Reports

Copper Wire Manufacturing Plant Project Report 2025: Market by Region, Market by Application, Key Players, Pre-feasibility, Capital Investment Costs, Production Cost Analysis, Expenditure Projections, Return on Investment (ROI), Economic Feasibility, CAPEX, OPEX, Plant Machinery Cost

Copper Wire Manufacturing Plant Project Report: Key Insights and Outline

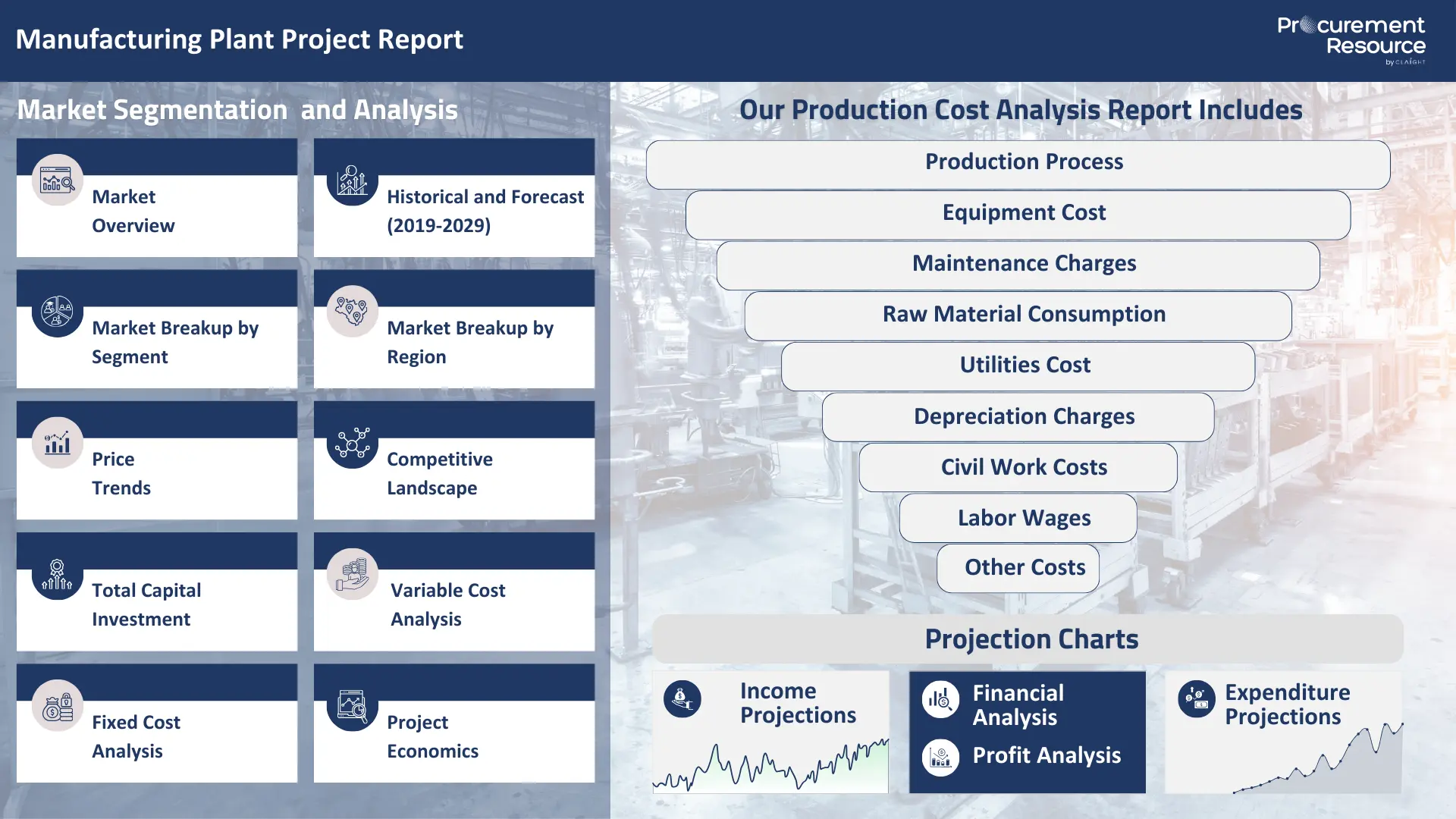

Copper Wire Manufacturing Plant Project Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.

Planning to Set Up a Copper Wire Plant? Request a Free Sample Project Report Now!

Copper wires are wires produced from pure copper metal via drawing and annealing. They are utilized in various industries such as electrical and electronics, automotive, construction, telecommunications, and renewable sources sector. They are used in electrical power distribution systems. In the construction industry, they are used for building wiring in homes and commercial buildings. In telecommunications, copper wires are utilized for telephone lines and internet cables. Additionally, they are used in electric motors and appliances for efficient energy conversion, as well as in renewable energy systems like solar panels and wind turbines for effective electricity transmission. The automotive industry also utilizes copper wires for wiring harnesses that connect various electrical components within vehicles.

Top Manufacturers of Copper Wire

- Prysmian Group

- Nexans

- Southwire Company

- General Cable Technologies Corporation

- Sumitomo Electric Industries Ltd.

- Ningbo Jintian Copper (Group) Co., Ltd.

- KGHM Polska Miedz

Feedstock for Copper Wire

The direct raw material used to produce Copper Wire is copper metal. Copper wire is produced via the drawing and annealing of copper rods, which are derived from copper metal. The availability and cost of copper metal directly influence the production and supply of copper wires. The fluctuations in the cost and availability of copper metal due to various factors, such as market demand, supply constraints, and global economic conditions, impact the production cost of copper wires. The increasing levels of extraction and mining of copper also increase the production level of copper wires.

The disruptions in the supply chain, such as mining issues, geopolitical factors, or transportation challenges, further affect the availability of copper, which impacts the procurement and pricing of copper wires. The demand for copper in various downstream industries, like construction, automotive, and electronics, also supports the production and supply of copper wires. The utilization of copper in renewable energy technologies such as wind turbines and solar panels, as well as electric vehicles, also impacts the pricing of copper. The operational status of the apparatus and machinery used for the manufacturing process, such as drawing machines, annealing ovens, extrusion machines, and shears and cutters, ensure steady production and supply of copper wires.

Market Drivers for Copper Wire

The market for copper wires is majorly driven by their application in various downstream industries such as electronics and electrical, construction, automotive, telecommunications, and renewable energy sectors. The utilization of copper wires for power distribution and transmission systems, coupled with the increasing global consumption of electricity, elevates the demand for copper wires in the electrical and electronics industry. The requirement for high-quality copper wiring for residential and commercial buildings, coupled with the global rise in construction and infrastructure projects, boosts the market for copper wires in the construction industry. Their incorporation in renewable energy sources, such as solar and wind power systems, also contributes to the market expansion of copper wires.

The rising demand for high-quality copper cables and the expansion of telecommunication networks further promote the market growth for copper wires. Their usage in electrical systems in vehicles, as well as the rise of electric vehicles, fuels the market for copper wires in the automotive industry. Technological advancements such as innovations in electrical technologies and smart grid solutions enhance the efficiency and reliability of power distribution systems, which in turn drives demand for high-performance copper wires. The production cost also impacts the market for copper wires as the fluctuations in the cost and availability of the feedstock used to produce the wires, such as copper metal, directly affect the demand and procurement of copper wires.

Capital Expenditure (CAPEX) for Copper wires includes the initial cost of the machinery and equipment required for the production process, such as drawing machines and annealing furnaces, as well as the plant setup cost and technological expenses.Additionally, Capital Expenditure (CAPEX) for the initial cost of the machinery and equipment required for copper wire production influences the pricing of copper wires. Another factor that drives the procurement of copper wires is the Operational Expenditure (OPEX), which includes the energy costs for the smooth operation of equipment like drawing machines and annealing furnaces, as well as the regular maintenance and repair costs.

Manufacturing Process

This report comprises a thorough value chain evaluation for Copper Wire manufacturing and consists of an in-depth production cost analysis revolving around industrial Copper Wire manufacturing.

- Production via drawing and annealing: The feedstock used in the manufacturing process is copper metal.

The manufacturing process of copper wire occurs via the drawing and annealing process. The production process starts by casting molten copper metal to form copper rods. In the next step, the copper rods undergo drawing with the help of diamond dies, followed by cooling them with coolant and lubricant to get fine gauge wires. The wire obtained after drawing copper rods is processed via annealing in an electric furnace. The temperature is carefully monitored to avoid overheating. Finally, the bunching process then bunches the wires to set the wire into different size ranges.

Properties of Copper Wire

Copper wires are made by drawing pure copper into thin strands of wire of varying thicknesses. This reddish-brown wire can be tin-plated to enhance corrosion resistance and solderability, but tin-plating does not convert it into a true copper alloy. Pure copper has a melting point of 1085°C, while tin-plated or alloyed versions may have slightly different melting ranges. Copper wire’s excellent thermal and electrical conductivity, moderate tensile strength, corrosion resistance, and ductility make it ideal for various electrical and electronic applications. To enhance safety, copper wires are insulated with industrial polymers such as PVC, PE, PP, PUR, and PTFE to prevent short circuits and fire risks.

Copper Wire Manufacturing Plant Report provides you with a detailed assessment of capital investment costs (CAPEX) and operational expenses (OPEX), generally measured as cost per metric ton (USD/MT). This approach ensures that your investment decisions are aligned with the latest industry standards and economic feasibility metrics, enhancing your manufacturing efficiency and financial planning.

Apart from that, this Copper Wire manufacturing plant report also covers the leading technology providers that help you plan a robust plan of action related to Copper Wire manufacturing plant and its production process, and also by helping you with an in-depth supplier database. This report provides exclusive insights into the best manufacturing practices for Copper Wire and technology implementation costs. This report also covers operational cash flow, fixed and variable costs, and detailed break-even point analysis, ensuring that your manufacturing process is not only efficient but also economically viable in the competitive market landscape.

In addition to operational insights, the Copper Wire manufacturing plant report also comprehensively focuses on lifecycle cost analysis, maintenance costs, and energy consumption costs, which are critical for maintaining long-term sustainability and profitability. Our manufacturing cost analysis extends to include regulatory compliance costs, inventory holding costs, and logistics and distribution costs, providing a holistic view of the potential expenses and savings.

We at Procurement Resource ensure that this report is not only cost-efficient, environmentally sustainable, and aligned with the latest technological advancements but also that you are equipped with all necessary tools to optimize supply chain operations, manage risks effectively, and achieve superior market positioning for Copper Wire.

Key Insights and Report Highlights

| Report Features | Details |

|---|---|

| Report Title | Copper Wire Manufacturing Plant Project Report |

| Preface | Overview of the study and its significance. |

| Scope and Methodology | Key Questions Answered, Methodology, Estimations & Assumptions. |

| Executive Summary | Global Market Scenario, Production Cost Summary, Income Projections, Expenditure Projections, Profit Analysis. |

| Global Market Insights | Market Overview, Historical and Forecast (2019-2029), Market Breakup by Segment, Market Breakup by Region, Price Trends (Raw Material Price Trends, Copper Wire Price Trends), Competitive Landscape (Key Players, Profiles of Key Players). |

| Detailed Process Flow | Product Overview, Properties and Applications, Manufacturing Process Flow, Process Details. |

| Project Details | Total Capital Investment, Land and Site Cost, Offsites/Civil Works Cost, Plant Machinery Cost, Auxiliary Equipment Cost, Contingency, Consulting and Engineering Charges, Working Capital. |

| Variable Cost Analysis | Raw Material Specifications, Raw Material Consumption, Raw Material Costs, Utilities Consumption and Costs, Co-product Cost Credit, Labour Requirements and Costs. |

| Fixed Cost Analysis | Plant Repair & Maintenance Cost, Overheads Cost, Insurance Cost, Financing Costs, Depreciation Charges. |

| General Sales and Administration Costs | Costs associated with sales and administration |

| Project Economics | Techno-economic Parameters, Income Projections, Expenditure Projections, Financial Analysis (Payback Period, Net Present Value, Internal Rate of Return), Profit Analysis, Production Cost Summary. |

| Report Format | PDF for BASIC and PREMIUM; PDF+Dynamic Excel for ENTERPRISE. |

| Pricing and Purchase Options | BASIC: USD 2999 PREMIUM: USD 3999 ENTERPRISE: USD 5999 |

| Customization Scope | The report can be customized based on the customer’s requirements. |

| Post-Sale Analyst Support | 10-12 Weeks of support post-sale. |

| Delivery Format | PDF and Excel via email; editable versions (PPT/Word) on special request. |

Key Questions Covered in our Copper Wire Manufacturing Plant Report

- How can the cost of producing Copper Wire be minimized, cash costs reduced, and manufacturing expenses managed efficiently to maximize overall efficiency?

- What are the initial investment and capital expenditure requirements for setting up an Copper Wire manufacturing plant, and how do these investments affect economic feasibility and ROI?

- How do we select and integrate technology providers to optimize the production process of Copper Wire, and what are the associated implementation costs?

- How can operational cash flow be managed, and what strategies are recommended to balance fixed and variable costs during the operational phase of Copper Wire manufacturing?

- How do market price fluctuations impact the profitability and cost per metric ton (USD/MT) for Copper Wire, and what pricing strategy adjustments are necessary?

- What are the lifecycle costs and break-even points for Copper Wire manufacturing, and which production efficiency metrics are critical for success?

- What strategies are in place to optimize the supply chain and manage inventory, ensuring regulatory compliance and minimizing energy consumption costs?

- How can labor efficiency be optimized, and what measures are in place to enhance quality control and minimize material waste?

- What are the logistics and distribution costs, what financial and environmental risks are associated with entering new markets, and how can these be mitigated?

- What are the costs and benefits associated with technology upgrades, modernization, and protecting intellectual property in Copper Wire manufacturing?

- What types of insurance are required, and what are the comprehensive risk mitigation costs for Copper Wire manufacturing?

1 Preface

2 Scope and Methodology

2.1 Key Questions Answered

2.2 Methodology

2.3 Estimations & Assumptions

3 Executive Summary

3.1 Global Market Scenario

3.2 Production Cost Summary

3.3 Income Projections

3.4 Expenditure Projections

3.5 Profit Analysis

4 Global Copper Wire Market

4.1 Market Overview

4.2 Historical and Forecast (2019-2029)

4.3 Market Breakup by Segment

4.4 Market Breakup by Region

4.6 Price Trends

4.6.1 Raw Material Price Trends

4.6.2 Copper Wire Price Trends

4.7 Competitive Landscape

4.8.1 Key Players

4.8.2 Profiles of Key Players

5 Detailed Process Flow

5.1 Product Overview

5.2 Properties and Applications

5.3 Manufacturing Process Flow

5.4 Process Details

6 Project Details, Requirements and Costs Involved

6.1 Total Capital Investment

6.2 Land and Site Cost

6.3 Offsites/ Civil Works Cost

6.4 Plant Machinery Cost

6.5 Auxiliary Equipment Cost

6.6 Contingency, Consulting and Engineering Charges

6.6 Working Capital

7 Variable Cost Analysis

7.1 Raw Materials

7.1.1 Raw Material Specifications

7.1.2 Raw Material Consumption

7.1.3 Raw Material Costs

7.2 Utilities Consumption and Costs

7.3 Co-product Cost Credit

7.4 Labour Requirements and Costs

8 Fixed Cost Analysis

8.1 Plant Repair & Maintanence Cost

8.2 Overheads Cost

8.3 Insurance Cost

8.4 Financing Costs

8.5 Depreciation Charges

9 General Sales and Administration Costs

10 Project Economics

10.1 Techno-economic Parameters

10.2 Income Projections

10.3 Expenditure Projections

10.4 Financial Analysis

10.5 Profit Analysis

10.5.1 Payback Period

10.5.2 Net Present Value

10.5.3 Internal Rate of Return

11 References

Compare & Choose the Right Report Version for You

RIGHT PEOPLE

At Procurement Resource our analysts are selected after they are assessed thoroughly on having required qualities so that they can work effectively and productively and are able to execute projects based on the expectations shared by our clients. Our team is hence, technically exceptional, strategic, pragmatic, well experienced and competent.

RIGHT METHODOLOGY

We understand the cruciality of high-quality assessments that are important for our clients to take timely decisions and plan strategically. We have been continuously upgrading our tools and resources over the past years to become useful partners for our clientele. Our research methods are supported by most recent technology, our trusted and verified databases that are modified as per the needs help us serve our clients effectively every time and puts them ahead of their competitors.

RIGHT PRICE

Our team provides a detailed, high quality and deeply researched evaluations in competitive prices, that are unmatchable, and demonstrates our understanding of our client’s resource composition. These reports support our clientele make important procurement and supply chains choices that further helps them to place themselves ahead of their counterparts. We also offer attractive discounts or rebates on our forth coming reports.

RIGHT SUPPORT

Our vision is to enable our clients with superior quality market assessment and actionable evaluations to assist them with taking timely and right decisions. We are always ready to deliver our clients with maximum results by delivering them with customised suggestions to meet their exact needs within the specified timeline and help them understand the market dynamics in a better way.

Ethyl Acrylate Manufacturing Plant Project Report 2025: Cost Analysis, ROI, and Feasibility Insights

Ethyl Acrylate Manufacturing Plant Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.

Hydrotalcite Manufacturing Plant Project Report 2025: Cost Analysis, ROI, and Feasibility Insights

Hydrotalcite Manufacturing Plant Project Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.

1-Decene Manufacturing Plant Project Report 2025: Cost Analysis, ROI, and Feasibility Insights

1-Decene Manufacturing Plant Project Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.