Methylene Diphenyl Diisocyanate (MDI) Production Cost Reports

Chemicals

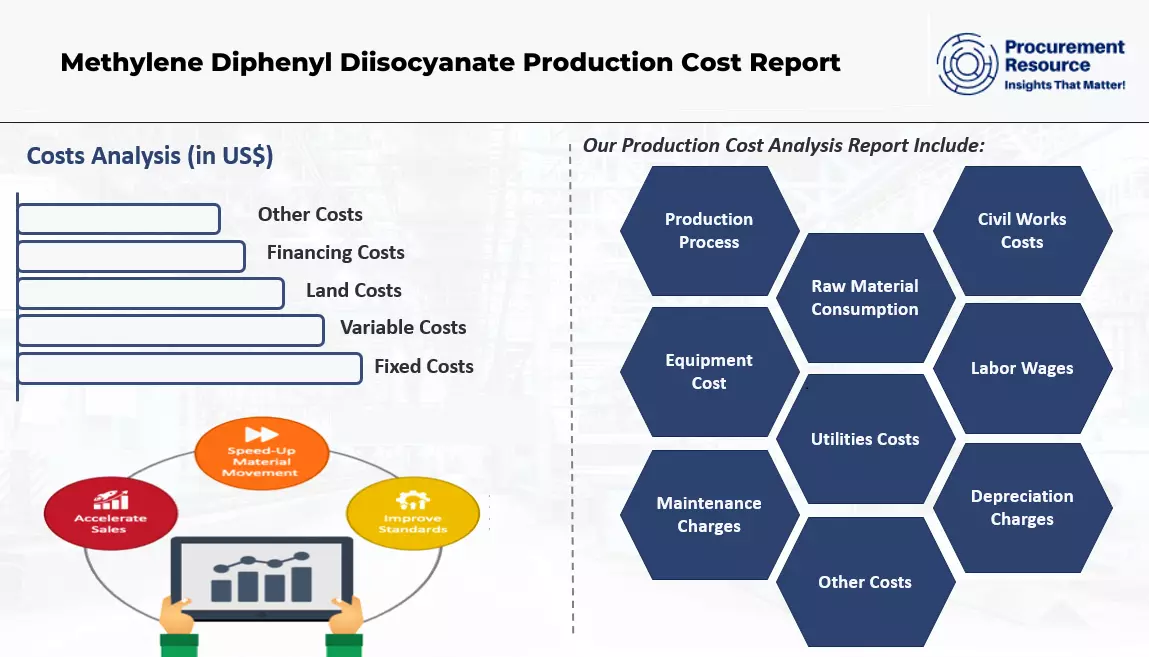

The report provides a detailed analysis essential for establishing a Methylene Diphenyl Diisocyanate (MDI) manufacturing plant. It encompasses all critical aspects necessary for Methylene Diphenyl Diisocyanate (MDI) production, including the cost of Methylene Diphenyl Diisocyanate (MDI) production, Methylene Diphenyl Diisocyanate (MDI) plant cost, Methylene Diphenyl Diisocyanate (MDI) production costs, and the overall Methylene Diphenyl Diisocyanate (MDI) manufacturing plant cost. Additionally, the study covers specific expenditures associated with setting up and operating a Methylene Diphenyl Diisocyanate (MDI) production plant. These encompass manufacturing processes, raw material requirements, utility requirements, infrastructure needs, machinery and technology requirements, manpower requirements, packaging requirements, transportation requirements, and more.

Methylene Diphenyl Diisocyanate (MDI) is a chemical compound used across various industries due to its excellent properties. Its man applications include the production of rigid polyurethane foams for insulation in construction, flexible foams for automotive seating and furniture upholstery, and components for household appliances like refrigerators and air conditioners. MDI is also essential in manufacturing adhesives and sealants, elastomers, and specialty applications in the oil and gas industry.

The market for Methylene Diphenyl Diisocyanate (MDI) is driven by its usage in the production of polyurethane foams, which are used in construction for insulation, soundproofing, and as structural materials. Its utilization to manufacture components such as seats, dashboards, and insulation materials elevates its demand in the automotive industry.

The rising demand for appliances like refrigerators, air conditioners, and other electronic goods that utilize MDI-based components amplifies its market appeal. Overall, industrial Methylene Diphenyl Diisocyanate (MDI) procurement is influenced by its application in various industries such as automotive, construction, electronics, furniture, and polymer industries, the availability of its raw materials (aniline and formaldehyde), the cost of its raw materials, the rising demand for MDI-based electronic appliances, technological advancements, the rising demand for eco-friendly products, urbanization trends, and regional market dynamics.

Raw Material for Methylene Diphenyl Diisocyanate (MDI) Production

According to the Methylene Diphenyl Diisocyanate (MDI) manufacturing plant project report, the key raw materials used in the production of Methylene Diphenyl Diisocyanate (MDI) include aniline-formaldehyde.

Manufacturing Process of Methylene Diphenyl Diisocyanate (MDI)

The extensive Methylene Diphenyl Diisocyanate (MDI) production cost report consists of the following major industrial manufacturing processes:

- Production via Phosgenation: The manufacturing process of Methylene Diphenyl Diisocyanate (MDI) starts with a reaction of aniline with formaldehyde to produce a mixture of diphenylmethane diamine (MDA) and polymeric amines (PMDA). Finally, the mixture undergoes a phosgenation reaction to produce MDI and polymeric MDI, followed by their separation to produce Methylene Diphenyl Diisocyanate (MDI) as the final product.

- Production via Oxidative Carbonylation: The production process of Methylene Diphenyl Diisocyanate (MDI) starts with the oxidative carbonylation of aniline to form ethyl phenyl carbamate (EPC), which is further reacted with formaldehyde to give diphenylene diurethane (MDU). Finally, the MDU undergoes decomposition to produce Methylene Diphenyl Diisocyanate (MDI) as the final product and polymeric MDI (PMDI) as the by-product.

Methylene Diphenyl Diisocyanate is a diisocyanate comprising diphenylmethane with two isocyanate groups at the 4- and 4'-positions. It functions like an allergen and a hapten. It looks like a light-yellow color solid. It is available in several structural variants, ranging from pure monomeric MDIs (MMDI) to multifunctional polymeric MDIs (PMDI). It is not soluble in water, and it reacts with water to release carbon dioxide and form urea linkages. The MDI systems are highly reactive and typically react with polyol and chain-extenders or curatives such as diols or triols. It can be toxic if inhaled, ingested, or absorbed by the skin. Based on the type of solution it is combined with, it can cause a burn.

Methylene Diphenyl Diisocyanate (MDI) Production Cost Processes with Cost Analysis

Methylene Diphenyl Diisocyanate (MDI) Production via Phosgenation

This report presents a detailed cost analysis of methylene diphenyl diisocyanate (MDI) production from aniline and formaldehyde using the phosgenation process.

Details: Germany - based plant Q1 2025 From $ 2499.00 USD

Methylene Diphenyl Diisocyanate (MDI) Production via Oxidative Carbonylation

This report presents a detailed cost analysis of Methylene Diphenyl Diisocyanate (MDI) production from aniline and formaldehyde using the oxidative carbonylation process.

Details: Germany - based plant Q1 2025 From $ 2499.00 USD

Product Details

| Particulars | Details |

|---|---|

| Product Name | Methylene Diphenyl Diisocyanate |

| Scope | Manufacturing Process: Process Flow, Material Flow, Material Balance Raw Material and Product Specifications: Raw Material Consumption, Product and Co-product Generation Land and Site Cost: Offsites/Civil Works, Equipment Cost, Auxiliary Equipment Costs, Contingency, Engineering and Consulting Charges, Working Capital Variable Cost: Raw Material, Utilities, Other Variable Costs Fixed Cost: Labor Requirements and Wages, Overhead Expenses, Maintenance Charges, Other Fixed Costs Financing Costs: Interest on Working Capital, Interest on Loans Other Costs: Depreciation Charges, General Sales and Admin Cost |

| Currency | US$ (Data can also be provided in the local currency) |

| Pricing and Purchase Options | Basic: US$ 2499 Premium: US$ 3499 Enterprise: US$ 4799 |

| Customization Scope | The report can be customized as per the requirement of the customer |

| Post-Sale Analysts Report | 10-12 weeks of post-purchase analyst support after report delivery for any queries from the deliverable |

| Delivery Format | PDF and Excel format through email (editable version in PPT/Word format of the report can be also provided on special request) |

How does our Methylene Diphenyl Diisocyanate (MDI) Production Cost Report Provide Exhaustive Data and Extensive Insights?

At Procurement Resource, we not only focus on optimizing the should cost of production for Methylene Diphenyl Diisocyanate (MDI) but also provide our clients with extensive intel and rigorous information on every aspect of the production process. By utilizing a comprehensive cost model, we help you break down expenses related to raw materials, labor, and technology, offering clear pathways to savings. We also assist in evaluating the capital expenditure (CAPEX) and operating expenses (OPEX), which are often measured as cost per unit of production, such as USD/MT, ensuring that your financial planning is aligned with industry benchmarks.

We offer valuable insights on the top technology providers, in-depth supplier database, and best manufacturers, helping you make informed decisions to improve efficiency. Additionally, we design the most feasible layout for your production needs, ensuring the entire process runs smoothly. By minimizing the cash cost of production, we ensure that you stay competitive while securing long-term profitability in the growing Methylene Diphenyl Diisocyanate (MDI) market. Partnering with Procurement Resource guarantees that every aspect of your production is cost-efficient, advanced, and tailored to your specific requirements.

Key Questions Answered in This Report

- What are the key requirements for setting up a Methylene Diphenyl Diisocyanate (MDI) manufacturing plant?

- How is Methylene Diphenyl Diisocyanate (MDI) manufactured?

- What is the process flow involved in producing Methylene Diphenyl Diisocyanate (MDI)?

- What are the raw material requirements and costs for producing Methylene Diphenyl Diisocyanate (MDI)?

- What is the total size of land required for setting up a Methylene Diphenyl Diisocyanate (MDI) manufacturing plant?

- What are the construction requirements for setting up a Methylene Diphenyl Diisocyanate (MDI) manufacturing plant?

- What are the machinery requirements for producing Methylene Diphenyl Diisocyanate (MDI)?

- What are the utility requirements and costs for producing Methylene Diphenyl Diisocyanate (MDI)?

- What are the manpower requirements for producing Methylene Diphenyl Diisocyanate (MDI)?

- What are the average salaries/wages of manpower working in a Methylene Diphenyl Diisocyanate (MDI) manufacturing plant?

- What are the packaging requirements and associated costs for Methylene Diphenyl Diisocyanate (MDI)?

- What are the transportation requirements and associated costs for Methylene Diphenyl Diisocyanate (MDI)?

- What are the capital costs for setting up a Methylene Diphenyl Diisocyanate (MDI) manufacturing plant?

- What are the operating costs for setting up a Methylene Diphenyl Diisocyanate (MDI) manufacturing plant?

- What should be the price of Methylene Diphenyl Diisocyanate (MDI)?

- What will be the income and expenditures for a Methylene Diphenyl Diisocyanate (MDI) manufacturing plant?

Need more help?

- We can tailor the report as per your unique requirements such as desired capacity, future expansion plans, product specifications, mode of financing, plant location, etc.

- We can also provide a flexible, easy-to-use, dynamic excel-based cost-model/ dashboard where you can change the inputs to get different outputs

- Speak to our highly skilled team of analysts for insights on the recent trends and innovations, industry best practices, key success and risk factors, product pricing, margins, return on investment, industry standards and regulations, etc.

- Gain an unparalleled competitive advantage in your domain by understanding how to optimize your business operations and maximize profits

- For further assistance, please connect with our analysts

Compare & Choose the Right Report Version for You

You can easily get a quote for any Procurement Resource report. Just click here and raise a request. We will get back to you within 24 hours. Alternatively, you can also drop us an email at sales@procurementresource.com.

RIGHT PEOPLE

At Procurement Resource our analysts are selected after they are assessed thoroughly on having required qualities so that they can work effectively and productively and are able to execute projects based on the expectations shared by our clients. Our team is hence, technically exceptional, strategic, pragmatic, well experienced and competent.

RIGHT METHODOLOGY

We understand the cruciality of high-quality assessments that are important for our clients to take timely decisions and plan strategically. We have been continuously upgrading our tools and resources over the past years to become useful partners for our clientele. Our research methods are supported by most recent technology, our trusted and verified databases that are modified as per the needs help us serve our clients effectively every time and puts them ahead of their competitors.

RIGHT PRICE

Our team provides a detailed, high quality and deeply researched evaluations in competitive prices, that are unmatchable, and demonstrates our understanding of our client’s resource composition. These reports support our clientele make important procurement and supply chains choices that further helps them to place themselves ahead of their counterparts. We also offer attractive discounts or rebates on our forth coming reports.

RIGHT SUPPORT

Our vision is to enable our clients with superior quality market assessment and actionable evaluations to assist them with taking timely and right decisions. We are always ready to deliver our clients with maximum results by delivering them with customised suggestions to meet their exact needs within the specified timeline and help them understand the market dynamics in a better way.

SELECT YOUR LICENCE TYPE

- Review the available license options and choose the one that best fits your needs. Different licenses offer varying levels of access and usage rights, so make sure to pick the one that aligns with your requirements.

- If you're unsure which license is right for you, feel free to contact us for assistance.

CLICK 'BUY NOW'

- Once you've selected your desired report and license, click the ‘Buy Now’ button. This will add the report to your cart. You will be directed to the registration page where you’ll provide the necessary information to complete the purchase.

- You’ll have the chance to review your order and make adjustments, including updating your license or quantity, before proceeding to the next step.

COMPLETE REGISTRATION

- Enter your details for registration. This will include your name, email address, and any other necessary information. Creating an account allows you to easily manage your orders and gain access to future purchases or reports.

- If you already have an account with us, simply log in to streamline the process.

CHOOSE YOUR PAYMENT METHOD

- Select from a variety of secure payment options, including credit/debit cards, PayPal, or other available gateways. We ensure that all transactions are encrypted and processed securely.

- After selecting your payment method, you will be redirected to a secure checkout page to complete your transaction.

CONFIRM YOUR PURCHASE

- Once your payment is processed, you will receive an order confirmation email from sales@procurementresource.com confirming the dedicated project manger and delivery timelines.

ACCESS YOUR REPORT

- The report will be delivered to you by the project manager within the specified timeline.

- If you encounter any issues accessing your report, project manager would remain connected throughout the length of the project. The team shall assist you with post purchase analyst support for any queries or concerns from the deliverable (within the remit of the agreed scope of work).