Product

Propylene Oxide Price Trend and Forecast

Propylene Oxide Price Trend and Forecast

Propylene Oxide Regional Price Overview

Get the latest insights on price movement and trend analysis of Propylene Oxide in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Propylene Oxide Price Trend for the First Half of 2025

| Product | Category | Region | Price | Time Period |

| Propylene Oxide | Flavours and Fragrances | China | $1007 USD/MT | May 2025 |

Stay updated with the latest Propylene Oxide prices, historical data, and tailored regional analysis

Asia

In the first half of 2025, the propylene oxide market in Asia remained under consistent downward pressure. January saw a modest price rise, supported by reduced plant operating rates and firmer feedstock costs. However, demand from downstream sectors like polyether polyols and polyurethanes stayed weak due to seasonal slowdowns and cautious buying. February experienced steeper declines as the Lunar New Year holidays curtailed activity, while oversupply and aggressive price competition from new capacities intensified the bearish trend.

Propylene Oxide Price Chart

Please Login or Subscribe to Access the Propylene Oxide Price Chart Data

March brought some supply-side relief through maintenance shutdowns, but demand continued to lag. As Q2 began, several plants announced temporary shutdowns due to poor margins, though this was offset by sluggish exports, Ramadan-related demand dips, and continued weakness in construction. April saw further price drops as feedstock propylene softened and downstream buyers continued to procure only as needed. The prices of propylene oxide settled at around 1007 USD/MT (spot FD) during May’25 in the Chinese domestic market.

Europe

The propylene oxide market in Europe followed a mixed but mostly bearish trajectory in H1’25. January began with a modest increase, supported by higher feedstock costs and post-holiday restocking. February remained steady due to balanced supply disruptions, though demand from key sectors like construction and coatings stayed weak.

By March, the market declined notably as downstream consumption fell and competition from Asian imports increased. Shutdowns of older production units and high energy costs further pressured the market. Entering Q2, conditions remained difficult. April was marked by subdued trading, logistical bottlenecks, and limited recovery in industrial output. Demand stayed flat as macroeconomic uncertainty and high borrowing costs hindered recovery in end-use segments.

North America

In North America, the propylene oxide market trended weakly throughout the first half of 2025. January showed slight strength amid restocking and tighter feedstock supply, despite logistical disruptions and soft demand. In February, downstream sectors such as polyurethane and coatings pulled back, dragging prices lower.

March deepened the slump as oversupply and reduced exports added pressure. As Q2 began, prices continued to decline. April saw weak buying interest, with most downstream players cautious due to high production costs and slow housing and industrial activity. Market sentiment stayed pessimistic, and producers faced margin compression amid persistent demand stagnation.

Analyst Insight

According to Procurement Resource, the Propylene Oxide market is expected to remain weak overall. Limited demand recovery, cautious procurement, and global economic uncertainty will likely cap any short-term price rebound, despite some supply-side adjustments.

Propylene Oxide Price Trend for Q4 of 2024

| Product | Category | Region | Price | Time Period |

| Propylene Oxide | Flavours and Fragrances | China | 1213 USD/MT | October'24 |

| Propylene Oxide | Flavours and Fragrances | China | 1160 USD/MT | December'24 |

Stay updated with the latest Propylene Oxide prices, historical data, and tailored regional analysis

Asia

In the Asian region, the Propylene Oxide market exhibited an overall declining trend during the last quarter of 2024. This was primarily driven by weak downstream demand, leading to limited buying activity from key industries, including polyurethane and surfactants. While feedstock prices for propylene and chlorine experienced slight increases in certain regions, the impact was insufficient to support sustained market growth. Some areas in Northeast Asia saw a rise in propylene prices, but this trend was not consistent across the region.

The increase in feedstock prices was mainly due to supply constraints and pre-holiday restocking in select markets. However, despite these temporary price adjustments, demand remained subdued, reflecting broader economic challenges. Manufacturers adopted cautious purchasing strategies, focusing on just-in-time procurement to prevent overstocking in a volatile market. The overall market activity in Asia remained weak, as many buyers refrained from bulk procurement due to lackluster industrial activity and a broader economic slowdown. The monthly average prices in the Chinese market were approximately 1213 USD/MT (CIF) in October and around 1160 USD/MT in December.

Europe

In Europe, the Propylene Oxide market also struggled during Q4 of 2024, primarily due to weak demand in key end-use sectors such as construction and automotive. The construction industry experienced a significant slowdown, driven by high borrowing costs and inflationary pressures, which reduced demand for related products like polyols. Although the automotive sector provided some support through increased vehicle production and sales, it was insufficient to counterbalance the broader market weakness. Consequently, Propylene Oxide prices in Europe remained under downward pressure.

Manufacturers adjusted production rates to align with reduced demand, while new global production capacities further intensified the market strain. The focus shifted to managing inventories efficiently in an environment characterized by low utilization rates. The lack of a substantial recovery in downstream industries limited any upward momentum in prices, keeping market sentiment cautious. Additionally, upcoming maintenance shutdowns at key feedstock facilities in Asia were expected to influence regional supply dynamics, though they were unlikely to provide immediate relief to the European market.

North America

In North America, the Propylene Oxide market followed similar trends observed in Asia and Europe, facing downward pressure due to weak downstream demand. Key consuming industries, such as polyols and surfactants, showed limited buying interest, contributing to the market slowdown. Although production levels increased with the restart of key production facilities, this was counterbalanced by a preference for just-in-time procurement rather than bulk purchases.

Additionally, a cautious macroeconomic outlook, characterized by reduced industrial activity and hesitancy in bulk investments, further dampened market sentiment. The subdued demand across North America sustained the downward price trend through December. Despite efforts to maintain balanced inventories, the overall conservative approach to procurement kept market activity muted.

Analyst Insight

According to Procurement Resource, looking ahead, the Propylene Oxide market is expected to maintain this weak trajectory, with no immediate relief expected in the short term as production continued to outpace demand, contributing to the continued market pressure.

Propylene Oxide Price Trend for Q3 of 2024

| Product | Category | Region | Price | Time Period |

| Propylene Oxide | Flavours and Fragrances | Asia | 1221 USD/MT | July'24 |

| Propylene Oxide | Flavours and Fragrances | Asia | 1207 USD/MT | September'24 |

Stay updated with the latest Propylene Oxide prices, historical data, and tailored regional analysis

Asia

The price trajectory of propylene oxide remained stable in the third quarter of 2024. Average spot prices were around 1221 USD/MT in July and 1207 USD/MT in September. Throughout the quarter, prices fluctuated but within a narrow range. There were some sudden dips, primarily due to falling propylene prices, an important feedstock. The decline in feedstock prices limited cost support for propylene oxide, preventing any dramatic price rebounds and keeping prices range-bound.

Additionally, the downstream procurement market adopted a wait-and-see approach, focusing on on-demand purchasing of raw materials. While some new orders and increased order volumes initially sparked enthusiasm among manufacturers, this optimism was short-lived as falling upstream prices led buyers to expect further declines. Overall, market sentiment remained weak, but prices stayed stable.

Europe

The European propylene oxide market maintained a positive outlook in the third quarter of 2024. Propylene oxide prices rose despite weak demand from the construction and automobile sectors. The main driver behind the price increase was the rising cost of propylene, a key feedstock, due to constrained supply caused by lower availability of import cargoes and reduced domestic production. This drove up production costs for manufacturers and squeezed their profit margins. Overall, the upward trend in propylene oxide prices was supported by higher propylene prices, despite weak demand from key sectors such as polyurethane foams (used in car seats and insulation).

North America

Propylene prices in the North American markets followed an oscillating trajectory in line with global trends. Initially, the market maintained positive sentiment. However, in September, influenced by declining propylene prices in Asia, prices began to fall. Demand for propylene oxide also softened as market participants expected further price declines.

Additionally, logistical challenges arose due to seasonal hurricanes. Some plants had to halt production due to storm-related disruptions; however, the impact was limited, and normal supply levels were restored after a short period.

Analyst Insight

According to Procurement Resource, the prices of propylene oxide are expected to show an oscillating trajectory in the upcoming quarter influenced by evolving global events and other driving factors.

Propylene Oxide Price Trend for Q2 of 2024

| Product | Category | Region | Price | Time Period |

| Propylene Oxide | Flavours and Fragrances | China | 1270 USD/MT to 1257 USD/MT | Q2'24 |

Stay updated with the latest Propylene Oxide prices, historical data, and tailored regional analysis

Asia

The Chinese propylene oxide market experienced a continuous slow-paced downtrend throughout the second quarter of 2024 as its monthly average shifted from 1270 USD/MT to 1257 USD/MT. In April, prices remained relatively stable with slight declines, influenced by moderate cost support from raw materials and varied market conditions between northern and southern regions. However, as the quarter progressed, the prices declined at a faster pace due to insufficient procurement rates.

The raw material prices also fluctuated, providing limited cost support and a balanced supply in East China. Additionally, inventory pressures in Shandong eased, but overall demand for the commodity remained average. Therefore, by late June, the market continued to decline, influenced by fluctuating raw material prices and an average performance on the demand side. Throughout the quarter, downstream buyers remained cautious, leading to downward pressure on prices. Despite some cost support from rebounding raw material prices, the market outlook remained stagnant, with a strong wait-and-see attitude prevailing among market participants.

Europe

In Europe, the propylene glycol market reported a gradual decline since the advent of the second quarter of 2024. The major setback of the market came from the depreciation of the construction sector, particularly in Germany, where April reports indicated an almost 17% decline. The sector was, in turn, adversely affected by the rampant inflation forced by the European Central Bank’s inclining rise in borrowing costs. The drop in polyol demand further made the recovery of the market much more difficult. These challenges were further escalated by inclining inventories and weak feedstock support.

North America

In North America, propylene oxide prices were stable compared to the rest of the world. After the hurricane season, the downstream players increased their stocking activities, propelling the end-user demand for the commodity and driving up its prices. However, cost support of feedstock sectors turned bleak throughout this quarter, exerting a negative influence on the overall dynamics of the market.

As the quarter drew towards its termination, the end-user sector played a significant role in stabilizing the momentum. Although the procurement from PPE and construction industries remained subdued due to low levels of investments, the other industries, such as propylene glycol, registered a high number of orders, reflected well in the price trend of propylene oxide.

Analyst Insight

According to Procurement Resource, the price trend of Propylene Oxide is expected to face southwards in the next quarter given the bleak outlook of global construction sector and fall in cost of feedstock commodities.

Propylene Oxide Price Trend for Q1 of 2024

| Product | Category | Region | Price | Time Period |

| Propylene Oxide | Flavours and Fragrances | USA | 223 USD/MT | March 2024 |

| Propylene Oxide | Flavours and Fragrances | Europe | 123 USD/MT | March 2024 |

| Propylene Oxide | Flavours and Fragrances | China | 1289 USD/MT | January’24 |

| Propylene Oxide | Flavours and Fragrances | China | 1272 USD/MT | March’24 |

Stay updated with the latest Propylene Oxide prices, historical data, and tailored regional analysis

Asia

The propylene oxide prices were observed to be tottering in the Asian markets during the first quarter of 2024. Indian manufacturers did feel the slight pinch of rising feedstock costs. As the crude oil got costlier the downstream demands from the fuel additive sectors also rose, so the pricing outlook in the Indian market was largely optimistic. However, in the Chinese market, the price trajectory was more confined and consolidated. This was primarily attributed to a relaxed supply factor.

With new production capacity, including 150,000 tons/year from Tianjin Petrochemical and 300,000 tons/year from Jincheng Petrochemical in the previous year and continued supply addition in 2024, raised the available supply volumes in the market multifolds. And thus because of this competition, the suppliers had to keep the prices down even amidst rising production costs. In the Chinese propylene oxide market, the monthly average prices went from around 1289 USD/MT in January’24 to about 1272 USD/MT in March’24.

Europe

The European propylene oxide prices saw swift fluctuations. Initially, when the feedstock costs and downstream demands both lay low, the prices also remained downward wavering for the most part. However, the pattern was completely different in the second half. The fire retardant and fuel additive industries started making supportive purchases, which brought back some of the supplier’s confidence. Thus, after marginally plunging in the first couple of months, the European price trend inclined again in the latter phase. Still, it was the growing crude oil prices that kept the markets lifted for the majority of the said duration.

North America

The American propylene oxide prices underwent more fluctuations compared to the Asian markets as various geopolitical and geoeconomic factors came into play in American trade dynamics. Initially, as the fuel and energy prices just began to rise the consumers paid attention and made purchases in the early months.

Coating, chemical, and fuel industries all supported domestic trade in the early days. Thus, the first half of the quarter was relatively more inclined. However, in the second half of the quarter, the suppliers had to cut down the prices. The demands dipped unsustainably low at the higher prices, so the suppliers were left with no choice but to provide discounts. Overall, a varying price trajectory was observed.

Analyst Insight

According to Procurement Resource, considering the current supply and demand dynamics, the market projections look hopeful for the coming times. Positive price performances are anticipated in all the different regions.

Propylene Oxide Price Trend for October - December of 2023

| Product | Category | Region | Price | Time Period |

| Propylene Oxide | Flavours and Fragrances | Asia | 1305 USD/MT | October’23 |

| Propylene Oxide | Flavours and Fragrances | Asia | 1288 USD/MT | November’24 |

Stay updated with the latest Propylene Oxide prices, historical data, and tailored regional analysis

Asia

Propylene Oxide is a direct resultant product of the oxidation of propylene, so the price trend are usually observed to be in a close alliance with the propylene price trajectory. Since propylene oxide is extensively used as a fumigant and pesticide for various industries, the market offtakes from these downstream industries also influence the market run for propylene oxide. During the final quarter of the year 2023, the propylene oxide prices were observed to be wavering throughout the said time in the Asian regional markets.

As the quarter began, the propylene oxide prices continued their downhill journey of the previous months as the monthly average prices fell from about 1305 USD/MT in October to about 1288 USD/MT in November’23. However, by the end of the quarter, the market prices rebounded as the regular movement of the inventory stocks created space for growth. Overall, mixed market trend were witnessed.

Europe

The European propylene oxide market trend were mostly observed to be swinging low during the third quarter of the year 2023. At first, the plunging prices of feedstock propylene pulled the market trend down by substantially reducing the upstream production costs. Second, the bearish downstream demands also didn’t have a very positive effect on the propylene oxide price trend.

North America

The American price trend for propylene oxide were not very different from their European counterparts as the prices here, too, dwelled low for the majority of the said period. The approaching holiday season called for reduced industrial activity, which in turn pushed the propylene oxide market trend southward.

Analyst Insight

According to Procurement Resource, the Propylene Oxide prices are likely to continue to waver in the coming months. Driven primarily by the downstream demands, the market trend are expected to fluctuate going forward as well.

Propylene Oxide Price Trend for the July - September of 2023

Asia

In Asian countries, propylene oxide prices depreciated with the decline in the cost of raw materials and weak demand globally. In China, in July, the propylene oxide prices stood at around 1331 USD/MT, while in September, they fell to approximately 1310 USD/MT (Spot FD).

The downstream industries, such as the construction, automobile, and packaging sectors, faced disruptions in their functioning that resulted in lowering the demand for propylene oxide. However, as the quarter progressed, the depreciation in the prices became less steep. This decline in propylene oxide prices was attributed to the slow recovery of the Chinese industrial sector and the rise in the cost of energy production.

Europe

In European countries, the initial phase of the third quarter suffered from the weak performance of the end-user industries and the poorly struggling condition of the economy. In addition to this, the demand also remained weak, especially during the initial phase, as the hike in inflation and interest rates charged by banks offered no help, neither to the consumer nor to the industrial sector. However, after the initial dip, the subsequent months offered some relief to the propylene oxide prices as the propylene oxide price graph began to incline with improvement in the cost of feedstock materials and a rise in the appetite of packaging industries.

North America

In the third quarter, only the month of July faced the adverse consequences of bearish demand for propylene oxide and deteriorating economic conditions. As seen in the European countries, the negative pressure of inflation and depletion in the prices of feedstock materials played a significant role in keeping propylene oxide in the red zone. But in the later months, the propylene oxide price graph trajectory began to improve as the plastics and chemical manufacturing sector bloomed, raising the number of inquiries of propylene oxide.

Analyst Insight

According to Procurement Resource, the price trend of Propylene Oxide are estimated to slowly recover after a period of depreciation as the improving demand and cost of raw materials are expected to influence the prices of propylene oxide positively.

Propylene Oxide Price Trend for First Half of 2023

Asia

The first quarter of 2023 proved to be in favor of the rise in the price of propylene oxide owing to high volatility in the upstream crude oil and feedstock costs. In the mid-quarter, the rise was much more significant due to the limited availability of products as the production rates slumped in the region. However, in the second quarter, the trend moved downwards with insufficient support from the downstream industries and constriction in the purchasing potential of buyers. The decline was more prominent in the month of June as the high level of production was not met with suitable demand.

Europe

In Europe, the price trend of propylene oxide fell throughout the first and second quarters of 2023 due to a lack of support from the market conditions. Consistently falling prices of crude oil and rising rates of interest took a heavy toll on the prices of propylene oxide. Among the downstream industries, construction and polyol were specifically low. In addition to this, low procurement rates from domestic and international buyers and a lower number of inquiries ultimately resulted in the decline in propylene oxide prices.

North America

The US banking sector fell consistently in the first and second quarter of 2023, and due to this, the interest rates charged by banks increased several folds, which affected the propylene oxide price trend negatively. The conditions became much more challenging in the second quarter as demand and feedstock sectors remained in the negative zone. The uprising inflation, slow movements in downstream industries, and economic downfall in the region eventually led to the decline in the price trend of propylene oxide.

Analyst Insight

According to Procurement Resource, the price trend of Propylene Oxide is expected to fall in the upcoming quarters due to declining demand, a challenging economy, and high rates of inflation.

Propylene Oxide Price Trend for the Second Half of 2022

Asia Pacific

The Asian-Pacific region saw a fluctuating trend in the third quarter due to the oscillating feedstock prices and reduction in production costs by the manufacturers. The prices increased a bit in the mid-quarter as the crude oil prices increased, impacting the petrochemical and allied sectors.

This incline was, however, short-lived and the prices of propylene oxide took a dip towards the end of the quarter. This declining trend continued till the fourth quarter. Port congestion leading to disruption in export-import in South Korea and China, decreased manufacturing, destocking by local exporters, and global freight changes negatively affected the propylene oxide price trend.

Europe

The third quarter saw fluctuation in the prices of propylene oxide. These are majorly attributed to the reduction in feedstock prices and the decrease in downstream orders from the end-user industries. Another factor adding to the declining-inclining price trend is the rise in inflation that depreciated the value of the currency.

The prices, however, stabilized towards the end of the quarter. This was not seen further in the fourth quarter, as the prices dipped due to declining demand, increased production costs and a shortage of supply. Manufacturers reduced their profit margins amid high inflation rates and reduced inquiries.

North America

The North American market oscillated in the third quarter of 2022. The decline in prices was attributed to the reduction in the cost of production. The feedstock prices also fluctuated along with the increase in inventories. The price trend of propylene oxide was also influenced by reduced crude oil prices. The prices saw a slight incline towards the end of the third quarter, but this was not followed in the fourth quarter and the prices gradually declined throughout the quarter.

Analyst Insight

According to Procurement Resource, the prices of Propylene Oxide are expected to decline in the coming month given the reduced demand, rising inflation, and fluctuating crude oil prices.

Propylene Oxide Price Trend For the Second Quarter of 2022

Asia

In June 2022, the price for propylene oxide fell in the Chinese market as the price of feedstock propylene weakened. The demand from downstream industries as well as in the regional market was low along with flat shipments which in turn supported the low prices. In the second week of June, the average propylene oxide prices were assessed at around 11,033 RMB/MT dropping by almost 4.34% since May 2022.

Propylene Oxide Price Trend For the First Quarter of 2022

Asia

The average enterprise price of propylene oxide was 11,800.00 RMB/MT on February 10, up 6.31% from January 10, and up 28.19% in a three-month cycle. The price of propylene oxide on the market increased in the second week of February.

The price of the raw material propylene had been pretty robust in Q1 of 2022, and the cost side had some support. Some firms were running at a low capacity, and supply was scarce. The downstream on-demand follow-up scenario was adequate. The mainstream propylene oxide quote in Shandong's propylene oxide market on the 10th was approximately 11,500-11,600 RMB/MT.

Propylene Oxide Price Trend For the Fourth Quarter of 2021

Asia

The cascading impact of the surge in crude oil prices on global supply constraints caused propylene and other oil equivalents to gain value in price trend, driving up propylene oxide prices in Asia in October and November. The polyurethane industry's market for propylene oxide remained robust throughout the quarter.

With spot activity picking up pace following a brief respite in the global port container crisis in December, the prompt delivery of import supplies forced traders in India to make downward revisions to PO contracts, which were hovering around 2934 USD/MT Ex-Mumbai. Meanwhile, the Japanese market saw a fall in propylene oxide prices throughout December, following record highs in November, but the percentage decline was not big enough due to constant costs of implementing in the polyurethane sectors.

Europe

The European market faced the brunt of crude oil supply limits and spiking energy prices, which combined to create manufacturing constraints for PO resulting in considerable price increases all through the 4th quarter of 2021. The relentless rise in upward cost pressures combined with the rising demands for PO in the polyol industry compelled producers to make regular upward price revisions to generate significant netbacks. Germany propylene oxide prices, which settled around 3595 USD/MT FOB Hamburg in December, suggested low domestic inventories in the face of increased export activity.

North America

In North America, the PO market entered the final quarter of 2021 with favorable feelings. Propylene oxide prices continued to rise steadily throughout October and a large portion of November, owing to the jump in propylene input cost.

Influenced by the region's crude oil supply deficit, mostly as a result of reduced refinery operations due to ongoing repairs at Louisiana facilities following landfall by Hurricane Ida, the flow of propylene feed remained scarce in the region's PO facilities. However, prices in the United States remained stable in December, settling at 3465 USD/MT FOB Louisiana, owing to a decline in propylene prices and increased offtakes in global various end-use industries following supply chain renovation.

Propylene Oxide Price Trend For First, Second and Third Quarters of 2021

Asia

PO supply was raised in the first quarter of 2021 to coincide with the completion of turnarounds at several large plants in the northeast Asian region. Additionally, the advent of new manufacturing facilities in China increased overall supply in the Asia-Pacific.

However, because of the Chinese Lunar New Year vacations, the PO market in China stayed subdued, resulting in uneven demand results. Consumption of propylene glycols and polyols increased in the second part of Q1, generating an increase in overall market pricing.

Supply in the Asia Pacific region was sufficient to meet the demand of end-use sectors, however, it varied significantly in several major markets around the region. In China, because of rising inflation rates, the costs of the crucial feedstock propylene remained stable for the majority of Q2, adding to buyer resistance. In June, the FOB Qingdao PO debate was resolved at 1981 USD/MT. In Southeast Asia, the second COVID wave wreaked havoc on downstream markets, reducing demand.

Propylene oxide prices increased considerably in the Asia Pacific region in the third quarter. Propylene prices in the upstream sector were stable in Q3 due to rising inflation rates in China's domestic market. Producers in China received continuous orders from downstream polyether polyol producers, resulting in the price increase. Global shortages of the chemical had a spillover impact on the Indian economy, resulting in a sharp increase in its pricing. The price CFR JNPT (India) was last resolved at 2555 USD/MT in September.

Europe

PO availability in the European region was constrained during the first quarter as a result of reduced feedstock production from refineries in response to increased pandemic cases and new lockout limitations. The situation deteriorated further as imports from Asia were hampered by the Chinese Lunar New Year, compounded by the disruption caused by harsh weather conditions in the United States. However, demand from the regional polyol maker remained strong throughout the quarter.

In the European continent, the overall forecast for the PO market continued to improve in Q3 of 2021. Across the region, supply circumstances improved. Due to a shortage of upstream propylene required to manufacture propylene oxide in Q3 2021, its price increased. The construction sector continued to be a strong buyer of PO derivatives throughout the quarter. Propylene Glycol demand remained robust in this quarter as well, owing to the cosmetics and pharmaceutical industries.

North America

Supplies of PO remained scarce in Q1 2021, as major US propylene factories were shut down for planned maintenance in the first half of the year. The tight supply scenario was exacerbated further when many propylene manufacturers stayed down due to serious freezing weather in the Gulf of Mexico region of the United States.

However, increased consumption in the downstream polyols and polyurethanes sectors boosted regional demand. Due to rising demand and supply constraints, regional propylene oxide prices more than doubled in March settlements, reaching 2600 USD/MT in mid-March.

As the US chemical industry recovered from the devastation caused by winter storm Uri, improved operations at refineries and PDH units contributed to an improvement in propylene oxide supplies in North America compared to the last quarter. Improved availability, on the other hand, did not affect regional pricing, which continued to rise throughout the quarter.

FOB Louisiana (USA) negotiations concluded in June at 2581 USD/MT, an increase of 356 USD/MT above March levels. The supply-demand situation remained uneven in the second quarter, as seasonal offtakes from downstream polyol makers increased to meet growing building demand. Demand was bolstered further by increased polyol and propylene glycol shipments.

Propylene oxide prices increased in the domestic market in the North American region in Q3 2021. The combination of rising propylene prices and a scarcity of PO inventories resulted in a tightening of the material's supply fundamentals. A similar pattern was observed globally, as PO supply had been severely curtailed since the start of the year. The scarcity of raw materials and the rising production costs have had a twofold effect on the region's production rates.

Additionally, the supply chain was harmed throughout the quarter by limited logistical availability in the region. PO demand was robust in the third quarter, as downstream isocyanates continued to draw higher volumes in response to the demands for polyurethanes in the US marketplace. As a result, propylene oxide prices increased throughout Q3. The worldwide PO market experienced a scarcity as a result of unanticipated turnarounds by large producers such as Dow Chemicals in the aftermath of Hurricane Ida.

Latin America

Increased demand for hygiene-related items and disposable goods as a result of the pandemic resulted in increased polyethylene and polypropylene demand in South America in 2021. PP imports increased to $226 million in November 2021, up from $203 million in January 2020. The demand and supply balance of propylene oxide was fairly balanced during the year, thanks to imports.

Propylene Oxide Price Trend For the Year 2020

Asia

As a result of scheduled maintenance and future turnarounds at many manufacturing plants, propylene oxide (PO) spot and contractual sales were regulated by manufacturers in light of the staggering decrease in net supplies. Durable demand for polyols also prompted some integrated PO manufacturers to shift their focus to polyol production instead of simply selling propylene oxide.

As China's furniture and home furnishing sector entered the peak demand season in September following a 16.4% increase in July, demand for polyols increased. Supply constraints increased as numerous PO factories in Shandong faced unexpected environmental inspections, forcing them to cut production rates.

Due to the scheduled maintenance shutdown of Nanjing Hongbaoli's hydrogen-peroxide-propylene oxide plant in late August, the overall operating rate of PO plants in China decreased significantly to 77% by the quarter's conclusion. Spot propylene oxide prices in China, which had been hovering around 2350 USD/MT, had risen to 2400 USD/MT by September end.

Europe

With a noticeable uptick in downstream demand, domestic manufacturers increased their operational rates in the third quarter. Global supply constraints had a direct impact on the market dynamics of the chemical in Europe, resulting in low inventory levels despite strong demand for downstream polyols.

North America

The strong recovery in polyol demand boosted PO market sentiments in North America. A sudden mismatch in supply and demand caused by constrained production and an unexpected resurgence in downstream demand increased the market's shortfall for its derivatives. Propylene oxide prices in the region quickly increased in September, following the sharp slant in demand trend. With numerous production facilities on the Gulf coast declared inoperable due to Hurricane Laura fears, the region's total supply tightened, resulting in a significant rise in its average price for the quarter.

Latin America

South America began its fourth quarter of 2020 with a positive outlook on the polymer market. During the first half of 2020, the region was one of the hardest hit, but it recovered quickly in the second half. The automobile sector in South America increased polypropylene usage in the third quarter. Vehicle production levels in Brazil and Argentina improved since May and stabilized in August. In April, the industry was almost completely shut down due to the coronavirus outbreak.

Procurement Resource provides latest prices of Propylene Oxide. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

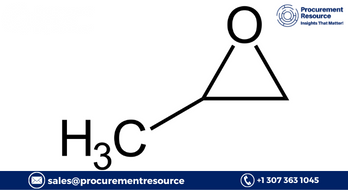

About Propylene Oxide

In appearance, Propylene Oxide appears as a clear, colourless volatile liquid with an ethereal odour. It has a flashpoint of about -35°F, while its boiling point is about 95°F. Its primary role is its use in the manufacture of polyether polyols, which are further utilised in the production of polyurethane plastics. Its niche applications include its use as a pesticide and a fumigant for the sterilisation of packaged foods and plastic medical instruments. It is also utilised as a fumigant, in making detergents or lubricants, and to make other chemicals.

Propylene Oxide Product Details

| Report Features | Details |

| Product Name | Propylene Oxide |

| Industrial Uses | Intermediates, Adhesives and sealant chemicals, Flame retardants, Fuels and fuel additives, Lubricant additives, Surface active agents, Adhesive, Automotive care |

| Chemical Formula | CH3CHCH2O or C3H6O |

| Synonyms | 75-56-9, 2-Methyloxirane, Epoxypropane, 1,2-Epoxypropane, Propylene epoxide, 1,2-Propylene oxide, Methyl oxirane, 1,2-Epoxypropane, Propene oxide, Methyl ethylene oxide, Methylethylene oxide |

| Molecular Weight | 58.080 g/mol |

| Supplier Database | The Dow Chemical Company, BASF SE, Huntsman Corporation, Sumitomo Chemical Co., Ltd., LyondellBasell Industries Holdings B.V., Royal Dutch Shell Plc. |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Propylene Oxide Production Processes

- Production of Propylene Oxide via Chlorohydrin; and via Oxidation

In order to produce Propylene Oxide via oxidation, propylene is used as a starting material. In this process, propylene is oxidised with the addition of an organic hydroperoxide, which finally produces Propylene Oxide.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Related News

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com