Product

Thermo Mechanically Treated Bar (TMT Bar) Price Trend and Forecast

Thermo Mechanically Treated Bar (TMT Bar) Price Trend and Forecast

TMT Bar Regional Price Overview

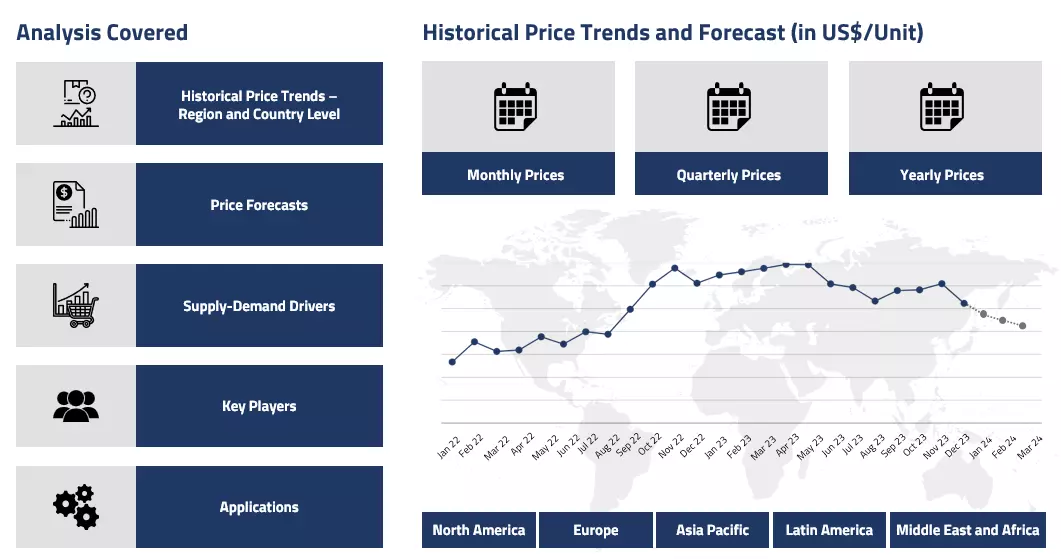

Get the latest insights on price movement and trend analysis of Thermo Mechanically Treated Bars (TMT Bars) in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

TMT Bar Price Trend for Q2 of 2025

In the second quarter of 2025, TMT bar prices showed signs of stabilization after a prolonged period of decline observed in late 2024. The quarter started with cautious market sentiment, as exporters faced pressure from subdued international demand and increased competition from alternative suppliers. High inventory levels in importing countries and delayed project timelines initially kept transaction volumes low.

Thermo Mechanically Treated Bars Price Chart

Please Login or Subscribe to Access the Thermo Mechanically Treated Bars Price Chart Data

As the quarter progressed, prices began to firm slightly, supported by a seasonal rise in construction activity and the rollout of infrastructure projects across key regions, especially in Asia and Africa. Exporters benefited from steady raw material costs, including iron ore and coal, which provided a more predictable pricing environment. While global economic uncertainty continued to weigh on sentiment, the impact was softened by consistent procurement from markets with ongoing urban development needs.

Currency movements remained relatively stable, helping maintain competitiveness in key export destinations. Meanwhile, demand in developed markets like Europe stayed weak due to broader economic slowdown and policy-related uncertainties, but emerging markets showed more resilience. This divergence allowed Indian exporters to find opportunities despite global headwinds.

Analyst Insight

According to Procurement Resource, TMT bar prices are likely to stay steady or increase gradually, supported by infrastructure-driven demand and stable input costs.

TMT Bar Price Trend for Q1 of 2025

Asia

In the first quarter of 2025, TMT bar prices in Asia showed mixed movement. Early in the quarter, there was some positive sentiment due to China's economic stimulus announced at the end of 2024. However, the boost was short-lived. Demand in the construction sector remained weak, especially in China, where the real estate market continued to struggle. Despite efforts to reduce production, Chinese mills still pushed exports aggressively, keeping pressure on regional prices.

In India, local producers continued to face stiff competition from imported steel, which limited their ability to raise prices. Raw material costs, particularly iron ore and coking coal, showed ups and downs, which added uncertainty for TMT pricing. Although a few mills cut output to balance supply, the overall effect on prices was limited due to ongoing oversupply and slow demand recovery.

Europe

European TMT bar prices improved steadily throughout Q1’25. The turnaround began as mills started to increase flat steel prices, and TMT bars followed a similar trend. A recovering automotive sector, though not directly tied to TMT demand, helped improve sentiment across the steel market. Additionally, reduced production from winter cutbacks tightened supply, allowing prices to rise more easily.

The new carbon border tax mechanism made non-EU imports more expensive, pushing buyers to source locally, which supported domestic pricing. Service centres also restocked in anticipation of further increases, helping to create consistent upward pressure during the quarter. Overall, the European TMT market moved away from the lows seen in late 2024 and entered a more optimistic phase.

North America

North America saw sharp volatility in TMT bar prices in Q1’25. The key driver was the implementation of new tariffs on all steel imports in March, which triggered a wave of price hikes across the market. Buyers rushed to place orders before the tariffs took effect, causing a temporary surge in demand. Mills took advantage of the situation by raising prices and tightening availability. This led to longer delivery times and some buyers being placed on allocation. The construction sector, a major consumer of TMT bars, faced cost pressures as prices rose rapidly. Overall, Q1 was marked by uncertainty and fast-changing conditions.

Analyst Insight

According to Procurement Resource, TMT bar prices may remain unstable in the coming months as global trade policies, supply adjustments, and demand recovery continue to shape the market.

TMT Bar Price Trend for the Second Half of 2024

Asia

In the second half of 2024, TMT bar prices in Asia faced considerable downward pressure. The primary reason was weak demand from construction and infrastructure sectors, especially in China and India. In China, sluggish real estate activity and subdued manufacturing slowed steel consumption, while production remained high. This led to excess supply, prompting Chinese mills to export aggressively at lower rates.

India also saw prices fall due to reduced domestic demand and a significant rise in cheaper steel imports, which flooded the market and undercut local producers. Lower raw material costs, like iron ore and coking coal, helped steelmakers maintain profitability even as prices declined. Some positive sentiment returned towards the end of the year after China introduced economic stimulus measures, but it was not strong enough to reverse the broader downward trend.

Europe

In Europe, TMT bar prices were volatile but showed some signs of recovery after hitting their lowest in late summer. Weak construction demand and high inflation had weighed down the market earlier in the half. However, starting October, producers attempted to raise prices, driven by rising raw material costs and slightly improved sentiment following China’s stimulus.

Some buying activity picked up at the distributor level, especially for small quantities. Still, overall demand from key sectors like housing and infrastructure remained soft. Uncertainty due to ongoing trade issues with the US and a sluggish economic environment in Germany also limited the price recovery. While prices did edge upward towards the end, the market stayed cautious.

North America

TMT bar prices in North America began to stabilize in H2’24 after a sharp drop earlier in the year. Domestic demand from construction was moderate, with stable infrastructure spending helping support the market. Supply remained consistent, but overall sentiment was shaken by political developments, especially with new tariff plans announced by the incoming US administration.

The threat of higher tariffs on imported steel from Mexico, Canada, and China created uncertainty, which led to delayed purchases and muted market activity. Despite these challenges, prices did not fall significantly further and seemed to find a floor as the year ended.

Analyst Insight

According to Procurement Resource, TMT bar prices may stabilize in the coming months as stimulus efforts, rising raw material costs, and trade policies start influencing global supply and demand dynamics.

Thermo Mechanically Treated Bar (TMT Bar) Price Trend for the First Half of 2024

Asia

During the first half of 2024, the price trend of TMT bars in China was marked by significant volatility, primarily driven by weak demand in the real estate and infrastructure sectors. The ongoing financial struggles of local governments led to delays and cancellations of numerous infrastructure projects, reducing demand for steel bars. As a result, prices faced substantial downward pressure, with producers experiencing shrinking profit margins and, in some cases, losses. In response, steel bar producers urged authorities to implement measures to restrict output and stabilize prices.

Some producers in Shanxi province reduced furnace capacity, temporarily halting production to curb the supply and support prices. Despite these efforts, the overall market sentiment remained bearish due to the persistent challenges in the downstream construction sectors. The futures market also played a role, with speculation further exacerbating price fluctuations, prompting calls for tighter supervision. Overall, the TMT bar market in China experienced a challenging first half of the year, reflecting broader economic difficulties and sector-specific challenges.

Europe

In the early months of the year, the price trend of the TMT bar acquired some momentum as the demand from the downstream industries improved gradually. As a result, the traders and manufacturers of the commodity increased their production volumes in order to match the prospects of growing procurement rates. However, as the month progressed, the demand from the downstream increased and declined, registering a significant decline in April and a frail recovery in the rest of the months. The major cause of this slowdown was the setback received from the automotive industries as compared to the previous year, leading to the southward trail of TMT bar prices.

North America

The fluctuations in the TMT bar market witnessed in the European and Asian countries were seen in the North American market as well. Similar to these regions, initially, the demand from the downstream industries remained on the positive side, raising optimism among the market players. However, as the global trading tensions accelerated, the consumers of the commodity opted for a cautious stance and halted any bulk purchases. Further, in the first quarter, the low water levels in the Panama Canal and the collapse of the Baltimore Bridge in the second quarter lowered the overall export statists of the TMT bar, visible in the lower-end oscillation of its prices.

Analyst Insight

According to Procurement Resource, the price of Thermo Mechanically Treated Bar is estimated to be driven by the global automotive industries; however, it might be hampered by weak global trading activities.

Thermo mechanically treated bar (TMT Bar) Price Trend for the Second Half of 2023

Asia

In the last two quarters of 2023, thermo mechanically treated bar (TMT Bar) prices in the Asian region primarily varied at the lower end of the spectra. Monthly price declines of an average of one to three percent were observed in India for steel up until the conclusion of the December quarter.

Building on the decline in steel prices from the previous quarter, the Indian market's thermo mechanically treated bar (TMT Bar) price index saw further declines in figures based on the subdued construction and automotive sales. However, in the Chinese thermo mechanically treated bar (TMT Bar) market, price patterns began to decline in October 2023 only and were able to maintain stability in the previous months. But in the last quarter, the consumers adopted a wait-and-see approach, which hampered the movement of the thermo mechanically treated bar (TMT Bar) price trend.

Europe

During the last quarter of 2023, price patterns in the European thermo mechanically treated bar (TMT Bar) market was seen to be continuously declining. The traders anticipated that a decline in production activities might help in stabilizing the declining prices of thermo mechanically treated bar (TMT Bar), but the demand for the product fell by unexpected margins, and even with lowered rates of production, the thermo mechanically treated bar (TMT Bar) price trend failed to gain any momentum resulting in the downfall of the price trend.

North America

During the specified time, there were mixed trends observed in the US thermo mechanically treated bar (TMT Bar) market. Due to initial supply shortages in the market, prices were high, but the incline was limited to the third quarter only.

In the latter months, it was noticed that stockpiles were increasing exponentially, which led to a decline in pricing as the traders started practicing destocking activities by offering huge discounts on bulk purchases, but this did not show any relief in the downfall of the thermo mechanically treated bar (TMT Bar) price trend.

Analyst Insight

According to Procurement Resource, the price trend of Thermo mechanically treated bar (TMT Bar) is expected to follow a zig-zag movement around a mean value in the upcoming quarters as the bleak interest of the automotive and construction industries is expected to stabilize.

Thermo Mechanically Treated Bars (TMT Bars) Price Trend for First Half of 2023

Asia

The prices of thermo mechanically treated bars (TMT Bars) increased in the first quarter of 2023 with support from the construction and raw materials sector. The domestic market of thermo mechanically treated bars (TMT Bars) in China witnessed a positive market momentum after a long period of COVID restrictions and New Year holidays.

In the initial months of the second quarter, the prices remained in the positive zone, but soon, the activities of the construction industry began to decline. In addition to this, the overseas industries also reduced their interest in the Asian thermo mechanically treated bars (TMT Bars) markets, hampering the growth of thermo mechanically treated bars (TMT Bars) prices.

Europe

In European countries, the prices of thermo mechanically treated bars (TMT Bars) surged in the first quarter of 2023 due to high procurement from the construction sector, especially in the domestic sectors. The second quarter of 2023 was much more volatile than the first one, as the market trend of thermo mechanically treated bars (TMT Bars) fluctuated throughout the quarter.

The most significant influencing factor was the negative impact of the labor crisis and the plunging economic condition of the European countries. The labor strikes led to a halt in construction activities, and with high uncertainties in the market, many consumers remained hesitant to place large orders, thus pushing the prices of thermo mechanically treated bars (TMT Bars) toward a negative trajectory.

North America

The incline in prices of thermo mechanically treated bars (TMT Bars) in the first quarter caused by the revival of the construction sector was adversely affected by the sliding economic conditions, debt crises, and low interest of consumers in the second quarter of 2023. The weak movement of the construction industries, slowing down of infrastructural activities, rising bank interest rates, and increasing stockpiles of thermo mechanically treated bars (TMT Bars) in the region combined affected the TMT Bars price trend.

Analyst Insight

According to Procurement Resource, the price trend of Thermo Mechanically Treated Bars (TMT Bars) is expected to decline majorly due to weak economic conditions and declining demand from the end-user sector.

Procurement Resource provides latest prices of Thermo Mechanically Treated Bars (TMT Bars). Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About TMT Bar

Thermo mechanically treated bars (TMT Bars) are manufactured via a specialized process that involves subjecting them to thermal and mechanical treatments. The steel bars are first heated at elevated temperatures and then cooled. This gives the bar increased strength, high ductility, and resistance to corrosion. They are known to have a thick exterior and a soft internal material. In addition to this, they also have the ability to provide strength to the concrete and thus help in enduring the durability of buildings, bridges and other structures.

TMT Bar Product Details

| Report Features | Details |

| Product Name | Thermo Mechanically Treated Bars (TMT Bars) |

| Industrial Uses | Construction, Automotive industry, Heavy machinery |

| HS Code | 72141090 |

| Supplier Database | ArcelorMittal Zenica, Balkan Steel Engineering Ltd, Essar Steel, HBIS Group, SIDERAL S.H.P.K., TATA Steel, ATLAS TMT Bars Pvt Ltd, Jindal Steel & Power Ltd |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com