Product

Vinylbenzene Price Trend and Forecast

Vinylbenzene Price Trend and Forecast

Vinylbenzene Regional Price Overview

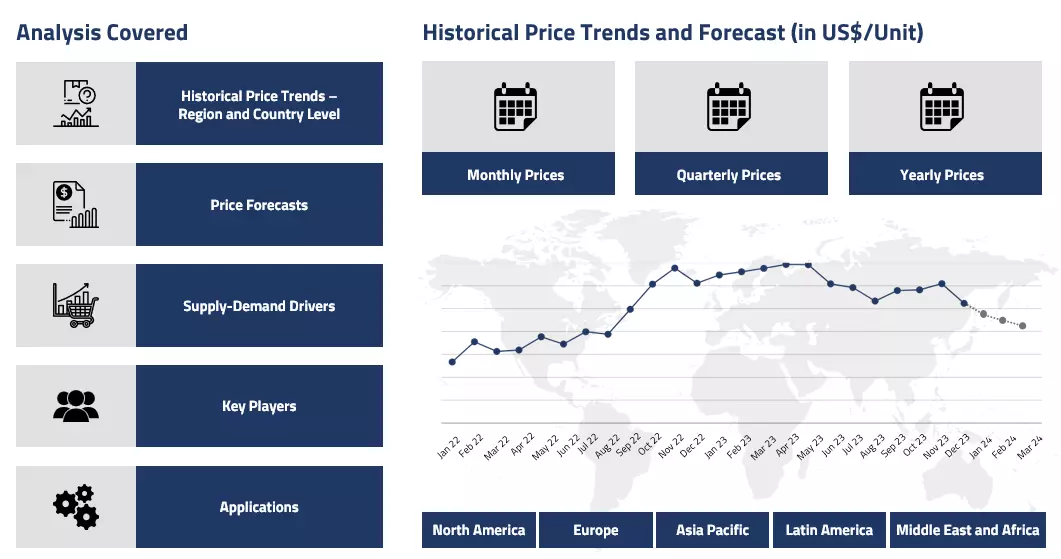

Get the latest insights on price movement and trend analysis of Vinylbenzene in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Vinylbenzene Price Trend For the First Quarter of 2022

| Product | Category | Region | Price | Time Period |

| Vinylbenzene | Chemicals | China | 1197 USD/MT | Jan 2022 |

| Vinylbenzene | Chemicals | Germany | 1600 USD/MT | Jan 2022 |

| Vinylbenzene | Chemicals | North America | 1406 USD/MT | Jan 2022 |

Stay updated with the latest Vinylbenzene prices, historical data, and tailored regional analysis

Asia

In the Asia-Pacific area, vinylbenzene prices followed the rising tendencies in Q1. Market sentiments in the domestic market were favorably influenced by thriving downstream sectors such as plastic rubber and disposable cups. The cost of the feedstocks benzene and ethylene rose in tandem with crude oil prices.

Vinylbenzene Price Chart

Please Login or Subscribe to Access the Vinylbenzene Price Chart Data

The Omicron virus epidemic in China led manufacturers to suspend production, causing supply disruption in the Asia-Pacific market as key manufacturers temporarily halted output. In January, the price of the chemical was 1197 USD/MT CFR Shanghai, China.

Europe

Vinylbenzene prices in the European market increased in the first quarter of 2022 owing to increased prices of the raw materials. The prolonged conflict between Russia and Ukraine disrupted the supply of crude oil and natural gas, forcing firms to raise manufacturing costs.

As a result, the trade route was harmed, and the supply chain became unbalanced. Furthermore, demand from downstream industries such as packaging and insulation remained strong throughout the quarter, resulting in price increases. Vinylbenzene prices in Germany for the first month of the quarter were 1600 USD/MT, CFR Hamburg.

North America

Prices in the North American market accelerated during the first quarter of 2022, rising from 1406 USD/MT FOB Texas in January to 1650 USD/MT FOB Texas at the conclusion of the quarter.

As a result of the war between Russia and Ukraine, escalating vinylbenzene prices in the US market were accompanied by increasing crude oil prices. The cost of production for major companies increased, affecting the chemical’s market. The demand prognosis for downstream packaging, automotive, and rubber sectors remained positive, and as a result, vinylbenzene prices increased in Q1 2022.

Vinylbenzene Price Trend For the Fourth Quarter of 2021

Asia

Vinylbenzene prices in the Asia Pacific area were flat in Q4 compared to Q2 and Q3. The major industries in India and China were believed to be under pressure due to increased local production and weak import demand. Because of the plentiful availability of feedstock benzene, market trade activity slowed.

India's solid demand for automobiles and household appliances persisted, and the downstream market remained stable, with customers purchasing products on a need-to basis and anticipating additional price reductions. Prices were 1269 USD/MT Ex-Vadodara in the last week of December, while prices in China were 1340 USD/MT FOB Qingdao.

Europe

Vonylbenzene prices in Europe fell in Q4 due to hoarding of inventory and oversupplies. In Germany, mood appeared to be skewed due to weak demand. Expansive production edges had been viewed as an extra cost of vinylbenzene production up to this point, owing to crucial production disruptions in the fourth quarter that left the stockpiles vulnerable.

As a result of the lower demand, benzene inventories steadily increased. In Q4 2021, supplies were anticipated to be exhausted, resulting in a steeply backward price curve. According to reports, the margin for vinylbenzene over benzene in the downstream market was higher in November, with the gap exceeding 500 USD/MT for the month, although a spread of 250 USD/MT normally signifies a well-balanced market.

North America

Due to good demand and strong downstream sectors, price in North America remined on the higher end when compared to Q2 and Q3. In October, US vinylbenzene exports to the world declined by more than 9% due to rising freight charges on key US trade routes and a reduction in demand from key export destinations, according to a monthly analysis of the industry.

In October, US exports fell to 121,854 MT. In October, Mexico upped its imports of US vinylbenzene to 80,595 MT. Meanwhile, prices were relatively consistent in H2 of Q4, and according to evaluations from the second week of December, US pricing increased by 3% on a FOB basis, indicating early symptoms of a market change.

Vinylbenzene Price Trend For First, Second and Third Quarters of 2021

Asia

Supplies in the APAC area exhibited mixed results in the first quarter, as numerous facilities' turnarounds came to a conclusion and manufacturers worked at optimum efficiency. Prices in India spiked during the quarter, maintaining an average of 1084.5 USD/MT CFR JNPT due to increased demand from downstream industries such as ABS and Polyvinyl benzene.

In China, demand increased due to an influx of inquiries from downstream Polyvinyl benzene and ABS manufacturers and was claimed to have reached pre-pandemic levels in Q2. Dull purchasing attitudes in the Asia Pacific area drove down vinylbenzene prices in Q3. The market trend for vinylbenzene in India shifted higher, with prices rising from 1183 USD/MT to 1418 USD/MT in Q3 2021.

Europe

During the first quarter of 2021, supplies were scarce as a key vinylbenzene factory remained closed in early February, followed by poor industrial and commercial activity amid worries of a second COVID-19 pandemic.

However, opposite to supply, increasing demand led in a massive increase in its pricing. As merchants reported depleted pre-stocked stocks and delayed imports, the quarterly pattern was expected to continue. Benzene pricing trend evaluated optimistic attitudes in European nations during Q3.

The strong price of benzene resulted in a price increase for practically all styrenics. The downstream building and construction industries increased their demand for vinylbenzene in September. Throughout the quarter, offtakes from the ABS and Polyvinyl Benzene production plants remained steady. In September, the price of the chemical in Germany was set at 1340 USD/MT.

North America

Supplies in the North American area were constrained in Q1 2021, as several facilities were undergoing maintenance turnarounds throughout the first half of the year. Following that, cold weather in the US Gulf area created production difficulties, resulting in large plant outages in mid-February. However, demand was on the rise as downstream consumption improved, resulting in a sharp increase in regional prices from 1300 USD/MT in January to 1900 USD/MT on a CFR basis in March 2021.

Supplies increased in Q2 as the US Gulf region's industrial infrastructure recovered and heavy aromatic crackers ran at higher rates. Due to strong domestic demand for Styrenics like ABS and Polyvinyl Benzene, Styrolution and LyondellBasell removed the force majeures. With FOB Texas discussion valued at USD 1360 in June, the pricing pattern showed a progressive easing equal to market supply.

The market in North America underwent upheaval in the third quarter of 2021. As Hurricane Ida made landfall on the Gulf Coast of the United States, the AmSty manufacturing facility at Saint James, Louisiana, with a production capacity of 950 KTPA, was shut down preemptively, affecting the cost of the chemical in the region. During the last week of September, the price was 1310 USD/MT.

Vinylbenzene Price Trend For the Year 2020

Asia

Ample stockpiles of the chemical in China, along with unfavorable offtakes, cast a pall over the Southeast Asian market's fundamentals. Several firms, including SP Chemical and Abel Chemical, performed a quick turnaround in vinylbenzene producing units to balance the decreased demand and supply imbalance.

Although regional fundamentals improved, inventory levels in China did not shift significantly as numerous firms continued to operate at above 80 percent market competence. In August, vinylbenzene prices were range bound at 650-680 USD/MT CFR China, in line with the bleak market picture. By the conclusion of the quarter, demand for polyvinyl benzene and ABS had returned to normal, leaving just independent vinylbenzene makers in the red.

Europe

Since the end of August, numerous industrial and downstream industries had completed scheduled turnarounds, which helped to restore demand supply fundamentals in the European area. Producers were heard operating at lower rates in order to avoid losses caused by market instability.

In September, demand for downstream derivatives such as ABS and SAN increased significantly, owing to increased demand for automotive, electronics, consumer appliances, and furniture. However, thanks to Covid-19, demand from the construction industry remained cloaked in containment measures, with the UK and Russia leading the way with double-digit declines.

North America

Despite many maintenance turnarounds and forced outages due to worries of a succession of factories weighed on demand fundamentals. Despite this, a modest increase in vinylbenzene demand from the automotive sector gave a ray of optimism for the industry's overall demand fundamentals.

By the conclusion of the third quarter, demand from Asian countries such as Taiwan and South Korea had alleviated the supply glut. Seasonally storms, the supply of the chemical in North America was found to be adequate. Styrolution, a major US player, announced the closure of its two vinylbenzene plants in Texas and Bayport.

Procurement Resource provides latest prices of Vinylbenzene. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Vinylbenzene

Styrene is a chemical compound that has the formula C6H5CH=CH2. Although ageing samples might seem yellowish, this benzene derivative is a white oily liquid. The chemical is easy to evaporate and has a sweet odor, albeit it has a less pleasant odor at large concentrations. Polystyrene and many copolymers are made from styrene.

Vinylbenzene Product Details

| Report Features | Details |

| Product Name | Vinylbenzene |

| Industrial Uses | Construction, Plastics, Paints and Synthetic Rubber, Agricultural products, Chemical intermediate |

| Chemical Formula | C8H8 |

| Synonyms | Styrene, Phenylethene, Phenylethylene, Cinnamene, Styrol |

| Molecular Weight | 104.15 g/mol |

| Supplier Database | BASF SE, Braskem, Chevron Phillips Chemical Company LLC, China Petroleum & Chemical Corporation, Eastman Chemical Company, Exxon Mobil Corporation, Flint Hills Resources, Hengyi Industries Sdn Bhd, INEOS, LG Chem, LyondellBasell Industries Holdings BV |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Vinylbenzene Production Processes

- Vinylbenzene Production from Ethylbenzene; from Ethane and Benzene; Methanol and Toluene

In the process using ethylbenzene, a catalytic dehydrogenation process is used. Vinylbenzene is made by dehydrating diluted ethylbenzene with steam over a fixed-bed catalyst under adiabatic conditions.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com