Rise in Prices of Vinyl Acetate Monomer and Ethylene Vinyl Acetate by 4-6 percent hurts the profitability & margin of Pidilite Industries Limited

Due to the rising prices of VAM and EVA (28% VA Content), India’s Pidilite Industries Ltd, the parent company of the adhesive brand Fevicol, unexpectedly reported a 15 percent drop in quarterly profit.

As rural markets and smaller cities struggle to recover from the economic effects of COVID-19, rising inflation has compelled cash-strapped households to tighten expenditures.

The Mumbai-based company reported that for the three months till December, its consolidated net profit decreased to 3.04 billion rupees (USD 37.26 million). According to Refinitiv IBES statistics, analysts anticipated the company to earn a profit of 3.82 billion rupees on average.

The manufacturer of building chemicals saw its slowest growth in nine quarters as its consolidated revenue from operations increased 5.2 percent to 29.98 billion rupees. Price increases in the previous quarter overstated revenue.

Pidilite, known for its waterproofing solution Dr. Fixit and synthetic resin glue fevicol, reported a 4.7 percent in the price of raw ingredients. The Managing Director, Bharat Puri state that the demand in rural and semi-urban areas is still strained.

The consumer and bazaar segment’s sales of adhesives, craft supplies, and chemicals for construction and painting to retail customers saw a 6.9 percent increase in revenue. 80 percent of the business’s revenue comes from this division.

A moderate sales increase was reported by the overseas businesses, but earnings before interest, taxes, depreciation, and amortisation were still under pressure from rising VAM and EVA (28% VA Content) and the impact of currency devaluation.

Although VAM and EVA (28% VA Content) have decreased, this has not yet been reflected in the gross margins because they consumed expensive inventory this quarter. Ahead of this earnings report, the stock price settled at 1.13 percent down at INR 2383.35 rupees.

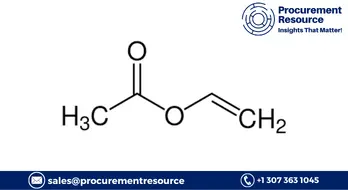

Vinyl Acetate Monomer (VAM) Price Trend

North America

Vinyl Acetate monomer Prices decreased primarily as feedstock prices for acetic acid continued to fall and energy costs in the US market stabilised. Imported Vinyl Acetate Monomer prices also continued to be relatively less expensive than domestic prices. In the aftermath of constant consumption rates on the domestic market, production rates remained low.

Request Access For Regular Price Update of Vinyl Acetate

Despite falling natural gas prices and steadily falling feedstock acetic acid prices, production costs were steady. As freight costs have decreased, imports from the Asia-Pacific region have grown. As the construction industry experienced a dip in demand during the current winter, demand from downstream industries such as Paints & Coatings, Adhesives, and Polymers decreased.

Asia Pacific

Prices for vinyl acetate monomer kept falling as demand dynamics from downstream sectors remained subdued. According to various market participants, the inflexible buying mentality in the market is a result of low consumption rates and few inquiries.

Additionally, the cost pressure on downstream Vinyl Acetate Monomer has been modest due to the continued weakness in feedstock Acetic acid pricing. However, reduced consumer confidence and lower consumption rates were caused by COVID lockdowns and the dismal performance of the building industry.

Europe

The European Vinyl Acetate Monomer market sentiment remained subdued as participants in the industry reported few inquiries from downstream consumers and the West had slow consumption rates as a result of subdued consumer attitude. According to reports from various businesses, the risk of a recession is still diminishing.

While imports from the Asia-Pacific region have continued to be plentiful and increased the amount of material accessible in the European market, feedstock acetic acid prices have decreased on the European continent, relieving cost pressure. The early half of the quarter was characterised by port congestion and labour strikes, which subsided during the second half of the quarter.

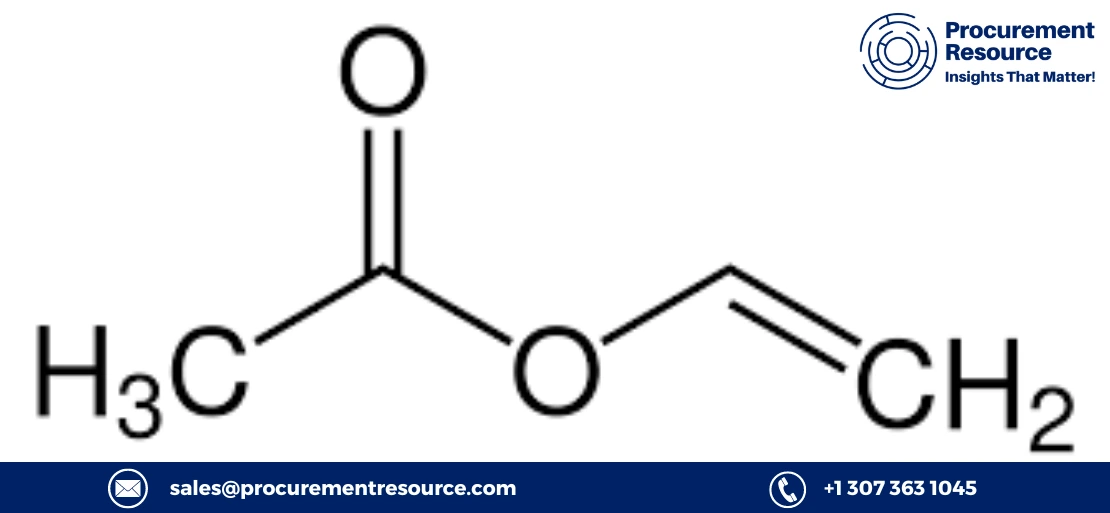

Ethylene Vinyl Acetate (EVA) latest Price Trend

Asia Pacific

In the Asian region, EVA prices were continually falling. Due to the steady decline in the price of the feedstock ethylene, the upstream cost pressure on the product values lessened. On account of the downstream processors' adverse demand mood, vinyl acetate prices also decreased more noticeably in the second half of the quarter.

The pricing of the goods was also significantly impacted by the depreciation in the currency values of significant producers like China brought on by the economic slowdown and regular lockdowns.

Europe

Prices for EVA dropped throughout Europe. As a result of declining downstream industry offtakes and a parallel dip in the price of vinyl acetate, production costs decreased and upstream cost pressure was relieved. In addition, despite production being reduced due to limited input supplies from the exporters, inventory levels rose as a result of weak EVA demand, little downstream buyer offtake, and high inflation.

North America

EVA prices continue to decline in North America, with the decline becoming more pronounced in quarter H2. Due to consistent manufacturing costs and firm feedstock prices, prices only slightly declined, while end-user sector demand was only mild. However, as of the middle of the third quarter, the prices of the feedstocks ethylene and vinyl acetate sharply declined as a result of rising stockpiles and falling demand from downstream sectors. It decreased the production values' fixed costs.

Read More About Vinyl Acetate Production Cost Reports - REQUEST FREE SAMPLE COPY IN PDF

As per Procurement Resource, the parent firm of the adhesive brand Fevicol, India's Pidilite Industries, surprisingly reported a 15% decline in quarterly earnings due to the growing VAM and EVA (28% VA Content) and reduced demand. Rising inflation has forced cash-strapped households to reduce spending as they seek to recover from the economic effects of COVID-19 in rural markets and smaller cities.

.webp)