Product

Thiram Price Trend and Forecast

Thiram Price Trend and Forecast

Thiram Regional Price Overview

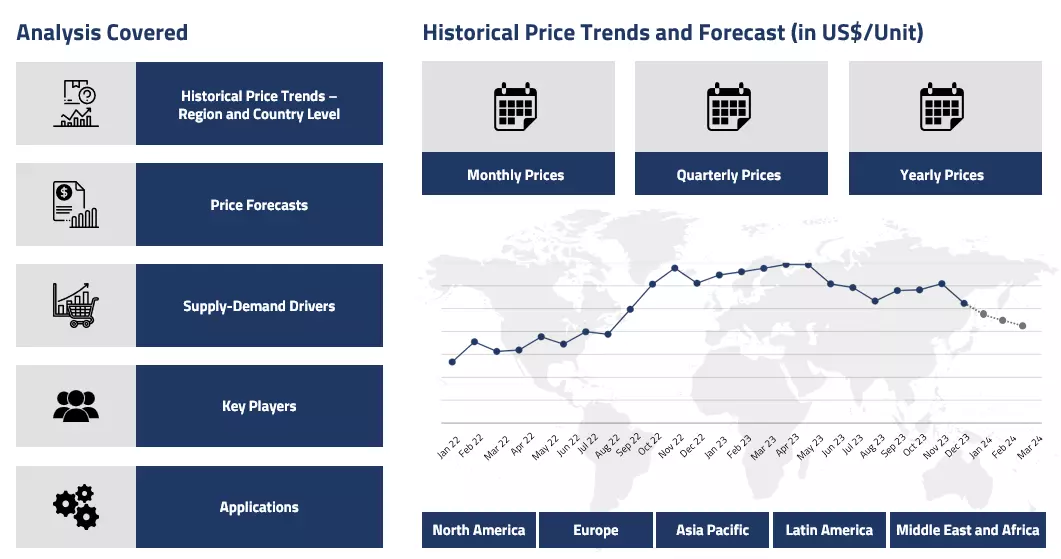

Get the latest insights on price movement and trend analysis of Thiram in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Thiram Price Trend for Q2 of 2025

Asia

In the second quarter of 2025, Thiram prices in Asia showed a fluctuating pattern, largely shaped by the agrochemical sector’s performance. The quarter began on a slower note, as weak demand and market oversupply led to downward pressure on prices.

Thiram Price Chart

Please Login or Subscribe to Access the Thiram Price Chart Data

However, as the Kharif planting season approached, demand from the agricultural sector picked up, particularly in India. This recovery in downstream activity contributed to a rebound in pricing towards the latter half of the quarter. Export activity to nearby Asian countries also saw a marginal improvement, helping stabilize the market. By the end of Q2, Thiram prices operated within a narrow range as supply and demand began to balance out.

Europe

The European Thiram market experienced moderate price strength in the first half of Q2, supported by seasonal demand from the agriculture industry. Fertilizer and herbicide producers increased their purchasing activity ahead of spring planting. However, this momentum did not sustain through the entire quarter.

By June, demand had softened slightly, and prices began to ease as buyers became cautious amid logistical bottlenecks at key ports like Hamburg. Despite these challenges, local distribution networks helped maintain steady trade within the region, especially to nearby markets such as France and the Netherlands. Overall, pricing remained relatively stable with minor fluctuations.

North America

In North America, Thiram prices reflected a sluggish start to the quarter, mainly due to reduced agrochemical demand and stricter regulatory conditions. Pesticide usage slowed under evolving EPA guidelines, and planting delays driven by climate-related factors further weakened consumption.

Although the pharmaceutical sector maintained steady interest, it wasn’t enough to lift overall market sentiment. Supply remained ample as production continued steadily, leading to an inventory build-up. In the latter part of Q2, there was a slight improvement in pricing as demand began to recover, though activity remained cautious overall.

Analyst Insight

According to Procurement Resource, Thiram prices are expected to stay stable with a slight upward bias, supported by steady agricultural demand and regional recovery in agrochemical usage.

Thiram Price Trend for Q1 of 2025

Asia

During Q1'25, the Thiram market in Asia experienced a notable upward price trajectory, primarily influenced by tight supply conditions and increased agricultural activity. In China, the largest producer in the region, Thiram prices climbed steadily as manufacturers faced higher production costs due to rising chemical intermediates and energy expenses.

The post-Chinese New Year period saw accelerated demand as the agricultural season commenced, with farmers stocking up on fungicides for spring applications. Indian markets similarly witnessed price appreciation, driven by strong domestic agricultural demand and reduced inventory levels. Export volumes remained robust throughout the quarter, particularly to Southeast Asian countries where rubber cultivation drove consistent Thiram consumption. Supply chain pressures, including lingering logistics constraints, further contributed to the bullish trend in the Asian market.

Europe

The European Thiram market displayed more moderate price movements during Q1'25. Prices trended slightly upward, though not as dramatically as in Asia. The European agricultural sector saw typical seasonal demand for fungicides, but this was somewhat tempered by regulatory scrutiny and ongoing substitution with newer fungicide alternatives in certain applications.

Western European manufacturers maintained stable production levels, helping to keep extreme price volatility in check. However, higher upstream chemical costs did exert upward pressure on Thiram pricing, particularly in Eastern European markets where import dependency is higher. The rubber processing industry, another key consumer of Thiram, showed consistent demand patterns throughout the quarter, providing steady support for prices despite not driving significant increases.

North America

In North America, Thiram prices followed a gently ascending trend during Q1'25. The market benefited from balanced supply conditions, with domestic production maintaining relatively steady output levels. Agricultural demand began picking up toward the end of the quarter as farmers prepared for the spring planting season, particularly in the southern states where earlier application occurs.

The rubber and polymer sectors showed stable consumption patterns, neither significantly increasing nor decreasing their Thiram requirements. A noteworthy influence came from higher production costs, as manufacturers passed along increases in energy and raw material expenses. Import volumes remained consistent with historical patterns, though discussions around potential tariff adjustments created some uncertainty in the market. Overall, while prices increased, the North American Thiram market avoided the sharp spikes seen in some Asian regions.

Analyst Insight

According to Procurement Resource, Thiram prices are expected to maintain their upward momentum into Q2'25, particularly in Asia where agricultural demand will likely peak. Supply constraints may gradually ease as production catches up, potentially moderating price increases by mid-year, especially in European and North American markets.

Thiram Price Trend for the Second Half of 2024

Asia

In the second half of 2024, thiram prices in Asia experienced a moderate upward trajectory. The market was primarily influenced by fluctuations in key raw materials, which showed a mixed trend early in the period but stabilized with a slight recovery toward year-end. Chinese manufacturers faced challenges from typhoons and port congestion during Q3, leading to higher intra-Asia freight costs that temporarily disrupted supply chains. Meanwhile, the Indian market remained more stable, with only marginal price increases.

The agrochemical sector showed mixed performance, with favorable monsoon conditions supporting domestic demand in some areas, while delayed rains in other regions curbed growth. Production adjustments in China helped balance market conditions by Q4, with manufacturers strategically managing inventory levels despite economic headwinds.

Europe

The European thiram market exhibited a more pronounced upward trend throughout H2’24. Initially, prices were driven higher by significant tightening of raw material supply, with freight costs from Asia to Europe soaring. German manufacturers faced production challenges amid manufacturing slowdowns and regional conflicts that disrupted supply chains. The agricultural sector's seasonal demand patterns influenced market dynamics, with a gradual decline in fertilizer consumption as the peak season subsided toward year-end. By Q4, logistics challenges at Hamburg port began to ease, allowing for smoother supply chains and inventory replenishment, contributing to a moderation in price increases by December.

North America

In North America, thiram prices followed an irregular pattern throughout the second half of 2024. The market initially saw price increases in Q3, driven by production outages and reduced operational capacities. Labor strikes at key ports further complicated the supply situation. However, as these disruptions began to ease in Q4, the market experienced a correction with prices declining from their peak.

Demand from the agricultural sector remained steady but unspectacular, while pharmaceutical applications provided consistent baseline consumption. The export market, particularly to Mexico and Latin America, showed slowing growth by year-end. Fluctuations in raw material costs created a complex environment for manufacturers throughout the period.

Analyst Insight

According to Procurement Resource, the Thiram market is expected to stabilize in early 2025, with regional price differences likely to narrow as global logistics improved.

Thiram Price Trend for the First Half of 2024

Thiram, a dithiocarbamate, is a synthetic chemical compound used in the protection of plants. It is a potent fungicide and bactericide and is often applied to seeds to protect them from fungal infection during germination. Therefore, the primary demand for thiram came from the agriculture sector in the said period. Initially, the demand was low in the winter months, but it soon picked up as the year entered the planting season in different parts of the world. Apart from this, the prices of thiram were seen to be heavily dependent on its feedstocks, dimethylamine, and sulphuric acid.

The prices of feedstocks witnessed regional variations, but the average global trend showed an uptick in prices. The Red Sea crisis had severely affected the global supply chains as ships had to take a longer route to avoid attacks which delayed shipments and increased the freight rates. This event had a massive effect on the prices of most commodities including the feedstocks of thiram. This increased the production costs of thiram, and to maintain the profit margins, the manufacturers had to raise prices. Overall, the prices of thiram witnessed an upward trend in the first half of 2024.

Analyst Insight

According to Procurement Resource, the prices of thiram are expected to continue following a similar trend trend in the upcoming quarter as well influenced by the variations in prices of feedstocks, especially sulphuric acid.

Thiram Price Trend for the Second Half of 2023

Thiram is primarily used in protecting crops from fungal diseases, such as mildew and mold. Additionally, thiram serves as a crucial component in seed treatments, enhancing seedling vigor and protecting seeds from soil-borne pathogens. The increasing emphasis on crop productivity and yield optimization further fuels the demand for thiram-based products and drives its market demand.

In Asia, fluctuations in thiram prices were tied to variations in feedstock costs, exaggerated by issues like delays in shipments due to geopolitical tensions and slow economic recovery, particularly in China. Additionally, the Indian pesticide market also reported a slowdown in the procurement of thiram from the downstream pesticide industries as the delayed sowing season disrupted the demand cycle and imparted a negative influence on the thiram price trend during H2 of 2023.

Europe also experienced stagnancy in thiram prices due to trade disruptions from geopolitical challenges and the crude oil crisis. The struggle with imports and exports was fueled by the ongoing Israel-Hamas crisis and additional sanctions on Russian imports. North America also faced weak demand, leading to excess availability and declining prices, compounded by declining costs of methylamine and other chemicals and reduced trading activities among dealers.

Analyst Insight

According to Procurement Resource, the price of Thiram is estimated to be guided by the number of queries from the downstream industries and dynamics of global trade.

Thiram Price Trend for the First Half of 2023

Thiram is an agrochemical used to control pests and microbes like bacteria, fungi, etc. It can also be used in the cosmetic industry to increase the shelf life and anti-bacterial and anti-fungal properties of products. As it is sourced from its feedstock materials, Dimethylamine and Sulfuric Acid, the prices also vary in accordance with the variations in the prices of these materials.

Thiram had a stable start in January’23 as the Chinese industries ramped up production after a long Covid-19 lockdown. The inventories were rising fast, and the demands from the downstream market were stable. The Thiram prices, after staying steady, initially started falling by mid-Q1 and continued their downhill journey for the rest of the said period as the inventories were overflowing. A decline in downstream demands and upstream costs also contributed to the falling price trend. Overall, the Thiram market was observed to be fluctuating during H1 2023.

Analyst insight

According to Procurement Resource, the Thiram prices are expected to continue fluctuating since the demands and the production costs influencing the market fundamentals remain volatile.

Procurement Resource provides latest prices of Thiram. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Thiram

Thiram is a white to yellow crystalline solid extensively used as a fungicide. Thiram is an organic disulfide that results from the formal oxidative dimerization of N, N-dimethyldithiocarbamic acid. It is an agrochemical in seeds and crops to prevent harvest losses due to rodents and pests.

It is also used as a bactericide and in sunscreens formulations. Sometimes, Thiram is used as a source of sulfur in the vulcanization of rubbers. It is a common environmental hazard as it seeps down the soil and contaminates the groundwater.

Thiram Product Details

| Report Features | Details |

| Product Name | Thiram |

| HS CODE | 38089230 |

| CAS Number | 137-26-8 |

| Industrial Uses | Bactericides, Agrochemicals, Sunscreens, Rubber Processing, Antiseptic Drug |

| Chemical Formula | C6H12N2S4 |

| Synonyms | Dimethylcarbamothioic dithioperoxyanhydride, Tetramethylthiuram disulfide, Thiuram |

| Molecular Weight | 240.43 g/mol |

| Supplier Database | Guanlong Longhua, Nantong Baoye, Dow AgroSciences, Bayer SA, Nufarm |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Thiram Production Processes

- Production of Thiram from Dimethylamine and Sulfuric Acid

In this process, Thiram is produced via dimethylamine and carbon disulfide in the presence of sodium hydroxide, hydrogen peroxide, and sulfuric acid.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com