Product

Nitrobenzene Price Trend and Forecast

Nitrobenzene Price Trend and Forecast

Nitrobenzene Regional Price Overview

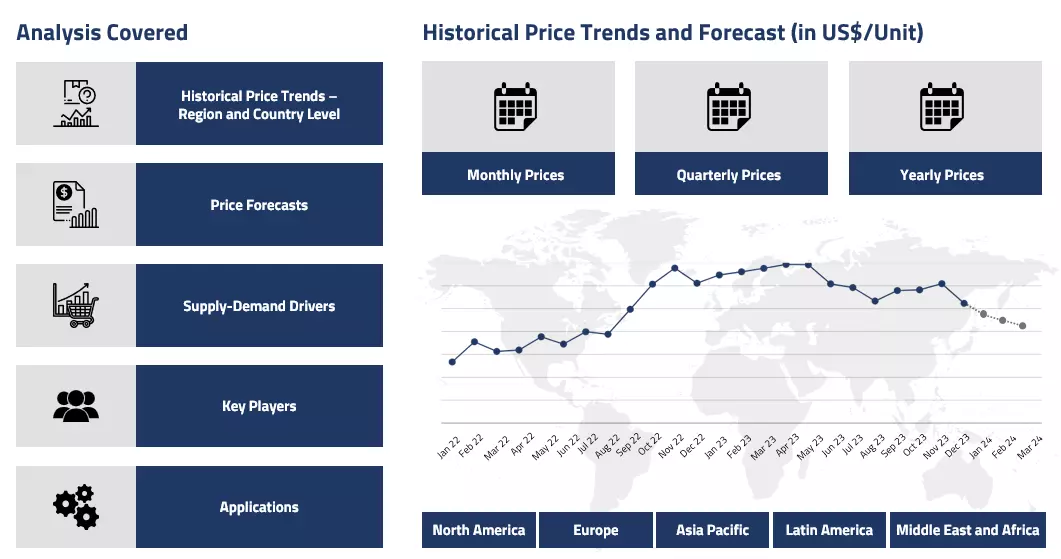

Get the latest insights on price movement and trend analysis of Nitrobenzene in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Nitrobenzene Price Trend for the Q3 of 2024

Asia

In Asia, nitrobenzene prices were under pressure due to fluctuating feedstock costs, particularly benzene, whose price volatility influenced downstream chemical production. The region's ongoing challenges, including weak industrial production rates and slower demand for downstream derivatives like aniline, contributed to a softening price environment for nitrobenzene. Additionally, various regulatory policies aimed at reducing industrial emissions had a mixed impact on supply levels.

Nitrobenzene Price Chart

Please Login or Subscribe to Access the Nitrobenzene Price Chart Data

Manufacturers were forced to adjust operations, especially in China and India, where production cuts or slower activity impacted overall market sentiment. Despite some support from domestic demand in emerging markets, the market's overall sluggishness persisted throughout the quarter.

Europe

In Europe, the market faced similar challenges, as high energy costs and feedstock price volatility continued to weigh on nitrobenzene production. The European chemical sector struggled to regain momentum, particularly in the face of reduced demand for key derivatives like aniline, which is vital for the polyurethane industry.

Economic concerns, particularly inflationary pressures and high interest rates, further curtailed investment in industrial activity, exacerbating the downtrend. Moreover, logistical challenges, including potential port strikes and ongoing labor disputes, added to the uncertainties in the supply chain. Geopolitical factors, such as the ongoing conflict between Russia and Ukraine, also indirectly influenced feedstock availability and cost structures, compounding the difficulties faced by producers.

North America

In North America, nitrobenzene prices mirrored the bearish tone seen globally, with domestic manufacturing sectors exhibiting weak demand. The U.S. market, in particular, faced headwinds due to ongoing economic uncertainties, including high inflation rates and supply chain disruptions caused by natural disasters. Feedstock benzene prices were highly volatile due to fluctuating oil prices and shifts in crude oil inventory levels.

The market for derivatives, such as aniline, remained tepid, leading to reduced offtake for nitrobenzene. The potential strike actions at key ports and rail networks posed an additional challenge for supply logistics, further destabilizing the market. However, some level of stability was brought in by ongoing labor negotiations, which helped avoid major disruptions in the supply chain towards the end of the quarter.

Analyst Insight

According to Procurement Resource, the price trend of Nitrobenzene is expected to mimic the fluctuations of its feedstock markets and changes in the global trading patterns.

Nitrobenzene Price Trend for the Q2 of 2024

Asia

During the second quarter of 2024, nitrobenzene prices in majority of the Asian countries exhibited a mixed trend. Initially, prices eased due to increased output and reduced spot trades to South Asia and Europe, influenced by high freight charges. This situation prompted the domestic players to use the piled-up nitrobenzene inventories in aniline, which subsequently reduced-price pressure throughout the value chain. Additionally, with slightly elevated benzene prices, the nitrobenzene market saw slight stabilization.

In China, prices remained steady as production levels were kept low to manage excess capacity. The rise in crude prices in May led to an increase in benzene and other feedstock prices, but the demand for nitro-based fertilizers decreased, easing raw material costs. By the end of the quarter, MDI prices increased, supporting the demand for aniline and nitrobenzene. However, the impact of high freight costs and lower demand in Europe and the Middle East led to an oversupply situation. Despite ongoing production, the market anticipated higher future demand, supported by easing interest rates and economic stimulus measures in China.

Europe

The European countries witnessed a gradual rise in their industrial output during the second quarter of 2024, supporting an uptrend in the prices of nitrobenzene. Initially, the bearish tone of the market was influenced by the rising tensions at German ports due to labor strikes and port congestion activities. However, the improved outlook of the downstream industries, such as MDI and aniline, in both domestic and overseas markets, supported the northward momentum of the nitrobenzene price trend. Additionally, the constrained supply of finished goods from the Asian players amid disrupted trade routes and escalating geopolitical tensions turned the focus of end-user industries towards in-house production, leading to the upward momentum of the nitrobenzene market.

North America

In Q2 2024, the North American nitrobenzene market remained stable, with positive dynamics influenced by moderate demand from end-use manufacturing sectors, including benzene production. The close correlation between crude oil and nitrobenzene prices played a significant role, with naphtha production, a key input for nitrobenzene, being impacted by fluctuations in crude oil prices.

The disruptions from hurricanes further influenced petroleum markets, affecting both crude oil production and refining operations. The market experienced a modest increase in nitrobenzene prices, reflecting subtle shifts in dynamics. Despite the onset of the summer demand season, gasoline markets in the US remained weak, extending limited support to the market.

However, the US factory output saw a surprising rise in May, leading to increased nitrobenzene production despite high interest rates negatively affecting production rates. The container freight rates on key routes to and from Brazil soared due to strong demand and capacity shortages, adding to the complexity of the market. Additionally, freight spot rates increased, driven by supply chain issues and adverse weather conditions, further impacting nitrobenzene price dynamics.

Analyst Insight

According to Procurement Resource, the price of Nitrobenzene is estimated to be driven by the rising cost of production, which in turn is influenced by limited crude oil production and its rising prices in the adjacent quarters.

Nitrobenzene Price Trend for the Q1 of 2024

| Product | Category | Region | Price | Time Period |

| Nitrobenzene | Chemicals | Asia | 1339 USD/MT | March’24 |

Stay updated with the latest Nitrobenzene prices, historical data, and tailored regional analysis

Asia

The stabilization of nitrobenzene price trend during the first quarter of 2024 was influenced by the support from its upstream raw material, benzene. This surge in the market momentum came after the termination of the Chinese New Year and spring festivities in the region.

Post-holiday season surge in the market trend raised the appetite of downstream industries, which supported the uptrend in the prices of nitrobenzene. Further, the production costs surged with the rise in crude oil and naphtha costs, which prompted the traders to sustain their price quotations of nitrobenzene. However, the ongoing trading challenges amid loss of exporting margins, raising the level of inventories, and raising the concerns of the traders.

Europe

The nitrobenzene prices in Europe experienced a subtle decline in the first quarter of 2024 due to ample supply availability domestically and sustained demand from end-use manufacturing sectors. The production rate surpassed demand, widening the gap between supply and consumption. The drop in European naphtha prices compared to Asia prompted decreased overseas shipments in the region, further impacting the overall cost of production of nitrobenzene in the region.

Additionally, rising imports of naphtha and natural gas from the Middle East and Russia contributed to oversupply in the European market, driving prices down further. Additionally, the slower economic growth in Europe following interest rate hikes, led to a frail sentiment of the downstream industries, reducing their overall appetite and spending budgets. Further, the labor disputes in Germany added to the extension of shipment arrival time, constraining the international supply chains and raising the concerns of the traders amid their declining profit margins.

North America

The nitrobenzene prices surging in the US markets were primarily influenced by the rise in crude oil prices. This increase in nitrobenzene prices mirrored the global uptick in crude oil values while signaling a rebound in demand as destocking approaches completion. The additional constraints on European and Asian supply chains amid rising geopolitical tensions between Israel and Iran further raised crude oil prices, heightening concerns about supply disruptions and inflation.

The OPEC+ also maintained its current oil supply policy, tightening the production volumes of domestic as well as overseas manufacturing units. The rising appetite of Asian countries, particularly China, after the New Year holiday season further boosted the momentum of the market in the later months of the first quarter, keeping the pricing trajectory of nitrobenzene in the northward direction.

Analyst Insight

According to Procurement Resource, the price trend of Nitrobenzene is expected to be driven by the supply crunch of feedstock benzene and the expanding appetite of the downstream food, beverage, and chemical industries around the globe.

Nitrobenzene Price Trend for the October - December of 2023

Asia

Nitrobenzene, an important and versatile chemical, is a direct result of the nitration of benzene, which is achieved by reacting benzene with nitric acid. Hence, nitrobenzene prices greatly depend on the market patterns of its feedstock materials, benzene, and nitric acid. During the said period, nitrobenzene’s market performance was observed to be very fluctuating/mixed. Other than cuts in domestic market demands, the fall in international trade also impacted the nitrobenzene trade heavily.

The trade disturbances were caused because of the freight hurdles in the winter season at the Panama and Suez Canal. This led to a significant decline in the offshore trade prospects and since the nitrobenzene market was being supported by the domestic downstream industries only, the prices dwelled at the lower side of the curve for the majority of the said time.

Europe

The European market trend for nitrobenzene were not much different from the Asian market. The prices here, too, witnessed regular fluctuations, majorly towards the lower side during the said time period. Other than the plunge in the feedstock prices, the limited domestic queries proved detrimental to the nitrobenzene market. Overall, weak market sentiments were recorded in Q4’23.

North America

The North American nitrobenzene market closely mimicked the market behavior of its Asian and European counterparts during the given period. Owing to the lackluster demands, difficult logistics, and fluctuating feedstock prices, the price of nitrobenzene varied feebly during the said period.

Analyst Insight

According to Procurement Resource, Nitrobenzene price trend are likely to oscillate in the coming months; the market trend are anticipated to behave similarly given the current supply-demand 78p-dynamics and other macroeconomic factors.

Nitrobenzene Price Trend for the July - September of 2023

Asia

The Nitrobenzene market observed mixed price trend in Asia; owing to the dull demands, the first half of the quarter saw Nitrobenzene price trend wavering on the lower side. The oversupplied inventories forced suppliers to cut down the prices in order to maintain stock movement. However, as time progressed, the stocks started depleting while the demands from downstream pharma and cosmetics sectors increased, which pushed the price graph for nitrobenzene up.

As a result, the second half of the given quarter witnessed a sharp rise in nitrobenzene prices. A surge in the feedstock benzene and nitric acid prices also played a role in elevating the nitrobenzene price trend. Hence, with an initial decline and sharp rebound in the second half of the given time span, the overall market sentiments remained mixed for the entire period.

Europe

The fluctuating trend of the Asian market were also mirrored in the European nitrobenzene market as the second half of the quarter saw some recovery in the market prices after a sharp slump in the initial phase of the quarter. Overall, fluctuating price trend were observed by nitrobenzene during the said time period.

North America

The North American nitrobenzene market also exhibited similar fluctuating market trend during the entire span of Q3’23. Following the market demands, the nitrobenzene prices rose slightly after remaining on a falling trajectory in the initial phase. The general market outlook remained wavering.

Analyst Insight

According to Procurement Resource, Nitrobenzene prices are likely to continue to fluctuate in the coming months as well, owing to the tribulations in the consumption sectors.

Nitrobenzene Price Trend for the First Half of 2023

Asia

Some market revival was observed at the beginning of 2023 as the downstream industries started enquiring about prices. The manufacturing also ramped up to cater to the demands; the commencement of the Lunar New Year was also an important reason for this respite.

Nitrobenzene prices grew for most of the first quarter, but as the quarter shifted, the inventory stocks started rising as the demands dipped. So, the prices started swinging towards the lower end of the curve. Overall, a mixed and fluctuating price trend was observed throughout the first half of 2023.

Europe

With an almost similar run, the Nitrobenzene prices oscillated in the European market as well. The rise in inflation and energy prices made the upstream and production processes very expensive, which pushed the Nitrobenzene prices up, especially in the first quarter. As inflation kept affecting the purchasing capacities, the consumer demands started dipping in the second quarter. Major European economies like Germany even underwent a recession. These instances reduced the market offtakes, but the inventories started piling up, forcing the Nitrobenzene prices down for most of Q2. So, an oscillating market sentiment was observed.

North America

The North American Nitrobenzene market could not behave any differently than the other global markets, as the prices varied with the downstream demands here as well. The market experienced some upward swings in the first quarter and the beginning of the second quarter, but oversupply dominated the latter half of the second quarter as the demands were on a decline.

Analyst Insight

According to Procurement Resource, the price trend for Nitrobenzene are expected to remain unsettled in the coming months, given the current pricing fundamentals.

Nitrobenzene Price Trend for the Second Half of 2022

Asia

Nitrobenzene prices struggled throughout the second half of 2022. As the Chinese industries were still facing the aftermath of the strict COVID-19 lockdown, the nascent trade was very much revolving around necessity-based consumer behavior. Most of the downstream industries, like pharma, fragrance, chemicals, etc., laid low during the period, which posed feeble demands for Nitrobenzene. With low market activity around Nitrobenzene, the prices mostly wavered around the lower end of the curve. Overall, dull market sentiments were observed.

Europe

Mixed price trend for Nitrobenzene were observed in the European market. The war in the European backyard pushed the entire region into economic turmoil. Since the crude oil prices skyrocketed, the upstream costs got unsustainably high. So, the third quarter started on a high note, but as prices were still low in the Chinese market, cheap Asian imports handled the situation in the latter half of the third quarter. But declined inventories again pushed up the prices as the fourth quarter began. A dip in demand aided the price situation to some extent at the end of Q4. Overall, Nitrobenzene prices kept swinging throughout the second half of the year 2022.

North America

In the American Nitrobenzene market, the prices swung low for most of the discussed period. The low prices were the result of already high inventory stocks and dipped demands from end consumer sectors. Some reverse fluctuations were observed in the middle of the second quarter, but an overall slumping sentiment was observed.

Analyst insight

According to Procurement Resource, the price trend for Nitrobenzene are expected to remain fluctuating given the current supply-demand dynamics amid rising inflation rates.

Nitrobenzene Price Trend For the Second Quarter of 2022

Asia

During the second quarter, the market for Nitrobenzene experienced growth. The domestic market's rising demand for the goods as a result of healthy consumer buying behaviour supported the price increase. The demand for the commodity surged as a result of an increase in the production of the downstream derivative aniline.

Moreover, the price of upstream oil increased dramatically, which raised the price of nitrobenzene. Furthermore, the growing freight costs added fuel to the already rising price levels. The merchants were compelled to continue the trend because the factory-side pricing was so high. The market for nitrobenzene was however further driven by high import taxes.

Europe

Prices for Nitrobenzene increased in the German market during the second quarter of 2022. The lack of supply led to an increase in upstream crude values, which helped to underpin the price increase. The EU government imposed sanctions on Russian oil imports as a result of the conflict between Russia and Ukraine, which reduced the crude supply.

Moreover, the price of Nitrobenzene increased due to an increase in demand from producers of the downstream product aniline. The high level of demand in the domestic market and the limited supply forced the suppliers to increase their offerings to protect their margins. Additionally, the growing price of fuel boosts freight costs, which in turn increases the cost of nitrobenzene.

North America

The price trend of Nitro Benzene in the second quarter of 2022 reflected a conflicting mood in the US market. At first, Nitrobenzene's price increased in line with the trend of upstream Crude and feedstock Benzene. Due to restrictions on importing Russian crude, there was a limited supply of crude on the local market, which drove up the price of nitrobenzene.

Later, when the product's demand in the home market decreased, prices began to decline. Moreover, as consumer demand decreased and market buying decreased, the downstream derivative market's production reduced, which further lowered the price of nitrobenzene. Secondly, the market for Nitro Benzene was significantly impacted by the regional markets' diminishing demand.

Nitrobenzene Price Trend For the First Quarter of 2022

Asia

The price of nitrobenzene surged significantly in the first quarter of 2022, owing to rising demand from the downstream aniline industry. Traders revised their offerings in response to rising petroleum prices in order to protect their profit margins. The Shanghai port disruption hindered commercial activity and was a key cause in price increases in China. The increase in COVID cases led to output cuts in pandemic-affected areas by the end of Q1 2022, causing anxiety in the regional market. The price concluded at 1312 USD/MT CFR JNPT in March 2022.

Europe

Price fluctuations in the feedstock benzene caused mixed feelings in Europe in the first quarter of 2022. The price drop was facilitated by the increasing number of Omicron variant cases in Germany, which led to nitrobenzene pricing restrictions. However, prices began to climb in early March as a result of higher upstream pricing.

Russia is one of Germany's top natural gas and petroleum exporters, and the unexpected escalation of tensions between Russia and Ukraine prompted a further rise in upstream benzene prices, impacting nitrobenzene pricing. Furthermore, increased demand from downstream sectors such as aniline, polyurethane, and MID drove up the nitrobenzene price in Europe by approximately 5%.

North America

The start of the Ukraine-Russia conflict in the last week of February pushed up global crude oil prices, causing a substantial increase in raw material prices on the international market. Meanwhile, worldwide economic recovery and seasonal demand fueled the overall increase in the chemical’s prices in North America.

While rising raw material costs pushed downstream products prices higher across regional markets, demand fundamentals for the downstream aniline market's product remained strong. In Q1-2022, the price of nitrobenzene in the United States ranged between 1250-1380 USD/MT.

Nitrobenzene Price Trend (Q4 2021)

Asia

The market prognosis in China was positive, with progress in offtakes from both domestic and foreign markets. Nitrobenzene FOB Shanghai price was estimated at 1135 USD/MT in December, up 102 USD/MT from October. In India, there were varied feelings about Nitrobenzene.

The price rose in October and November as the value of imports from South Korea remained stable and buying momentum improved. Thus, throughout October and November, Ex-Mumbai price grew effectively from 1412.43 USD/MT to 1444.68 USD/MT, before settling at 1433.26 USD/MT in December, indicating an overall increase from October.

Europe

The robust feedstock benzene values encouraged an exponential growth in nitrobenzene prices in the fourth quarter of 2021 in the European market. Furthermore, demand from downstream tyre producers remained strong during the quarter.

An acute energy shortage owing to supply constraints resulted in costly production, pushing the price of the chemical even higher. Despite the reduction in freight costs in December, the price remained high due to high benzene prices. However, due to the end of the year, buying emotions dwindled in the last month of the quarter.

North America

Nitrobenzene market sentiments in the United States were bolstered in Q4 2021, driven by an increase in the number of inquiries in the domestic market. Furthermore, increased demand from downstream aniline and synthetic rubber producers supported Nitrobenzene price rise during this time period. Nitrobenzene prices began to relax in November due to plentiful supply and rising upstream Benzene prices. Prices rebounded in December, owing to strong demand and an extraordinary spike in benzene prices.

Nitrobenzene Price Trend (Q1-Q3 2021)

Asia

In the Indian market, the price increased by more than 25% in the quarter, hovering around 1153.9 USD/MT in March. During this quarter, the Asian market had reasonable demand for the chemical, owing to improving economic conditions and the product's seasonal upswing. During second quarter, demand for nitrobenzene from local aniline and agrochemicals producers remained consistent, supporting its price trend. Thus, in June 2021, its price in China and India was roughly 878 USD/MT and 937 USD/MT, respectively.

Because of rising upstream benzene prices and high freight costs, price in China effectively climbed. Despite strong demand for derivative aniline in India, delayed nitrobenzene offtakes from the automotive and rubber industries eclipsed its strong demand as an aniline feedstock. Prices rose from 1289 USD/MT to 1367 USD/MT in Q3 2021, continuing an upward trend. FOB Shanghai (China) evaluations stabilized at 943 USD/MT in early September.

Europe

Following the second wave of COVID-19, the European market saw a drop in downstream demand as industrial output decreased due to staffing shortages and lockdown limitations. Prices improved little throughout the quarter, but upstream benzene settlements improved significantly.

Nitrobenzene prices rose as benzene prices rose owing to worldwide shortages and fewer imports from main producing countries. Furthermore, higher freight costs contributed to the total price increase of the chemical during this quarter. As a result, dealers raised their product prices to defend their margins in order to keep their profits.

Due to the high pricing environment for upstream chemicals and ongoing tightness in regional supplies, the European price curve of the chemical gained in the third quarter of 2021, drawing cues from solid Asian stocks. In Q3, margins were stable, bolstered by high sales, although supply remained scarce as customers resorted to Chinese suppliers. Increases in raw material pricing and logistical expenses have been passed on to end consumers, according to a trader. In Q3 2021, rising freight costs exacerbated the pricing trend across the area.

North America

Market mood for the chemical in the United States remained positive throughout the quarter, bolstered by strong demand from regional and worldwide markets. However, sub-freezing weather interrupted domestic output in the United States, as key upstream units experienced force majeure in mid-February.

While benzene supply remained critically low due to unforeseen plant shutdowns, strong demand from downstream industries such as aniline and MDI pushed regional nitrobenzene bids higher. Despite regional shortages, the chemical saw reasonable demand in the North American market this quarter, backed by strong offtakes from downstream derivative makers.

The price of nitrobenzene increased across the United States as benzene costs rose due to a protracted material scarcity following the winter disaster. Demand for downstream products like aniline and other agrochemicals remained strong. Asia's supply remained constrained, with players unable to build up significant supplies. As a result, price increased dramatically in the North American region in the third quarter.

Nitrobenzene Price Trend Overview 2020

Asia

Due to hurricanes Delta and Laura in October of 2020, there were considerable logistics interruptions, resulting in a huge gap in nitrobenzene demand and supply across Southeast Asia. Prices increased by twofold in Q4 2020 as a result of supply constraints. The increase in prices of benzene owing to persistent increases in crude values impacted the increase in prices of nitrobenzene in the quarter ended December. CFR price in India averaged 618.75 USD/MT in the fourth quarter of 2020.

Europe

The price of nitrobenzene increased in the fourth quarter of 2020 because benzene prices were high due to a lack of supply vs strong demand across the area. Although demand in Q4 of FY20 was lower than previous year because to fears of a new coronavirus and a second lockdown across the area, it was still higher than the entire year of 2020. Traders were confident about a significant return in crude prices in Q1 2021 as the price of petroleum rose.

North America

In Q4, the petrochemical industry appeared to have entered a recovery phase after months of poor demand for Benzene. During Corona, supplies that were stalled due to lockdown and a shortage of labour were rushed to their target in the final quarter.

Owing to a steady rise in oil prices and limited supplies into the region due to a series of storms, benzene demand remained strong in December. As a result of the market fundamentals, the increase in benzene prices impacted supply, demand, and pricing for nitrobenzene in the region.

Procurement Resource provides latest prices of Nitrobenzene. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Nitrobenzene

The organic compound nitrobenzene has the chemical formula C6H5NO2. It's a pale-yellow oily insoluble in water which smells a bit similar to almonds. Greenish-yellow crystals form when it freezes. It is made on a as a precursor to aniline from benzene on an industrial level. It is occasionally employed as a solvent in the laboratory, particularly for electrophilic reagents.

Nitrobenzene Product Details

| Report Features | Details |

| Product Name | Nitrobenzene |

| Chemical Formula | C6H5NO2 |

| Synonyms | Nitrobenzol, Oil of mirbane |

| Molecular Weight | 123.11 g/mol |

| Supplier Database | BASF SE, The Chemours Company (DuPont), Covestro AG, Huntsman International LLC, Wanhua |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Nitrobenzene Production Processes

- Nitrobenzene Production from Benzene and Nitric Acid

Nitration of benzene using a combination of intense sulfuric acid, water, and nitric acid produces Nitrobenzene. This combination is also known as "mixed acid." Because of the exothermicity of the reaction, nitrobenzene synthesis is one of the most hazardous processes in the chemical industry.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com