Product

Sulphur Dioxide Price Trend and Forecast

Sulphur Dioxide Price Trend and Forecast

Sulphur Dioxide Regional Price Overview

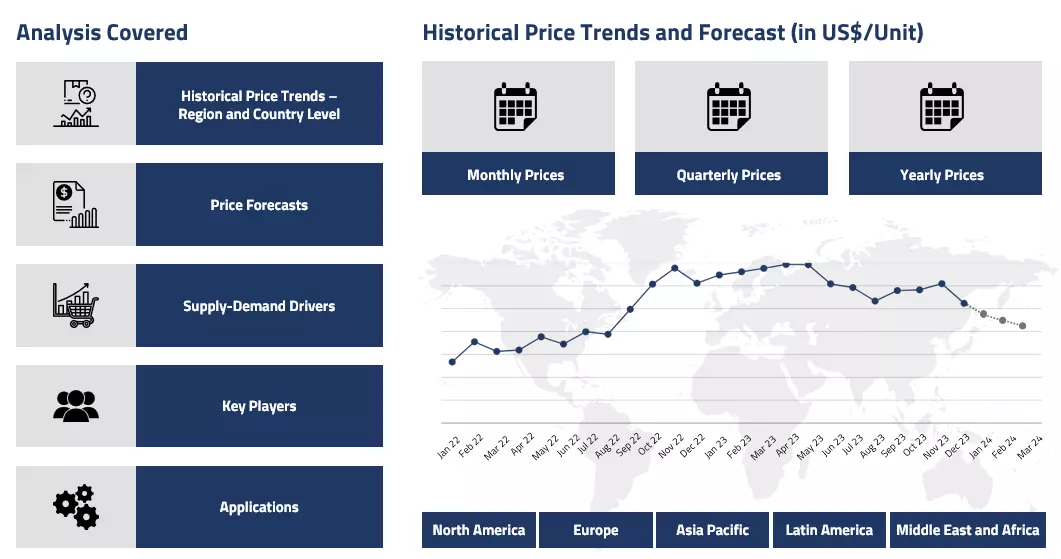

Get the latest insights on price movement and trend analysis of Sulphur Dioxide in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Sulphur Dioxide Price Trend for Q1 of 2025

| Product | Category | Region | Price | Time Period |

| Sulphur Dioxide | Chemicals | China | 442 USD/MT | March 2025 |

Stay updated with the latest Sulphur Dioxide prices, historical data, and tailored regional analysis

Asia

In Q1'25, the Sulphur Dioxide market in Asia experienced an initial upward trend, primarily due to strong demand from the fertilizer and chemical sectors. China, as the dominant market, saw a rise in prices following the Chinese New Year holiday when industrial activity picked up. The need for Sulphur Dioxide from the fertilizer industry, driven by the start of the spring planting season, further supported the price hike.

Sulphur Dioxide Price Chart

Please Login or Subscribe to Access the Sulphur Dioxide Price Chart Data

However, as the quarter progressed, the market in China saw a downturn. After the initial surge in demand, the market cooled down as the post-holiday boost faded, and logistical issues eased. This caused a slight slump in prices by the end of the quarter. Elsewhere in Asia, supply remained fairly steady, though local disruptions led to some price fluctuations in specific regions. The spot prices in the Chinese domestic market settled around 442 USD/MT during the end of the said quarter.

Europe

In Europe, the Sulphur Dioxide market remained stable throughout Q1’25. Prices were mostly unchanged as demand from sectors like chemicals and fertilizers was steady, without any significant spikes. The steady supply from both domestic production and imports helped maintain equilibrium in the market. Although there was some seasonal increase in demand from the fertilizer industry, it wasn’t enough to drive substantial price changes. The overall market in Europe was characterized by stability, with no significant disruptions affecting supply or demand during the quarter.

North America

The Sulphur Dioxide market in North America showed limited price movement during Q1’25. The supply of Sulphur Dioxide remained steady, with production levels in the Gulf Coast region meeting demand. The fertilizer and chemical industries maintained consistent demand, so there were no major fluctuations in consumption. However, some regional tightness was observed, particularly in the southeastern US, where imports from Mexico and Canada are crucial. These minor supply constraints led to some price pressure, but it wasn’t enough to cause significant price increases. Overall, the market in North America remained balanced throughout the quarter.

Analyst Insight

According to Procurement Resource, the Sulphur Dioxide market is likely to experience stability in Europe and North America, with minor fluctuations in response to shifts in demand and supply. In Asia, the market will likely continue to see volatility due to seasonal demand changes and supply chain disruptions.

Sulphur Dioxide Price Trend for the Second Half of 2024

Asia

In the Asian region, the price of Sulphur Dioxide also saw an upward trajectory in the second half of 2024. Tight Sulphur supply, exacerbated by logistical disruptions such as typhoons and port congestion, contributed to rising prices. Strong seasonal demand from the agrochemical and fertilizer sectors further strained supply chains.

Import limitations, particularly from China, and the maintenance shutdowns of key refineries added to the supply-demand imbalance. Despite efforts to stabilize supply, the market remained tight throughout the quarter.

Europe

The European market for Sulphur Dioxide in H2’24 was similarly characterized by rising prices. The surge in Sulphur feedstock costs, driven by sanctions on Russian crude, significantly impacted production expenses. The agrochemical sector, particularly for fertilizers, was a major demand driver, with increased agricultural activity boosting the need for Sulphuric Acid and Sulphur Dioxide. Supply disruptions, including plant shutdowns and port congestion, further strained the market. Increased imports and plant restarts provided some relief, but logistical challenges continued to push prices upward.

North America

In the second half of 2024, the Sulphur Dioxide market in North America experienced a significant upward price trend, primarily driven by supply constraints and increased demand. The region faced disruptions such as labor strikes at Canadian ports, severe winter rail delays, and natural disasters like Hurricane Helene. These issues led to tight supply and limited availability, which pushed prices higher. Additionally, strong demand from the agrochemical sector during the plantation season added further pressure, as fertilizers and soil replenishment needs soared. Despite high refinery utilization rates in the Gulf Coast and Midwest, supply shortages persisted, maintaining a bullish market sentiment.

Analyst Insight

According to Procurement Resource, the market for Sulphur Dioxide is expected to remain tight in early 2025, driven by ongoing supply challenges and strong demand from the agrochemical sector.

Sulphur Dioxide Price Trend for the First Half of 2024

| Product | Category | Region | Price | Time Period |

| Sulphur Dioxide | Chemicals | UK | 405 USD/MT (CIF, Felixstowe) | January’24 |

| Sulphur Dioxide | Chemicals | UK | 399 USD/MT (CIF, Felixstowe) | June’24 |

Stay updated with the latest Sulphur Dioxide prices, historical data, and tailored regional analysis

Asia

Sulphur dioxide (SO2) is a colorless gas that is highly significant in various industrial applications due to its properties as a preservative and disinfectant. It is usually produced industrially in the combustion of metal Sulphur; hence, the price trajectory for both sulphur and sulphur dioxide aligns closely with each other. During the first two quarters of 2024, sulphur dioxide prices were found to be largely stable for the majority period.

In China, with the consistent efforts to boost the manufacturing sectors, both sulphur and sulphur dioxide demands saw some increase. Therefore, sulphur dioxide prices also elevated marginally. However, the unrestricted availability of supplies in the region kept the sulphur dioxide market consolidated.

Europe

Compared to the Asian market, the European sulphur dioxide market was more rangebound throughout the first half of the year 2024. The food and chemical industries were facing inventory pressures in some regions while other regions struggled attributing to the supply chain challenges in the region. With these issues, the downstream demand for sulphur dioxide started witnessing a decline in the region. Therefore, the overall price graph remained tepid during the said period. In the United Kingdom, the monthly average prices went from about 405 USD/MT (CIF, Felixstowe) in January’24 to around 399 USD/MT (CIF, Felixstowe) in June’24.

North America

Just like the Asian and European sulphur dioxide markets, the prices remained stable in the US domestic market as well. This stability was supported by sufficient inventory levels meeting the steady demand from the downstream agrochemical sector. The supply chain remained regularly operational, allowing for consistent market conditions despite other looming geopolitical concerns. Moreover, the stability in the crude oil sector also kept the upstream outlook steady. Overall, an average market performance was observed for sulphur dioxide throughout the said period.

Analyst Insight

According to Procurement Resource, with the regional variations in the supply and demand outlooks of Sulphur Dioxide, the prices are expected to vary regionally in the coming months.

Sulphur Dioxide Price Trend for the Second Half of 2023

| Product | Category | Region | Price | Time Period |

| Sulphur Dioxide | Bulk Chemicals | Europe | 414 USD/MT (UK, CIF Felixstowe) | H2 2023 |

Stay updated with the latest Sulphur Dioxide prices, historical data, and tailored regional analysis

Asia

The sulphur dioxide market performance was notably weak during the last two quarters of 2023. The prices for both its feedstock materials sulphur and oxygen slumped continuously. Weak product movement because of lackluster demands from the various downstream sectors also pushed the sulphur dioxide price graph downwards.

The price trajectory was weak in the third quarter, but the Chinese market was still responding to it with little demand, however, as the fourth quarter began the market situation became even more fickle and the prices tumbled down at an even faster rate. Depreciation in the fertilizer market also turned out to be a big blow to the Asian sulphur dioxide market. Overall, tepid price sentiments were witnessed in H2’23.

Europe

The European market’s performance for sulphur dioxide was very mixed during the said period. The price trends showed numerous fluctuations throughout the said tenure following the regional supply and demand dynamics the market fluctuated within very confined limits. During the third quarter a sudden drop was witnessed in the monthly average prices however, the market was able to redeem itself. Following this, the suppliers became cautious and acquired a wait-and-see approach with procurement.

This helped in narrowing the gap between supply and demand outlooks and resulted in an almost plateaued price curve in the following quarter. The monthly prices averaged around 414 USD/MT (UK, CIF Felixstowe) throughout the said period.

North America

The American market sentiments for sulphur dioxide were not much different from their Asian counterparts. As the third quarter began the region felt a little relieved from the excess inflationary pressure it had been facing for a long time due to the economic turmoil.

The feedstock materials were also provided the required upstream cost support. However, the market demands continued to be the primary driver and pulled the price graph southward because of their sluggish trajectory. As the fourth quarter began even the upstream factors became regressive and failed to provide any substantial cost support. Overall, a very weak market performance was witnessed.

Analyst Insight

According to Procurement Resource, given the current demand dynamics, Sulphur Dioxide prices are expected to plunge going forward in the coming months.

Sulphur Dioxide Price Trend for the First Half of 2023

Asia

The price trend of sulphur dioxide oscillated throughout the first quarter. Initially, the trend suffered from the falling feedstock cost, weak movement of the Asia-Pacific market, and ample availability of the product in the market. But as the quarter progressed, the market activities rose after the Lunar holidays and were set on the path of their recovery, depicted by the rise in the demand from the water treatment and chemical synthesis industries. But soon, the price trend of sulphur dioxide took a bearish turn as the second quarter suffered from a rise in the level of inventories.

In addition to this, the slow cost of feedstock materials and high uncertainties in the prices of crude oil also hampered the price trend of sulphur dioxide and eventually caused it to move downwards.

Europe

The weak cost of feedstock materials and high uncertainties in the market dynamics in Europe exerted a negative effect on the price trend of sulphur dioxide in the first and second quarters of 2023. From the perspective of the downstream industries, the European market observed low interest from buyers in sulphur dioxide and its derived products, which lowered the number of orders from the downstream industries. In addition to this, investors were also reluctant to invest in this sector, and thus, the price trend of sulphur dioxide fell in the first half of 2023.

North America

In the first quarter of 2023, the price trend of sulphur dioxide was adversely affected by the steep fall in consumption rates by the downstream industries and the high level of stocks of the product in the market. Additionally, the oscillations in the crude oil prices, which caused the manufacturers to reduce their production costs, hampered the growth of the sulphur dioxide price trend in the second quarter. As observed in the first quarter, the feedstock cost, subdued demand, and overall weak fundamentals of the market affected the price trend of sulphur dioxide negatively.

Analyst Insight

According to Procurement Resource, the price trend of Sulphur Dioxide is estimated to showcase a southwards trajectory as the demand from the downstream industries and cost of feedstock materials do not seem to support the growth of the sulphur dioxide market.

Sulphur Dioxide Price Trend For the Second Half of 2022

North America

The second half of 2022 witnessed a plunging price trend for sulphur dioxide in the North American region, mainly on the back of frail demand from the downstream industry (fertilizer). The Russia-Ukraine war further worsened the situation of the sulphur dioxide market as the foothold of the fertilizer industry wavered. Constrained and overtly saturated supply chains and ports further weighed heavily on the sulphur dioxide price trend in the second half of 2022.

In the fourth quarter of 2022, the sulphur dioxide price trajectory stayed bearish owing to the lackadaisical market sentiments and the inflationary sniffling, among other miscellaneous dynamics in the North American region. Moreover, on the arrival of the colder waves in the winter season in the region, the application of sulphur dioxide as a refrigerant tumbled down. This further pulled the strings of the sulphur dioxide price trend in North America. Additionally, supply abundance and lulled demand brought the prices down.

Asia

The Sulphur Dioxide prices remained unstable to a weaker end throughout the second half of 2022. The primary reasons for the negative movement in the sulphur dioxide market in the Asia-Pacific region came from unstable demand dynamics from the downstream industries, further agitated by the Russia-Ukraine war. Moreover, the excess supplies from Europe and many Asian countries rendered the prices of sulphur dioxide a heavy blow. Additionally, the decreased feedstock production cost of sulphur and the enervated demand quotient of the downstream sulphuric acid further pushed the prices for sulphur dioxide down in the second half of 2022 in the Asian region.

Europe

The sulphur dioxide prices in the European region were recorded to recede in the second half of 2022. The primary reasons could be pinned on the rising inventories, dwindling demand from the downstream industries, and overall general demand among end users. Additionally, the dip in crude oil prices (feedstock)knocked the sulphur dioxide prices down in the region.

On the trade front, the pervasive and wide-ranged aftermath of the Russia-Ukraine war also caused uncertain and bearish sentiments for the sulphur dioxide market. Furthermore, the enfeebled sulphuric acid prices and the freight charges contributed to the dropping price trend for sulphuric acid and the surplus inventory.

Procurement Resource provides latest prices of Sulphur Dioxide. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Sulphur Dioxide

Sulfur Dioxide (SO2) is a heavy, colourless and poisonous gas classed as an inorganic compound. It has a distinct choking, pungent and irritating odour. It is used for producing chemicals in food and metal processing along with the paper pulping industry.

Sulphur Dioxide Product Details

| Report Features | Details |

| Product Name | Sulphur Dioxide |

| Industrial Uses | Manufacturing chemicals as a disinfectant and preserving in breweries and food/canning, in the textile industry, in metal and food processing, in paper pulping, and batteries. |

| Chemical Formula | SO2 |

| CAS Number | 7446-09-5 |

| Synonyms | sulfur dioxide, sulphur dioxide, Sulfurous anhydride, 7446-09-5, Sulfurous oxide |

| HS Code | 28112905 or 90271000 |

| Molecular Weight | 64.07 g/mol |

| Supplier Database | BASF, INEOS CALABRIAN, DowDuPont, Nutrien, Shell Canada, Yara International, Calabrian, Zhejiang Jihua Group, PVS Chemicals, Allied Universal, Carus Group, DX Group, Praxair Technology, Mil-Spec Industries Corp, Metorex Limited, Goro Nickel S.A.S., and Votorantim Metais. |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Sulphur Dioxide Production Processes

Sulfide ores like copper sulfide (CuS) or zinc sulfide (ZnS) are subjected to a roasting process in the presence of oxygen. This roasting step facilitates the oxidation of sulfur within the ores, leading to the creation of sulfur dioxide (SO2) gas. The resulting sulfur dioxide can be collected and undergo further processing.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com