Product

Neopentyl Glycol Price Trend and Forecast

Neopentyl Glycol Price Trend and Forecast

Neopentyl Glycol Regional Price Overview

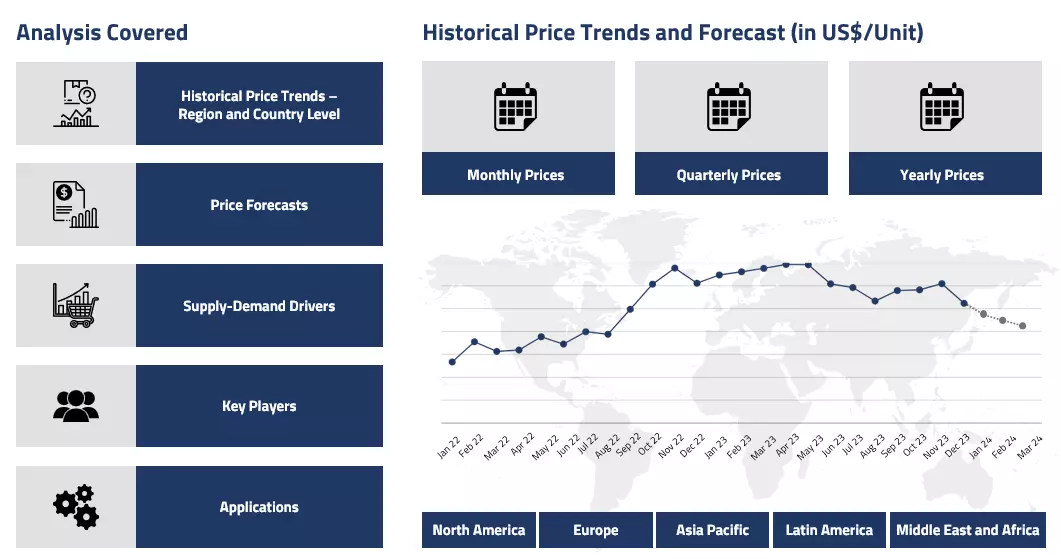

Get the latest insights on price movement and trend analysis of Neopentyl Glycol in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Neopentyl Glycol Price Trend for the Q4 of 2024

Asia

The Neopentyl Glycol market in Asia experienced notable fluctuations during the fourth quarter of 2024, primarily driven by variations in the price of formaldehyde, a key feedstock. In India, formaldehyde prices initially increased in the early part of the quarter before gradually declining toward the end. This directly impacted Neopentyl Glycol production costs, leading to moderate adjustments in market prices.

Neopentyl Glycol Price Chart

Please Login or Subscribe to Access the Neopentyl Glycol Price Chart Data

Steady demand from the coatings, plastics, and construction industries helped maintain price stability during the initial phase, supported by strong procurement activity that sustained overall market sentiment. However, as the quarter progressed, production cost pressures and fluctuations in raw material availability contributed to price corrections. In response, regional manufacturers adjusted their production levels to align with changing feedstock costs, ensuring sufficient supply while preventing market oversaturation.

Europe

In Europe, the Neopentyl Glycol market remained relatively stable at the beginning of the fourth quarter of 2024. Consistent demand from end-use sectors such as automotive and building materials supported steady pricing. However, as the quarter progressed, the market experienced a seasonal slowdown, particularly during the holiday period, leading to a slight decline in demand.

In response, manufacturers adjusted production volumes to prevent inventory buildup. Meanwhile, import activities helped maintain a stable supply chain despite reduced industrial activity. Toward the end of the quarter, the overall price trend reflected a slight dip, primarily driven by declining feedstock costs and weaker downstream demand.

North America

The North American Neopentyl Glycol market followed a similar pattern to that of Europe, maintaining stable conditions during the early part of the fourth quarter of 2024, supported by consistent demand from the construction and coatings industries. However, as the quarter progressed, the market experienced a seasonal downturn due to reduced industrial activity around the holiday period.

Pricing trends reflected this shift, with initial stability followed by a slight decline as downstream demand softened. Domestic production, coupled with stable imports, ensured adequate supply levels, preventing any significant disruptions. By the end of the quarter, the market remained well-balanced, aligning with seasonal adjustments in supply and demand dynamics.

Analyst Insight

According to Procurement Resource, the neopentyl glycol price graph is expected to exhibit similar trends in the near future, primarily influenced by fluctuations in feedstock costs.

Neopentyl Glycol Price Trend for the Q3 of 2024

Asia

In Asia, the neopentyl glycol market exhibited a contrasting trend, with prices remaining weak to stable throughout Q3 2024. The region’s market was characterized by a balanced supply-demand scenario, where growth in demand was limited. In key Asian markets like China and India, demand for neopentyl glycol was sluggish, driven by adverse weather conditions and weakened downstream activity. In India, heavier-than-expected rainfall disrupted construction activities, reducing the demand for neopentyl glycol used in construction-related products like paints and coatings.

Similarly, in China, seasonal demand for neopentyl glycol slowed, further hampered by weather disruptions caused by Typhoon Yagi and concerns over potential damage from Typhoon Bebinca. These uncertainties, along with the slowdown in the construction sector and business closures during the Mid-Autumn Festival, further dampened market sentiment. As a result, the Asian neopentyl glycol market remained largely subdued, with limited upward pressure on prices.

Europe

In Europe, the neopentyl glycol market remained relatively stable during Q3 2024, showing moderate demand across key sectors. The region’s construction and manufacturing industries, while not exhibiting the same level of demand surge seen in North America, continued to support a steady consumption of neopentyl glycol. European industries, particularly in the paints and coatings segment, relied on neopentyl glycol for production, maintaining a consistent level of demand. However, unlike the North American market, Europe did not face as tight a supply chain, allowing the region to avoid significant price spikes. The steady availability of neopentyl glycol in Europe, combined with stable but not overly robust demand, kept the market balanced without significant price fluctuations.

North America

In North America, the neopentyl glycol market experienced a noticeable upward trend in prices during Q3 2024. The primary driver of this price surge was strong demand from the downstream construction sector, which maintained robust purchasing activity throughout the quarter. The construction industry, particularly in the United States, saw sustained growth, adding significant job opportunities and driving demand for materials like neopentyl glycol, which is widely used in the production of construction paints and coatings.

Additionally, anticipation of further growth in the construction sector motivated consumers to stock up on construction materials, leading to increased purchasing activity for neopentyl glycol. Despite this heightened demand, the North American market maintained a relatively balanced supply, as inventories of domestically produced neopentyl glycol were sufficient to meet consumption needs. While supply remained tight, it was not enough to trigger significant shortages, but the overall imbalance between strong demand and steady supply contributed to an upward movement in neopentyl glycol prices.

Analyst Insight

According to Procurement Resource, the price trend of Neopentyl Glycol is expected to favor from the surging demand from the downstream industries and rising production costs in the adjacent quarters.

Neopentyl Glycol Price Trend for the Q2 of 2024

Asia

The Chinese neopentyl glycol market experienced considerable price volatility throughout the second quarter of 2024, ultimately leading to a significant price increase by the end phase. This volatility occurred despite a decrease in demand from the downstream sector. The primary driver of the price surge was the rising costs of key raw materials, including formaldehyde and crude oil, which led to higher production rates and, consequently, increased neopentyl glycol prices.

Additionally, the market faced significant disruptions due to factory equipment malfunctions and partial sales stoppages, resulting in a shortage of goods and further constraining supply. Further, the inflation in key production areas also contributed to increased production costs, intensifying the supply issues and driving prices higher. Even though the demand from the paints and coatings sector was somewhat bleak, the elevated production costs mitigated the effect of this reduced demand on neopentyl glycol prices.

Europe

The compounded effect of constrained supply chains and gradual improvement in the demand for neopentyl glycol led to a positive inclination in its price trend during the second quarter of 2024. From the supply side, the market was challenged by limited Asian imports due to escalating costs of transport and longer lead times. On the demand side, the market registered some gains amid improving downstream activities as relaxation in economic constraints and fall in market competition re-directed the focus of end-user industries towards domestic produce and helped in the surge in the pricing trajectory of neopentyl glycol.

North America

In North America, the neopentyl glycol market saw relative price stability initially as compared to the Asian markets, which was followed by a slight increase in the latter part of June. This pricing pattern was largely due to moderate demand from the downstream paints and coatings industry. However, the primary factor behind the eventual price uptick was a constrained supply situation within the United States. The supply constraints were compounded by high costs associated with imports, influenced by elevated freight charges and shipping delays caused by persistent port congestion.

The costs of importing neopentyl glycol were notably higher due to increased average container prices and doubled leasing rates on key routes from Asia to the US. Despite these challenges, demand from essential downstream sectors remained moderate, but a resurgence in new orders led US service providers to increase their production activities significantly towards the end of the second quarter. This increase in business activities added upward pressure on neopentyl glycol prices amidst the ongoing supply difficulties.

Analyst Insight

According to Procurement Resource, the price of Neopentyl Glycol is expected to be driven by rising demand from the downstream industries and limited support from the global production rates of the commodity.

Neopentyl Glycol Price Trend for the Q1 of 2024

| Product | Category | Region | Price | Time Period |

| Neopentyl Glycol | Chemicals | USA | 2300 USD/MT | March’24 |

| Neopentyl Glycol | Chemicals | Europe | 2130 USD/MT | March’24 |

Stay updated with the latest Neopentyl Glycol prices, historical data, and tailored regional analysis

Asia

In China, the neopentyl glycol market saw slight increases in domestic prices, attributed to heightened upstream cost support. The manufacturing units of neopentyl glycol raised their production rates in anticipation of improving market conditions. The direct downstream industries also experienced marginal growth after the Chinese New Year holiday season.

The upstream isobutyraldehyde prices in the domestic market also rose slightly, contributing to overall cost support for neopentyl glycol. However, downstream demand from the paint industry remained sluggish, indicating a cautious procurement approach among end-user industries. However, towards the end of the quarter, the neopentyl glycol market underwent slight fluctuations, but with the rising cost support from the upstream isobutyraldehyde market, the neopentyl glycol market prevailed an uptrend in its pricing patterns.

Europe

In line with global trends, the neopentyl glycol market in Europe experienced a consistent upward trajectory in prices, primarily driven by heightened demand, particularly from the paints and coatings industry. This surge is evident through notable increases in neopentyl glycol demand, notably attributed to a rise in new car production, highlighting its significant consumption of automotive paints and coatings.

Additionally, the economic indicator of the market suggests a modest decrease in the Euro area's annual inflation, reflecting an improving economic landscape marked by and slow and gradual rise in industrial growth of the market, favoring the incline in neopentyl glycol prices. The loss of imports further depreciated the level of inventories at a faster pace than anticipated by traders, eventually leading to an uptrend in the prices of neopentyl glycol.

North America

During the first quarter of 2024, the neopentyl glycol market witnessed divergent trends during the early and later phases of the quarter. Initially, neopentyl glycol prices surged due to the escalating costs of essential raw materials like crude oil and benzene, coupled with strong demand from the paints and coatings sector.

This demand surge was further driven by a remarkable surge in sales figures in the automotive and construction sectors, with increased activity observed in the US construction sector, particularly in renovation projects and housebuilding activities. The stabilization of mortgage rates further bolstered the market outlook. However, escalating raw material costs pressured OQ Chemicals' margins, prompting a necessary price hike for neopentyl glycol to maintain profitability.

Analyst Insight

According to Procurement Resource, the price trend of Neopentyl Glycol is expected to be driven by the rising appetite of downstream paints, coatings, and automotive industries along with the surging cost of feedstock benzene and crude oil.

Neopentyl Glycol Price Trend for the October - December of 2023

Asia

The price trend of neopentyl glycol, after registering a good start at the beginning of the last quarter of 2023, could not uphold the momentum till the end of the said quarter. The reduction in quoted prices of neopentyl glycol in China was based on the challenges presented by the downstream and upstream industries.

The escalation of last quarter was based on the appreciation of the Chinese currency as compared to the US dollar; however, this was not sufficient to drive the neopentyl glycol prices upwards in Q4 of 2023. The meek procurement and robust rise in inventory levels exacerbated the negative influence on the neopentyl glycol price trend and pushed them toward the lower end of the spectra.

Europe

The oscillations in the neopentyl glycol prices during the fourth quarter of 2023 were caused by the complex interplay of a number of macro and micro-industrial factors. The rate at which the European industrial sector was progressing was altered by the rise in economic challenges. The German and French economies shrank by significant numbers, and this caused ripples in the manufacturing and trading sectors, leading to fluctuations in the neopentyl glycol prices.

North America

The neopentyl glycol price trend in North America mirrored the trend observed in European countries. None of the market determiners supported the neopentyl glycol momentum in the fourth quarter of 2023. The demand from the downstream industries was lukewarm, and along with this, the declining prices of crude oil lowered the production cost, and thus, the traders had no choice but to reduce their price quotations in order to sustain in the competitive market.

Analyst Insight

According to Procurement Resource, the price trend of Neopentyl Glycol are expected to be dictated by the fluctuating cost of raw materials, rising pressure of inflation, and strict monetary policies adopted by the government around the world.

Neopentyl Glycol (NPG) Price Trend for the July - September of 2023

Asia

Neopentyl Glycol experienced a very mixed market run in the Asian region during the given period of Q3’23. After a slow start initially, the first half witnessed a notable retardation in the price graph. This downfall in neopentyl glycol prices was a testament to the slow pace of post-COVID economic recovery in China.

Since the construction businesses suffered from dull demands, the market queries for neopentyl glycol were also tumbling. However, the second half of the quarter saw the neopentyl glycol market making a rebound as the purchase orders finally started coming in. Since the inventories finally started vacating and the cost support increased from the feedstock materials, the neopentyl glycol price index also registered some positively increasing numbers. Overall, a fluctuating price trend was observed for neopentyl glycol during the said period.

Europe

The European neopentyl glycol industry almost mimicked the Asian industry’s market trend for the concerned period. After a receding first half, the price trend saw substantial inclination in the second half of the third quarter of the year 2023.

Initially, the surplus stocks in inventories compelled suppliers to keep the prices low amidst tepid downstream demands; however, as the stockpiles depleted and the demands picked up, an escalation was seen in market prices in the second half of the quarter. A dependence on Asian exports also contributed to these wavering price patterns. Overall, mixed market sentiments were observed.

North America

The North American neopentyl glycol market oscillated throughout the said period, but the fluctuations were more streamlined. And since the fluctuations were confined within a limited range, the market outlook was more or less stable throughout.

Analyst Insight

According to Procurement Resource, the Neopentyl Glycol prices are likely to continue to fluctuate going forward since the uncertain market demands continue to guide the market sentiments.

Neopentyl Glycol Price Trend for the First Half of 2023

Asia

Neopentyl Glycol observed mixed price trend throughout the said period of H1’23. Prices fluctuated in the positive direction during the first quarter after tottering low for a long time in the past year. Market fundamentals improved, not just a surge in queries, but freight situation, supply chains, trade routes, etc. all contributed to a growth in the Neopentyl Glycol market.

Especially in India, a sharp inclination in prices was observed because of high demand. However, as the inventories started levelling up and market demands got stagnant at one point, the market growth prospects also reduced. With these factors taking control, the Neopentyl Glycol prices were observed to be depreciating for most of the second quarter.

Europe

Contrary to the Asian market the European market trend didn’t change much from the previous year and continued their journey downhill in the first half of the year 2023 as well. As such a long period of mountainous inflation fundamentally altered consumer behavior, the monetary spending pivoted more to necessary and experience related businesses. The coating and construction industry was still struggling, so the Neopentyl Glycol prices succumbed to dull demands and wavered on the lower side.

North America

The North American Neopentyl Glycol market fluctuated for the entire time during the first two quarters of 2023. The market started slow, continuing the sluggish run from previous quarters, but by the middle of the first quarter, some improvement in demand dynamics was observed and the prices peaked by the end of Q1’23. But as the supplies started stockpiling, the price trend again turned south in the second quarter and rode down with some temporary reverse fluctuations.

Analyst Insight

According to Procurement Resource, the market demand will continue to be the key driving factor, and Neopentyl Glycol prices will fluctuate further.

Neopentyl Glycol Price Trend for the Second Half of 2022

Asia

Neopentyl Glycol prices wavered at the lower end of the price curve throughout the second half of the year 2022. The Asian market exhibited bearish sentiments. Low buyer interest in the product and excess supplies ensured poor performance all through the said period.

The stringent trade restriction in China at the beginning of the year because of COVID containment protocols and a total shutdown of many consumer industries were primarily the reasons behind such a weak market run. The global trade dynamics were also disturbed because of various other armed tensions. Inflation was peaking and the markets were generally suffering with feeble posed requirements.

Europe

European Neopentyl Glycol market almost replicated the market trend observed in the Asian region. Prices swung low because of demand destruction. Industrial operations became increasingly unsustainable as the conflict between Russia and Ukraine pushed the entire region into a deep state of energy insecurity and mounting inflation. The skyrocketed power and gas bills were detrimental to the general purchasing sentiments as shopping became very necessity centric. Overall, a slumped market performance was observed.

North America

The American Neopentyl Glycol market could not behave any differently than its Asian and European counterparts. As the Neopentyl Glycol prices slashed globally, the American market observed a similar trajectory. Since international trade was almost nil, the domestic trade exchanges related to Neopentyl Glycol were also unsatisfactory. Hence, the prices remained on a downward trajectory.

Analyst Insight

According to Procurement Resource, since the Neopentyl Glycol market performance remained stuck this year, some improvement is estimated in the coming months; however, the current inventory stock levels pose some difficult questions.

Neopentyl Glycol Price Trend For the Second Quarter of 2022

Asia

Since the first quarter of 2022, the price of neopentyl glycol has been steadily increasing. At the end of the second quarter, Saudi Arabia raised the selling price of crude oil to Asian nations. Due to covid-related concerns, China's supply chain was experiencing delays, which caused changes in the producers' quotations within a specific range.

The APAC neopentyl glycol market is driven by rising demand from the construction and automotive sectors. The downstream industries in the area are impacted by the high-cost pressure of upstream isobutyraldehyde. At the end of the second quarter, the price of neopentyl glycol was 248040 INR/MT Ex-Mumbai and 2600 USD/MT FOB Qingdao, China.

Europe

In the second quarter, Neopentyl Glycol saw an increase in demand throughout Europe. Petrochemical markets in the area were impacted by the volatility of crude oil prices and the hostilities between Russia and Ukraine. The demand for neopentyl glycol from downstream sectors like paints and coatings drove up costs even further in the area. At the conclusion of the second quarter, the price of neopentyl glycol was reported at 3025 USD/MT FOB Hamburg.

North America

The price trend for Neopentyl Glycol (NPG) registered an upward progressing pattern in the US domestic market. The region's volatile crude oil prices had an impact on the commodities upstream. As the price of crude oil and natural gas increased, so did the pricing of isobutyraldehyde upstream. Due to the rise in the price of raw materials, BASF has increased the price of neopentyl glycol throughout North and South America.

Neopentyl Glycol prices grew due to demand from downstream paints & coatings, adhesives, and other driving sectors. The eastern Europe war-related repercussions damaged the US market. At the end of the quarter, Neopentyl Glycol settled for 3637 USD/MT FOB Louisiana.

Neopentyl Glycol Price Trend For the First Quarter of 2022

Asia

In Q1 2022, there was a rise in Neopentyl Glycol (NPG) price to 2580 USD/MT FOB-Qingdao at the conclusion of the quarter in China, owing to a change of 3.8 percent as compared to the past quarter. Freight rates have also increased significantly in Japan and South Korea as a result of the ongoing conflict between Russia and Ukraine.

Stable demand from downstream sectors resulted in an increase in upstream value and an insufficient supply on the worldwide market. Due to a sharp increase in international pricing, dealers were able to boost their profits by increasing their offerings. Numerous manufacturing units extended their offerings to maintain their margins in the face of rising input costs.

Europe

Neopentyl glycol prices climbed in the first quarter of 2022, starting at 2390 USD/MT and eventually reaching 2610 USD/MT FOB Hamburg, owing to growing demand from both the local and foreign markets, as well as rising input costs.

A price rise of 2.6% was noted from Q4 2021 to Q1 2022. When asked about shipments to Asia, domestic producers cited the scarcity of raw materials for another couple of weeks. Global inflationary pressures on market mood are exacerbated by high crude oil and soaring feedstock prices.

North America

In Q1 2022, North America observed a spike in neopentyl glycol prices owing to instability in the crude oil market, which has been influenced by the Russia-Ukraine war. Feedstock propylene and isobutyraldehyde prices also climbed with surging crude and natural gas prices.

The spike in demand for downstream paints and coatings, dyes, and fillers and the halt of all activities between Russia and the USA during the conflict prompted the prices to grow stronger. A rise of 13.2 percent in Neopentyl Glycol in Q1 was noted in the USA as compared to the prices of the prior quarter, which covered up all the expenditures, including high freight rates and other shipment charges reaching up to 3011 USD/MT FOB Louisiana.

Neopentyl Glycol Price Trend For the Fourth Quarter of 2021

Asia

In Q4 2021, the Asian market had a mixed outlook that differed by nation. In India, prices were influenced by excess supply and steady to declining demand. Thus, in the Indian market, NPG prices continued to decline in the third quarter, owing to ample supply and decreasing offtake from the downstream paints, coatings and construction sectors. Monthly average prices for NPG (99 percent) ex Mumbai reached at 8461.39 USD/MT in December, an increase of 4947.71 USD/MT from October.

Europe

In Europe, the NPG market saw an uptick in the third quarter of 2021, owing to the product's limited supply and increased demand from downstream producers. Imports from China were delayed, resulting in a scarcity of feedstock in the region, which inflated the price of the chemical. Neopentyl glycol prices remained high in this quarter due to strong feedstock offers and decreased production levels due to the energy crisis. As a result, Neopentyl Glycol FOB Hamburg prices in December were USD 2095/MT.

North America

In North America, the market had a decreasing trend in the fourth quarter of 2021, owing to abundant supply and steady to declining demand from downstream Paints and Coatings, Automotive, and Construction. Additionally, the decline in the price of the feedstock Formaldehyde led to the decline in the price of NPG during this time period.

However, NPG prices increased somewhat by USD 40/MT from October to November, but then fell precipitously in December, owing to sluggish trading activity and reduced buying impetus associated with the end of the year. As a result, FOB Louisiana neopentyl glycol prices were determined to be USD 2610/MT, indicating a considerable decrease of around 5% from October.

Neopentyl Glycol Price Trend For First, Second and Third Quarters of 2021

Asia

The Asia Pacific region's market was balanced to constrained in the first quarter of 2021. Cost pressures on regional customers were exacerbated further by rising raw material prices and worldwide inflation in NPG rates. In India, as a result of Covid's revival, market activity slowed, reducing domestic use of NPG as the wait-and-see attitude intensified in the first part of the quarter. Whereas in the Chinese market, despite rising building activity, offtakes remained stable.

The market continued to grow in Q3 of 2021, owing to continuous demand from downstream producers. In China, neopentyl glycol prices increased significantly during the quarter as a result of an unanticipated and exceptional power supply shortage that compelled firms to reduce production and strained the worldwide supply chain.

Guangdong, China's southernmost province, has also been impacted by power shortages. Guangdong is a key industrial and maritime hub. In India, after gaining substantial value in July, August saw a modest increase in NPG price. Between July and September, neopentyl glycol prices increased from 2585 to 2929 USD/MT.

Europe

The European region's supply of NPG was constrained in the first quarter of 2021 due to a force majeure declaration by the BASF facility in Germany due to gas leakage difficulties that froze production levels indefinitely.

In the second quarter of 2021, the supply prognosis for NPG in the European market was very constrained, owing to the restricted availability of critical upstream goods, which resulted in decreased production rates in the first part of the quarter.

In May, a key manufacturer, OQ chemical, completed a lengthy turnaround, easing supply by specified margins. Thus, Perstorp increased the price of NPG by 356 USD/MT in the second quarter of 2021, while the total pricing trend remained stable.

Supply prospects increased in the market during the third quarter of 2021. Price in Germany was assessed in September at 2105 USD/MT FOB Hamburg.

North America

In Q1 2021, the North American region's supply of NPG was constrained due to limited availability of upstream products whereas demand, on the other hand, remained robust due to consistent offtakes from the downstream coatings sector. BASF announced an increase in neopentyl glycol prices of 600 USD/MT in March, adding to the previous quarter's rise.

While its supply increased dramatically in the second quarter, the market outlook remained constrained due to NPG's restricted manufacturing operations. As a result, OQ Chemical increased their neopentyl glycol prices by 220 USD/MT in June. FOB Texas negotiations reached 1770 USD/MT in June.

During the third quarter of 2021, the NPG market displayed an upward trend. The FOB Texas price increased from 1890 USD/MT in early July to 2010 USD/MT at the month's end. BASF, the largest petrochemical firm in the world, hiked NPG prices in the region. Eastman also announced a price hike for NPG in North America beginning October 1, 2021.

Neopentyl Glycol Price Trend For the Year 2020

Asia

Asian nations had a strong rebound from COVID 19 in Q4 2020, which boosted demand for NPG from a variety of downstream sectors. The price of the feedstock Formaldehyde increased from 147.5 USD/MT in October to 205.1 USD/MT in December.

China also suffered a severe scarcity of the feedstock formaldehyde as a result of decreasing upstream methanol shipments from Iran, which influenced PEG pricing in China. In September 2020 BASF-YPC (a 50-50 joint venture between BASF and SINOPEC) extended the manufacturing capacity of neopentyl glycol at its state of art Verbund plant in Nanjing, Chinas. The new expansion was aimed at boosting the company's market position.

Europe

European countries were substantially impacted by the quick dissemination of new COVID 19, owing to the region's partial shutdown. Reduced Formaldehyde supply sustained its prices across the area, despite an increase in demand from the domestic market. BASF was heard increasing their NPG pricing twice in a quarter in Europe, owing to robust demand and supply constraints.

North America

North America had a rapid recovery in demand from both the industrial and home sectors during the fourth quarter of 2020. Demand for NPG increased significantly, despite the fact that supply remained constrained owing to the declaration of force majeure on numerous plants on the Gulf Coast in Q4 2020 due to a hurricane season. BASF boosted their NPG pricing in North America by 0.08 USD/MT in November 2020.

Procurement Resource provides latest prices of Neopentyl Glycol. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Neopentyl Glycol

2,2-dimethylpropane-1,3-diol also called Neopentyl glycol is an organic chemical compound. Polyesters, paints, lubricants, and plasticizers are synthesized using it. When employed in the production of polyesters, it increases the product's resistance to heat, light, and water. By esterifying fatty or carboxylic acids, synthetic lubricating esters having a lower oxidation or hydrolysis potential than natural esters may be synthesized.

Neopentyl Glycol Product Details

| Report Features | Details |

| Product Name | Neopentyl Glycol |

| Applications | Paints & Coatings, Adhesives & Sealants, Lubricants, Plasticizers, Insulation Materials |

| Chemical Formula | C5H12O2 |

| Synonyms | 2,2-Dimethylpropane-1,3-diol, 2,2-Dimethyl-1,3-propanediol |

| Molecular Weight | 104.148 g/mol |

| Supplier Database | BASF SE, Eastman Chemical Company, MITSUBISHI GAS CHEMICAL COMPANY, INC, Wanhua Chemical Group Co., Ltd, OXEA GmbH, TCI Chemicals (India) Pvt. Ltd, LG Chem Ltd |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Neopentyl Glycol Production processes

- Production of Neopentyl Glycol via Aldol Reaction

On commercial scale, NPG is manufactured through Aldol reaction, where two carbonyl compounds are joined to generate a product called Aldol. This produces the intermediate hydroxypivaldehyde, which can be transformed to neopentyl glycol by a Cannizzaro reaction with sufficient formaldehyde or via palladium on carbon hydrogenation.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com