Product

Lithium Carbonate Price Trend and Forecast

Lithium Carbonate Price Trend and Forecast

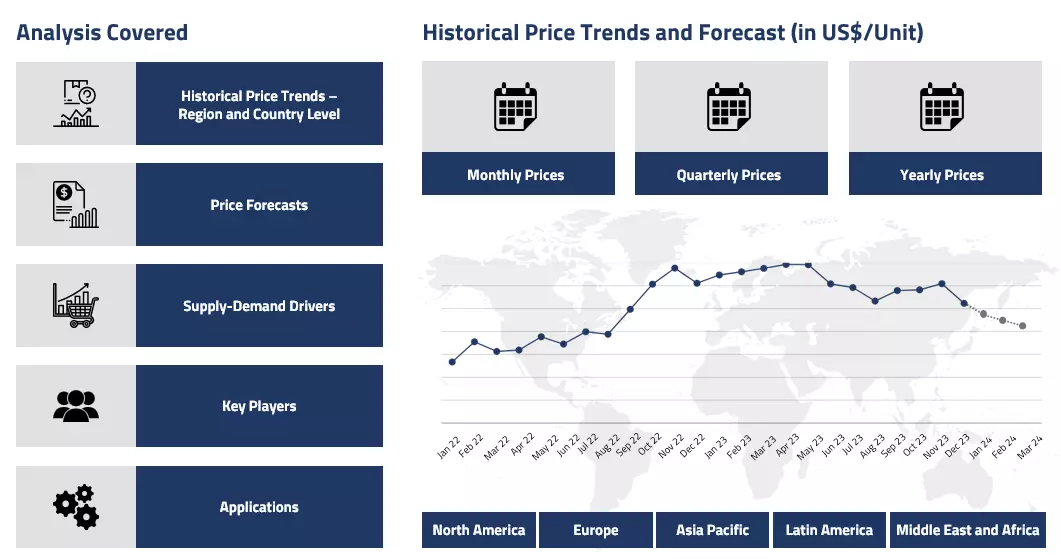

Lithium Carbonate Regional Price Overview

Get the latest insights on price movement and trend analysis of Lithium Carbonate in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Lithium Carbonate Price Trend for Q1 of 2025

| Product | Category | Region | Price | Time Period |

| Lithium Carbonate | Chemicals | China | $9,199/MT | March 2025 |

| Lithium Carbonate | Chemicals | USA | $10,988/MT | March 2025 |

Stay updated with the latest Lithium Carbonate prices, historical data, and tailored regional analysis

Asia

In Asia, lithium carbonate prices in the first quarter of 2025 experienced fluctuating trends, shaped by a persistent imbalance between supply and demand. The quarter began with downward pressure on prices, largely due to elevated production levels from key suppliers, especially China. Although maintenance shutdowns at several lithium salt plants temporarily restricted output, production quickly rebounded with strong momentum by mid-quarter. This recovery, combined with steady import volumes mainly from Chile added further weight to an already well-supplied market.

Lithium Carbonate Price Chart

Please Login or Subscribe to Access the Lithium Carbonate Price Chart Data

On the demand side, activity remained mixed. A slowdown in the electric vehicle (EV) sector led to weaker procurement, although this was partially offset by a short-lived recovery in demand from the energy storage segment. Overall, the market remained volatile, with pricing struggling to find stable support amid shifting fundamentals.

Europe

European lithium carbonate prices moved through a mixed trajectory in Q1 2025, reflecting the ongoing impact of global oversupply and uneven demand. Early in the quarter, elevated inventory levels and sluggish market activity kept prices under sustained pressure. Additional supply from major producers, particularly Chile, further reinforced the surplus.

Despite these challenges, the latter part of the quarter saw modest demand recovery—driven by gradual upticks in the electric vehicle (EV) and energy storage segments—which briefly steadied the market. Even so, the broader sentiment remained cautious, with persistent oversupply continuing to limit any meaningful upward momentum in prices.

North America

North America’s lithium carbonate market experienced fluctuating price trends in the first quarter of 2025, largely shaped by rising supply and muted demand. Regional production increased following the resumed operations at several lithium salt plants, contributing to a growing global surplus. However, persistent geopolitical tensions and weak demand from key sectors particularly electric vehicles (EVs) continued to weigh on prices.

Expectations of expanded global capacity, especially from Chile and Australia, further compounded the supply overhang. While late-quarter signs of stabilization emerged, driven by a modest uptick in EV demand, policy uncertainties and supply chain disruptions sent mixed signals across the market. Prices steadied slightly by quarter-end, though the outlook remained cautious as producers worked to recalibrate supply strategies.

Analyst Insight

According to Procurement Resource, lithium carbonate market is likely to remain volatile in the near future. Downstream sectors appear supportive; however, the supply situation will also remain a key driver.

Lithium Carbonate Price Trend for Q4 of 2024

| Product | Category | Region | Price | Time Period |

| Lithium Carbonate | Chemicals | China | 10942 USD/MT | October 2024 |

| Lithium Carbonate | Chemicals | China | 10715 USD/MT | December 2024 |

| Lithium Carbonate | Chemicals | USA | 11080 USD/MT | October 2024 |

| Lithium Carbonate | Chemicals | USA | 10800 USD/MT | December 2024 |

Stay updated with the latest Lithium Carbonate prices, historical data, and tailored regional analysis

Asia

Asia witnessed range-bound movements in the lithium carbonate price curve during the early part of Q4, driven by stable production and moderate demand. A balance between supply and demand emerged following the Golden Week holidays in October. However, as the quarter progressed, downstream consumption, particularly in the industrial and automotive sectors, slowed due to seasonal factors.

Consequently, prices began to decline toward the end of the quarter as manufacturers reduced procurement to manage year-end inventories. The monthly average prices for lithium carbonate went from about 10942 USD/MT in October 2024 to around 10715 USD/MT by December 2024. This downward trend was further reinforced by weakening export demand, an oversupply in regional markets, and bearish industry sentiment.

Europe

The lithium carbonate market in Europe exhibited mixed trends during the last quarter of 2024. Supply chain challenges and import restrictions influenced the price trajectory, which closely followed trends in the Chinese market. At the beginning of the quarter, fluctuations in production and inventory levels were driven by regional shifts. Despite stabilization efforts, the automotive industry experienced a decline in demand due to the ongoing seasonal slowdown. Although market stabilization policies had some effect, they did not fully counteract the impact of high inventory levels carried over from previous quarters. The market faced oversupply and cautious demand for battery-grade lithium carbonate, leading to a downward price trend throughout the period.

North America

In North America, lithium carbonate prices followed global trends, initially remaining stable before turning downward. During the first half of the fourth quarter, prices experienced moderate movements, but demand from key industries, such as automotive and infrastructure, declined as the quarter progressed. The price trajectory moved downward due to seasonal fluctuations and cautious purchasing behavior from downstream buyers.

The monthly average prices went from about 11080 USD/MT in October’24 to around 10800 USD/MT in December of 2024. Additionally, with ample availability of both domestic and imported materials, there were no significant supply bottlenecks, further contributing to the price decline as market participants prioritized year-end inventory adjustments and stock clearance. Towards the end of the quarter, demand remained subdued as downstream industries shut down for the Christmas holidays.

Analyst Insight

According to Procurement Resource, the lithium carbonate price graph is expected to show downward movements in the near future as ample supplies due to low-cost production are likely to suppress market prices.

Lithium Carbonate Price Trend for Q3 of 2024

Asia

The prices of lithium carbonate showed an overall declining trend throughout the third quarter of 2024. In early July, an incline in the inventory volumes could be witnessed since the manufacturers were utilizing capacities optimally anticipating higher demands from both domestic and international markets. Lithium carbonate production from both lithium concentrate and lithium mica became high. However, downstream demand from the lithium hydroxide and other consuming sectors was weak and failed to meet earlier anticipations.

The demand from the electrode sector improved but was limited. The market experienced pressure from high inventories and overcapacity. As the inventories continued to accumulate, the prices declined further. Overall, a falling price trajectory was observed in the Chinese lithium carbonate market during the said time period.

Europe

The lithium carbonate market maintained a pessimistic outlook in the third quarter of 2024. The oversupply of feedstock lithium and weak demand from the downstream sectors dragged the prices down. With major downstream demand for lithium carbonate coming from the automobile sector, the price of lithium carbonate suffered as the sales of new cars were low in the said period. Significant declines in new car sales, as well as a sharp drop in electric vehicle (EV) sales, were witnessed in major markets like Germany, France, and Italy.

North America

The lithium carbonate market in North America followed trends similar to those observed in other global markets, maintaining a sullen outlook throughout the third quarter. Prices of lithium carbonate declined, mirroring the downward trajectory seen in the Chinese market. Significant investments in the battery sector are being expected, with around $50 billion anticipated to be invested in battery production facilities by the end of the year, as companies like Panasonic, LG Energy Solution, and Samsung SDI expand their operations. However, the overall market could not counter the global decline in lithium prices caused by overproduction.

Additionally, International Battery Metals (IBAT), a Canadian company, announced the suspension of operations at its direct lithium extraction plant due to a significant decline in lithium prices, which have dropped over 80% in the past year due to overproduction in China and reduced electric vehicle demand. This downturn has also affected other companies, with Chinese battery manufacturer CATL halting production at some mines and Albemarle implementing cost cuts and layoffs.

Analyst Insight

According to Procurement Resource, the prices of lithium carbonate are expected to remain fluctuating due to ample supply and high inventories amid low demand from the downstream sectors.

Lithium Carbonate Price Trend for Q2 of 2024

Asia

Throughout the second quarter of 2024, the price trend of lithium carbonate in China witnessed a continuous decline. The primary cause of this decline was attributed to the rise in supply of the commodity coupled with a slowdown in demand. On the supply side, the production levels inclined as the majority of operational plants raised their efficiency after the May Day holidays, increasing the quarterly supply of the commodity. However, the procurement rates of the commodity did not grow in parallel with it but were better than the last quarter.

The battery manufacturing industries maintained their production schedules. However, towards the end of the quarter, the end user new energy vehicles market reported a slight improvement in the market trend, raising the hopes of the traders for future quarters.

Europe

The European countries struggled with the frail outlook of the EV battery industries, reflected in the southward movement of lithium carbonate prices. Throughout the second quarter, the countries struggled with their dependence on Chinese imports of raw materials. This was further strained by the rising freight charges and delayed shipment arrivals amid rising tensions at the Red Sea and the re-routing of its trade route.

Another setback for the market came from the reduced purchasing activities of the consumer as the swindling economic indicators amplified their concerns and pushed them to opt for a cautious approach. Although the reduction of the European Central Bank’s interest rates towards the latter end of the quarter aimed at stabilizing the market momentum a little its effect is yet to be seen on the pricing patterns of lithium carbonate.

North America

In North America, the growth of EV demand during the second quarter of 2024 was slower than anticipated by the trading community. The surge in import volumes of the commodity indicated a gradual recovery of the supply sector of the market. Additionally, the in-house production of the commodity was also geared up in anticipation of the escalating momentum of the downstream industries. However, the high inflationary pressure and surge in interest rates raised the borrowing costs for the downstream industries and thus depreciated their procurement appetite, asserting an adverse effect on the pricing trajectory of lithium carbonate.

Analyst Insight

According to Procurement Resource, the price of Lithium Carbonate is expected to trace the trajectory set by the end-user EV industries and improved strategies for the global supply of lithium.

Lithium Carbonate Price Trend for Q1 of 2024

| Product | Category | Region | Price | Time Period |

| Lithium Carbonate | Chemicals | USA | 14500 USD/MT | March 2024 |

| Lithium Carbonate | Chemicals | Europe | 14350 USD/MT | March 2024 |

| Lithium Carbonate | Chemicals | South America | 13800 USD/MT | March 2024 |

Stay updated with the latest Lithium Carbonate prices, historical data, and tailored regional analysis

Asia

In the first quarter of 2024, the lithium prices remained stable in China, Japan, and Korea which further influenced the stability in the pricing patterns of lithium carbonate. The weak consumer demand and limited transactions during the initial phase of the quarter in China, soured the optimism of the manufacturing as well as the trading sector, well reflected in the dim outlook of lithium carbonate prices during the first half of the quarter.

Similarly, South Korean, and East Asian traders also reported poor demand, both in battery and original equipment manufacturing sectors. However, in China and India, despite of sluggish demand for battery-grade lithium salts, the improvement in the economic growth of the region supported the stabilization of the lithium carbonate price trend. Overall, the market remained quiet, with buyers well stocked and end user industries showcasing little appetite for the compound.

Europe

Throughout the first quarter of 2024, the German market witnessed a continued decline in lithium carbonate prices due to weak support from upstream spodumene ore and other raw materials, affecting production costs. This decline was further escalated by the weak demand from downstream lithium-ion batteries and energy storage systems manufacturers. Towards the end of the quarter, the prices experienced much more steeper decline due to the influx of cheaper imports from Chile and other nations.

The market players, in the mid of the quarter, adopted a wait-and-watch approach as they eyed towards the conclusion of Lunar New Year celebrations in China. Additionally, shifts in market dynamics, such as the reduction in the traditional premium of lithium hydroxide prices over lithium carbonate prices in the Europe and global shipping disruptions eventually limited the growth momentum of the lithium carbonate market.

North America

In the first quarter of 2024, the USA's lithium carbonate attained stagnancy, showing consistent prices without any significant fluctuations. Prices have aligned with European rates and maintained a premium over CIF seaborne Asia prices. Despite the increase in new vehicle sales in the US from January to March, the battery manufacturing industries registered a dim market momentum which was well reflected in the pricing pattern of lithium carbonate.

Additionally, due to factory shutdowns, shipping delays, and a power outage in the region, the consumers were skeptical of raising their demand quotations. The trading challenges caused by low water levels in Panama Canal and reduction in the imports from Asian countries via Red Sea route further exerted a negative influence on the pricing trajectory of lithium carbonate.

Analyst Insight

According to Procurement Resource, the price trend of Lithium Carbonate is estimated to dwindle with the oscillating global trading patterns and rising skepticism among the downstream industries.

Lithium Carbonate Price Trend for October - December of 2023

Asia

With lithium carbonate prices plummeting, the Chinese refining companies were forced to either reduce or suspend their production activities. The significant drop in battery material prices further escalated the losses for Chinese producers, which was eventually visible in the significant drop in lithium carbonate prices. Further, as the EV battery manufacturers in China held back purchases, the inventories accumulated and challenges for the lithium carbonate traders inclined.

Europe

The challenging conditions of the lithium carbonate market were not only limited to the Asian countries as the European region also faced similar struggles. The inflationary and economic challenges carried forward by the previous quarters and supply chain disruptions led to a substantial fall in trading activities. Further, in line with the Asian countries, the functioning of the downstream EV batteries sector faced an abrupt slowdown as it itself suffered from the ill consequences of the deteriorating US-China relations and enhanced dependence on Russian imports. These unfavorable dynamics of the market eventually caused the downfall of lithium carbonate prices.

North America

In Q4 of 2023, the US lithium carbonate market faced persistent weakness with declining prices attributed to South American imports and sluggish demand from electric vehicle battery manufacturers. Additionally, the increased domestic production and reduced raw material costs contribute to a rise in market pressure. Further, the overall trend of lithium carbonate prices mirrored trend in China and Europe, marked by surplus inventories and subdued downstream demand. Another factor that influenced the prices heavily was the falling prices of lithium salts, which reduced the overall manufacturing costs and, in turn, the lithium carbonate price trajectory.

Analyst Insight

According to Procurement Resource, the price trend of Lithium Carbonate are estimated to oscillate as the downstream EV sector is yet to show any positive signs in its market movements.

Lithium Carbonate Price Trend for July - September of 2023

| Product | Category | Region | Price | Time Period |

| Lithium Carbonate | Chemicals | India | 35000 USD/MT | July’23 |

| Lithium Carbonate | Chemicals | India | 30000 USD/MT | September’23 |

Stay updated with the latest Lithium Carbonate prices, historical data, and tailored regional analysis

Asia

The Asian lithium carbonate market registered consistent depreciation during the said period of the third quarter of the year 2023. Because of its growing demand over the past year, especially from the lithium-ion battery manufacturing sector, the suppliers had started hoarding products, anticipating higher profits. However, the demands plateaued after a point and pushed the lithium carbonate market prices downhill.

The lithium carbonate prices in the Indian domestic market slid by around 10% initially from July to August and then further dropped by around 4% in the next set of months. The monthly average spot prices plunged from about 35000 USD/MT in July to around 30000 USD/MT in September’23. Overall, slumping market trend were observed for lithium carbonate throughout the said period of Q3’23.

Europe

The European lithium carbonate market also mirrored the Asian market trend as the prices kept falling throughout the given quarter here as well. Since the lithium carbonate prices had fallen in the international market the import rates subsided for Europe. Along with that, the domestic downstream consumption industries were not responding in a very favourable manner since the market queries also slumped. The existing stocks were well capable of catering to whatever demand was posed during the said time period.

North America

The North American lithium carbonate market could behave no differently than the other global markets as the prices depicted a downward wavering graph here as well. With a widened gap between the supply and demand dynamics of the region, the market prices plunged throughout the third quarter of the year 2023.

Analyst Insight

According to Procurement Resource, not much improvement is expected in the Lithium Carbonate price trend going forward. The price forecasts suggest that the prices will continue to fall for some time in the coming months as well.

Lithium Carbonate Price Trend for the First Half of 2023

Asia

The lithium carbonate market followed a bearish trend in the first quarter and during the initial phase of the second quarter of 2023. The weak demand from the downstream industries and the rising level of inventories challenged the growth of the lithium carbonate price trend.

In the second half of the second quarter, the trend reversed, and the market showed some positive movements. The inventories started to deplete as the domestic manufacturers were unable to get the raw materials, due to which the rates of production fell. In addition to this, the demand for electric vehicles and the automotive sector increased significantly during this time, leading to the rise in the price trend of lithium carbonate.

Europe

In Europe, the downfall in the price trend of lithium carbonate was a result of a number of reasons. The quotes offered by the downstream industries declined consistently during the first two quarters, and along with the rise in inflation and energy prices, the price trend of lithium carbonate struggled to maintain its momentum. The purchasing potential of domestic as well as international consumers also slumped while the supply chains worked efficiently, causing the price trend of lithium carbonate to decline.

North America

In the first two quarters, the lithium carbonate market in the US struggled with a decline in the number of new orders and a drop in competition among the EV manufacturers. Further, with the revival of the Chinese automotive and manufacturing sector after a long stretch of stagnancy, its dependency on North American imports declined, which negatively affected the lithium carbonate price trend.

Analyst Insight

According to Procurement Resource, the price trend of Lithium Carbonate is estimated to decline as the consumption rates of EV industries will likely decline in the upcoming quarters.

Lithium Carbonate Price Trend for the Second Half of 2022

Asia Pacific

The supply-demand dynamics struggled to find equilibrium in the Asian market during the third quarter of 2022. Supply from the manufacturers was not able to meet the increasing demand from the market and during the same time, some significant manufacturers temporarily restricted their production. Instead of benefiting from this disproportion, the prices plummeted in the region. Even in the fourth quarter, the market struggled to gain momentum. The price trend of Lithium carbonate was mostly affected by the subsidies on new energy vehicles.

Europe

The prices of Lithium carbonate fluctuated in the third quarter of 2022. The decline in sales, high inflation rates, and soaring energy production costs remained a challenge for the European market. The market trend of Lithium carbonate was thus, similar to that observed in the Asian-Pacific market. In the later months of the fourth quarter, the prices declined due to low demand, restricted exports, and fluctuating economic conditions. The price drop was also attributed to the drop in market competitiveness.

North America

In the third quarter, the North American region showcased a positive trajectory. This trend was supported by the consistent support of the feedstock prices and as a result, the profit margins of the producers increased. The fourth quarter did not follow the trend of the third quarter. The decline in the prices was due to a rise in inventories, weak market sentiments, and a drop in the growth of the electric vehicles market. The battery manufacturing industries were also not able to increase their supply and thus the price trend of Lithium carbonate took a dip in the fourth quarter.

Analyst Insight

The prices of Lithium Carbonate are estimated to decrease in the upcoming quarter. The decline in the growth of the electric vehicle sector, uncertainties in the market, and low demand from the end-user industries will play a major role in deciding the price trend of Lithium Carbonate.

Lithium Carbonate Price Trend for the First Half of 2022

Asia

The price trend for Lithium Carbonate kept strong during the first quarter owing to the limited inventory and high downstream demand. The downstream lithium hydroxide market was on the rise owing to the strong cost support. The second quarter continued with positive price trend. However, the prices fell slightly mid-quarter as the demand side was impacted owing to epidemic restrictions. Also, the acceptance of high-priced lithium salts was low.

Europe

Lithium carbonate prices surged throughout the first quarter owing to robust demand from the downstream sectors. With the manufacturers restricting activities with the Russian suppliers, the feedstock prices soared. The situation worsened with the Russian invasion of Ukraine, triggering an energy crisis and high-cost inflation. The prices dwindled but recovered soon as the demand surpassed the supply.

North America

Similar price trend were seen in the US domestic market. The prices kept high owing to solid demand amid labour shortages, power consumption restrictions, high feedstock prices, supply shortages and inflationary pricing. With the world switching to greener methods a massive surge in the market was created to acquire lithium carbonate manufacturing processes/facilities, thus driving the prices further.

Procurement Resource provides latest prices of Lithium Carbonate. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Lithium Carbonate

Lithium Carbonate is an inorganic salt heavily used in the production of metal oxides. It is a potent irritant when mixed with water. It is an essential medicine as it is used in the treatment of mood disorders. It is widely used in the manufacturing of lithium-ion batteries.

Lithium Carbonate Product Details

| Report Features | Details |

| Product Name | Lithium Carbonate |

| HS CODE | 283691 |

| CAS Number | 554132 |

| Chemical Formula | Li2CO3 |

| Synonyms | Carbonic Acid lLithium Salt, Dilithium Carbonate |

| Molecular Weight | 73.89 g/mol |

| Supplier Database | Tianqi Lithium, Targray |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Lithium Carbonate Production Process

Lithium carbonate is manufactured via brine. The impurities such as boron and magnesium is removed from the brine which is then precipitated by adding sodium carbonate. The precipitate obtained is subjected to purification process thereby giving lithium carbonate.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e., government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Related News

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com