Product

Sebacic Acid Price Trend and Forecast

Sebacic Acid Price Trend and Forecast

Sebacic Acid Regional Price Overview

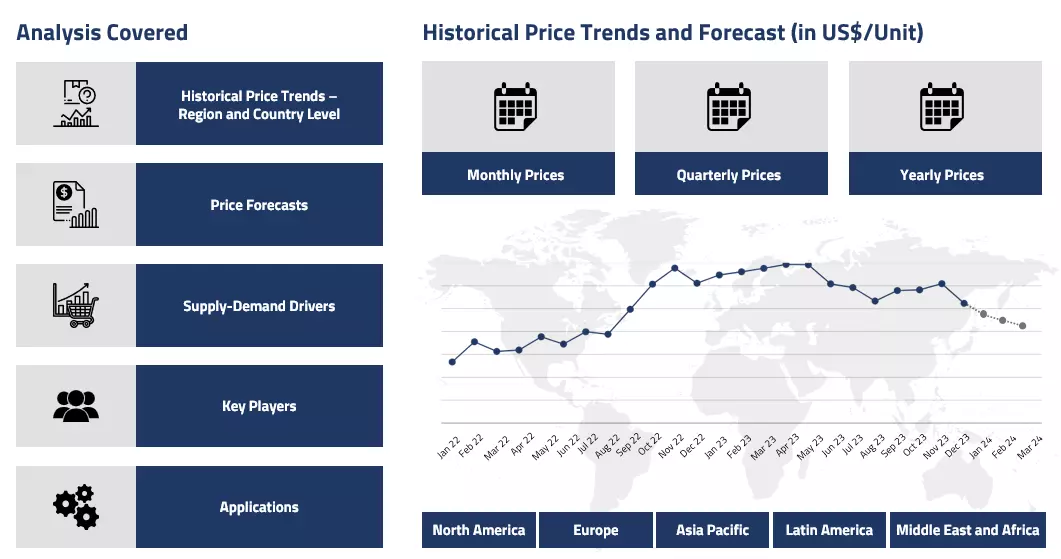

Get the latest insights on price movement and trend analysis of Sebacic Acid in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Sebacic Acid Price Trend for the First Half of 2025

In the first half of 2025, Sebacic Acid prices remained relatively stable with a slight upward trend, supported by consistent demand and steady feedstock supply, primarily castor oil. India, being the major producer of castor oil, saw smooth harvest inflows and minimal logistical disruptions, which ensured a healthy supply of raw materials for Sebacic Acid production. The steady demand from key downstream sectors such as plastics, lubricants, and personal care products helped maintain a balanced market environment.

Sebacic Acid Price Chart

Please Login or Subscribe to Access the Sebacic Acid Price Chart Data

Improved industrial demand in January and February created a positive start to the year. With increasing interest in sustainable and bio-based chemicals, applications of Sebacic Acid in eco-friendly polymers and specialty chemicals remained strong. Export interest, particularly from Europe, added to market confidence. However, global trade uncertainties, currency fluctuations, and rising tariff tensions introduced minor volatility in cost projections, especially for Indian exporters.

Crude oil market fluctuations and shifting geopolitical conditions, including U.S. trade moves and sanctions, indirectly influenced global chemical trade sentiment, but the impact on Sebacic Acid was moderate due to its niche supply chain and less dependency on fossil feedstocks.

Analyst Insight

According to Procurement Resource, the market is expected to stay firm, driven by sustainability goals and stable castor oil supply, though external trade and currency risks may continue to affect export competitiveness.

Sebacic Acid Price Trend for the Second Half of 2024

In the second half of 2024, Sebacic Acid prices saw mixed trends, influenced largely by the volatility in the castor oil market, its key raw material. Prices remained firm during the third quarter as castor oil supplies tightened due to reduced production in India, especially in major growing regions like Gujarat.

The limited availability of castor seeds at processing mills and uncertain weather conditions earlier in the year added to the supply stress. As a result, Sebacic Acid prices held steady or experienced mild upward pressure, particularly in export-driven markets such as Europe and North America.

However, the price trend eased slightly during the fourth quarter. Castor oil prices in India declined gradually from October to December, helped by a slowdown in speculative activity and weak port logistics that temporarily held back exports. These changes in upstream dynamics offered mild relief to downstream buyers of Sebacic Acid.

Despite this softening, steady demand from industrial users in plastics, lubricants, and cosmetics kept the market relatively balanced. Manufacturers managed inventory levels cautiously, while buyers showed interest in long-term contracts to hedge against future supply uncertainties.

Analyst Insight

According to Procurement Resource, Sebacic Acid prices are expected to stay stable, supported by ongoing demand and relatively firm castor oil supply conditions into early 2025.

Sebacic Acid Price Trend for the First Half of 2024

The price trend of sebacic acid during the first half of 2024 was influenced by fluctuations in its primary feedstock, castor oil. In the early months of the year, the sebacic acid market witnessed a tepid performance, reflecting the vacillating prices of castor oil. Geopolitical disturbances and logistical challenges, such as shipping delays and disruptions in international trade, created an uneven market environment. Some countries faced an oversupply of castor oil due to lower import demand, while others had stockpiling issues, which indirectly kept sebacic acid prices from gaining substantial upward momentum.

As India, a major producer and exporter of castor oil, projected an increase in castor seed production, it initially led to a slight dip in the feedstock's prices. This surplus of castor oil in the domestic market impacted the cost of sebacic acid as well, contributing to a downward price trend. However, the international market's lukewarm demand further reinforced this pattern, resulting in a relatively stagnant price movement for sebacic acid during the first quarter.

In the second quarter, the dynamics shifted as Indian farmers, observing a steady demand for castor oil from international markets, began limiting the supply. This intentional tightening of castor oil availability pushed the market sentiments upward, directly impacting the price trajectory of sebacic acid. The feedstock's constrained supply, coupled with steady demand for sebacic acid from downstream industries, led to upward price pressure in the latter half of the quarter. Nevertheless, this increase was moderated by the fact that initial excess supplies of castor oil had balanced the market in the early phase of Q2, preventing a sharp price spike.

Analyst Insight

According to procurement resources, the price of Sebacic Acid is thus the market's direction will likely depend on the supply-demand dynamics of the major markets and limited availability of raw materials.

Sebacic Acid Price Trend for the Second Half of 2023

The extensive use of sebacic acid in the production of polymers, including polyesters, polyamides, and plasticizers, is a primary market driver. Sebacic acid is also known for playing a key role as a key ingredient in the production of various applications such as textiles, cosmetics, lubricants, and pharmaceuticals. Additionally, the increasing demand for bio-based and renewable chemicals further contributes to the expansion of the sebacic acid market.

In the final two quarters of 2023, sebacic acid prices experienced a rapid decline. Sebacic acid is derived from castor seeds, and therefore, its prices closely mirror the price trends of its source. The cultivation of the castor crop thrived in semi-arid regions such as Gujrat and Rajasthan in India, which eventually caused an unexceptional bloom in the inventories. Thus, throughout the aforementioned period, the castor oil industry faced reduced market demands along with consistent inventory supplies, leading to an oversupply crisis not only in India but several other nations such as Indonesia, Brazil, and China.

However, it was observed that as the year approached its end, the dynamics of the market started to improve, and the prices began to stagnate. This relief in the market sentiments came from the rise in the spending budget of the consumers at the onset of the holiday season and the spike in the industrial activities of downstream polymer sectors.

Analyst Insight

According to Procurement Resource, the price trend of Sebacic Acid is estimated to bear the trajectory paved by the demand from the downstream polymer and plasticizer sector and trading activities around the globe.

Procurement Resource provides latest prices of Sebacic acid. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Sebacic Acid

Sebacic acid comes in the form of a white powdery granule. Sebacic acid is the 1,8-dicarboxy derivative of octane and is an alpha, omega-dicarboxylic acid. It serves as both a human and a plant metabolite. It is a dicarboxylic fatty acid and an alpha, omega-dicarboxylic acid. It is a sebacate(2-) and sebacate conjugate acid. It comes from a decane hydride.

Sebacic Acid Product Details

| Report Features | Details |

| Product Name | Sebacic Acid |

| HS CODE | 291713 |

| CAS Number | 111-20-6 |

| Industrial Uses | Production of lubricants, Production of plasticizers, Used as plant and human metabolite |

| Chemical Formula | C10H18O4 |

| Synonyms | 1,8-Octane Dicarboxylic acid, 1,10-Decanedioic acid |

| Molecular Weight | 202.25 g/mol |

| Supplier Database | Arkema Group, Hokoku Co., Ltd., Shipra Agrichem Pvt Ltd (SAPL), BASF SE |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Sebacic Acid Production Processes

- Production of Sebacic Acid from Castor Oil and Sodium Hydroxide

The main fatty acid found in castor beans is produced through a procedure that involves extracting ricinoleic acid from sodium hydroxide and alkaline solutions. Approximately 87% of castor oil contains ricinoleic acid. Following caustic digestion, the ricinoleic acid is broken down to produce capryl alcohol and sebacic acid. Sebacic acid is often produced with a lesser yield, hence purification techniques are employed to get higher yields of purity.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com