Reports

Rhodium Manufacturing Plant Project Report 2025: Market by Region, Market by Application, Key Players, Pre-feasibility, Capital Investment Costs, Production Cost Analysis, Expenditure Projections, Return on Investment (ROI), Economic Feasibility, CAPEX, OPEX, Plant Machinery Cost

Rhodium Manufacturing Plant Project Report 2025: Cost Analysis & ROI

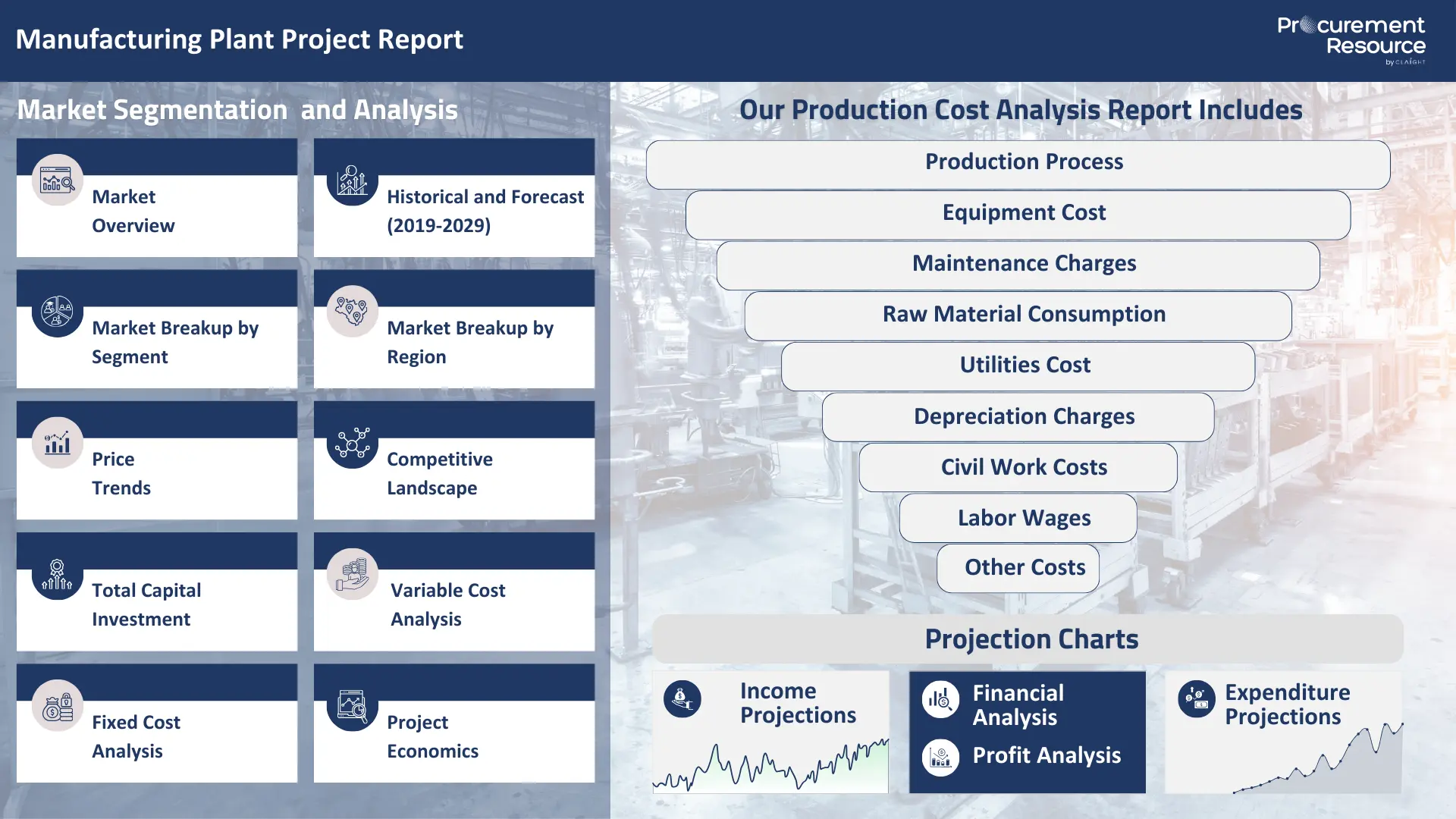

Rhodium Manufacturing Plant Project Report by Procurement Resource thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down Rhodium plant capital cost around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall Rhodium manufacturing plant cost and the cash cost of manufacturing.

Planning to Set Up a Rhodium Plant? Request a Free Sample Project Report Now!

Rhodium (Rh) is a silvery-white, hard, and exceptionally rare precious metal which belongs to the platinum group metals (PGMs). It is highly resistant to corrosion and is the most reflective of all metals. Rhodium is recovered in very small quantities as a byproduct of the mining and refining of platinum and nickel ores. The production process is a highly complex and lengthy hydrometallurgical operation that involves separating the various valuable metals from the ore. Rhodium is considered the most expensive of all precious metals, due to its extreme rarity and crucial role as an industrial catalyst, particularly in the automotive industry.

Applications of Rhodium

The applications of Rhodium are mainly focused on limited, high-value sectors that can justify its extreme cost and that leverage its unique catalytic and surface properties.

- Automotive Catalytic Converters: Rhodium is widely used as an essential catalyst in three-way catalytic converters for gasoline-powered vehicles. It is exceptionally effective at reducing harmful nitrogen oxides (NOx) in the exhaust stream, which converts them into harmless nitrogen gas. This is the dominant application, which consumes over 80% of the global rhodium supply.

- Glass and Fibreglass Manufacturing: Rhodium is also alloyed with platinum to create bushings (crucibles) with fine holes through which molten glass is extruded to produce glass fibres and high-quality flat panel display glass. The Rhodium provides strength and resists corrosion at the very high temperatures of the process.

- Electrical Contacts and Plating: A thin layer of Rhodium is electroplated onto electrical contacts and connectors to provide a hard, durable, and corrosion-resistant surface that ensures a long-lasting, low-resistance connection.

- Fine Jewellery: Rhodium is also widely used as a final plating on high-end white gold and sterling silver jewellery. This thin, highly reflective layer provides a brilliant white finish, increases scratch resistance, and prevents tarnishing.

- Catalysts in the Chemical Industry: Rhodium-based catalysts are often used in certain industrial chemical processes, such as in the Monsanto process for producing acetic acid and in the hydroformylation of alkenes.

Top 5 Global Producers of Rhodium

Rhodium is produced as a byproduct of the mining operations of major platinum and nickel producers. The global supply is extremely concentrated, with a handful of companies in South Africa and Russia accounting for the vast majority of output. The top global producers are:

- Anglo American Platinum (Amplats)

- Sibanye-Stillwater

- Impala Platinum Holdings Limited (Implats)

- Norilsk Nickel (Nornickel)

- Northam Platinum Limited

Feedstock and Raw Material Dynamics for Rhodium Production

The feedstock for Rhodium is the trace amount of the metal contained within platinum and nickel ores. Therefore, its supply is entirely dependent on the economics of these primary metals.

- Platinum Group Metal (PGM) Ores: The ultimate source of Rhodium is the PGM ore mined primarily from the Bushveld Igneous Complex in South Africa. This ore is mined for its platinum and palladium content, with Rhodium being a much smaller but highly valuable byproduct.

- Nickel-Copper Ores: The other major source is the nickel-copper sulfide ores from the Norilsk-Talnakh deposits in Russia, where Rhodium is recovered as a byproduct of nickel and palladium production.

- Supply Inelasticity: A crucial market dynamic is that the supply of Rhodium is inelastic. As it is a byproduct, its production volume cannot be increased in response to high demand or prices unless the primary mining of platinum and nickel is also increased. This often leads to extreme price volatility.

Market Drivers for Rhodium

The rhodium market is almost entirely driven by the global automotive industry and its response to environmental regulations.

- Automotive Emissions Standards: The single most important driver of the Rhodium market is the strictness of global vehicle emissions regulations. As governments in major markets like China, Europe, and the United States implement stricter limits on the emission of nitrogen oxides (NOx) from gasoline vehicles, automotive manufacturers are forced to use larger amounts of Rhodium in their catalytic converters to meet these standards.

- Automotive Production Volume: The global production volume of gasoline and hybrid vehicles is a direct driver of rhodium demand. Higher car sales lead to higher demand for catalytic converters.

- Extreme Price Volatility: The combination of inelastic supply and strong, regulation-driven demand leads to periods of extreme price volatility, which is a major market characteristic. This high cost can, in turn, drive efforts to thrift or substitute the metal.

- Growth of Battery Electric Vehicles (BEVs) (Market Restraint): The rapid global transition to battery electric vehicles represents the most significant long-term threat to rhodium demand. BEVs have no internal combustion engine and no exhaust system, and therefore require no catalytic converter. Each BEV that replaces a gasoline car eliminates a source of future rhodium demand.

CAPEX and OPEX in Rhodium Production

The CAPEX and OPEX for producing Rhodium are part of the massive costs associated with building and operating a world-scale PGM mining and refining complex.

CAPEX (Capital Expenditure)

The initial investment cost to develop a PGM mine and refinery is exceptionally high, running into many billions of dollars. The plant capital cost includes:

- Mine Development: The massive cost of constructing deep, underground mines and their associated infrastructure.

- Concentrator and Smelter: A large, on-site facility with crushing, milling, and flotation circuits, followed by a capital-intensive smelter with large electric arc furnaces.

- Precious Metal Refinery (PMR): A highly complex and secure refining facility designed to perform the intricate multi-stage chemical separation of the individual PGMs (platinum, palladium, Rhodium, etc.) from each other. This is a primary investment cost.

OPEX (Operating Expenses)

Production or operating costs are driven by the high costs of deep-level mining and the energy-intensive refining processes.

- Mining Costs: The largest operational expense, which includes labour, energy, explosives, and the maintenance of heavy mining equipment.

- Energy Costs: Extremely high and continuous consumption of electricity is required for the grinding mills and, most significantly, for the massive electric arc furnaces in the smelter. This is a primary factor in the cash cost of production.

- Chemical Reagents: The complex hydrometallurgical refining process requires a large and continuous supply of various powerful and often corrosive chemicals, such as sodium bisulfate, sodium hydroxide, hydrochloric acid, and sodium nitrite.

- Labour Costs: The entire process is very labour-intensive and requires a large, highly skilled workforce of miners, metallurgists, and chemical engineers.

- Fixed Costs: It accounts for the high depreciation and amortisation of the massive capital investment in the mine, plants, and refinery.

Manufacturing Process

This report comprises a thorough value chain evaluation for Rhodium production and consists of an in-depth production cost analysis revolving around the industrial extraction and refining process.

- Production from PGM Ore: The manufacturing process of Rhodium begins by refining platinum group metals (PGM), where the first step is to extract a noble metal from the PGM ore through precipitation. The resulting residue is treated with sodium bisulfate and then melted to form rhodium sulfate. Then, this sulfate is treated with sodium hydroxide to produce rhodium hydroxide. Next, hydrochloric acid is added to rhodium hydroxide to create a purified acid solution of rhodium chloride (H3RhCl6). Further, sodium nitrite and ammonium chloride are introduced to precipitate the Rhodium. Then, the precipitate is dissolved in hydrochloric acid and heated. Finally, the solution is burned to remove any remaining impurities, which leaves behind purified rhodium metal as the final product.

Properties of Rhodium

Rhodium (Rh) is a rare, hard, silvery-white, and noble precious metal.

Physical Properties

- Appearance: A hard, durable, silvery-white, highly reflective metallic solid.

- Odour: Odourless.

- Molecular Formula: Rh (as an element).

- Molar Mass: 102.905 g/mol.

- Melting Point: It has a high melting point of 1,964 degree Celsius.

- Boiling Point: It has a very high boiling point of 3,695 degree Celsius.

- Density: It is a very dense metal, with a density of 12.41 g/cm³.

- Flash Point: Not applicable, as it is a non-flammable metal.

Chemical Properties

- Reactivity: Rhodium is a noble metal, which makes it exceptionally unreactive. It is extremely resistant to corrosion, oxidation, and tarnishing in air.

- Acid Resistance: It has extraordinary resistance to attack by most acids, including aqua regia, which can dissolve platinum and gold.

- Catalytic Activity: Rhodium is an outstanding catalyst, particularly for the reduction of nitrogen oxides (NOx) to nitrogen gas (N2), which is the basis for its primary use in three-way catalytic converters.

- Alloying: It is used as an alloying agent with platinum and palladium to increase their hardness and corrosion resistance.

- Oxidation States: Its most common oxidation state in its chemical compounds is +3.

Rhodium Manufacturing Plant Report provides you with a detailed assessment of capital investment costs (CAPEX) and operational expenses (OPEX), generally measured as cost per metric ton (USD/MT). This approach ensures that your investment decisions are aligned with the latest industry standards and economic feasibility metrics, enhancing your manufacturing efficiency and financial planning.

Apart from that, this Rhodium manufacturing plant report also covers the leading technology providers that help you plan a robust plan of action related to Rhodium manufacturing plant and its production process(es), and also by helping you with an in-depth supplier database. This report provides exclusive insights into the best manufacturing practices for Rhodium and technology implementation costs. This report also covers operational cash flow, fixed and variable costs, and detailed break-even point analysis, ensuring that your manufacturing process is not only efficient but also economically viable in the competitive market landscape.

In addition to operational insights, the Rhodium manufacturing plant report also comprehensively focuses on lifecycle cost analysis, maintenance costs, and energy consumption costs, which are critical for maintaining long-term sustainability and profitability. Our manufacturing cost analysis extends to include regulatory compliance costs, inventory holding costs, and logistics and distribution costs, providing a holistic view of the potential expenses and savings.

We at Procurement Resource ensure that this report is not only cost-efficient, environmentally sustainable, and aligned with the latest technological advancements but also that you are equipped with all necessary tools to optimize supply chain operations, manage risks effectively, and achieve superior market positioning for Rhodium.

Key Insights and Report Highlights

| Report Features | Details |

|---|---|

| Report Title | Rhodium Manufacturing Plant Project Report |

| Preface | Overview of the study and its significance. |

| Scope and Methodology | Key Questions Answered, Methodology, Estimations & Assumptions. |

| Executive Summary | Global Market Scenario, Production Cost Summary, Income Projections, Expenditure Projections, Profit Analysis. |

| Global Market Insights | Market Overview, Historical and Forecast (2019-2029), Market Breakup by Segment, Market Breakup by Region, Price Trends (Raw Material Price Trends, Rhodium Price Trends), Competitive Landscape (Key Players, Profiles of Key Players). |

| Detailed Process Flow | Product Overview, Properties and Applications, Manufacturing Process Flow, Process Details. |

| Project Details | Total Capital Investment, Land and Site Cost, Offsites/Civil Works Cost, Plant Machinery Cost, Auxiliary Equipment Cost, Contingency, Consulting and Engineering Charges, Working Capital. |

| Variable Cost Analysis | Raw Material Specifications, Raw Material Consumption, Raw Material Costs, Utilities Consumption and Costs, Co-product Cost Credit, Labour Requirements and Costs. |

| Fixed Cost Analysis | Plant Repair & Maintenance Cost, Overheads Cost, Insurance Cost, Financing Costs, Depreciation Charges. |

| General Sales and Administration Costs | Costs associated with sales and administration |

| Project Economics | Techno-economic Parameters, Income Projections, Expenditure Projections, Financial Analysis (Payback Period, Net Present Value, Internal Rate of Return), Profit Analysis, Production Cost Summary. |

| Report Format | PDF for BASIC and PREMIUM; PDF+Dynamic Excel for ENTERPRISE. |

| Pricing and Purchase Options | BASIC: USD 2999 PREMIUM: USD 3999 ENTERPRISE: USD 5999 |

| Customization Scope | The report can be customized based on the customer’s requirements. |

| Post-Sale Analyst Support | 10-12 Weeks of support post-sale. |

| Delivery Format | PDF and Excel via email; editable versions (PPT/Word) on special request. |

Key Questions Covered in our Rhodium Manufacturing Plant Report

- How can the cost of producing Rhodium be minimized, cash costs reduced, and manufacturing expenses managed efficiently to maximize overall efficiency?

- What is the estimated Rhodium manufacturing plant cost?

- What are the initial investment and capital expenditure requirements for setting up a Rhodium manufacturing plant, and how do these investments affect economic feasibility and ROI?

- How do we select and integrate technology providers to optimize the production process of Rhodium, and what are the associated implementation costs?

- How can operational cash flow be managed, and what strategies are recommended to balance fixed and variable costs during the operational phase of Rhodium manufacturing?

- How do market price fluctuations impact the profitability and cost per metric ton (USD/MT) for Rhodium, and what pricing strategy adjustments are necessary?

- What are the lifecycle costs and break-even points for Rhodium manufacturing, and which production efficiency metrics are critical for success?

- What strategies are in place to optimize the supply chain and manage inventory, ensuring regulatory compliance and minimizing energy consumption costs?

- How can labor efficiency be optimized, and what measures are in place to enhance quality control and minimize material waste?

- What are the logistics and distribution costs, what financial and environmental risks are associated with entering new markets, and how can these be mitigated?

- What are the costs and benefits associated with technology upgrades, modernization, and protecting intellectual property in Rhodium manufacturing?

- What types of insurance are required, and what are the comprehensive risk mitigation costs for Rhodium manufacturing?

1 Preface

2 Scope and Methodology

2.1 Key Questions Answered

2.2 Methodology

2.3 Estimations & Assumptions

3 Executive Summary

3.1 Global Market Scenario

3.2 Production Cost Summary

3.3 Income Projections

3.4 Expenditure Projections

3.5 Profit Analysis

4 Global Rhodium Market

4.1 Market Overview

4.2 Historical and Forecast (2019-2029)

4.3 Market Breakup by Segment

4.4 Market Breakup by Region

4.6 Price Trends

4.6.1 Raw Material Price Trends

4.6.2 Rhodium Price Trends

4.7 Competitive Landscape

4.8.1 Key Players

4.8.2 Profiles of Key Players

5 Detailed Process Flow

5.1 Product Overview

5.2 Properties and Applications

5.3 Manufacturing Process Flow

5.4 Process Details

6 Project Details, Requirements and Costs Involved

6.1 Total Capital Investment

6.2 Land and Site Cost

6.3 Offsites/ Civil Works Cost

6.4 Plant Machinery Cost

6.5 Auxiliary Equipment Cost

6.6 Contingency, Consulting and Engineering Charges

6.6 Working Capital

7 Variable Cost Analysis

7.1 Raw Materials

7.1.1 Raw Material Specifications

7.1.2 Raw Material Consumption

7.1.3 Raw Material Costs

7.2 Utilities Consumption and Costs

7.3 Co-product Cost Credit

7.4 Labour Requirements and Costs

8 Fixed Cost Analysis

8.1 Plant Repair & Maintanence Cost

8.2 Overheads Cost

8.3 Insurance Cost

8.4 Financing Costs

8.5 Depreciation Charges

9 General Sales and Administration Costs

10 Project Economics

10.1 Techno-economic Parameters

10.2 Income Projections

10.3 Expenditure Projections

10.4 Financial Analysis

10.5 Profit Analysis

10.5.1 Payback Period

10.5.2 Net Present Value

10.5.3 Internal Rate of Return

11 References

Compare & Choose the Right Report Version for You

You can easily get a quote for any Procurement Resource report. Just click here and raise a request. We will get back to you within 24 hours. Alternatively, you can also drop us an email at sales@procurementresource.com.

RIGHT PEOPLE

At Procurement Resource our analysts are selected after they are assessed thoroughly on having required qualities so that they can work effectively and productively and are able to execute projects based on the expectations shared by our clients. Our team is hence, technically exceptional, strategic, pragmatic, well experienced and competent.

RIGHT METHODOLOGY

We understand the cruciality of high-quality assessments that are important for our clients to take timely decisions and plan strategically. We have been continuously upgrading our tools and resources over the past years to become useful partners for our clientele. Our research methods are supported by most recent technology, our trusted and verified databases that are modified as per the needs help us serve our clients effectively every time and puts them ahead of their competitors.

RIGHT PRICE

Our team provides a detailed, high quality and deeply researched evaluations in competitive prices, that are unmatchable, and demonstrates our understanding of our client’s resource composition. These reports support our clientele make important procurement and supply chains choices that further helps them to place themselves ahead of their counterparts. We also offer attractive discounts or rebates on our forth coming reports.

RIGHT SUPPORT

Our vision is to enable our clients with superior quality market assessment and actionable evaluations to assist them with taking timely and right decisions. We are always ready to deliver our clients with maximum results by delivering them with customised suggestions to meet their exact needs within the specified timeline and help them understand the market dynamics in a better way.

SELECT YOUR LICENCE TYPE

- Review the available license options and choose the one that best fits your needs. Different licenses offer varying levels of access and usage rights, so make sure to pick the one that aligns with your requirements.

- If you're unsure which license is right for you, feel free to contact us for assistance.

CLICK 'BUY NOW'

- Once you've selected your desired report and license, click the ‘Buy Now’ button. This will add the report to your cart. You will be directed to the registration page where you’ll provide the necessary information to complete the purchase.

- You’ll have the chance to review your order and make adjustments, including updating your license or quantity, before proceeding to the next step.

COMPLETE REGISTRATION

- Enter your details for registration. This will include your name, email address, and any other necessary information. Creating an account allows you to easily manage your orders and gain access to future purchases or reports.

- If you already have an account with us, simply log in to streamline the process.

CHOOSE YOUR PAYMENT METHOD

- Select from a variety of secure payment options, including credit/debit cards, PayPal, or other available gateways. We ensure that all transactions are encrypted and processed securely.

- After selecting your payment method, you will be redirected to a secure checkout page to complete your transaction.

CONFIRM YOUR PURCHASE

- Once your payment is processed, you will receive an order confirmation email from sales@procurementresource.com confirming the dedicated project manger and delivery timelines.

ACCESS YOUR REPORT

- The report will be delivered to you by the project manager within the specified timeline.

- If you encounter any issues accessing your report, project manager would remain connected throughout the length of the project. The team shall assist you with post purchase analyst support for any queries or concerns from the deliverable (within the remit of the agreed scope of work).

Email Delivery Price: $ 2699.00

Ethyl Acrylate Manufacturing Plant Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.

Read MoreEmail Delivery Price: $ 2699.00

Hydrotalcite Manufacturing Plant Project Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.

Read MoreEmail Delivery Price: $ 2699.00

1-Decene Manufacturing Plant Project Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.

Read More