Product

Turpentine Price Trend and Forecast

Turpentine Price Trend and Forecast

Turpentine Regional Price Overview

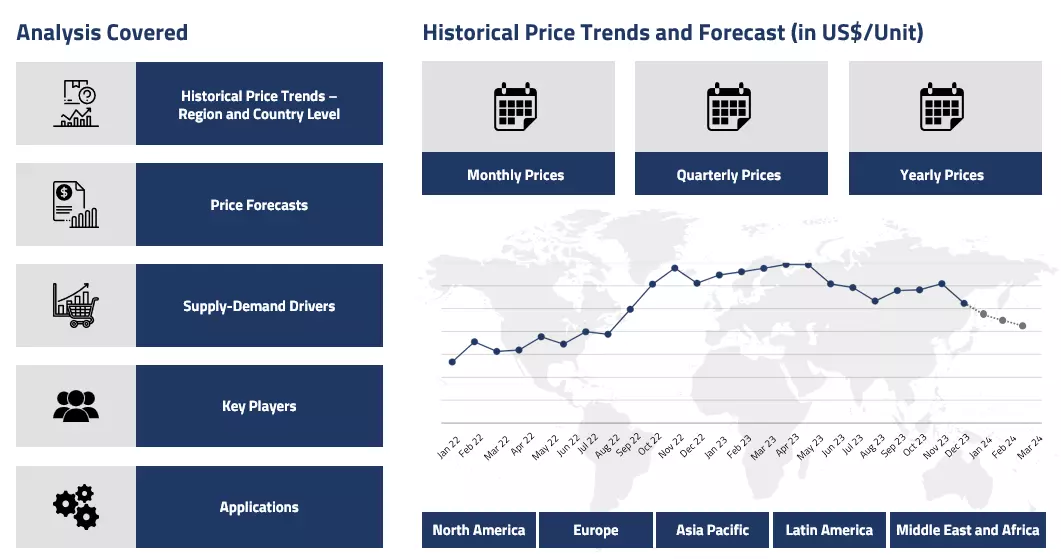

Get the latest insights on price movement and trend analysis of Turpentine in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa).

Turpentine Price Trend for Q1 of 2025

Turpentine prices experienced significant upward momentum throughout Q1’25, particularly for natural gum turpentine derived from pine trees. The quarter began with already elevated prices following increases in late 2024, and this bullish trend continued through February and March. Brazilian Pinus elliottii gum turpentine led the surge, with prices rising dramatically compared to the previous year.

Turpentine Price Chart

Please Login or Subscribe to Access the Turpentine Price Chart Data

The price increases stemmed primarily from severe supply constraints, as several production facilities in Brazil reported being completely sold out through February and March. This supply shortage occurred because turpentine is a byproduct of pine oleoresin processing, and manufacturers had reduced overall processing rates due to softer demand in downstream rosin markets. With lower processing volumes but sustained demand for turpentine, the market faced significant supply pressure.

Demand remained robust throughout the quarter, particularly from key end-use sectors including aroma chemicals, fragrances, and household cleaning products. This strong demand, coupled with limited availability, created a seller's market where buyers had little negotiating power. North American markets also experienced price increases, though somewhat less dramatic than those seen in South American exports.

Analyst Insight

According to Procurement Resource, Turpentine prices are anticipated to continue rising through Q2’25, with no immediate solution to the supply constraints as rosin processing rates are expected to remain low.

Turpentine Price Trend for the Second Half of 2024

Turpentine prices followed a downward trajectory throughout the second half of 2024, influenced by multiple market factors. In Q3, prices initially showed some stability but soon declined as production costs fell due to drop in crude oil prices. The monsoon season in Asia dampened construction activities, a key downstream industry, further weakening demand and pushing prices lower.

The market continued its bearish trend into Q4, with only brief periods of price recovery. Supply disruptions from port strikes in North America and Europe created temporary logistical challenges, but these weren't enough to significantly boost prices due to persistently weak demand. The hurricane season extending into November affected US production but didn't tighten supplies as consumption remained below capacity across regions.

By December, most suppliers engaged in inventory liquidation to avoid year-end tax implications, putting additional downward pressure on prices. Despite APAC seeing a modest price recovery in December as regional supplies tightened, the overall market sentiment remained cautious with minimal off-takes from downstream industries like paints, coatings, and construction materials.

Analyst Insight

According to Procurement Resource, the Turpentine market is expected to remain under pressure in early 2025, with potential stabilization dependent on construction sector recovery and improved market fundamentals.

Turpentine Price Trend for the First Half of 2024

The global turpentine market experienced a mix of rising and dipping trends in the first two quarters of 2024, influenced by various regional factors. In North America, a robust performance in the construction sector, marked by increased house completions and heightened commercial activities, drove demand in February and March despite a January slowdown due to challenging weather conditions. This was compounded by rising crude oil prices in the first quarter which increased production costs, moving ahead even though the crude oil prices slowed down in the second quarter, the demand trajectory kept the turpentine market supported in the states.

In contrast, Asia, particularly India, faced significant price declines due to reduced demand from the paint and coating industry, and a slowdown in construction during the winter season in the early months. As time progressed the demands started redeeming and did provide some cost support to the Indian turpentine markets, however, the oversupply situation of inventories quickly made up for the esteemed growth. Overall, mixed market sentiments were observed for turpentine.

Analyst Insight

According to Procurement Resource, given the current supply and demand dynamics, Turpentine prices are likely to remain hinged in the coming months as well.

Turpentine Price Trend for the Second Half of 2023

The turpentine market is primarily driven by its usage as a solvent in paints, varnishes, and coatings. It makes it a vital component in the construction and manufacturing sectors. Additionally, turpentine finds extensive use in the production of fragrances, flavorings, and pharmaceuticals, further bolstering demand.

In the chemical industry, it serves as a raw material for the synthesis of resins, adhesives, and synthetic rubber. Its growing popularity of eco-friendly and bio-based products enhances the market prospects for turpentine as a renewable and sustainable resource.

In the third quarter, the turpentine price trend bore a bullish trend as the global textile and construction industries shared a suitable outlook. Also, the positive performance of the paint and coatings industries became exponential in the consecutive quarter, which positively influenced the market. In Asia, the traders also noted a relief in inflationary pressure and a remarkable rebound of the economic parameters that led to the surge in the turpentine price trend. This bullish run was further carried forward in the fourth quarter, too, as the global renovation projects and purchasing activities pushed the market to the upper side.

In the European and North American regions, the trend remained mild throughout the H2 of 2023 as the manufacturers and housing industries crumbled under the pressure of rising interest rates and inflation. Additionally, the disruption of the Red Sea route and drought in the Panama Canal lowered the export volumes from Europe and North America, respectively.

Analyst Insight

According to Procurement Resource, the price trend of Turpentine is expected to oscillate in the upcoming quarters as the outlook of the downstream industries looks negative.

Turpentine Price Trend for the First Half of 2023

Turpentine prices observed wavering price trend throughout the first half of the year 2023. Turpentine market trend were fundamentally driven by the downstream demands from the chemical and construction sectors. In the Asian market, the industrial recovery in China and infrastructure development in India fueled the demands for Turpentine, so the price trend inclined at the beginning, but sufficient supplies soon plateaued the price curve.

The domestic situation was better for the Asian Turpentine market; however, the export queries took a serious hit. Further, high inflation in Europe and America affected the construction sector negatively, and the Turpentine consumption got bearish. This caused an oversupply in the Asian market, although moderate demands kept the Turpentine market afloat. Overall, mixed market sentiments were experienced.

Analyst Insight

According to Procurement Resource, the demand outlook suggests a similar consumption pattern for the coming months as well. However, the situation is anticipated to improve for the American and European Turpentine markets moving forward.

Procurement Resource provides latest prices of Turpentine. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Turpentine

Turpentine is one of the oldest and most common industrial solvents. It is distinct from other chemical solvents as it is derived from a renewable source. Turpentine is a chemical that is naturally derived from live pine trees, as it has been for decades. It is ready for use in industrial applications after a thorough distillation process.

Turpentine Product Details

| Report Features | Details |

| Product Name | Turpentine |

| Industrial Uses | Solvent, Water Proofing, Sanitation, Cosmetics, Insect Repellants |

| Chemical Formula | C10H16 |

| Synonyms | Gum turpentine, Spirits of gum turpentine, Turpentine gum |

| Molecular Weight | 136.23 g/mol |

| Supplier Database | PT. Naval Overseas, Wuzhou Pine Chemicals Ltd., Punjab Rosin and Chemicals Works, Wuzhou Sun Shine Forestry & Chemicals Co.,, Forestar Chemical Co., Ltd., Deqing Yinlong Industrial Co., Ltd., Deqing Jiyuan synthetic Resin Co., Ltd., Resin Chemicals Co., Ltd |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Turpentine Production Processes

- Production of Turpentine from Natural Resin

Turpentine is extracted from the natural resin of pine trees during the distillation process.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com