Product

Toluenediamine Price Trend and Forecast

Toluenediamine Price Trend and Forecast

Toluenediamine Regional Price Overview

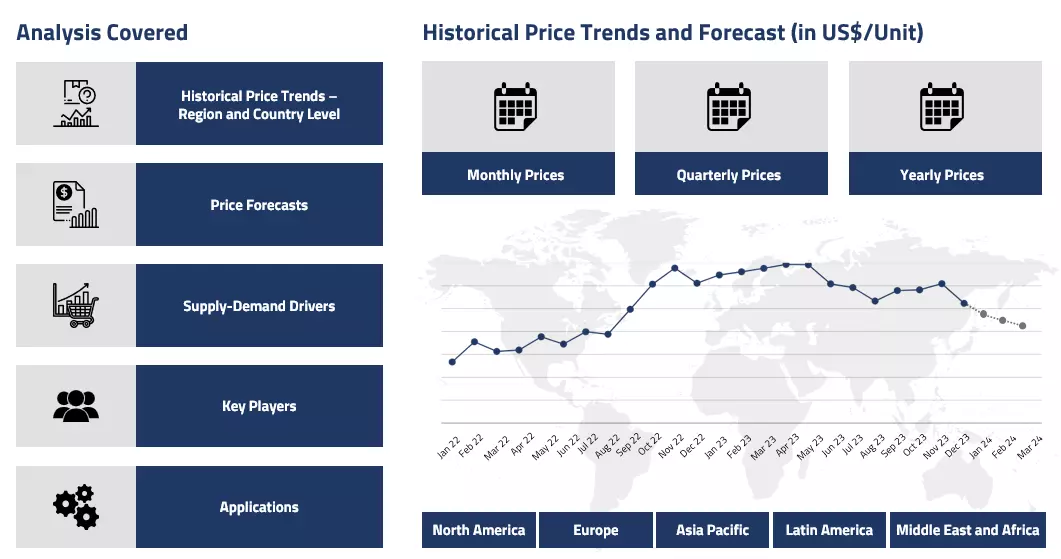

Get the latest insights on price movement and trend analysis of Toluenediamine in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Toluenediamine (TDA) Price Trend for Q1 of 2025

Asia

In Q1’25, the Asian Toluenediamine (TDA) market experienced mixed price trends driven by regional production dynamics. China's strengthened domestic production capabilities, following CNOOC's Daxie expansion, created downward pressure on TDA prices across the region. Chinese producers, particularly those affiliated with Sinopec, strategically adjusted their TDA pricing to maintain market share while balancing production costs.

Toluenediamine Price Chart

Please Login or Subscribe to Access the Toluenediamine Price Chart Data

The increased self-sufficiency in toluene production directly impacted TDA manufacturing costs, allowing Chinese producers to offer more competitive pricing. Other Asian markets struggled with weak demand from the polyurethane sector, which remained a key consumption driver for TDA. By March, the market had achieved some stability, though at lower price levels compared to Q4 2024, as manufacturers navigated between serving domestic needs and pursuing export opportunities.

Europe

European TDA prices in Q1’25 followed a volatile path, beginning with an upward trajectory in January driven by tight supplies and increasing feedstock costs. February saw prices peak as crude oil costs rose and competition intensified from Chinese imports. The proposed EU industrial strategy aimed at reducing energy costs provided some optimism for regional TDA producers who had been operating under significant cost pressures.

Major chemical companies like BASF restructured their operations during this period, impacting the overall supply-demand balance for TDA and related products. The quarter ended with prices stabilizing but remaining elevated compared to Q4’24 levels, supported by increased intra-regional trade that partially alleviated supply constraints. European producers maintained cautious production rates given the persistent uncertainty in downstream polyurethane and construction markets.

North America

The North American TDA market navigated a challenging first quarter in 2025. The market began slowly, with limited trading activity around the Presidential Day holiday in February reflecting seasonal patterns. As the quarter progressed, significant maintenance activities across key production facilities temporarily constrained TDA supply, providing some support to prices despite modest demand.

The ongoing impact of Trump's presidency and associated tariff policies affected chemical supply chains, creating cost pressures for TDA producers reliant on imported feedstocks. By March, the market had reached a relative equilibrium, with prices stabilizing as supply constraints eased. Demand from the construction sector showed early signs of improvement, though not enough to drive significant price increases.

Analyst Insight

According to Procurement Resource, TDA prices are likely to rally strong in the coming months. While regional price disparities will likely persist, recovery in construction and automotive sectors coupled with stabilizing energy costs may provide more balanced market conditions in the coming months.

Toluenediamine (TDA) Price Trend for the Year 2024

Asian

The Asian region witnessed a volatile year for TDA pricing in 2024. The first quarter showed promising upward momentum, particularly in India, driven by strong demand from agrochemicals and pharmaceuticals sectors. However, this positive trend was short-lived as oversupply issues emerged by Q2, pushing prices downward. South Korean TDA prices were particularly affected by maintenance at GS Caltex and fluctuating feedstock costs.

In China, reduced demand from end-use industries such as polyurethane manufacturing created further downward pressure. The second half of 2024 saw continued price erosion across the region, exacerbated by logistical challenges including port congestion and container repositioning issues. By Q4, the market had stabilized at lower levels with sufficient stockpiles meeting the subdued demand.

Europe

European TDA prices in 2024 demonstrated consistent decline throughout the year. Beginning with a downward trend in Q1 due to reduced fertilizer sector demand and farmer protests across the region, the negative price environment persisted into Q2 with an oversupply situation. The construction sector, particularly housing, struggled throughout the year, weakening demand for TDA in paints and coatings applications.

Rising interest rates and inflation further constrained purchasing power. By Q3, the European construction sector had fallen into a deep slump, accelerating TDA price drops. The final quarter of 2024 continued this bearish trend, with high inventories and balanced but underwhelming demand from industries such as polyurethane and other aromatics. Geopolitical uncertainties and fluctuating crude oil prices exerted additional pressure on prices.

North America

In North America, Toluenediamine (TDA) prices followed a downward trajectory throughout 2024. The first quarter started with moderate pricing, but as the year progressed, prices steadily declined due to weakening demand from the polyurethane sector. This trend was heavily influenced by the bearish performance of its feedstock toluene, which experienced significant price drops throughout the year.

Supply chain disruptions, including the Longshoremen's Association strike in Q4, further complicated market dynamics. Despite some growth in the construction industry, the broader economic slowdown dampened TDA demand, particularly in the latter half of 2024. Manufacturers responded by reducing production rates, but this was insufficient to offset the oversupply situation that persisted through year-end.

Analyst Insight

According to Procurement Resource, the TDA market anticipates continued price pressure in early 2025, with potential stabilization by mid-year contingent on economic recovery and downstream demand improvement.

Toluenediamine Price Trend for the Second Half of 2023

Toluenediamine prices usually vary along with the variation in the prices of its feedstock toluene prices. During the said period of H2’23 the prices were observed to be mimicking the variations in the toluene market. In the Asian markets, particularly India and China, the Toluenediamine prices fluctuated within very closed limits.

Toluenediamine serves as a crucial component in the production of polyurethane, and epoxy resins and also plays a critical role in rubber vulcanization processes. Thus the demands and consumptions from these industries also determine the price performance in the concerned markets. In the Asian markets, the third quarter was still somewhat positive for the price trajectory, albeit the fourth quarter saw notable declines.

Major festival holidays in India limited the industrial activity in the region which pushed the demands down slightly. The inventories had also become capable of catering to whatever demands consumers offered. Thus, the toluenediamine prices varied within a limited range during the second half of 2023.

Analyst Insight

According to Procurement Resource, after the eruption of the Israel and Hamas conflict, the market situation, particularly for petrochemicals, is a bit complicated. The prices for toluenediamine are expected to rise going forward.

Toluenediamine Price Trend for the First Half of 2023

Toluenediamine prices closely mimic the price trend of its feedstock toluene. During the first half of the year 2023, the Toluenediamine market experienced mixed price sentiments. With consistent demands from the downstream color and pigment sectors, the prices first rose in the first quarter.

However, an oversupply of products started dominating in the second quarter. The upstream costs also tumbled with a fall in crude oil and energy prices. Ease in offshore product movement restrictions with restored supply chains also influenced the falling price trend. The struggling construction sector pushed down the demands from the paint, coating, and adhesive industries. Overall, mixed market sentiments were observed.

Analyst Insight

According to Procurement Resource, the Toluenediamine price trend are likely to continue fluctuating in a similar manner in the upcoming months as well.

Toluenediamine Price Trend for the Second Half of 2022

Asia

In the Asian Pacific region, the prices of Toluenediamine fluctuated due to the sea-saw trend followed by the prices of feedstock toluene. The decline in the prices during the initial months of the third quarter was due to the dwindling operational costs and extreme weather conditions in the region.

The effects of the depreciating value of the currency and the slow economic growth further aided this price drop. In the fourth quarter, the crude oil prices were unstable along with the downstream demands from industries such as paints, coatings, etc., resulting in sluggish price trend for Toluenediamine.

Europe

A declining trend in the prices of Toluenediamine was persistent throughout the third and fourth quarters in the European region. The prices declined majorly due to rising inflation and weak demand from the end-user industries. The prices were also affected by the rise in inventory levels along with the falling crude oil prices. Due to the above-mentioned factors, consumer confidence in the market remained weak and the prices of Toluenediamine followed a downward trajectory.

North America

The prices fluctuated during the said period as the decreased demand from the downstream industries adversely affected the market. Low demand also raised the inventory levels and thus the supply and demand equilibrium of the market was disrupted. However, there was a slight improvement in the prices towards the end of the third quarter as the demand improved slightly and the production costs also declined due to the decline in natural gas costs. However, this trend was not followed in the fourth quarter and the prices nosedived.

Analyst Insight

According to Procurement Resource, the price trend for Toluenediamine are expected to follow a downward trajectory due to the weak demand from the end-sector industries, sluggish behaviour of the market, and uncertain crude oil prices.

Procurement Resource provides latest prices of Toluenediamine. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Toluenediamine

Toluenediamine is collectively used to refer to all the ortho and para isomeric forms of toulenediamine with the same common formula. But, depending on the position of the -amino groups, the properties of the isomers change. 2,4-diaminotoluene (one of the isomeric forms) is produced by hydrogenating 2,4-dinitrotoluene using a nickel catalyst. Its reaction with the chemical compound benzene diazonium chloride gives the cationic azo dye Basic Orange 1.

Toluenediamine Product Details

| Report Features | Details |

| Product Name | Toluenediamine |

| HS CODE | 292151 |

| CAS Number | 25376-45-8 |

| Industrial Uses | Organic Dyes, Hair Dyes, Rubber Industry, Chemical Substrate |

| Chemical Formula | C7H10N2 |

| Synonyms | Diaminotoluene, Methylphenylene diamine, TDA, Toluenediamine isomers, Tolylenediamine |

| Molecular Weight | 122.17 g/mol |

| Supplier Database | BASF SE, Cangzhou Dahua Group Co., Ltd., Covestro AG, Fujian Southeast Electrochemical Co., Ltd. |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Toluenediamine Production Processes

- Production of Toluenediamine from Toluene

In process involves hydrogenating dinitrotoluene in the presence of an acid catalyst in a continuous well-stirred tank reactor. Then the unreacted substrates are separated, giving crude toluenediamine refined via distillation.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com