Product

Propane-1,2-diol Price Trend and Forecast

Propane-1,2-diol Price Trend and Forecast

Propane-1,2-diol Regional Price Overview

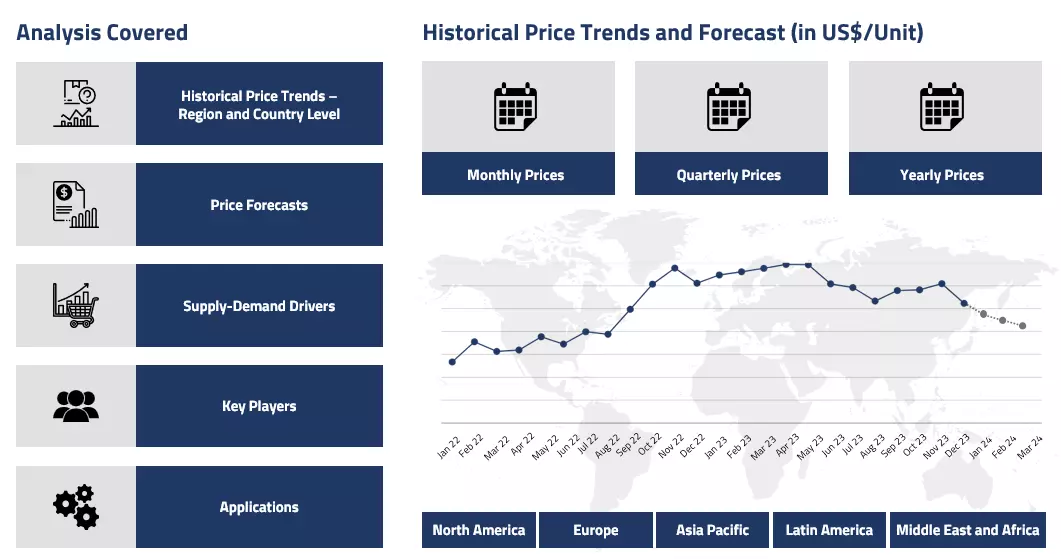

Get the latest insights on price movement and trend analysis of Propane-1,2-diol in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Propane-1,2-diol Price Trend for the First Half of 2025

Asia

In the first half of 2025, the Asian market for Propane-1,2-diol showed mostly stable to slightly soft trends. Demand from downstream sectors such as food additives, pharmaceuticals, and personal care products remained steady but not strong enough to push prices up. In China, new petrochemical capacities added pressure to the local supply chain, making the market more competitive and limiting upward price movement. Meanwhile, weak demand from the construction and coatings industries also kept overall buying sentiment cautious.

Propane-1,2-diol Price Chart

Please Login or Subscribe to Access the Propane-1,2-diol Price Chart Data

In India, high inventories and moderate consumption further reduced the price fluctuations, while South Korea saw a gradual pick-up in industrial activity, helping stabilize the market. Overall, Asia witnessed a calm and well-balanced PG market during H1’25, with no major disruptions.

Europe

In Europe, the Propane-1,2-diol market remained soft throughout H1’25, influenced by slow economic recovery and weak industrial output. Demand from key sectors such as automotive, construction, and personal care was subdued due to ongoing macroeconomic uncertainty. The availability of raw materials was consistent, and there were no major supply chain challenges. The mild winter also meant that seasonal consumption was lower than usual. Additionally, the strong euro during parts of the period helped ease import costs, indirectly applying downward pressure on domestic prices. Suppliers maintained adequate stock levels, and overall price movement was limited due to weak downstream demand.

North America

The North American PG market experienced more volatility compared to Asia and Europe. Early in the year, a severe winter increased heating fluid and antifreeze demand, temporarily supporting prices. However, strong export activity drew down domestic inventories, creating short-term supply tightness. Production resumed as winter eased, but logistical issues, especially at ports, kept supply constrained during parts of Q1. By Q2, market conditions began to stabilize as infrastructure recovered and production improved. Still, exports remained high, keeping pressure on local availability and preventing significant price relief.

Analyst Insight

According to Procurement Resource, Propane-1,2-diol prices are expected to gradually firm up across all regions, supported by seasonal demand recovery and improved industrial activity.

Propane-1,2-diol Price Trend for the Second Half of 2024

Asia

In the second half of 2024, the Propane-1,2-diol market in Asia experienced varying trends across countries. During Q3, prices generally moved upward due to strong demand from end-use sectors like cosmetics, pharmaceuticals, and food processing. Manufacturing activity remained healthy, and logistical disruptions such as port congestion and shipping delays limited supply in some regions, which added to the price pressure.

As Q4 began, demand in China stayed high, especially in November, with companies building up stock for year-end sales. However, other countries in the region, like South Korea, saw lower industrial demand and an effort to reduce inventory levels, which caused a slight easing in prices. As a result, while some markets remained firm, others saw softer prices, making the overall trend mixed.

Europe

In Europe, Propane-1,2-diol prices followed a relatively weak pattern in H2’24. Q3 saw prices falling gradually due to sluggish demand from key industries such as automotive, plastics, and construction. Rising logistics costs and ongoing shipping disruptions added uncertainty, but they weren’t enough to push prices up because supply remained comfortable. This cautious environment extended into Q4, where seasonal slowdowns in industrial activity and an already sufficient supply kept prices under pressure. Buyers avoided bulk purchases and focused on using existing inventories, leading to little change in market sentiment across the quarter.

North America

In North America, the market for Propane-1,2-diol stayed stable throughout the second half of the year. In Q3, demand remained modest, with many industries relying on existing stocks. Sectors such as coatings, personal care, and pharmaceuticals showed some signs of improvement, but it wasn’t enough to trigger a significant price shift. By Q4, purchasing activity remained conservative, as businesses prepared for year-end closures and avoided excess stock. Supply was steady, and with no major disruptions, prices remained largely flat across the period.

Analyst Insight

According to Procurement Resource, Propane-1,2-diol prices are expected to stay moderate in the coming months. Any noticeable recovery will likely depend on stronger industrial activity and improved global economic signals.

Propane-1,2-diol Price Trend for the First Half of 2024

Asia

The price of propane-1,2-diol witnessed a mixed trend during the first quarter of 2024. These oscillations were influenced by the uncertain purchasing patterns of the consumer sector. Further, amid the holiday season in China and its reduced appetite, other Asian countries struggled with the depreciation in currency values in comparison to the US Dollar, fueling the skepticism of the consumer sector.

Additionally, the cost support of feedstock commodities was also under the pressure of these adverse market conditions. Hence, as a result, the overall sentiments of the market depreciated in the second quarter and the pricing patterns of the commodity faced southwards. The consumer outlook was additionally softened under the excessive pressure of inflation.

Europe

Unlike the Asian countries, the price of propane-1,2-diol registered a slight uptick during the first quarter of 2024. This surge was a consequence of prolonged geopolitical tensions, logistic issues, and consistently depleting inventories. Additionally, along with the domestic downstream industries, the overseas markets also showcased a significant interest in the commodity as they raised their procurement rates, providing room to the in-house traders to raise their quotations of propane-1,2-diol. However, despite of these favorable instances, the pricing trajectory of propane-1,2-diol took a reverse turn in the second quarter of 2024. In the first quarter, the consumer sector was pressurized under the escalating prices, and as a result, they reduced their number of orders and adopted a wait-and-watch approach.

North America

The North American market of propane-1,2-diol closely resonated with the Asian pricing pattern as the prices in the first quarter oscillated towards the lower end of the pricing spectrum before declining in the second quarter. The market participants anticipated that these bearish market sentiments were a consequence of the weak stance of downstream industries and the depreciating momentum of the US economy. Throughout the first half of the year, the region also struggled to sustain its export margins as re-routing of traditional trade routes and surge in freight charges reduced the overseas inquiries, and eventually, the number of shipments of propane-1,2-diol declined, raising concerns about the trading and manufacturing sectors.

Analyst Insight

According to Procurement Resource, the price trend of Propane-1,2-diol is expected to resonate with its feedstock commodities and bleak sentiments of the global consumer sector in the forthcoming months of the year.

Propane-1,2-diol Price Trend for the Second Half of 2023

Asia

In the third and fourth quarters of 2023, propane-1,2-diol prices remained at the lower end of the price spectrum in Asia. Propane-1,2-diol is a key ingredient in polyurethane foams, lubricants, and personal care items. The demand dynamics from these sectors, coupled with fluctuations in feedstock prices, had a significant influence on the propane-1,2-diol market.

The depreciation in raw material costs during this period contributed to the overall decline in propane-1,2-diol prices. This was further fueled by the limited industrial growth and loss of trade due to the disruption of Red Sea routes. Additionally, suppliers faced pressure to discount prices due to excessive rise in inventories and subdued demand, resulting in a downward trajectory for prices overall.

Europe

Similarly, in Europe, propane-1,2-diol market trends mirrored those observed in Asia during the fourth quarter of 2023. The depreciation in the cost of feedstock materials and other raw materials exerted a negative influence on the overall trend of the market. In view of the economic sensitivity of the region, the traders started to cut back their profit margins, and when the situation became dire, the producers also imposed cuts in production and investments that led to the downfall of the propane-1,2-diol price trend.

North America

In North America, the propane-1,2-diol market experienced comparable depreciation trends to those witnessed in Asian and European markets. The rising economic uncertainties in the market were the major concerns of the traders. The loss of the export rates in view of drought-like conditions in the Panama Canal eventually increased the level of inventories of propane-1,2-diol in the region, administrating the downslide of propane-1,2-diol prices.

Analyst Insight

According to Procurement Resource, the price trend of Propane-1,2-diol is expected to depict the trend of its downstream industries in the upcoming quarters.

Propane-1,2-diol Price Trend for the First Half of 2023

Asia

Propane-1,2-diol observed mixed price trend in the Asian region during the first half of 2023. As the lockdown was lifted in China, a slow but positive market revival was observed. The construction sector picked up pace, and the downstream demands for Propane-1,2-diol started rising in the first quarter.

With a positive inclination in prices after a long-time supplier also ramped up production, expecting a speedy recovery, but as the quarter shifted, the market pulled back gear as the inventories rose owing to oversupply, and the construction sector still stayed slow. This led to a disturbed supply-demand dynamic, and the prices exhibited a downward trend in the second quarter. So, the Asian Propane-1,2-diol market remained fluctuating throughout.

Europe

In continuation with its previous years’ experience, the European Propane-1,2-diol market showcased similar drowning trend in H1 2023 as well. As the economic situation didn’t improve much, Germany even underwent a recession, and the construction sector didn’t pick up.

Even though some recovery in the freight mediums and supply chains provided upstream support, low demands still dominated overall. Some reverse fluctuations were observed at the time of the quarter shift, but the general market sentiment was depressing for Propane-1,2-diol in Europe.

North America

The North American Propane-1,2-diol market fluctuated throughout both quarters in 2023. Prices continued to decline for the first half of the first quarter but started experiencing some stability after that. Though the general market sentiment was still depreciating, a recovery in downstream demands helped a little. However, the American economy’s detrimental effect on trade was still visible as the two major US banks collapsed. Propane-1,2-diol price trend returned southward by the end of the second quarter after an almost stagnant run.

Analyst insight

According to Procurement Resource, the Propane-1,2-diol market is expected to strive for improvement, with downstream demands continuing to be the major driving factor.

Propane-1,2-diol Price Trend For Second, Third and Fourth Quarters of 2022

Asia

Propane-1,2-diol prices remained on a declining trajectory for almost all three quarters from Q2 to Q4 of 2022 in the Asian region. The fundamental reason behind such poor performance was the Covid 19 pandemic. The Chinese government implemented a total lockdown in the region for Covid 19 containment.

An absolute industrial shutdown immediately seized most market exchanges, resulting in diminished downstream demands for Propane-1,2-diol, as the construction sector was one of the most impacted ones. Even after the lockdown was lifted, the market couldn’t stabilize as the buying sentiments got altered substantially, and spending became more necessity centric. Overall, as the downstream construction sector didn’t improve, the Propane-1,2-diol price trend also remained downward facing, with some temporary, short-lived reverse fluctuations.

Europe

The European Propane-1,2-diol market also witnessed a similar declining trend during the said period. The primary reason for this sharp price depreciation was the ongoing war between the countries of Russia and Ukraine. As Russia waged war against Ukraine, the European Union issued sanctions and cut down all kinds of economic exchanges with the country, including those of crude oil and natural gas.

This immediately hiked energy prices in Europe, skyrocketing prices for most other commodities as well, ultimately raising the living costs. Supply chains also got disturbed, disrupting trade routes. Hiked energy bills shattered all the expenditure dynamics for people. The construction businesses felt the wrath of this changed consumer sentiment, and the downstream demands dipped. This lowered demand caused the price trend for Propane-1,2-diol to remain on declining trajectories.

North America

The American Propane-1,2-diol market could not behave any differently from the global Propane-1,2-diol market trend. As the Chinese market restricted exchanges and the supply chains got disrupted for Europe, the American supplies kept piling up in the inventories with little to no demand. Inflation rose here, too, following the global economy. Overall, falling price trend were observed in the Northern American region.

Analyst insight

According to Procurement Resource, the Propane-1,2-diol market will strive for stability, but the overall market sentiment will still depend on the market offtakes from downstream industries.

Propane-1,2-diol Price Trend For the First Quarter of 2022

Asia

In the first quarter of 2022, the propane-1,2-diol market in the Asia-Pacific region had a considerable increase in market dynamics as the upstream and feedstock cost support continued to increase. These market emotions were substantially bolstered by the increased crude oil offers in the absence of Russian Crude Oil.

While the Chinese Lunar New Year vacations and Winter Olympics-related production rate limits reduced the market outlook in China, the arbitrage remained mute. In addition, the comeback of COVID in China had a significant influence on market emotions and margins, and during the quarter ending in March 2022, the FOB Qingdao price for USP grade was resolved at 2,701 USD/MT.

Europe

Based on the grades of the chemical on the German domestic market, the market in Europe exhibited conflicting opinions. The decrease in temperature affected enquiries from the antifreeze industry, which in turn had an effect on the industrial-grade offerings despite the increasing crude oil and upstream offers on the European market.

The special military operation conducted by Russia over Ukraine and the resolute opposition of European nations to such a move had indirect effects on market dynamics in addition to driving upstream energy prices to all-time highs. As a result of the commodities gyration's ripple impact, the producer's quotes had many turbulences, with March FOB Hamburg negotiations concluding at 3,136 USD/MT.

North America

The North American market remained positive during the entirety of the first quarter. In the early part of the quarter, feedstock propylene shortages slowed production rates at one of the largest plants, where a fire broke out last week in December. The cost support from upstream energy values stagnates on a higher trajectory as the OPEC+ alliance stagnates on the decision to gradually expand crude oil production against the rapid expansion in demand, followed by the commodity gyration caused by the war in eastern Europe.

Such a shift in the outlook bolstered the manufacturers' desire to increase quotes, with March FOB West Coast negotiations for propane-1,2-diol pharma grade estimated at 3055 USD/MT.

Propane-1,2-diol Price Trend For the Fourth Quarter of 2021

Asia

In October, the price of the chemical on the Asian Market hit its highest level of the year due to the impact of escalating raw material costs, as well as their scarcity and high freight expenses. The Chinese government's "Dual Control Policy" for energy rationing, which compelled factories to cut their operating rates, also contributed to price shocks in China.

The average price of the chemical decreased in November, despite the pharma sector's continued solid demand, as supply chain issues eased, allowing propylene oxide feedstock to reach their destination. Propane-1,2-diol prices in China and India for the month of December hovered at 2,824 USD/MT FOB Qingdao and 3,376 USD/MT FFG Ex-Delhi NCR, respectively, as a result of the constantly falling raw material costs. Negative growth in the automobile industry as a result of a chip shortage delayed propane-1,2-diol usage in the antifreeze market.

Europe

Throughout the whole fourth quarter of 2021, the European propane-1,2-diol market remained constrained. Due to the combined whammy of soaring feedstock costs and the catastrophic energy crisis, which boosted input costs, prices surged continuously. In the second part of the quarter, the pharmaceuticals industry experienced an extraordinary increase in demand as the Omicron version rapidly expanded throughout the area.

Additionally, spot prices were elevated due to supply chain interruptions at the beginning of the quarter and Coronavirus-induced shipping constraints towards the quarter's conclusion. In Germany, the average FOB Hamburg price in December was estimated at 2,670 USD/MT.

North America

The North American market anticipated soaring pricing patterns in October due to robust propylene oxide and propylene feedstock backed by soaring upstream crude oil prices that persisted from the previous quarter. With numerous U.S. facilities experiencing force majeure as a result of the storm Ida's destruction, the country's supply gap widened.

In November, however, manufacturers were able to experience some respite due to the replenishment of crude oil stocks through the coordinated release of strategic reserves and the recovery of plant operations disrupted by hurricanes.

Nonetheless, the market was surrounded by fresh scarcity in propylene feedstock supply as a result of ExxonMobil's Baytown facility's suspended operations following a fire explosion, causing propane-1,2-diol prices to climb again, settling between 2895 USD/MT and 3055 USD/MT FOB West Coast. The pharmaceutical industry's demand for the chemical remained robust during the fourth quarter of 2021.

Propane-1,2-diol Price Trend For First, Second and Third Quarters of 2021

Asia

Propane-1,2-diol was in short supply in the Asia-Pacific area due to the limited availability of feedstock as a result of planned plant shutdowns at various manufacturing facilities, followed by a decline in imports from the Middle East. Propane-1,2-diol prices increased throughout the area due to an increase in input costs and a decline in output.

In India, the March prices on a CFR basis were 1,399 USD/MT. Amid the second COVID wave in India, the supply forecast in Southeast Asia remained severely constrained due to a chronic scarcity of raw materials, which was impacted by lackluster buying attitudes.

Due to China's soaring inflation rate, several Chinese shoppers were hesitant to purchase the expensive propylene. In June, FOB Tianjin pharma grade propane-1,2-diol prices settled at 2,930 USD/MT. Since the beginning of July, China's domestic market for the chemical experienced an increase in demand.

The maintenance closure of facilities in Shaanxi and Shandong led to a fall in supply, while demand on the pharmaceutical market remained steady, resulting in a price increase. In September, Ex-Mumbai propane-1,2-diol prices in India were last estimated at 3,378 USD/MT.

Europe

The supply in the European region was constricted during the whole first quarter of 2021 due to the limited availability of feedstock, with the majority being redirected to the manufacturing of polyols. In addition, supply remained constrained as a result of a 50 percent drop in imports from the United States during the preceding quarter and the Middle East, where a major petrochemical factory announced a turnaround in February.

Propane-1,2-diol supplies remained tight in the second quarter of 2021 due to the shutdown of large steam crackers in Northwest Europe, which limited the supply of the important feedstock Propylene in Europe. However, the number of propane-1,2-diol exports from the United States increased over the previous quarter.

Propane-1,2-diol prices climbed in the third quarter of 2021, followed by a rise in demand from the European end-user industry. European spot propane-1,2-diol prices resumed their downward trend in the second quarter, followed by an increase in regional supply.

North America

During the first quarter of 2021, interruptions to propane-1,2-diol supplies continued, continuing from the prior disruptions. Propane-1,2-diol prices in North America increased as a result of increased demand and constrained supply. In March, Dow Chemicals hiked the price of both grades of the chemical by 22 USD/MT. In June, the FOB Connecticut (USA) contractual price of Mono propylene glycol (MPG)-pharmaceutical grade was estimated to be 2,795 USD/MT, a decrease of 45 USD/MT from March rates.

Mid-August saw Dow Chemical declare force majeure at its PO factory, adding to the manufacturer's troubles. In August, the price of the chemical (industrial grade) was estimated at 2520 USD/MT, a 7 percent increase over July levels. Numerous North American manufacturers revised their September offers for several grades of the chemical in response to a severe demand-supply imbalance.

Propane-1,2-diol Price Trend For the Year 2020

Asia

Due to turnarounds at the upstream PO facilities, the availability of the chemical remained constrained in the fourth quarter of 2020, impeding the production of both Mono- and Di- propylene glycol. China's diminished production of industrial-grade PG led to a regional shortage of the substance. As the region suffered harsh winters, the

Aviation Industry continued to support the quarterly need for anti-freeze products. On the Indian market, propane-1,2-diol prices experienced a slight decrease in the first half of the fourth quarter, followed by a consistent increase throughout the remainder of the quarter. The average price for the quarter was 1,275 USD/MT.

Europe

The European market experienced pressure in the fourth quarter due mostly to a reported deficiency of the feedstock propylene oxide, as its amounts were reportedly redirected to polyols manufacturing. The sudden increase in propane-1,2-diol prices on Asian markets and the hurricane season in the United States prompted a rise in trade inquiries from the European region.

The fragrance industry's demand for Di-propylene glycol remained robust, but the pharmaceutical industry's need skyrocketed to battle the spread of the COVID-19 virus. Demand for Mono- propylene glycol from the anti-freeze industry skyrocketed throughout the winters, despite the industry's efforts to counteract the uncertainty caused by the second lockdown enforced across Europe owing to the new COVID type. This resulted in a panic over the supply of securities despite the favorable forecast for demand.

North America

Demand for the chemical tightened during the early half of the fourth quarter due to moderate weather conditions across the United States and travel limitations caused by an increase in COVID-19 cases. Early in the fourth quarter, the Gulf area of the United States was plagued by production challenges at industrial plants.

In October, LyondellBasell declared force majeure at its upstream Propylene Oxide factory in Pasadena, Texas, which had a severe impact on the region's production of PG and other downstream goods. Some facilities destroyed by Hurricane Laura at the end of August were anticipated to be restored by the middle of the fourth quarter, easing product supply late in the quarter.

At the conclusion of the fourth quarter, the antifreeze industry saw a significant increase in demand owing to the winter season. Nevertheless, demand remained constrained in comparison to the previous year.

Procurement Resource provides latest prices of Propane-1,2-diol. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Propane-1,2-diol

Propane-1,2-diol is a synthetic liquid material that absorbs water. It is also used to manufacture polyester compounds, and as a foundation for deicing solutions. It is utilized by the chemical, food, and pharmaceutical sectors as an antifreeze when leakage could lead to contact with food. It is a thick, colorless liquid that is almost odorless and has a mildly sweet flavor. Having two alcohol groups, this substance is classified as a diol. It is miscible with several solvents, including as water, acetone, and chloroform.

Propane-1,2-diol Product Details

| Report Features | Details |

| Product Name | Propane-1,2-diol |

| Industrial Uses | Transportation, Building & Construction, Food & Beverage, Pharmaceuticals, Cosmetics & Personal Care, Paints & Coatings, Consumer Goods, Electronics, Textile industry |

| Chemical Formula | C3H8O2 |

| Synonyms | Propylene glycol |

| Molecular Weight | 76.095 g/mol |

| Supplier Database | The Dow Chemical Company, LyondellBasell Industries N.V., BASF SE, Archer Daniels Midland Company, Global Bio-chem Technology Group Co., Ltd, DuPont Tate, Lyle Bio Products |

| Region/Countries Covered | Asia Pacific: China , India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland , Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Propane-1,2-diol Production Processes

- Production of Propane-1,2-diol from Propylene Oxide

The hydration process is used to produce propane-1,2-diol. Propylene oxide is hydrolyzed in the presence of a catalyst, such as sulphuric acid, in this process. The ultimate product is propane-1,2-diol, which is obtained by purifying the solution further.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com