Product

Laurolactam Price Trend and Forecast

Laurolactam Price Trend and Forecast

Laurolactam Regional Price Overview

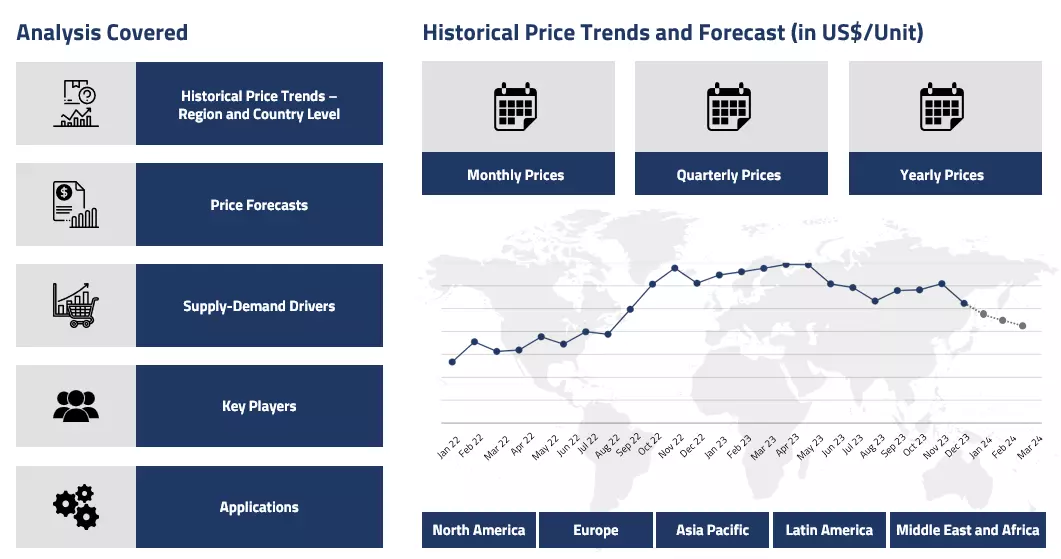

Get the latest insights on price movement and trend analysis of Laurolactam in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Laurolactam Price Trend for the First Half of 2025

Asia

In the first half of 2025, Laurolactam prices in Asia showed a gradual downward trend. This was mainly due to sluggish demand from key downstream sectors like engineering plastics and synthetic fibres. The early part of the year saw moderate activity, but by Q2, the market softened further as regional automotive production declined seasonally and exports remained weak.

Laurolactam Price Chart

Please Login or Subscribe to Access the Laurolactam Price Chart Data

Although there were brief supply-side disruptions, such as plant shutdowns in South Korea, the gap was quickly filled by rising imports from other countries. Margins came under pressure as rising upstream costs were not matched by any real improvement in end-user demand. Overall, the market remained oversupplied, and price recovery attempts failed to gain traction.

Europe

Laurolactam prices in Europe were relatively mixed during H1’25. Early in the year, there was some recovery as downstream demand particularly from automotive and industrial plastics showed signs of strength. This helped stabilize prices temporarily. However, logistical issues such as port congestion in key regions added delays and uncertainty, limiting further gains.

By Q2, downstream sectors began to diverge. While some applications held steady, others like rubber-based products weakened, dragging overall demand. The production cost environment stayed soft, offering little support for price hikes. Sentiment remained cautious as buyers hesitated to commit amid ongoing macroeconomic and trade uncertainties.

North America

In North America, Laurolactam prices faced steady downward pressure throughout the first half of the year. Demand from core industries, especially automotive and construction, remained muted despite a brief uptick in car sales in early Q2. That momentum quickly faded as high borrowing costs and inflation continued to weigh on consumer spending.

Procurement stayed conservative, and even though supply was well-balanced, weak downstream activity limited any scope for price recovery. Trade tensions and tariff uncertainties further dampened market confidence, resulting in cautious purchasing patterns and restrained price movement.

Analyst Insight

According to Procurement Resource, Laurolactam prices are likely to remain flat to mildly bearish unless downstream demand picks up meaningfully or supply tightens unexpectedly.

Laurolactam Price Trend for the Year 2024

Asia

In 2024, the Asian Laurolactam market experienced a year marked by fluctuations, mostly following the broader chemical and polymer industry trends. In the first half of the year, prices saw a steady rise as demand from the nylon sector remained strong and supply was impacted by logistical issues and higher freight costs. Disruptions in global shipping routes and regional tensions led to longer transit times and reduced import volumes, which kept the market tight.

Moving into the third quarter, prices declined briefly due to a slowdown in downstream consumption, as buyers turned cautious amid uncertain market signals. However, the situation reversed in the final quarter when supply constraints and improved sentiment led to a price rebound, especially in China. Southeast Asian markets largely mirrored China's pricing direction, ending the year on a firmer note.

Europe

Laurolactam prices in Europe remained relatively stable for most of the year. The market was supported by consistent demand from the automotive and textile sectors, even as energy and production costs shifted due to geopolitical tensions. During the middle of the year, prices dipped slightly owing to weak downstream interest and sufficient local supply.

However, scheduled maintenance at some facilities and seasonal demand in the final quarter helped maintain balance in the market. Though there was some pressure from imported material, it was offset by steady local consumption and controlled inventory levels.

North America

In North America, the Laurolactam market showed resilience throughout 2024. Early in the year, the market faced challenges due to supply chain disruptions and cautious buying, but steady demand from the manufacturing and automotive sectors provided support.

As the year progressed, prices gradually picked up, reflecting stronger industrial activity and a stable supply environment. Even though external uncertainties, such as upcoming political events, made market players slightly wary, overall demand held firm. Toward the end of the year, logistical challenges continued but did not heavily disrupt the pricing momentum.

Analyst Insight

According to Procurement Resource, Laurolactam prices are expected to stay firm, supported by recovering demand and tight global supply, though market risks from geopolitical and economic factors may cause some volatility.

Laurolactam Price Trend for the Second Half of 2023

Asia

A steep depreciation in the price trend of Laurolactam was observed during the third quarter as the muted demand from the downstream industries only increased the inventory levels concerning the traders. The investors in this sector were also skeptical due to rising uncertainties and along with the reduction in the prices of crude oil, the Laurolactam price trend moved southwards.

The bearish sentiments of the market perished during the fourth quarter, too. The end-user industries did not witness much difference in their functioning, but the stockpiles of Laurolactam inclined on account of excessive supply and unbalanced demand, reducing the Laurolactam prices by the end of the year 2023.

Europe

A visible decline in the market sentiments of Laurolactam prices was observed during the last two quarters of 2023. In view of oscillating market activities, the downstream polymers industries muted their trading activities and thus failed to offer any support to the Laurolactam price trend. Additionally, several other factors, such as downward driving crude oil prices and rising competition in the market, projected ill sentiments in front of the manufacturers of Laurolactam and thus led to the decline in Laurolactam prices.

North America

Initially, the devaluation in the Laurolactam market was not as sudden as observed in the European and Asian countries, as the prices first inclined during the third quarter and then steadily began to fall. In view of subdued demand from the downstream industries and accumulated inventories, the Laurolactam market sentiments lacked support and thus began to decline. Additionally, the fourth quarter also faced a cautious nature of overseas industries which further affected the Laurolactam price trend negatively.

Analyst Insight

According to Procurement Resource, the price trend of Laurolactam is estimated to struggle with the challenging downstream demand and declining cost of feedstock materials.

Laurolactam Price Trend for the First Half of 2023

Asia

Laurolactam is used as a raw material in the production of nylon and related fibers, and thus, its market dynamics are dependent upon it. In the first quarter, the prices of Laurolactam inclined as the demand from the downstream industries such as textile inclined, supporting the growth of the market. However, the excessive buildup of inventories, imbalance in the supply and demand sectors, and weak support from the feedstock market led to the decline in the price trend of Laurolactam.

Europe

The price trend of Laurolactam in Europe increased throughout the first and second quarters of 2023. During this time, the downstream textile businesses continued to see a rise in demand. To maintain the price trend of Laurolactam and deal with the rising inventory levels, the traders lowered their profit margins. In the first two quarters of 2023, this modification had a relatively negative impact on the Laurolactam market.

North America

In the early part of the first quarter, the price trend of Laurolactam experienced an upturn due to heightened demand from downstream industries. However, in the latter half of the first quarter and throughout the second quarter, prices declined due to an abundance of stockpiles and reduced demand from the textile sector. As a result, manufacturers and traders were compelled to lower their price quotations, ultimately leading to a decline in the price trend of Laurolactam.

Analyst Insight

According to Procurement Resource, the price trend of Laurolactam is estimated to struggle with the low demand from the downstream sectors and weak support from the feedstock markets.

Procurement Resource provides latest prices of Laurolactam. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Laurolactam

Laurolactam is a white, water-insoluble crystalline solid readily soluble in organic solvents like benzene and cyclohexane. It is acutely toxic to aquatic life, with long-lasting effects. Laurolactam belongs to the class of macrocyclic lactams and is primarily used as a monomer in the production of nylon-12 and other polyamides.

Laurolactam Product Details

| Report Features | Details |

| Product Name | Laurolactam |

| CAS Number | 947-04-6 |

| Industrial Uses | Plastics, Polymers, Chemical Substrates |

| Chemical Formula | C12H23NO |

| Synonyms | Azacyclotridecan-2-one, Dodecalactam |

| Molecular Weight | 197.32 g/mol |

| Supplier Database | Evonik Industries, Arkema SA, Merck KGaA, Toray Industries Inc, DowDuPont |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Laurolactam Production Processes

- Production of Laurolactam from Cyclododecane

In this process, cyclododecane is converted into cyclododecanone, which further reacts with hydroxylamine in the presence of an oximation solvent to produce cyclododecanone oxime. The intermediate is separated into the oily phase and the aqueous phase. It then undergoes rearrangement in the presence of rearrangement catalyst having an aromatic ring to give the desired Laurolactam.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e., government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com