Lotte And INEOS Announced The Addition Of 3rd Line For The Manufacturing Of VAM At Ulsan, South Korea

A Vinyl Acetate Monomer Plant To Be Built By INEOS And LOTTE In Ulsan, South Korea

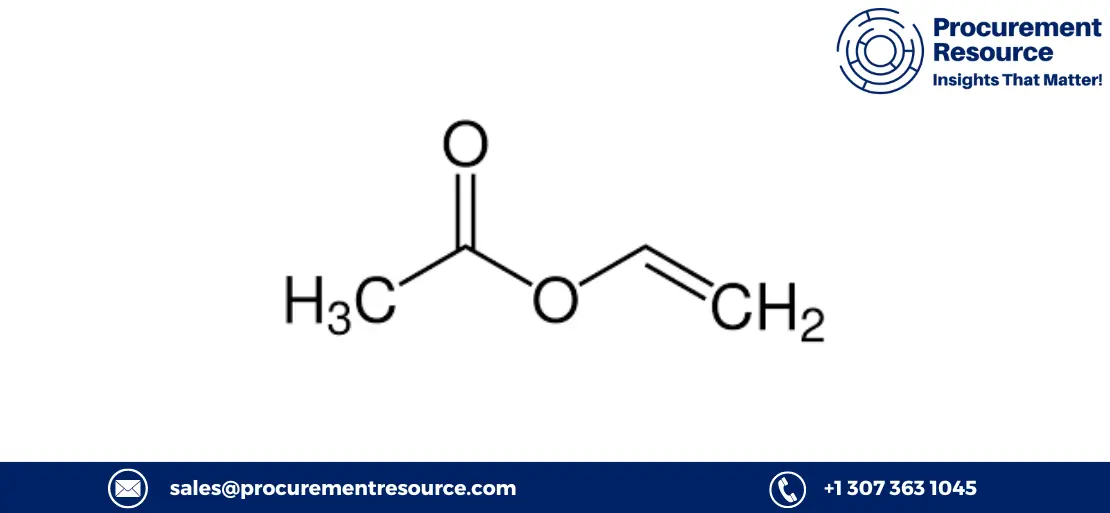

LOTTE and INEOS Chemical to add a third VAM plant to boost the production capacity of vinyl acetate monomer (VAM) from the existing 4,50,000 tons to 7,00,000 tons. The latest plant is planned to commence operation by 2025 end.

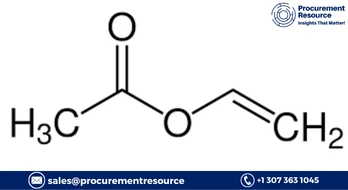

VAM has extensive applications in daily products, including solar panels, adhesives, windscreens, polarising films, food packaging, and paints. In recent years, the demand for VAM has raised significantly in order to fulfil global solar power generation. The extra land alongside the existing plant in Ulsan was purchased by LOTTE and INEOS Chemical for constructing the latest VAM plant and has started with the Front-End Engineering Design (FEED) work with LOTTE Engineering and Construction.

The CEO of INEOS Acetyls, David Brooks, stated that the INEOS-LOTTE team in Ulsan hold an impeccable record for yielding projects in a safe and timely manner. This investment, employing the well-proven INEOS technology, will sustain the customer growth plans in Northeast Asia as well as all over the world.

Previous News

During January 2019, it was announced by BP that it is planning to invest an amount of USD 175 million through its acetyl production joint venture at Ulsan with Lotte Chemical (Seoul, South Korea) in order to grow the capacity of acetic acid and VAM to 650,000 metric tons/year and 400,000 metric tons/year, respectively.

BP approved the deal for selling its petrochemicals business to Ineos for USD 5 billion, enclosing BP’s acetyl, aromatics, and affiliated businesses worldwide. Ineos agreed to pay USD 4 billion after completion, with the leftover USD 1 billion delayed till June 2021.

Reqest Access For Regular Price Update of Vinyl Acetate

In Ulsan, the shutdown of the Lotte INEOS Vinyl Acetate Monomer (VAM) plant, which is the best VAM plant in Ulsan, is planned. On March 10, 2023, the plant will be closed off for maintenance. It was impossible to control the information concerning how long the outage might last. The top VAM plant based in Ulsan, South Korea, has a yearly production capacity of 210,000 mt.

Vinyl Acetate Monomer (VAM) Price Analysis Across The Different Regions

North America

The prices of Vinyl Acetate Monomer recently dropped primarily as the prices of feedstock Acetic acid persisted in dropping of late, and energy costs were steady in the US market. At the same time, prices of imported Vinyl Acetate Monomer also stayed lower in comparison to regional prices. The rate of production stayed frail, considering the steady consumption rates in the regional market.

The production cost stayed steady as prices of Natural gas dropped, whereas the prices of feedstock Acetic acid persistently declined. In the meantime, the Asia pacific imports propped amidst lower freight charges. The downstream Paints & coatings and Adhesives and polymers industry demand reduced as a decline in demand was witnessed by the construction industry during the endless winter.

Meanwhile, the consumer sentiment persisted in being bearish in the US market, while international market demand was also steady as Europe resumed encountering weak consumer sentiment. In the meantime, the US Federal Reserve persisted in tightening the monetary policy to curb inflation.

Asia Pacific

The prices of Vinyl Acetate Monomer persisted in lowering as the downstream demand dynamics stayed bearish. The market's purchasing sentiment was deemed rigid because of factors like snuck consumption rates and restricted queries, reported by many market players. In addition, the prices of feedstock Acetic acid continued being sluggish, which led to frail cost pressure on downstream Vinyl Acetate Monomer. At the same time, the construction industry's underwhelming performance, paired with covid lockdowns, added to the feeble consumer sentiment and weak consumption rates.

Europe

The market sentiment for European Vinyl Acetate Monomer stayed bearish since the players in the market reported restricted queries from downstream users since the West witnessed a sluggish consumption rate due to frail consumer sentiment. In the meantime, recession threats persist in relaxing, as reported by various firms. At the same time, prices of feedstock Acetic acid declined in the European continent, relieving the price stress, while Asia pacific imports stayed adequate, raising the available material in the European market.

Read More About Vinyl Acetate Production Cost Reports - REQUEST FREE SAMPLE COPY IN PDF

According to the article by Procurement Resource, Lotte and INEOS will add a third line for the manufacturing of VAM at Ulsan, South Korea. The operation is expected to start in 2025. The new plant is expected to boost the production capacity of vinyl acetate monomer (VAM) from the existing 4,50,000 tons to 7,00,000 tons.

To carry out the operation, an extra land right next to the existing plant in Ulsan was bought by LOTTE and INEOS Chemical. The plan will employ the Front-End Engineering Design (FEED) work with LOTTE Engineering and Construction and the well-proven INEOS technology.

.webp)