Reports

Dimethylcyclosiloxane Manufacturing Plant Project Report 2025: Market by Region, Market by Application, Key Players, Pre-feasibility, Capital Investment Costs, Production Cost Analysis, Expenditure Projections, Return on Investment (ROI), Economic Feasibility, CAPEX, OPEX, Plant Machinery Cost

Dimethylcyclosiloxane Manufacturing Plant Project Report: Key Insights and Outline

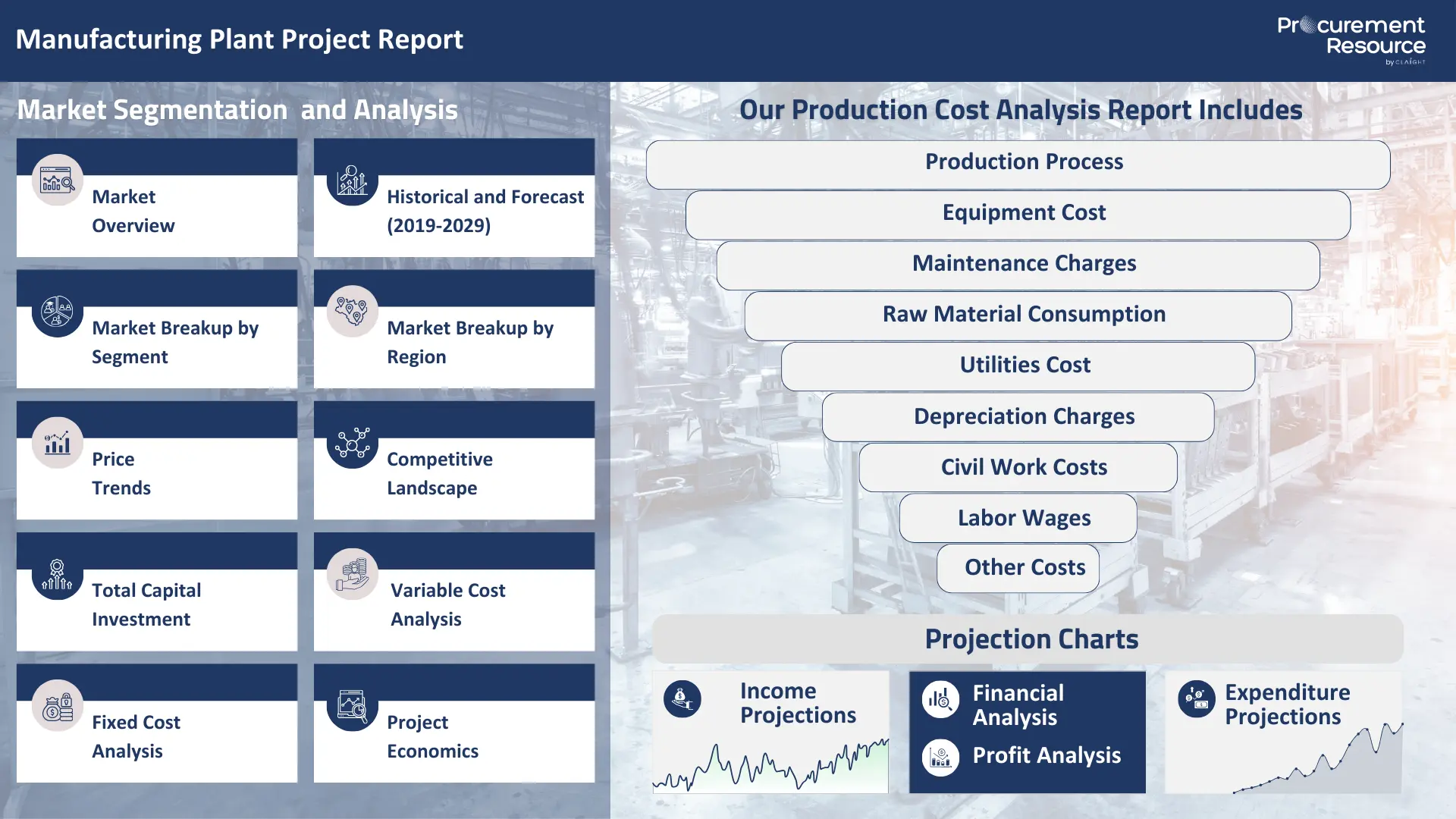

Dimethylcyclosiloxane Manufacturing Plant Project Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down Dimethylcyclosiloxane plant capital cost around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall Dimethylcyclosiloxane manufacturing plant cost and the cash cost of manufacturing.

Planning to Set Up a Dimethylcyclosiloxane Plant? Request a Free Sample Project Report Now!

Dimethylcyclosiloxane (DMC) is a class of cyclic siloxane oligomers, primarily consisting of D4 (octamethylcyclotetrasiloxane), D5 (decamethylcyclopentasiloxane), and D6 (dodecamethylcyclohexasiloxane). These volatile cyclic compounds work as the fundamental building blocks of silicone polymers and work as an important intermediate in the vast majority of silicone fluid, elastomer, and resin production.

Industrial Applications of Dimethylcyclosiloxane

Dimethylcyclosiloxane have various industrial applications because of its usage as a fundamental monomer for silicone polymers and its unique properties as a volatile carrier and emollient.

- Silicone Polymer Production: They work as direct precursors for synthesising a vast array of silicone polymers.

- Silicone Fluids: Linear polydimethylsiloxane (PDMS) fluids are produced by ring-opening polymerisation of DMCs. These fluids are used as lubricants, hydraulic fluids, defoamers, damping fluids, and in personal care products.

- Silicone Elastomers (Rubbers): High molecular weight silicone rubbers are formed by cross-linking linear PDMS derived from DMCs. These are used in seals, gaskets, medical devices, automotive components, and construction sealants.

- Silicone Resins: They are used as binders, protective coatings, and in high-temperature applications.

- Personal Care and Cosmetics: D4, D5, and D6 are widely used for their sensory properties, low toxicity, and volatility.

- Emollients and Conditioning Agents: They provide a smooth, non-greasy feel in skin creams, lotions, hair conditioners, and deodorants.

- Delivery Vehicles: They work as volatile carriers for active ingredients (e.g., antiperspirants, fragrances) because of their rapid evaporation, leaving behind a dry, silky feel.

- Cleaning and Polishing Products: They are used in polishes for vehicles, furniture, and metals because of their lubricating and protective properties.

- Antifoaming Agents: They are employed as effective antifoams in various industrial processes (like wastewater treatment, food processing, pulp and paper) due to their low surface tension.

- Coatings, Adhesives, and Sealants: They are utilised as additives to improve flow, levelling, and surface properties or as curing agents.

- Electronics and Electrical Applications: They are use in the production of encapsulants, insulators, and thermal management materials because of their excellent electrical insulation and thermal stability.

Top 5 Industrial Manufacturers of Dimethylcyclosiloxane

The Dimethylcyclosiloxane manufacturing is done by major global chemical companies that specialise in silicones and organosilicon chemistry.

- Dow Inc.

- Shin-Etsu Chemical Co., Ltd.

- Wacker Chemie AG

- Momentive Performance Materials Inc.

- Elkem ASA

Feedstock for Dimethylcyclosiloxane and Its Market Dynamics

The primary feedstock for Dimethylcyclosiloxane production is silicon and methyl chloride.

Major Feedstocks and their Market Dynamics:

- Silicon Metal: It is produced by heating quartz (silicon dioxide, SiO2) with carbon reductants (coke, charcoal) in an electric arc furnace at extremely high temperatures. The price of silicon metal is heavily influenced by electricity costs, the cost of raw materials (quartz, carbon), and demand from its major end-uses (aluminium alloys, silicones, solar panels, semiconductors).

- Methyl Chloride: It is primarily produced by the reaction of methanol with hydrogen chloride gas (HCl), or less commonly, by the chlorination of methane. Methanol can be petrochemical (from natural gas/coal) or bio-based. Hydrogen chloride is often a co-product of other chemical processes. The price of methyl chloride is linked to the cost of methanol and HCl. Methanol prices are influenced by natural gas or coal prices. Its demand from its primary end-uses (e.g., silicones, butyl rubber, agricultural chemicals, methyl cellulose) affects its price.

Market Drivers for Dimethylcyclosiloxane

The market for Dimethylcyclosiloxane (DMC) is driven by the expanding silicone industry and increasing demand from various end-use sectors.

- Growing Silicone Industry: The global demand for silicone polymers (fluids, elastomers, resins) in diverse applications like sealants, adhesives, gaskets, lubricants, insulators, medical devices, prosthetics, drug delivery systems, etc., contributes to its demand.

- Expanding Personal Care and Cosmetics Market: The growing consumer demand for high-performance, aesthetically pleasing, and safe personal care products (shampoos, conditioners, skin creams, deodorants) fuels the use of DMCs as emollients, carriers, and conditioning agents.

- Growth in Industrial and Speciality Applications: Increasing demand for antifoaming agents, textile softeners, polishes, and additives in paints/coatings contributes to DMC consumption across various industrial sectors.

- Technological Advancements: Continuous improvements in the Direct Process (e.g., new catalysts, reactor designs) lead to higher yields, better selectivity, and enhanced production efficiency for DMCs.

- Geographical Market Dynamics:

- Asia-Pacific (APAC): This region is the largest and fastest-growing market for Dimethylcyclosiloxane. This is driven by massive growth in silicone production (to support its construction, automotive, and electronics industries), expanding personal care markets, and increasing industrialisation.

- North America and Europe: These regions maintain significant demand, driven by mature silicone industries, advanced personal care markets, and high-tech electronics manufacturing.

Capital and Operational Expenses for a Dimethylcyclosiloxane Plant

Establishing a Dimethylcyclosiloxane manufacturing plant involves a significant total capital expenditure (CAPEX) and careful management of ongoing operating expenses (OPEX). A detailed cost model and production cost analysis are crucial for determining economic feasibility and optimising the overall Dimethylcyclosiloxane plant cost. Due to the corrosive, flammable, and reactive nature of the materials involved, robust engineering and stringent safety systems are paramount.

CAPEX: Comprehensive Dimethylcyclosiloxane Plant Capital Cost

The total capital expenditure (CAPEX) for a Dimethylcyclosiloxane plant covers all fixed assets required for the Direct Process (Rochow synthesis), subsequent hydrolysis, condensation reaction, cyclisation, and extensive purification. This is a major component of the overall investment cost.

- Site Acquisition and Preparation (5-8% of Total CAPEX):

- Land Acquisition: Purchasing suitable industrial land, typically within or adjacent to a petrochemical/chemical complex for feedstock (methyl chloride) integration. Requires extensive safety buffer zones due to highly flammable and corrosive chemicals.

- Site Development: Foundations for reactors, complex distillation columns, furnaces, robust containment systems, internal roads, drainage systems, and high-capacity utility connections (power, water, steam, natural gas, potentially chlorine for methyl chloride).

- Raw Material Storage and Handling (10-15% of Total CAPEX):

- Silicon Metal Storage: Silos for granular silicon metal with conveying systems.

- Methyl Chloride Storage: Pressurised and refrigerated tanks for methyl chloride, with extensive leak detection and safety measures due to its flammability and toxicity.

- Water Treatment: Systems for producing high-purity demineralised water for hydrolysis.

- Catalyst Storage: Storage for copper catalysts (for Direct Process) and hydrolysis/condensation catalysts (e.g., strong acids/bases), potentially in inert conditions.

- Direct Process Reaction Section (25-35% of Total CAPEX):

- Fluidised Bed Reactor: A specialised reactor designed for the high-temperature (e.g., 280-350°C) gas-solid reaction of silicon metal with methyl chloride in a fluidised bed. Requires precise temperature control, robust materials of construction (e.g., specialised alloys for corrosion/erosion resistance), and dust handling systems. This is central to the Dimethylcyclosiloxane manufacturing plant cost.

- Catalyst Injection/Dispersion System: For introducing copper catalyst.

- Chlorosilane Separation and Purification (Post-Direct Process) (20-30% of Total CAPEX):

- Complex Distillation Train: Extensive, high-efficiency, multi-stage distillation columns are paramount for separating the crude mixture of methylchlorosilanes (dimethyldichlorosilane, chlorotrimethylsilane, methyltrichlorosilane, silicon tetrachloride) and unreacted methyl chloride. Columns must be made of corrosion-resistant materials (e.g., Hastelloy) and operate under specific pressure/temperature profiles. This is the most complex and expensive part of the primary chlorosilane production.

- HCl Recovery: Systems for recovering hydrogen chloride (HCl) gas, a valuable by-product.

- Hydrolysis, Condensation, and Cyclisation Section (20-30% of Total CAPEX):

- Hydrolysis Reactor: A reactor where dimethyldichlorosilane (the primary input for DMCs) is reacted with water to form silanol intermediates and hydrochloric acid. This is a highly exothermic and corrosive reaction.

- Acid Recovery/Neutralisation: Systems for recovering or neutralising the hydrochloric acid byproduct.

- Condensation Reactor: For the condensation reaction of silanol intermediates to form linear siloxanes. This often involves heating or specific catalysts.

- Cyclisation Reactor: For the cyclisation of linear siloxanes to form dimethylcyclosiloxane oligomers (DMC mixture). This involves cracking or depolymerisation catalysed by strong acids or bases at elevated temperatures.

- Dimethylcyclosiloxane (DMC) Purification (10-15% of Total CAPEX):

- Distillation Columns: A series of high-efficiency distillation columns is crucial for separating the desired dimethylcyclosiloxane oligomers (D4, D5, D6) from each other, from linear siloxanes, and from lighter/heavier by-products. This often involves vacuum distillation.

- Finished Product Storage and Packaging (5-8% of Total CAPEX):

- Storage Tanks: For purified DMCs (D4, D5, D6), requiring airtight, potentially insulated or heated tanks.

- Packaging Equipment: Pumps, filling stations for drums, IBCs, or bulk tankers.

- Utility Systems (10-15% of Total CAPEX):

- High-Capacity Steam Generation: Boilers for heating reactors and distillation columns.

- Extensive Cooling Water System: Cooling towers and pumps for exothermic reactions and distillation condensers.

- Electrical Distribution: Explosion-proof and intrinsically safe electrical systems.

- Compressed Air and Nitrogen Systems: For pneumatic controls and inert blanketing.

- Wastewater Treatment Plant: Specialised facilities for treating acidic wastewater.

- Automation and Instrumentation (5-10% of Total CAPEX):

- Advanced DCS/PLC systems for precise monitoring and control of all process parameters.

- Highly sensitive gas detectors for methyl chloride and HCl, and other safety sensors.

- Safety and Environmental Systems: Robust fire detection and suppression, explosion protection, emergency ventilation, extensive containment for corrosive/flammable spills, and specialised scrubber systems for HCl. These are paramount.

- Engineering, Procurement, and Construction (EPC) Costs (10-15% of Total CAPEX):

- Includes highly specialised process design, material sourcing for extreme conditions (corrosive, high temp/pressure), construction of safe facilities, and rigorous commissioning.

Overall, these components define the total capital expenditure (CAPEX), significantly impacting the initial Dimethylcyclosiloxane plant capital cost and the viability of the investment cost.

OPEX: Detailed Manufacturing Expenses and Production Cost Analysis

Operating expenses (OPEX) are the recurring manufacturing expenses necessary for the continuous production of Dimethylcyclosiloxane. These costs are crucial for the production cost analysis and determining the cost per metric ton (USD/MT) of DMCs.

- Raw Material Costs (Approx. 50-70% of Total OPEX):

- Silicon Metal: Major raw material expense. Its cost is influenced by electricity prices. Strategic industrial procurement is vital to managing market price fluctuation.

- Methyl Chloride: Significant cost, influenced by methanol prices.

- Water: For hydrolysis, a relatively low-cost raw material, but high volumes.

- Catalysts: Cost of copper catalyst (Direct Process) and hydrolysis/condensation/cyclisation catalysts (acids/bases), and their replenishment.

- Process Chemicals: Acids/bases for neutralisation, scrubbing.

- Utility Costs (Approx. 15-25% of Total OPEX):

- Energy: Primarily electricity for furnaces (Direct Process), pumps, compressors, agitators, and extensive distillation columns. Heating and cooling for reactions and separations are major energy consumers, directly impacting operational cash flow.

- Steam: For reboilers in distillation.

- Cooling Water: For extensive process cooling.

- Natural Gas/Fuel: For process heating.

- High-Purity Nitrogen/Inert Gas: Continuous consumption for blanketing and purging.

- Labour Costs (Approx. 8-15% of Total OPEX):

- Salaries, wages, and benefits for skilled operators, maintenance staff, and QC personnel. Due to the complex petrochemical processes, hazardous materials, and advanced controls, highly trained personnel are essential.

- Maintenance and Repairs (Approx. 3-6% of Fixed Capital):

- Routine preventative maintenance programs, unscheduled repairs, and replacement of parts for corrosive reactors (especially hydrolysis), distillation columns, and furnaces. This includes lifecycle cost analysis for major equipment.

- Waste Management and Environmental Compliance (3-7% of Total OPEX):

- Costs associated with treating and disposing of acidic wastewater (e.g., from HCl recovery/neutralisation) and managing air emissions (e.g., methyl chloride, VOCs, silicon dust). Strict environmental regulations are crucial. HCl byproduct recovery/sale can offset costs.

- Depreciation and Amortisation (Approx. 5-10% of Total OPEX):

- Non-cash expenses account for the wear and tear of the high total capital expenditure (CAPEX) assets over their useful life. These are important for financial reporting and break-even point analysis.

- Indirect Operating Costs (Variable):

- Insurance premiums, property taxes, and expenses for research and development aimed at improving production efficiency metrics or exploring new cost structure optimisation strategies.

- Logistics and Distribution: Costs for transporting raw materials to the plant and finished Dimethylcyclosiloxane to customers, often requiring bulk liquid handling.

Effective management of these operating expenses (OPEX) through continuous process improvement, stringent safety protocols, efficient industrial procurement of feedstock, and maximising byproduct valorisation is paramount for ensuring the long-term profitability and competitiveness of Dimethylcyclosiloxane manufacturing.

Dimethylcyclosiloxane Industrial Manufacturing Process

This report comprises a thorough value chain evaluation for Dimethylcyclosiloxane manufacturing and consists of an in-depth production cost analysis revolving around industrial Dimethylcyclosiloxane manufacturing. The process outlines a multi-stage synthesis starting from basic elements.

Production from Methyl Chloride and Silicon:

- The manufacturing process of dimethylcyclosiloxane starts with a reaction between silicon metal with methyl chloride in the presence of a copper catalyst. The reaction leads to the formation of dimethylchlorosilane as an intermediate. This compound is then separated by distillation. Now, this dimethylchlorosilane is hydrolysed with water to form silanol and hydrochloric acid. The silanol then goes through condensation to create linear siloxane chains that are finally cyclized (into cyclic siloxanes like D4, D5, and D6. These cyclic siloxanes are purified by distillation to obtain pure dimethylcyclosiloxane.

Properties of Dimethylcyclosiloxane

Dimethylcyclosiloxane (DMC) refers to a class of cyclic silicon-oxygen compounds where each silicon atom is bonded to two methyl groups, forming a ring structure. Their unique structures provide a distinct set of physical and chemical properties that make them highly desirable for their various industrial applications.

Physical Properties (Varying by Ring Size - D4, D5, D6):

- Appearance: Clear, colourless, and odourless liquids at room temperature

- Volatility: Relatively volatile; D4 is the most volatile, followed by D5 and D6. Excellent volatile carriers in personal care products.

- D4 (C8H24O4Si4): Boiling Point ~175 degree Celsius, Melting Point ~17 degree Celsius

- D5 (C10H30O5Si5): Boiling Point ~210 degree Celsius, Melting Point ~-38 degree Celsius

- D6 (C12H36O6Si6): Boiling Point ~245 degree Celsius, Melting Point ~-3 degree Celsius

- Density: 0.95-0.96 g/mL, lighter than water

- Solubility: Insoluble in water, but highly soluble in organic solvents (e.g., alcohols, esters, hydrocarbons) and other silicones

- Viscosity: Low viscosity, non-greasy feel in personal care formulations

- Surface Tension: Very low surface tension, excellent spreading and wetting properties

- Thermal Stability: Excellent resistance to degradation at high temperatures

Chemical Properties:

- Cyclic Siloxane Structure: Ring structure with alternating silicon and oxygen atoms (-Si-O-Si-O-) and two methyl groups attached to each silicon atom. This structure is highly flexible and stable.

- Reactivity (Ring-Opening Polymerisation): Under acidic or basic catalysis, the ring can be opened and polymerised to form linear polydimethylsiloxane (PDMS) chains, the primary method for silicone polymer synthesis.

- Low Reactivity in Formulations: Generally non-reactive and stable in cosmetic formulations, compatible with other ingredients

- Hydrolysis: Can slowly hydrolyse in the presence of strong acids or bases over time, particularly in aqueous environments

- Biodegradability: Ongoing study on environmental fate; D4, D5, and D6 face regulatory scrutiny due to persistence and potential bioaccumulation in certain regions

Dimethylcyclosiloxane Manufacturing Plant Report provides you with a detailed assessment of capital investment costs (CAPEX) and operational expenses (OPEX), generally measured as cost per metric ton (USD/MT). This approach ensures that your investment decisions are aligned with the latest industry standards and economic feasibility metrics, enhancing your manufacturing efficiency and financial planning.

Apart from that, this Dimethylcyclosiloxane manufacturing plant report also covers the leading technology providers that help you plan a robust plan of action related to Dimethylcyclosiloxane manufacturing plant and its production process(es), and also by helping you with an in-depth supplier database. This report provides exclusive insights into the best manufacturing practices for Dimethylcyclosiloxane and technology implementation costs. This report also covers operational cash flow, fixed and variable costs, and detailed break-even point analysis, ensuring that your manufacturing process is not only efficient but also economically viable in the competitive market landscape.

In addition to operational insights, the Dimethylcyclosiloxane manufacturing plant report also comprehensively focuses on lifecycle cost analysis, maintenance costs, and energy consumption costs, which are critical for maintaining long-term sustainability and profitability. Our manufacturing cost analysis extends to include regulatory compliance costs, inventory holding costs, and logistics and distribution costs, providing a holistic view of the potential expenses and savings.

We at Procurement Resource ensure that this report is not only cost-efficient, environmentally sustainable, and aligned with the latest technological advancements but also that you are equipped with all necessary tools to optimize supply chain operations, manage risks effectively, and achieve superior market positioning for Dimethylcyclosiloxane.

Key Insights and Report Highlights

| Report Features | Details |

|---|---|

| Report Title | Dimethylcyclosiloxane Manufacturing Plant Project Report |

| Preface | Overview of the study and its significance. |

| Scope and Methodology | Key Questions Answered, Methodology, Estimations & Assumptions. |

| Executive Summary | Global Market Scenario, Production Cost Summary, Income Projections, Expenditure Projections, Profit Analysis. |

| Global Market Insights | Market Overview, Historical and Forecast (2019-2029), Market Breakup by Segment, Market Breakup by Region, Price Trends (Raw Material Price Trends, Dimethylcyclosiloxane Price Trends, Competitive Landscape (Key Players, Profiles of Key Players). |

| Detailed Process Flow | Product Overview, Properties and Applications, Manufacturing Process Flow, Process Details. |

| Project Details | Total Capital Investment, Land and Site Cost, Offsites/Civil Works Cost, Plant Machinery Cost, Auxiliary Equipment Cost, Contingency, Consulting and Engineering Charges, Working Capital. |

| Variable Cost Analysis | Raw Material Specifications, Raw Material Consumption, Raw Material Costs, Utilities Consumption and Costs, Co-product Cost Credit, Labour Requirements and Costs. |

| Fixed Cost Analysis | Plant Repair & Maintenance Cost, Overheads Cost, Insurance Cost, Financing Costs, Depreciation Charges. |

| General Sales and Administration Costs | Costs associated with sales and administration |

| Project Economics | Techno-economic Parameters, Income Projections, Expenditure Projections, Financial Analysis (Payback Period, Net Present Value, Internal Rate of Return), Profit Analysis, Production Cost Summary. |

| Report Format | PDF for BASIC and PREMIUM; PDF+Dynamic Excel for ENTERPRISE. |

| Pricing and Purchase Options | BASIC: USD 2999 PREMIUM: USD 3999 ENTERPRISE: USD 5999 |

| Customization Scope | The report can be customized based on the customer’s requirements. |

| Post-Sale Analyst Support | 10-12 Weeks of support post-sale. |

| Delivery Format | PDF and Excel via email; editable versions (PPT/Word) on special request. |

Key Questions Covered in our Dimethylcyclosiloxane Manufacturing Plant Report

- How can the cost of producing Dimethylcyclosiloxane be minimized, cash costs reduced, and manufacturing expenses managed efficiently to maximize overall efficiency?

- What is the estimated Dimethylcyclosiloxane manufacturing plant cost?

- What are the initial investment and capital expenditure requirements for setting up a Dimethylcyclosiloxane manufacturing plant, and how do these investments affect economic feasibility and ROI?

- How do we select and integrate technology providers to optimize the production process of Dimethylcyclosiloxane, and what are the associated implementation costs?

- How can operational cash flow be managed, and what strategies are recommended to balance fixed and variable costs during the operational phase of Dimethylcyclosiloxane manufacturing?

- How do market price fluctuations impact the profitability and cost per metric ton (USD/MT) for Dimethylcyclosiloxane, and what pricing strategy adjustments are necessary?

- What are the lifecycle costs and break-even points for Dimethylcyclosiloxane manufacturing, and which production efficiency metrics are critical for success?

- What strategies are in place to optimize the supply chain and manage inventory, ensuring regulatory compliance and minimizing energy consumption costs?

- How can labor efficiency be optimized, and what measures are in place to enhance quality control and minimize material waste?

- What are the logistics and distribution costs, what financial and environmental risks are associated with entering new markets, and how can these be mitigated?

- What are the costs and benefits associated with technology upgrades, modernization, and protecting intellectual property in Dimethylcyclosiloxane manufacturing?

- What types of insurance are required, and what are the comprehensive risk mitigation costs for Dimethylcyclosiloxane manufacturing?

1 Preface

2 Scope and Methodology

2.1 Key Questions Answered

2.2 Methodology

2.3 Estimations & Assumptions

3 Executive Summary

3.1 Global Market Scenario

3.2 Production Cost Summary

3.3 Income Projections

3.4 Expenditure Projections

3.5 Profit Analysis

4 Global Dimethylcyclosiloxane Market

4.1 Market Overview

4.2 Historical and Forecast (2019-2029)

4.3 Market Breakup by Segment

4.4 Market Breakup by Region

4.6 Price Trends

4.6.1 Raw Material Price Trends

4.6.2 Dimethylcyclosiloxane Price Trends

4.7 Competitive Landscape

4.8.1 Key Players

4.8.2 Profiles of Key Players

5 Detailed Process Flow

5.1 Product Overview

5.2 Properties and Applications

5.3 Manufacturing Process Flow

5.4 Process Details

6 Project Details, Requirements and Costs Involved

6.1 Total Capital Investment

6.2 Land and Site Cost

6.3 Offsites/ Civil Works Cost

6.4 Plant Machinery Cost

6.5 Auxiliary Equipment Cost

6.6 Contingency, Consulting and Engineering Charges

6.6 Working Capital

7 Variable Cost Analysis

7.1 Raw Materials

7.1.1 Raw Material Specifications

7.1.2 Raw Material Consumption

7.1.3 Raw Material Costs

7.2 Utilities Consumption and Costs

7.3 Co-product Cost Credit

7.4 Labour Requirements and Costs

8 Fixed Cost Analysis

8.1 Plant Repair & Maintanence Cost

8.2 Overheads Cost

8.3 Insurance Cost

8.4 Financing Costs

8.5 Depreciation Charges

9 General Sales and Administration Costs

10 Project Economics

10.1 Techno-economic Parameters

10.2 Income Projections

10.3 Expenditure Projections

10.4 Financial Analysis

10.5 Profit Analysis

10.5.1 Payback Period

10.5.2 Net Present Value

10.5.3 Internal Rate of Return

11 References

Compare & Choose the Right Report Version for You

RIGHT PEOPLE

At Procurement Resource our analysts are selected after they are assessed thoroughly on having required qualities so that they can work effectively and productively and are able to execute projects based on the expectations shared by our clients. Our team is hence, technically exceptional, strategic, pragmatic, well experienced and competent.

RIGHT METHODOLOGY

We understand the cruciality of high-quality assessments that are important for our clients to take timely decisions and plan strategically. We have been continuously upgrading our tools and resources over the past years to become useful partners for our clientele. Our research methods are supported by most recent technology, our trusted and verified databases that are modified as per the needs help us serve our clients effectively every time and puts them ahead of their competitors.

RIGHT PRICE

Our team provides a detailed, high quality and deeply researched evaluations in competitive prices, that are unmatchable, and demonstrates our understanding of our client’s resource composition. These reports support our clientele make important procurement and supply chains choices that further helps them to place themselves ahead of their counterparts. We also offer attractive discounts or rebates on our forth coming reports.

RIGHT SUPPORT

Our vision is to enable our clients with superior quality market assessment and actionable evaluations to assist them with taking timely and right decisions. We are always ready to deliver our clients with maximum results by delivering them with customised suggestions to meet their exact needs within the specified timeline and help them understand the market dynamics in a better way.

Ethyl Acrylate Manufacturing Plant Project Report 2025: Cost Analysis, ROI, and Feasibility Insights

Ethyl Acrylate Manufacturing Plant Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.

Hydrotalcite Manufacturing Plant Project Report 2025: Cost Analysis, ROI, and Feasibility Insights

Hydrotalcite Manufacturing Plant Project Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.

1-Decene Manufacturing Plant Project Report 2025: Cost Analysis, ROI, and Feasibility Insights

1-Decene Manufacturing Plant Project Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.