Product

Trimethylolpropane Price Trend and Forecast

Trimethylolpropane Price Trend and Forecast

Trimethylolpropane Regional Price Overview

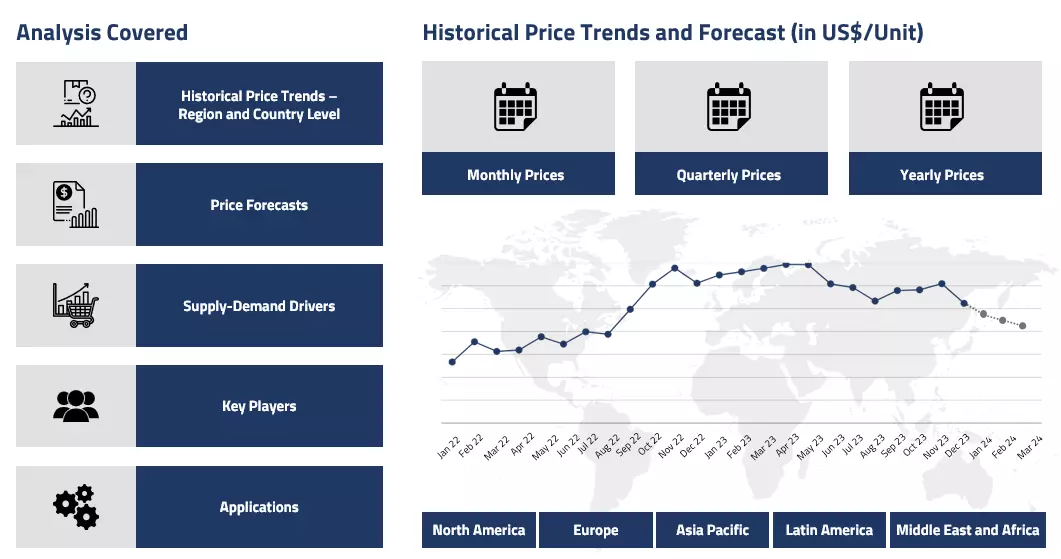

Get the latest insights on price movement and trend analysis of Trimethylolpropane in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Trimethylolpropane (TMP) Price Trend for Q1 of 2025

Asia

In Asia, the TMP market showed a weak performance during Q1’25. The quarter began on a quiet note following the New Year holidays, with demand from key sectors like coatings and resins staying subdued. Suppliers faced challenges from high inventory levels and cautious buying activity, which led to slow and steady price reductions. Although there were brief supply disruptions mid-quarter due to maintenance at some facilities, the overall impact on prices was limited as end-user demand remained low.

Trimethylolpropane Price Chart

Please Login or Subscribe to Access the Trimethylolpropane Price Chart Data

As March progressed, sellers continued offering material at competitive rates to clear stock, and while there was some restocking interest at lower levels, it wasn’t strong enough to shift the overall market trend. The pricing across the region moved gradually downward through the quarter, largely due to persistent oversupply and weak consumption.

Europe

In Europe, the TMP market followed a soft trajectory throughout Q1’25. After the winter break, the expected post-holiday recovery in demand did not materialize, especially from the automotive and coatings sectors. Production levels remained stable, but the lack of strong buying interest and additional pressure from imports kept the market under strain.

Sellers adjusted their offers downward to boost sales, but purchasing remained cautious. Although there was a brief uptick in activity mid-quarter as some buyers took advantage of low prices, the effect was short-lived. The market continued to feel the effects of weak economic conditions and a sluggish industrial sector, resulting in a slow but consistent price decline throughout the period.

North America

In North America, TMP prices were more stable compared to other regions during Q1’25, though the overall sentiment was still soft. At the start of the quarter, limited availability supported firmer prices due to logistical disruptions and planned plant shutdowns. However, once supply normalized in February, the market experienced growing pressure from muted demand.

Consumption from downstream industries remained flat, and producers began adjusting their pricing strategies to align with the cautious buying environment. By March, prices had softened slightly, influenced by broader economic uncertainty and stable production levels. While some cost-side pressures were observed, they were not enough to trigger significant price movements.

Analyst Insight

According to Procurement Resource, the TMP market is expected to remain balanced with limited volatility. Prices may stay range-bound in the near term unless there are notable shifts in demand or unexpected supply disruptions.

Trimethylolpropane (TMP) Price Trend for the Year 2024

Asia

In 2024, the Asian market for Trimethylolpropane experienced a fluctuating price trend across all four quarters. Early in the year, prices moved slightly upward due to a short-lived increase in procurement activity. However, the pace of demand slowed down soon after, especially from key downstream industries, which kept the overall price movement within a narrow range. The mid-year period was marked by occasional supply tightness caused by maintenance shutdowns at some facilities, briefly pushing prices up.

Despite this, ample availability and cautious buying behaviour led to a downward trend as the year progressed. By the final quarter, prices in countries like India displayed mild dips and remained stable due to balanced supply levels and moderate industry demand. The overall market tone in Asia was mixed but leaned slightly bearish by year-end.

Europe

In Europe, Trimethylolpropane prices stayed relatively steady for most of 2024. The market was supported by consistent demand from major consumer sectors, particularly in construction and coatings. There were no major supply disruptions, and logistics chains ran smoothly throughout the year. Although seasonal factors briefly influenced consumption patterns during colder months, the impact was minimal. Traders generally operated on short-term procurement cycles, buying based on immediate requirements rather than long-term contracts. This cautious approach, combined with a steady flow of goods, helped maintain price stability. Towards the end of the year, the market remained calm, with only minor fluctuations observed.

North America

The North American Trimethylolpropane market showed limited price movement throughout 2024. The region saw steady demand from core sectors such as automotive and resins, while overall production levels met the needs of the market effectively. Despite some minor disruptions caused by logistical challenges in the earlier part of the year, supply chains quickly adapted. Price changes were minimal, and the market showed resilience against external pressures. Seasonal shifts, including the onset of colder weather, had a minimal effect on consumption patterns. As the year drew to a close, the market maintained a balanced outlook, with stable prices and well-aligned supply-demand dynamics.

Analyst Insight

According to Procurement Resource, Trimethylolpropane prices are expected to face slight downward pressure due to high inventories and cautious demand from end-user industries.

Trimethylolpropane Price Trend for the Second Half of 2023

Asia

In Asian countries, the limited improvement of the feedstock industries translated into the pricing patterns of trimethylolpropane during the H2 of 2023. Additionally, the traders also noted the surge in the inventories as ample supplies from both the domestic and overseas players flooded the market, unbalancing the supply-demand dynamics of the trimethylolpropane market.

The slowdown of the market was further escalated by the slow economic turnout of the Asian countries. However, as the fourth quarter progressed, the cost of feedstock chemicals increased, and so did trimethylolpropane. The Chinese market showcased only marginal improvement, but the rest of the region experienced a dynamic change in the pricing trajectory of trimethylolpropane.

Europe

The European trimethylolpropane market swindled during the initial phase of the quarter as the raw materials and production costs fluctuated. However, as the third quarter progressed towards its end, the downstream industries slowly and steadily returned to their earlier pace, and their procurement rates inclined. The fourth quarter also sustained this trend, but only till the middle of it, as the surging interest rates, oscillating economic landscape, and high energy prices limited the growth momentum of the market and eventually led to a stagnancy in the pricing movement of trimethylolpropane.

North America

Defying the global trend, the North American trimethylolpropane market attained a southward journey throughout the third and fourth quarters of 2023. The elevated cost of raw materials and difficulties in acquiring the desired amount of crude oil for production lowered consumer confidence in the sector and eventually pushed the prices towards a southward trend. Another contributing factor was the exponential hike in inventories as the downsliding exporting volumes and stunted domestic growth of the market worked as a roadblock for the trimethylolpropane pricing trail.

Analyst Insight

According to Procurement Resource, the price of Trimethylolpropane is expected to attain an overall bearish trend as the traders anticipate that the production volumes might overpower the future demand of the commodity while the feedstock sector also extends only limited support.

Trimethylolpropane Price Trend for the First Half of 2023

Asia

The Chinese Trimethylolpropane market exhibited mixed price trend during the said period as the prices fluctuated throughout. Till the middle of the second quarter, the Trimethylolpropane prices traversed in a zig-zag manner, continuously rising and falling every month. By the middle of Q2, the prices observed a straight fall.

Steady market demands from downstream textile, coating, adhesive, plasticizers, etc. industries and the inventory levels determined the price trend as the supply-demand dynamics ensured the product movement in the market, which caused many fluctuations. Demands drove the rising curves, while high inventory levels pushed the prices down. Overall, a swinging market behavior was observed.

Europe

The European Trimethylolpropane market mostly observed low swinging price trend throughout the discussed period. The high inflation here had affected the downstream industries severely. The construction, coating, etc. sectors were almost shut down and registered very few queries. An evident decline in demand guided the market sentiments, causing the Trimethylolpropane prices to waver on the lower end of the curve.

North America

The North American Trimethylolpropane market behaved no differently than its European counterpart as the prices tottered around the lower side here as well. Decreased downstream demands drove the market sentiments; with the failure of two major US banks, the market exhibited feeble sentiments.

Analyst Insight

According to Procurement Resource, the price trend for Trimethylolpropane will continue to fluctuate, rallying behind the unstable demands from the consuming industries and available stocks in the market.

Trimethylolpropane Price Trend for the Second Half of 2022

Asia

The price trend for trimethylolpropane were majorly affected by its feedstock materials, butanal, and formaldehyde. The formaldehyde market declined in the third quarter of 2022 as the demand from the domestic sector declined.

The prices, however, gained some momentum during the end months of the third quarter as the demand from downstream industries rose and invariably inclined the trimethylolpropane prices. The price trend was also stable in the initial months of the fourth quarter and then declined in the later months. The decreased demand and rise in inventories negatively impacted the market, declining the price trend for trimethylolpropane.

Europe

The feedstock prices in the European region for trimethylolpropane saw a weak demand from the end-sector industries and a rise in inventories. Weak economic conditions and low confidence of buyers due to the doom of recession further impacted the price trend of trimethylolpropane negatively. The unstable trading activities and increased production costs also fueled the declining price trend for trimethylolpropane.

North America

The market for feedstocks of trimethylolpropane fluctuated in the North American market. The prices were majorly affected by the upstream market and lower demand from the industries. The prices also suffered adversely from the rising inflation rates, uncertain crude oil prices, and low export levels. All these factors combinedly kept the price trend for trimethylolpropane in the negative zone.

Analyst Insight

According to Procurement Resource, the price trend for trimethylolpropane are expected to decline in the upcoming months as the demand from end-user industries will continue to remain unstable along with weak consumer confidence in the market.

Procurement Resource provides latest prices of Trimethylolpropane. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Trimethylolpropane

Trimethylolpropane (TMP) is a colourless to white solid widely used as a building block in the polymer industry. It is a triol- containing three hydroxyl groups: with a distinct odour. TMP is hygroscopic and is readily soluble in water and alcohol. Owing to its versatile nature, it is widely used in varnishes, plasticizers, surfactants, coatings, and lubricant products.

Trimethylolpropane Product Details

| Report Features | Details |

| Product Name | Trimethylolpropane |

| HS CODE | 29054100 |

| CAS Number | 77-99-6 |

| Industrial Uses | Textiles, Paints/ Coatings, Adhesives/ Lubricants, Polymers, Plasticizers, Surfactants |

| Chemical Formula | C6H14O3 |

| Synonyms | TMP, 2-Ethyl-2-(hydroxymethyl)propane-1,3-diol |

| Molecular Weight | 134.17 g/mol |

| Supplier Database | Lanxess, Jilin Petrochemical, Oxea, Mitsubishi Gas Chemical, Perstorp |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Trimethylolpropane Production Processes

- Production of Trimethylolpropane from formaldehyde: This method is usually carried out in two steps. Firstly, the condensation of butanal with formaldehyde followed by the Cannizzaro reaction – a base-induced disproportionation of two molecules of a non-enolizable aldehyde to give the required product, i.e., Trimethylolpropane.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com