Reports

Gasoline Manufacturing Plant Project Report 2025: Market by Region, Market by Application, Key Players, Pre-feasibility, Capital Investment Costs, Production Cost Analysis, Expenditure Projections, Return on Investment (ROI), Economic Feasibility, CAPEX, OPEX, Plant Machinery Cost

Gasoline Manufacturing Plant Project Report 2025: Cost Analysis, ROI, and Feasibility Insights

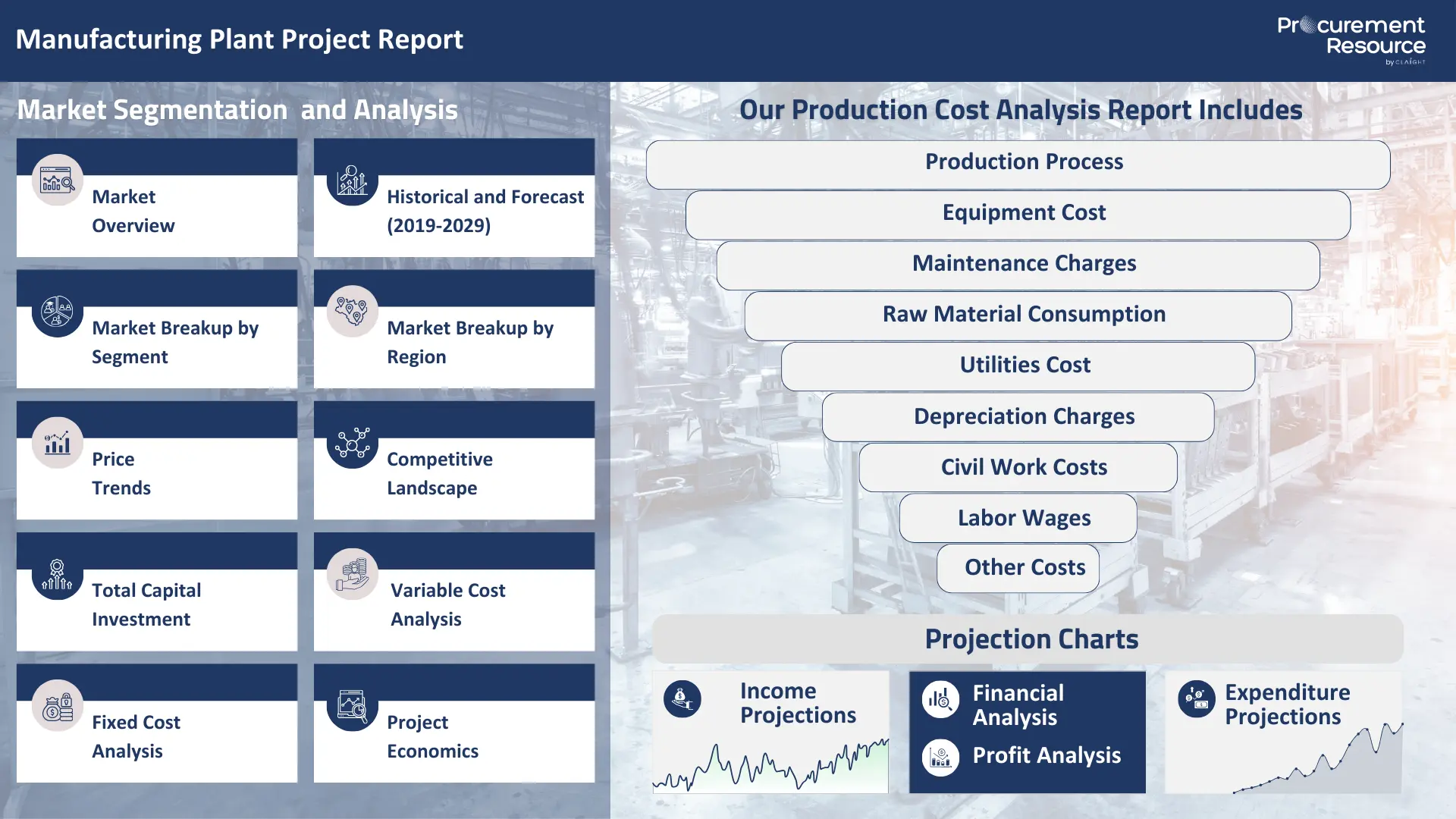

Gasoline Manufacturing Plant Project Report by Procurement Resource thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down Gasoline plant capital cost around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimisation and helps in identifying effective strategies to reduce the overall Gasoline manufacturing plant cost and the cash cost of manufacturing.

Planning to Set Up a Gasoline Plant? Request a Free Sample Project Report Now!

Gasoline, commonly known as petrol, is a transparent, petroleum-derived flammable liquid used as fuel in internal combustion engines. It is a complex mixture of various hydrocarbons and additives, refined from crude oil. Its primary function is to power motor vehicles, which makes it an indispensable commodity in global transportation and logistics.

Industrial Applications of Gasoline (Industry-wise Proportion):

- Automotive and Transportation (Largest Share): Most of the gasoline produced is consumed by passenger cars, motorcycles, and light commercial vehicles for personal and commercial transportation. This includes the massive fleet of private vehicles, taxis, and small delivery vans that operate daily.

- Power Generation (Small Share): Gasoline also fuels portable generators, often used for backup power in residential, commercial, or construction sites where grid electricity is unavailable or unreliable.

- Agricultural and Construction Equipment: Smaller gasoline engines power a range of equipment such as lawnmowers, chainsaws, pumps, and some construction tools.

- Recreational Vehicles and Marine Vessels: Gasoline is the fuel of choice for many recreational vehicles like ATVs, snowmobiles, and various small boats.

- Solvent Applications (Minor Share): In very specific industrial contexts, gasoline, or its components (like naphtha derived during refining), can be used as a solvent for oils and fats, though this accounts for a minimal proportion of its overall consumption.

Top Manufacturers of Gasoline

Gasoline production is primarily handled by large multinational oil and gas companies with extensive refining capabilities. These companies often operate integrated value chains from exploration to retail.

- Bharat Petroleum Corporation Limited (BPCL)

- ExxonMobil (via global operations and partnerships)

- Sinopec (China Petroleum & Chemical Corporation)

- Saudi Aramco

- Royal Dutch Shell

Feedstock for Gasoline and Its Dynamics

The raw material for gasoline production is crude oil. Understanding the dynamics affecting crude oil is important to any production cost analysis for gasoline.

Value Chain and Dynamics Affecting Raw Materials:

- Upstream (Exploration and Production): Crude oil is extracted from geological formations deep underground or offshore. The cost of crude oil is influenced by exploration success rates, drilling technology, and geopolitical stability in oil-producing regions, which in turn impacts the production cost and supply for gasoline.

- Midstream (Transportation): Once extracted, crude oil is transported to refineries via pipelines, oil tankers (marine), rail cars, or trucks. Transportation manufacturing expenses are affected by distance, mode of transport, and global freight rates. Disruptions in major shipping lanes or pipeline networks significantly impact the delivered raw material cost.

- Crude Oil Prices: Crude oil prices are highly volatile and influenced by:

- Global Supply and Demand: OPEC+ production decisions, non-OPEC supply (e.g., US shale oil), and global economic growth (which drives demand) are critical.

- Geopolitical Tensions: Conflicts, political instability, or sanctions in major oil-producing regions disrupt supply and cause price spikes.

- Inventory Levels: Stockpiles of crude oil (e.g., Strategic Petroleum Reserves in the US) influence market sentiment and prices.

- Financial Market Speculation: Trading in crude oil futures and other financial instruments amplify price movements.

- Seasonal Factors: Demand for gasoline increases during summer driving seasons in many parts of the world, influencing crude oil demand.

- Crude Oil Quality: Different types of crude oil (light sweet vs. heavy sour) have varying compositions. Heavier, sour crude oils often require more extensive and energy-intensive refining processes to produce gasoline, which increase the cash cost of production and impact the economic feasibility if a refinery is optimised for lighter crudes.

Market Drivers for Gasoline

The consumption and demand for gasoline are primarily shaped by transportation needs, economic development, and demographic trends, with significant variations across geo-locations.

- Growing Vehicle Fleet and Road Transportation: The fundamental driver for gasoline is the continuous increase in the global number of passenger vehicles, motorcycles, and commercial vehicles. The rising disposable incomes, urbanisation, and expanding logistics networks directly translate into higher vehicle ownership and increased fuel demand.

- Economic Expansion and Industrial Activity: A strong economy leads to increased transportation of goods, higher commuter traffic, and elevated industrial activities, many of which rely on gasoline-powered equipment. This directly correlates with increased consumption of gasoline.

- Infrastructure Development: Investment in road networks, highways, and transportation corridors facilitates easier movement of vehicles, which in turn supports higher gasoline demand. This is relevant in developing regions experiencing rapid infrastructural growth.

- Consumer Behaviour and Mobility: Lifestyle choices, commuting patterns, and travel habits significantly influence gasoline demand. While trends like ride-sharing or public transport expansion exist, personal vehicle use remains dominant in many areas, which contributes to the market demand for gasoline.

- Geo-locations: Asia-Pacific, especially India, China, and Southeast Asian nations, is a major growth region for gasoline consumption. This is due to large and growing populations, rapid urbanisation, expanding middle classes, and rising vehicle penetration. Developed regions like North America and Europe, while having higher per-capita consumption, exhibit more mature markets with potential shifts towards electric vehicles influencing long-term demand. Fuel pricing, taxes, and government policies (e.g., emission standards, fuel efficiency mandates) in specific geo-locations also play an important role.

CAPEX and OPEX for a Gasoline Plant

A comprehensive production cost analysis for gasoline manufacturing in a refinery requires a detailed breakdown of both Total Capital Expenditure (CAPEX) and Operating Expenses (OPEX). This provides insight into the economic feasibility and cost model for such a massive industrial operation, detailing the gasoline manufacturing plant cost.

Total Capital Expenditure (CAPEX) for a Gasoline Plant (Refinery)

The gasoline plant capital cost represents the enormous initial investment cost, CAPEX, required to build and commission a complex crude oil refinery that produces gasoline as a primary product.

- Process Units & Machinery (Direct Fixed Capital):

- Crude Distillation Unit (CDU): The foundational unit, including furnaces, distillation columns (atmospheric and vacuum), heat exchangers, and associated piping for initial separation of crude oil into fractions.

- Catalytic Reformer: Units with reactors, furnaces, and separators to convert low-octane naphtha into high-octane gasoline components (reformate) using platinum or rhenium catalysts.

- Fluid Catalytic Cracking (FCC) Unit: A large, complex unit with a reactor, regenerator, and fractionator, designed to break down heavier fractions (gas oil) into lighter, more valuable products like gasoline components. This is a very significant part of the gasoline manufacturing plant cost.

- Hydrocracker/Hydrotreater Units: Reactors where heavier petroleum fractions or high-sulfur streams are treated with hydrogen under high pressure and temperature to produce lighter, cleaner products and remove impurities.

- Alkylation Unit: Combines light olefin gases with isobutane to produce high-octane gasoline blendstock (alkylate).

- Isomerisation Unit: Converts straight-chain hydrocarbons into branched-chain isomers for higher octane.

- Merox/Amine Treatment Units: For removing sulfur compounds from various streams to meet fuel specifications.

- Pumps, Compressors, Turbines: Large-scale machinery for moving liquids and gases throughout the refinery.

- Heat Exchangers & Furnaces: Extensive networks for process heating and cooling.

- Piping, Valves, Instrumentation: Thousands of kilometres of complex piping, safety valves, control valves, sensors, and a sophisticated Distributed Control System (DCS) for refinery automation and safety.

- Storage Tanks: Numerous large tanks for crude oil feedstock, intermediate products, and various grades of finished gasoline.

- Utilities and Offsites Infrastructure:

- Power Plant/Co-generation Unit: To generate electricity and steam for the refinery's massive energy requirements.

- Water Treatment Facilities: For raw water intake, purification, and wastewater treatment (Effluent Treatment Plant - ETP) to meet stringent environmental norms, especially critical for a gasoline manufacturing plant cost.

- Flare System: For safe disposal of excess gases during upsets or shutdowns.

- Fire Fighting and Safety Systems: Comprehensive fire suppression, detection, and emergency response infrastructure.

- Laboratories and Quality Control: State-of-the-art labs for crude assay, in-process analysis, and finished product quality certification.

- Warehouses & Maintenance Shops: For spare parts, chemicals, and equipment repair.

- Administrative Buildings & Employee Facilities.

- Land & Civil Works: Large tracts of land are required, along with extensive civil engineering for foundations, roads, drainage, and structural supports.

- Indirect Costs:

- Engineering & Project Management: Fees for FEED (Front-End Engineering Design), detailed engineering, and overall project management.

- Construction Labour & Supervision: Cost of the immense workforce required for construction.

- Contingency: A significant percentage (often 15-25% or more) allocated for unforeseen challenges, delays, or cost overruns in such mega-projects.

- Pre-commissioning and Start-up Costs: Expenses during the initial testing and operational ramp-up phase.

Operating Expenses (OPEX) for a Gasoline Plant:

Operating expenses (OPEX) are the continuous manufacturing expenses incurred to produce gasoline from crude oil. These are critical for determining the cost per metric ton (USD/MT) and are meticulously tracked in the production cost analysis.

- Raw Material Costs:

- Crude Oil: The purchase cost of various crude oil blends. Its price fluctuations heavily dictate the final gasoline price.

- Additives: Costs of various chemicals blended into gasoline (e.g., octane enhancers, detergents, anti-corrosion agents, oxygenates like ethanol).

- Catalysts: Regular replenishment of expensive catalysts used in reforming, cracking, hydrotreating, and alkylation units.

- Hydrogen: Often produced internally but represents a significant utility or raw material cost, especially for hydrotreatment processes.

- Utility Costs: Refineries are highly energy-intensive operations.

- Electricity: For running pumps, compressors, fans, and lighting.

- Steam: For heating processes, driving turbines, and stripping columns.

- Fuel Gas: Often generated internally as a byproduct (refinery gas) but still represents a fixed and variable cost if external supply is needed.

- Cooling Water: For cooling process streams.

- Process Water: For various operations, including desalter and steam generation.

- Operating Labour Costs:

- Salaries, wages, and benefits for a large workforce of highly skilled operators, engineers, chemists, maintenance technicians, safety personnel, and administrative staff required for 24/7 operation.

- Maintenance and Repairs:

- Ongoing preventative maintenance, turnaround costs (periodic full shutdowns for major inspections and repairs), and unscheduled repairs due to equipment wear and tear.

- Depreciation and Amortisation:

- The non-cash expense of depreciation and amortisation spreads the huge total capital expenditure (CAPEX) over the useful life of the refinery's assets. This is a critical factor in the cost model and financial reporting.

- Plant Overhead Costs:

- Insurance, property taxes, administrative support, security, laboratory consumables, R&D for process improvements, and environmental monitoring fees.

- Environmental Compliance Costs:

- Costs associated with meeting emission standards (air and water), waste disposal, and potential carbon taxes or credits. This includes the operation of effluent treatment plants and air quality monitoring systems.

- Transportation Costs (Finished Product):

- Costs for transporting the refined gasoline from the refinery to terminals and distribution points via pipelines, tanker trucks, rail cars, or barges.

- Marketing and Distribution Costs:

- Expenses related to selling the gasoline to wholesalers and retailers.

Optimising these fixed and variable costs through efficient operations, technological upgrades, and strategic raw material procurement is crucial for the profitability and economic feasibility of industrial gasoline manufacturing.

Manufacturing Process of Gasoline

This report comprises a thorough value chain evaluation for Gasoline manufacturing and consists of an in-depth production cost analysis revolving around industrial Gasoline manufacturing.

Fractional Distillation Process for Gasoline:

The primary industrial manufacturing process for gasoline begins with fractional distillation of crude oil. The feedstock for this process is crude oil. Crude oil is first heated to very high temperatures, about 400 degree Celsius, causing most of its hydrocarbon components to vaporise. This hot vapour-liquid mixture is then introduced into the bottom of a tall fractionating column. Inside the column, a temperature gradient exists, being hottest at the bottom and coolest at the top. As the hydrocarbon vapours rise, they cool, and fractions condense at different levels based on their boiling points.

Lighter, lower-boiling-point hydrocarbons, such as gasoline components (C5-C12 hydrocarbons), rise higher in the column before condensing and being collected as liquid fractions. On the other hand, heavier, higher-boiling point fractions condense lower down. The gasoline fraction obtained directly from distillation is then subjected to further refining processes like catalytic reforming, cracking, and blending with additives to achieve desired octane levels and other specifications.

Properties of Gasoline

Gasoline is a complex mixture, but its key properties are essential for its function as a fuel.

- Physical State: It is a volatile liquid at ambient conditions.

- Colour: It appears as a clear, colourless to amber.

- Odour: It has a distinctive petroleum-like odour.

- Density: Less dense than water (around 0.72-0.77 g/cm³), causing it to float on water.

- Solubility: Insoluble in water.

- Flash Point: Extremely low, below 0 degree Celsius, indicating high flammability.

- Boiling Point Range: Varies depending on blend, but generally between 30 degree Celsius and 200 degree Celsius.

- Octane Rating: A measure of its resistance to knocking or pre-ignition in spark-ignition engines (e.g., RON, MON, AKI).

- Vapour Pressure: Crucial for engine starting, particularly in different climates.

- Energy Content: High energy density, providing significant power upon combustion.

Gasoline Manufacturing Plant Report provides you with a detailed assessment of capital investment costs (CAPEX) and operational expenses (OPEX), generally measured as cost per metric ton (USD/MT). This approach ensures that your investment decisions are aligned with the latest industry standards and economic feasibility metrics, enhancing your manufacturing efficiency and financial planning.

Apart from that, this Gasoline manufacturing plant report also covers the leading technology providers that help you plan a robust plan of action related to Gasoline manufacturing plant and its production process, and also by helping you with an in-depth supplier database. This report provides exclusive insights into the best manufacturing practices for Gasoline and technology implementation costs. This report also covers operational cash flow, fixed and variable costs, and detailed break-even point analysis, ensuring that your manufacturing process is not only efficient but also economically viable in the competitive market landscape.

In addition to operational insights, the Gasoline manufacturing plant report also comprehensively focuses on lifecycle cost analysis, maintenance costs, and energy consumption costs, which are critical for maintaining long-term sustainability and profitability. Our manufacturing cost analysis extends to include regulatory compliance costs, inventory holding costs, and logistics and distribution costs, providing a holistic view of the potential expenses and savings.

We at Procurement Resource ensure that this report is not only cost-efficient, environmentally sustainable, and aligned with the latest technological advancements but also that you are equipped with all necessary tools to optimise supply chain operations, manage risks effectively, and achieve superior market positioning for Gasoline.

Key Insights and Report Highlights

| Report Features | Details |

|---|---|

| Report Title | Gasoline Manufacturing Plant Project Report |

| Preface | Overview of the study and its significance. |

| Scope and Methodology | Key Questions Answered, Methodology, Estimations & Assumptions. |

| Executive Summary | Global Market Scenario, Production Cost Summary, Income Projections, Expenditure Projections, Profit Analysis. |

| Global Market Insights | Market Overview, Historical and Forecast (2019-2029), Market Breakup by Segment, Market Breakup by Region, Price Trends (Raw Material Price Trends, Gasoline Price Trends), Competitive Landscape (Key Players, Profiles of Key Players). |

| Detailed Process Flow | Product Overview, Properties and Applications, Manufacturing Process Flow, Process Details. |

| Project Details | Total Capital Investment, Land and Site Cost, Offsites/Civil Works Cost, Plant Machinery Cost, Auxiliary Equipment Cost, Contingency, Consulting and Engineering Charges, Working Capital. |

| Variable Cost Analysis | Raw Material Specifications, Raw Material Consumption, Raw Material Costs, Utilities Consumption and Costs, Co-product Cost Credit, Labour Requirements and Costs. |

| Fixed Cost Analysis | Plant Repair & Maintenance Cost, Overheads Cost, Insurance Cost, Financing Costs, Depreciation Charges. |

| General Sales and Administration Costs | Costs associated with sales and administration |

| Project Economics | Techno-economic Parameters, Income Projections, Expenditure Projections, Financial Analysis (Payback Period, Net Present Value, Internal Rate of Return), Profit Analysis, Production Cost Summary. |

| Report Format | PDF for BASIC and PREMIUM; PDF+Dynamic Excel for ENTERPRISE. |

| Pricing and Purchase Options | BASIC: USD 2999 PREMIUM: USD 3999 ENTERPRISE: USD 5999 |

| Customization Scope | The report can be customized based on the customer’s requirements. |

| Post-Sale Analyst Support | 10-12 Weeks of support post-sale. |

| Delivery Format | PDF and Excel via email; editable versions (PPT/Word) on special request. |

Key Questions Covered in our Gasoline Manufacturing Plant Report

- How can the cost of producing Gasoline be minimised, cash costs reduced, and manufacturing expenses managed efficiently to maximise overall efficiency?

- What is the estimated Gasoline manufacturing plant cost?

- What are the initial investment and capital expenditure requirements for setting up a Gasoline manufacturing plant, and how do these investments affect economic feasibility and ROI?

- How do we select and integrate technology providers to optimise the production process of Gasoline, and what are the associated implementation costs?

- How can operational cash flow be managed, and what strategies are recommended to balance fixed and variable costs during the operational phase of Gasoline manufacturing?

- How do market price fluctuations impact the profitability and cost per metric ton (USD/MT) for Gasoline, and what pricing strategy adjustments are necessary?

- What are the lifecycle costs and break-even points for Gasoline manufacturing, and which production efficiency metrics are critical for success?

- What strategies are in place to optimise the supply chain and manage inventory, ensuring regulatory compliance and minimising energy consumption costs?

- How can labour efficiency be optimised, and what measures are in place to enhance quality control and minimise material waste?

- What are the logistics and distribution costs, what financial and environmental risks are associated with entering new markets, and how can these be mitigated?

- What are the costs and benefits associated with technology upgrades, modernisation, and protecting intellectual property in Gasoline manufacturing?

- What types of insurance are required, and what are the comprehensive risk mitigation costs for Gasoline manufacturing?

1 Preface

2 Scope and Methodology

2.1 Key Questions Answered

2.2 Methodology

2.3 Estimations & Assumptions

3 Executive Summary

3.1 Global Market Scenario

3.2 Production Cost Summary

3.3 Income Projections

3.4 Expenditure Projections

3.5 Profit Analysis

4 Global Gasoline Market

4.1 Market Overview

4.2 Historical and Forecast (2019-2029)

4.3 Market Breakup by Segment

4.4 Market Breakup by Region

4.6 Price Trends

4.6.1 Raw Material Price Trends

4.6.2 Gasoline Price Trends

4.7 Competitive Landscape

4.8.1 Key Players

4.8.2 Profiles of Key Players

5 Detailed Process Flow

5.1 Product Overview

5.2 Properties and Applications

5.3 Manufacturing Process Flow

5.4 Process Details

6 Project Details, Requirements and Costs Involved

6.1 Total Capital Investment

6.2 Land and Site Cost

6.3 Offsites/ Civil Works Cost

6.4 Plant Machinery Cost

6.5 Auxiliary Equipment Cost

6.6 Contingency, Consulting and Engineering Charges

6.6 Working Capital

7 Variable Cost Analysis

7.1 Raw Materials

7.1.1 Raw Material Specifications

7.1.2 Raw Material Consumption

7.1.3 Raw Material Costs

7.2 Utilities Consumption and Costs

7.3 Co-product Cost Credit

7.4 Labour Requirements and Costs

8 Fixed Cost Analysis

8.1 Plant Repair & Maintanence Cost

8.2 Overheads Cost

8.3 Insurance Cost

8.4 Financing Costs

8.5 Depreciation Charges

9 General Sales and Administration Costs

10 Project Economics

10.1 Techno-economic Parameters

10.2 Income Projections

10.3 Expenditure Projections

10.4 Financial Analysis

10.5 Profit Analysis

10.5.1 Payback Period

10.5.2 Net Present Value

10.5.3 Internal Rate of Return

11 References

Compare & Choose the Right Report Version for You

RIGHT PEOPLE

At Procurement Resource our analysts are selected after they are assessed thoroughly on having required qualities so that they can work effectively and productively and are able to execute projects based on the expectations shared by our clients. Our team is hence, technically exceptional, strategic, pragmatic, well experienced and competent.

RIGHT METHODOLOGY

We understand the cruciality of high-quality assessments that are important for our clients to take timely decisions and plan strategically. We have been continuously upgrading our tools and resources over the past years to become useful partners for our clientele. Our research methods are supported by most recent technology, our trusted and verified databases that are modified as per the needs help us serve our clients effectively every time and puts them ahead of their competitors.

RIGHT PRICE

Our team provides a detailed, high quality and deeply researched evaluations in competitive prices, that are unmatchable, and demonstrates our understanding of our client’s resource composition. These reports support our clientele make important procurement and supply chains choices that further helps them to place themselves ahead of their counterparts. We also offer attractive discounts or rebates on our forth coming reports.

RIGHT SUPPORT

Our vision is to enable our clients with superior quality market assessment and actionable evaluations to assist them with taking timely and right decisions. We are always ready to deliver our clients with maximum results by delivering them with customised suggestions to meet their exact needs within the specified timeline and help them understand the market dynamics in a better way.

Ethyl Acrylate Manufacturing Plant Project Report 2025: Cost Analysis, ROI, and Feasibility Insights

Ethyl Acrylate Manufacturing Plant Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.

Hydrotalcite Manufacturing Plant Project Report 2025: Cost Analysis, ROI, and Feasibility Insights

Hydrotalcite Manufacturing Plant Project Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.

1-Decene Manufacturing Plant Project Report 2025: Cost Analysis, ROI, and Feasibility Insights

1-Decene Manufacturing Plant Project Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.