Product

Refined Coconut Oil Price Trend and Forecast

Refined Coconut Oil Price Trend and Forecast

Refined Coconut Oil Regional Price Overview

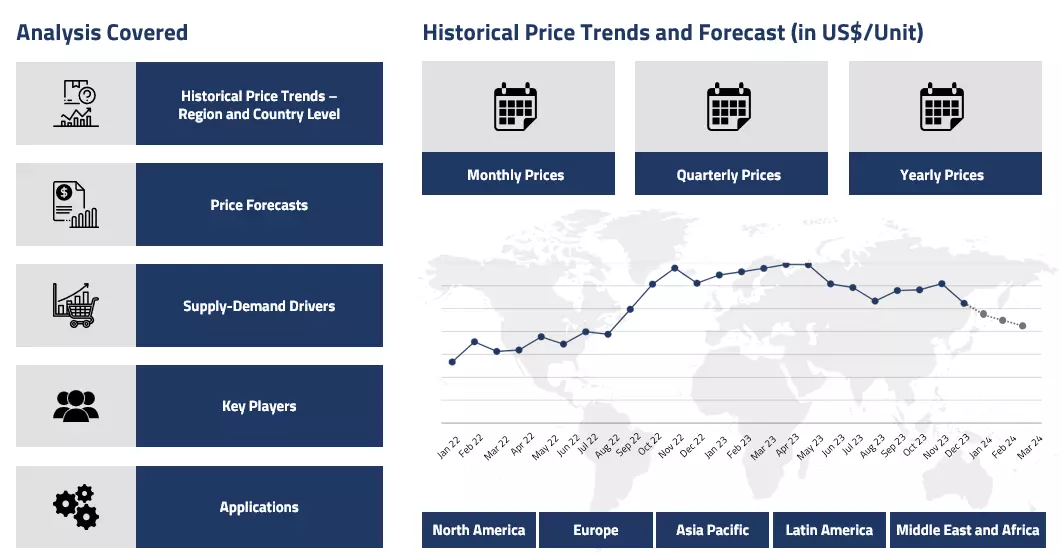

Get the latest insights on price movement and trend analysis of Refined Coconut Oil in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Refined Coconut Oil Price Trend for Q2 of 2025

| Product | Category | Region | Price | Time Period |

| Refined Coconut Oil | Food and Beverages | Indonesia | 1208 USD/MT | April 2025 |

| Refined Coconut Oil | Food and Beverages | Malaysia | 1303 USD/MT | April 2025 |

| Refined Coconut Oil | Food and Beverages | Philippines | 1397 USD/MT | April 2025 |

Stay updated with the latest Refined Coconut Oil prices, historical data, and tailored regional analysis

Asia

Refined coconut oil values in Asia remained on an upward trend for most of the second quarter of 2025, mirroring ongoing shortages in supplies and high demand in domestic as well as export markets. Shortage of fresh coconuts attributable to adverse climatic conditions continued to plague processors with tight stocks and occasional adjustments to production timelines. In key producing countries, refiners managed through restricted input flows, while export orders from major destinations added to the pressure on available supplies.

Refined Coconut Oil Price Chart

Please Login or Subscribe to Access the Refined Coconut Oil Price Chart Data

The refined coconut oil prices were 1208 USD/MT (EXW) in Indonesia and 1303 USD/MT (EXW) in Malaysia, while 1397 USD/MT (EXW) in Philippines during April. Producers also preferred to retain inventories in hopes of improved prices, further straining the supply chain. The food and personal care industries continued steady buying, further cushioning higher price levels. In a number of markets, currency fluctuations and shipping schedules added to extra volatility, leading buyers to lock in contracts before prices rose further.

Europe

In the European region, refined coconut oil price curve experienced upward pricing pressure, mirroring supply bottlenecks and Asian shipment delays. Imports came at a slower rate as exporters struggled with reduced volumes, prompting numerous European buyers to shift procurement strategies and seek alternative supplies. Demand from the food, cosmetics, and health industries was stable, increasing competition for every arriving shipment.

Processing costs also experienced some hikes because of elevated input costs, further contributing to firmness in the market for finished oil. Overall, during the quarter, the European market reflected the tightness experienced in origin nations, and price changes were primarily driven by global supply issues.

North America

In North America, the market for refined coconut oil followed the same trajectory, with consumers facing consistent difficulties in procuring imports. Lower availability in primary exporting Asian nations meant consumers had limited spot inventories, causing prices to rise throughout the continent.

Refiners and distributors tightly controlled allocation, monitoring incoming receipts as well as local demand. Market sentiment was influenced by continuous speculation about easing of supply shortages, with price negotiations reflecting the ongoing pressure to match customer commitments.

Analyst Insight

According to Procurement Resource, refined coconut oil prices are expected to remain sensitive to global supply conditions. Any improvement in coconut yields or logistical flows could provide relief, but buyers will likely continue to monitor markets closely for further changes.

Refined Coconut Oil Price Trend for Q1 of 2025

| Product | Category | Region | Price | Time Period |

| Refined Coconut Oil | Food and Beverages | Indonesia | 1169 USD/MT | January 2025 |

| Refined Coconut Oil | Food and Beverages | Indonesia | 1185 USD/MT | March 2025 |

| Refined Coconut Oil | Food and Beverages | Malaysia | 1253 USD/MT | January 2025 |

| Refined Coconut Oil | Food and Beverages | Malaysia | 1280 USD/MT | March 2025 |

| Refined Coconut Oil | Food and Beverages | Philippines | 1338 USD/MT | January 2025 |

| Refined Coconut Oil | Food and Beverages | Philippines | 1370 USD/MT | March 2025 |

Stay updated with the latest Refined Coconut Oil prices, historical data, and tailored regional analysis

Asia

Price trends for refined coconut oil in key Southeast Asian markets during the first quarter of 2025 reflected broader market dynamics, shaped by constrained supply, steady demand growth, and competition with alternative oils. In Indonesia, prices saw a steady rise from around 1169 USD/MT (EXW) in January to approximately 1185 USD/MT in March. The increase was driven by tightening supplies amid moderate production levels and growing demand from exporters and domestic buyers.

Competition with palm kernel oil, a key substitute, added to price pressures as industries sought cost-effective alternatives. Malaysia followed a similar trajectory, with prices moving from about 1253 USD/MT in January to around 1280 USD/MT in March. Strong international demand, particularly from the EU, the U.S., and China, kept the market firm despite some expectations of supply adjustments.

The Philippines, as the largest global producer, saw prices rise from approximately 1338 USD/MT in January to around 1370 USD/MT in March. A constrained production outlook, coupled with rising interest from food and industrial sectors, supported this trend. With global demand projected to hold steady and supply facing uncertainty due to climate variability, prices may remain firm in the near term.

Europe

Since Asia drives supply for most of the coconut products globally, the price trend in Europe was not very different for refined coconut oil than the Asian markets. Initially, prices remained relatively stable before increasing at a steady pace. As the quarter progressed, the rate of increase accelerated due to rising costs of raw materials and transportation, driven by strong demand from the food and cosmetics industries. However, toward the end of the quarter, the market showed signs of stabilization, with expectations of a potential price adjustment.

North America

The refined coconut oil price trend in North American markets also followed a similar pattern to its Asian and European counterparts. Prices began to rise gradually in January, accelerating in the later months of the quarter as increased orders from the downstream sector reflected expectations of further price hikes. Additionally, supply constraints and rising import costs contributed to the upward price trend. However, by the end of the quarter, the pace of increase slowed as market participants grew more cautious in response to the elevated prices.

Analyst Insight

According to Procurement Resource, the refined coconut oil price trend is expected to remain rangebound in the coming months after a bullish run in the current quarter, as supplies from key regions stabilize.

Refined Coconut Oil Price Trend for the Q4 of 2024

| Product | Category | Region | Price | Time Period |

| Refined Coconut Oil | Food and Beverages | Malaysia | 1222 USD/MT | October'24 |

| Refined Coconut Oil | Food and Beverages | Malaysia | 1235 USD/MT | December'24 |

| Refined Coconut Oil | Food and Beverages | Philippines | 1326 USD/MT | October'24 |

| Refined Coconut Oil | Food and Beverages | Philippines | 1335 USD/MT | December'24 |

Stay updated with the latest Refined Coconut Oil prices, historical data, and tailored regional analysis

Asia

In Q4 of 2024, the prices of refined coconut oil in Asia experienced an upward trend. Malaysia and the Philippines faced supply issues due to the limited availability of copra. Severe weather conditions and unusual phenomena such as El Nino significantly impacted coconut yields in key growing regions. For the Philippines, the refined coconut oil price was around 1326 USD/MT (EXW) in October and increased to around 1335 USD/MT in December 2024.

In Malaysia, the overall pricing outlook was positive for most of Q4, though the market was relatively more consolidated in the first half of the quarter. The monthly average prices (EXW) in the Malaysian refined coconut oil market rose from about 1222 USD/MT in October to around 1235 USD/MT in December 2024. The export market thrived as demand grew for vegetarian and vegan food options. Overall, the refined coconut oil price curve showed growth in the last quarter of 2024.

Europe

Europe saw a steady rise in prices for refined coconut oil as markets struggled to compete with limited supply from Asia. The European market was heavily reliant on imports, causing refined coconut oil prices in Europe to mirror the trends in Asia. A supply crunch in major exporting countries like the Philippines and Malaysia led to a slight increase in refined coconut oil prices in Europe.

The rising demand for sustainable, plant-based alternatives, particularly from the food processing and cosmetics sectors, further supported the price increase. However, importers remained cautious in their procurement, as rising prices and other constricting factors were narrowing profit margins.

North America

Refined coconut oil prices experienced a moderate upward trend in North America during the last quarter of 2024, reflecting the trends seen in the Asian and European markets. Reduced imports from Asian countries and declining inventories further supported the rise in prices. Despite this, demand remained stable, with strong demand from the food products and personal care sectors contributing to the upward movement of the refined coconut oil price curve.

Analyst Insight

According to Procurement Resource, moving forward, the refined coconut oil price trajectory is expected to show moderate increases in the upcoming months driven by current supply and demand dynamics.

Refined Coconut Oil Price Trend for the Q3 of 2024

| Product | Category | Region | Price | Time Period |

| Refined Coconut Oil | Food and Beverages | Indonesia | 1083 USD/MT | July'24 |

| Refined Coconut Oil | Food and Beverages | Indonesia | 1123 USD/MT | September'24 |

| Refined Coconut Oil | Food and Beverages | Philippines | 1253 USD/MT | July'24 |

| Refined Coconut Oil | Food and Beverages | Philippines | 1302 USD/MT | September'24 |

Stay updated with the latest Refined Coconut Oil prices, historical data, and tailored regional analysis

Asia

The prices of refined coconut oil followed an upward trajectory during the third quarter of 2024, marked by significant volatility. Disruptions in the supply of feedstock, particularly coconut, contributed to this fluctuation. Reduced yields due to severe weather conditions, such as El Niño, combined with increased demand, led to a surge in coconut prices. This made it more difficult for downstream industries, including coconut oil enterprises, to secure raw materials.

In the Philippines, prices rose from around 1253 USD/MT (EXW) in July to approximately 1302 USD/MT (EXW) in September. Cuts in production, coupled with smaller coconuts, made it challenging for refiners to extract oil. Similarly, in Indonesia, prices increased from around 1083 USD/MT (EXW) in July to approximately 1123 USD/MT (EXW) in September. The region faced reduced feedstock availability as direct purchases by Chinese buyers from local farmers destabilized local markets, leading to price hikes and delayed shipments. Overall, the quarter was marked by elevated prices of refined coconut oil.

Europe

The prices of refined coconut oil mirrored the trends in the Asian market throughout the third quarter of 2024. Unlike other edible oils, which experienced a decline during the summer months due to low demand, the prices of refined coconut oil surged. The prices remained elevated in the region due to ongoing supply shortages, which made sourcing feedstocks more challenging.

North America

The North American markets followed similar trends to other global markets during Q3'24. As major exporting countries of refined coconut oil faced challenges, prices in the region rose due to inflated import costs. Additionally, a gap between supply and demand, driven by the scarcity of feedstocks, further contributed to the price increase.

Analyst Insight

According to Procurement Resource, the prices of Refined Coconut Oil will continue to show upward movements in the upcoming quarter until the supply of the feedstock normalizes in the market. However, some price softening may occur by the end of the year as businesses diversify and secure their supplies.

Refined Coconut Oil Price Trend for the First Half of 2024

| Product | Category | Region | Price | Time Period |

| Refined Coconut Oil | Food and Beverages | Indonesia | 1011 USD/MT (EXW) to around 1090 USD/MT | H1'24 |

| Refined Coconut Oil | Food and Beverages | Philippines | 1265 USD/MT | June’24 |

Stay updated with the latest Refined Coconut Oil prices, historical data, and tailored regional analysis

Asia

Asia accounts for the most coconut-producing and exporting countries in the world; therefore, the price transitions here dictate the global coconut markets. During the first half of the year 2024, refined coconut oil prices were found raging for the entire span of six months. Coconut production in India has been reduced primarily due to the adverse impacts of climate change, notably severe heatwaves and high temperatures that have led to water scarcity and disrupted irrigation systems. These extreme weather conditions have caused crop wilting, lower quality yields, and increased pest populations.

Additionally, environmental stress has accelerated the maturation of coconuts. Following an inclined price trajectory, the average prices in the Philippines averaged around 1265 USD/MT (EXW) in June’24. Similarly, in the Indonesian refined coconut oil market a shift from about 1011 USD/MT (EXW) to around 1090 USD/MT (EXW) over the concerned timeframe. These price transitions did incorporate some reverse fluctuations as well; however, the overall market inclination was largely positive around this time.

Europe

Since Asian coconut oil exports dictate the global refined coconut oil market, the trend in European markets was also found to reflect the oscillations of the Asian markets. The downstream demands in the European markets were quite steady and regular, with not much surprise. However, the available supplies and logistical disruptions emerged as the biggest price drivers for the European refined coconut oil markets.

Since the pirate issues erupted in the Red Sea with frequent Houthi attacks on carriage shipments, the freight charges surged up, on top of that, the limited availability of coconut and associated products at the source locations further complicated the regional trade scenario. Overall, the trend exhibited variations for the European market; after a soft start, prices picked up as the first quarter came to an end. However, with steady normalization in the demand outlook, the second quarter closed on a relatively stable note.

North America

The refined coconut oil witnessed a varying price pattern in the North American markets; the prices had a slow start in the region as the downstream demands were sluggish during the peak winter months. As time progressed, the downstream demands also started improving along with that, the price curve also started inclining steadily.

At one point, the various geopolitical and other trade-related disruptions really affected the overall pricing outlook. However, as the second quarter neared conclusion, the markets started stabilizing again. With these oscillating movements, the downstream demands remained the key market driver. Overall, mixed market sentiments were witnessed in H1’24.

Analyst Insight

According to Procurement Resource, Refined Coconut Oil prices are expected to normalize in the global markets going forward. The supply and demand outlooks are looking more conducive.

Refined Coconut Oil Price Trend for the Second Half of 2023

Asia

Owing to the steady rise in downstream industry consumption rates, the refined coconut oil market started the third quarter on a positive note. As a result, the price of Indonesian refined coconut oil increased during that time. Nevertheless, a subsequent downturn was noted as purchases by the consumer sector steadily slowed down.

Global logistical issues, such as shifting transportation prices and the emergence of less expensive substitutes, further complicated the dynamics of the industry. Notwithstanding these obstacles, the market for refined coconut oil concluded the year on a good note in terms of production costs. Malaysia, on the other hand, showed tenacity, seeing little fluctuation and only a minor decline in averages.

Europe

In the third quarter of 2023, European traders witnessed a notable increase in refined coconut oil price trends. This uptick was driven by exponentially rising demand from domestic consumers, boosting sentiments of refined coconut oil prices. However, producers faced challenges from adverse weather conditions, including sudden floods and erratic rainfall patterns, which reduced agricultural output and constrained material availability in the market. Nonetheless, market dynamics shifted in the fourth quarter due to the fragile state of the global economy and an excess of overseas imports.

North America

The interplay between the trading sector, demand, and production rates had a significant impact on the price trend of refined coconut oil in the third and fourth quarters of 2023. Prices for refined coconut oil rose in the third quarter due to a combination of a rise in export margins and increasing consumer demand.

The gap between supply and demand was also increased by an increase in bulk orders and the scarcity of raw materials, which contributed to the price trend upward. But by the end of the fourth quarter, stockpiles had grown, upending the fundamentals of the market for refined coconut oil.

Analyst Insight

According to Procurement Resource, the price trend of Refined Coconut Oil is estimated to incline further as the limited production and rise in demand will widen the gap between supply and demand sectors of the market.

Refined Coconut Oil Price Trend for the First Half of 2023

Asia

In the Asia-Pacific, the prices of refined coconut oil oscillated amid the uneven trend in demand from the downstream sector in the first quarter. The rise in stockpiles aided by high production rates only resulted in the downfall in the prices of refined coconut oil. In the second quarter, too, the falling cost of crude oil, the pressure of rising inventory levels, and slow demand from the consumer sector challenged the growth of the refined coconut oil price trend.

Europe

The first quarter of 2023 in European countries was similar to what was observed in Asia Pacific. The rise in production rates amid low demand led to the southward movement of refined coconut oil prices in the first half of the first quarter. The trend stabilized a little towards the end phase as the removal of export limitations benefited the momentum of refined coconut oil prices. This growth phase was short-lived as higher stockpiles and low demand affected the second-quarter price trend of refined coconut oil negatively.

North America

In North America, the downstream industries such as food and cosmetics showcased a mixed demand trend. The first half of the first quarter enjoyed inflation in food prices due to the ongoing Russia-Ukraine crisis and disruptions in the supply chains, but the second half struggled with the rise in number of stockpiles. The momentum continued to plunge in the second quarter, too, due to weak support from the export rates and a fall in the prices of corn, edible oils, and other grains.

Analyst Insight

According to Procurement Resource, the price trend of Refined Coconut Oil is estimated to struggle with high production rates and lower demand, which will likely result in an imbalance between supply-demand dynamics.

Procurement Resource provides latest prices of Refined Coconut Oil. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com