Product

Unbleached Kraft Paper Price Trend and Forecast

Unbleached Kraft Paper Price Trend and Forecast

Unbleached Kraft Paper Regional Price Overview

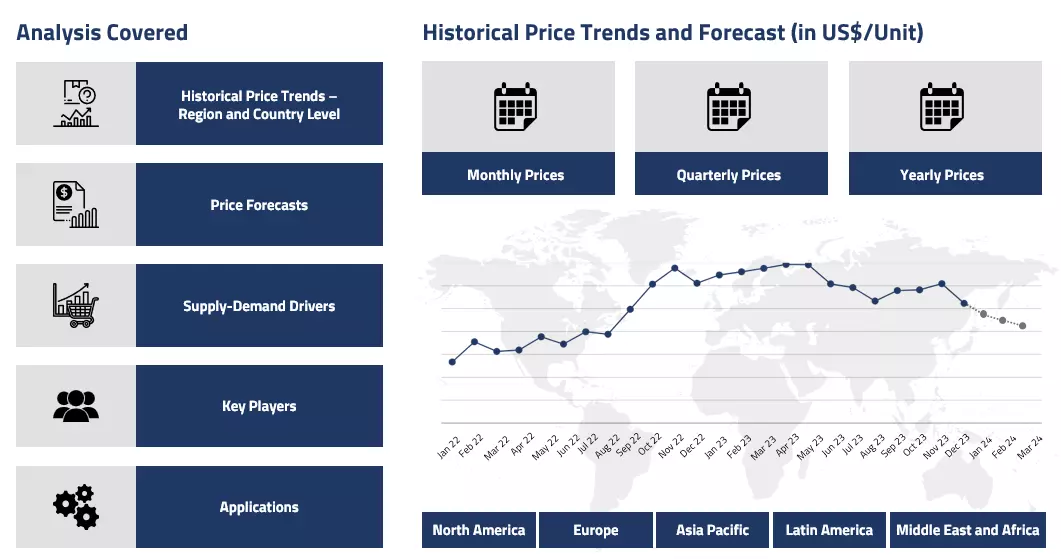

Get the latest insights on price movement and trend analysis of Unbleached Kraft Paper in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Unbleached Kraft Paper Price Trend for Q1 of 2025

In the first quarter of 2025, unbleached kraft paper prices followed an upward trajectory despite mixed market conditions. January began with major producers announcing substantial price increases, though these were not immediately reflected in market indexes. By February, the market partially accepted these increases, with leading indexes recognizing a $40 per ton gain in the prices.

Unbleached Kraft Paper Price Chart

Please Login or Subscribe to Access the Unbleached Kraft paper Price Chart Data

The price movement throughout Q1 was primarily driven by manufacturers' need to improve margins rather than by strong demand fundamentals. This was particularly notable since recycled fiber input costs had actually decreased in the months preceding the quarter. March concluded with further upward pressure when The Navigator Company announced additional increases of 4-7% on all packaging papers, set to take effect at the start of Q2.

Throughout the quarter, export volumes remained important but showed cooling compared to their April 2024 peak, with global demand conditions remaining somewhat weak despite prior benefits from shipping disruptions like the Red Sea crisis.

Analyst Insight

According to Procurement Resource, Unbleached Kraft Paper prices are expected to continue rising in the coming months, with proposed tariffs on Mexico presenting a significant risk factor for export demand and industry capacity utilization.

Unbleached Kraft Paper Price Trend for the Second Half of 2024

The unbleached kraft paper market showed notable fluctuations during the second half of 2024. Prices initially declined in the third quarter, with some European producers reporting reductions of €20-40 per tonne as demand softened following a quiet summer period. This cooling trend contradicted earlier expectations of sustained upticks that had allowed price increases earlier in the year.

The market situation worsened due to external factors as European producers faced increased competition in overseas markets, particularly from Russian suppliers who targeted these regions after facing EU bans. This displacement pushed European volumes back to their home continent, creating downward price pressure.

A significant fire at Mondi's Stambolijski mill in Bulgaria, which produces 100,000 tonnes of unbleached kraft paper annually, temporarily tightened supply in Q4. While some anticipated this would stabilize or increase prices, the impact was muted due to overall weak demand, especially in key markets like Germany and France.

In India, the story was different, as kraft paper prices surged by over 20% in the final quarter, attributed to limited waste paper availability and restricted supply. This severely squeezed profit margins for corrugated box manufacturers who couldn't proportionally adjust their end product prices.

Analyst Insight

According to Procurement Resource, with mixed supply-demand dynamics and ongoing geographical disparities, the Unbleached Kraft Paper market might remain unpredictable heading into 2025, with price stability dependent on economic recovery in Europe and improvements in waste paper collection systems globally.

Unbleached Kraft Paper Price Trend for the First Half of 2024

The European sack kraft paper and unbleached kraft paper market showed significant improvement in early 2024, with optimism rising among producers and price increases applied across both bleached and unbleached grades. Price hikes were implemented in the UK and across Europe. Producers remained bullish, citing improved global market conditions, particularly in southern Europe, while buyers were more cautious, noting that some of the price increases might be driven by destocking and pre-emptive ordering rather than organic demand.

Supply chain disruptions, such as the Red Sea crisis and Finland's transport strikes, affected shipments and drove up transport costs, especially for overseas buyers. Regionalization of trade flows and sustained high interest rates in Europe continued to impact the market, particularly in the construction sector, leading to varying levels of demand. Despite these challenges, many producers reported positive developments and increased order volumes, the market was improving but remained cautious about the pace of recovery.

Analyst Insight

According to Procurement Resource, some regional variation is anticipated in the Unbleached Kraft Paper industry going forward. The Indian markets are projecting slight degradations in the kraft paper sector.

Unbleached Kraft Paper Price Trend for the Second Half of 2023

Unbleached kraft paper prices were observed to be oscillating in a narrow range during the second half of the year 2023. The first three months were slightly firm on the price front as the price trend registered very gentle inclinations during this period. Going forward, as the fourth quarter arrived, the prices tumbled because of the sudden fall in downstream demands from the paper industry; however, then the market stabilized and experienced borderline stagnancy for the remainder of the period.

In the Indian unbleached kraft paper market, the monthly average prices went from around 453 USD/MT in July’23 to about 460 USD/MT in December’23. This called for a marginal half-yearly movement of around 1% in the Indian unbleached kraft paper market, reflecting well the stable nature of the unbleached kraft paper industry.

Analyst Insight

According to Procurement Resource, the Unbleached Kraft Paper market is expected to continue to behave in a similar manner going forward; the prices are estimated to oscillate in a narrow range.

Unbleached Kraft Paper Price Trend for the First Half of 2023

In the first and second quarters of 2023, the price trend of unbleached kraft paper suffered from decreased demand as a result of the high level of market stocks. This also contributed to lower production and price levels, particularly for unbleached grades. In addition to this, the adoption of plastic bag restrictions, which were led by the European Commission's efforts to reduce the use of lightweight plastic bags in the EU, has increased demand for unbleached kraft paper in Europe and had a beneficial effect on the sector.

On the other hand, as the shift in consumer behavior became apparent, e-commerce and meal delivery also boosted demand. Therefore, the substitution of single-use plastic has a bigger impact on the unbleached kraft paper market as compared to e-commerce, especially for Central Europe, since they currently have the highest use of lightweight plastic bags out of Europe. Traditional demand drivers, such as construction activity, showed constriction in their market dynamics due to high-interest rates and inflation and, in turn, hampered the growth of the unbleached kraft paper price trend.

Analyst Insight

According to Procurement Resource, the price of Unbleached Kraft Paper is expected to follow an oscillating trajectory as the demand for unbleached kraft paper is estimated to be affected by the ban on the usage of plastics and demand from downstream industries.

Procurement Resource provides latest prices of Unbleached Kraft Paper. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com