The Margins Of Ethylene/Ethane In The US To Stay Narrow In 2023

The US cracking ethane margin into ethylene will probably stay at an all-time low through 2023 as the feedstock ethane prices stay higher, and ethylene demand might remain feeble on downgraded regional and global GDP forecasts.

In high probability the US ethylene's premium to ethane will stay low in 2023 and must primarily oscillate in the middle of an all-time narrow range that occurred previously beginning in mid-2022 between -3¢/lb to +4¢/lb. Whether cracking margins drop in the middle of this range in 2023 will mainly rely on the everyday price volatility of ethane in the US.

Request Access For Regular Price Update of Ethylene

Among the most significant factors that propelled the narrowing of ethane cracking margins during 2022 was the price rise of US ethane, which was mostly following the natural gas prices in the US amidst the energy shock worldwide triggered by the invasion of Ukraine by Russia in February. US Ethylene is mainly linked to prices of natural gas and ethane, while pricing in Asia and Europe is tied more to the costs of crude oil and naphtha.

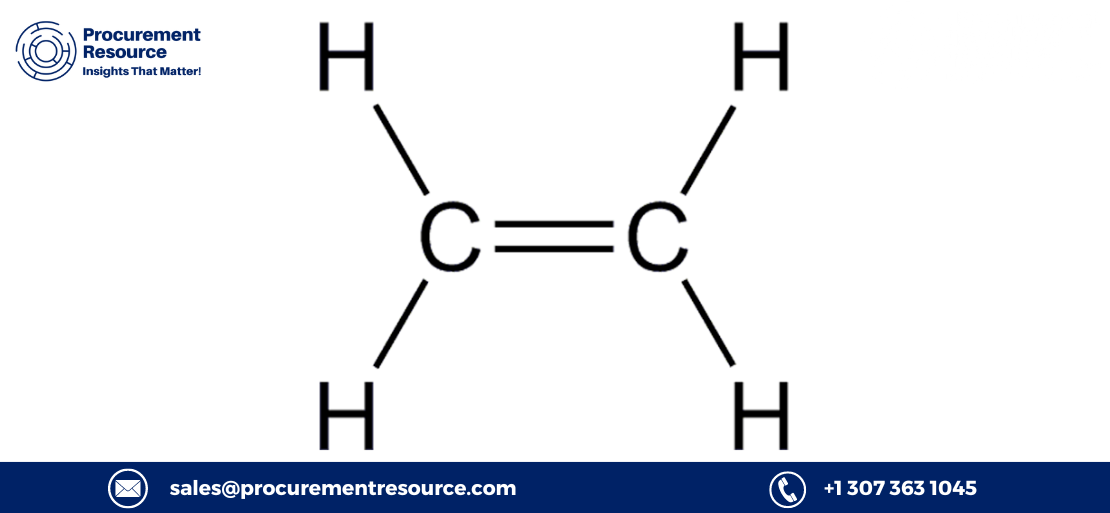

Ethylene is employed for a wide range of uses but mainly for being polymerized to make polyethylene (PE), which is the most prevalent plastic. It is also used to make ethylene oxide when it is oxidized, which is further used in products like paints, anti-freezes, and solvents. Also, Ethylene goes through chlorination in order to create ethylene dichloride (EDC), which is the principal element of polyvinyl chloride (PVC) pipes. In order to form ethylbenzene (EB), which is the main styrene building block used for making styrofoam, Ethylene is alkylated with benzene.

Prices of US ethane advanced in the first half of 2022 by a shocking 95.5pc, from 34.0625¢/USG to 66.625¢/USG. This doubling feedstock prices for ethane predictably corrupted US cracking margins, especially in the first half of 2022.

Margins for Ethane will likely stay on the positive spectrum during 2023, as they have since September began, as the US cracker fleet is able to consistently and tactically scale back run rates to retain profitability's modicum. US Gulf coast crackers are presently assessed to be operating at rates in the range of mid-to-high 70pc, which is way lower compared to the high 80pc to low 90pc rate range amidst a more promising supply-demand conditions for ethylene.

Read More About Ethylene Production Cost Reports - REQUEST FREE SAMPLE COPY IN PDF

Paired with downward run rates of cracker, a time for destocking ethylene must persist in the middle of 2023; in any case, the market attempts to work down inventory. Inventories of ethylene in the US set an all-time high during the first quarter of 2022 and slowly decreased in the second and third quarters.

US ethylene inventories were at 1.45mn metric tonnes (t) during the first quarter, as per American Fuel & Petrochemical Manufacturers (AFPM) data and later dropped to 1.24mn t in the second quarter after which it dropped again in the third quarter to 1.16mn t. This declining trend will persist till 2023.

As producers of ethylene make less product and deliberately work down inventory, margins for ethane cracking shall persist and hold the line at hardly positive; however, no noteworthy improvement in margin is expected till either costs of US ethane decline to more historic levels or ethylene derivatives demand such as polyethylene increases.

While the prices of US ethane did post a major 45pc decline through September-end from late August this year, present prices of ethane are still approximately double compared to the end of 2019. Costs will likely not fall back to the 15-20¢/USG late 2019 range because markets for natural gas will likely stay extremely volatile, as Ukraine's hostilities are unlikely to cease and will likely not cause an urgent unwinding of Western sanctions on the energy complex in Russia.

According to the article by Procurement Resource, the margins for US cracking ethane are expected to remain at an all-time low through 2023 as the costs of feedstock ethane stayed higher while ethylene demand stayed low on downgraded regional and global GDP forecasts. The narrowing of ethane cracking margins was caused due to the price rise of US ethane, which was triggered by natural gas prices in the US amidst the energy shock worldwide activated by the invasion of Ukraine by Russia in February.

However, it is anticipated that the US market might see an increase of 45% in ethylene supply by 2025, which will provide the petrochemical producers with a major competitive edge, especially in the European market.

.webp)