Reports

Light Diesel Oil Manufacturing Plant Project Report 2025: Market by Region, Market by Application, Key Players, Pre-feasibility, Capital Investment Costs, Production Cost Analysis, Expenditure Projections, Return on Investment (ROI), Economic Feasibility, CAPEX, OPEX, Plant Machinery Cost

Light Diesel Oil Manufacturing Plant Project Report 2025: Cost Analysis & ROI

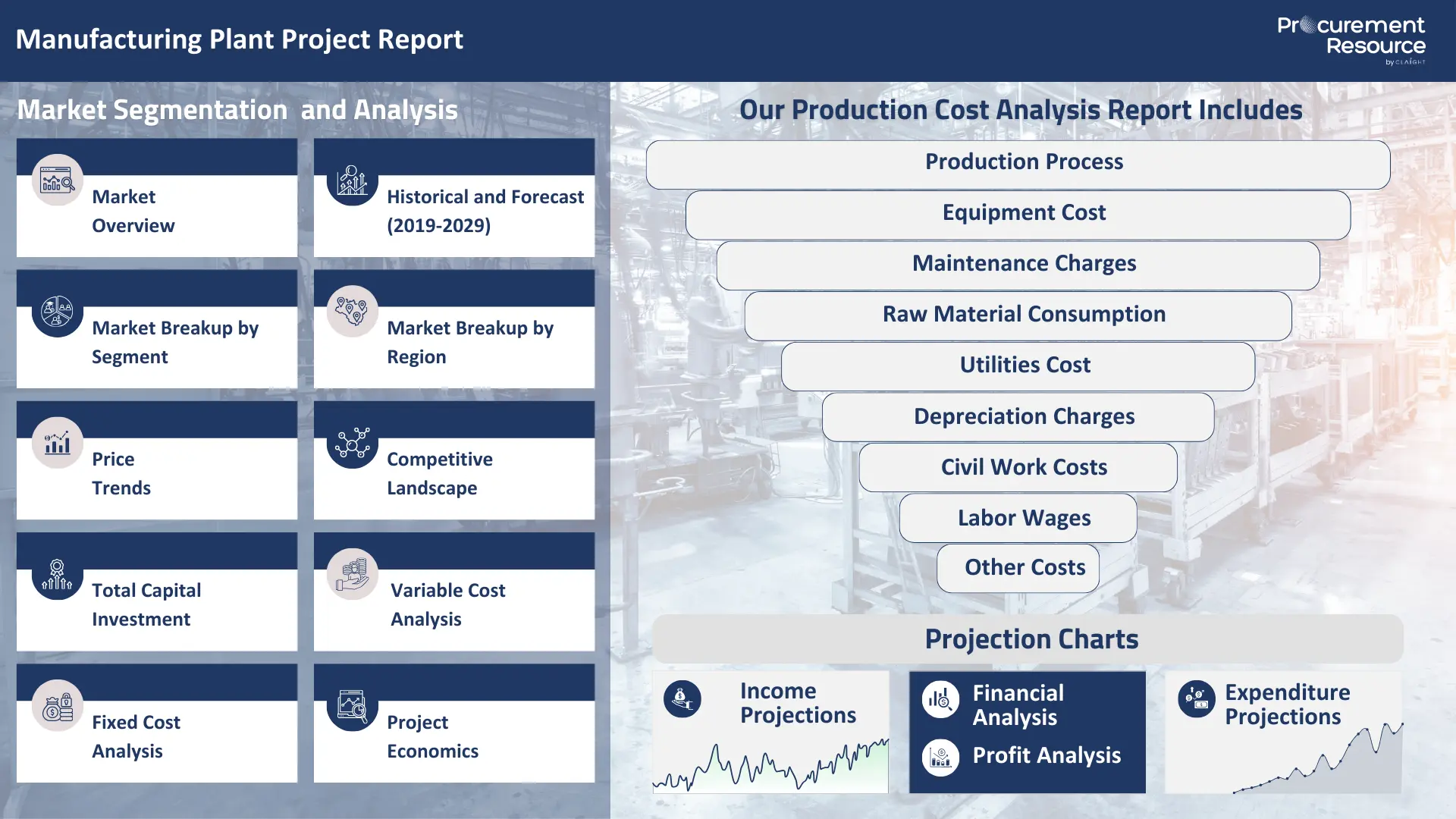

Light Diesel Oil Manufacturing Plant Project Report by Procurement Resource thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down Light Diesel Oil plant capital cost around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimisation and helps in identifying effective strategies to reduce the overall Light Diesel Oil manufacturing plant cost and the cash cost of manufacturing.

Planning to Set Up a Light Diesel Oil Plant? Request a Free Sample Project Report Now!

Light Diesel Oil (LDO) is a versatile petroleum product with the chemical formula generally ranging from C9 to C16 hydrocarbons. It is a light, reddish-brown liquid that serves as a fuel for various industrial and commercial applications. LDO is characterised by its lower viscosity and flash point compared to heavier fuel oils, which makes it a valuable middle distillate in the petroleum industry.

Applications of Light Diesel Oil

LDO is a critical fuel source across several sectors due to its efficient combustion properties and relatively lower cost.

- Industrial Fuel (60-70%): LDO is extensively used as a fuel for industrial furnaces, boilers, and kilns. Industries such as textiles, power generation, ceramics, and steel rely on LDO for heat and energy.

- Agricultural Sector (15-20%): It is a primary fuel for agricultural machinery, including tractors, irrigation pump sets, and farming equipment in rural areas.

- Commercial and Transport (10-15%): LDO is used in small-scale power generators (DG sets) and certain commercial vehicles with low-rpm engines.

Top 5 Manufacturers of Light Diesel Oil

The production of LDO is an integral part of the broader petroleum refining industry. The major players are large-scale oil and gas corporations that operate refineries.

- Indian Oil Corporation Ltd. (India)

- Hindustan Petroleum Corporation Ltd. (India)

- Bharat Petroleum Corporation Ltd. (India)

- ExxonMobil (USA)

- Shell (Netherlands/UK)

Feedstock for LDO and Value Chain Dynamics

The LDO value chain is directly linked to the global crude oil market, as it is a key refined product. The cash cost of production is highly influenced by crude oil prices.

- Raw Material Sourcing: The sole feedstock is crude oil. Its price is the single largest component of the manufacturing expenses and is subject to significant fluctuations due to geopolitical events and supply-demand dynamics.

- Energy and Utilities: The refining process is highly energy-intensive, requiring a significant power supply for heating crude oil and running pumps and other equipment. Energy costs are a substantial part of the overall operating expenses (OPEX).

Market Drivers for Light Diesel Oil

The market for Light Diesel Oil (LDO) is driven by a combination of factors related to industrial activity, agriculture, and its competitive position in the fuel market.

- Robust Industrialisation and Infrastructure Development: The primary driver for the LDO market is the growth of the industrial sector, mainly in emerging economies of the Asia-Pacific region. Industries such as textiles, power generation, ceramics, and construction rely heavily on LDO for powering boilers, furnaces, and small-scale generators. As industrial infrastructure expands and manufacturing output increases, the demand for a cost-effective and readily available fuel like LDO rises in tandem.

- Growth in the Agricultural Sector: LDO plays a vital role in the agricultural sectors of many countries, especially where a lack of modern power grid access makes it the preferred fuel for irrigation pumps, tractors, and other farm machinery. The need for efficient and reliable fuel to support agricultural productivity and food security, mainly in large agricultural economies like India, directly contributes to the demand for LDO.

- Price Competitiveness and Operational Flexibility: LDO is often a more economical alternative to other fuels like High-Speed Diesel (HSD) or natural gas for certain industrial applications. This price competitiveness makes it an attractive choice for businesses focused on minimising their manufacturing expenses. Its lower viscosity and clean-burning properties compared to heavier fuel oils also provide operational flexibility, as it can be used in a variety of industrial burners and engines. The ability to manage the cash cost of production is critical for businesses in these sectors, and LDO provides a cost-effective solution.

- Demand for Backup Power Systems: In regions with unreliable power grids, commercial establishments, hospitals, and industrial facilities use diesel generators for backup power. LDO is a common fuel for these generators, ensuring uninterrupted operations. This demand for energy security and resilience further fuels the LDO market.

Regional Market Details

- Asia-Pacific: This is the largest and fastest-growing market for LDO, driven by robust industrial activities in countries like India and China, as well as a large agricultural base.

- North America and Europe: The market is mature, with demand primarily coming from established industrial sectors. Stricter environmental regulations, however, are shifting some demand towards cleaner fuels.

- Latin America, the Middle East, and Africa: These regions are experiencing steady growth in the LDO market, fuelled by industrialisation, infrastructure development, and growing energy needs.

CAPEX (Capital Expenditure) for an LDO Plant

The total capital expenditure (CAPEX) for an LDO manufacturing plant is substantial, as it is part of a larger, integrated oil refinery. The high light diesel oil plant capital cost is a significant barrier to entry for new players.

- Refinery and Distillation Unit (60-70% of total CAPEX): The investment cost includes the cost of the main atmospheric distillation column, furnaces, heat exchangers, and associated piping.

- Utility and Off-site Facilities (15-20%): This includes steam boilers, cooling towers, power generation units, and fire safety systems.

- Storage and Handling (10-15%): Large-scale storage tanks for crude oil and finished LDO, as well as pumping stations and loading terminals, are essential.

- Supporting Infrastructure (5-10%): This includes control rooms, laboratories, and administrative buildings.

OPEX (Operating Expenses) for an LDO Plant

Controlling operating expenses (OPEX) is vital for a profitable operation, as raw material costs are the largest variable. A detailed production cost analysis is used to determine the economic feasibility and cash cost of production.

- Raw Material Procurement (70-80% of total OPEX): The cost of crude oil is the single most significant manufacturing expense.

- Energy Consumption (10-15%): The electricity and fuel required for the distillation process are a major variable cost.

- Workforce Compensation (3-5%): Salaries for skilled engineers, operators, and maintenance staff are a fixed cost.

- Maintenance and Repairs (2-3%): Routine and preventative maintenance for the complex machinery is a fixed cost.

- Depreciation and Amortisation: These are non-cash charges associated with the plant's initial cost. They are factored into the overall manufacturing plant cost analysis.

- Environmental Compliance and Waste Management (1-2%): Costs for treating wastewater and managing emissions are an important operational expense.

Manufacturing Process of Light Diesel Oil

This report provides a thorough value chain evaluation for light diesel oil manufacturing, including an in-depth production cost analysis revolving around industrial light diesel oil manufacturing.

Production via Fractional Distillation of Crude Oil

- The manufacturing process of Light Diesel Oil (LDO) is an integrated part of a crude oil refinery. The process, known as fractional distillation, is a physical separation method based on the different boiling points of the hydrocarbons present in crude oil.

- The process begins by heating crude oil in a furnace to a temperature of about 350-400 degree Celsius, converting the lighter components into vapour. This vaporised mixture is then fed into a tall distillation column (fractionating column), where it rises. As the vapour climbs, it cools, and the various hydrocarbon fractions condense at different temperature zones. The lightest fractions, such as LPG and gasoline, condense at the top of the column at lower temperatures. LDO, a middle distillate, condenses at a specific, cooler temperature range in the middle of the column, where it is collected separately. Heavier fractions like lubricating oils and bitumen remain at the bottom. This efficient segregation process yields LDO as a final product with specific properties.

Properties of Light Diesel Oil

Composition

- A mixture of hydrocarbons, primarily alkanes, cycloalkanes, and aromatic compounds.

- Carbon chain length: generally C9 to C16.

Physical Characteristics

- Appearance: Pale yellow to reddish-brown liquid.

- Viscosity: Lower than that of heavy fuel oils.

- Flash Point: Above 66 degree Celsius, classifying it as a Class C fuel.

- Density: Ranges from 0.85 to 0.89 g/cm³.

Functional Properties

- Effi-Effective: Often a more economical fuel choice than high-speed diesel for industrial applications where engine performance is not the primary concern.

- Stabcient Combustion: Burns cleanly with minimal residue, which makes it suitable for industrial burners and boilers.

- Costle: Has good storage stability and is less prone to degradation compared to some other fuels.

Light Diesel Oil Manufacturing Plant Report provides you with a detailed assessment of capital investment costs (CAPEX) and operational expenses (OPEX), generally measured as cost per metric ton (USD/MT). This approach ensures that your investment decisions are aligned with the latest industry standards and economic feasibility metrics, enhancing your manufacturing efficiency and financial planning.

Apart from that, this Light Diesel Oil manufacturing plant report also covers the leading technology providers that help you plan a robust plan of action related to Light Diesel Oil manufacturing plant and its production process, and also by helping you with an in-depth supplier database. This report provides exclusive insights into the best manufacturing practices for Light Diesel Oil and technology implementation costs. This report also covers operational cash flow, fixed and variable costs, and detailed break-even point analysis, ensuring that your manufacturing process is not only efficient but also economically viable in the competitive market landscape.

In addition to operational insights, the Light Diesel Oil manufacturing plant report also comprehensively focuses on lifecycle cost analysis, maintenance costs, and energy consumption costs, which are critical for maintaining long-term sustainability and profitability. Our manufacturing cost analysis extends to include regulatory compliance costs, inventory holding costs, and logistics and distribution costs, providing a holistic view of the potential expenses and savings.

We at Procurement Resource ensure that this report is not only cost-efficient, environmentally sustainable, and aligned with the latest technological advancements but also that you are equipped with all necessary tools to optimise supply chain operations, manage risks effectively, and achieve superior market positioning for Light Diesel Oil.

Key Insights and Report Highlights

| Report Features | Details |

|---|---|

| Report Title | Light Diesel Oil Manufacturing Plant Project Report |

| Preface | Overview of the study and its significance. |

| Scope and Methodology | Key Questions Answered, Methodology, Estimations & Assumptions. |

| Executive Summary | Global Market Scenario, Production Cost Summary, Income Projections, Expenditure Projections, Profit Analysis. |

| Global Market Insights | Market Overview, Historical and Forecast (2019-2029), Market Breakup by Segment, Market Breakup by Region, Price Trends (Raw Material Price Trends, Light Diesel Oil Price Trends), Competitive Landscape (Key Players, Profiles of Key Players). |

| Detailed Process Flow | Product Overview, Properties and Applications, Manufacturing Process Flow, Process Details. |

| Project Details | Total Capital Investment, Land and Site Cost, Offsites/Civil Works Cost, Plant Machinery Cost, Auxiliary Equipment Cost, Contingency, Consulting and Engineering Charges, Working Capital. |

| Variable Cost Analysis | Raw Material Specifications, Raw Material Consumption, Raw Material Costs, Utilities Consumption and Costs, Co-product Cost Credit, Labour Requirements and Costs. |

| Fixed Cost Analysis | Plant Repair & Maintenance Cost, Overheads Cost, Insurance Cost, Financing Costs, Depreciation Charges. |

| General Sales and Administration Costs | Costs associated with sales and administration |

| Project Economics | Techno-economic Parameters, Income Projections, Expenditure Projections, Financial Analysis (Payback Period, Net Present Value, Internal Rate of Return), Profit Analysis, Production Cost Summary. |

| Report Format | PDF for BASIC and PREMIUM; PDF+Dynamic Excel for ENTERPRISE. |

| Pricing and Purchase Options | BASIC: USD 2999 PREMIUM: USD 3999 ENTERPRISE: USD 5999 |

| Customization Scope | The report can be customized based on the customer’s requirements. |

| Post-Sale Analyst Support | 10-12 Weeks of support post-sale. |

| Delivery Format | PDF and Excel via email; editable versions (PPT/Word) on special request. |

Key Questions Covered in our Light Diesel Oil Manufacturing Plant Report

- How can the cost of producing Light Diesel Oil be minimised, cash costs reduced, and manufacturing expenses managed efficiently to maximise overall efficiency?

- What is the estimated Light Diesel Oil manufacturing plant cost?

- What are the initial investment and capital expenditure requirements for setting up a Light Diesel Oil manufacturing plant, and how do these investments affect economic feasibility and ROI?

- How do we select and integrate technology providers to optimise the production process of Light Diesel Oil, and what are the associated implementation costs?

- How can operational cash flow be managed, and what strategies are recommended to balance fixed and variable costs during the operational phase of Light Diesel Oil manufacturing?

- How do market price fluctuations impact the profitability and cost per metric ton (USD/MT) for Light Diesel Oil, and what pricing strategy adjustments are necessary?

- What are the lifecycle costs and break-even points for Light Diesel Oil manufacturing, and which production efficiency metrics are critical for success?

- What strategies are in place to optimise the supply chain and manage inventory, ensuring regulatory compliance and minimising energy consumption costs?

- How can labour efficiency be optimised, and what measures are in place to enhance quality control and minimise material waste?

- What are the logistics and distribution costs, what financial and environmental risks are associated with entering new markets, and how can these be mitigated?

- What are the costs and benefits associated with technology upgrades, modernisation, and protecting intellectual property in Light Diesel Oil manufacturing?

- What types of insurance are required, and what are the comprehensive risk mitigation costs for Light Diesel Oil manufacturing?

1 Preface

2 Scope and Methodology

2.1 Key Questions Answered

2.2 Methodology

2.3 Estimations & Assumptions

3 Executive Summary

3.1 Global Market Scenario

3.2 Production Cost Summary

3.3 Income Projections

3.4 Expenditure Projections

3.5 Profit Analysis

4 Global Light Diesel Oil Market

4.1 Market Overview

4.2 Historical and Forecast (2019-2029)

4.3 Market Breakup by Segment

4.4 Market Breakup by Region

4.6 Price Trends

4.6.1 Raw Material Price Trends

4.6.2 Light Diesel Oil Price Trends

4.7 Competitive Landscape

4.8.1 Key Players

4.8.2 Profiles of Key Players

5 Detailed Process Flow

5.1 Product Overview

5.2 Properties and Applications

5.3 Manufacturing Process Flow

5.4 Process Details

6 Project Details, Requirements and Costs Involved

6.1 Total Capital Investment

6.2 Land and Site Cost

6.3 Offsites/ Civil Works Cost

6.4 Plant Machinery Cost

6.5 Auxiliary Equipment Cost

6.6 Contingency, Consulting and Engineering Charges

6.6 Working Capital

7 Variable Cost Analysis

7.1 Raw Materials

7.1.1 Raw Material Specifications

7.1.2 Raw Material Consumption

7.1.3 Raw Material Costs

7.2 Utilities Consumption and Costs

7.3 Co-product Cost Credit

7.4 Labour Requirements and Costs

8 Fixed Cost Analysis

8.1 Plant Repair & Maintanence Cost

8.2 Overheads Cost

8.3 Insurance Cost

8.4 Financing Costs

8.5 Depreciation Charges

9 General Sales and Administration Costs

10 Project Economics

10.1 Techno-economic Parameters

10.2 Income Projections

10.3 Expenditure Projections

10.4 Financial Analysis

10.5 Profit Analysis

10.5.1 Payback Period

10.5.2 Net Present Value

10.5.3 Internal Rate of Return

11 References

Compare & Choose the Right Report Version for You

You can easily get a quote for any Procurement Resource report. Just click here and raise a request. We will get back to you within 24 hours. Alternatively, you can also drop us an email at sales@procurementresource.com.

RIGHT PEOPLE

At Procurement Resource our analysts are selected after they are assessed thoroughly on having required qualities so that they can work effectively and productively and are able to execute projects based on the expectations shared by our clients. Our team is hence, technically exceptional, strategic, pragmatic, well experienced and competent.

RIGHT METHODOLOGY

We understand the cruciality of high-quality assessments that are important for our clients to take timely decisions and plan strategically. We have been continuously upgrading our tools and resources over the past years to become useful partners for our clientele. Our research methods are supported by most recent technology, our trusted and verified databases that are modified as per the needs help us serve our clients effectively every time and puts them ahead of their competitors.

RIGHT PRICE

Our team provides a detailed, high quality and deeply researched evaluations in competitive prices, that are unmatchable, and demonstrates our understanding of our client’s resource composition. These reports support our clientele make important procurement and supply chains choices that further helps them to place themselves ahead of their counterparts. We also offer attractive discounts or rebates on our forth coming reports.

RIGHT SUPPORT

Our vision is to enable our clients with superior quality market assessment and actionable evaluations to assist them with taking timely and right decisions. We are always ready to deliver our clients with maximum results by delivering them with customised suggestions to meet their exact needs within the specified timeline and help them understand the market dynamics in a better way.

SELECT YOUR LICENCE TYPE

- Review the available license options and choose the one that best fits your needs. Different licenses offer varying levels of access and usage rights, so make sure to pick the one that aligns with your requirements.

- If you're unsure which license is right for you, feel free to contact us for assistance.

CLICK 'BUY NOW'

- Once you've selected your desired report and license, click the ‘Buy Now’ button. This will add the report to your cart. You will be directed to the registration page where you’ll provide the necessary information to complete the purchase.

- You’ll have the chance to review your order and make adjustments, including updating your license or quantity, before proceeding to the next step.

COMPLETE REGISTRATION

- Enter your details for registration. This will include your name, email address, and any other necessary information. Creating an account allows you to easily manage your orders and gain access to future purchases or reports.

- If you already have an account with us, simply log in to streamline the process.

CHOOSE YOUR PAYMENT METHOD

- Select from a variety of secure payment options, including credit/debit cards, PayPal, or other available gateways. We ensure that all transactions are encrypted and processed securely.

- After selecting your payment method, you will be redirected to a secure checkout page to complete your transaction.

CONFIRM YOUR PURCHASE

- Once your payment is processed, you will receive an order confirmation email from sales@procurementresource.com confirming the dedicated project manger and delivery timelines.

ACCESS YOUR REPORT

- The report will be delivered to you by the project manager within the specified timeline.

- If you encounter any issues accessing your report, project manager would remain connected throughout the length of the project. The team shall assist you with post purchase analyst support for any queries or concerns from the deliverable (within the remit of the agreed scope of work).

Email Delivery Price: $ 2699.00

Ethyl Acrylate Manufacturing Plant Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.

Read MoreEmail Delivery Price: $ 2699.00

Hydrotalcite Manufacturing Plant Project Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.

Read MoreEmail Delivery Price: $ 2699.00

1-Decene Manufacturing Plant Project Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.

Read More