Product

Tetrahydrofuran Price Trend and Forecast

Tetrahydrofuran Price Trend and Forecast

Tetrahydrofuran Regional Price Overview

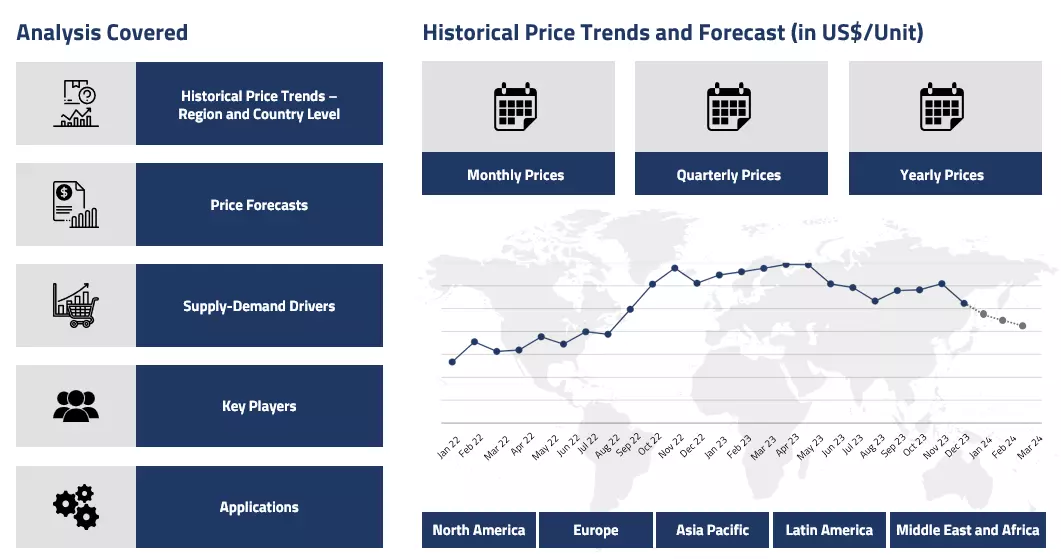

Get the latest insights on price movement and trend analysis of Tetrahydrofuran in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Tetrahydrofuran (THF) Price Trend for Q1 of 2025

Asia

In Asia, the Tetrahydrofuran (THF) market during Q1’25 followed a sluggish trajectory, driven largely by weak demand from key downstream industries such as automotive and electronics. Early in the quarter, the market remained soft as businesses in the region, particularly in China, were still recovering from the post-New Year period. Despite some steady demand for THF in the production of polyurethanes and plastics, there was limited buying interest, and market participants were cautious.

Tetrahydrofuran Price Chart

Please Login or Subscribe to Access the Tetrahydrofuran Price Chart Data

The price trend was further pressured by the softening demand for its primary feedstocks, including butadiene, which did not encourage strong recovery. Toward mid-February, there was temporary support as inventory levels balanced out and some production units underwent maintenance. However, the recovery remained slow, and by March, a further downtrend in prices occurred as sellers continued to adjust rates to offload excess inventory. Overall, the THF market in Asia was weighed down by low demand and excess supply, with prices showing a steady decline throughout the quarter.

Europe

In Europe, the THF market showed signs of weakness in Q1’25. The market faced downward pressure from sluggish demand in end-use sectors such as coatings and solvents, which are the primary consumers of THF. While feedstocks like butadiene were reasonably stable, demand from key industries remained soft, and production levels were stable, contributing to an oversupply situation.

Although there were some price fluctuations in the early quarter, driven by efforts to stimulate purchasing at lower price points, any potential gains were short-lived. European buyers were cautious, focusing on long-term agreements rather than committing to spot deals. The lack of significant restocking kept prices under pressure, and by the end of the quarter, prices were on a gradual decline, mirroring broader economic sluggishness and weak downstream demand.

North America

The THF market in North America during Q1’25 experienced more stability compared to Asia and Europe, although it still faced some softness. Early in the quarter, the market saw support due to tighter availability from logistics disruptions and scheduled plant turnarounds. However, these disruptions were resolved by February, leading to improved supply, but demand remained muted.

Industries such as automotive and construction, key consumers of THF, showed limited activity, contributing to the stagnant market. By March, as downstream buying continued to be slow, prices softened, reflecting cautious sentiment among market players. The market remained steady throughout the quarter, with minor fluctuations driven mainly by supply-side adjustments rather than a surge in demand.

Analyst Insight

According to Procurement Resource, the THF market is expected to remain in a period of slow recovery. Price trends will depend on the performance of key downstream sectors and any disruptions in the supply chain, particularly regarding raw materials like butadiene.

Tetrahydrofuran Price Trend for Q4 of 2024

Asia

In Q4’24, the Tetrahydrofuran (THF) market in Asia experienced a decline in demand, primarily driven by reduced consumption from key markets like China, India, and Southeast Asia. The lower demand for spandex, a major downstream product of THF, contributed to this softening.

The region's oversupply conditions were exacerbated by increased local production, which outpaced consumption. Additionally, the Asian market faced challenges such as refinery outages in the Middle East and Southeast Asia, which affected THF imports. Despite the stable production of Butanediol (the key feedstock for THF), the cautious buying behaviour and a focus on inventory management led to a bearish sentiment in the market.

Europe

In Europe, THF prices remained relatively stable throughout Q4’24. A balanced supply-demand scenario, supported by steady domestic demand, helped maintain price levels despite external pressures. Butanediol prices remained on the softer end, which contributed to stable production costs for THF. However, the region faced a significant reduction in THF exports, particularly to Asian markets like China and Bangladesh, as these countries increased their domestic production, leading to lower demand for European exports. Furthermore, economic challenges in the Eurozone, including weak demand from the construction and coating sectors, limited the upward pressure on THF prices, keeping them relatively stable for the quarter.

North America

In North America, THF prices showed slight fluctuations during Q4’24, influenced by a combination of factors including domestic consumption, feedstock availability, and logistical challenges. The steady demand from end-use sectors like the polymer industry provided some support to the market. However, the tight supply conditions for key feedstocks like Butanediol created periodic constraints, leading to minor price volatility. Additionally, logistical disruptions, particularly in port operations, added to market uncertainty. Despite these factors, THF prices in the region remained relatively stable, as strong domestic production and demand from the automotive and electronics industries helped offset supply challenges.

Analyst Insight

According to Procurement Resource, the Tetrahydrofuran (THF) prices are expected to remain relatively stable, with minor fluctuations due to ongoing supply-demand dynamics and feedstock availability. Economic recovery in key regions may drive incremental demand growth, but oversupply and cautious buying behaviour could keep prices in check.

Tetrahydrofuran Price Trend for Q3 of 2024

Asia

The Asian market for tetrahydrofuran encountered significant pricing pressures in the said period. Domestic production costs remained low, particularly influenced by butanediol pricing.

The region experienced a demand slowdown in key industrial sectors, particularly textiles and spandex manufacturing. Seasonal factors, including rising temperatures and traditional market slowdowns, further complicated pricing strategies. Shipping market challenges added additional complexity to market dynamics.

Europe

European tetrahydrofuran markets demonstrated volatile pricing characteristics. Supply constraints emerged from maintenance turnarounds and reduced feedstock availability, driving initial price increases. However, an influx of cheaper imports from Asia and North America subsequently moderated pricing. The market faced challenges similar to global agricultural markets, with weak demand from construction and industrial sectors creating a challenging pricing environment.

North America

During the third quarter of 2024, the North American tetrahydrofuran market experienced a complex pricing environment mirroring broader agricultural and chemical market trends. Similar to the corn market's challenges, the sector faced significant demand constraints. Production was impacted by feedstock availability, with supply limitations creating intermittent market disruptions. Proactive measures by major chemical producers helped stabilize prices, though demand from downstream sectors remained moderate

Analyst Insight

According to Procurement Resource, Tetrahydrofuran market recovery will likely depend on global economic indicators, industrial demand revival, and strategic production adjustments. The market remains sensitive to geopolitical and economic shifts.

Tetrahydrofuran Price Trend for Q2 of 2024

Asia

Initially, the trajectory of the tetrahydrofuran price trend during the second quarter of 2024 was quite stable, with moderate levels of supply and demand of the commodity. However, the market could not sustain this initial momentum, and the price trend of tetrahydrofuran registered a slight decline by the end of the quarter. However, the commodity received ample support from the feedstock sector as the consistent rise in their cost was evident in the inclining cost of production. Meanwhile, the escalating shipping costs and container shortages also exerted a positive influence on the tetrahydrofuran market.

The fluctuations, however, were caused by the hesitation of the consumers and a reduction in the number of bulk orders that eventually led to the destabilization of the tetrahydrofuran market dynamics.

Europe

The European countries noted a slight uptick in the prices of tetrahydrofuran, primarily driven by the positive stance of its downstream industries. Similar to the Asian countries, the market witnessed a substantial incline in the production cost of the commodity and the influx of expensive imports due to elevated cost of shipping, longer lead times, and surge in global prices of butanediol, a key feedstock of the commodity. This positive momentum of the market was further supported by the constrained functioning of the supply chains and struggling trading sector, which limited the availability of the commodity in the market, pushing its prices upwards.

North America

The tetrahydrofuran market in North America mirrored the trend observed in the European countries, and even the driving factors were similar. As the European markets, the region also witnessed the expansion of the procurement rates of tetrahydrofuran by the end-user industries. Meanwhile, the domestic production and influx of overseas imports into the region remained limited throughout the second quarter, widening the supply-demand gap of the market and pushing the prices of tetrahydrofuran in the northward direction. The manufacturers and traders were further compelled to increase their quotations due to the significant surge in production costs based on feedstock butanediol, naphtha, and crude oil.

Analyst Insight

According to Procurement Resource, the price of Tetrahydrofuran is estimated to move northwards globally under the influence of escalating prices of raw materials and shipping delays which in turn are affected by the rising geopolitical tensions.

Tetrahydrofuran Price Trend for Q1 of 2024

| Product | Category | Region | Price | Time Period |

| Tetrahydrofuran | Chemicals | USA | 2225 USD/MT | March 2024 |

| Tetrahydrofuran | Chemicals | Europe | 2283 USD/MT | March 2024 |

Stay updated with the latest Tetrahydrofuran prices, historical data, and tailored regional analysis

Asia

In the first quarter of 2024, China's tetrahydrofuran market faced a gradual decline in its pricing patterns due to weakened demand from key downstream sectors like furniture and construction. High inventory levels from increased 2023 production contributed to the price drop as producers aimed to clear surplus stocks. Government interventions to curb price hikes also affected the tetrahydrofuran demand indirectly.

Despite stable butane prices, regional variations occurred, with Eastern China seeing a slight dip in prices due to higher inventory levels, while Western and Central China remained stable to slightly higher. This decline benefited users in sectors like furniture and resin production but likely impacted tetrahydrofuran producers' profitability. However, as the quarter progressed towards its termination, the price trends in China began to oscillate, influenced by global economic recovery, feedstock costs, demand trends, and inventory management strategies.

Europe

Tetrahydrofuran serves as a crucial intermediate chemical in the European chemical sector. While China dominates production, Europe also plays a significant role in regulating the supply chains of tetrahydrofuran in the global market. It is used in various industries, including coatings, paints, and lubricating oil additives, which are the main drivers of the tetrahydrofuran market. However, despite its importance, the market registered a notable stagnancy despite the significant uptick in the economic indicators of the market.

The largest downstream market for tetrahydrofuran, which is vital in the automotive, construction, and infrastructure sectors globally, also remained under the red zone. The sales figures of unsaturated polymers also remained skeptical and raised the concerns of the trading community throughout the first quarter of 2024.

North America

In contrast to European countries, tetrahydrofuran prices in North America surged in the first quarter due to a combination of factors. Warmer weather conditions since January stimulated economic activity, contributing to increased demand for tetrahydrofuran. Additionally, disruptions in shipping routes, particularly in the Red Sea region, led to elevated shipping costs and delays in delivery times.

As a major importer heavily reliant on China as a prominent exporter, the United States faced supply chain disruptions and increased freight charges, further driving up tetrahydrofuran prices. These price fluctuations highlight the volatility and interconnectedness of global markets, influenced by economic, geopolitical, and environmental factors. Industry players also adapted well to the changing dynamics of the trading sector and effectively navigated through the changing landscape of the market.

Analyst Insight

According to Procurement Resource, the price trend of Tetrahydrofuran is expected to be driven by the rising number of sales in the downstream industries and the positive outlook of the feedstock industries.

Tetrahydrofuran Price Trend for the October - December of 2023

Asia

Tetrahydrofuran market performance in the Asian region was witnessed to be below average during the last quarter of the year 2023. THF market observed a very tepid procurement curve during this time span. Since the impending holiday season called for a decline in industrial activities, the market prices for tetrahydrofuran also started falling down, and whatever demands the consuming industries posed for tetrahydrofuran could easily be taken care of by the existing inventory stocks.

A significant depreciation in the crude oil prices around this time also didn’t help the tetrahydrofuran market sentiments much. Overall, downward fluctuating price trend were witnessed for tetrahydrofuran during the fourth quarter.

Europe

The European market trend for tetrahydrofuran closely mimicked the Asian trend as the prices here, too, kept oscillating towards the lower end of the curve. The supply chain and freight issues caused by the commencement of the Israel-Hams war kept the suppliers at their tows. Market uncertainties amidst these geopolitical and geoeconomic tensions kept the sentiments gloomy. This downturn in international trade impacted the tetrahydrofuran demand outlook very negatively and burdened the supply chains. The general market outlook for tetrahydrofuran was observed to be weak during Q4’23.

North America

The North American tetrahydrofuran market also followed along with its Asian and European counterparts as the THF prices witnessed swift declines during the last three months of 2023. Along with the overflowing domestic inventories, the holiday season further affected the downstream demand, leading to a fall in tetrahydrofuran consumption and, thus, the prices.

Analyst Insight

According to Procurement Resource, Tetrahydrofuran price trend are not likely to improve immediately since the inventory levels are high, and the market sentiment will take some time to rebound.

Tetrahydrofuran Price Trend for the July - September of 2023

Asia

The prime factor that drove the trajectory of tetrahydrofuran price trend in an upward direction was the rising cost of production. This increase in the production cost was supported by the forward movement of prices of raw materials and crude oil. The crude oil sector saw exponential growth as the majority of the crude oil and energy-producing nations followed the sanctions imposed by OPEC+ regarding exports. Additionally, the manufacturing rates of tetrahydrofuran were only mild as compared to the demand from the end-user sector, disbalancing the supply-demand equilibria and leading to the northward movement of the tetrahydrofuran price graph.

Europe

The improvement in industrial activities only extended a little support to the tetrahydrofuran market. With a gradual positive movement in the raw material industries, the tetrahydrofuran price trend in the third quarter were able to gain some stability. However, the growth of the market was stunted by severe economic challenges presented by the slowing down of financial growth and a consistent rise in inflationary pressure on the manufacturing and trading sectors. Due to these similar factors, the rates of procurement from the end user industries were also feeble and unable to provide the tetrahydrofuran price trend its required support.

North America

In North America, during the third quarter of 2023, the lukewarm demand from the downstream industries proved to be an obstacle for the tetrahydrofuran prices. On the other hand, other factors, such as a rise in the cost of feedstock chemicals, inclination in upstream industries, and a significant hike in the cost of natural gas, all seemed to support the rise in the tetrahydrofuran price trend. The trading sector of North America also worked efficiently towards the smooth functioning of the supply chains, but an imbalance in the demand caused the tetrahydrofuran price trend to fluctuate.

Analyst Insight

According to Procurement Resource, the price trend of Tetrahydrofuran are expected to oscillate in the upcoming months as the equilibrium of supply and demand will struggle to find a common ground.

Tetrahydrofuran Price Trend for the Fisrt Half of 2023

Asia

Tetrahydrofuran prices experienced mixed market behavior during the first half of the year 2023. The post-lockdown recovery was slow in the Chinese market; still, the price trend moved positively during the first half of the first quarter as the consumption sectors offered some demands.

However, the demands again got humble in the downstream polyurethanes, PVC, and other polymer industries as the end consumer purchasing capabilities were compromised by rising global inflation.

As the second quarter arrived, this also affected the reopening of plants and further pushed the market offtakes down. The tetrahydrofuran market experienced price depreciation in the second quarter with a dull market outlook.

Europe

In the European Tetrahydrofuran market, a faltering production cost caused the price to slide in the first quarter. Since the US released oil stocks from its strategic reserves, the crude oil price started normalizing in the European region as well. This released some of the market pressure caused by the Russia and Ukraine war.

Demands were also feeble, so both upstream and downstream situations pushed the Tetrahydrofuran market sentiments down. It was in the latter half of the second quarter the prices inclined marginally owing to the constricted supplies.

North America

In accordance with the global Tetrahydrofuran market outlook, the prices remained on a sliding journey in North American markets as well during the said period. High inflation in the domestic market because of rising interest rates limited the demand, which caused the prices to totter at the lower end.

Analyst Insight

According to Procurement Resource, after long fluctuations, the Tetrahydrofuran market is likely to strive for some stability in the coming months.

Tetrahydrofuran Price Trend For the Q2, Q3 and Q4 of 2022

Asia

Tetrahydrofuran, or THF, is commercially produced from butanediol and is primarily utilized in the chemical industry as a potent solvent and precursor of polymers. So, the price trend also depend on downstream demands from the chemical industry and the availability and prices of feedstock butanediol. During the said three quarters of 2022, the Tetrahydrofuran market outlook was mostly negative in the Asian region.

At the beginning of Q2, China had just come out of a long and stressful lockdown. Both production and purchasing capacities were constricted during that time. So, with insignificant exchanges in the biggest export market, the prices remained sluggish. The market recovery in the later months was also very slow and centered around the necessary commodities. Overall, a dull market sentiment was observed.

Europe

The war between Russia and Ukraine immediately changed the general market outlook for the entire European region. In the second quarter, a steep and sudden rise in prices was observed since the skyrocketing inflation pushed the production costs through the roof. However, the later months saw a sluggish market trend attributed to the demand depreciation amidst unsustainable operational costs.

North America

Exhibiting a mixed market behavior, the Tetrahydrofuran prices first consistently till the beginning of the final quarter of the year, primarily because of a rise in crude oil costs. Even with regular demands, the prices continued moving steadily and positively.

It was in the latter half of the fourth quarter that the prices shifted momentum and started decreasing since the demand outlook turned negative. These trend continued for the rest of the said period in a wavering manner.

Analyst Insight

According to Procurement Resource, projections do not look very positive for Tetrahydrofuran in the coming months. With fluctuations in demand dynamics, a mixed market outlook is expected.

Tetrahydrofuran Price Trend For the Q1 of 2022

Asia

Tetrahydrofuran (THF)prices in India surged during the first quarter of 2022. Following the outbreak of COVID-19 and the subsequent interruption of China's supply chains, the Indian pharmaceutical sector became increasingly reliant on Chinese imports.

Tetrahydrofuran offers ex-depot Chennai were reported at 8641 USD/MT in the Indian market in March. Additionally, as a result of widespread energy worries, China's output curtailed, and the APAC region's availability of several pharmaceutical feedstocks and solvents dropped.

Europe

Domestic tetrahydrofuran prices in the European region returned to a reasonable level in Q1 2022, following a significant increase. THF demand from pharmaceuticals, an important downstream market, remained largely stable, despite rising demand for other essential solvents. Due to geopolitical tensions, the Russia-Ukraine war put upward pressure on upstream values, resulting in a regional demand-supply mismatch for a number of commodities.

Maleic Anhydride and Butanediol costs also decreased to a certain point, and the price differential between raw materials and Tetrahydrofuran (THF) was reported to be significant owing to the supply and demand mismatch. CFR bids were so offered at 5160 USD/MT for the March 2022 quarter.

North America

Tetrahydrofuran prices increased by 3% in the first quarter of 2022, from 4180 USD/MT in February to 4180 USD/MT in March. The pricing rise in February was due to a shortage of products in the nation and increased demand from the pharmaceutical business. In the United States, THF's growing pricing trend was backed by a fragmented supply chain and high freight expenses.

Tetrahydrofuran Price Trend For the Fourth Quarter of 2021

Asia

Tetrahydrofuran prices increased in the final quarter of 2021, as numerous pharmaceutical businesses in India complained about a lack of THF solvents owing to China's October production cut. During the fourth quarter, upstream 1,4-butanediol (BDO) prices increased.

Additionally, as a result of China's dual control strategy in response to energy-related concerns, India's availability of certain pharmaceutical feedstocks and solvents has diminished. Tetrahydrofuran prices climbed as a result, eventually stabilizing at around 571940 INR/MT Ex-Depot Chennai in December.

Europe

Tetrahydrofuran prices in Europe increased significantly in Q4 2021, in line with global market dynamics. Due to a serious supply shortfall, European manufacturers of upstream BDO producers have been inundated with queries from Asia.

Due to persistent demand and scarcity of supplies, major manufacturers such as Ashland increased THF pricing in Europe in November. Demand from downstream producers of Polybutylene Terephthalate (PBT) was robust throughout the quarter.

North America

Tetrahydrofuran prices increased in the North American market during the fourth quarter, owing to increased demand from downstream sectors. Additionally, storm Ida struck the Gulf Coast of the United States, forcing the closure of numerous industrial plants due to power outages in the area, which impacted Q4 as well. Due to interruptions in logistics as a result of the climatic calamity, supply restrictions resulted in a rise in upstream Butanediol costs in the region this quarter.

Tetrahydrofuran Price Trend For First, Second and Third Quarters of 2021

Asia

In Asia, strong demand from a variety of downstream sectors combined with constrained supply pushed Tetrahydrofuran prices higher in Q1 2021. Congestion on the Europe-Asia route resulted in a scarcity of both BDO and THF. Tetrahydrofuran prices in India increased from 2436.2 USD/MT in January to 2597.4 USD/MT in March, owing to worldwide inflation in petrochemical pricing. The Asian market for THF was constant to robust throughout second quarter, despite reduced supply.

In May, India saw a sharp increase in costs, owing to delayed imports and crippled supply activity caused by the country's continuing epidemic. Tetrahydrofuran prices in India hovered around 5381 USD/MT in May.

In Asia's third quarter of 2021, the general market prognosis indicated an increasing trend. In India, rising freight costs combined with constant to robust local demand resulted in a considerable increase in THF pricing. A considerable increase in prices was noticed from July to September, when they increased from 4996 USD/MT to 5810 USD/MT Ex-Depot Chennai.

Europe

LyondellBasell's upstream PO manufacturing facility in Rotterdam was forced to shut down owing to technical difficulties, affecting THF production throughout the area and consequently increasing its pricing. BASF was heard favorably boosting the prices of BDO and THF in both January and March in Europe.

Demand from downstream sectors, along with a severe lack of feedstock chemicals, drove up prices across Europe in Q2 2021. Feedstock BDO prices have risen dramatically internationally as a result of a significant scarcity caused by reduced production activity. Prices increased across the European region during the third quarter. Imports from Asian nations decreased significantly as a result of a variety of causes, including rising logistical costs, restricted vessel capacity, and price hikes in Asia.

North America

THF availability in North America remained constrained in Q1 2021 because of regional feedstock BDO scarcities. The price of BDO and THF rose by 330 USD/MT and 440.5 USD/MT, respectively, effective 1st April 2021. Some producers expressed concern that government involvement might significantly constrain US THF supply in the future quarters.

Tetrahydrofuran prices increased significantly in the North America area in the second quarter, owing to a major scarcity of feedstock chemicals. Prolonged disruptions in production across the United States resulted in a dramatic increase in the price of BDO. Tetrahydrofuran prices in North America increased by 550 USD/MT in May.

Throughout the third quarter of 2021, prices increased across the North American area. During the quarter, robust demand from the downstream pharmaceutical sector continued to provide excellent profits for producers.

Tetrahydrofuran Price Trend For the Year 2020

Asia

In India, construction workers were kept away from job sites, which caused a pause on approximately 20,000 active projects in the country. Berger Paints, India's second-largest paint manufacturer, reported a 6.5 percent reduction in consolidated net profit for the fourth quarter ended March 31 to INR 1,032 million (USD13.76 million).

Due to the pandemic, the petrochemical industry was also negatively impacted and thus impacted the polymer industry. Owing to all these considerations, the tetrahydrofuran market was significantly influenced by COVID-19.

North America

The supply of BDO and derivatives in the United States was critically low, owing to production restrictions in the critical automobile industry, among other concerns. According to various market sources, the US supply of BDO derivative polytetramethylene ether glycol (PTMEG) was low, with an unplanned government order taking priority over contract clients.

The BDO derivative tetrahydrofuran, a precursor to PTMEG, was also subject to a separate government contract, further constraining supplies. THF was the primary market for BDO, accounting for more than 40% of US BDO output in 2020.

Procurement Resource provides latest prices of Tetrahydrofuran. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Tetrahydrofuran

At room temperature, Tetrahydrofuran (THF), commonly known as Oxolane, is a clear liquid chemical molecule. THF is a polar solvent with a low viscosity that may be combined with water. This substance is classed as heterocyclic chemical, specifically a cyclic ether. It is generally utilized as a precursor to polymers. Being polar and possessing a wide liquid range, THF is a useful solvent.

Tetrahydrofuran Product Details

| Report Features | Details |

| Product Name | Tetrahydrofuran |

| Industrial Uses | PTMEG, Spandex, Other polyurethanes, PVC, other solvents |

| Chemical Formula | C4H8O |

| Synonyms | Oxolane, 1,4-Epoxybutane, 1-Oxacyclopentane, Tetrahydrofuran, THF, 1,4-Butylene oxide, Cyclotetramethylene oxide fraction, Furanidin, Tetra-methylene oxide |

| Molecular Weight | 72.11 g/mol |

| Supplier Database | Ashland, BASF SE, CDC, Mitsubishi Chemical Corporation, Banner Chemicals Limited |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Tetrahydrofuran Production Processes

- Tetrahydrofuran Production from Butanediol

A dehydration technique is used to produce tetrahydrofuran (THF) from butanediol (BDO). The dehydration of 1,4-butanediol in the presence of a zirconium sulphate catalyst produces tetrahydrofuran in a straightforward and low-risk process.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com