Product

O-Xylene Price Trend and Forecast

O-Xylene Price Trend and Forecast

O-Xylene Regional Price Overview

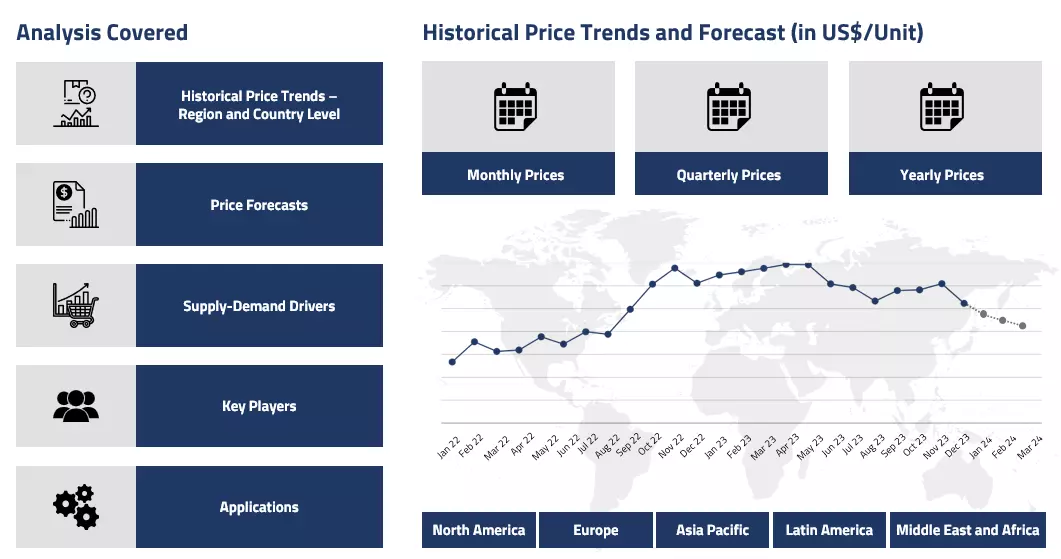

Get the latest insights on price movement and trend analysis of O-Xylene in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

O-Xylene Price Trend for the Q3 of 2024

Asia

In Asia, the o-xylene market faced challenges due to reduced downstream demand, particularly from the phthalic anhydride sector. The weak performance in the construction industry, a major end-user sector, exacerbated the situation. Converters in the region also struggled with balancing their inventories as downstream purchasing volumes remained lower than expected, adding pressure to the market.

O-Xylene Price Chart

Please Login or Subscribe to Access the O-Xylene Price Chart Data

The volatility in upstream crude oil prices further impacted the cost of production, though supply remained largely stable.

Europe

In Europe, the o-xylene market was similarly characterized by weak demand and sufficient supply. Economic headwinds in major economies like Germany led to a dampening of the construction sector, further reducing consumption from phthalic anhydride manufacturers. Delays in imports from Asia and the impact of fluctuating freight rates created additional complexity, but overall material availability remained adequate. The slowdown in new orders added pressure, leading to downward adjustments in market offers. Moreover, the easing of feedstock costs due to softer naphtha prices further reduced o-xylene prices in the region.

North America

North America followed a similar trajectory, with o-xylene prices reflecting weak market fundamentals. The manufacturing PMI in the United States stayed in the contraction zone, indicating ongoing struggles in the industrial sector. Demand from the downstream phthalic anhydride industry remained steady but limited, influenced by a sluggish real estate market, where new home construction saw some uptick but single-family housing remained weak. Domestic production also experienced minimal disruptions, although inventories were reportedly high, and some producers were eager to clear excess stock ahead of maintenance cycles. The volatility in crude oil prices added to market instability, as traders were hesitant to make long-term decisions.

Analyst Insight

According to Procurement Resource, the price trend of O-Xylene is expected to exhibit a bearish momentum in the upcoming sessions. This anticipated price decrease is linked to ongoing inventory destocking due to lower demand from downstream markets and underperformance in economic activities, further influencing the market's demand.

O-xylene Price Trend for the Q2 of 2024

Asia

In Q2 2024, the Chinese o-xylene market experienced downward pressure due to oversupply and fluctuating demand dynamics. While o-xylene prices remained high in the initial phase of the quarter, supported by unit maintenance and high overseas prices, the market faced challenges as new production units came online, increasing the supply of this resource. Additionally, South Korea's export volumes to the United States reduced in Q2 exaggerating the issue of oversupply of the commodity.

Additionally, subdued gasoline blending demand, compounded by lower gasoline prices and social blending material oversupply, further strained the market. With insufficient travel demand and the upcoming summer peak in the U.S., the arbitrage window between Asia and the U.S. fluctuated, additionally impacting prices of o-xylene. Consequently, o-xylene prices in China faced significant downward pressure, reflecting the broader trend of declining aromatic product prices and an increasingly unbalanced supply-demand scenario.

Europe

In the second quarter of 2024, ortho-xylene prices in Europe declined significantly due to weak raw material prices and subdued demand from the downstream derivative industry. The anticipated seasonal boost from the construction sector did not translate well into the price trend of o-xylene, contributing to the downward trend. Additionally, with reduced run rates at domestic crackers and lower import offers from Asia, adequate material availability kept prices low.

In Germany, o-xylene prices fell notably, reflecting weak market fundamentals and decreased feedstock prices. Additionally, logistical challenges in Asian imports and weak demand from the phthalic anhydride industry and the construction sector further pressured the market. The European Central Bank's interest rate cut aimed at controlling inflation may support future demand for commodities like o-xylene used in construction applications.

North America

In the second quarter of 2024, ortho-xylene prices in the US market experienced a downward trend, driven by weak market conditions and eased cost pressures from raw materials. This decline was further influenced by weak downstream derivative demand and ample material availability, prompting manufacturers to revise their o-xylene offers.

The decline in upstream commodity prices amid weak demand dynamics led to lower production costs for o-xylene, contributing to bearish market sentiment. Despite relatively sufficient availability to meet existing demand, the domestic phthalic anhydride industry's presented muted demand, particularly from the construction sector, compounded the downward pressure on prices. Additionally, economic uncertainties and adverse weather conditions reduced inquiries from overseas markets like Latin America and Mexico.

Analyst Insight

According to Procurement Resource, the pricing trajectory of O-xylene is expected to continue its southward trend as the end-user industries' outlook does not look favorable in the adjacent quarters, and with the decline in production costs, the prices of o-xylene might find it difficult to sustain.

O-xylene Price Index for the Q1 of 2024

| Product | Category | Region | Price | Time Period |

| O-Xylene | Chemicals | USA | 967 USD/MT | March’24 |

Stay updated with the latest O-Xylene prices, historical data, and tailored regional analysis

O-xylene Price Trend for the October - December of 2023

Asia

The O-xylene market only showed slight improvements in the last quarter of 2023 and thus failed to stand up to the traders’ anticipation. In China, several plants which underwent maintenance shutdowns in the last quarter resumed their production, but the domestic appetite of the consumers seemed to be crippled by the inflationary setback. However, a rise in exports to overseas industries, particularly in the US, helped the O-xylene Price trend to sustain in the market.

Europe

After a slight bullish run, O-xylene prices in the European market fell due to factors such as increasing supply, lower manufacturing costs, and ongoing sluggish demand. Another prime divergence of the market was the decreased feedstock naphtha prices brought on by poor domestic procurement and lower manufacturing expenses.

Additionally, the exports routed from the European countries were disrupted by the Israel-Hamas war, which in turn raised the level of inventories of the market and caused the O-xylene prices to move southwards.

North America

The bearish outlook of the O-xylene Price trend during Q4 of 2023 was the reflection of the entire xylene market in the US. The prices of raw materials required for the synthesis of O-xylene, such as benzene, nosedived in view of poor demand from direct consumers and low rates of procurement from the downstream industries. The market also seemed to have adhered to the fluctuations in the petrochemical industries and challenging economic indicators.

Analyst Insight

According to Procurement Resource, the price trend of O-xylene are estimated to be dependent on the harvest of raw materials and the effect of inflation on the food and beverage markets as this, in turn, dictates the O-xylene demand dynamics.

O-xylene Price Trend for the July - September of 2023

Asia

The O-xylene Price trend benefitted from the surge in the cost of xylene in the third quarter. The third quarter also favored the rise in prices of upstream products as well as demand from the downstream industries, which led to the upward movement of the o-xylene price graph.

In addition to this, the surge in the cost of crude oil raised the production prices and gave the o-xylene market its required momentum. However, the persistent downward pull of soaring inflation and the weak economic recovery of China proved to be a challenge for the traders.

Europe

The European countries experienced a significant incline in the O-xylene Price trend during the first two months of the third quarter. This phase witnessed a surge in the cost of feedstock materials amid the rising pressure of inflation and consistent hikes in bank interest rates.

Despite the adverse functioning of the European economy, the improvement in the raw materials sector and slight growth in o-xylene demand supported the inclination in the o-xylene price graph. However, the daunted market conditions soon caught up with the recovery rates and pushed the o-xylene prices into a downward spiral.

North America

The worldwide slowing down of economic growth had a negative effect on O-xylene Price trend in North America, too. The market thus failed to produce appropriate demand for o-xylene, and thus, in view of poor rates of procurement, the O-xylene Price trend had no support and fell gradually throughout the third quarter of 2023. The market of o-xylene also lost momentum as the cost of production rose by several folds on account of rising crude oil prices.

Analyst Insight

According to Procurement Resource, the price trend of O-Xylene are estimated to trace an oscillating trajectory as the demand for o-xylene and support from the feedstock sector is expected to remain weak in the upcoming quarters.

O-xylene Price Trend for the First Half of 2023

Asia

In Asia, the price trend of o-Xylene fluctuated in the first two quarters of 2023. In the initial phase, the prices declined due to the weak demand from the downstream sectors and ample availability of the product in the region.

But in the subsequent phase, the prices started to improve as the market regained its momentum after a long stretch of lunar new year holidays, especially in China. However, the trend stabilized and eventually declined in Q2 as the supply-demand dynamics normalized, given the over-supply of products in the market amid bearish demands.

Europe

In Europe, the prices of o-Xylene were stable throughout the first and second quarters of 2023. In this region, the major influencing factors were the stagnant purchasing potential of buyers and consistent demand from the end-user industries. The improving market sentiments, gradually increasing demand, slow production activities, and thus the depletion in the level of inventories further supported the o-Xylene market.

North America

A mixed trend in the prices of o-Xylene was observed in the North American region. The prices struggled to maintain stability in the initial months of the first quarter of 2023 but were supported by the positive demand outlook from the end-user sector and ample product availability to counter this demand. But soon enough, in the middle of the first quarter and throughout the second quarter, the price trend declined as manufacturers were forced to reduce their operation rates due to the weak demand from the downstream sectors.

Analyst Insight

According to Procurement Resource, the price trend of o-Xylene is expected to showcase a mixed trend. The demand from the downstream industries for o-Xylene seems uncertain, and the fluctuating market dynamics will likely affect the o-Xylene market.

Procurement Resource provides latest prices of O Xylene. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About O-Xylene

With the chemical formula C8H10, o-Xylene, also referred to as ortho-Xylene, is an aromatic hydrocarbon. One of the three isomers of xylene, it has an odor that is sweet and pungent and is a colorless liquid. In the chemical industry, o-Xylene is largely utilized as a solvent for a variety of purposes, including the manufacture of paints, coatings, adhesives, and rubber goods. Additionally, it is used in the production of medicines, dyes, and pesticides. Because of its mild toxicity and flammability, o-Xylene is regarded as a hazardous chemical.

O-Xylene Product Details

| Report Features | Details |

| Product Name | o-Xylene |

| Chemical Formula | C8H10 |

| Industrial Uses | Paints and coatings industry, Pesticide production, Printing inks, Rubber and plastics, Adhesives and sealants |

| HS Code | 29024100 |

| CAS Number | 95-47-6 |

| Molecular weight | 106.16 g/mol |

| Supplier Database | Royal Dutch Shell PLC, Reliance Industries Limited, China Petroleum and Chemical Corporation, Excon Mobil Corporation, Formosa Chemicals and Fibre Corporation |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

O-Xylene Production Processes

In this procedure, the platinum reforming technique is used to produce xylene. Additionally, a distillation process and an o-xylene column are used to make ortho-xylene (O-xylene) from the produced xylene.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com