Product

Sodium Cyanide Price Trend and Forecast

Sodium Cyanide Price Trend and Forecast

Sodium Cyanide Regional Price Overview

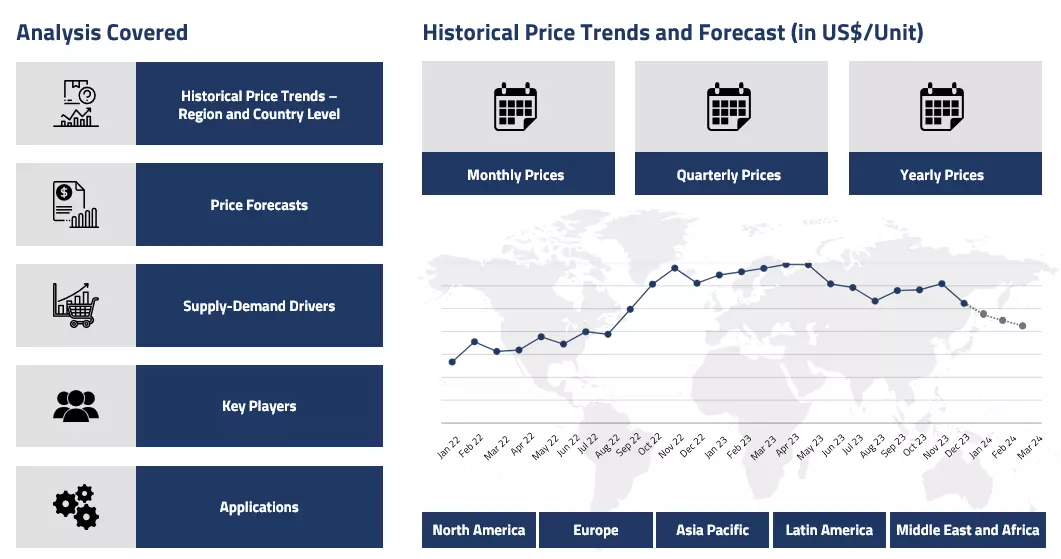

Get the latest insights on price movement and trend analysis of Sodium Cyanide in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Sodium Cyanide Price Trend for Q2 of 2025

Asia

In Asia, sodium cyanide prices showed moderate fluctuations during Q2’25, influenced primarily by the broader trends in mining chemicals and regional supply constraints. Demand remained steady from the gold and silver extraction industries, particularly in China and Southeast Asia. However, soft industrial output in parts of China especially in downstream sectors like textiles and alumina limited broader chemical consumption, which indirectly tempered demand for sodium cyanide.

Sodium Cyanide Price Chart

Please Login or Subscribe to Access the Sodium Cyanide Price Chart Data

While thiourea gained some traction as a cyanide alternative, sodium cyanide continued to hold its ground due to cost-effectiveness in large-scale mining. On the supply side, regional shutdowns in the chlor-alkali industry and limited availability of precursor chemicals like caustic soda contributed to a slightly tighter market. Overall, the Asian market stayed balanced, with cautious optimism among sellers.

Europe

The European market for sodium cyanide experienced a subdued quarter. Industrial demand remained soft across the region, mirroring the weak performance in alumina and chemical sectors. Caustic soda prices declined due to high inventories and sluggish output, which eased production costs for sodium cyanide but also signaled limited downstream consumption.

Some minor logistical issues at ports affected chemical distribution, but they were not significant enough to move the market drastically. With no major mining project expansions in the region, sodium cyanide purchases were mostly on an as-needed basis. Supply was stable, though competition from imported chemicals added some pricing pressure.

North America

In North America, sodium cyanide prices held relatively firm in Q2’25. Steady mining activity across the U.S. supported constant demand, especially from gold extraction operations. Strong domestic caustic soda output ensured an uninterrupted raw material supply, keeping sodium cyanide production smooth.

The U.S.-China trade tension had minimal direct impact on sodium cyanide, but broader chemical trade uncertainties encouraged local buyers to secure domestic sources, boosting internal demand. Export opportunities were slightly affected by shifting global flows, though overall sentiment stayed strong due to robust mining performance.

Analyst Insight

According to Procurement Resource, Sodium Cyanide prices may remain stable in the near term, supported by consistent mining demand and tight control over raw material supply.

Sodium Cyanide Price Trend for Q1 of 2025

During the first quarter of 2025, the Asian sodium cyanide market was influenced by the pricing dynamics of its key feedstocks, caustic soda and hydrogen cyanide, which experienced slight increases at the start of the quarter, followed by corrections and a subsequent recovery. The initial price increase was primarily driven by supply disruptions in China, stemming from lower plant run rates and inventory drawdowns during the Lunar New Year celebrations. Demand remained strong from mining and metallurgy industries.

However, as local inventories stabilized and downstream consumption eased, prices saw a moderate correction midway through the quarter. Towards the quarter’s end, a modest rebound occurred, likely due to fresh offtake and restocking in preparation for the next production cycle. Fluctuations persisted, with buyers adapting to changing cost structures driven by feedstock availability.

Europe

The European sodium cyanide market began the quarter on an upward trajectory, mirroring rising regional trends in caustic soda and hydrogen cyanide prices. Higher industrial offtake and logistical congestion in parts of the continent contributed to the initial price increase. However, this trend did not hold throughout the quarter. Following a peak, March saw a price dip, reflecting reduced purchasing activity and improved feedstock availability, aligning with movements in the upstream market. Despite this downturn, market sentiment remained optimistic. During the latter half of the quarter, prices began recovering, likely driven by restocking efforts and steady demand. Overall, supply chains remained balanced, with no major disruptions reported during this period.

North America

The North American sodium cyanide market followed a similar pattern to that of Asia. Early in the quarter, prices increased gradually as production levels adjusted to plant downtime and shipping delays. Rising caustic soda and hydrogen cyanide prices placed upward pressure on sodium cyanide spot prices. However, in the second half of the quarter, prices experienced a temporary dip, attributed to weaker downstream demand and improved inventories. Towards the quarter’s end, a slight price recovery was observed. The overall price trend in North America reflected volatility, primarily driven by fluctuations in feedstock costs and steady demand from end-user markets.

Analyst Insight

According to Procurement Resource, sodium cyanide price curve is expected to remain stable in the near future, as logistical and supply disruptions are anticipated to ease further in the coming months.

Sodium Cyanide Price Trend for the Second Half of 2024

Asia

During the second half of 2024, sodium cyanide prices in Asia experienced fluctuations, closely following trends in the upstream caustic soda and hydrogen cyanide markets, its primary feedstocks. Prices remained stable at the beginning, after reaching a peak in the previous quarter. However, adverse weather conditions, particularly in Southeast Asia, disrupted shipments, keeping sodium cyanide prices under pressure, especially towards the end of the third quarter. As the fourth quarter commenced, tightened environmental regulations and maintenance stoppages in China led to a reduction in caustic soda output, constraining downstream supply and pushing prices higher.

However, towards year-end, market conditions stabilized as plant production slightly improved, demand from industries such as pulp and paper weakened, and overall purchasing activity declined. Additionally, the holiday season in international markets tempered industrial demand around the New Year period. Overall, sodium cyanide prices exhibited mixed dynamics in the second half of 2024.

Europe

In Europe, sodium cyanide prices followed a gradual upward trend, driven by strong demand from the chemical and mining sectors and a firm caustic soda market, particularly in the United Kingdom. A steady supply and consistent offtake contributed to stable pricing with an upward bias. Demand from mining operations in Eastern Europe and specific industrial applications supported procurement activity. However, subdued construction and manufacturing sectors in other parts of the region limited broader price momentum. Towards the end of the year, an increase in imports and weaker industrial output pushed prices lower across mainland Europe. Despite this, the UK market remained more resilient, closing at a higher level compared to the start of the period.

North America

In North America, the sodium cyanide market started the second half of 2024 on a positive note. Rising caustic soda prices, caused by earlier production slowdowns and weather-related supply issues, contributed to higher sodium cyanide prices. Strong demand from gold mining and water treatment sectors, along with exports to Latin America, further supported price momentum. As the months progressed, production levels normalized, freight conditions improved, and domestic supply caught up, leading to a price correction. With winter approaching and industrial activity slowing, prices eased further. By year-end, the market had stabilized, exhibiting fewer fluctuations and a more balanced supply-demand scenario.

Analyst Insight

According to Procurement Resource, the sodium cyanide price curve is expected to see slight improvements as downstream industries resume operations following the New Year holidays.

Sodium Cyanide Price Trend for the First Half of 2024

Asia

Sodium cyanide prices observed a mixed trend during the first half of the year 2024, driven by variations in its upstream and downstream dynamics. The first quarter was relatively more stable and positively inclined in Asia, primarily because the upstream cost pressure was sustained for the majority of the first three months. Feedstock costs were high, and the commencement of the Israel-Hamas war in the Middle East disturbed the supply chains, further amplifying market uncertainties.

This led to unpredictable market behaviors in some regions. Some suppliers started hoarding products, anticipating production halts, while others tried to vacate the inventories. Amidst this, the market remained conflicted for the most part. As crude oil prices took a slight downturn in both India and China in the second quarter, the sodium cyanide market also experienced some relaxation. Overall, mixed market sentiments were witnessed.

Europe

In the European sodium cyanide market, the pricing outlook was not very different from the Asian sodium cyanide markets; the prices were found to fluctuate here as well. The European markets were relatively more disturbed than other global markets. Primarily, the long ongoing war in the European backyard between Russia and Ukraine intensified even more as it entered its third year. Along with that, the emergence of armed conflict between Israel and Hamas created more troubles for the already disturbed supply chains. The downstream consuming sentiments were generally weak, while the upstream dynamics remained the primary driver for the most part.

North America

In the American markets, the sodium cyanide prices were similar to the Asian and European sodium cyanide markets. The price graph showcased similar fluctuations; however, the overall market trajectory was still stable since the external disturbances were not as influential. The downstream mining industries, too, offered substantial support. The feedstock availability was sufficient. Overall, a more moderate and average price performance was witnessed for sodium cyanide in America during H1’24.

Analyst Insight

According to Procurement Resource, Sodium Cyanide prices are expected to waver in the upcoming quarters owing to the current supply and demand equation.

Sodium Cyanide Price Trend for the Second Half of 2023

Asia

In the early months of the third quarter, traders were optimistic about the price trajectory of sodium cyanide due to rising costs of feedstock materials like ammonia and methane, suggesting higher production costs.

Alongside increased procurement rates from downstream industries and gradually rising manufacturing expenses, sodium cyanide prices saw an upward trend. However, this optimistic market sentiment lasted only until the middle of the following quarter. Although initially supported by growing demand from both domestic and overseas industries, the prices eventually fell as export rates declined and the supply-demand gap widened due to excessive supply and subdued demand.

Europe

The price escalation of sodium cyanide in Europe during the third quarter of 2023 was driven by heightened consumer interest in both domestic and international markets.

This growth was further fueled by rising natural gas costs and the depreciation of the European economy against the US Dollar. Additionally, a temporary production halt by major industry players led to rapidly depleted inventories in the fourth quarter. However, later in the quarter, market conditions were dampened by increasing uncertainties in trading activities and disruptions in traditional trade routes, particularly due to issues with the Red Sea route.

North America

In North America, sodium cyanide prices initially saw only a slight increase in the third quarter. However, as consumers began stockpiling feedstock materials, production costs rose. Supply shortages were exacerbated by strong demand from both domestic and international markets and reduced export rates from Asian countries. Unlike the markets in Asia and Europe, North America managed to sustain its positive momentum into the fourth quarter, with sodium cyanide prices continuing to rise due to favorable consumer sentiments.

Analyst Insight

According to Procurement Resource, the price trend of Sodium Cyanide is expected to continue its northward trajectory as the uprising trading challenges and rise in the cost of raw materials will favor an uptrend in the pricing patterns of sodium cyanide in the upcoming quarters.

Sodium Cyanide Price Trend for First Half of 2023

Asia

The first and second quarters of 2023 witnessed a declining trend in the prices of sodium cyanide as the feedstock market failed to provide the required support.

The major factor that influenced this decline was the weak demand from the downstream industries, leading to a significant rise in the level of inventories. This low demand and high availability of sodium cyanide widened the supply-demand gap and, thus, negatively impacted the price trend of sodium cyanide.

Europe

The cost of feedstock materials fell consistently in the first and second quarters of 2023 due to the significant decline in prices of natural gas. In addition to this, low demand from downstream industries, restricted supply from Russia, and excess availability of the materials in the region affected the price trend of sodium cyanide throughout this phase. Overall, the market dynamics of sodium cyanide were also challenged by the negligible number of offtakes from domestic and international buyers, and as a result, the price trend of sodium cyanide declined in the European market.

North America

In North America, the price trend of sodium cyanide was majorly affected by the short demand for feedstock materials and rising levels of inventories in the first and second quarters of 2023. The decline in the prices was much more prominent in the second quarter.

The diminished level of inquiries, low consumption of consumers, and weak movement of its derivatives proved to be some major challenges in the region. In addition to this, the rate of exports to other North American countries also declined as the sea levels were not favorable, and thus, the price trend of sodium cyanide went southwards.

Analyst Insight

According to Procurement Resource, the price trend of Sodium Cyanide is estimated to decline in the upcoming quarters due to poor performance and negligible support from the feedstocks sector.

Procurement Resource provides latest prices of Sodium Cyanide. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Sodium Cyanide

Sodium cyanide is an inorganic compound that has a white appearance and is a water-soluble solid. Because of the chemical's high affinity for metals, this salt is extremely toxic. Its primary applications include gold mining, which takes advantage of its high reactivity to metals. It has a moderately strong foundation. When exposed to acid, it can produce the toxic gas hydrogen cyanide.

Sodium Cyanide Product Details

| Report Features | Details |

| Product Name | Sodium Cyanide |

| Industrial Uses | Mining, Electroplating |

| Chemical Formula | NaCN |

| Synonyms | Cyanosodium |

| Molecular Weight | 49.007 g/mol |

| Supplier Database | Anhui Shuguang Chemical Group, Cyanco Corporation, Chemours Company, Orica Limited, Taekwang Industrial Co., Ltd, CyPlus GmbH |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Sodium Cyanide Production Processes

- Production of Sodium Cyanide from Hydrogen Cyanide and Caustic Soda; from Sodium Carbonate, Charcoal and Ammonia; from Caustic Soda, Ammonia and Natural Gas

In the process using hydrogen cyanide and caustic soda, sodium cyanide is produced by reacting liquid anhydrous hydrogen cyanide with a sodium hydroxide solution. The finished product is a 30% wt solution of sodium cyanide.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com