Reports

Sodium Borohydride Manufacturing Plant Project Report 2025: Market by Region, Market by Application, Key Players, Pre-feasibility, Capital Investment Costs, Production Cost Analysis, Expenditure Projections, Return on Investment (ROI), Economic Feasibility, CAPEX, OPEX, Plant Machinery Cost

Sodium Borohydride Manufacturing Plant Project Report: Key Insights and Outline

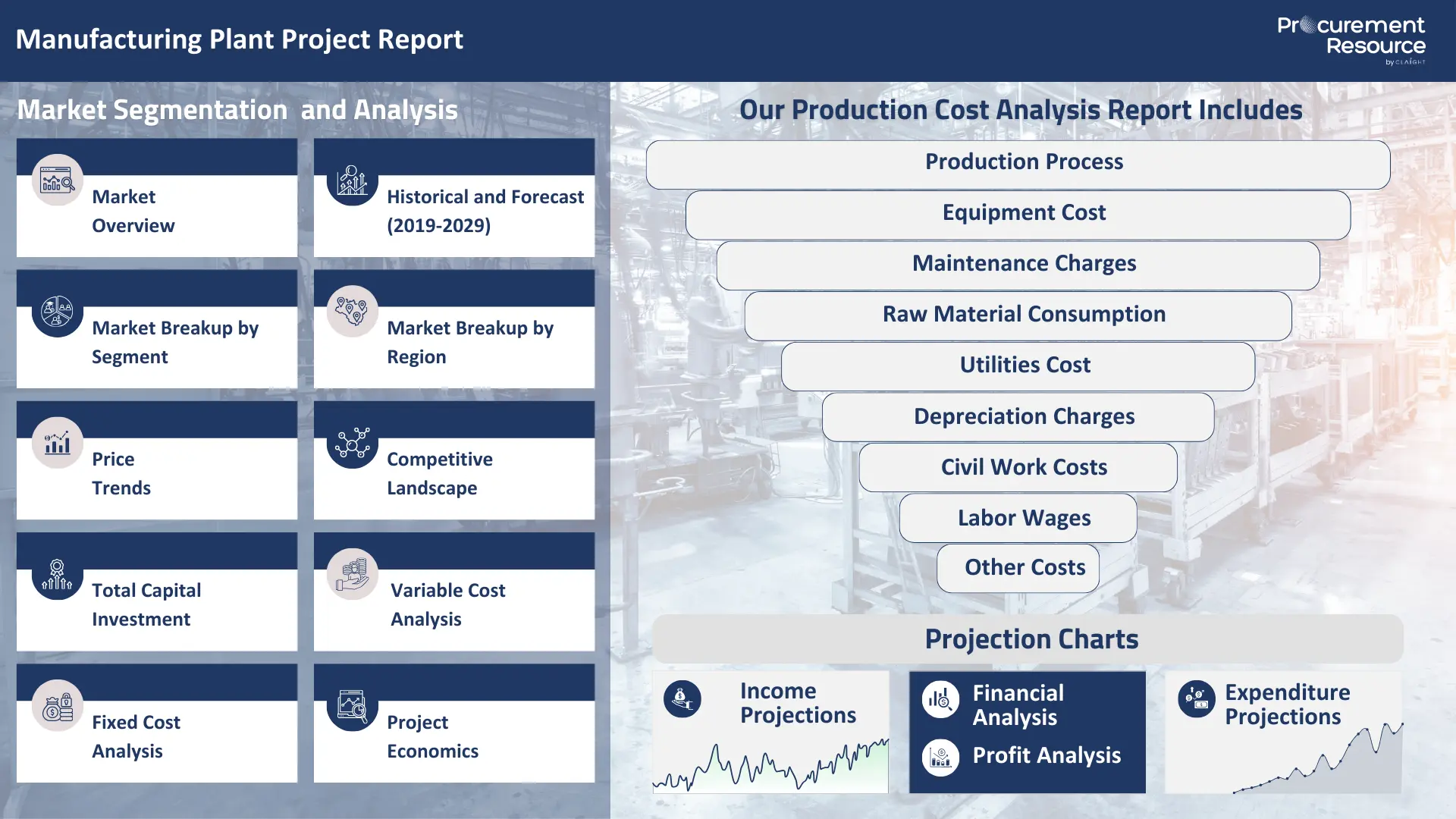

Sodium Borohydride Manufacturing Plant Project Report by Procurement Resource thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down Sodium Borohydride plant capital cost around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall Sodium Borohydride manufacturing plant cost and the cash cost of manufacturing.

Planning to Set Up a Sodium Borohydride Plant? Request a Free Sample Project Report Now!

Sodium borohydride is a versatile chemical compound that is primarily used as a reducing agent in various industrial applications. Its unique properties make it essential across multiple sectors, ranging from pharmaceuticals to pulp and paper.

Industrial Applications of Sodium Borohydride

Sodium borohydride is widely used in industrial settings because of its strong yet selective ability to reduce other compounds. It plays a vital role in several key industries.

- Pharmaceutical Industry: Sodium borohydride is used as an essential reducing agent in the synthesis of active pharmaceutical ingredients (APIs). Its selectivity allows for precise chemical transformations, which are essential for producing various drugs and pharmaceutical intermediates.

- Pulp and Paper Industry: In the pulp and paper manufacturing sector, sodium borohydride is extensively used as a bleaching agent. It helps to improve the brightness and whiteness of pulp, leading to higher quality paper products, especially in mechanical pulping processes.

- Fine Chemical Synthesis: It is also used in the production of a wide range of specialty chemicals and intermediates. Its reducing power is utilized for creating complex organic molecules that serve as building blocks for other industrial products.

- Wastewater Treatment: Sodium borohydride is also effective in removing heavy metal ions, such as mercury and silver, from industrial wastewater. It reduces these ions to their elemental, less soluble forms, allowing for easier separation and removal.

- Fuel Cell Technology: It is also explored for its potential in hydrogen generation for fuel cells. It can release hydrogen upon hydrolysis, offering a compact method for hydrogen storage and delivery.

- Metal Finishing: It also finds use as a reducing agent in electroless plating processes to deposit metal films (e.g., nickel or cobalt) onto various substrates without an external electrical current.

Top 5 Manufacturers of Sodium Borohydride

The global market for sodium borohydride involves several key players. Leading industrial manufacturers include:

- Vertellus Holdings LLC: A significant producer with a strong presence in various specialty chemical markets globally.

- Dow Chemical Company: The company is known for its broad portfolio of chemical products and advanced materials, including a focus on reducing agents.

- Sigma-Aldrich (Merck KGaA): A major supplier of laboratory chemicals and life science products, providing high-purity sodium borohydride for research and industrial use.

- Nippon Light Metal Co., Ltd.: A Japanese company with diverse chemical and metal production capabilities, contributing to the global supply chain for borohydrides.

- Inner Mongolia Fuyuan Chemical Co., Ltd.: A prominent Chinese manufacturer, contributing significantly to global supply and meeting the demand for various chemical derivatives.

Feedstock and Its Dynamics for Sodium Borohydride Manufacturing

The production of sodium borohydride relies on several raw materials, which include Methane, Sodium chloride, Borax, Methanol, and Hydrogen gas.

- Methane: As a primary source for hydrogen gas via steam reforming, the availability and price of methane are influenced by natural gas market dynamics. Fluctuations in energy prices, global supply-demand balances, and geopolitical events directly impact methane costs. Industrial procurement of methane often involves long-term contracts or spot market purchases, which affects the cash cost of production.

- Sodium Chloride: Sodium chloride is commonly known as salt, which is abundant and widely sourced. Its cost is generally stable, but transportation expenses and regional supply-demand balances can create localized price variations. The energy-intensive electrolysis process for sodium metal production also ties its manufacturing expenses to electricity costs.

- Borax: This boron mineral is refined to produce boric acid, a key intermediate. The global supply of borax is concentrated in a few regions (e.g., Turkey, USA), making its price susceptible to mining operations, regulatory changes, and international trade policies. Any disruption in borax supply directly impacts the raw material cost for sodium borohydride.

- Methanol: Methanol is produced from natural gas or coal, and its prices are linked to its feedstock costs and demand from various chemical industries, including its use in formaldehyde and fuel. Its role in converting boric acid to trimethyl borate makes it an important component in the value chain evaluation of sodium borohydride.

- Hydrogen Gas: It is generated on-site from methane in the Brown-Schlesinger process; the initial cost of methane and the energy required for steam reforming dictate the cost of hydrogen. Alternative hydrogen production methods and their associated investment cost are also factors to consider for future sodium borohydride plant capital cost assessments.

Fluctuations in the prices of these feedstocks, driven by global supply-chain disruptions, geopolitical tensions, or changes in demand from other industries, directly influence the production cost analysis for sodium borohydride. Efficient industrial procurement strategies are essential for managing these variable costs.

Market Drivers for Sodium Borohydride

The market for sodium borohydride is driven by several factors, including increasing consumption, rising demand across key industries, and evolving geopolitical landscapes influencing supply chains.

- Growing Demand in Pharmaceuticals: The continuous expansion of the pharmaceutical industry, particularly in emerging economies like India and China, fuels the demand for sodium borohydride as a critical reducing agent in drug synthesis. This drives a consistent need for industrial procurement of the product.

- Pulp and Paper Industry Growth: The growth in the pulp and paper industry globally is driven by increasing demand for packaging materials and tissue products further leads to steady consumption of sodium borohydride for bleaching.

- Expansion of Fine Chemical and Specialty Chemical Manufacturing: The synthesis of complex molecules in the fine chemical sector relies heavily on the selective reduction capabilities of sodium borohydride, which drives its market growth across various geo-locations.

- Environmental Regulations: Stricter environmental regulations promote the use of more efficient and less hazardous chemical processes globally. Therefore, it promotes the use of sodium borohydride in certain applications like wastewater treatment.

- Geographic Consumption Patterns: Major consumption centers for sodium borohydride include North America, Europe, and Asia-Pacific. The rapid industrial growth in countries like China and India significantly impacts global demand and highlights the importance of sodium borohydride cost considerations for new facilities to serve these markets.

CAPEX and OPEX for a Sodium Borohydride Manufacturing Plant

Understanding the total capital expenditure (CAPEX) and operating expenses (OPEX) is vital for the economic feasibility and production cost analysis of a sodium borohydride manufacturing plant.

CAPEX (Capital Expenditure)

The sodium borohydride plant capital cost is significantly influenced by the initial investment in equipment and infrastructure. Key CAPEX items, determining the investment cost, include:

- Reaction Vessels/Reactors: Specialized stainless steel or glass-lined reactors are required for various steps, including hydrogen generation, sodium hydride formation, trimethyl borate synthesis, and the final sodium borohydride reaction. These often come with agitation systems, heating/cooling jackets, and pressure controls.

- Electrolysis Units: For the on-site production of sodium metal from sodium chloride. This involves robust electrolytic cells (e.g., Downs cells), power rectifiers, and brine purification systems, which represent a significant portion of the total capital expenditure (CAPEX).

- Distillation Columns: Essential for the purification of methanol, the separation of trimethyl borate, and the recovery of unreacted raw materials. It also includes reboilers, condensers, and packed or tray sections.

- Hydrogen Generation Plant: Equipment for steam reforming of methane, including reformers, shift converters, and pressure swing adsorption (PSA) units for hydrogen purification.

- Material Handling Equipment: Conveyors, pneumatic transport systems, pumps (for liquids), and storage silos for solid raw materials like borax, and finished product storage.

- Utilities Infrastructure: Boilers for steam generation, cooling towers and chillers for process cooling, industrial air compressors, and comprehensive water treatment plants (raw water and demineralized water systems).

- Control Systems and Instrumentation: Advanced Distributed Control Systems (DCS) or Programmable Logic Controllers (PLCs) along with extensive instrumentation (flow meters, temperature sensors, pressure transmitters) for precise process control, automation, and safety interlocks.

- Buildings and Land: Construction of the main process building, raw material and finished product warehouses, administrative offices, laboratories, and the cost of land acquisition.

- Effluent Treatment Plant (ETP): A crucial component for managing liquid and gaseous waste streams to meet environmental regulations, including neutralization tanks, filtration units, and scrubbers for off-gases.

- Safety and Firefighting Systems: Comprehensive fire suppression systems, emergency showers and eyewash stations, gas detection systems, and explosion-proof electrical fittings are essential due to the presence of flammable materials.

OPEX (Operating Expenses)

Operating expenses or OPEX for sodium borohydride production are the ongoing costs associated with running the plant, which significantly influence the cost per metric ton (USD/MT). These contribute to the overall cash cost of production.

- Raw Material Costs: The most significant component of operating expenses (OPEX), encompassing the purchase cost of methane, sodium chloride, borax, methanol, and any other auxiliary chemicals. Volatility in feedstock prices directly impacts the production cost analysis.

- Energy Costs: Substantial electricity consumption for electrolysis, pumping, agitation, heating (e.g., steam for reforming, pyrolysis), and cooling. Natural gas costs for steam generation and methane supply are also major factors. Energy is a primary driver of fixed and variable costs.

- Labor Costs: Wages, salaries, and benefits for the operational workforce, including plant operators, maintenance technicians, engineers, quality control staff, and administrative personnel.

- Maintenance and Repairs: Costs associated with routine and preventative maintenance, procurement of spare parts for specialized equipment, and unforeseen repairs.

- Utilities: Costs for water consumption (process water, cooling water, boiler feed water), waste disposal fees, and other consumable utilities.

- Catalyst and Chemical Consumption: Costs of catalysts used in hydrogen generation (e.g., nickel-based catalysts for steam reforming) and other process chemicals or reagents that are consumed or degraded during the process.

- Depreciation and Amortization: Non-cash expenses representing the systematic allocation of the cost of tangible (depreciation) and intangible (amortization) assets over their useful economic life. It also significantly affects the overall economic feasibility model.

- Overhead Costs: General administrative expenses, insurance, property taxes, and other indirect costs not directly tied to production volume.

Manufacturing Process

This report comprises a thorough value chain evaluation for sodium borohydride manufacturing and consists of an in-depth production cost analysis revolving around industrial sodium borohydride manufacturing.

- Production from Brown-Schlesinger Process: The industrial manufacturing process for sodium borohydride primarily utilizes the Brown-Schlesinger process. The feedstock for this process includes methane, sodium chloride, borax, methanol, and hydrogen gas. The process begins with generating hydrogen gas through the steam reforming of methane. Concurrently, sodium metal is obtained by electrolyzing sodium chloride. Borax is then refined into boric acid, which is subsequently converted into trimethyl borate using methanol. In a critical intermediate step, sodium metal reacts with hydrogen to form sodium hydride. Finally, this sodium hydride reacts with trimethyl borate, yielding sodium borohydride as the desired final product.

Properties of Sodium Borohydride

Sodium borohydride (NaBH4) is an inorganic compound widely recognized for its strong reducing capabilities.

Physical Properties:

- Appearance: White crystalline solid.

- Molecular Formula: NaBH4

- Molar Mass: Approximately 37.83g/mol.

- Melting Point: Decomposes at approximately 400 degree Celsius (under inert atmosphere). It does not melt distinctly but rather decomposes.

- Density: Approximately 1.07g/cm3 at 20 degree Celsius.

- Solubility: Highly soluble in water (25g/100mL at 20 degree Celsius), methanol (16.4g/100mL at 20 degree Celsius), and ethanol. It has limited solubility in diethyl ether and tetrahydrofuran.

Chemical Properties:

- Reducing Agent: Sodium borohydride is a powerful yet selective reducing agent, commonly used to reduce aldehydes, ketones, and acyl halides to alcohols.

- Reactivity with Water: It reacts exothermically with water to produce hydrogen gas, especially in acidic conditions or at elevated temperatures: NaBH4(aq)+2H2O(l)→NaBO2(aq)+4H2?(g). This reaction is slower in alkaline solutions, which helps stabilize its aqueous solutions.

- Stability: Stable in dry air at room temperature. It slowly decomposes in moist air.

- Reactions with Protic Solvents: While soluble, it reacts with protic solvents (like water, methanol, ethanol) by releasing hydrogen, with the rate of reaction dependent on temperature and pH. It is more stable in alkaline aqueous solutions.

- Flammability: Non-flammable itself, but its reaction with water or acids produces flammable hydrogen gas.

Sodium Borohydride Manufacturing Plant Report provides you with a detailed assessment of capital investment costs (CAPEX) and operational expenses (OPEX), generally measured as cost per metric ton (USD/MT). This approach ensures that your investment decisions are aligned with the latest industry standards and economic feasibility metrics, enhancing your manufacturing efficiency and financial planning.

Apart from that, this Sodium Borohydride manufacturing plant report also covers the leading technology providers that help you plan a robust plan of action related to Sodium Borohydride manufacturing plant and its production process(es), and also by helping you with an in-depth supplier database. This report provides exclusive insights into the best manufacturing practices for Sodium Borohydride and technology implementation costs. This report also covers operational cash flow, fixed and variable costs, and detailed break-even point analysis, ensuring that your manufacturing process is not only efficient but also economically viable in the competitive market landscape.

In addition to operational insights, the Sodium Borohydride manufacturing plant report also comprehensively focuses on lifecycle cost analysis, maintenance costs, and energy consumption costs, which are critical for maintaining long-term sustainability and profitability. Our manufacturing cost analysis extends to include regulatory compliance costs, inventory holding costs, and logistics and distribution costs, providing a holistic view of the potential expenses and savings.

We at Procurement Resource ensure that this report is not only cost-efficient, environmentally sustainable, and aligned with the latest technological advancements but also that you are equipped with all necessary tools to optimize supply chain operations, manage risks effectively, and achieve superior market positioning for Sodium Borohydride.

Key Insights and Report Highlights

| Report Features | Details |

|---|---|

| Report Title | Sodium Borohydride Manufacturing Plant Project Report |

| Preface | Overview of the study and its significance. |

| Scope and Methodology | Key Questions Answered, Methodology, Estimations & Assumptions. |

| Executive Summary | Global Market Scenario, Production Cost Summary, Income Projections, Expenditure Projections, Profit Analysis. |

| Global Market Insights | Market Overview, Historical and Forecast (2019-2029), Market Breakup by Segment, Market Breakup by Region, Price Trends (Raw Material Price Trends, Sodium Borohydride Price Trends, Competitive Landscape (Key Players, Profiles of Key Players). |

| Detailed Process Flow | Product Overview, Properties and Applications, Manufacturing Process Flow, Process Details. |

| Project Details | Total Capital Investment, Land and Site Cost, Offsites/Civil Works Cost, Plant Machinery Cost, Auxiliary Equipment Cost, Contingency, Consulting and Engineering Charges, Working Capital. |

| Variable Cost Analysis | Raw Material Specifications, Raw Material Consumption, Raw Material Costs, Utilities Consumption and Costs, Co-product Cost Credit, Labour Requirements and Costs. |

| Fixed Cost Analysis | Plant Repair & Maintenance Cost, Overheads Cost, Insurance Cost, Financing Costs, Depreciation Charges. |

| General Sales and Administration Costs | Costs associated with sales andadministration |

| Project Economics | Techno-economic Parameters, Income Projections, Expenditure Projections, Financial Analysis (Payback Period, Net Present Value, Internal Rate of Return), Profit Analysis, Production Cost Summary. |

| Report Format | PDF for BASIC and PREMIUM; PDF+Dynamic Excel for ENTERPRISE. |

| Pricing and Purchase Options | BASIC: USD 2999 PREMIUM: USD 3999 ENTERPRISE: USD 5999 |

| Customization Scope | The report can be customized based on the customer’s requirements. |

| Post-Sale Analyst Support | 10-12 Weeks of support post-sale. |

| Delivery Format | PDF and Excel via email; editable versions (PPT/Word) on special request. |

Key Questions Covered in our Sodium Borohydride Manufacturing Plant Report

- How can the cost of producing Sodium Borohydride be minimized, cash costs reduced, and manufacturing expenses managed efficiently to maximize overall efficiency?

- What is the estimated Sodium Borohydride manufacturing plant cost?

- What are the initial investment and capital expenditure requirements for setting up a Sodium Borohydride manufacturing plant, and how do these investments affect economic feasibility and ROI?

- How do we select and integrate technology providers to optimize the production process of Sodium Borohydride, and what are the associated implementation costs?

- How can operational cash flow be managed, and what strategies are recommended to balance fixed and variable costs during the operational phase of Sodium Borohydride manufacturing?

- How do market price fluctuations impact the profitability and cost per metric ton (USD/MT) for Sodium Borohydride, and what pricing strategy adjustments are necessary?

- What are the lifecycle costs and break-even points for Sodium Borohydride manufacturing, and which production efficiency metrics are critical for success?

- What strategies are in place to optimize the supply chain and manage inventory, ensuring regulatory compliance and minimizing energy consumption costs?

- How can labor efficiency be optimized, and what measures are in place to enhance quality control and minimize material waste?

- What are the logistics and distribution costs, what financial and environmental risks are associated with entering new markets, and how can these be mitigated?

- What are the costs and benefits associated with technology upgrades, modernization, and protecting intellectual property in Sodium Borohydride manufacturing?

- What types of insurance are required, and what are the comprehensive risk mitigation costs for Sodium Borohydride manufacturing?

1 Preface

2 Scope and Methodology

2.1 Key Questions Answered

2.2 Methodology

2.3 Estimations & Assumptions

3 Executive Summary

3.1 Global Market Scenario

3.2 Production Cost Summary

3.3 Income Projections

3.4 Expenditure Projections

3.5 Profit Analysis

4 Global Sodium Borohydride Market

4.1 Market Overview

4.2 Historical and Forecast (2019-2029)

4.3 Market Breakup by Segment

4.4 Market Breakup by Region

4.6 Price Trends

4.6.1 Raw Material Price Trends

4.6.2 Sodium Borohydride Price Trends

4.7 Competitive Landscape

4.8.1 Key Players

4.8.2 Profiles of Key Players

5 Detailed Process Flow

5.1 Product Overview

5.2 Properties and Applications

5.3 Manufacturing Process Flow

5.4 Process Details

6 Project Details, Requirements and Costs Involved

6.1 Total Capital Investment

6.2 Land and Site Cost

6.3 Offsites/ Civil Works Cost

6.4 Plant Machinery Cost

6.5 Auxiliary Equipment Cost

6.6 Contingency, Consulting and Engineering Charges

6.6 Working Capital

7 Variable Cost Analysis

7.1 Raw Materials

7.1.1 Raw Material Specifications

7.1.2 Raw Material Consumption

7.1.3 Raw Material Costs

7.2 Utilities Consumption and Costs

7.3 Co-product Cost Credit

7.4 Labour Requirements and Costs

8 Fixed Cost Analysis

8.1 Plant Repair & Maintanence Cost

8.2 Overheads Cost

8.3 Insurance Cost

8.4 Financing Costs

8.5 Depreciation Charges

9 General Sales and Administration Costs

10 Project Economics

10.1 Techno-economic Parameters

10.2 Income Projections

10.3 Expenditure Projections

10.4 Financial Analysis

10.5 Profit Analysis

10.5.1 Payback Period

10.5.2 Net Present Value

10.5.3 Internal Rate of Return

11 References

Compare & Choose the Right Report Version for You

You can easily get a quote for any Procurement Resource report. Just click here and raise a request. We will get back to you within 24 hours. Alternatively, you can also drop us an email at sales@procurementresource.com.

RIGHT PEOPLE

At Procurement Resource our analysts are selected after they are assessed thoroughly on having required qualities so that they can work effectively and productively and are able to execute projects based on the expectations shared by our clients. Our team is hence, technically exceptional, strategic, pragmatic, well experienced and competent.

RIGHT METHODOLOGY

We understand the cruciality of high-quality assessments that are important for our clients to take timely decisions and plan strategically. We have been continuously upgrading our tools and resources over the past years to become useful partners for our clientele. Our research methods are supported by most recent technology, our trusted and verified databases that are modified as per the needs help us serve our clients effectively every time and puts them ahead of their competitors.

RIGHT PRICE

Our team provides a detailed, high quality and deeply researched evaluations in competitive prices, that are unmatchable, and demonstrates our understanding of our client’s resource composition. These reports support our clientele make important procurement and supply chains choices that further helps them to place themselves ahead of their counterparts. We also offer attractive discounts or rebates on our forth coming reports.

RIGHT SUPPORT

Our vision is to enable our clients with superior quality market assessment and actionable evaluations to assist them with taking timely and right decisions. We are always ready to deliver our clients with maximum results by delivering them with customised suggestions to meet their exact needs within the specified timeline and help them understand the market dynamics in a better way.

SELECT YOUR LICENCE TYPE

- Review the available license options and choose the one that best fits your needs. Different licenses offer varying levels of access and usage rights, so make sure to pick the one that aligns with your requirements.

- If you're unsure which license is right for you, feel free to contact us for assistance.

CLICK 'BUY NOW'

- Once you've selected your desired report and license, click the ‘Buy Now’ button. This will add the report to your cart. You will be directed to the registration page where you’ll provide the necessary information to complete the purchase.

- You’ll have the chance to review your order and make adjustments, including updating your license or quantity, before proceeding to the next step.

COMPLETE REGISTRATION

- Enter your details for registration. This will include your name, email address, and any other necessary information. Creating an account allows you to easily manage your orders and gain access to future purchases or reports.

- If you already have an account with us, simply log in to streamline the process.

CHOOSE YOUR PAYMENT METHOD

- Select from a variety of secure payment options, including credit/debit cards, PayPal, or other available gateways. We ensure that all transactions are encrypted and processed securely.

- After selecting your payment method, you will be redirected to a secure checkout page to complete your transaction.

CONFIRM YOUR PURCHASE

- Once your payment is processed, you will receive an order confirmation email from sales@procurementresource.com confirming the dedicated project manger and delivery timelines.

ACCESS YOUR REPORT

- The report will be delivered to you by the project manager within the specified timeline.

- If you encounter any issues accessing your report, project manager would remain connected throughout the length of the project. The team shall assist you with post purchase analyst support for any queries or concerns from the deliverable (within the remit of the agreed scope of work).

Email Delivery Price: $ 2699.00

Ethyl Acrylate Manufacturing Plant Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.

Read MoreEmail Delivery Price: $ 2699.00

Hydrotalcite Manufacturing Plant Project Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.

Read MoreEmail Delivery Price: $ 2699.00

1-Decene Manufacturing Plant Project Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.

Read More