Product

Ziram Price Trend and Forecast

Ziram Price Trend and Forecast

Ziram Regional Price Overview

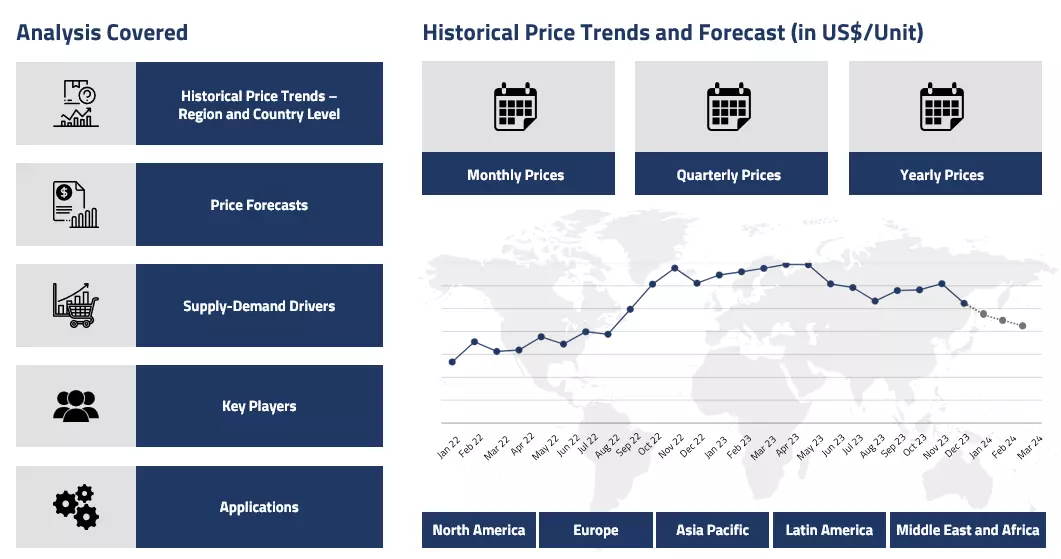

Get the latest insights on price movement and trend analysis of Ziram in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Ziram Price Trend for Q2 of 2025

In the second quarter of 2025, Ziram prices in China remained under pressure, mainly due to sluggish demand from key downstream sectors and an oversupplied zinc oxide market. Ziram, which relies heavily on zinc oxide and dimethylamine (DMA) as feedstocks, saw mixed cost pressures during this period. While zinc oxide prices softened throughout April due to high inventories and weak offtake—particularly from the tire and rubber industries—DMA price trends varied across regions, adding further complexity to the Ziram market.

Ziram Price Chart

Please Login or Subscribe to Access the Ziram Price Chart Data

Domestically, the poor performance of rubber-grade zinc oxide, driven by falling tire factory orders and high finished goods stockpiles, reduced the cost support for Ziram production. At the same time, low-grade zinc oxide prices temporarily rose due to supply shortages in steel ash, but this had limited impact on overall cost trends. Demand from ceramic and electronic-grade zinc oxide applications provided only partial support and could not compensate for the broader slowdown.

Meanwhile, dimethylamine trends diverged globally. In North America, DMA prices fell sharply due to lower agrochemical demand, export slowdown, and high inventories. However, in Asia-Pacific and Europe, prices rose moderately, supported by strong herbicide demand, stable feedstock costs, and increased pharmaceutical activity. This regional variation impacted import costs for DMA and caused some volatility in domestic Ziram production costs, though not enough to offset the weak demand fundamentals.

Analyst Insight

According to Procurement Resource, Ziram prices are expected to remain under pressure in the early part of Q3’25, if there is no significant recovery in the rubber, agrochemical and construction sectors.

Ziram Price Trend for Q1 of 2025

In the first quarter of 2025, Ziram prices followed region-specific trends shaped by shifting agrochemical demand, feedstock availability, and economic conditions. In North America, prices declined as weak demand from the agricultural sector persisted through winter. Cold weather and off-season conditions limited crop activity, reducing the need for fungicides like Ziram. Ample feedstock supply—particularly zinc and sulfur-based inputs—alongside cautious procurement behaviour and high production costs, further contributed to the bearish market trend.

In contrast, the APAC region experienced a mixed quarter. Ziram prices started weak in January and February due to sluggish agrochemical demand and reduced farm activity. However, March saw an upswing as preparations for the Kharif season ramped up, driving stronger consumption and stabilizing prices. Limited availability of raw materials and logistical delays due to the Lunar New Year also added mild cost pressure during this recovery phase.

Europe saw a firm pricing environment, with steady agrochemical demand throughout the quarter. Supply constraints, driven by ongoing logistical challenges and elevated input costs, supported a bullish price trend. The active plantation season further increased Ziram usage, particularly in Germany, where downstream demand remained strong.

Analyst Insight

According to Procurement Resource, Ziram prices may trend upward in the coming months, supported by seasonal agricultural demand and potential supply-side constraints from rising feedstock costs.

Ziram Price Trend for the Year 2024

In 2024, Ziram prices showed varied trends across regions, largely influenced by fluctuations in demand from the agrochemical sector and changes in feedstock costs, particularly zinc and sulfur derivatives. In the first half of the year, prices remained under pressure due to oversupply and muted demand in key agricultural markets, especially in North America and parts of Europe. Weather-related disruptions and cautious buying patterns from farmers led to lower procurement activity. Stable or falling zinc oxide and sulfuric acid prices also contributed to weaker cost support, keeping production costs relatively low and prices subdued.

In the third quarter, prices began to rise, especially in Asia and parts of North America, as favorable agricultural conditions revived demand. The agrochemical sector picked up pace with increased fertilizer and pesticide usage, which supported Ziram consumption. In the last quarter, despite moderate demand, prices remained steady to slightly firm due to rising input costs, logistical issues, and stronger manufacturing activity in India and Europe. Seasonal trends and improved crop output further helped sustain demand.

Analyst Insight

According to Procurement Resource, Ziram prices may remain stable with a slight upward bias, supported by consistent agrochemical demand and potential increases in feedstock costs.

Ziram Price Trend for the Second Half of 2023

Ziram price trend was observed to be inclining for the majority of the period under discussion. The agriculture sector anchored ziram’s market performance primarily. Along with that, the fluctuations in the feedstock zinc sulfate and dimethylamine prices were also reflected in ziram’s pricing fundamentals.

Quarter three began on a largely stable note at the beginning of July’23. The fungicide market was growing with higher demands as the summer season entailed a higher risk of fungal infections in crops. A significant rise in the energy prices and the feedstock materials prices also pushed the upstream production costs for ziram.

This pattern continued for most of the said period till the middle of the fourth quarter. However, the oversupplied inventories started dominating after that, and the prices started to plunge as the year-end approached. Overall, positive market sentiments were witnessed.

Analyst Insight

According to Procurement Resource, the Ziram market prices are likely to remain stable in the coming months. The supply and demand outlooks are aligned with each other, which suggests an equilibrium in the ziram market.

Ziram Price Trend for the First Half of 2023

Ziram is a fungicide used in farming to protect plants and crops from various fungal diseases. Its prices closely follow its feedstock Zinc Sulfate and Dimethylamine price fluctuations. Ziram market experienced a fluctuating price trend during the first half of the year 2023.

Inventory stocks were already high, so the upstream cost support was very limited. Suppliers got very few queries, so the price trend were mostly observed to be wavering on the lower side of the price curve. However, there were still some demands observed at the beginning of the first quarter, which pushed the prices up a little, especially in the Asian and American regions. But this incline was short-lived, and eventually, the momentum fizzled out. Overall, bearish market sentiments were observed owing to feeble demands.

Analyst insight

According to Procurement Resource, price trend for Ziram are expected to continue fluctuating since consumer demands continue to remain uncertain amid low consumer confidence and rising inflation.

Procurement Resource provides latest prices of Ziram. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Ziram

Ziram is a coordination compound of Zinc with dimethyl dithiocarbamate. It is a pale-yellow solid used as a broad-spectrum fungicide. It addresses scabs, leaf curls , brown rot and blight in plants and should be sprayed before the infection. As a protectant fungicide, Ziram remains active on the plant's surface, where it forms a chemical barrier between the plants and fungus. It can be directly sprayed on plants or via soil treatment.

Ziram Product Details

| Report Features | Details |

| Product Name | Ziram |

| HS CODE | 38089290 |

| CAS Number | 137-30-4 |

| Chemical Formula | Zn((CH3)2NCS2)2 |

| Synonyms | Zinc dimethyl dithiocarbamate, Dimethyl dithiocarbamic acid zinc salt |

| Molecular Weight | 305.81 g/mol |

| Supplier Database | Santa Cruz Biotechnology, Kinbester, CM-fine chemicals, Chemos |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Ziram Production Process

- Ziram Production from Dimethylamine and Zinc Sulfate

This process involves adding dimethylamine and ZnO to a reacting cylinder and then adding CS2 while blending. After the reaction process, the liquid is discharged from reacting cylinder, followed by water-washing, dewatering, and airflow-drying to obtain the solid product.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com