Product

Base Oil Price Trend and Forecast

Base Oil Price Trend and Forecast

Base Oil Regional Price Overview

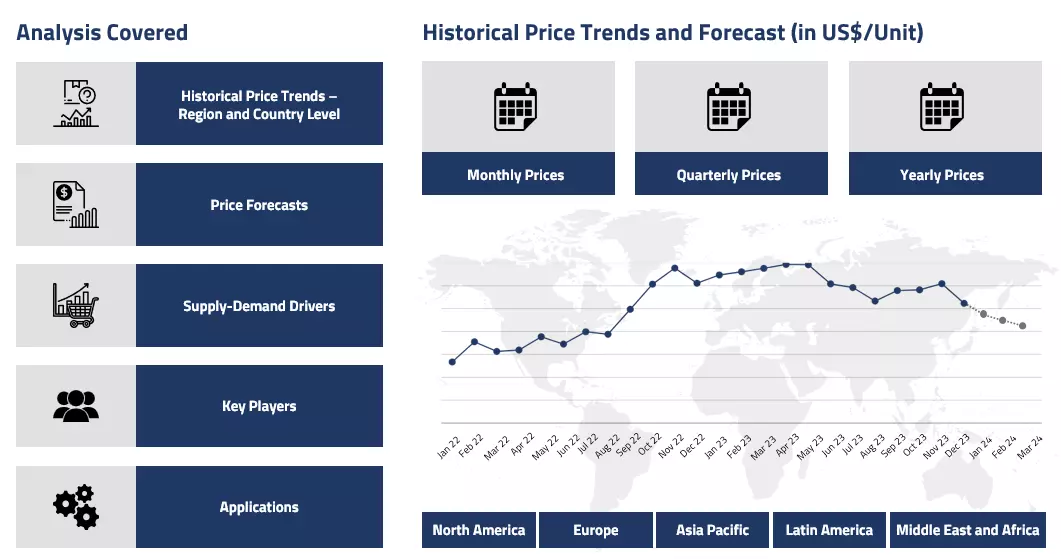

Get comprehensive insights into the Base Oil market, with a focused analysis of the Base Oil price trend across Asia, Europe, North America, Latin America, and the Middle East & Africa.

Base Oil Price Trend for Q1 of 2025

| Product | Category | Region | Price | Time Period |

| Base Oil | Chemical | Europe | 920 USD/MT | January 2025 |

| Base Oil | Chemical | Europe | 930 USD/MT | March 2025 |

| Base Oil | Chemical | USA | 1749 USD/MT | January 2025 |

| Base Oil | Chemical | USA | 1645 USD/MT | March 2025 |

Stay updated with the latest Base Oil prices, historical data, and tailored regional analysis

Asia

In China, base oil prices witnessed a fluctuating trajectory for the first quarter. Business slowed at the beginning of the year because so many traders suspended operations during the holiday season and some suppliers began building inventories ahead of the Lunar New Year.

Base Oil Price Chart

Please Login or Subscribe to Access the Base Oil Price Chart Data

With many production plants remaining offline during the holiday season put additional pressure on supply, but declining crude oil prices and lower freight helped mitigate this. Downstream sector buying interest remained weak in the latter weeks of the quarter too. Overall, a range-bound wavering price pattern was seen for base oil during the first quarter of 2025.

Europe

The European markets witnessed mixed trends during the first quarter of 2025. The prices were about 920 USD/MT (FD NWE) in January and around 930 USD/MT in March. In the beginning of the quarter, demand from downstream sector was slow, and sellers tended to take lower offers. However, as the quarter progressed, base oil availability got constricted with shifting supply chains. Sellers became cautious, holding back volumes in hopes of better returns. So, the European market concluded quarter on a little firmer note.

North America

The North American markets witnessed a different trend in the first quarter of 2025. The prices were about 1749 USD/MT (FOB Texas) in January and around 1645 USD/MT in March in the United States. Base Oil prices remained firm initially, with producers anticipating continuous demand and maintaining production at normal levels.

However, consumers became less keen on pursuing higher bids as the quarter progressed and spot demand slowed. Inventories started to accumulate, and sellers offered discounts to push sales. Depreciation in crude oil prices was also a reason the base oil market struggled in USA. The market weakened as the quarter ended, with supply taking a lead over demand and no significant boost coming from downstream markets.

Analyst Insight

According to Procurement Resource, the Base oils prices are expected to remain responsive to movements in crude oil prices. Downstream demand fluctuations can also command the price directions for base oil.

Base Oil Price Trend for Q4 of 2024

| Product | Category | Region | Price | Time Period |

| Base Oil | Chemical | Europe | 1,093 USD/MT | October'24 |

| Base Oil | Chemical | Europe | 965 USD/MT | December'24 |

Stay updated with the latest Base Oil prices, historical data, and tailored regional analysis

Asia

The Asian Base Oil market exhibited mixed trends during the last quarter of 2024. In India, imports increased due to reduced domestic production, which resulted from maintenance activities at certain plants. Rising vehicle sales and the corresponding demand for finished lubricants contributed to higher monthly imports, reversing the trend from the previous quarter.

Additionally, declining crude oil prices kept base oil prices on the lower end, prompting stockpiling at the beginning of the quarter. However, a more cautious market environment emerged later as prices showed slight improvements. Overall, production levels, import fluctuations, and automotive demand influenced the market’s oscillations during the last quarter of 2024.

Europe

Due to shifts in market fundamentals and reduced demand, Base Oil prices in Europe continued to decline throughout the quarter. Prices stood at approximately 1,093 USD/MT in October and around 965 USD/MT in December. In the European market, the price decline was primarily driven by high inventory levels. Additionally, relatively lower freight rates contributed to price moderation.

Seasonal factors, such as reduced demand during the holiday season, also influenced the market environment. Despite the overall decline, some market participants remained hesitant to reduce prices further, aiming to balance inventory levels. This cautious approach helped prevent a steeper market drop toward the end of the quarter.

North America

In North America, Base Oil prices remained relatively stable in the fourth quarter of 2024. Seasonal destocking led to reduced purchasing activity, as buyers kept inventory levels minimal to avoid taxation at year-end. The decline in demand from downstream lubricant sectors further impacted the Base Oil market. However, this reduced demand was offset by a softening supply at key production facilities due to seasonal slowdowns during the Christmas holidays. As a result, Base Oil prices remained steady despite a declining upstream crude oil market.

Analyst Insight

According to Procurement Resource, the Base Oil price curve is expected to witness an oscillating trend as demand from the downstream stream industries is likely to pick up. However, the fluctuations in the upstream crude oil market will continue to impact the base oil market.

Base Oil Price Trend for Q3 of 2024

Asia

The base oil market in the Asian region witnessed rigorous oscillations throughout the said quarter. Initially the prices kept strong and fell drastically owing to the fluctuations in the crude oil market. The off-season in the Chinese purchasing sector coupled with their increased focus on EV sales caused the terminal demand to fall.

The prices rebounded shortly during August owing to the extreme tensions in the Middle East; however, soon this momentum died down as the other weak macroeconomic factors took over. Further, the enhanced supply from non-OPEC+ countries was offsetting the overall balance of the oil and allied market worldwide. Hence, the prices of base oil suffered in September although some sort of stabilization was seen in the later stage of the quarter.

Europe

The European base oil markets were not different than the Asian markets. The persistent tensions in the Middle East and European backyard greatly shaped the domestic market momentum. For most part of the said quarter the prices kept low owing to the weak market fundamentals; however, the prices increased momentarily during the heightened escalations in the Middle East. Soon, the cautious attitude of the buyers took over impacted the price trajectory in base oil market. Further, the softening demand and extra supply from other oil producing nations took over causing the prices to fall throughout.

North America

Initially, the base oil prices kept stable owing to the domestic demand in the US domestic market. However, soon the crude oil stocks took over the demands causing the prices of all petrochemicals and allied products to dip in the market. This downward pressure coupled with other factors such as enhanced global supplies and unrelenting geopolitical tensions caused the buyers to adopt a wait-and-see attitude causing the prices to fall further.

Analyst Insight

According to Procurement Resource, the Base Oil prices are expected to decline further in the coming months. The falling global demands coupled with enhanced output will likely impact the concerned markets.

Base Oil Price Trend for Q2 of 2024

| Product | Category | Region | Price | Time Period |

| Base Oil | Chemical | Europe | 1140 USD/MT | April’24 |

| Base Oil | Chemical | Europe | 1173 USD/MT | May’24 |

| Base Oil | Chemical | USA | 1606 USD/MT | Q2’24 |

Stay updated with the latest Base Oil prices, historical data, and tailored regional analysis

Asia

A fluctuating trajectory of base oil prices in the Asian countries was driven by a number of obstacles incurred by the constant changes in global geopolitical policies, new cuts initiated by OPEC+, and demand for the commodity. The initial bleak sentiments of the market were driven by economic recovery optimism and Ukraine-Russia energy conflicts. The April-May slowdown was also initiated by the rise in Russia’s seaborne crude exports to some of the Asian countries amid only moderate demand for the commodity. However, throughout the quarter, India remained the focus of a number of base oil exporting regions as the country increased its appetite by several folds.

The particular rise in shipment arrivals from Saudi Arabia also suggested the reduction of ill effects of logistical disruptions caused by the diversion of the Red Sea route. Therefore, by the end of the quarter, the Asian base oil market registered some gains backed by a reassessment of production volumes, constrained Chinese supply chains, and expansion of the consumer base. Also, South Korea and Singapore reported a remarkable recovery in their exporting volumes of base oil, suggesting a positive trend in the pricing patterns of the commodity.

Europe

The base oil market of the European countries showcased a gradual incline in its momentum, with prices rising from an average of 1140 USD/MT in April to around 1173 USD/MT in May. The region was able to turn the depreciating dynamics of the previous quarter on the basis of an optimistic demand outlook. The market gains were much more prominent in the last month of the quarter.

Even this month, the announcement of OPEC’s extension of output cuts and gradual phase-out of the production reduction initially hampered the upwards trend, but soon, the market rebounded strongly, registering an overall uptrend. Additionally, the geopolitical tensions amid the escalating Middle East tensions further suggested the potential disruption of oil production and shipments, prompting an urgency amongst the European buyers, supporting the positive atmosphere of base oil prices in the European countries.

North America

In the US, the first two months of the second quarter witnessed negligible movement in the prices of base oil as they averaged around 1606 USD/MT only. The stagnancy in the market was largely influenced by the optimistic outlook of economic indicators and a slight ease in Israel-Iran tensions, reducing the risk premiums.

However, towards the end of the quarter, the market started to move rather swiftly as the US inventories of crude oil declined to almost 4% lower than the five-year average for the same period, as reported by EIA. This trend withstood the rise in manufacturing activities and the return of consumer confidence in this sector.

Analyst Insight

According to Procurement Resource, the price trend of Base Oil is expected to improve but only marginally given the current trembling geopolitical situation and elevation in global inflationary pressure.

Base Oil Price Trend for Q1 of 2024

| Product | Category | Region | Price | Time Period |

| Base Oil | Chemical | USA | USD 1482/MT | March’24 |

| Base Oil | Chemical | Europe | USD 1130/MT | March’24 |

Stay updated with the latest Base Oil prices, historical data, and tailored regional analysis

Asia

Asia's base oils demand set an optimistic tone in the first quarter of 2024 as it rose with the seasonal increase in lubricant consumption in the region. Initially, the traders offered the commodity at discounted prices to boost consumption activities. However, this discount was narrowed in the later months, resulting in a slow and gradual rise in the prices of base oil. China's domestic prices for base oils remain steady, indicating steady demand, particularly for heavy-grade oils.

Singapore's base oils exports to China also remained stable, indicating cautious buying in China and cautious sales from Asia. Additionally, Singapore's exports to Southeast Asia have risen, highlighting the rise in the consumption activities and export of the region to multiple major markets. In India, demand was somewhat stagnant as the country had yet to offer base oil at reasonable prices in order to sustain the competition. However, the domestic consumption made up for the export loss, and thus, the Indian traders were reluctant to reduce their price quotations of base oil.

Europe

The European countries struggled to maintain the pace of base oil prices set by the previous quarters as through January and February, the pricing trajectory followed a gradual declining pattern. These meek sentiments of the market were a result of an increase in the number of sanctions on Russian imports and the divergence of the consumer base to other alternative options amid the rising constraints on the supply chains. Another change in the landscape was that the European producers were also emphasizing alternative fuel options, such as diesel, etc., to sustain their profit margins.

Further, the Turkish imports moved towards Russian suppliers as they competitively arranged their pricing quotations in order to gain an advantage in the global markets. Further, the rise in instances of Houthi attacks on overseas shipments arriving through the Red Sea route has increased the delivery time and reduced the interest of overseas players in the European base oil market, resulting in the downfall of the base oil price trend in the first quarter of 2024.

North America

During the first quarter of 2024, the US base oil market stabilized amid ongoing negotiations and uncertainty about demand. The price increases announced by major players like ExxonMobil and Paulsboro initially led to a rise in base oil prices. Additionally, factors such as rising crude oil prices, supply constraints due to several plant shutdowns, disruptions in shipping routes, and limited vessel space also contributed to the inclination in base oil price trends. However, despite the approaching spring season, demand for base oil has not surged as expected, leading to questions about proposed price hikes. Many suppliers are adopting a wait-and-see approach, delaying price changes until market conditions are clarified.

Analyst Insight

According to Procurement Resource, the price trend of Base Oil is expected to grow by significant margins in the forthcoming quarters as the Asian and North American markets are estimated to raise their procurement rates in the upcoming spring season.

Base Oil Price Trend for Q4 of 2023

| Product | Category | Region | Price | Time Period |

| Base Oil | Chemical | USA | 1460 USD/MT | Dec-2023 |

| Base Oil | Chemical | USA | 1528 USD/MT | October’23 |

| Base Oil | Chemical | Europe | 917 USD/MT | Dec-2023 |

| Base Oil | Chemical | Europe | 943 USD/MT | October’23 |

Stay updated with the latest Base Oil prices, historical data, and tailored regional analysis

Asia

Base oil price trends continued along similar lines as they were in the previous quarter. Asian markets were largely stable, with barely any major fluctuations in the price graph during the final quarter of the year 2023. Unrestricted availability of the feedstock crude oil ensured uninterrupted supplies while the demands were also regular and consistent. The market sentiments were positive for the most period as the little fluctuations in the price curve were mostly positive. The major section of sales came from the rubber and engine oil industries. The supply and demand dynamics were mostly stable, with a little tilt towards the rising side. Overall, the base oil market trends were observed to be buoyant and floating firmly throughout the said period of Q4’23.

Europe

The European base oil market, too, oscillated within very confined limits. The market exuded borderline stability during the concerned period of Q4’23. However, because of existing inventory stocks, the average monthly prices for base oil slid slightly by about 2% by the end of the quarter. The monthly average prices for SN 150 type base oil stood at around 943 USD/MT (FD NWE) in October’23 and shifted to around 917 USD/MT by December ’23. Overall, mixed market sentiments were observed.

North America

The North American base oil market replicated the base oil price trends from the European markets. Industrial activities took a hit in the region because of the economic uncertainties, owing to which the market demands suffered slightly in the region. Though within the narrow boundaries, the prices were found to be wavering at the lower end of the scale. The base oil prices went from around 1528 USD/MT (FOB, Texas) in October’23 to around 1460 USD/MT in December’23.

Analyst Insight

According to Procurement Resource, given the current market dynamics and the inventory situation, the Base Oil prices are likely to continue to fluctuate in a similar manner in the coming months as well.

Base Oil Price Trend for Q3 of 2023

Asia

The base oil price trend showcased a slacked movement in the third quarter of 2023. The Asia-Pacific's base oil regional prices suffered from the onset of the holiday season in China, which led to the slowing down of the momentum of downstream industries. Throughout the majority of the quarter, the base oil price trajectory seemed to struggle with feeble support from the downstream and feedstock sectors and the excess influx of Russian imports. During the end phase, the prices observed a strong recovery as demand expanded and while the supply chains faced several disruptions.

Europe

The initial phase of the third quarter faced dwindling base oil market sentiments due to similar factors pushing it into the negative zone, as seen in the Asia Pacific countries. The most significant contributor to this downfall of the base oil price trend was the lower rates of production and sales in the lubricants industries.

In the month of September, the market activities seemed to improve on the back of slow production rates and stably growing demand. This is also indicative in the figures as the prices of base oil grew from around 883 USD/MT (FD, NEW) in July to 926 USD/MT in September (FD, NEW).

North America

Due to the excess availability of base oil and its muted demand, the base oil price trend took a bearish turn in the first half of the third quarter. The prices rebounded during the middle of this quarter with the help of the increasing cost of crude oil, which in turn raised the prices of production. In view of the restricted supply of base oil and moderate demand, the manufacturers increased their price quotations and thus caused an uptick in base oil price trend.

Analyst Insight

According to Procurement Resource, the price trend of Base oil is estimated to experience an oscillating trajectory as the demand for base oil and the cost of its feedstock materials seems to be fluctuating.

Base Oil Price Trend for the First Half of 2023

Asia Pacific

The base oil prices in the Asian Pacific region were adversely affected by the reduced demands and low production rates. Even after ease in covid restriction policies and OPEC+ production cuts, base oil prices continued to struggle. The slowdown of spot sales and the falling trend of crude oil prices have inhibited the enthusiasm of distributors to hold goods, and the increase in overseas imports eased the concerns about tighter supply caused by domestic maintenance in the early stage.

The imminent arrival of a large amount of Group II oil products at Chinese ports made up for the production losses during the planned maintenance period of domestic producers in February and March, putting further pressure on the spot market. The same stagnancy followed in the second quarter, where the prices inclined though marginally owing to certain market volatilities. Hence, the availability of ample products and low demands from the lubricant industries caused the price trend to remain flat in the Chinese domestic market.

Europe

The European market was stagnant in terms of the prices of base oil as the supply and demand equilibrium was maintained throughout the first two quarters of 2022. Given the subdued demands across the European markets, the manufacturers were forced to lower their quotations hoping for positive product movement. However, no positive impact was seen in the market, and the suppliers dumped the surplus supplies in the international market at much cheaper rates. The overall market of base oil slipped, adversely affecting the prices.

North America

The price trend for base oil remained weak in the US domestic market owing to muted market sentiments. The price trend was negatively affected by the declining sales in downstream industries. The cost of raw materials, logistical infrastructure, and labor increased in the region, which was responsible for the marginal hike in base oil prices.

Analyst Insight

According to Procurement Resource, the price trend for Base Oil are expected to oscillate in the upcoming quarter. The price decrease by the manufacturers had not been successful in attracting new businesses. The end-user demands from domestic and international markets seem uncertain, which will have a major impact on the prices of base oil globally.

Base Oil Price Trend for the Year 2022

Asia

Since the beginning of 2022, international crude oil prices have kept increasing, which directly impacted the price trend for base oil. In the first quarter, the cost of industrial white oil averaged 7583.74 RMB/MT in the Chinese domestic market, recording a 41.67% Y-O-Y increase. The mismatch between supply and demand and the continued destocking owing to geopolitical turbulence led to the continuous price rise. The steady demand from the automotive sector further supported the raised quotations. The high costs of raw materials coupled with poor logistics lowered the profit margins of the manufacturers.

The price of second-tier base oil averaged 6447.5 RMB/MT, registering an 80.6% Y-O-Y increase towards the end of the second quarter. The Indian base oil market, however, registered corrections in prices in the second half of the year 2022. The third quarter saw a consistent decline in the monthly average prices of the base oil prices as cheap Russian oil became available for both India and China following the Russian invasion of Ukraine in early 2022. The monthly average prices went from 1178 USD/MT in July’22 to about 1152 USD/MT in December’22 in the Indian domestic markets.

Europe

With Europe being the most hard-hit region owing to the Russia-Ukraine war, inflation and commodity pricing reached blazing highs. The complete embargo on Russian oil by the EU, coupled with retaliatory sanctions, led to huge volatilities in the crude oil and allied markets. The high power costs coupled with steady demand kept base oil prices towards the high end of the scale. The base oil price averaged 1620 USD/MT during H1’22. However, strategic attempts at correcting the market dynamics paid off in the second half of the year. The US announced a release of its strategic oil reserves to placate the high-heading market. Thereby, base oil prices are traced back to H2’22.

North America

The price trend in the US domestic market was in line with the global outlook. The strong demand from the downstream sectors and limited supply owing to high raw material prices, poor logistics, and skilled labor shortages added to the high quotations of base oil. However, In the second half of the year 2022, the US base oil market depreciated substantially as the inflation in the global economy strengthened the US Dollar, mitigating the domestic prices in the country. The monthly average prices for base oil went from about 1855 USD/MT in July’22 to around 1640 USD/MT in December’22 in the US domestic market.

Analyst Insight

According to Procurement Resource, the price of Base Oil is expected to stabilize in the coming quarter. With the release of supplies from the US and OPEC+, the supply-side constraints will soften. The current bearish market sentiments amid the stockpiling of supplies will directly impact the pricing patterns.

Procurement Resource provides latest prices of Base Oil. Each price database is tied to a user-friendly graphing tool dating back to 2014, which provides a range of functionalities: configuration of price series over user defined time period; comparison of product movements across countries; customisation of price currencies and unit; extraction of price data as excel files to be used offline.

About Base Oil

Base oil refers to lubrication grade oils that are derived from refining crude oil (mineral base oil) or chemical synthesis (synthetic base oil). Group II base oils contain more than 90% saturates, less than 0.3% sulphur, and have a viscosity index of 80 to 120. They are commonly produced through hydrocracking, which is a more complex process than that used for Group I base oils. Group II base oils have better antioxidation properties because all of their hydrocarbon molecules are saturated.

Base Oil Product Details

| Report Features | Details |

| Product Name | Base Oil |

| HS Code | 271019 |

| Industrial Uses | Rubber Manufacturing, Textiles, Blending of Engine Oils |

| Supplier Database | Chevron Corporation, Exxon Mobil Corporation, Hyundai and Shell Base Oil Co., Petro-Canada Lubricant, Saudi Arabian Oil Co. |

| Region/Countries Covered | Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, South Korea, Iraq, Saudi Arabia, Malaysia, Nepal, Taiwan, Sri Lanka, UAE, Israel, Hongkong, Singapore, Oman, Kuwait, Qatar, Australia, and New Zealand Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru Africa: South Africa, Nigeria, Egypt, Algeria, Morocco |

| Currency | US$ (Data can also be provided in local currency) |

| Supplier Database Availability | Yes |

| Customization Scope | The report can be customized as per the requirements of the customer |

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

Note: Our supplier search experts can assist your procurement teams in compiling and validating a list of suppliers indicating they have products, services, and capabilities that meet your company's needs.

Base Oil Production Processes

- Production of Base Oils (Group II) via Hydroprocessing

In this process, vacuum gas oil is used as a feedstock which is run through a hydrocracker at very high pressures. Inside the hydrocarbon, the molecules are reshaped and saturated. Sulfur is converted into hydrogen sulfide gas and nitrogen into ammonia, forming a waxy base oil containing more than 90% saturated compounds.

The second reactor is a catalytic dewaxer which converts the wax molecules to isoparaffins and causes even more saturation. Finally, the final few percent of residual aromatic compounds are saturated to form Group II base oils in a lower temperature but very high-pressure finishing step.

Methodology

The displayed pricing data is derived through weighted average purchase price, including contract and spot transactions at the specified locations unless otherwise stated. The information provided comes from the compilation and processing of commercial data officially reported for each nation (i.e. government agencies, external trade bodies, and industry publications).

Assistance from Experts

Procurement Resource is a one-stop solution for businesses aiming at the best industry insights and market evaluation in the arena of procurement. Our team of market leaders covers all the facets of procurement strategies with its holistic industry reports, extensive production cost and pre-feasibility insights, and price trends dynamics impacting the cost trajectories of the plethora of products encompassing various industries. With the best analysis of the market trends and comprehensive consulting in light of the best strategic footstep, Procurement Resource got all that it takes.

Client's Satisfaction

Procurement Resource has made a mark for itself in terms of its rigorous assistance to its clientele. Our experienced panel of experts leave no stone unturned in ensuring the expertise at every step of our clients' strategic procurement journey. Our prompt assistance, prudential analysis, and pragmatic tactics considering the best procurement move for industries are all that sets us apart. We at Procurement Resource value our clients, which our clients vouch for.

Assured Quality

Expertise, judiciousness, and expedience are the crucial aspects of our modus operandi at Procurement Resource. Quality is non-negotiable, and we don't compromise on that. Our best-in-class solutions, elaborative consulting substantiated by exhaustive evaluation, and fool-proof reports have led us to come this far, making us the ‘numero uno' in the domain of procurement. Be it exclusive qualitative research or assiduous quantitative research methodologies, our high quality of work is what our clients swear by.

Related News

Table Of Contents

Our Clients

Get in Touch With Us

UNITED STATES

Phone:+1 307 363 1045

INDIA

Phone: +91 8850629517

UNITED KINGDOM

Phone: +44 7537 171117

Email: sales@procurementresource.com

.webp)

.webp)