. While upstream costs showed some pressure, demand was generally mixed, especially in India where automotive trends diverged across segments and construction slowed during monsoons.

Europe

Polyisoprene prices in Europe followed a largely neutral to stable trend during H1’25. In January and February, weak demand from the automotive and construction sectors led to low buying activity. Inventory levels were adequate, and logistics had improved, keeping the market balanced.

March saw mild optimism as downstream recovery signals started appearing, prompting slight increases in spot prices. However, the momentum didn’t carry far into Q2. By early June, despite marginal relief from lower feedstock prices and better supplier delivery times, demand remained muted, especially in Germany. Buyers continued to be conservative in their procurement strategies, which helped maintain price stability.

North America

Polyisoprene prices in North America stayed mostly flat in Q1’25 due to steady production and soft downstream demand. In January and February, extreme weather disrupted logistics slightly but had minimal impact on overall pricing, as inventories were sufficient.

March showed signs of improvement, with rising automotive sector demand lifting sentiment modestly. Entering Q2, April brought a slight upward movement in prices, driven by better coordination between supply and purchasing behaviour. This trend held through May and early June as trading activity normalized, although the overall market remained cautious due to policy-related uncertainties.

Analyst Insight

According to Procurement Resource, Polyisoprene prices are expected to stay steady in the short term, with minor volatility depending on feedstock trends and downstream recovery pace in key regions.

Polyisoprene Price Trend for the Year 2024

Asia

In Asia, Polyisoprene prices followed a fluctuating path throughout 2024. In the first half of the year, prices climbed steadily due to strong demand from the automotive and tire industries, combined with rising feedstock costs, especially butadiene. Weather-related supply chain disruptions also supported price increases during this period. However, the trend shifted in the second half, particularly in Q4, as demand weakened in key markets like Japan.

The automotive sector saw declining sales and subdued trading activity. Despite earlier gains, prices began to cool due to adequate inventories and cautious buying behaviour. Inflationary pressures and earthquake-related disruptions also affected market sentiment, keeping overall pricing on a softer note towards the end of the year.

Europe

In Europe, the Polyisoprene market experienced a largely bullish trend during 2024. The first half saw consistent price increases supported by rising demand from the automotive and tire industries. Limited inventories and seasonal industrial activity further lifted prices.

The European Central Bank's easing policies encouraged investment, indirectly boosting demand. However, in the final quarter, momentum slowed as demand from both automotive and construction sectors weakened. Ongoing economic uncertainty, along with logistical issues like rail disruptions and adverse weather, contributed to a more cautious and balanced market. Prices stayed relatively stable in Q4, reflecting a shift from bullish to more neutral conditions.

North America

North America’s Polyisoprene market saw a volatile year. The first half was marked by falling prices, driven by weak demand and high inventories. Inflation and economic uncertainty weighed heavily on downstream consumption. Q3 brought mixed results—prices dipped initially due to oversupply but recovered later as supplier activity rose and production costs increased. However, Q4 again showed signs of strain.

Downstream demand remained soft, especially in the automotive sector, while port strikes and reduced trading activity in December impacted supply chains. Despite some improvement in market sentiment, prices remained under pressure through the year-end.

Analyst Insight

According to Procurement Resource, the Polyisoprene market may remain cautious but could stabilize if downstream demand picks up and supply chain issues ease.

Polyisoprene Price Trend for the Second Half of 2023

Asia

The Asian polyisoprene market performed weakly during the said period of the second half of the year 2023. Since the global inflationary pressure was released a little at the beginning of the third quarter, consumer interest was slightly restored. Especially in the Chinese market as the country fought a very long battle with the Covid-19 pandemic. However, the EV market was still seeing fewer take-offs.

The inventories were flooded with unused stocks, which almost forced the market suppliers to cut down the prices. Despite this, the price trend was relatively stable in the third quarter but moving ahead plunged consistently in the fourth quarter. Overall, a very mixed market trend was witnessed.

Europe

The European polyisoprene market was very strongly influenced by its Asian counterparts during the said period. The market here began on a lower note at the beginning of the third quarter as both the upstream and downstream drivers were acting against the market’s favor.

The crowded inventories kept the upstream drivers struggling while the bearish demands made the downstream factors gasp. The situation didn’t improve in the final quarter as well, instead, the demands dipped even more adding on to the steepness of the plunging price graph. Overall, dull market performance was witnessed in H2’23.

North America

Contrary to the global trend, the polyisoprene market had a relatively positive start in the American market in July of 2023. Since the economic situation in the region just got a little better the consumer market saw some improvement. However, the incline was short-lived as the prices started to dip down the very next month in September. Because of the initial surge the price graph first plateaued and then completely turned southward. Almost the same plummeting trajectory was witnessed in the last quarter as well.

Analyst Insight

According to Procurement Resource, the current market outlook suggests a continuation of the present trend in the coming months. The market is expected to continue to waver. Growth in the EV industry is required to push the Polyisoprene market forward.

Polyisoprene Price Trend for the First Half of 2023

Asia

As the manufacturing industries started reviving in China after the Covid 19 lockdown was lifted, demands from downstream automobiles, rubber, and latex saw a hike, leading to a rise in Polyisoprene prices. Prices inclined throughout the first quarter, but as the quarter shifted, some downward movement was seen in Q2’s first month, as the Polyisoprene inventory levels had risen. But due to the rise in the number of queries from both the domestic and international markets, the demand again dominated over other factors, such as lowered upstream costs and existing stocks, keeping the price trend for Polyisoprene on a positive trajectory.

Europe

Mixed sentiments were observed in the Polyisoprene sector in European markets. During Q1, the prices hovered at lower values as the demand, especially from the automobile sector, took a hit. Also, the port congestions and freight difficulties affected the consumer’s confidence in the market. But soon, the market recovered in the second quarter due to the rise in new inquiries from the market, causing the polyisoprene prices to incline.

North America

The polyisoprene market had a slow start yet was positive and inclined until mid-Q1. But as the interest rates heightened and the stockpiles rose, prices declined in March only to recover at the end of the next quarter. The downstream demands from the automotive, rubber, and latex industries primarily drove these fluctuations in the market trend.

Analyst insight

According to Procurement Resource, the market projection for Polyisoprene looks good, and the price trend will likely rise. The uncertain demands from downstream industries will continue to be the major influencing factor in determining price trend.

Procurement Resource provides latest prices of Polyisoprene. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Polyisoprene

Polyisoprene is the collective class of polymers obtained via the polymerization of isoprene. It is an elastomer, i.e., it can recover its original shape after being stretched or deformed. Polyisoprene is a diene polymer consisting of two double bonds in the carbon backbone. Usually, it exists in 4 isomeric forms, with the cis (cis-1,4-polyisoprene) and trans forms being more common. The cis isomer is commonly referred to as natural rubber, which has been extracted naturally from tree sap since times immemorial.

Polyisoprene Product Details

| Report Features | Details |

| Product Name | Polyisoprene |

| HS CODE | 40026000 |

| CAS Number | 9003-31-0 |

| Industrial Uses | Latex Products, Tires, Adhesives, Waterproof Fabrics, Sporting Goods |

| Chemical Formula | (C5H8)x |

| Synonyms | 2-methyl-1,3-butadiene, homopolymer |

| Molecular Weight | Variable |

| Supplier Database | Firestone, Eni, Cray Valley, LG Chem, Lanxess |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Polyisoprene Production Processes

- Production of Polyisoprene from Polymerization

Polyisoprene is produced via the polymerization of isoprene in the presence of suitable catalysts. The yield and form of isomer depend on which catalyst is used. Likewise, the polymerization process in the presence of Zeigler-Natta catalyst produces a highly pure form of cis polyisoprene.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com