Reports

Zinc Manufacturing Plant Project Report 2025: Market by Region, Market by Application, Key Players, Pre-feasibility, Capital Investment Costs, Production Cost Analysis, Expenditure Projections, Return on Investment (ROI), Economic Feasibility, CAPEX, OPEX, Plant Machinery Cost

Zinc Manufacturing Plant Project Report 2025: Cost Analysis, ROI, and Feasibility Insights

Zinc Manufacturing Plant Project Report by Procurement Resource thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down Zinc plant capital cost around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall Zinc manufacturing plant cost and the cash cost of manufacturing.

Planning to Set Up a Zinc Plant? Request a Free Sample Project Report Now!

Zinc is a chemical element with the symbol Zn and atomic number 30. It exists in the form of a bluish-white, lustrous metal that is somewhat brittle at room temperature. It is recognised for its corrosion resistance and valuable mechanical properties when alloyed with other metals. Zinc is a crucial material in a wide range of industries, such as construction, automotive, and consumer goods.

Applications of Zinc

Zinc finds significant uses in the following key industries:

- Galvanisation: Zinc is widely used to galvanise steel and iron to protect them from corrosion. It acts as a sacrificial metal, corroding preferentially to steel, thereby shielding it from rust and extending its lifespan by decades. Galvanised steel is crucial for elements like roofing, cladding, gutters, and piping in the construction and infrastructure sectors.

- Alloys: Zinc is also utilised as a component in forming various alloys, such as brass and zinc-aluminium alloys. These alloys are used in the production of die-cast fittings and components for automobile manufacturing, mechanical engineering, and electronics. Zinc alloys are valued for their strength, hardness, and corrosion resistance.

- Batteries: Zinc is also used as an essential component in dry-cell batteries, such as zinc-manganese batteries and zinc-air batteries. It is used as the outer casing and the anode, facilitating voltage generation.

- Zinc Oxide and Chemicals: Zinc oxide is produced from zinc, which is used in the manufacturing of rubber, ceramics, and pharmaceuticals. Zinc salts are also used in various chemical applications, including anti-corrosion agents, alloys, and batteries. Zinc-based fertilisers are used to promote plant cell respiration and carbohydrate metabolism.

- Electronics and Electrical: Zinc is often used as a vital component in the technology we rely on every day, including the circuit boards of mobile phones. Its good electromagnetic field resistance properties make it an effective shielding material for radio frequency interference.

Top 7 Manufacturers of Zinc

The global zinc market is highly concentrated, with a few key players dominating production due to specialised mining, smelting, and refining capabilities. Leading global manufacturers include:

- Glencore

- Hindustan Zinc

- Teck Resources

- Nyrstar

- Nexa Resources

- Boliden Group

- China Minmetals Nonferrous Metals Co., Ltd.

Feedstock and Raw Material Dynamics for Zinc Manufacturing

The primary feedstock for industrial Zinc manufacturing is zinc ore, with a significant portion of production also coming from recycled materials. Comprehending the value chain and market aspects of inputs is essential for analysing costs and economic feasibility of zinc production.

- Zinc Ore: The most common ore is zinc blende, which is also known as sphalerite (ZnS). After mining, the ore undergoes concentration through froth flotation to separate the zinc from other minerals. Global mine production is expected to increase significantly, driven by new capacity in Australia, China, Mexico, and the Democratic Republic of Congo. However, mine closures and resource depletion pose long-term challenges.

- Sulfuric Acid (H2SO4): Sulfuric acid is used in the leaching process to dissolve zinc from the roasted zinc oxide. It is one of the most widely produced industrial chemicals. Global sulfuric acid prices are influenced by sulfur feedstock prices and operational shifts at refineries.

- Coke: Coke is a solid carbon material derived from coal. It is used as a reducing agent in pyrometallurgical processes to obtain zinc metal from zinc oxide. Global coke prices are influenced by the cost of coal and the demand from the steel and metallurgical industries.

- Electricity: The hydrometallurgical process (roast-leach-electrowin) is highly energy-intensive, with electricity being a major cost factor for electrolysis. The cost of electricity, its source, and the efficiency of the electrolysers are paramount to the economic viability of zinc manufacturing.

- Recycled Zinc: Secondary production, which recovers zinc from steel-making dust and scrap, supplies about 34% of developed-market needs and is growing at a significant rate. This trend is driven by an emphasis on sustainability and recycling initiatives, which also supports smelter margins.

Market Drivers for Zinc

The market for zinc is mainly led by its demand as a galvanising agent for steel to prevent corrosion. The global construction, automotive, and galvanisation industries heavily influence the demand for zinc. Industrial development in infrastructure and transportation has increased zinc usage for protective coatings and alloys. The Asia-Pacific region, especially China, leads in both production and consumption due to its massive steel output and expanding manufacturing base, making it the strongest driver of global zinc demand.

- Infrastructure-led Galvanising Demand: The continuous expansion of construction and infrastructure projects worldwide, particularly in developing economies, is fuelling a strong demand for galvanised steel. Zinc's essential role in protecting steel from rust and corrosion ensures its robust consumption, contributing significantly to the economic feasibility of zinc manufacturing.

- Growth of Corrosion-Resistant Steel in EV and Renewables: The global push for clean energy and the continuous expansion of the solar energy (photovoltaics) and electric vehicle (EV) sectors are creating unprecedented demand for zinc. Zinc is used to protect steel components in solar panels and electric vehicles from corrosion, ensuring their durability and longevity. The demand for corrosion-resistant steel in electric vehicles and renewable energy is also driving the market for Zinc.

- Zinc-Intensive Electronics Miniaturisation: The relentless growth in consumer electronics, data centres, and advanced technologies is driving a strong demand for zinc. Its use in electrical contacts, switches, and conductors is irreplaceable for components requiring high reliability and performance, ensuring its robust consumption.

- Expansion of Zinc-Based Fertilisers: With a rising global population, the demand for increased agricultural productivity is driving a strong demand for zinc-based fertilisers. Zinc is a crucial micronutrient for plants, and its use in fertiliser enrichment programs is a major driver of this market.

- Emergence of Zinc-Ion and Zinc-Air Batteries: The development of new energy storage technologies, such as zinc-ion and zinc-air batteries, presents a significant future driver. These batteries, which utilise zinc as a key component, are being explored for grid-scale storage, creating additional demand for zinc.

CAPEX and OPEX in Zinc Manufacturing

A production cost review for Zinc manufacturing includes large capital costs (CAPEX) and recurring operating costs (OPEX).

CAPEX (Capital Expenditure):

The Zinc plant capital cost covers investment in smelting units, electrolysis equipment, pollution control systems, and ore handling infrastructure. It includes:

- Land and Site Preparation: Expenses include obtaining mining claims and land for setting up the processing plant, along with grading, foundation work, and utilities. As zinc involves toxic and corrosive materials, safe handling requires containment, designated safety areas, and good ventilation.

- Building and Infrastructure: Construction of specialised conversion reactors, purification columns, reduction furnaces, melting furnaces, product storage, and advanced analytical laboratories. Buildings must be designed for chemical resistance, robust safety, and stringent handling of hazardous materials.

- Mining Equipment: Heavy machinery such as excavators, loaders, drills, and dump trucks for extracting zinc ore.

- Ore Preparation: Crushers, grinders (ball mills), and sieving equipment to finely grind the zinc ore.

- Roasting Furnace: A specialised furnace for roasting zinc sulfide concentrate to produce zinc oxide, which requires robust refractory lining, heating systems, and a high degree of automation.

- Leaching and Purification: Leaching tanks for dissolving zinc oxide in sulfuric acid, followed by a purification plant to remove impurities using zinc dust.

- Electrolysis Cells: Large-scale electrolytic cells for the electrowinning of zinc from the purified solution. This is a major capital item, requiring significant investment in specialised electrodes and rectifiers.

- Melting and Casting Furnaces: High-temperature induction furnaces to melt the purified zinc and cast it into zinc ingots.

- Raw Material and Byproduct Handling Systems: Systems for safely feeding zinc ore and other raw materials. Equipment for capturing and recycling the excess magnesium and magnesium chloride byproduct.

- Chlorine and Argon Gas Handling Systems: Dedicated, sealed storage for liquid chlorine and argon, vaporisers, and corrosion-resistant piping for safe delivery of gases to the reactors. This is a critical safety and capital investment.

- Utilities and Support Systems: Installation of robust electrical power distribution (very high demand for furnaces and electrolysis), industrial cooling water systems, and compressed air systems.

- Control Systems and Instrumentation: Highly advanced DCS (Distributed Control Systems) or PLC-based systems with extensive temperature, pressure, flow, and level sensors, specialised gas detectors, and multiple layers of safety interlocks. These are critical for precise control, optimising yield, and ensuring the highest level of safety due to hazardous and reactive chemicals.

- Pollution Control Equipment: In Zinc production, both gas scrubbers and specialised effluent treatment systems for liquid and solid waste are necessary. These environmental measures play a major role in the Zinc manufacturing plant cost.

OPEX (Operating Expenses):

Operating expenses include the cost of buying zinc ore, electricity, labour, and consumables for refining processes. It mainly covers:

- Raw Material Costs: The key cost component is the procurement of zinc ore concentrate, sulfuric acid, and coke. Any price variation in these inputs changes both the production cash cost and the final USD/MT cost of zinc.

- Energy Costs: Usage of electricity for furnaces, pumps, compressors, and electrolysis units. The energy intensity of the entire process is a major contributor to the overall Zinc production cost analysis.

- Labour Costs: Wages, salaries, benefits, and specialised training costs for a skilled workforce, including miners, operators, chemical engineers, and safety personnel. Due to the inherent hazards, labour costs are significantly higher due to specialised training and strict adherence to protocols.

- Utilities: Ongoing costs for process water, cooling water, and compressed air.

- Maintenance and Repairs: Expenses for routine preventative maintenance, periodic inspection and replacement of equipment in corrosive and high-temperature environments.

- Packaging Costs: The recurring expense of purchasing suitable packaging materials and casting moulds for the zinc ingots.

- Transportation and Logistics: Costs associated with inward logistics for raw materials and outward logistics for distributing the finished product globally.

- Fixed Costs: Manufacturing Zinc involves fixed costs such as depreciation of equipment, property taxes, and insurance for operational safety.

- Variable Costs: Variable costs include raw material requirements, energy consumed during processing, and direct labour tied to production volumes.

- Quality Control Costs: Significant ongoing expenses for extensive analytical testing of ore samples and the final zinc product to ensure high purity and compliance with market standards.

- Waste Disposal Costs: Processing Zinc comes with significant costs for proper waste handling and wastewater treatment under safety rules.

Manufacturing Process

This report comprises a thorough value chain evaluation for Zinc manufacturing and consists of an in-depth production cost analysis revolving around industrial Zinc manufacturing.

- Production via Ore Preparation, Roasting, Leaching, Electrolysis, and Melting : The production process of zinc involves a hydrometallurgical method, a multi-step process that starts with zinc ore. The ore is first finely ground and then roasted in a furnace to convert zinc sulfide (ZnS) into zinc oxide (ZnO). The roasted material is then leached with sulfuric acid to dissolve the zinc, forming zinc sulfate (ZnSO4). The resulting solution undergoes purification to remove impurities, such as cadmium, copper, and cobalt, using zinc dust. The purified zinc sulfate solution is then subjected to electrolysis, where an electric current is passed through the solution, causing pure zinc metal to deposit on the cathode. The pure electrodeposited zinc is then peeled off the cathodes, melted, and cast into zinc ingots. The melting and casting process also allows for alloying with other metals to produce various zinc products. The overall process is known as the roast-leach-electrowin process.

Properties of Zinc

Zinc is a chemical element, a bluish-white transition metal, which is valued for its corrosion resistance, ductility, and high strength-to-weight ratio.

Physical Properties

- Appearance: Bluish-white, lustrous metal.

- Odour: Odourless.

- Molecular Formula: Zn

- Molar Mass: 65.38g/mol

- Melting Point: 419.5 degree Celsius

- Boiling Point: 907 degree Celsius

- Density: 7.14g/cm3 at 20 degree Celsius

- Flash Point: Not applicable, as it is a non-flammable metal.

Chemical Properties

- Corrosion Resistance: Its most significant chemical property is that, when zinc is exposed to air, it reacts rapidly to form a dull grey zinc oxide coating, which prevents further atmospheric corrosion. This property makes it an ideal material for galvanising steel and iron.

- Amphoteric Nature: Zinc is an amphoteric metal, meaning it reacts with both strong acids and strong alkalis, which makes it a versatile chemical.

- Reactivity with Water: It does not react with water under normal conditions. However, in the presence of water vapour and oxygen, metallic zinc can react to form zinc hydroxide.

- Conductivity: Zinc is a good conductor of electricity and heat. Its high electrical conductivity makes it a valuable component in batteries.

- Reducing Agent: Zinc is a powerful reducing agent, capable of reducing various organic and inorganic compounds.

- Toxicity: Zinc is an essential trace element for human health, but excessive intake can lead to adverse effects.

Zinc Manufacturing Plant Report provides you with a detailed assessment of capital investment costs (CAPEX) and operational expenses (OPEX), generally measured as cost per metric ton (USD/MT). This approach ensures that your investment decisions are aligned with the latest industry standards and economic feasibility metrics, enhancing your manufacturing efficiency and financial planning.

Apart from that, this Zinc manufacturing plant report also covers the leading technology providers that help you plan a robust plan of action related to Zinc manufacturing plant and its production process(es), and also by helping you with an in-depth supplier database. This report provides exclusive insights into the best manufacturing practices for Zinc and technology implementation costs. This report also covers operational cash flow, fixed and variable costs, and detailed break-even point analysis, ensuring that your manufacturing process is not only efficient but also economically viable in the competitive market landscape.

In addition to operational insights, the Zinc manufacturing plant report also comprehensively focuses on lifecycle cost analysis, maintenance costs, and energy consumption costs, which are critical for maintaining long-term sustainability and profitability. Our manufacturing cost analysis extends to include regulatory compliance costs, inventory holding costs, and logistics and distribution costs, providing a holistic view of the potential expenses and savings.

We at Procurement Resource ensure that this report is not only cost-efficient, environmentally sustainable, and aligned with the latest technological advancements but also that you are equipped with all necessary tools to optimize supply chain operations, manage risks effectively, and achieve superior market positioning for Zinc.

Key Insights and Report Highlights

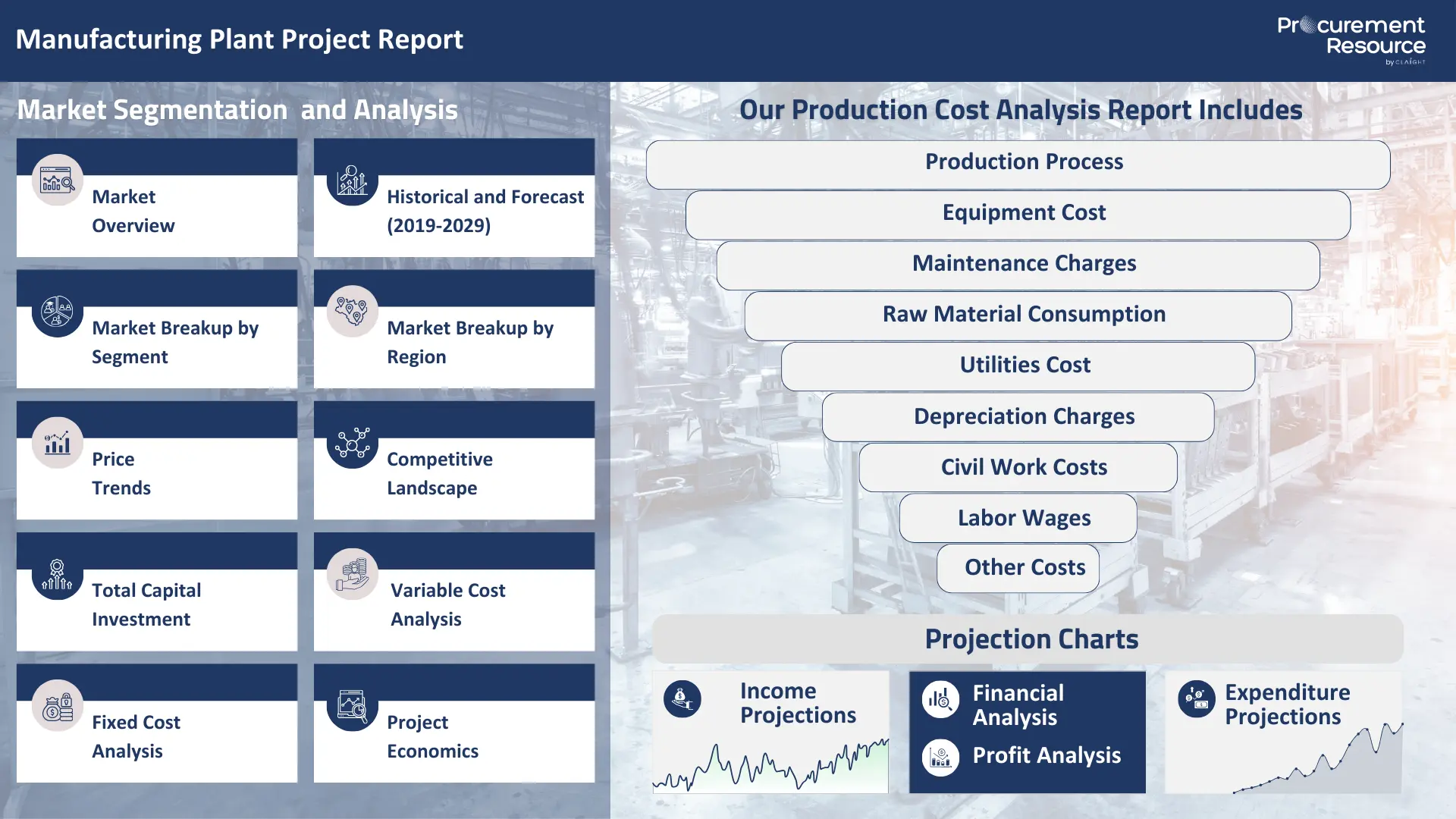

| Report Features | Details |

|---|---|

| Report Title | Zinc Manufacturing Plant Project Report |

| Preface | Overview of the study and its significance. |

| Scope and Methodology | Key Questions Answered, Methodology, Estimations & Assumptions. |

| Executive Summary | Global Market Scenario, Production Cost Summary, Income Projections, Expenditure Projections, Profit Analysis. |

| Global Market Insights | Market Overview, Historical and Forecast (2019-2029), Market Breakup by Segment, Market Breakup by Region, Price Trends (Raw Material Price Trends, Zinc Price Trends), Competitive Landscape (Key Players, Profiles of Key Players). |

| Detailed Process Flow | Product Overview, Properties and Applications, Manufacturing Process Flow, Process Details. |

| Project Details | Total Capital Investment, Land and Site Cost, Offsites/Civil Works Cost, Plant Machinery Cost, Auxiliary Equipment Cost, Contingency, Consulting and Engineering Charges, Working Capital. |

| Variable Cost Analysis | Raw Material Specifications, Raw Material Consumption, Raw Material Costs, Utilities Consumption and Costs, Co-product Cost Credit, Labour Requirements and Costs. |

| Fixed Cost Analysis | Plant Repair & Maintenance Cost, Overheads Cost, Insurance Cost, Financing Costs, Depreciation Charges. |

| General Sales and Administration Costs | Costs associated with sales and administration |

| Project Economics | Techno-economic Parameters, Income Projections, Expenditure Projections, Financial Analysis (Payback Period, Net Present Value, Internal Rate of Return), Profit Analysis, Production Cost Summary. |

| Report Format | PDF for BASIC and PREMIUM; PDF+Dynamic Excel for ENTERPRISE. |

| Pricing and Purchase Options | BASIC: USD 2999 PREMIUM: USD 3999 ENTERPRISE: USD 5999 |

| Customization Scope | The report can be customized based on the customer’s requirements. |

| Post-Sale Analyst Support | 10-12 Weeks of support post-sale. |

| Delivery Format | PDF and Excel via email; editable versions (PPT/Word) on special request. |

Key Questions Covered in our Zinc Manufacturing Plant Report

- How can the cost of producing Zinc be minimized, cash costs reduced, and manufacturing expenses managed efficiently to maximize overall efficiency?

- What is the estimated Zinc manufacturing plant cost?

- What are the initial investment and capital expenditure requirements for setting up a Zinc manufacturing plant, and how do these investments affect economic feasibility and ROI?

- How do we select and integrate technology providers to optimize the production process of Zinc, and what are the associated implementation costs?

- How can operational cash flow be managed, and what strategies are recommended to balance fixed and variable costs during the operational phase of Zinc manufacturing?

- How do market price fluctuations impact the profitability and cost per metric ton (USD/MT) for Zinc, and what pricing strategy adjustments are necessary?

- What are the lifecycle costs and break-even points for Zinc manufacturing, and which production efficiency metrics are critical for success?

- What strategies are in place to optimize the supply chain and manage inventory, ensuring regulatory compliance and minimizing energy consumption costs?

- How can labor efficiency be optimized, and what measures are in place to enhance quality control and minimize material waste?

- What are the logistics and distribution costs, what financial and environmental risks are associated with entering new markets, and how can these be mitigated?

- What are the costs and benefits associated with technology upgrades, modernization, and protecting intellectual property in Zinc manufacturing?

- What types of insurance are required, and what are the comprehensive risk mitigation costs for Zinc manufacturing?

1 Preface

2 Scope and Methodology

2.1 Key Questions Answered

2.2 Methodology

2.3 Estimations & Assumptions

3 Executive Summary

3.1 Global Market Scenario

3.2 Production Cost Summary

3.3 Income Projections

3.4 Expenditure Projections

3.5 Profit Analysis

4 Global Zinc Market

4.1 Market Overview

4.2 Historical and Forecast (2019-2029)

4.3 Market Breakup by Segment

4.4 Market Breakup by Region

4.6 Price Trends

4.6.1 Raw Material Price Trends

4.6.2 Zinc Price Trends

4.7 Competitive Landscape

4.8.1 Key Players

4.8.2 Profiles of Key Players

5 Detailed Process Flow

5.1 Product Overview

5.2 Properties and Applications

5.3 Manufacturing Process Flow

5.4 Process Details

6 Project Details, Requirements and Costs Involved

6.1 Total Capital Investment

6.2 Land and Site Cost

6.3 Offsites/ Civil Works Cost

6.4 Plant Machinery Cost

6.5 Auxiliary Equipment Cost

6.6 Contingency, Consulting and Engineering Charges

6.6 Working Capital

7 Variable Cost Analysis

7.1 Raw Materials

7.1.1 Raw Material Specifications

7.1.2 Raw Material Consumption

7.1.3 Raw Material Costs

7.2 Utilities Consumption and Costs

7.3 Co-product Cost Credit

7.4 Labour Requirements and Costs

8 Fixed Cost Analysis

8.1 Plant Repair & Maintanence Cost

8.2 Overheads Cost

8.3 Insurance Cost

8.4 Financing Costs

8.5 Depreciation Charges

9 General Sales and Administration Costs

10 Project Economics

10.1 Techno-economic Parameters

10.2 Income Projections

10.3 Expenditure Projections

10.4 Financial Analysis

10.5 Profit Analysis

10.5.1 Payback Period

10.5.2 Net Present Value

10.5.3 Internal Rate of Return

11 References

Compare & Choose the Right Report Version for You

RIGHT PEOPLE

At Procurement Resource our analysts are selected after they are assessed thoroughly on having required qualities so that they can work effectively and productively and are able to execute projects based on the expectations shared by our clients. Our team is hence, technically exceptional, strategic, pragmatic, well experienced and competent.

RIGHT METHODOLOGY

We understand the cruciality of high-quality assessments that are important for our clients to take timely decisions and plan strategically. We have been continuously upgrading our tools and resources over the past years to become useful partners for our clientele. Our research methods are supported by most recent technology, our trusted and verified databases that are modified as per the needs help us serve our clients effectively every time and puts them ahead of their competitors.

RIGHT PRICE

Our team provides a detailed, high quality and deeply researched evaluations in competitive prices, that are unmatchable, and demonstrates our understanding of our client’s resource composition. These reports support our clientele make important procurement and supply chains choices that further helps them to place themselves ahead of their counterparts. We also offer attractive discounts or rebates on our forth coming reports.

RIGHT SUPPORT

Our vision is to enable our clients with superior quality market assessment and actionable evaluations to assist them with taking timely and right decisions. We are always ready to deliver our clients with maximum results by delivering them with customised suggestions to meet their exact needs within the specified timeline and help them understand the market dynamics in a better way.

Ethyl Acrylate Manufacturing Plant Project Report 2025: Cost Analysis, ROI, and Feasibility Insights

Ethyl Acrylate Manufacturing Plant Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.

Hydrotalcite Manufacturing Plant Project Report 2025: Cost Analysis, ROI, and Feasibility Insights

Hydrotalcite Manufacturing Plant Project Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.

1-Decene Manufacturing Plant Project Report 2025: Cost Analysis, ROI, and Feasibility Insights

1-Decene Manufacturing Plant Project Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.