Reports

Iridium Manufacturing Plant Project Report 2025: Market by Region, Market by Application, Key Players, Pre-feasibility, Capital Investment Costs, Production Cost Analysis, Expenditure Projections, Return on Investment (ROI), Economic Feasibility, CAPEX, OPEX, Plant Machinery Cost

Iridium Manufacturing Plant Project Report 2025: Cost Analysis, ROI, and Feasibility Insights

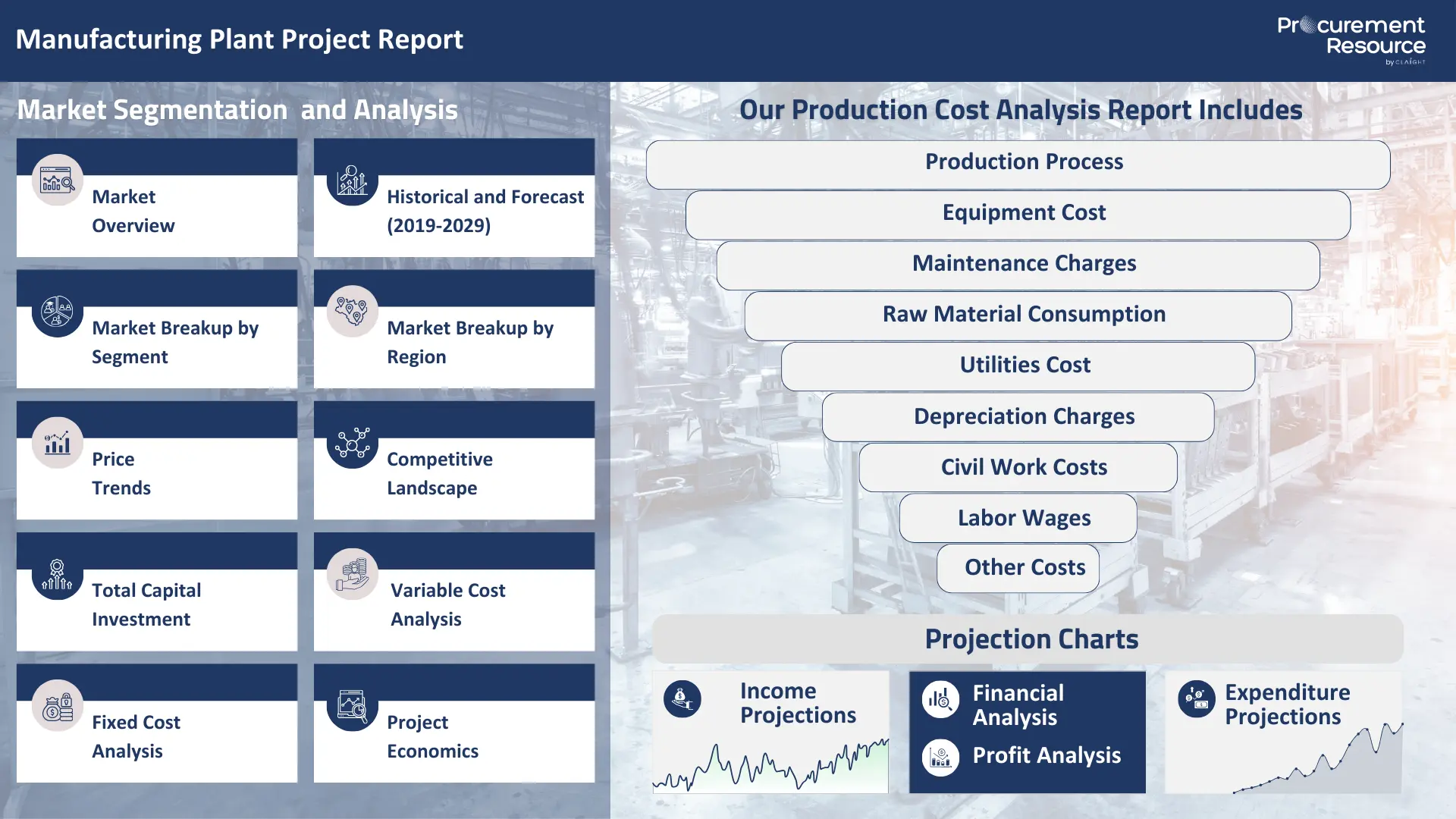

Iridium Manufacturing Plant Project Report by Procurement Resource thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down Iridium plant capital cost around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimisation and helps in identifying effective strategies to reduce the overall Iridium manufacturing plant cost and the cash cost of manufacturing.

Planning to Set Up a Iridium Plant? Request a Free Sample Project Report Now!

Iridium (Ir) is a rare and precious metal, belonging to the platinum group. It is characterised by its silvery-white colour and extreme density. Iridium is one of the densest and most corrosion-resistant metals known. This unique combination of properties makes it invaluable for high-tech industrial applications where durability and performance are paramount.

Applications of Iridium

- Electronics and Electrical Contacts (40-50%): Iridium's high melting point and resistance to arcing make it ideal for electrical contacts in spark plugs, relays, and electrodes. It is also used in specialised electronic components and sensors.

- Chemical Processing and Catalysts (20-25%): Due to its exceptional corrosion resistance, Iridium is used to make crucibles and other high-temperature equipment for chemical processing. It also serves as a catalyst in various chemical reactions, including those for producing acetic acid.

- High-Performance Alloys (15-20%): Iridium is alloyed with platinum to create very hard and durable materials used in aerospace, medical devices (e.g., pacemakers), and pen nibs. Its hardness improves the longevity of these products.

- Automotive Industry (5-8%): Iridium is a crucial component in high-performance spark plugs. Its high melting point and electrical conductivity improve ignition efficiency and lifespan.

- Other Speciality Uses (2-5%): This includes minor applications in jewellery, medical devices, and as a radioactive source in certain industrial instruments.

Top 5 Manufacturers of Iridium

The production of Iridium is closely tied to the mining and refining of other Platinum Group Metals (PGMs). Major manufacturers are large-scale PGM producers.

- Anglo American Platinum Ltd.

- Impala Platinum Holdings Ltd.

- Sibanye-Stillwater

- Norilsk Nickel

- Heraeus Precious Metals

Feedstock for Iridium and Value Chain Dynamics

The industrial manufacturing process of Iridium from hydrophobic ionic liquids begins with an Iridium-containing material extracted from ore. Iridium is a minor component of platinum and nickel ores. The process uses several key chemical raw materials, including various acids, salts, and gases.

A thorough value chain evaluation elucidates the intricate dynamics affecting these critical inputs at each level:

- Iridium-Containing Material Sourcing: The primary feedstock is a concentrate of Platinum Group Metals (PGMs) obtained from mining operations. Major deposits are found in geo-locations like South Africa, Russia, and Zimbabwe.

- Mining Costs and Volatility: The cost of this raw material is tied to the high capital investment costs of mining and refining PGM ores. Iridium is often a byproduct, so its supply is inelastic. It is not produced based on its own demand. This makes its price highly susceptible to market price fluctuations in the broader PGM market.

- Hydrophobic Ionic Liquids: This is a specialised solvent used for the separation of precious metals.

- Speciality Chemical Pricing: The cost of these liquids is tied to speciality chemical production. The choice of Technology Provider can significantly impact the initial investment cost, CAPEX and ongoing operating expenses (OPEX).

- Commodity Chemical Sourcing: The process uses common industrial chemicals like hydrochloric acid (HCl), nitric acid (HNO3), ammonium chloride (NH4Cl), and sulfuric acid.

- Upstream Chemical Prices: The costs of these reagents are linked to energy prices and the production of sulfur and chlorine. This impacts the overall production cost analysis for Iridium.

- Energy and Utilities: The process involves high-temperature steps like calcination and hydrogen reduction.

- Energy-Intensive Steps: These processes consume a lot of energy (fuel or electricity). This is a major part of operating expenses (OPEX) and influences the cash cost of production.

The dynamics affecting these raw materials are complex and interconnected, spanning global mining markets, energy prices, and precious metal markets. Strategic industrial procurement practices, diligent management of fixed and variable costs, and effective supply chain optimisation are all paramount. They help ensure the economic feasibility and competitive cost per metric ton (USD/MT) for Iridium production. The security and environmental risks of handling precious metals and hazardous chemicals are also significant concerns.

Market Drivers for Iridium

The market for Iridium is primarily driven by robust demand from high-tech industrial sectors that require its unique properties. These prevailing market forces profoundly influence the total capital expenditure (CAPEX) allocated for Iridium production facilities and necessitate meticulous management of recurring operating expenses (OPEX).

- Growth in Electronics and High-Tech Manufacturing: The increasing global demand for advanced electronics, sensors, and speciality electrodes drives significant consumption of Iridium. Its durability and electrical properties make it ideal for these applications. This translates into substantial demand, directly impacting the Iridium plant capital cost associated with establishing or expanding production units.

- Chemical and Catalytic Applications: The chemical industry's ongoing need for highly corrosion-resistant materials and effective catalysts ensures a steady demand for Iridium. Its use in the production of acetic acid and other chemicals is a key driver.

- Expansion in Medical Devices and Aerospace: As technology advances, Iridium alloys are used more in critical medical devices (e.g., pacemakers, defibrillator electrodes) and aerospace applications. Its durability and biocompatibility are highly valued.

- Global Supply Constraints: Iridium is an extremely rare element. Its supply is limited and dependent on the mining of other PGMs. This inherent supply constraint, combined with rising demand, leads to significant market price fluctuation. This makes the production cost analysis mainly important for producers.

- Regional Production and Consumption Patterns:

- South Africa and Russia: These are dominant producers of Iridium due to their large PGM mining operations. The Iridium manufacturing plant cost in these geo-locations is focused on refining and separation technologies.

- North America, Europe, and Asia-Pacific (Japan): These are major consumers of Iridium. Their high-tech manufacturing, chemical processing, and electronics industries drive demand. Capital investment (CAPEX) in these regions often prioritises R&D and processing for high-purity Iridium, influencing the overall cost model.

CAPEX (Capital Expenditure) Requirements for an Iridium Plant

Establishing a dedicated Iridium manufacturing plant requires a substantial total capital expenditure (CAPEX). This significant financial outlay covers highly specialised equipment for handling precious metals and corrosive materials in a complex refining process. It represents a considerable investment cost for producers.

- Site Preparation and Foundational Infrastructure (5-8% of total CAPEX): This includes securing a suitable industrial site. Allocations are made for robust foundational work, essential for supporting heavy processing equipment. The development of access roads, efficient drainage systems, and specialised security infrastructure also falls under this initial spending phase.

- Raw Material and Chemical Storage Systems (typically 10-15%):

- Precious Metal Vaults: Secure, high-security storage for Iridium-containing concentrate and finished product.

- Acid and Chemical Tanks: Dedicated storage vessels for corrosive chemicals like hydrochloric acid, nitric acid, and various purification agents. These tanks must be made of highly corrosion-resistant materials (e.g., glass-lined steel).

- Gas Storage: Cylinders or bulk tanks for hydrogen gas, which is used for reduction.

- Fluid Transfer Systems: Extensive networks of corrosion-resistant and leak-proof pumps, valves, and piping for the secure movement of hazardous liquids.

- Acid Dissolution and Leaching Section (15-20%):

- Dissolution Reactors: Glass-lined or speciality alloy reactors designed to dissolve the Iridium material in hot acids. These units demand precise temperature and pressure management systems.

- Filtration Units: Highly efficient filtration systems to separate the dissolved metals solution from insoluble ore residues.

- Precious Metal Separation Section (30-40%): This is typically the most capital-intensive segment of the plant, critical for achieving high-purity Iridium.

- Solvent Extraction Units: Reactors and liquid-liquid separators where ionic liquids and other chemical agents are used to selectively separate Iridium from other PGMs and impurities (e.g., platinum, rhodium).

- Crystallisation Tanks: Vessels for the controlled crystallisation of specific Iridium salts, such as ammonium hexachloroiridate.

- Centrifuges and Filters: For efficient solid-liquid separation of Iridium salts from solution.

- Purification Reactors: Units for removing specific impurities like iron using hydrazine hydrate and hydrogen peroxide.

- Calcination and Reduction Section (10-15%):

- High-Temperature Furnaces: Specialised, high-temperature furnaces designed for the calcination of Iridium salts.

- Hydrogen Reduction Furnaces: Reactors where the oxide is reduced to pure Iridium metal using a stream of hydrogen gas. These furnaces require a robust design for high temperatures and controlled atmospheres.

- Finished Product Management and Packaging (5-8%):

- Metal Melting Furnaces: If Iridium is sold as an ingot or button, induction furnaces are used.

- Packaging Lines: Specialised packaging equipment for Iridium powder or ingots, often in tamper-evident containers.

- Secure Storage: High-security vaults for finished precious metal products.

- Plant Utilities and Support Infrastructure (10-15%):

- Acid Recovery Systems: Units for recovering and recycling used acids to reduce raw material consumption.

- Cooling Systems: Large cooling towers, chillers, and associated piping networks for managing exothermic reactions.

- Power Distribution: A robust electrical infrastructure, including substations and internal distribution lines, is required to power all plant operations reliably.

- Water Management: Systems for process water purification and a comprehensive Effluent Treatment Plant (ETP) for managing highly acidic and metal-containing wastewater.

- Control and Monitoring Systems (5-8%):

- Advanced Automation Platforms: Distributed Control Systems (DCS) or Programmable Logic Controllers (PLCs), enabling precise, real-time control over critical parameters like temperature, pressure, flow, and composition, significantly enhancing production efficiency metrics and overall operational safety.

- Process Analysers: Online analytical tools (e.g., spectrophotometers, ICP-OES) for continuous monitoring of metal concentrations and purity.

- Research and Quality Assurance Facilities (2-3%):

- Well-equipped analytical laboratories dedicated to raw material verification, in-process testing, and final product quality assurance for precious metals.

- Safety and Environmental Protection Systems (5-10%):

- Comprehensive acid fume scrubbers, robust fire suppression, and stringent emergency shutdown (ESD) protocols.

- Spill containment measures and specialised ventilation systems for handling precious metals and hazardous chemicals.

- Exhaust scrubbers for managing atmospheric emissions.

- Project Execution and Licensing Expenses: Significant financial outlays for detailed plant design, equipment procurement, construction activities, and overall project management. This can also include technology licensing fees from a specialised Technology Provider.

OPEX (Operating Expenses) Considerations for an Iridium Plant

Managing the daily operating expenses (OPEX) is paramount for sustaining profitability and maintaining a robust operational cash flow in Iridium production. These recurring costs directly influence the cash cost of production and the ultimate cost of goods sold (COGS).

- Raw Material Procurement (50-65% of total OPEX):

- Iridium-Containing Concentrate: Direct procurement costs for the primary feedstock, which is highly variable based on PGM market prices.

- Chemical Reagents: Expenses for hydrochloric acid, nitric acid, ammonium chloride, and other purification chemicals.

- Hydrogen Gas: Cost for the hydrogen used in the reduction step.

- Hydrophobic Ionic Liquids: Replenishment of this speciality solvent.

- Energy Consumption (15-20%): The process demands considerable energy inputs, particularly for high-temperature steps.

- Electricity: Powering essential pumps, agitators, compressors, and analytical equipment.

- Fuel/Gas: Providing the necessary heat for high-temperature calcination and reduction furnaces.

- Cooling Water: Utilised extensively for managing exothermic reactions and condensation.

- Workforce Compensation (8-12%):

- Wages, comprehensive benefits, and ongoing training programs for the plant's dedicated workforce. This includes skilled metallurgists, proficient chemical engineers, rigorous quality control specialists, and experienced maintenance personnel.

- Consumables and Replacements (3-5%):

- Routine replacement of filters, furnace linings (refractories), and other wear-and-tear components.

- Laboratory chemicals and supplies required for ongoing testing and quality assurance.

- Specialised packaging materials for the finished product.

- Equipment Maintenance and Repairs (3-4%):

- Implementing diligently planned preventative maintenance programs for all critical equipment, particularly high-temperature furnaces and corrosion-resistant reactors.

- Promptly addressing unexpected equipment malfunctions to minimise costly downtime.

- Non-Energy Utilities (1-2%):

- Costs associated with process water, cooling water makeup, and associated water treatment.

- Expenditures for compressed air and inert gases utilised for safety and purging.

- Environmental Compliance and Waste Management (5-10%): This is a significant factor due to the nature of PGM refining.

- Costs associated with operating the Effluent Treatment Plant (ETP) for highly acidic and metal-containing wastewater.

- Expenditures for treating air emissions (e.g., from furnaces).

- Fees for the proper disposal of hazardous waste and tailings.

- Permit fees and regulatory monitoring are also factored into these costs.

- Precious Metal Recovery from Waste: Costs and efforts to recover any minute traces of PGMs from waste streams.

- Depreciation and Amortisation: These non-cash charges systematically allocate the Iridium plant capital cost over the useful economic life of the plant's assets. They also account for any applicable technology licensing fees.

- Overhead and Administrative Costs (2-3%):

- General corporate expenses, comprehensive insurance premiums (often higher for precious metals facilities), property taxes, investments in research and development efforts, and sales/marketing activities.

A thorough production cost analysis is vital to accurately determine the should cost of production and ensure Iridium is competitively priced per cost per metric ton (USD/MT). Continuous dedication to cost structure optimisation, coupled with effective supply chain optimisation and strategic adaptation to market price fluctuation for feedstock, is critical for sustained success. This fundamentally underpins the economic feasibility and robust Return on Investment (ROI) for Iridium manufacturers. The break-even point analysis remains a constant metric for guiding operational planning.

Manufacturing Process of Iridium

This report comprises a thorough value chain evaluation for Iridium manufacturing and consists of an in-depth production cost analysis revolving around industrial Iridium manufacturing. The process separates Iridium from other metals using a special solvent.

Production from Hydrophobic Ionic Liquids:The industrial manufacturing process of Iridium starts by dissolving an extracted Iridium-containing material in hydrochloric acid. This is followed by adding nitric acid and ammonium chloride. This reacts to form a mixed ammonium salt of Iridium and platinum. In the next step, other metals are removed using a special separation process. Then, the product is oxidised. This gives pure ammonium hexachloroiridate crystals. These crystals are then heated in a process called calcination. This is followed by a reduction using hydrogen gas to produce pure Iridium as the final product.

Properties of Iridium

Iridium (Ir), with an atomic number of 77, is a chemical element. It belongs to the Platinum Group of Metals (PGMs). It is a hard, brittle, and dense transition metal. Iridium is known for being extremely corrosion-resistant, even at very high temperatures.

Key Physical and Chemical Properties of Iridium:

- Chemical Symbol: Ir

- Appearance: Silvery-white metal.

- Density: One of the densest elements, at 22.56 g/cm3.

- Melting Point: Extremely high, at 2446 degree Celsius (4435 degree Fahrenheit). This makes it valuable for high-temperature applications.

- Boiling Point: Very high, at 4428 degree Celsius (8002 degree Fahrenheit).

- Hardness: Very hard and brittle, making it difficult to work with and machine in its pure form. It is often alloyed with other metals to make it more workable.

- Corrosion Resistance: It is virtually immune to corrosion from acids, bases, and salts. It is one of the few metals that can withstand the corrosive conditions in aqua regia.

- Catalytic Activity: A highly active catalyst in various chemical reactions.

- Electrical Properties: It has good electrical conductivity and is used in electrical contacts.

- Toxicity: Iridium metal is not considered toxic in its metallic form. However, some of its compounds can be.

Iridium Manufacturing Plant Report provides you with a detailed assessment of capital investment costs (CAPEX) and operational expenses (OPEX), generally measured as cost per metric ton (USD/MT). This approach ensures that your investment decisions are aligned with the latest industry standards and economic feasibility metrics, enhancing your manufacturing efficiency and financial planning.

Apart from that, this Iridium manufacturing plant report also covers the leading technology providers that help you plan a robust plan of action related to Iridium manufacturing plant and its production process, and also by helping you with an in-depth supplier database. This report provides exclusive insights into the best manufacturing practices for Iridium and technology implementation costs. This report also covers operational cash flow, fixed and variable costs, and detailed break-even point analysis, ensuring that your manufacturing process is not only efficient but also economically viable in the competitive market landscape.

In addition to operational insights, the Iridium manufacturing plant report also comprehensively focuses on lifecycle cost analysis, maintenance costs, and energy consumption costs, which are critical for maintaining long-term sustainability and profitability. Our manufacturing cost analysis extends to include regulatory compliance costs, inventory holding costs, and logistics and distribution costs, providing a holistic view of the potential expenses and savings.

We at Procurement Resource ensure that this report is not only cost-efficient, environmentally sustainable, and aligned with the latest technological advancements but also that you are equipped with all necessary tools to optimise supply chain operations, manage risks effectively, and achieve superior market positioning for Iridium.

Key Insights and Report Highlights

| Report Features | Details |

|---|---|

| Report Title | Iridium Manufacturing Plant Project Report |

| Preface | Overview of the study and its significance. |

| Scope and Methodology | Key Questions Answered, Methodology, Estimations & Assumptions. |

| Executive Summary | Global Market Scenario, Production Cost Summary, Income Projections, Expenditure Projections, Profit Analysis. |

| Global Market Insights | Market Overview, Historical and Forecast (2019-2029), Market Breakup by Segment, Market Breakup by Region, Price Trends (Raw Material Price Trends, Iridium Price Trends), Competitive Landscape (Key Players, Profiles of Key Players). |

| Detailed Process Flow | Product Overview, Properties and Applications, Manufacturing Process Flow, Process Details. |

| Project Details | Total Capital Investment, Land and Site Cost, Offsites/Civil Works Cost, Plant Machinery Cost, Auxiliary Equipment Cost, Contingency, Consulting and Engineering Charges, Working Capital. |

| Variable Cost Analysis | Raw Material Specifications, Raw Material Consumption, Raw Material Costs, Utilities Consumption and Costs, Co-product Cost Credit, Labour Requirements and Costs. |

| Fixed Cost Analysis | Plant Repair & Maintenance Cost, Overheads Cost, Insurance Cost, Financing Costs, Depreciation Charges. |

| General Sales and Administration Costs | Costs associated with sales and administration |

| Project Economics | Techno-economic Parameters, Income Projections, Expenditure Projections, Financial Analysis (Payback Period, Net Present Value, Internal Rate of Return), Profit Analysis, Production Cost Summary. |

| Report Format | PDF for BASIC and PREMIUM; PDF+Dynamic Excel for ENTERPRISE. |

| Pricing and Purchase Options | BASIC: USD 2999 PREMIUM: USD 3999 ENTERPRISE: USD 5999 |

| Customization Scope | The report can be customized based on the customer’s requirements. |

| Post-Sale Analyst Support | 10-12 Weeks of support post-sale. |

| Delivery Format | PDF and Excel via email; editable versions (PPT/Word) on special request. |

Key Questions Covered in our Iridium Manufacturing Plant Report

- How can the cost of producing Iridium be minimised, cash costs reduced, and manufacturing expenses managed efficiently to maximise overall efficiency?

- What is the estimated Iridium manufacturing plant cost?

- What are the initial investment and capital expenditure requirements for setting up an Iridium manufacturing plant, and how do these investments affect economic feasibility and ROI?

- How do we select and integrate technology providers to optimise the production process of Iridium, and what are the associated implementation costs?

- How can operational cash flow be managed, and what strategies are recommended to balance fixed and variable costs during the operational phase of Iridium manufacturing?

- How do market price fluctuations impact the profitability and cost per metric ton (USD/MT) for Iridium, and what pricing strategy adjustments are necessary?

- What are the lifecycle costs and break-even points for Iridium manufacturing, and which production efficiency metrics are critical for success?

- What strategies are in place to optimise the supply chain and manage inventory, ensuring regulatory compliance and minimising energy consumption costs?

- How can labour efficiency be optimised, and what measures are in place to enhance quality control and minimise material waste?

- What are the logistics and distribution costs, what financial and environmental risks are associated with entering new markets, and how can these be mitigated?

- What are the costs and benefits associated with technology upgrades, modernisation, and protecting intellectual property in Iridium manufacturing?

- What types of insurance are required, and what are the comprehensive risk mitigation costs for Iridium manufacturing?

1 Preface

2 Scope and Methodology

2.1 Key Questions Answered

2.2 Methodology

2.3 Estimations & Assumptions

3 Executive Summary

3.1 Global Market Scenario

3.2 Production Cost Summary

3.3 Income Projections

3.4 Expenditure Projections

3.5 Profit Analysis

4 Global Iridium Market

4.1 Market Overview

4.2 Historical and Forecast (2019-2029)

4.3 Market Breakup by Segment

4.4 Market Breakup by Region

4.6 Price Trends

4.6.1 Raw Material Price Trends

4.6.2 Iridium Price Trends

4.7 Competitive Landscape

4.8.1 Key Players

4.8.2 Profiles of Key Players

5 Detailed Process Flow

5.1 Product Overview

5.2 Properties and Applications

5.3 Manufacturing Process Flow

5.4 Process Details

6 Project Details, Requirements and Costs Involved

6.1 Total Capital Investment

6.2 Land and Site Cost

6.3 Offsites/ Civil Works Cost

6.4 Plant Machinery Cost

6.5 Auxiliary Equipment Cost

6.6 Contingency, Consulting and Engineering Charges

6.6 Working Capital

7 Variable Cost Analysis

7.1 Raw Materials

7.1.1 Raw Material Specifications

7.1.2 Raw Material Consumption

7.1.3 Raw Material Costs

7.2 Utilities Consumption and Costs

7.3 Co-product Cost Credit

7.4 Labour Requirements and Costs

8 Fixed Cost Analysis

8.1 Plant Repair & Maintanence Cost

8.2 Overheads Cost

8.3 Insurance Cost

8.4 Financing Costs

8.5 Depreciation Charges

9 General Sales and Administration Costs

10 Project Economics

10.1 Techno-economic Parameters

10.2 Income Projections

10.3 Expenditure Projections

10.4 Financial Analysis

10.5 Profit Analysis

10.5.1 Payback Period

10.5.2 Net Present Value

10.5.3 Internal Rate of Return

11 References

Compare & Choose the Right Report Version for You

RIGHT PEOPLE

At Procurement Resource our analysts are selected after they are assessed thoroughly on having required qualities so that they can work effectively and productively and are able to execute projects based on the expectations shared by our clients. Our team is hence, technically exceptional, strategic, pragmatic, well experienced and competent.

RIGHT METHODOLOGY

We understand the cruciality of high-quality assessments that are important for our clients to take timely decisions and plan strategically. We have been continuously upgrading our tools and resources over the past years to become useful partners for our clientele. Our research methods are supported by most recent technology, our trusted and verified databases that are modified as per the needs help us serve our clients effectively every time and puts them ahead of their competitors.

RIGHT PRICE

Our team provides a detailed, high quality and deeply researched evaluations in competitive prices, that are unmatchable, and demonstrates our understanding of our client’s resource composition. These reports support our clientele make important procurement and supply chains choices that further helps them to place themselves ahead of their counterparts. We also offer attractive discounts or rebates on our forth coming reports.

RIGHT SUPPORT

Our vision is to enable our clients with superior quality market assessment and actionable evaluations to assist them with taking timely and right decisions. We are always ready to deliver our clients with maximum results by delivering them with customised suggestions to meet their exact needs within the specified timeline and help them understand the market dynamics in a better way.

Ethyl Acrylate Manufacturing Plant Project Report 2025: Cost Analysis, ROI, and Feasibility Insights

Ethyl Acrylate Manufacturing Plant Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.

Hydrotalcite Manufacturing Plant Project Report 2025: Cost Analysis, ROI, and Feasibility Insights

Hydrotalcite Manufacturing Plant Project Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.

1-Decene Manufacturing Plant Project Report 2025: Cost Analysis, ROI, and Feasibility Insights

1-Decene Manufacturing Plant Project Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.