Product

Urea Formaldehyde Resins Price Trend and Forecast

Urea Formaldehyde Resins Price Trend and Forecast

Urea Formaldehyde Resins Regional Price Overview

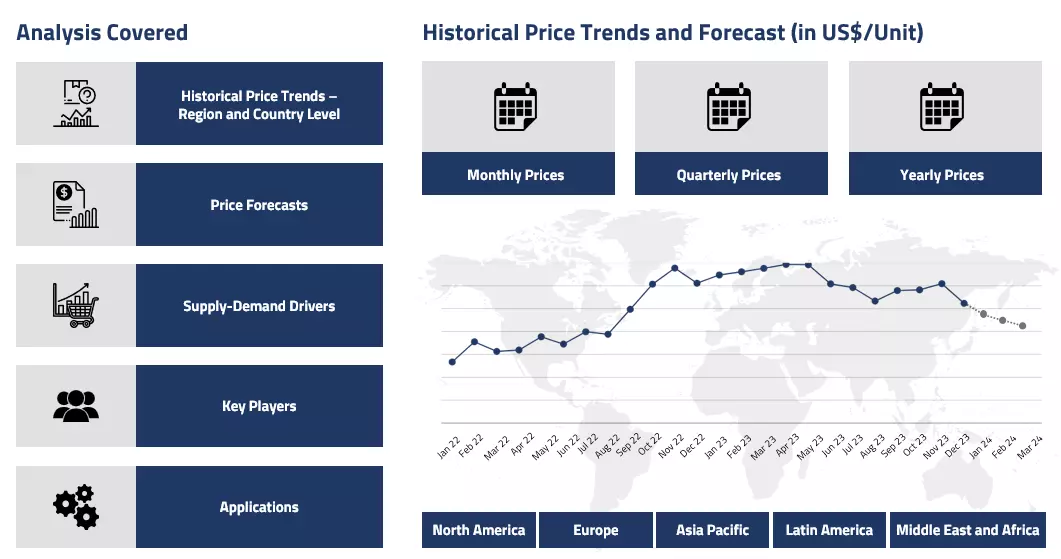

Get the latest insights on price movement and trend analysis of Urea Formaldehyde Resins in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Urea Formaldehyde Resin Price Trend for Q1 of 2025

Asia

In Asia, the price trend for urea formaldehyde resin was mixed during the first quarter of 2025. The market started on a soft note in January, mainly due to the seasonal slowdown during Lunar New Year celebrations. Demand from the construction and furniture industries remained low, and this kept prices from rising despite stable raw material costs. However, things began to improve by mid-February.

Urea Formaldehyde Resins Price Chart

Please Login or Subscribe to Access the Urea Formaldehyde Resins Price Chart Data

As downstream sectors like wood panel manufacturing and construction gradually picked up activity, the need for resin increased. At the same time, input costs edged higher due to rising raw material prices and transport delays from the Middle East. By the end of March, prices had recovered modestly, driven by growing domestic demand and improved market sentiment in China and Southeast Asia.

Europe

In Europe, urea formaldehyde resin prices moved up consistently throughout Q1’25. Early in the quarter, production costs were already elevated due to high utility prices and limited availability of input materials. Local manufacturers faced supply constraints caused by disruptions in import routes and plant maintenance. While demand from the construction sector was moderate, industrial usage for adhesives and laminates kept offtake stable.

February brought some relief when regulatory concerns were eased, allowing producers to operate more confidently. In March, slight improvements in construction activity in parts of Western Europe pushed demand further, supporting the upward price movement. Overall, the European market experienced firm pricing backed by cost pressures and steady industrial consumption.

North America

In North America, the market for urea formaldehyde resin saw strong price growth during Q1 2025. The upward trend was mainly fueled by tight supply of raw materials caused by multiple unplanned shutdowns at major production sites. Demand from key sectors like automotive and engineered wood remained solid, which kept consumption levels high.

Even though input costs were mixed, limited availability and strong downstream pull put upward pressure on resin prices. Activity in the construction sector was somewhat uneven, but infrastructure-related projects helped maintain overall resin demand. The quarter ended with prices significantly higher than where they started, reflecting the supply-driven nature of the market.

Analyst Insight

According to Procurement Resource, prices are expected to stay firm into Q2’25, with further direction depending on feedstock availability and the pace of recovery in the construction sector.

Urea Formaldehyde Resins Price Trend for Q4 of 2024

| Product | Category | Region | Price | Time Period |

| Urea Formaldehyde Resins | Chemicals | Europe | 840 USD/MT | October'24 |

| Urea Formaldehyde Resins | Chemicals | Europe | 845 USD/MT | December'24 |

Stay updated with the latest Urea Formaldehyde Resins prices, historical data, and tailored regional analysis

Asia

The Urea Formaldehyde Resin market in Asia experienced fluctuating price trends throughout the fourth quarter of 2024, influenced by volatility in its key feedstocks and broader market conditions. The rising urea prices during the initial months of the quarter, driven by strong demand and supply chain disruptions, led to an increase in production costs for resin manufacturers. China faced logistical challenges, including port congestion and adverse weather conditions, which further constrained supply. However, despite these challenges, downstream industries such as construction and furniture manufacturing maintained steady demand, preventing sharp price declines.

Towards the end of the quarter, easing feedstock prices and subdued year-end procurement activities led to price stabilization. Additionally, India, a major consumer, had secured adequate supply through contracts, reducing spot market demand and further balancing the market. The overall trend for Urea Formaldehyde Resin in Q4 2024 was marked by an initial uptrend due to cost pressures, followed by stabilization as feedstock volatility subsided and demand dynamics normalized across the region.

Europe

The Urea Formaldehyde Resin market in Europe experienced a steady rise in prices early in Q4 2024 before stabilizing towards the quarter’s end. Strong demand from downstream industries contributed to market stability, while efficient supply chains ensured steady production. Producers managed inventory levels effectively, preventing major disruptions. Businesses adapted to seasonal changes smoothly, maintaining operational consistency. Upstream prices remained stable, reinforcing market steadiness. The prices were about 840 USD/MT (FOB) in October and around 845 USD/MT in December.

North America

The Urea Formaldehyde Resin market in North America remained largely stable throughout Q4 2024, with only minor fluctuations. Market stability was supported by consistent demand and predictable procurement trends. Supply chains operated without major disruptions, allowing producers to maintain adequate inventory levels to meet steady consumption. The slight fluctuations in feedstock prices had minimal impact on resin prices, as balanced supply and demand dynamics ensured stability. Both buyers and sellers approached the market with caution, contributing to a steady pricing environment.

Analyst Insight

According to Procurement Resource, the Urea Formaldehyde Resins prices graph is expected to show regional variations in the prices influenced by the local demand patters and other macroeconomic factors.

Urea Formaldehyde Resins Price Trend for Q3 of 2024

Asia

In Asian markets, the urea formaldehyde resin price curve displayed mixed trends in the third quarter of 2024. According to the urea formaldehyde resin price database, prices followed the trend of the upstream urea market. Initially, urea formaldehyde resin prices showed a steady trend, but as the quarter progressed, the market experienced a downward shift.

Prices were influenced by supply issues, government policies on exports, and fluctuating demand from downstream industries. Despite the price decrease, resin manufacturers occasionally increased production. Demand for resins remained strong in the construction and furniture markets, but buyers were cautious, waiting for prices to decrease further. However, towards the end of the quarter, the price curve stabilized as demand balanced out supply.

Europe

Throughout the third quarter of 2024, the urea formaldehyde resin price graph continued to rise steadily in European markets. Although supply disruptions from the previous quarter stabilized, the prices of the commodity increased. Strong demand for plywood, fiberboard, and laminates persisted, driven by high demand for these products. Additionally, rising raw material costs and expensive energy prices complicated resin production for manufacturers. As production costs increased, urea formaldehyde resin prices continued to climb throughout the quarter. Due to limited capacity for price adjustments, manufacturers and buyers had to adapt to a market with rising costs.

North America

During Q3'24, the North American market for urea formaldehyde resins exhibited a wavering trend. Prices fluctuated due to various factors, including increased demand from the construction and furniture sectors. However, challenges in feedstock availability and supply chain disruptions persisted. Manufacturers adjusted their costs according to fluctuations in raw materials, while others attempted to maintain steady prices. Imports from China and other countries were affected by disruptions caused by hurricanes, adding another layer of uncertainty. By the end of the quarter, prices became range-bound as supply stabilized.

Analyst Insight

According to Procurement Resource, the Urea Formaldehyde Resins prices are expected to show slight upward movements in the near future, resembling the rise in the feedstock costs.

Urea Formaldehyde Resins Price Trend for the First Half of 2024

| Product | Category | Region | Price | Time Period |

| Urea Formaldehyde Resins | Chemicals | Europe | 811 USD/MT (FOB NEW) | January’24 |

| Urea Formaldehyde Resins | Chemicals | Europe | 780 USD/MT | June’24 |

Stay updated with the latest Urea Formaldehyde Resins prices, historical data, and tailored regional analysis

Asia

Urea formaldehyde resin prices exhibited minor oscillations throughout the first half of the year 2024. The prices closely followed the variations in feedstock methanol and urea prices. Since both the feedstocks showcased wavering price patterns, the upstream dynamics mostly remained muted for urea-formaldehyde resins in both Indian and Chinese markets. Therefore, the prices mostly fluctuated between close limits for the entire period. Moreover, the downstream demands also showcased buoyancy in the regional markets. With this, the price trajectory was almost stable for the said period of H1’24.

Europe

Urea-formaldehyde resin is a non-transparent thermosetting resin known for its high tensile strength, rigidity, and resistance to mold and mildew, making it a popular choice in the production of particleboard, plywood, and other wood products; it serves as an adhesive that binds wood particles together. Therefore, the demands from these consuming sectors determined the pricing trajectory for UFR during the first six months of 2024.

In the European markets, the prices had a positive start at the beginning of the first quarter in January, primarily because of the regional supply chain curtailments. However, as the domestic demands stabilized and the logistics showed some improvements, the prices started to fall again in the following months. Overall, a largely stable and wavering price graph was observed. In Europe, the monthly average prices went from about 811 USD/MT (FOB NEW) in January’24 to around 780 USD/MT in June’24.

North America

During the first half of the year 2024, the urea-formaldehyde resin prices in America mimicked the variations in their Asian and European counterparts very closely. The rates were found to be consolidated here as well. Along with the tepidness in crude oil prices, the domestic and global political and economic disruptions also influenced the urea formaldehyde resin’s price performance in the US market. Overall, the urea-formaldehyde resin prices remained anchored in America throughout the concerned period.

Analyst Insight

According to Procurement Resource, since the global crude oil prices have stared correcting slightly, the Urea Formaldehyde Resins prices are also expected to improve steadily over the next few months. A positive market performance is expected.

Urea Formaldehyde Resin Price Trend for the Second Half of 2023

Asia

In the Asian markets, particularly in China and India, the price trends for urea-formaldehyde resins were influenced by fluctuating prices of feedstock urea and formaldehyde. Initially, formaldehyde prices remained low due to declining methanol prices, while urea prices showed marginal growth owing to a balanced supply and demand dynamic.

As methanol prices rose around November, formaldehyde prices increased slightly, although the demand remained flat, resulting in a balanced market outlook. By the end of December, formaldehyde prices experienced further fluctuations, but the market consolidated due to stable sales and environmental restrictions. Meanwhile, urea prices showed a slight upward trend due to positive market sentiments.

Europe

In Europe, the pricing trends for urea-formaldehyde resins mirrored those in Asia, with frequent fluctuations influenced by varying demand and feedstock costs. Formaldehyde prices initially declined due to weakened demand and lower methanol costs. However, geopolitical tensions, such as the Israel-Hamas conflict, disrupted trade and logistics, leading to increased feedstock prices and freight charges.

Consequently, formaldehyde prices rose towards the end of the fourth quarter. Urea prices in Europe started slowly due to high inventories but surged later due to supply chain disturbances and high fertilizer demand during the peak winter sowing season.

North America

In North America, the price trends for urea-formaldehyde resins followed a similar pattern to those in Europe. Formaldehyde prices initially remained low but inclined during the latter half of the quarter due to rising feedstock prices, constrained supplies, and high demand. The urea market mirrored this trend, with better performance in the latter half of the quarter driven by supply disturbances and increased demand. Overall, the price trajectory for urea-formaldehyde resins in North America showed an upward trend by the end of the year.

Analyst Insight

According to Procurement Resource, the price trend of Urea Formaldehyde Resin is estimated to improve gradually in the next quarters; however, some month-on-month fluctuations might slightly alter this trajectory.

Urea Formaldehyde Resins Price Trend for the First Half of 2023

Asia

The Asia-Pacific region witnessed high demand for urea formaldehyde resins and restricted supply that helped its prices to shoot up. Another major cause of this incline was the revival of Chinese market activities after the upliftment of COVID-19 restrictions and the Lunar New Year season.

However, in the second quarter, the prices moved feebly due to the lack of support from the feedstock market. The strong supply of urea formaldehyde resins in the market while the demand from downstream industries declined drastically, causing the price trend of urea formaldehyde resins to fall consistently.

Europe

In the first and second quarters of 2023, the prices of urea formaldehyde resins had a gradual decline. In the first quarter, the cost of feedstock materials depreciated by almost a double-digit percentage, affecting the price trend of urea formaldehyde resins negatively.

In the second quarter, in addition to the poor performance of the feedstock prices, the demand from the downstream industries remained subdued from both domestic and international buyers as the rates of consumption from consumers took a hit. The rates of export to overseas nations also took a hit, and due to that, the price trend of urea formaldehyde resins moved southwards.

North America

In North America, the price trend of urea formaldehyde resins was hit by the weak performance of the feedstock market in the first quarter of 2023. In addition to this, strong supply and low rates of procurements ultimately caused the level of inventories to shoot up, causing a reduction in urea formaldehyde resins prices.

In the second quarter, the decline was much more prominent in the months of May and June, as demand from the furniture and wood industries was almost negligible. And on top of this, the crisis in the banking sector raised the levels of inflation and interest, hampering the prices of urea formaldehyde resins.

Analyst Insight

According to Procurement Resource, the price trend of Urea Formaldehyde Resins is expected to showcase a negative trajectory as the purchasing potential of buyers is declining, and high uncertainties in the economic conditions are estimated to affect the urea formaldehyde resins prices negatively.

Urea Formaldehyde Resins Price Trend for the Second Half of 2022

Asia

Poor demand for urea formaldehyde resins in the Asia-Pacific region led to a fall in their price trend. The downfall in the prices of fertilizers was the major contributor to this subdued demand for urea formaldehyde. An ample supply of urea formaldehyde resins in the region and low rates of procurement ultimately resulted in a decline in the price trend of urea formaldehyde resins in the last two quarters of 2022.

Europe

The third quarter of 2022 was favorable for the movement of the prices of urea formaldehyde resins in Europe. In this region, the rates of production of urea formaldehyde resins were affected by the costs of natural gas due to delays in shipments and the ongoing Russia-Ukraine crisis. However, in the fourth quarter, the price trend were hit by surplus availability of the product, low rates of procurement, and fluctuating freight charges. In addition to this, Russia imposed high quotas on imports that further increased the availability of the product in the region, hampering the growth of the urea formaldehyde resins price trend.

North America

The price trend of urea formaldehyde resins declined gradually in the third quarter of 2022 and steeply in the fourth. The major cause of this decline was the poor purchasing potential of buyers during this time frame. In addition to this, the downstream sector was also affected by declined rates of exports as the number of inquiries from the overseas players failed to provide the urea formaldehyde resins market the required support.

Analyst Insight

According to Procurement Resource, the price trend of Urea Formaldehyde resin is estimated to decline due to lackluster demand from downstream industries and feeble performance of the global markets.

Urea Formaldehyde Resins Price Trend For the First Half of 2022

Asia

Due to China and India being the major manufacturers of urea formaldehyde resins and having the largest consumer bases, the Asia Pacific region currently has the largest market for urea formaldehyde, and this trend is anticipated to last into the forecast period. The need and demand for food are growing along with the population, and as a result, agriculture operations are continuously evolving. The Asia-Pacific region will use more urea-formaldehyde resins as a result of these changes, which depend on fertiliser performance and efficiency.

North America

The urea formaldehyde market is anticipated to experience tremendous growth in North America, with the US predicted to lead the majority of regional expansion. Various uses in architecture and construction are sustaining urea formaldehyde market sales in the US. As observed from the urea formaldehyde price trend, North America witnessed an upward slope in Q1 of 2022.

Latin America

Due to an increase in construction activity, nations like Brazil and Mexico are also generating a significant amount of demand for urea formaldehyde. Additionally, these nations' automobile industries are also experiencing a major increase, which will create favourable conditions for market growth. As a result, urea formaldehyde resins prices are witnessing an upward trend.

Urea Formaldehyde Resins Price Trend for Fourth Quarter of 2021

Asia

In Asia Pacific, formaldehyde prices increased in October before declining in the final two months of the quarter. Rising natural gas prices added to the expense of feedstock methanol during the first half of Q4, resulting in a sharp increase in downstream product pricing.

The price decline in the later part of Q4 was mostly due to lower methanol prices and an influx of imports from China. In the fourth quarter of 2021, urea prices also rose. Urea formaldehyde resin prices increased due to growing feedstock prices.

Europe

In Europe, urea prices improved significantly in the fourth quarter. Its price in European markets rose due to higher feedstock ammonia prices, increased input costs due to the energy crisis, and rising natural gas prices.

Moreover, increased freight rates and a scarcity of shipping containers played havoc on its prices in the third quarter. However, prices of formaldehyde fell in Q4 compared to Q2 and Q3 as a result of ample supply and weakening demand in Germany, Belgium, and other European countries. As a result of the lower methanol costs, the price of formaldehyde has also dropped. Demand for formaldehyde in the resin industry has also decreased.

North America

Due to a large increase in the price of raw materials, the price of urea surged in the fourth quarter of 2021 in the North American region. However, when compared to Q2 and Q3, formaldehyde prices remained on the low side. Feedstock methanol prices declined in the United States in the fourth quarter of 2021, owing to a slowdown in industrial applications and fuel consumption, as well as an increase in Omicron instances.

Urea Formaldehyde Resins Price Trend for First, Second and Third Quarters of 2021

Asia

Prices of urea have rose steadily across the Asian market, owing to increased demand from both the domestic and foreign fertiliser markets. Prices in China spiked in Q1 2021 as a result of a partial lockdown in response to an increase in daily COVID-19 cases. While this had little effect on urea production in the country, it did cause problems with road transit and exports.

Meanwhile, demand for urea in India improved from the previous quarter, and limited supply sustained its pricing. Due to an uptick in industrial activity across the region, demand for formaldehyde remained steady from its derivatives sectors like plastics and resins at first. However, methanol supply limits resulted in a formaldehyde shortage in the domestic market. The resin market followed the path of its feedstock and showed a downward trend in its prices.

In the second quarter, the price of urea in India rose due to increased seasonal demand from both the domestic and international markets. However, attitudes on the regional market for formaldehyde were divided across Asia Pacific. After years of steady increases, the price of the resin dropped significantly in August, aided by lower raw material formaldehyde rates in the market.

During the third quarter of 2021, the Asian market saw a major increase in the price of urea. The Chinese resin industry saw consistent demand for the compound, but the sector also reported low material supply. The lack of imports was partly owing to global agri-commodity markets' overall strength, China's temporary suspension of exports, and Western economic sanctions on Belarus. In the third quarter, formaldehyde prices were relatively stable.

Europe

During the first quarter of 2021, the European urea market saw steady domestic & global demand. The resins industry boosted its need for formaldehyde, but lower supplies created market tensions. Due to a lack of feedstock formaldehyde in the markets, urea formaldehyde resin prices increased significantly.

Due to the slow rate of economic improvement in the second quarter, demand for urea-formaldehyde remained modest to low. The average price stayed the same.

Urea formaldehyde resin prices surged sharply in the European markets in Q3 2021, owing to strong seasonal offtakes and rising fertilizer demand.

North America

In the first quarter of 2021, demand for feedstock urea climbed in the North American region, but prices remained high due to scarcity. Following a protracted winter storm and trade disruption, formaldehyde prices increased as well. The combination of these factors pushed up the price of resins on the market.

During the second quarter, the price of formaldehyde in North American markets fell overall. The resin manufacturers didn't benefit much from the cheap costs because demand was suppressed as a result of their pact. In this quarter, the cost of urea-formaldehyde was low.

In the third quarter of 2021, the market price of formaldehyde increased significantly. This was caused by its shortage in the regional markets. Feedstock urea received mixed reviews. However, as Q3 came to a close, the urea market gained traction as feedstock ammonia began to rise in response to rising natural gas costs. Overall, the cost of formaldehyde resin increased during the quarter.

Urea Formaldehyde Resins Price Trend for the Year 2020

Asia

China's urea shipments increased dramatically at the start of the fourth quarter. However, with the start of the Rabi season in India, its demand increased dramatically. The growing demand for urea in fertilisers limited the supply of this critical feedstock for resin production, raising urea formaldehyde resin prices.

Europe

In the fourth quarter of 2020, formaldehyde prices in Europe increased significantly. As a direct result of this price increase, the cost of resins has also risen.

North America

Due to lower demand at the conclusion of the agricultural season in the United States, supply of feedstock urea remained abundant in Q4. As harvesting drew to a conclusion, the overall rate of demand began to slowdown. Meanwhile, the cost of the formaldehyde skyrocketed. The combination of these factors resulted in an increase in urea formaldehyde resin prices in US markets.

Procurement Resource provides latest prices of Urea Formaldehyde Resin. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Urea Formaldehyde Resins

Urea formaldehyde resins or urea-methanal is a non-transparent thermosetting resin or polymer. It is manufactured from urea and formaldehyde.

Urea Formaldehyde Resins Product Details

| Report Features | Details |

| Product Name | Urea Formaldehyde Resins |

| Synonyms | Poly(methi(bis(hydroxymethyl))ureylene)amer, Polynoxylin, Polyoxymethylene urea |

| Industrial Uses | Particle Board, Medium Density Fiberboard, Plywood, Wood Adhesive |

| Supplier Database | Hexion, BASF SE, ADVACHEM, Kronoplus Limited, Georgia-Pacific Chemicals |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Urea Formaldehyde Resins Production Processes

- Production of Urea Formaldehyde Resin from Urea and Methanol

A commonly used method for producing formaldehyde from methanol is followed by another method in which the formaldehyde is first reacted with urea. The resulting product is then polymerized to yield the Urea Formaldehyde Resin.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com