Reports

Lithium Fluoride Manufacturing Plant Project Report 2025: Market by Region, Market by Application, Key Players, Pre-feasibility, Capital Investment Costs, Production Cost Analysis, Expenditure Projections, Return on Investment (ROI), Economic Feasibility, CAPEX, OPEX, Plant Machinery Cost

Lithium Fluoride Manufacturing Plant Project Report: Key Insights and Outline

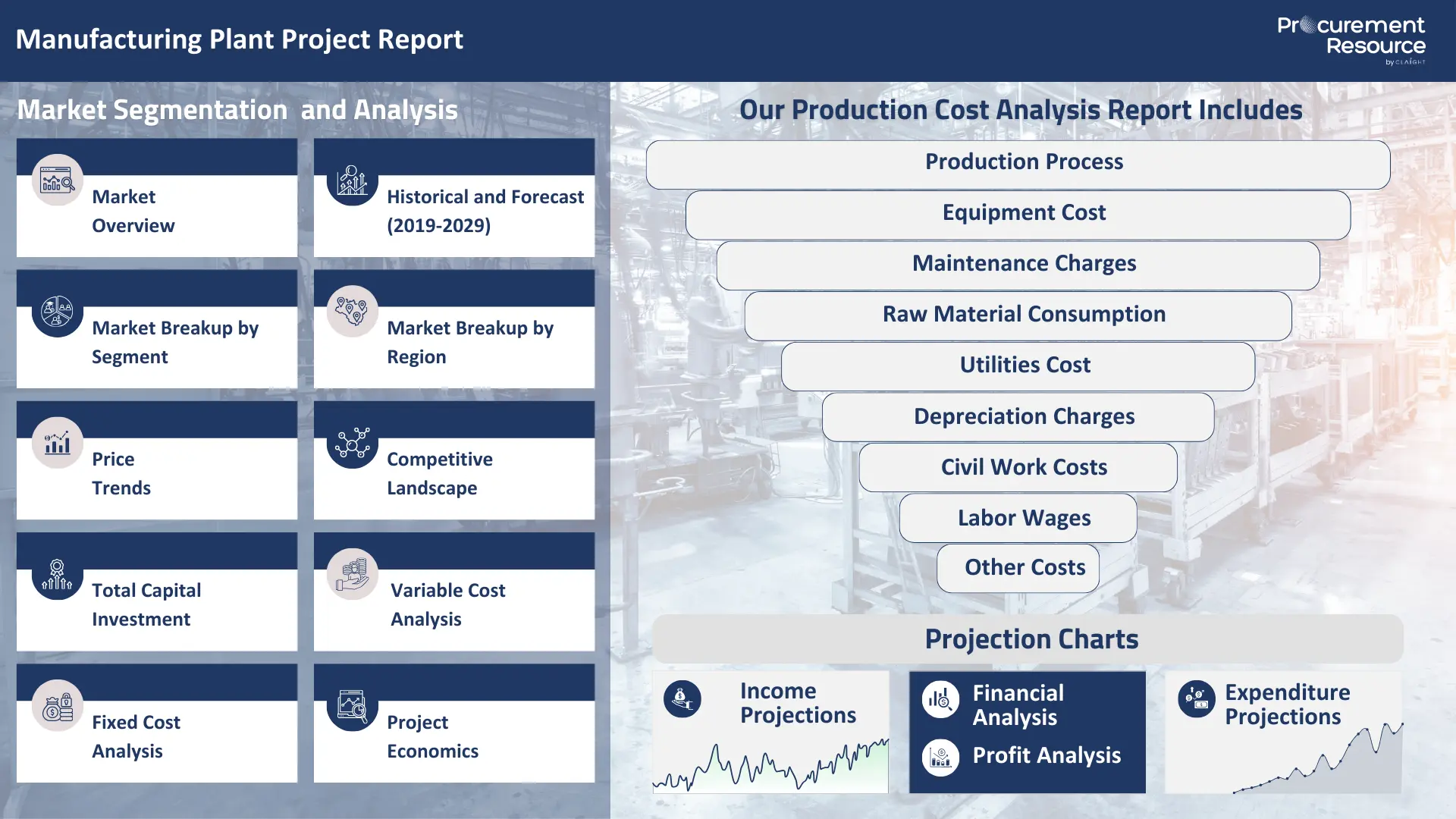

Lithium Fluoride Manufacturing Plant Project Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.

Planning to Set Up a Lithium Fluoride Plant? Request a Free Sample Project Report Now!

Lithium fluoride (LiF) is a chemical compound with a wide range of applications across various industries. It is utilized for its transparency in the ultraviolet spectrum, which makes it ideal for specialized UV optics and laser windows. In ceramics and glass production, LiF acts as a flux to facilitate uniform melting. It also finds application in energy storage as a precursor for lithium-ion battery components and emerging fluoride-ion batteries. Additionally, LiF is used in the nuclear industry as a coolant and solvent in molten salt reactors and for neutron shielding. It is applied in radiation measurement instruments and thermoluminescent dosimeters. Furthermore, LiF is used as a welding flux and in aluminium electrolysis. Its applications extend to displays and lighting through its use in fluorescent materials.

Top Manufacturers of Lithium Fluoride

- Iwatani Corporation

- Axiom Chemicals Pvt. Ltd.

- Celtic Chemicals Ltd

- American Elements

- FMC Corporation

Feedstock for Lithium Fluoride

The direct raw materials required to produce Lithium Fluoride are lithium hydroxide and hydrogen fluoride. Thus, factors such as the surge or decline in the prices and availability of the major raw materials directly impact the overall supply chain of Lithium Fluoride.

The availability of lithium ore, the primary raw material for lithium hydroxide, impacts its price. Factors such as tight supply conditions lead to higher prices, while oversupply reduces them. Increases in mining costs due to resource scarcity or operational challenges drive up the price of lithium hydroxide. The demand for lithium-ion batteries, mainly in the electric vehicle (EV) sector, drives lithium hydroxide prices. The ability to integrate new technologies, such as recycling or more efficient extraction methods, impacts procurement decisions.

The cost of raw materials, such as fluorspar, impacts the price of hydrogen fluoride. Increases in these costs lead to higher prices for hydrogen fluoride. Imbalances between supply and demand cause price fluctuations. Strong demand, mainly from downstream industries and sectors like petrochemicals and refrigerants, drives up prices. Also, various advancements in production technologies affect costs and efficiency, which further influences procurement and prices.

Market Drivers for Lithium Fluoride

The market demand for Lithium fluoride is driven by its application as an important component in the electrolyte of lithium-ion batteries, which are widely used in electric vehicles (EVs), energy storage systems (ESS), and consumer electronics like smartphones and laptops. The global rise in the demand for EVs and renewable energy storage solutions boosts the demand for lithium fluoride. The increasing adoption of electric vehicles due to environmental concerns and government incentives drives the demand for lithium-ion batteries, which in turn propels the demand for lithium fluoride. The usage of lithium-ion batteries for storing energy generated from renewable sources like solar and wind power further increases the demand for lithium fluoride.

The widespread use of consumer electronics such as laptops, tablets, and smartphones also contributes to the demand for lithium-ion batteries and, in turn, lithium fluoride. Innovations in lithium fluoride production and lithium-ion battery technology enhance performance and reduce costs, which drives its market growth. Its utilization in the production of ceramics and glass, coupled with the growing demand from construction and household goods sectors, contributes to its market growth. Its usage in nuclear applications, such as in molten salt reactors, supports market growth, mainly in regions that invest heavily in nuclear energy.

Industrial Lithium Fluoride procurement is impacted by the fluctuations in the prices of raw materials like lithium carbonate and hydrogen fluoride, which affect the cost of producing lithium fluoride. Innovations in recycling and alternative lithium sources mitigate supply risks and stabilize prices over time. Advancements in mining technologies improve extraction efficiency and reduce costs, which further influences procurement costs.

Capital expenditure (CAPEX) for establishing a lithium fluoride manufacturing plant includes expenditures on equipment such as stainless-steel reactors, crushers and grinders, rotary kilns, acid leaching equipment, filtration and separation equipment, spray or rotary dryers, etc., along with the infrastructure and technology. The Operating expenses (OPEX) for Lithium Fluoride include the cost of raw materials such as lithium hydroxide and hydrogen fluoride, utilities like electricity and water, labor costs for the workforce, maintenance expenses for equipment and facilities, packaging and transportation costs, and overhead expenses such as administrative fees and insurance.

Manufacturing Process

This report comprises a thorough value chain evaluation for Lithium Fluoride manufacturing and consists of an in-depth production cost analysis revolving around industrial Lithium Fluoride manufacturing.

- Production by chemical reaction of lithium hydroxide with hydrogen fluoride: The feedstock utilized for the industrial manufacturing process consists of lithium hydroxide and hydrogen fluoride.

The manufacturing process of lithium fluoride involves lithium hydroxide and hydrogen fluoride as the starting materials. The process initiates with the chemical reaction between lithium hydroxide and hydrogen fluoride. The reaction results in the production of Lithium fluoride as the final product and water as the byproduct. The resultant compound is further heated under specific temperatures to give anhydrous lithium fluoride as the final product.

Properties of Lithium Fluoride

Lithium Fluoride is a white inorganic chemical that consists of one lithium and one fluorine atom. It is a white crystalline powdered compound with a molecular weight of 26.0 g/mol. It is a highly toxic chemical that is inorganic in nature. It has melting and boiling points of 870.2 degree Celsius and 1676 degree Celsius, respectively. It dissolves in other chemical solvents, such as hydrogen fluoride. However, it is immiscible in alcohol and water. It has a density of 2.640 g/cu cm and has a vapor pressure of 1 mm Hg at 1047 degree Celsius. It decomposes when heated at higher temperatures to emit toxic fumes of fluoride. It volatilizes at a temperature in the range of 1100-1200 degree Celsius. It is a hazardous compound that can react with hydrofluoric acid to produce lithium bifluoride as the final product. It is a white crystalline solid that has no odor with a bitter-saline taste.

Lithium Fluoride Manufacturing Plant Report provides you with a detailed assessment of capital investment costs (CAPEX) and operational expenses (OPEX), generally measured as cost per metric ton (USD/MT). This approach ensures that your investment decisions are aligned with the latest industry standards and economic feasibility metrics, enhancing your manufacturing efficiency and financial planning.

Apart from that, this Lithium Fluoride manufacturing plant report also covers the leading technology providers that help you plan a robust plan of action related to Lithium Fluoride manufacturing plant and its production process, and also by helping you with an in-depth supplier database. This report provides exclusive insights into the best manufacturing practices for Lithium Fluoride and technology implementation costs. This report also covers operational cash flow, fixed and variable costs, and detailed break-even point analysis, ensuring that your manufacturing process is not only efficient but also economically viable in the competitive market landscape.

In addition to operational insights, the Lithium Fluoride manufacturing plant report also comprehensively focuses on lifecycle cost analysis, maintenance costs, and energy consumption costs, which are critical for maintaining long-term sustainability and profitability. Our manufacturing cost analysis extends to include regulatory compliance costs, inventory holding costs, and logistics and distribution costs, providing a holistic view of the potential expenses and savings.

We at Procurement Resource ensure that this report is not only cost-efficient, environmentally sustainable, and aligned with the latest technological advancements but also that you are equipped with all necessary tools to optimize supply chain operations, manage risks effectively, and achieve superior market positioning for Lithium Fluoride.

Key Insights and Report Highlights

| Report Features | Details |

|---|---|

| Report Title | Lithium Fluoride Manufacturing Plant Project Report |

| Preface | Overview of the study and its significance. |

| Scope and Methodology | Key Questions Answered, Methodology, Estimations & Assumptions. |

| Executive Summary | Global Market Scenario, Production Cost Summary, Income Projections, Expenditure Projections, Profit Analysis. |

| Global Market Insights | Market Overview, Historical and Forecast (2019-2029), Market Breakup by Segment, Market Breakup by Region, Price Trends (Raw Material Price Trends, Lithium Fluoride Price Trends), Competitive Landscape (Key Players, Profiles of Key Players). |

| Detailed Process Flow | Product Overview, Properties and Applications, Manufacturing Process Flow, Process Details. |

| Project Details | Total Capital Investment, Land and Site Cost, Offsites/Civil Works Cost, Plant Machinery Cost, Auxiliary Equipment Cost, Contingency, Consulting and Engineering Charges, Working Capital. |

| Variable Cost Analysis | Raw Material Specifications, Raw Material Consumption, Raw Material Costs, Utilities Consumption and Costs, Co-product Cost Credit, Labour Requirements and Costs. |

| Fixed Cost Analysis | Plant Repair & Maintenance Cost, Overheads Cost, Insurance Cost, Financing Costs, Depreciation Charges. |

| General Sales and Administration Costs | Costs associated with sales and administration |

| Project Economics | Techno-economic Parameters, Income Projections, Expenditure Projections, Financial Analysis (Payback Period, Net Present Value, Internal Rate of Return), Profit Analysis, Production Cost Summary. |

| Report Format | PDF for BASIC and PREMIUM; PDF+Dynamic Excel for ENTERPRISE. |

| Pricing and Purchase Options | BASIC: USD 2999 PREMIUM: USD 3999 ENTERPRISE: USD 5999 |

| Customization Scope | The report can be customized based on the customer’s requirements. |

| Post-Sale Analyst Support | 10-12 Weeks of support post-sale. |

| Delivery Format | PDF and Excel via email; editable versions (PPT/Word) on special request. |

Key Questions Covered in our Lithium Fluoride Manufacturing Plant Report

- How can the cost of producing Lithium Fluoride be minimized, cash costs reduced, and manufacturing expenses managed efficiently to maximize overall efficiency?

- What are the initial investment and capital expenditure requirements for setting up a Lithium Fluoride manufacturing plant, and how do these investments affect economic feasibility and ROI?

- How do we select and integrate technology providers to optimize the production process of Lithium Fluoride, and what are the associated implementation costs?

- How can operational cash flow be managed, and what strategies are recommended to balance fixed and variable costs during the operational phase of Lithium Fluoride manufacturing?

- How do market price fluctuations impact the profitability and cost per metric ton (USD/MT) for Lithium Fluoride, and what pricing strategy adjustments are necessary?

- What are the lifecycle costs and break-even points for Lithium Fluoride manufacturing, and which production efficiency metrics are critical for success?

- What strategies are in place to optimize the supply chain and manage inventory, ensuring regulatory compliance and minimizing energy consumption costs?

- How can labor efficiency be optimized, and what measures are in place to enhance quality control and minimize material waste?

- What are the logistics and distribution costs, what financial and environmental risks are associated with entering new markets, and how can these be mitigated?

- What are the costs and benefits associated with technology upgrades, modernization, and protecting intellectual property in Lithium Fluoride manufacturing?

- What types of insurance are required, and what are the comprehensive risk mitigation costs for Lithium Fluoride manufacturing?

1 Preface

2 Scope and Methodology

2.1 Key Questions Answered

2.2 Methodology

2.3 Estimations & Assumptions

3 Executive Summary

3.1 Global Market Scenario

3.2 Production Cost Summary

3.3 Income Projections

3.4 Expenditure Projections

3.5 Profit Analysis

4 Global Lithium Fluoride Market

4.1 Market Overview

4.2 Historical and Forecast (2019-2029)

4.3 Market Breakup by Segment

4.4 Market Breakup by Region

4.6 Price Trends

4.6.1 Raw Material Price Trends

4.6.2 Lithium Fluoride Price Trends

4.7 Competitive Landscape

4.8.1 Key Players

4.8.2 Profiles of Key Players

5 Detailed Process Flow

5.1 Product Overview

5.2 Properties and Applications

5.3 Manufacturing Process Flow

5.4 Process Details

6 Project Details, Requirements and Costs Involved

6.1 Total Capital Investment

6.2 Land and Site Cost

6.3 Offsites/ Civil Works Cost

6.4 Plant Machinery Cost

6.5 Auxiliary Equipment Cost

6.6 Contingency, Consulting and Engineering Charges

6.6 Working Capital

7 Variable Cost Analysis

7.1 Raw Materials

7.1.1 Raw Material Specifications

7.1.2 Raw Material Consumption

7.1.3 Raw Material Costs

7.2 Utilities Consumption and Costs

7.3 Co-product Cost Credit

7.4 Labour Requirements and Costs

8 Fixed Cost Analysis

8.1 Plant Repair & Maintanence Cost

8.2 Overheads Cost

8.3 Insurance Cost

8.4 Financing Costs

8.5 Depreciation Charges

9 General Sales and Administration Costs

10 Project Economics

10.1 Techno-economic Parameters

10.2 Income Projections

10.3 Expenditure Projections

10.4 Financial Analysis

10.5 Profit Analysis

10.5.1 Payback Period

10.5.2 Net Present Value

10.5.3 Internal Rate of Return

11 References

Compare & Choose the Right Report Version for You

RIGHT PEOPLE

At Procurement Resource our analysts are selected after they are assessed thoroughly on having required qualities so that they can work effectively and productively and are able to execute projects based on the expectations shared by our clients. Our team is hence, technically exceptional, strategic, pragmatic, well experienced and competent.

RIGHT METHODOLOGY

We understand the cruciality of high-quality assessments that are important for our clients to take timely decisions and plan strategically. We have been continuously upgrading our tools and resources over the past years to become useful partners for our clientele. Our research methods are supported by most recent technology, our trusted and verified databases that are modified as per the needs help us serve our clients effectively every time and puts them ahead of their competitors.

RIGHT PRICE

Our team provides a detailed, high quality and deeply researched evaluations in competitive prices, that are unmatchable, and demonstrates our understanding of our client’s resource composition. These reports support our clientele make important procurement and supply chains choices that further helps them to place themselves ahead of their counterparts. We also offer attractive discounts or rebates on our forth coming reports.

RIGHT SUPPORT

Our vision is to enable our clients with superior quality market assessment and actionable evaluations to assist them with taking timely and right decisions. We are always ready to deliver our clients with maximum results by delivering them with customised suggestions to meet their exact needs within the specified timeline and help them understand the market dynamics in a better way.

Ethyl Acrylate Manufacturing Plant Project Report 2025: Cost Analysis, ROI, and Feasibility Insights

Ethyl Acrylate Manufacturing Plant Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.

Hydrotalcite Manufacturing Plant Project Report 2025: Cost Analysis, ROI, and Feasibility Insights

Hydrotalcite Manufacturing Plant Project Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.

1-Decene Manufacturing Plant Project Report 2025: Cost Analysis, ROI, and Feasibility Insights

1-Decene Manufacturing Plant Project Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.