Reports

Lithium Carbonate Manufacturing Plant Project Report 2025: Market by Region, Market by Application, Key Players, Pre-feasibility, Capital Investment Costs, Production Cost Analysis, Expenditure Projections, Return on Investment (ROI), Economic Feasibility, CAPEX, OPEX, Plant Machinery Cost

Lithium Carbonate Manufacturing Plant Project Report: Key Insights and Outline

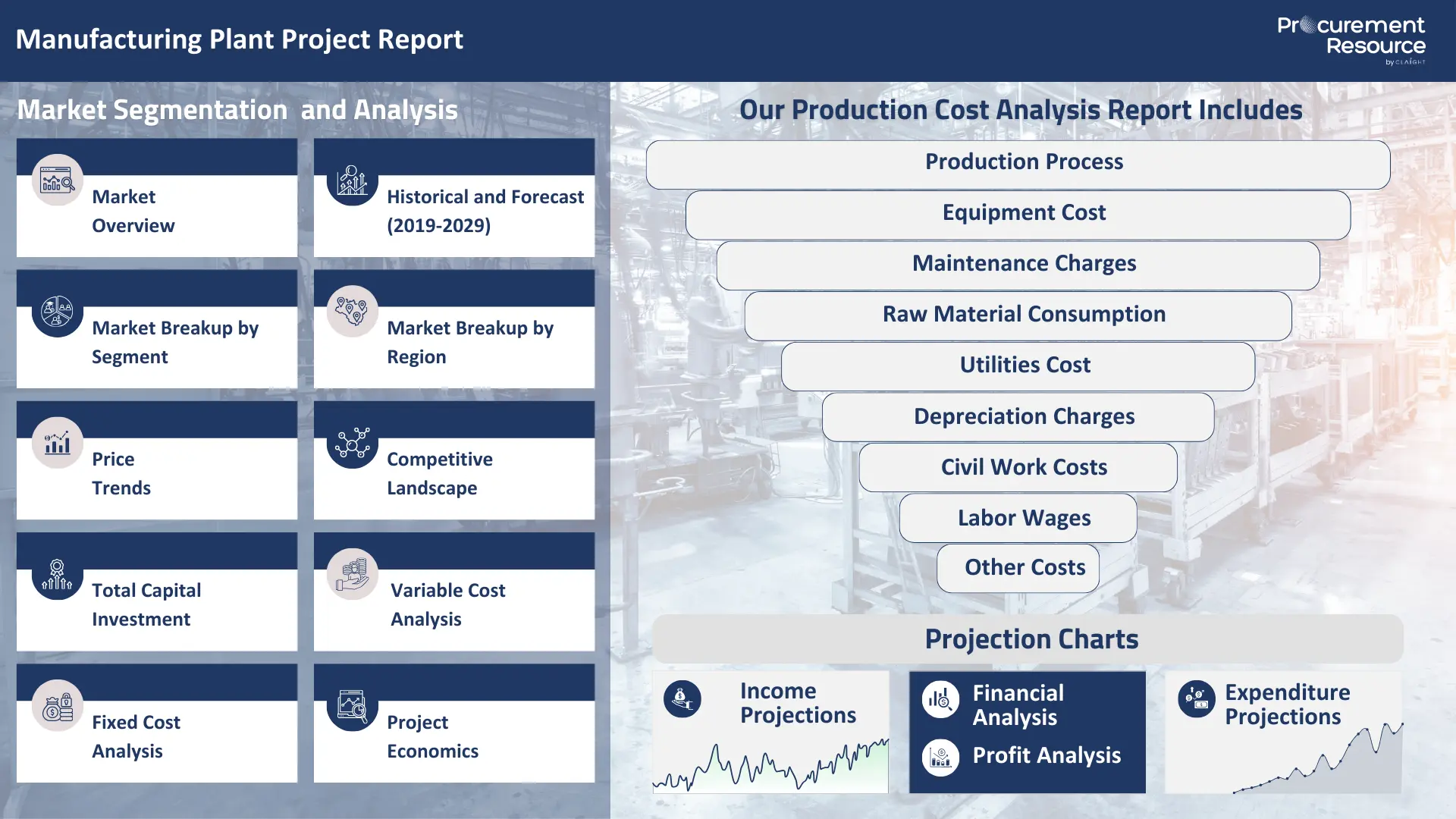

Lithium Carbonate Manufacturing Plant Project Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.

Planning to Set Up a Lithium Carbonate Plant? Request a Free Sample Project Report Now!

Lithium Carbonate is a lithium salt with a wide range of applications in industries. It is used in the ceramic and glass industries for manufacturing sealants, durable glazes, and oven glasses that are heat resistant. It is also used in the medical and pharmaceutical industry for the treatment of manic episodes of bipolar disorder. Lithium Carbonate is also used as an accelerator in the construction industry for manufacturing fast-setting cement, mortars, plasters, and tile adhesives. It is mainly used to speed up the setting process of cement formulations, which reduces construction time and cost. It is often used as a precursor for the synthesis of compounds used in the production of lithium-ion batteries. It is also used as a crosslinking agent to enhance the properties of plastics and synthetic rubber.

Top Manufacturers of Lithium Carbonate

- Albemarle Corporation

- Sociedad Quimica y Minera de Chile (SQM)

- Ganfeng Lithium Group Co., Ltd.

- Tianqi Lithium Industry Co., Ltd.

- Arcadium Lithium

- Livent Corporation

- Lithium Americas Corp.

- Sigma Lithium Corporation

- Mineral Resources

- Pilbara Minerals

Feedstock for Lithium Carbonate

The feedstock required for the production of Lithium Carbonate is Alpha Spodumene or Triphane. The procurement of Alpha Spodumene or Triphane is mainly affected by extraction method, processing costs, and geological availability. The distribution of spodumene deposits directly impacts its sourcing. The geological characteristics of these deposits serve as factors that determine the cost and ease of extraction. The costs involved in mining and the conversion of alpha spodumene into usable forms for lithium extraction through calcination, also affect how Spodumene is sourced. Environmental measures and the management of mining waste also impact the procurement of spodumene and can also lead to supply disruptions or increased costs.

Market Drivers for Lithium Carbonate

The demand for Lithium Carbonate is predominantly driven by its application as a medication in the treatment of anxiety and bipolar disorder. Its utilization in the medical and pharmaceutical industries for the treatment of manic episodes further contributes to its market expansion. Its expansion in the production of sealants, oven glasses, and durable glazes further enhances its demand in the glass, construction, and manufacturing industries. Its usage as an accelerator in the production of mortars and fast-setting cement further promotes its demand in the construction industry. Its involvement as a precursor in manufacturing Lithium-ion batteries also contributes to its demand in the consumer electronic industry.

The industrial procurement of Lithium carbonate is governed by its source and the cost and availability of raw materials. Fluctuations in the demand from industries such as electronics (for batteries) and electric vehicles also affect the market and procurement strategies for lithium carbonate. Capital expenditures (CAPEX) for setting up a manufacturing plant for lithium carbonate involves infrastructure costs, which include the construction of evaporation ponds. It also includes investments in kilns, ion exchange columns, heavy machinery, and precipitation tanks. The operational expenditures (OPEX) for producing lithium carbonate involve the cost of sourcing lithium-containing materials such as spodumene or brine solutions. It also includes costs for chemicals used in the extraction and refining processes. Expenses related to water, electricity, and other utilities important for the production and processing activities are also covered under OPEX.

Manufacturing Process

This report comprises a thorough value chain evaluation for Lithium Carbonate manufacturing and consists of an in-depth production cost analysis revolving around industrial Lithium Carbonate manufacturing.

- Production from Lithium Carbonate: The feedstock required for the production of lithium carbonate involves alpha spodumene or triphane. The process starts with the calcination of alpha spodumene to form beta spodumene, followed by sulfating it to form a pregnant leach solution. Further, the pregnant leach solution undergoes purification by adding sodium carbonate, followed by further purification through ion exchange, which leads to the synthesis of lithium carbonate.

Properties of Lithium Carbonate

Lithium Carbonate is a soft alkali metal with the chemical formula of Li2CO3. It appears in the form of white crystalline powder with low solubility in water. The density of the compound is 2.11 g/cm³. Moreover, the melting point and the boiling point of the compound are 723°C and 1,310°C, respectively. It is also insoluble in alcohol and acetone. The molecular mass of the compound is 73.89 g/mol. It has low thermal stability as compared to other alkali metal carbonates. The compound decomposes at the temperature of 1300°C, producing lithium oxide and carbon dioxide.

Lithium Carbonate Manufacturing Plant Report provides you with a detailed assessment of capital investment costs (CAPEX) and operational expenses (OPEX), generally measured as cost per metric ton (USD/MT). This approach ensures that your investment decisions are aligned with the latest industry standards and economic feasibility metrics, enhancing your manufacturing efficiency and financial planning.

Apart from that, this Lithium Carbonate manufacturing plant report also covers the leading technology providers that help you plan a robust plan of action related to Lithium Carbonate manufacturing plant and its production process(es), and also by helping you with an in-depth supplier database. This report provides exclusive insights into the best manufacturing practices for Lithium Carbonate and technology implementation costs. This report also covers operational cash flow, fixed and variable costs, and detailed break-even point analysis, ensuring that your manufacturing process is not only efficient but also economically viable in the competitive market landscape.

In addition to operational insights, the Lithium Carbonate manufacturing plant report also comprehensively focuses on lifecycle cost analysis, maintenance costs, and energy consumption costs, which are critical for maintaining long-term sustainability and profitability. Our manufacturing cost analysis extends to include regulatory compliance costs, inventory holding costs, and logistics and distribution costs, providing a holistic view of the potential expenses and savings.

We at Procurement Resource ensure that this report is not only cost-efficient, environmentally sustainable, and aligned with the latest technological advancements but also that you are equipped with all necessary tools to optimize supply chain operations, manage risks effectively, and achieve superior market positioning for Lithium Carbonate.

Key Insights and Report Highlights

| Report Features | Details |

|---|---|

| Report Title | Lithium Carbonate Manufacturing Plant Project Report |

| Preface | Overview of the study and its significance. |

| Scope and Methodology | Key Questions Answered, Methodology, Estimations & Assumptions. |

| Executive Summary | Global Market Scenario, Production Cost Summary, Income Projections, Expenditure Projections, Profit Analysis. |

| Global Market Insights | Market Overview, Historical and Forecast (2019-2029), Market Breakup by Segment, Market Breakup by Region, Price Trends (Raw Material Price Trends, Lithium Carbonate Price Trends), Competitive Landscape (Key Players, Profiles of Key Players). |

| Detailed Process Flow | Product Overview, Properties and Applications, Manufacturing Process Flow, Process Details. |

| Project Details | Total Capital Investment, Land and Site Cost, Offsites/Civil Works Cost, Plant Machinery Cost, Auxiliary Equipment Cost, Contingency, Consulting and Engineering Charges, Working Capital. |

| Variable Cost Analysis | Raw Material Specifications, Raw Material Consumption, Raw Material Costs, Utilities Consumption and Costs, Co-product Cost Credit, Labour Requirements and Costs. |

| Fixed Cost Analysis | Plant Repair & Maintenance Cost, Overheads Cost, Insurance Cost, Financing Costs, Depreciation Charges. |

| General Sales and Administration Costs | Costs associated with sales and administration |

| Project Economics | Techno-economic Parameters, Income Projections, Expenditure Projections, Financial Analysis (Payback Period, Net Present Value, Internal Rate of Return), Profit Analysis, Production Cost Summary. |

| Report Format | PDF for BASIC and PREMIUM; PDF+Dynamic Excel for ENTERPRISE. |

| Pricing and Purchase Options | BASIC: USD 2999 PREMIUM: USD 3999 ENTERPRISE: USD 5999 |

| Customization Scope | The report can be customized based on the customer’s requirements. |

| Post-Sale Analyst Support | 10-12 Weeks of support post-sale. |

| Delivery Format | PDF and Excel via email; editable versions (PPT/Word) on special request. |

Key Questions Covered in our Lithium Carbonate Manufacturing Plant Report

- How can the cost of producing Lithium Carbonate be minimized, cash costs reduced, and manufacturing expenses managed efficiently to maximize overall efficiency?

- What are the initial investment and capital expenditure requirements for setting up an Lithium Carbonate manufacturing plant, and how do these investments affect economic feasibility and ROI?

- How do we select and integrate technology providers to optimize the production process of Lithium Carbonate, and what are the associated implementation costs?

- How can operational cash flow be managed, and what strategies are recommended to balance fixed and variable costs during the operational phase of Lithium Carbonate manufacturing?

- How do market price fluctuations impact the profitability and cost per metric ton (USD/MT) for Lithium Carbonate, and what pricing strategy adjustments are necessary?

- What are the lifecycle costs and break-even points for Lithium Carbonate manufacturing, and which production efficiency metrics are critical for success?

- What strategies are in place to optimize the supply chain and manage inventory, ensuring regulatory compliance and minimizing energy consumption costs?

- How can labor efficiency be optimized, and what measures are in place to enhance quality control and minimize material waste?

- What are the logistics and distribution costs, what financial and environmental risks are associated with entering new markets, and how can these be mitigated?

- What are the costs and benefits associated with technology upgrades, modernization, and protecting intellectual property in Lithium Carbonate manufacturing?

- What types of insurance are required, and what are the comprehensive risk mitigation costs for Lithium Carbonate manufacturing?

1 Preface

2 Scope and Methodology

2.1 Key Questions Answered

2.2 Methodology

2.3 Estimations & Assumptions

3 Executive Summary

3.1 Global Market Scenario

3.2 Production Cost Summary

3.3 Income Projections

3.4 Expenditure Projections

3.5 Profit Analysis

4 Global Lithium Carbonate Market

4.1 Market Overview

4.2 Historical and Forecast (2019-2029)

4.3 Market Breakup by Segment

4.4 Market Breakup by Region

4.6 Price Trends

4.6.1 Raw Material Price Trends

4.6.2 Lithium Carbonate Price Trends

4.7 Competitive Landscape

4.8.1 Key Players

4.8.2 Profiles of Key Players

5 Detailed Process Flow

5.1 Product Overview

5.2 Properties and Applications

5.3 Manufacturing Process Flow

5.4 Process Details

6 Project Details, Requirements and Costs Involved

6.1 Total Capital Investment

6.2 Land and Site Cost

6.3 Offsites/ Civil Works Cost

6.4 Plant Machinery Cost

6.5 Auxiliary Equipment Cost

6.6 Contingency, Consulting and Engineering Charges

6.6 Working Capital

7 Variable Cost Analysis

7.1 Raw Materials

7.1.1 Raw Material Specifications

7.1.2 Raw Material Consumption

7.1.3 Raw Material Costs

7.2 Utilities Consumption and Costs

7.3 Co-product Cost Credit

7.4 Labour Requirements and Costs

8 Fixed Cost Analysis

8.1 Plant Repair & Maintanence Cost

8.2 Overheads Cost

8.3 Insurance Cost

8.4 Financing Costs

8.5 Depreciation Charges

9 General Sales and Administration Costs

10 Project Economics

10.1 Techno-economic Parameters

10.2 Income Projections

10.3 Expenditure Projections

10.4 Financial Analysis

10.5 Profit Analysis

10.5.1 Payback Period

10.5.2 Net Present Value

10.5.3 Internal Rate of Return

11 References

Compare & Choose the Right Report Version for You

RIGHT PEOPLE

At Procurement Resource our analysts are selected after they are assessed thoroughly on having required qualities so that they can work effectively and productively and are able to execute projects based on the expectations shared by our clients. Our team is hence, technically exceptional, strategic, pragmatic, well experienced and competent.

RIGHT METHODOLOGY

We understand the cruciality of high-quality assessments that are important for our clients to take timely decisions and plan strategically. We have been continuously upgrading our tools and resources over the past years to become useful partners for our clientele. Our research methods are supported by most recent technology, our trusted and verified databases that are modified as per the needs help us serve our clients effectively every time and puts them ahead of their competitors.

RIGHT PRICE

Our team provides a detailed, high quality and deeply researched evaluations in competitive prices, that are unmatchable, and demonstrates our understanding of our client’s resource composition. These reports support our clientele make important procurement and supply chains choices that further helps them to place themselves ahead of their counterparts. We also offer attractive discounts or rebates on our forth coming reports.

RIGHT SUPPORT

Our vision is to enable our clients with superior quality market assessment and actionable evaluations to assist them with taking timely and right decisions. We are always ready to deliver our clients with maximum results by delivering them with customised suggestions to meet their exact needs within the specified timeline and help them understand the market dynamics in a better way.

Ethyl Acrylate Manufacturing Plant Project Report 2025: Cost Analysis, ROI, and Feasibility Insights

Ethyl Acrylate Manufacturing Plant Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.

Hydrotalcite Manufacturing Plant Project Report 2025: Cost Analysis, ROI, and Feasibility Insights

Hydrotalcite Manufacturing Plant Project Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.

1-Decene Manufacturing Plant Project Report 2025: Cost Analysis, ROI, and Feasibility Insights

1-Decene Manufacturing Plant Project Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.