Reports

Praseodymium Manufacturing Plant Project Report 2025: Market by Region, Market by Application, Key Players, Pre-feasibility, Capital Investment Costs, Production Cost Analysis, Expenditure Projections, Return on Investment (ROI), Economic Feasibility, CAPEX, OPEX, Plant Machinery Cost

Praseodymium Manufacturing Plant Project Report 2025: Cost Analysis & ROI

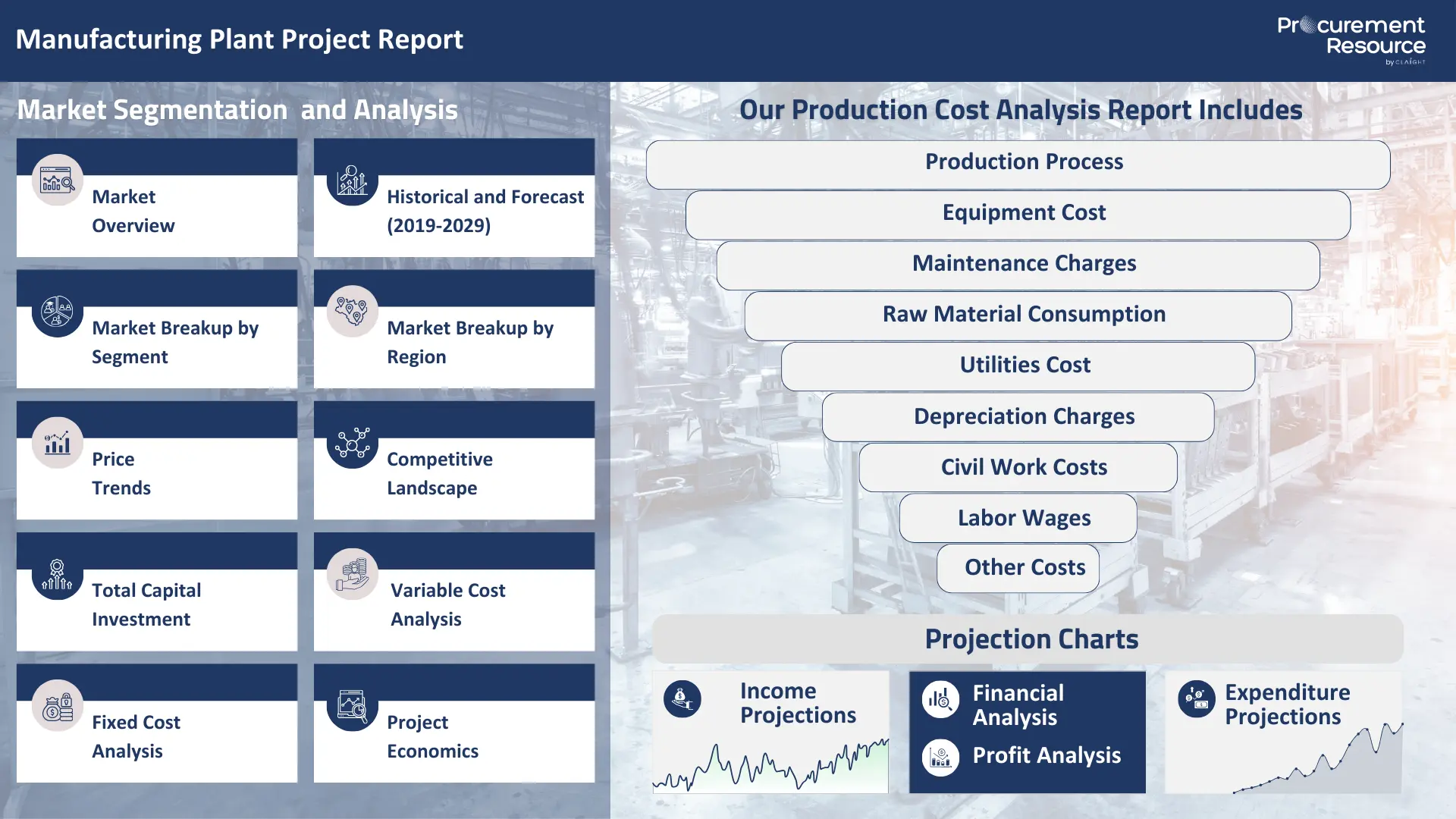

Praseodymium Manufacturing Plant Project Report by Procurement Resource thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down Praseodymium plant capital cost around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall Praseodymium manufacturing plant cost and the cash cost of manufacturing.

Planning to Set Up a Praseodymium Plant? Request a Free Sample Project Report Now!

Praseodymium (Pr) is a soft, silvery, malleable rare-earth element belonging to the lanthanide series of the periodic table. It is too reactive to be found in its native metallic form and is instead extracted from rare-earth minerals, primarily monazite and bastnaesite. It occurs alongside other rare-earth elements. Praseodymium is known for its magnetic and optical properties. Its most significant and rapidly growing application is as an important component in the world's strongest permanent magnets (neodymium-iron-boron magnets), which are essential for high-efficiency electric motors and generators. It is also used as a potent alloying agent and as a colourant for speciality glasses and ceramics.

Applications of Praseodymium

The applications of praseodymium are concentrated in high-technology sectors that leverage its unique magnetic, metallurgical, and optical properties.

- High-Strength Permanent Magnets: Praseodymium is widely used as a key component in manufacturing neodymium-iron-boron (NdFeB) permanent magnets, along with neodymium. It is often used to partially substitute for neodymium and is particularly important for enhancing the magnet's coercivity and performance at higher temperatures.

- Glass and Ceramics Colourant: Praseodymium compounds are also used as a powerful colourant to impart a distinctive bright yellow or green colour to glass, enamels, and ceramics. Didymium glass, which contains both praseodymium and neodymium, is used in welder's goggles because it strongly absorbs the yellow light and infrared radiation from the welding flame.

- Alloying Agent: It is often used as a component of mischmetal, which is an alloy that is used to make flints for lighters. It is also used to create high-strength magnesium alloys that are used in aircraft engines, where it improves the alloy's strength and creep resistance at high temperatures.

- Lighting and Lasers: The salts of praseodymium are also used in the cores of carbon arc lights, which were historically important for the motion picture industry and for floodlighting, as they produce a bright white light that closely mimics the colour spectrum of natural sunlight.

- Fibre Optic Amplifiers: Praseodymium-doped fluoride glass fibre is used to create fibre optic amplifiers that can amplify a light signal directly at the 1.3 micrometre wavelength, without first needing to convert it to an electronic signal.

Top 4 Global Producers of Praseodymium

The primary production of praseodymium is a complex mining, separation, and refining operation. The global supply chain for all rare-earth elements is highly concentrated, with a few companies and countries dominating the market. The top global producers are the major rare-earth mining and separation companies:

- China Northern Rare Earth Group (China)

- Lynas Rare Earths, Ltd. (Australia/Malaysia)

- MP Materials (USA)

- China Southern Rare Earth Group (China)

Feedstock and Raw Material Dynamics for Praseodymium Production

The feedstock for praseodymium is the naturally occurring rare-earth ore. The economics of its production are dictated by the complex geology, metallurgy, and geopolitics of the entire rare-earth element supply chain.

- Rare-Earth Ores: Praseodymium is co-extracted with all other rare-earth elements from specific minerals, most commonly:

- Bastnaesite: A fluorocarbonate mineral that is the primary source of rare earths at major mines like Mountain Pass in the USA.

- Monazite: A reddish-brown phosphate mineral that is a significant source of rare earths, often found in heavy mineral sands deposits.

- Complex Extraction and Separation: The production cost analysis is driven by the extremely complex and capital-intensive process required to separate the 17 individual rare-earth elements from each other. After the ore is mined, concentrated, and chemically cracked through leaching, the mixed rare-earth solution enters a solvent extraction plant. This plant uses hundreds of individual mixer-settler stages to painstakingly separate each element based on minute differences in its chemical properties.

Market Drivers for Praseodymium

The demand for praseodymium is driven by the global transition to green energy and high-efficiency electric technologies.

- Growth in the Electric Vehicle (EV) and Wind Turbine Markets: The single largest driver of the Praseodymium market is the exponential growth in the demand for high-strength NdFeB magnets. These magnets are essential for the high-efficiency permanent magnet motors used in the vast majority of electric vehicles and the direct-drive generators used in large offshore wind turbines.

- Miniaturisation of Electronics: The continuous demand for smaller, lighter, and more powerful consumer electronics, such as smartphones, headphones, drones, and computer hard drives, relies on the unparalleled magnetic strength of rare-earth magnets.

- Geopolitical Supply Chain Security: The high concentration of rare-earth mining and, more importantly, processing and separation in China has become a major global economic and security concern. This is a powerful driver for governments and companies in the US, Europe, and Australia to invest in and develop their own independent "mine-to-magnet" supply chains.

- Price Dynamics of other Rare Earths: Praseodymium is often traded as a combined oxide with neodymium ("NdPr oxide"). Its price and demand are closely linked to the price of neodymium, for which it can partially substitute, and the extremely high price of heavy rare earths like dysprosium, which are also used to improve the thermal performance of magnets.

CAPEX and OPEX in Praseodymium Production

The CAPEX and OPEX for producing a separated rare-earth element like praseodymium are extremely high, reflecting the massive scale and complexity of the entire mine-to-metal process.

CAPEX (Capital Expenditure)

The initial investment cost to establish a rare-earth mine and separation plant is in the billions of dollars. The plant capital cost includes:

- Mine Development: The massive cost of developing a large open-pit mine and its associated infrastructure.

- Concentrator and Cracking Plant: A plant with crushing, grinding, and flotation circuits, followed by large kilns and leaching tanks to chemically break down the ore.

- Solvent Extraction (SX) Separation Plant: This is the most complex and capital-intensive part of the process, consisting of hundreds of mixer-settler units, pumps, and piping arranged in long, complex trains. This is a primary investment cost.

- Refining and Metallization Facility: A final facility for converting the separated praseodymium oxide into a metal, which includes high-temperature furnaces for metallothermic reduction or electrolysis.

- Waste Management Infrastructure: Extensive and costly facilities for managing and safely storing the large volumes of waste (tailings), which can sometimes contain low-level radioactive elements like thorium.

OPEX (Operating Expenses)

Production or operating costs are driven by the high consumption of chemical reagents and energy.

- Mining and Crushing Costs: The standard high costs of large-scale mining operations, including fuel, explosives, electricity, and maintenance.

- Chemical Reagents: A primary factor in the cash cost of production is the massive and continuous consumption of strong acids (hydrochloric or sulfuric), bases (sodium hydroxide), and specialised organic solvents and extractants required for the multi-stage solvent extraction process.

- Energy Costs: The entire process is highly energy-intensive, with significant electricity consumption for grinding, heating kilns and furnaces, and operating the thousands of pumps and mixers in the SX plant.

- Waste Treatment Costs: High and long-term costs associated with the safe management and disposal of the large volumes of chemical and mineral waste.

- Labour Costs: A highly skilled, multidisciplinary workforce of geologists, metallurgists, chemical engineers, and plant operators is required.

- Fixed Costs: It covers the very high depreciation and amortisation of the massive capital investment.

Manufacturing Process

This report comprises a thorough value chain evaluation for Praseodymium production and consists of an in-depth production cost analysis revolving around the industrial extraction and refining process.

- Production via Extraction from Minerals (Bastnaesite and Monazite): The manufacturing process of Praseodymium occurs via extraction from minerals. The process begins with the mining and concentration of rare-earth ores like monazite and bastnaesite, followed by a chemical cracking and leaching process to dissolve the rare earths into a solution. The extraction process is completed through solvent extraction, where the mixed solution is passed through hundreds of stages to precisely separate the individual rare-earth elements. After separation, the purified praseodymium is precipitated and converted to an oxide. Then, this oxide is converted to a fluoride or chloride salt, which is finally reduced to metal through a high-temperature refining process to obtain Praseodymium as the final product.

Properties of Praseodymium

Praseodymium (Pr) is a soft, silvery rare-earth element and a member of the lanthanide series.

Physical Properties

- Appearance: A soft, malleable, and ductile metal with a silvery-white colour that has a distinct yellowish tinge.

- Odour: Odourless.

- Molecular Formula: Pr (as an element).

- Molar Mass: 140.907 g/mol.

- Melting Point: Its melting point is approximately 931 degree Celsius.

- Boiling Point: Its boiling point is approximately 3,520 degree Celsius.

- Density: It is approximately 6.77 g/cm³.

- Flash Point: Not applicable. However, the metal can be pyrophoric, especially as dust or shavings, and can ignite spontaneously in air.

Chemical Properties

- Reactivity: Praseodymium is one of the more reactive lanthanides. It tarnishes readily when exposed to air, forming a green oxide layer that spalls off, exposing fresh metal to further oxidation. The metal must be stored under mineral oil or in an inert atmosphere. It reacts with water to produce praseodymium hydroxide and hydrogen gas.

- Oxidation States: Its most common and stable oxidation state in its compounds is +3. It can also exhibit a +4 state in some solid-state oxides and fluorides.

- Colour of Ions: The Praseodymium(III) ion is responsible for the characteristic bright yellowish-green colour it imparts to glass, ceramics, and solutions.

- Magnetic Properties: The metal is paramagnetic at room temperature.

Praseodymium Manufacturing Plant Report provides you with a detailed assessment of capital investment costs (CAPEX) and operational expenses (OPEX), generally measured as cost per metric ton (USD/MT). This approach ensures that your investment decisions are aligned with the latest industry standards and economic feasibility metrics, enhancing your manufacturing efficiency and financial planning.

Apart from that, this Praseodymium manufacturing plant report also covers the leading technology providers that help you plan a robust plan of action related to Praseodymium manufacturing plant and its production process(es), and also by helping you with an in-depth supplier database. This report provides exclusive insights into the best manufacturing practices for Praseodymium and technology implementation costs. This report also covers operational cash flow, fixed and variable costs, and detailed break-even point analysis, ensuring that your manufacturing process is not only efficient but also economically viable in the competitive market landscape.

In addition to operational insights, the Praseodymium manufacturing plant report also comprehensively focuses on lifecycle cost analysis, maintenance costs, and energy consumption costs, which are critical for maintaining long-term sustainability and profitability. Our manufacturing cost analysis extends to include regulatory compliance costs, inventory holding costs, and logistics and distribution costs, providing a holistic view of the potential expenses and savings.

We at Procurement Resource ensure that this report is not only cost-efficient, environmentally sustainable, and aligned with the latest technological advancements but also that you are equipped with all necessary tools to optimize supply chain operations, manage risks effectively, and achieve superior market positioning for Praseodymium.

Key Insights and Report Highlights

| Report Features | Details |

|---|---|

| Report Title | Praseodymium Manufacturing Plant Project Report |

| Preface | Overview of the study and its significance. |

| Scope and Methodology | Key Questions Answered, Methodology, Estimations & Assumptions. |

| Executive Summary | Global Market Scenario, Production Cost Summary, Income Projections, Expenditure Projections, Profit Analysis. |

| Global Market Insights | Market Overview, Historical and Forecast (2019-2029), Market Breakup by Segment, Market Breakup by Region, Price Trends (Raw Material Price Trends, Praseodymium Price Trends), Competitive Landscape (Key Players, Profiles of Key Players). |

| Detailed Process Flow | Product Overview, Properties and Applications, Manufacturing Process Flow, Process Details. |

| Project Details | Total Capital Investment, Land and Site Cost, Offsites/Civil Works Cost, Plant Machinery Cost, Auxiliary Equipment Cost, Contingency, Consulting and Engineering Charges, Working Capital. |

| Variable Cost Analysis | Raw Material Specifications, Raw Material Consumption, Raw Material Costs, Utilities Consumption and Costs, Co-product Cost Credit, Labour Requirements and Costs. |

| Fixed Cost Analysis | Plant Repair & Maintenance Cost, Overheads Cost, Insurance Cost, Financing Costs, Depreciation Charges. |

| General Sales and Administration Costs | Costs associated with sales and administration |

| Project Economics | Techno-economic Parameters, Income Projections, Expenditure Projections, Financial Analysis (Payback Period, Net Present Value, Internal Rate of Return), Profit Analysis, Production Cost Summary. |

| Report Format | PDF for BASIC and PREMIUM; PDF+Dynamic Excel for ENTERPRISE. |

| Pricing and Purchase Options | BASIC: USD 2999 PREMIUM: USD 3999 ENTERPRISE: USD 5999 |

| Customization Scope | The report can be customized based on the customer’s requirements. |

| Post-Sale Analyst Support | 10-12 Weeks of support post-sale. |

| Delivery Format | PDF and Excel via email; editable versions (PPT/Word) on special request. |

Key Questions Covered in our Praseodymium Manufacturing Plant Report

- How can the cost of producing Praseodymium be minimized, cash costs reduced, and manufacturing expenses managed efficiently to maximize overall efficiency?

- What is the estimated Praseodymium manufacturing plant cost?

- What are the initial investment and capital expenditure requirements for setting up a Praseodymium manufacturing plant, and how do these investments affect economic feasibility and ROI?

- How do we select and integrate technology providers to optimize the production process of Praseodymium, and what are the associated implementation costs?

- How can operational cash flow be managed, and what strategies are recommended to balance fixed and variable costs during the operational phase of Praseodymium manufacturing?

- How do market price fluctuations impact the profitability and cost per metric ton (USD/MT) for Praseodymium, and what pricing strategy adjustments are necessary?

- What are the lifecycle costs and break-even points for Praseodymium manufacturing, and which production efficiency metrics are critical for success?

- What strategies are in place to optimize the supply chain and manage inventory, ensuring regulatory compliance and minimizing energy consumption costs?

- How can labor efficiency be optimized, and what measures are in place to enhance quality control and minimize material waste?

- What are the logistics and distribution costs, what financial and environmental risks are associated with entering new markets, and how can these be mitigated?

- What are the costs and benefits associated with technology upgrades, modernization, and protecting intellectual property in Praseodymium manufacturing?

- What types of insurance are required, and what are the comprehensive risk mitigation costs for Praseodymium manufacturing?

1 Preface

2 Scope and Methodology

2.1 Key Questions Answered

2.2 Methodology

2.3 Estimations & Assumptions

3 Executive Summary

3.1 Global Market Scenario

3.2 Production Cost Summary

3.3 Income Projections

3.4 Expenditure Projections

3.5 Profit Analysis

4 Global Praseodymium Market

4.1 Market Overview

4.2 Historical and Forecast (2019-2029)

4.3 Market Breakup by Segment

4.4 Market Breakup by Region

4.6 Price Trends

4.6.1 Raw Material Price Trends

4.6.2 Praseodymium Price Trends

4.7 Competitive Landscape

4.8.1 Key Players

4.8.2 Profiles of Key Players

5 Detailed Process Flow

5.1 Product Overview

5.2 Properties and Applications

5.3 Manufacturing Process Flow

5.4 Process Details

6 Project Details, Requirements and Costs Involved

6.1 Total Capital Investment

6.2 Land and Site Cost

6.3 Offsites/ Civil Works Cost

6.4 Plant Machinery Cost

6.5 Auxiliary Equipment Cost

6.6 Contingency, Consulting and Engineering Charges

6.6 Working Capital

7 Variable Cost Analysis

7.1 Raw Materials

7.1.1 Raw Material Specifications

7.1.2 Raw Material Consumption

7.1.3 Raw Material Costs

7.2 Utilities Consumption and Costs

7.3 Co-product Cost Credit

7.4 Labour Requirements and Costs

8 Fixed Cost Analysis

8.1 Plant Repair & Maintanence Cost

8.2 Overheads Cost

8.3 Insurance Cost

8.4 Financing Costs

8.5 Depreciation Charges

9 General Sales and Administration Costs

10 Project Economics

10.1 Techno-economic Parameters

10.2 Income Projections

10.3 Expenditure Projections

10.4 Financial Analysis

10.5 Profit Analysis

10.5.1 Payback Period

10.5.2 Net Present Value

10.5.3 Internal Rate of Return

11 References

Compare & Choose the Right Report Version for You

You can easily get a quote for any Procurement Resource report. Just click here and raise a request. We will get back to you within 24 hours. Alternatively, you can also drop us an email at sales@procurementresource.com.

RIGHT PEOPLE

At Procurement Resource our analysts are selected after they are assessed thoroughly on having required qualities so that they can work effectively and productively and are able to execute projects based on the expectations shared by our clients. Our team is hence, technically exceptional, strategic, pragmatic, well experienced and competent.

RIGHT METHODOLOGY

We understand the cruciality of high-quality assessments that are important for our clients to take timely decisions and plan strategically. We have been continuously upgrading our tools and resources over the past years to become useful partners for our clientele. Our research methods are supported by most recent technology, our trusted and verified databases that are modified as per the needs help us serve our clients effectively every time and puts them ahead of their competitors.

RIGHT PRICE

Our team provides a detailed, high quality and deeply researched evaluations in competitive prices, that are unmatchable, and demonstrates our understanding of our client’s resource composition. These reports support our clientele make important procurement and supply chains choices that further helps them to place themselves ahead of their counterparts. We also offer attractive discounts or rebates on our forth coming reports.

RIGHT SUPPORT

Our vision is to enable our clients with superior quality market assessment and actionable evaluations to assist them with taking timely and right decisions. We are always ready to deliver our clients with maximum results by delivering them with customised suggestions to meet their exact needs within the specified timeline and help them understand the market dynamics in a better way.

SELECT YOUR LICENCE TYPE

- Review the available license options and choose the one that best fits your needs. Different licenses offer varying levels of access and usage rights, so make sure to pick the one that aligns with your requirements.

- If you're unsure which license is right for you, feel free to contact us for assistance.

CLICK 'BUY NOW'

- Once you've selected your desired report and license, click the ‘Buy Now’ button. This will add the report to your cart. You will be directed to the registration page where you’ll provide the necessary information to complete the purchase.

- You’ll have the chance to review your order and make adjustments, including updating your license or quantity, before proceeding to the next step.

COMPLETE REGISTRATION

- Enter your details for registration. This will include your name, email address, and any other necessary information. Creating an account allows you to easily manage your orders and gain access to future purchases or reports.

- If you already have an account with us, simply log in to streamline the process.

CHOOSE YOUR PAYMENT METHOD

- Select from a variety of secure payment options, including credit/debit cards, PayPal, or other available gateways. We ensure that all transactions are encrypted and processed securely.

- After selecting your payment method, you will be redirected to a secure checkout page to complete your transaction.

CONFIRM YOUR PURCHASE

- Once your payment is processed, you will receive an order confirmation email from sales@procurementresource.com confirming the dedicated project manger and delivery timelines.

ACCESS YOUR REPORT

- The report will be delivered to you by the project manager within the specified timeline.

- If you encounter any issues accessing your report, project manager would remain connected throughout the length of the project. The team shall assist you with post purchase analyst support for any queries or concerns from the deliverable (within the remit of the agreed scope of work).

Email Delivery Price: $ 2699.00

Ethyl Acrylate Manufacturing Plant Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.

Read MoreEmail Delivery Price: $ 2699.00

Hydrotalcite Manufacturing Plant Project Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.

Read MoreEmail Delivery Price: $ 2699.00

1-Decene Manufacturing Plant Project Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.

Read More